Abstract

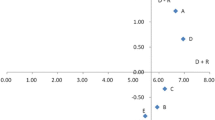

This paper documents a new series two-stage DEA modeling framework for credit risk evaluation in terms of operating performance efficiency and effectiveness that is implemented to a sample of listed Greek firms of basic resources and chemicals sector. In the series stages two types of DEA metrics are used: The first type is based on the range adjusted measure (RAM) whereas the second type is based on a common set of weights (CSW) of RAM. Performance inefficiency is uncovered in both performance dimensions, but the real problem of inefficiency of the sampled firms is a lower level of effectiveness, rather than operating performance efficiency. The operating efficiency is not correlated with effectiveness, and thus it seems that there is not a link between the performance at the operational (cost-oriented) and financial (profit-oriented) spaces of the firm. Therefore, sample firms should give more emphasis on their profit-oriented policies to ensure their success in the industry. The research framework may benefit not only Greek listed firms, but also firms in other countries to quantify their performance and improve their competitive advantages.

Similar content being viewed by others

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609.

Altman, E. I., Haldeman, R. G., & Narayanan, P. (1977). Zeta analysis: A new model to identify bankruptcy risk of corporations. Review of Banking and Finance, 1(1), 29–51.

Altman, E. I., & Saunders, A. (1998). Credit risk measurement: Developments over the last 20 years. Journal of Banking & Finance, 21(11–12), 1721–1742.

Asmild, M., Paradi, J. C., Reese, D. N., & Tam, F. (2007). Measuring overall efficiency and effectiveness using DEA. European Journal of Operational Research, 178(1), 305–321.

Avkiran, N. K. (1999). The evidence of efficiency gains: The role of mergers and the benefits to the public. Journal of Banking & Finance, 23(7), 991–1013.

Aziz, M. A., & Dar, H. A. (2006). Predicting corporate bankruptcy: Where we stand. Corporate Governance, 6(1), 18–33.

Bahrammirzaee, A. (2010). A comparative survey of artificial intelligence applications in finance: artificial neural networks, expert system and hybrid intelligent systems. Neural Computing and Applications, 19(8), 1165–1195.

Balcaen, S., & Ooghe, H. (2006). 35 Years of studies on business failure: an overview of the classic statistical methodologies and their related problems. The British Accounting Review, 38(1), 63–93.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Models for estimating technical and scale efficiencies in Data Envelopment Analysis. Management Science, 30(9), 1078–1092.

Becchetti, L., & Sierra, J. (2003). Bankruptcy risk and productive efficiency in manufacturing firms. Journal of Banking & Finance, 27(11), 2099–2120.

Bruni, M. E., Beraldi, P., & Iazzolino, G. (2014). Lending decisions under uncertainty: A DEA approach. International Journal of Production Research, 52(3), 766–775.

Caldis, A. P. (2007). The application of data envelopment analysis to credit risk measurement (M.Sc. thesis, University of the Witwatersrand, Johannesburg)

Charnes, A., Cooper, W. W., Golany, B., Seiford, L., & Stutz, J. (1985). Foundations of data envelopment analysis for Pareto-Koopmans efficient empirical production functions. Journal of Econometrics, 30(1–2), 91–107.

Charnes, A., Cooper, W., Lewin, A., & Seiford, L. (1994). Data envelopment analysis: Theory, methodology, and application. Dordrecht: Kluwer Academic Publishers.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444.

Cielen, A., Peeters, L., & Vanhoof, K. (2004). Bankruptcy prediction using a data envelopment analysis. European Journal of Operational Research, 154(2), 526–532.

Cielen, A., & Vanhoof, K. (1999). Bankruptcy prediction using a data envelopment analysis. Diebenpeek: Manuscript, Limburg University.

Coelli, T. J., Prasada Rao, D. S., O’Donnell, C. J., & Battese, G. E. (2005). An introduction to efficiency and productivity analysis (2nd ed.). New York: Springer.

