Abstract

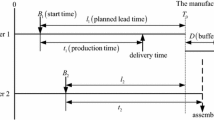

This paper investigates the impact of two time-based payment contracts in an assembly system that consists of one assembler and two suppliers, in which both suppliers’ production times are stochastic. The assembler initially chooses the contract type (delay payment contract vs on-time payment contract) and the buffer time, and two suppliers have to simultaneously determine their production lead times. We find that in equilibrium, both suppliers cut down their production lead times under the delay payment contract, and this makes them worse off than that under the on-time payment contract. Differently, the delay payment contract is the assembler’s dominant option. This is because by setting the buffer time, the assembler can significantly mitigate the possible delay risk caused by the suppliers’ decentralization under the delay payment contract. It also shows that the entire supply chain achieves the same service level under either the centralized condition or the decentralized condition, regardless of the applied payment contract type. Note that these results are robustness when we extend the model into the system containing N (N \(>\) 2) independent suppliers.

Similar content being viewed by others

Notes

Note that the due date for the suppliers may differ from the consumer’s request deliver time. See more from wikipedia, source: http://en.wikipedia.org/wiki/Boeing_787_Dreamliner.

Note that the compensation cost is not determined by the buffer time.

References

Anupindi, R., & Bassok, Y. (1999). Centralization of stocks: Retailers versus manufacturer. Management Science, 45(2), 178–191.

Ai, X. Z., Chen, J., & Ma, J. H. (2012). Contracting with demand uncertainty under supply chain competition. Annals of Operations Research, 201(1), 17–38.

Blocher, J. D., & Chhajed, D. (2008). Minimizing customer order lead-time in a two-stage assembly supply chain. Annals of Operations Research, 161(1), 25–52.

Bayiz, M., & Corbett, C.J. (2005). Coordination and Incentive Contracts in Project Management under Asymmetric Information.working paper. UCLA Anderson school. University of California, Los angeles, Los angeles.

Cachon, G.P. (2003). Supply chain coordination with contracts. The Handbook of Operations Research and Management Science.

Cachon, G., & Lariviere, M. (2005). Supply chain coordination with revenue sharing contracts. Management Science, 51(1), 30–44.

Friedman, J. W. (1986). Game theory with applications to economics. NewYork: Oxford University Press.

Gerchak, Y., & Wang, Y. (2004). Revenue sharing and wholesale-price contracts in assembly systems with random demand. Production and Operations Management, 13, 23–33.

Greising, D., & Johnsson, J. (2007). Behind Boeing’s 787 delays. Chicago Tribune (December 8) pp. 5–6.

Grout, J. R. (1996). A model of incentive contracts for just-in-time delivery. European Journal of Operational Research, 96, 139–147.

Grout, J. R. (1998). Influencing a supplier using delivery windows: Its effect on the variance of flow time and on-time delivery. Decision Science, 29(3), 747–764.

Gurnani, H., & Gerchak, Y. (2007). Coordination in decentralized assembly systems with uncertain component yields. European Journal of Operational Research, 176(3), 1559–1576.

Guiffrida, A. L., & Nagi, R. (2006). Cost characterizations of supply chain delivery performance. International Journal of Production Economics, 102, 22–36.

Guler, M. G., & Bilgic, T. (2009). On coordinating an assembly system under random yield and random demand. European Journal of Operational Research, 196(1), 342–350.

Iyer, A. V., & Bergen, M. E. (1997). Quick response in manufacturer-retailer channels. Management Science, 43(4), 559–570.

Liu, Y. D., Song, J. S., & Yao, D. D. (2003). Order fill rate, leadtime variability, and advance demand information in an assemble to order system. Operations Research, 51(2), 292–308.

Kwon, H. D., Lippman, S. A., Cardle, K. M., & Tang, C. S. (2010). Project management contracts with delayed payments. Manufacturing and Service Operations Management, 12(4), 692–707.

Liu, Jj, & Chen, H. (1999). Optimal pacing in an assembly-based multi-stage production system. Annals of Operations Research, 87, 87–101.

Leng, M. M., & Parlar, M. (2010). Game-theoretic analyses of decentralized assembly supply chains: Non-cooperative equilibria versus coordination with cost-sharing contracts. European Journal of Operational Research, 204, 96–104.

Rudi, N. (1998). Optimal inventory levels in systems with common components. Working paper, W.E.Simon Graduate School of Business Administration, University of Rochester, N.Y.

Song, J. S., & Zipkin, P. (2003). Supply chain operations: Assemble-to-order systems. In S. Graves & R. D. Kok (Eds.), Hand books in operations research and management science (Vol. 11). Amsterdam: North Holland. The Netherlands.

Song, J. S., & Yao, D. D. (2002). Performance analysis and optimization of assemble to order with random leadtimes. Operations Research, 50(5), 889–903.

Tsay, A. (1999). The quantity flexibility contract and supplier–customer incentives. Management Science, 45(10), 1339–1358.

Tang, O., & Grubbstrom, R. W. (2003). The detailed coordination problem in a two-level assembly system with stochastic leadtimes. International Journal of Production Economics, 81, 415–429.

