Abstract

We address the effect of uncertainty on a manufacturer’s dynamic production and pricing decisions over a finite planning horizon. The demand for products, which depends on their price, is characterized by two stochastic processes: potential demand and customer price sensitivity. An optimal policy for coordinating production and pricing is a time-dependent feedback rule with respect to the state of the manufacturer’s inventories. We show that when the volatility of customer sensitivity to the product price is negligible, the optimal policy can be obtained analytically. Moreover, our simulations demonstrate that the volatility of stochastic customer price sensitivity does not have a strong effect on the manufacturer’s expected profit. Therefore, the solution derived for the case of customer price sensitivity with zero volatility can serve as a good approximation heuristic for the optimal policy if the true volatility of customer price sensitivity is within 40 % of its mean and the volatility of potential demand is within 25 % of its mean. Moreover, under these conditions, a simplified, time-independent control rule deteriorates expected profits by only 1.5 %.

Similar content being viewed by others

References

Bertsekas, D. P. (2005a). Dynamic programming and optimal control (Vol. 1). Nashua, NH: Athena Scientific.

Bertsekas, D. P. (2005b). Dynamic programming and optimal control (Vol. 2). Nashua, NH: Athena Scientific.

Chakravarty, A. K. (2011). A contingent plan for disaster response. International Journal of Production Economics, 134(1), 2–15.

Chan, L. M. A., Shen, Z. J. M., Simchi-Levi, D., & Swann, J. L. (2004). Coordination of pricing and inventory decisions: A survey and classification. In Handbook of quantitative supply chain analysis: Modeling in the ebusiness era. Alphen aan den Rijn, Netherlands: Kluwer.

Chen, H., Wu, O. Q., & Yao, D. D. (2010). On the benefit of inventory-based dynamic pricing strategies. Production and Operations Management, 19(3), 249–260.

Chen, X., & Simchi-Levi, D. (2006). Coordinating Inventory control and pricing strategies with random demand and fixed ordering cost: The continuous review model. Operations Research Letters, 34, 323–332.

Desai, V. S. (1996). Interactions between members of a marketing-production channel under seasonal demand. European Journal of Operational Research under, 90, 115–141.

Elmaghraby, W., & Keskinocak, P. (2003). Dynamic pricing in the presence of inventory considerations: Research overview, current practices and future directions. Management Science, 49(10), 1287–1309.

Escudero, L. F., Kamesam, P. V., King, A. J., & Wets, R. J. B. (1993). Production planning via scenario modelling. Annals of Operations Research, 43, 311–335.

Freidenfelds, J. (1980). Capacity expansion when demand is a birth-death process. Operations Research, 28, 712–721.

Freidenfelds, J. (1981). Capacity expansion: Analysis of simple models with applications. New York, NY: North-Holland.

Gayon, J. P., & Dallery, Y. (2007). Dynamic vs static pricing in a make-to-stock queue with partially controlled production. Operations Research Spectrum, 29(2), 193–205.

Gayon, J. P., Talay, I., Karaesmen, F., & Ormeci, E. L. (2009). Optimal pricing and production policies of a make-to-stock system with fluctuating demand. Probability in the Engineering and Informational Science, 23, 205–230.

Gerchak, Y., & Grosfeld-Nir, A. (2004). Multiple lotsizing in production to order with random yields: Review of recent advances. Annals of Operations Research, 126(1–4), 43–69.

Ghosh, M. K., Arapostathis, A., & Marcus, S. I. (1993). Optimal control of switching diffusions with application to flexible manufacturing systems. SIAM Journal of Control and Optimization, 31, 1183–1204.

Haurie, A. (1995). Time scale decomposition in production planning for unreliable flexible manufacturing system. European Journal of Operational Research, 82, 339–358.

Henig, M., & Gerchak, Y. (1990). The structure of periodic review policies in the presence of random yield. Operations Research, 38(4), 634–643.

Jørgensen, S., Kort, P. M., & Zaccour, G. (1999). Production, inventory, and pricing under cost and demand learning effects. European Journal of Operational Research, 117(2), 382–395.

Karatzas, I. (1980). Optimal discounted linear control of the Wiener process. Journal of Optimization Theory and Applications, 31(3), 431–440.

Karlin, S. (1958). The application of renewal theory to the study of inventory policies. In K. Arrow, S. Karlin, & H. Scarf (Eds.), Studies in the mathematical theory of inventory and production. Stanford, CA: Stanford University Press.

Khmelnitsky, E., & Caramanis, M. (1998). One-machine \(N\)-part-type optimal set-up scheduling: Analytical characterization of switching surfaces. IEEE Transactions on Automatic Control, 43(11), 1584–1588.

Kim, H., Lu, J. C., Kvam, P. H., & Tsao, Y. C. (2011). Ordering quantity decisions considering uncertainty in supply-chain logistics operations. International Journal of Production Economics, 134(1), 16–27.

Kogan, K., & Perkins, J. R. (2003). Infinite horizon production planning with periodic demand: solvable cases and a general numerical approach. IIE Transactions, 35(1), 61–71.

Kogan, K., & Spiegel, U. (2006). Optimal policies for inventory usage, production and pricing of fashion goods over a selling period. Journal of the Operational Research Society, 57, 304–315.

Kogan, K., & Tapiero, C. (2007). Supply chain games: Operations management and risk valuation. Boston, MA: Springer.

Maimon, O., Khmelnitsky, E., & Kogan, K. (1998). Optimal flow control in manufacturing systems: Production planning and scheduling. Boston, MA: Kluwer.

Meybodi, M., & Foote, B. (1995). Hierarchical production planning and scheduling with random demand and production failure. Annals of Operations Research, 59, 259–280.