Cooper, W. W., Park, K. S., & Pastor, J. T. (1999). RAM: A range adjusted measure of inefficiency for use with additive models, and relations to other models and measures in DEA. Journal of Productivity Analysis, 11(1), 5–42.

Cooper, W. W., Ruefli, T. W., Deng, H., Wu, J., & Zhang, Z. (2008). Are state-owned banks less efficient? A long- vs. short-run Data Envelopment Analysis of Chinese banks. International Journal of Operational Research, 3(5), 533–556.

Cooper, W. W., Seiford, L. M., & Tone, T. (2007a). Data Envelopment Analysis: A comprehensive text with models, applications, references and DEA-solver software. New York: Springer Science + Business Media Inc.

Cooper, W. W., Seiford, L. M., Tone, K., & Zhu, J. (2007b). Some models and measures for evaluating performances with DEA: Past accomplishments and future prospects. Journal of Productivity Analysis, 28, 151–163.

Diakoulaki, D., Mavrotas, G., & Papayannakis, L. (1992). A multicriteria approach for evaluating the performance of industrial firms. Omega, 20(4), 467–474.

Dimitras, A. I., Slowinski, R., Susmaga, R., & Zopounidis, C. (1999). Business failure prediction using rough sets. European Journal of Operational Research, 7(3), 263–280.

Doumpos, M., Kosmidou, K., Baourakis, G., & Zopounidis, C. (2002). Credit risk assessment using a multicriteria hierarchical discrimination approach: A comparative analysis. European Journal of Operational Research, 138(2), 392–412.

Doumpos, M., & Zopounidis, C. (2004). Multicriteria decision aid classification methods. New York: Kluwer Academic Publishers.

Doumpos, M., & Zopounidis, C. (2007). Model combination for credit risk assessment: A stacked generalization approach. Annals of Operations Research, 151(1), 289–306.

Emel, A. B., Oral, M., Reisman, A., & Yolalan, R. (2003). A credit scoring approach for the commercial banking sector. Socio-Economic Planning Sciences, 37(2), 103–123.

Evanoff, D. D., & Israilevich, P. R. (1991). Productive efficiency in banking. Econometric Perspectives, 15(4), 11–32.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society Series A (General), 120(3), 253–281.

Guan, J., & Chen, K. (2012). Modeling the relative efficiency of national innovation systems. Research Policy, 41(1), 102–115.

Hollingsworth, B., & Smith, P. (2003). Use of ratios in data envelopment analysis. Applied Economics Letters, 10(1), 733–735.

Iazzolino, G., Bruni, M. E., & Beraldi, P. (2013). Using DEA and financial ratings for credit risk evaluation: An empirical analysis. Applied Economics Letters, 20(14), 1310–1317.

Industry Classification Benchmark (ICB). (2005). Rules for the management of the industry classification Benchmark, Dow Jones Indexes and FTSE: The Index Company.

Jahanshahloo, G. R., Memariani, A., Lotfi, H. F., & Rezai, H. Z. (2005). A note on some of DEA models and finding efficiency and complete ranking using common set of weights. Applied Mathematics and Computation, 166(2), 265–281.

Keasey, K., McGuinness, P., & Short, H. (1990). Multilogit approach to predicting corporate failure—Further analysis and the issue of signal consistency. Omega, 18(1), 85–94.

Li, H., Sun, J., & Wu, J. (2010). Predicting business failure using classification and regression tree: An empirical comparison with popular classical statistical methods and top classification mining methods. Expert Systems with Applications, 37(8), 5895–5904.

Mareschal, B., & Brans, J. P. (1991). BANKADVISER: An industrial evaluation system. European Journal of Operational Research, 54(3), 318–324.

Martin, D. (1977). Early warning of bank failure: A logit regression approach. Journal of Banking & Finance, 1(3), 249–276.

Merrill, L., Pierce, Fenner & Smith Incorporated (MLPF&S). (2005). iQmethod SM . Our Approach to Global Equity Valuation, Accounting, and Quality of Earnings. New York: Merrill Lynch Global Securities Research & Economics Group.

