Abstract

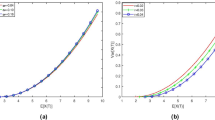

This paper focuses on risk control problem of the insurance company in enterprise risk management. The insurer manages its financial risk through purchasing excess-of-loss reinsurance, and investing its wealth in the constant elasticity of variance stock market. We model risk process by Brownian motion with drift, and study the optimization problem of maximizing the exponential utility of terminal wealth under the controls of reinsurance and investment. Using stochastic control theory, we obtain explicit expressions for optimal polices and value function. We also show that the optimal excess-of-loss reinsurance is always better than optimal proportional reinsurance. And some numerical examples are given.

Similar content being viewed by others

References

Asmussen, S., HØjgaard, B., & Taksar, M. (2000). Optimal risk control and dividend distribution policies: Example of excess-of-loss reinsurance for an insurance for an insurance corporation. Finance and Stochastics, 4, 299–324.

Bai, L., & Guo, J. (2008). Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint. Insurance: Mathematics and Economics, 42, 968–975.

Bai, L., & Guo, J. (2010). Optimal dynamic excess-of -loss reinsurance and multidimensional portfolio selection. Science China-Mathematics, 53(7), 1787–1804.

Blome, C., & Schoenherr, T. (2011). Supply chain risk management in finical crises-a multiple case-study approach. Int. J. Production Economics, 134, 43–57.

Browne, S. (1995). Optimal investment policies for a firm with random risk process: Exponential utility and minimizing the probability of ruin. Mathematics of Operations Research, 20(4), 937–958.

Chacko, G., & Viceira, L. (2005). Dynamic consumption and portfolio choice with stochastic volatility in incomplete markets. The Review of Financial Studies, 18(4), 1369–1402.

Consigli, G., & Dempster, M. (1998). Dynamic stochastic programming for asset-liability management. Annals of Operations Research, 81, 131–162.

COSO (2004). Enterprise Risk Management-Integrated Framework Executive Summary. Committee of Sponsoring Organizations of the Treadway Commission.

Fleming, W., & Soner, H. (2005). Controlled Markov process an viscosity solutions (2nd ed.). New York: Springer.

Gerber, H. U. (1979). An introduction to mathematical risk theory (Vol. 8). Philadelphia: SS Huebner Foundation for Insurance Education, Wharton School, University of Pennsylvania.

Grandell, J. (1991). Aspects of risk theory. New York: Springer-Verlag.

Gu, M., Yang, P., Li, S., & Zhang, J. (2010). Constant elasticity of variance model for proportional reinsurance and investment strategies. Insurance: Mathematics and Economics, 46, 580–587.

Hainaut, D. (2009). Dynamic asset allocation under VaR constraint with stochastic interest. Annals of Operations Research, 172(1), 97–117.

Irgens, C., & Paulsen, J. (2004). Optimal control of risk exposure, reinsurance and investment for insurance portfolios. Insurance: Mathematics and Economics, 35, 21–51.

Liang, Z., & Guo, J. (2007). Optimal proportional reinsurance and ruin probability. Stochastic Models, 23(2), 333–350.

Liang, Z., Yuen, K. C., & Cheung, K. C. (2012). Optimal reinsurance-investment problem in constant elasticity of variance stock market for jump-diffusion risk model. Applied Stochastic Models in Business and Industry, 28, 585–597.

Luo, S., Taksar, M., & Tsoi, A. (2008). On reinsurance and investment for large insurance portfolios. Insurance: Mathematics and Economics, 42, 434–444.

Meng, H., & Zhang, X. (2010). Optimal risk control for the excess of loss reinsurance policies. Astin Bulletins, 40(1), 179–197.

Merton, R. C. (1969). Life portfolio selection under uncertainty: the continuous-time case. The Review of Economics and Statistics, 51(3), 247–257.

Schroder, M. (1989). Computing the constant elasticity of variance option pricing formula. The Journal of Finance, XLIV(1), 211–219.

Schmidli, H. (2001). Optimal proportional reinsurance policies in a dynamic setting. Scandinavian Actuarial Journal, 1, 55–68.

Olson, D. L., & Wu, D. D. (2008). Enterprise risk management. Singapore: World Scientific Publishing Co., Ltd.

Promislow, S. D., & Young, V. R. (2005). Minimizing the probability of ruin when claims follow Brownian motion with drift. North American Actuarial Journal, 9(3), 109–128.

Taksar, M., & Markussen, C. (2003). Optimal dynamic reinsurance policies for large insurance portfolios. Finance and Stochastic, 7, 97–121.

Wu, D. D., Chen, S. H., & Olson, D. L. (2014). Business intelligence in risk management: Some recent progress. Information Sciences, 256, 1–7.

Wu, D. D., & Olson, D. L. (2009). Enterprise risk management: small business scorecard analysis. Production Planning and Control, 20(4), 362–369.

Wu, D. D., & Olson, D. L. (2010a). Enterprise risk management: Coping with model risk in a large bank. Journal of the Operational Research Society, 61(2), 179–190.

Wu, D. D., & Olson, D. L. (2010b). Enterprise risk management: A DEA VaR approach in vendor selection. International Journal of Production Research, 48(16), 4919–4932.

Wu, D. D., & Olson, D. L. (2013). Computational simulation and risk analysis: An introduction of state of the art research. Mathematical and Computer Modeling, 58, 1581–1587.