Mirzapour Al-e-hashem, S. J. M., Malekly, H., & Aryanezhad, M. B. (2011). A multi-objective robust optimization model for multi-product multi-site aggregate production planning in a supply chain under uncertainty. International Journal of Production Economics, 134(1), 28–42.

Sethi, S., & Thompson, G. L. (1980). Turnpike horizons for production planning. Management Science, 26(3), 229–241.

Sethi, S. P., Yan, H., Zhang, H., & Zhang, Q. (2002). Optimal and hierarchical controls in dynamic stochastic manufacturing systems. Manufacturing and Service Operations Management, 4, 133–170.

Tapiero, C. S. (1988). Applied stochastic models and control in management. New York, NY: North Holland.

Wu, D., & Olson, D. L. (2010a). Enterprise risk management: Coping with model risk in a large bank. Journal of the Operational Research Society, 61, 179–190.

Wu, D., & Olson, D. L. (2010b). Enterprise risk management: A DEA VaR approach in vendor selection. International Journal of Production Research, 48(16), 4919–4932.

Wu, O. Q., & Chen, H. (2010). Optimal control and equilibrium behavior of production-inventory systems. Management Science, 56(8), 1362–1379.

Wu, D., Olson, D. L., Seco, L. A., & Birge, J. R. (2011a). Introduction to the special issue on “operational research and Asia risk management”. Asia-Pacific Journal of Operational Research, 28(1), v–xi.

Wu, D., Olson, D. L., & Birge, J. R. (2011b). Introduction to the special issue on “Enterprise risk Management in Operations”. International Journal of Production Economics, 134(1), 1–2.

Yano, C. A., & Lee, H. L. (1995). Lot sizing with random yields: A review. Operations Research, 43(2), 311–334.

Yin, R., & Rajaram, K. (2007). Joint pricing and inventory control with a markovian demand model. European Journal of Operational Research., 182(1), 113–126.

Zipkin, P. (1989). Critical number polices for inventory models with periodic data. Management Science, 35(1), 71–80.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Here we detail the solution analysis of the dynamic coefficient \(a_2 (t)\). Substituting solution (20) for \(a_1 (t)\) in (21), we obtain a linear, first-order differential equation, with the general solution

where \(a_2 (T)=0\) is the terminal condition for determining constant \(k_3 \).

In (33), \(\int {a_1 (t)dt} \) takes the following form

That is,

Thus, (33) is reduced to

Therefore,

That is,

From the terminal condition, \(a_2 (T)=0\), we have \(k_3 =\frac{\alpha e^{2\sqrt{\beta r_2 }T}}{\beta }\). Therefore,

Appendix 2

Table 5 presents the set of parameters for an additional experiment.

We have computed the expected profits when varying both the volatility of potential demand, \(\sigma _a \), and the volatility of customer price sensitivity, \(\sigma _b \). As in the case of the original set of parameters (Fig. 2), the curve of the expected profit is concave. The observed maximum value is 7887.15 monetary units for \(\sigma _a =0.5\) (around 5 % of the mean potential demand) and \(\sigma _b =0.02\) (around 10 % of the mean customer price sensitivity).

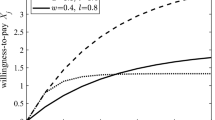

Similarly to Fig. 4, three different volatility modes are examined. The first mode refers to \(\sigma _a =0.5\) and \(\sigma _b =0.1\mu _b \), which result in near-optimal performance. The second mode refers to raising the volatility, \(\sigma _b \), up to 40 % of the mean, i.e., \(\sigma _a =0.5,\sigma _b =0.4\mu _b \) reflecting very high volatility of customer sensitivity to price. In the third mode the volatility, \(\sigma _a \), is set at 40 % of the mean, i.e., \(\sigma _a =4\) and \(\sigma _b =0.1\mu _b \), reflecting very high volatility of potential demand.

The difference between the profits obtained in modes 1 and 3 reflects the loss of profit due to the high volatility of potential demand. The difference between the profits obtained in modes 1 and 2 reflects the loss of profit due to the high volatility of customer price sensitivity. The higher the ratio of these differences, the lower the relative impact of the volatility of customer price sensitivity on profit as compared to the impact of the volatility of the potential demand on profit. This ratio, which is shown in Fig. 10, decreases from the factor of 4.24 for \({\mu _b }/{\mu _a }=0.005\), to 2.99 for \({\mu _b }/{\mu _a }=0.02\) (coincides with value of \({\mu _b }/{\mu _a }\) in Table 5) and then to 2.124 for \({\mu _b }/{\mu _a }=0.05\). Similarly to what was obtained for the original set, the conclusion is that the smaller the value of \({\mu _b }/{\mu _a }\), the lower the relative impact of volatility of customer sensitivity to price on the profit as compared to the impact of volatility of potential demand on the profit. Specifically, within the range of \({\mu _b }/{\mu _a }\) values [0, 0.0575], a range even larger than that obtained for the original set, the lower bound for this ratio is larger than 2, i.e., the impact of uncertainty in potential demand is two times greater than the impact of uncertainty in customer price sensitivity. Figure 10 shows that for the entire examined spectrum of ratios \({\mu _b }/{\mu _a }\), the expected profit for the cases of high volatility of potential demand is inferior to the expected profit for the cases of high volatility of customer price sensitivity.

Rights and permissions

About this article

Cite this article

Herbon, A., Kogan, K. Time-dependent and independent control rules for coordinated production and pricing under demand uncertainty and finite planning horizons. Ann Oper Res 223, 195–216 (2014). https://doi.org/10.1007/s10479-014-1616-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1616-4