Moody’s Corporate Finance. (2009). Rating Methodology. Global Steel Industry, January.

Mostafa, M. M. (2009). Modeling the competitive market efficiency of Egyptian companies: A probabilistic neural network analysis. Expert Systems with Applications, 36, 8839–8848.

Neely, A., Gregory, M., & Platts, K. (1995). Performance measurement system design: A literature review and research agenda. International Journal of Operations & Production Management, 15(4), 80–116.

Nickell, P., Perraudin, W., & Varotto, S. (2000). Stability of rating transitions. Journal of Banking & Finance, 24(1–2), 203–227.

Norusis, J. M. (2004). SPSS 12 guide to data analysis. Upper Saddle River: Prentice Hall.

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18(1), 109–131.

Paradi, J. C., Asmild, M., & Simak, P. C. (2004). Using DEA and worst practice DEA in credit risk evaluation. Journal of Productivity Analysis, 21(2), 153–165.

Pendharkar, P. C. (2011). A hybrid radial basis function and data envelopment analysis neural network for classification. Computers & Operations Research, 38(1), 256–266.

Pendharkar, P. C., & Troutt, M. D. (2012). Interactive classification using data envelopment analysis. Annals of Operations Research. doi:10.1007/s10479-012-1091-1098.

Pilateris, P. (2000). The evaluation of contractors based on financial data using data envelopment analysis (M.Sc. thesis, University of Toronto, Toronto).

Pilateris, P., & McCabe, B. (2003). Contractor financial evaluation model (CFEM). Canadian Journal of Civil Engineering, 30(3), 487–499.

Premachandra, I. M., Bhabra, G. S., & Sueyoshi, T. (2009). DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. European Journal of Operational Research, 193(2), 412–424.

Psillaki, M., Tsolas, I. E., & Margaritis, D. (2010). Evaluation of credit risk based on firm performance. European Journal of Operational Research, 201(3), 873–881.

Ravi Kumar, P., & Ravi, V. (2007). Bankruptcy prediction in banks and firms via statistical and intelligent techniques—A review. European Journal of Operational Research, 180(1), 1–28.

Roy, B. (1991). The outranking approach and the foundations of ELECTRE methods. Theory and Decision, 31, 49–73.

Shuai, J. J., & Li, H. L. (2005). Using rough set and worst practice DEA in business failure prediction. In D. Ślezak, et al. (Eds.), Rough sets, fuzzy sets, data mining, and granular computing (pp. 503–510). Berlin/Heidelberg: Springer.

Simak, P. C. (1999). DEA based analysis of corporate failure. M.Sc. thesis, University of Toronto, Toronto.

Simar, L., & Wilson, P. W. (2008). Statistical inference in nonparametric frontier models: Recent developments and perspectives. In H. O. Fried, C. A. K. Lovell, & S. S. Schmidt (Eds.), The measurement of productive efficiency and productivity growth (pp. 421–521). Oxford: Oxford University Press.

Siriopoulos, C., & Tziogkidis, P. (2010). How do Greek banking institutions react after significant events? A DEA approach. Omega, 38(5), 294–308.

Siskos, Y., Zopounidis, C., & Pouliezos, A. (1994). An integrated DSS for financing firms by an industrial development bank in Greece. Decision Support Systems, 12(2), 151–168.

Skogsvik, K. (1990). Current cost accounting ratios as predictors of business failure: The Swedish case. Journal of Business Finance & Accounting, 17(1), 137–160.

Spronk, J., Steuer, R. E., & Zopounidis, C. (2005). Multicriteria decision aid/analysis in finance. In J. Figueira, S. Greco, & M. Ehrgott (Eds.), Multiple criteria decision analysis: State of the art surveys (pp. 799–857). New York: Springer.

Tangen, S. (2004). Performance measurement: From philosophy to practice. International Journal of Productivity and Performance Management, 53(8), 726–737.

Troutt, M. D., Rai, A., & Zhang, A. (1996). The potential use of DEA for credit applicant acceptance systems. Computers & Operations Research, 23(4), 405–408.