Wu, D. D., Olson, D. L., & Birge, J. R. (2011). Introduction to special issue on “Enterprise risk management in operations”. International Journal of Production Economics, 134(1), 1–2.

Acknowledgments

This research was supported by the Natural Science Foundation of Jiangsu Higher Education Institution of China (No. 13KJD110006), SJTU Special Funds for Cross Deciplines (No. 10JCY11) and the National Natural Science Foundation of China (No. 11101215).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In this appendix, we prove Theorem 4.2.

Proof

Step 1: Propose the ansatz. Mimicking the method of Browne (1995, p.942) or Liang et al. (2012, p.588), we want to find a solution to (4.2) with the form

where \(G(t,s)\) is a suitable function to be determined. And, the boundary condition \(V(T,x,s)=u(x)\) implies that

Let \(G_t , G_s , G_{ss}\), be the partial derivatives of \(G(t,s)\). Note that

Step 2: Derive the optimal control. Substituting (7.3) back into the HJB Eq. (4.2), since \(V-\uplambda _0 <0\), we get

Let

and

Differentiating \(f_1 (\pi ,t)\)with respect to \(\pi \) yields the minimizer

and the value of \(f_1 (\pi ,t)\) at this minimizer is

Similarly, from the first order condition

we know that, without restriction with respect to \(a\),

which leads to

Step 3: Separate the variables. We need to discuss the two cases according to the value of \(\tilde{a}(t)\).

Case 1 \(({ {Nm>\theta }})\) If \(t<\bar{{T}}{:=}T+\frac{\ln (Nm)-\ln \theta }{r}\), then \(\tilde{a}(t)\in [0,\;N)\). So,

coincides with the optimal policy. Since \(T<\bar{{T}}, \left( {\pi ^{*}(t),a^{*}(t)} \right) \) is optimal policy on \(\left[ {0,\;T} \right] \).

Up to now, we still need to solve \(G(t,s)\) to find the optimal investment \(\pi ^{*}(t)\) and the value function \(V(t,x,s)\) in this case. Substituting \(\left( {\pi ^{*}(t),a^{*}(t)} \right) \) (i.e. expression (7.11)) back to (7.4), we can get

We appeal to power transformation technique and variable change method to solve the problem.

Let

with boundary condition

and

where \(h_t , h_y , h_{yy}\) are partial derivatives of \(h(t,y)\).

Putting the partial derivatives of \(G(t,s)\) into the Eq. (7.12), we obtain equation

where \(M_1 (t)=-m\mu _\infty (\eta -\theta )\mathrm{{e}}^{r(T-t)}+f_2 (a^{*},t)\). We try to find a solution of the above equation with the following form

with boundary condition

and

where \(K_1^{\prime }, L_1^{\prime }\) are the derivatives of \(K_1 (t),\;L_1 (t)\) respectively. Putting (7.19) into (7.16), we derive

By matching coefficients, we have

Taking into boundary condition, we have the solution of Eq. (7.21):

Putting these parameters into \(G(t,s)\), we obtain

Therefore the optimal investment policy is

and the corresponding value function has the form

where \(L_1 (t)\) and \(K_1 (t)\) is determined by (7.22) and (7.23), respectively.

Case 2 \(({ {Nm\le \theta }})\) If \(t<\bar{{T}}{:=}T+\frac{\ln (Nm)-\ln \theta }{r}\) (noting that \(\bar{{T}}\le T)\), then \(\tilde{a}(t)\in [0,\;N)\) from expression (7.9). Similar to case 1, incorporating the constants of the calculations, we get the optimal value function

where the constant \(k\) will be determined from the following (7.37), and the optimal policies are

where \(G(t,s)=K_1 (t)+L_1 (t)s^{-2\beta }+k.\) If \(\bar{{T}}\le t\le T\), then If \(\tilde{a}(t)\ge N\). We get that the optimal retention level is \(a^{*}(t)=N\). In this case, \(\mu (N)=\mu _\infty \), and \(\sigma ^{2}(N)=\sigma _\infty ^2\).

Putting the optimal policies

into the Eq. (7.4), we obtain

Again, we use the power transformation technique and variable change method to solve the Eq. (7.30) with the boundary condition (4.1).

Similarly, let \(G(t,s)=h(t,y),\;\;y=s^{-2\beta },\) we have

And we try to the following form and match coefficients,

Therefore, we get

which is the same as the expression \(L_1 (t)\), denoted by \(L(t)\) for simplicity.

and

Thus, in case 2, the optimal excess-of-loss reinsurance and investment policies are

where \(\pi ^{*}(t)=\frac{2r(\mu -r)+\beta (\mu -r)^{2}(1-\mathrm{{e}}^{-2r(T-t)})}{2r\sigma ^{2}s^{2\beta }}\frac{\mathrm{{e}}^{-r(T-t)}}{m}\). And the corresponding value function has the form

where choose \(k\) in the way that \(V(t,x,s)\) given by (7.37) is continuous at \(\bar{{T}}\), that is,

Thus, we complete the proof. \(\square \)

Rights and permissions

About this article

Cite this article

Li, Q., Gu, M. & Liang, Z. Optimal excess-of-loss reinsurance and investment polices under the CEV model. Ann Oper Res 223, 273–290 (2014). https://doi.org/10.1007/s10479-014-1596-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1596-4