Wang, Y., & Gerchak, Y. (2003). Capacity games in assembly systems with uncertain demand. Manufacturing and Service Operations Management, 5(3), 252–267.

Xiao, Y. B., Chen, J., & Lee, C. Y. (2010). Optimal decisions for assemble-to-order systems with uncertain assembly capacity. International Journal of Production Economics, 123, 155–165.

Yano, C. (1987). Stochastic leadtimes in two-level assembly systems. IIE Transactions, 19, 371–378.

Acknowledgments

We gratefully acknowledge all the editors and the reviewers for their valuable comments that significantly improved the paper. This work is supported by the National Natural Science Foundation of China (nos. 71102174, 71372019, 71231007), Specialized Research Fund for Doctoral Program of Higher Education of China (no. 20111101120019), Beijing Philosophy and Social Science Foundation of China (no. 11JGC106), Beijing Higher Education Young Elite Teacher Project (no.YETP1173) and China Postdoctoral Science Foundation (no. 2013M542066).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

Expending Eq. (4), we have:

Take both the first-order conditions of (17), we can show that:

Therefore, supplier’s expected cost is convex in \(l_{i}\), and the optimal \( l_{i}\) meets the first-order condition. We then demonstrate the uniqueness of the above results.

Considering the reaction curves of both suppliers in \(\frac{{\partial } C_{s_{i}}^{N}}{{\partial {l_{i}}}}\), we assume that:

and

Subsequently, we can show that

Since \(\frac{{\partial G{_{1}}({l_{1}},{l_{2}})}}{{\partial {l_{1}}}}-\frac{{ \partial G{_{2}}({l_{1}},{l_{2}})}}{{\partial {l_{1}}}}>0\), the response functions will meet once at most (Gurnani and Gerchak 2007). Also, referring to Friedman’s research (Friedman 1986, Theorem 2.4), there is always a Nash Equilibrium existing for a convex-payoff-functions game like ours. Therefore, the NE of both suppliers’ production lead times is unique. \(\square \)

Proof of Lemma 2

The assembler’s cost under delay payment contract, as shown in (9), can be represented as: \({C_{m}}=\beta A+\sum h_{i} {{B_{i}}}-C,(i=1,2),\) in which:

Subsequently, obtaining the first-order condition of \(D\) gives rise to the equilibrium result. \(\square \)

Proof of Proposition 2

We first assume that compared to the on-time payment contract, \(\Delta {l_{1}}\) and \(\Delta {l_{2}}\) are the reduced periods of suppliers’ production lead times under the delay payment contract, \(\Delta {l_{i}}=l_{_{i}}^{o}-l_{_{i}}^{n}\). Similarly, we assume that the assembler’s buffer time also increases \(\Delta D\) under the delay payment contract, \(\Delta D=D^{n}-D^{o}.\) Intuitively, it has \(\Delta {l_{1}} <\Delta D<\Delta {l_{2}}\) (\(\Delta {l_{1}}<\Delta {l_{2}}\)). Therefore, we can rewrite the assembler’s cost function under the on-time payment, where:

If the assembler just chooses a buffer time \({D^{n}}={D^{o}}+\Delta {l_{2}}\) under the delay payment contract, its cost:

From Eqs. (18) and (19), we can easily find that assembler’s penalty cost, inventory holding cost for component 2 are smaller and the compensation is larger under delay payment than the on-time payment, while the only inventory holding cost is not easy to confirm. Note that only in the extreme cases when the gap \(\Delta \) between \(\Delta {l_{1}}\) and \(\Delta {l_{2}}\) is very large, then the assembler may be better off under the on-time payment contract. However, this circumstance occurs only if the both suppliers’ production times follow the discrete distribution. Otherwise, if both times follow the continuous distribution, it is impossible for one factor changes slightly but the others react dramatically. Therefore, in general we can conclude that it is always profitable for the assembler to choose the delay payment contract with the application of buffer time.\(\square \)

Proof of Lemma 3

The centralized system’s cost can be extended to:

Taking the first-order derivatives of (\({L_{1}},{L_{1}}\)), we gain:

Investigating the Hessian Matrix of \(({L_{1}},{L_{2}})\):

Since that \(\frac{{{\partial ^{2}}{C_{c}}}}{{\partial {L_{1}}^{2}}}\frac{{{ \partial ^{2}}{C_{c}}}}{{\partial {L_{2}}^{2}}}-\frac{{{\partial ^{2}}{C_{c}} }}{{\partial {L_{1}}\partial {L_{2}}}}\frac{{{\partial ^{2}}{C_{c}}}}{{ \partial {L_{2}}\partial {L_{1}}}}>0\), the system’s total cost is joint convex in \(({L_{1}},{L_{2}})\). \(\square \)

Rights and permissions

About this article

Cite this article

Guan, X., Li, G. & Yin, Z. The implication of time-based payment contract in the decentralized assembly system. Ann Oper Res 240, 641–659 (2016). https://doi.org/10.1007/s10479-014-1579-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1579-5