Tsai, H. C., Chen, C. M., & Tzeng, G. H. (2006). The comparative productivity efficiency for global telecoms. International Journal of Production Economics, 103(2), 509–526.

Tsolas, I. E. (2010). Modeling bank branch profitability and effectiveness by means of DEA. International Journal of Productivity and Performance Management, 59(5), 432–451.

Ward, J. H. (1963). Hierarchical grouping to optimize an objective function. Journal of American Statistical Association, 58(301), 236–244.

Yeh, C. C., Chi, D. J., & Hsu, M. F. (2010). A hybrid approach of DEA, rough set and support vector machines for business failure prediction. Expert Systems with Application, 37(2), 1535–1541.

Yurdakul, M., & Iç, Y. T. (2004). AHP approach in the credit evaluation of the manufacturing firms in Turkey. International Journal of Production Economics, 88(3), 269–289.

Yurdakul, M., & Iç, Y. T. (2005). Development of a performance measurement model for manufacturing companies using the AHP and TOPSIS approaches. International Journal of Production Research, 43(21), 4609–4641.

Yurdakul, M., & Iç, Y. T. (2010). Development of a quick credibility scoring decision support system using fuzzy TOPSIS. Expert Systems with Applications, 37(1), 567–574.

Zavgren, C. V. (1985). Assessing the vulnerability to failure of American industrial firms: A logistic analysis. Journal of Business Finance and Accounting, 12(1), 19–45.

Zmijewski, M. E. (1984). Methodological issues related to estimation of financial distress prediction models. Journal of Accounting Research, 22(Supplement), 58–59.

Zopounidis, C. (1987). A multicriteria decision-making methodology for the evaluation of the risk of failure and an application. Foundations of Control Engineering, 12(1), 45–67.

Zopounidis, C., & Dimitras, A. I. (1998). Multicriteria decision aid methods for the prediction of business failure. Dordrecht: Kluwer Academic Publishers.

Zopounidis, C., & Doumpos, M. (1998). Developing a multicriteria decision support system for financial classification problems: The Finclas system. Optimization Methods and Software, 8(3–4), 277–304.

Zopounidis, C., Pouliezos, A., & Yannacopoulos, D. (1992). Designing a DSS for the assessment of company performance and viability. Computer Science in Economics and Management, 5(1), 41–56.

Acknowledgments

The author acknowledges the constructive comments of two reviewers and the Guest Editor Dr. Arivarignan Gunaseelan, which helped him to significantly improve the quality of this article.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

DEA efficiency scores of DMUs are derived by using different sets of weights obtained during the optimization process. For finding CSW the following model (3) based on fractional programming is used. This model is formulated to simultaneously maximize the ratio of outputs to inputs for all DMUs. For the use of fractional programming to derive DEA efficiency scores, the interested reader is referred to Cooper et al. (2007a, b) and Tsai et al. (2006).

For solving this model, the goal-programming formulation (model 4) based on the L∞ norm is used. This formulation takes into account the efficiency ratio of all DMUs to calculate and find a CSW so that the efficiency ratio of all DMUs becomes better as the ratio gets larger (Tsai et al. 2006).

By introducing a positive goal achievement variable, z, model (4) is converted to the following model (Jahanshahloo et al. 2005; Tsai et al. 2006):

Model (5) is identical to model (2). A set of (μ r *, v i *), i.e., CSW, can be calculated according to Eq. (6) and the efficiency score p j of a DMU can be calculated with the CSW.

In case that the Eq. (6) using CSW does not provide a complete ranking of DMUs, an alternative procedure by omitting the corresponding constraints of efficient DMUs can be employed (Jahanshahloo et al. 2005).

Appendix 2

The sampled listed firms are presented in the following Table 4.

Rights and permissions

About this article

Cite this article

Tsolas, I.E. Firm credit risk evaluation: a series two-stage DEA modeling framework. Ann Oper Res 233, 483–500 (2015). https://doi.org/10.1007/s10479-014-1566-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1566-x