Abstract

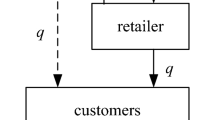

Bandit products have captured significant market shares in China and have started to expand throughout the world. A striking feature of supply chains for bandit products is decentralization, where the upstream firm determines the product quality and the downstream firms compete on prices. We study the competition between a centralized mainstream firm and a decentralized bandit supply chain. We demonstrate that the structural difference between the mainstream firm and the bandit supply chain reduces competition intensity and the quality difference between their products. Surprisingly, the inherent inefficiency in a bandit supply chain, combined with the force of competition, actually leads to both higher product quality and higher price. Furthermore, due to the free-riding effect, the bandit supply chain may even offer higher quality products than the mainstream firm. The mainstream firm’s profit as a function of the free-riding effect is U-shaped, so that free-riding by the bandit supply chain may eventually benefit the mainstream firm. Finally, decentralization benefits the bandit supply chain when the competition is on product features.

Similar content being viewed by others

Notes

Some bandit products are subject to suspicion of violating intellectual property laws and are a target of law enforcement actions. In this paper, we consider only legal bandit products, and focus on the impacts of their unique supply chain structure and free-riding.

We also analyzed a model that incorporates firm 1’s monopoly profit and firm 2’s timing decision, and found qualitatively similar results for our main research questions.

According to a Wall Street Journal report, some analysts estimate that MTK’s chipsets halved the time required to develop a phone and could lower costs by 25–50 % (Tsai 2010).

Recent industry evidence shows that bandit supply chains could have higher quality in comparison with mainstream firms’ products. For example, Tianyu, a well-known bandit product firm has begun to introduce high-end products (Lee et al. 2010).

References

Ai, X., Chen, J., & Ma, J. (2012). Contracting with demand uncertainty under supply chain competition. Annals of Operations Research, 201(1), 17–38.

Anderson, E. J., & Bao, Y. (2010). Price competition with integrated and decentralized supply chains. European Journal of Operational Research, 200(1), 227–234.

Banker, R. D., Khosla, I., & Sinha, K. K. (1998). Quality and competition. Management Science, 44(9), 1179–1192.

Başar, T., & Olsder, G. J. (1999). Dynamic noncooperative game theory (vol. 23). Society for Industrial Mathematics.

Bensoussan, A., Chen, S., & Sethi, S. P. (2014). Feedback Stackelberg solutions of infinite-horizon stochastic differential games. In F. El Ouardighi & K. Kogan (Eds.), Models and methods in economics and management sciences, Essays in honor of Charles S. Tapiero, Series 6161 (vol. 198, pp. 3–15). Cham: Springer.

Bohlmann, J. D., Golder, P. N., & Mitra, D. (2002). Deconstructing the pioneer’s advantage: Examining vintage effects and consumer valuations of quality and variety. Management Science, 48(9), 1175–1195.

Boyaci, T., & Gallego, G. (2004). Supply chain coordination in a market with customer service competition. Production and Operations Management, 13(1), 3–22.

Canaves, S., & Ye, J. (2009). Imitation is the sincerest form of rebellion in China. The Wall Street Journal.

Chambers, C., Kouvelis, P., & Semple, J. (2006). Quality-based competition, profitability, and variable costs. Management Science, 52(12), 1884–1895.

Chang, G. (2002). The cause and cure of china’s widening income disparity. China Economic Review, 13(4), 335–340.

Chintagunta, P. K., Bonfrer, A., & Song, I. (2002). Investigating the effects of store-brand introduction on retailer demand and pricing behavior. Management Science, 48(10), 1242–1267.

Cho, S. H., Fang, X., & Tayur, S. (2010). Combating strategic counterfeiters in licit and illicit supply chains. Working Paper, Tepper School of Business. Pittsburgh, PA: Carnegie Mellon University.

Corbett, C. J., & Karmarkar, U. S. (2001). Competition and structure in serial supply chains with deterministic demand. Management Science, 47(7), 966–978.

d’Aspremont, C., Gabszewicz, J. J., & Thisse, J. F. (1979). On Hotelling’s “stability in competition”. Econometrica, 47(5), 1145–1150.

Demirhan, D., Jacob, V. S., & Raghunathan, S. (2007). Strategic it investments: The impact of switching cost and declining it cost. Management Science, 53(2), 208–226.

Desai, P., Kekre, S., Radhakrishnan, S., & Srinivasan, K. (2001). Product differentiation and commonality in design: Boalancing revenue and cost drivers. Management Science, 47(1), 37–51.

Desai, P. S. (2001). Quality segmentation in spatial markets: When does cannibalization affect product line design? Marketing Science, 20(3), 265–283.

Grossman, G. M., & Shapiro, C. (1988a). Counterfeit-product trade. The American Economic Review, 78(1), 59–75.

Grossman, G. M., & Shapiro, C. (1988b). Foreign counterfeiting of status goods. The Quarterly Journal of Economics, 103(1), 79–100.

Güneş, E. D., Chick, S. E., Luk, N., & Van, W. (2010). Quality competition for screening and treatment services. Annals of Operations Research, 178(1), 201–222.

Ha, A. Y., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Management science, 54(4), 701–715.

Heatwole, A. -R. (2010). Shanzhai phones: Knock-offs are knocking on Africa’s door. Retrived May 21, 2012 from, http://www.mobileactive.org/shanzhai-phones-knock-offs-are-knocking-africas-door.

Hotelling, H. (1929). Stability in competition. The Economic Journal, 39(153), 41–57.

Jia, J. (2009). The low price strategy of Nokia. Retrieved May 21, 2012 from http://mnc.people.com.cn/GB/9179583.html. originally in Chinese, translated by the authors).

Kaya, Murat, & Özer, Özalp. (2009). Quality risk in outsourcing: Noncontractible product quality and private quality cost information. Naval Research Logistics (NRL), 56(7), 669–685.

Lee, H., Tseng, M. M., Siu, P., & Hoyt, D. W. (2010). Shanzhai (“bandit”) mobile phone companies: The guerrilla warfare of product development and supply chain management. Stanford, CA: Stanford Graduate School of Business Case GS-75.

Lehmann-Grube, U. (1997). Strategic choice of quality when quality is costly: The persistence of the high-quality advantage. The RAND Journal of Economics, 28(2), 372–384.

Lin, Y., Parlakturk, A., Swaminathan, J. (2013). Vertical Integration under Competition: Forward, backward, or no integration? Forthcoming, Production and Operations Management.

Liu, Y., & Tyagi, R. K. (2011). The benefits of competitive upward channel decentralization. Management Science, 57(4), 741–751.

Mills, D. E. (1995). Why retailers sell private labels. Journal of Economics and Management Strategy, 4(3), 509–528.

Moorthy, K. S. (1988). Product and price competition in a duopoly. Marketing Science, 7(2), 141–168.

Pauwels, K., & Srinivasan, S. (2004). Who benefits from store brand entry? Marketing Science, 23(3), 364–390.

Pekgün, P., Griffin, P.M., Keskinocak, P. (2009). Centralized vs. decentralized competition for price and lead-time sensitive demand. Working Paper, School of Industrial and Systems Engineering. Atlanta, GA: Georgia Tech.

Qian, Y. (2008). Impacts of entry by counterfeiters. Quarterly Journal of Economics, 123(4), 1577–1609.

Rhee, B. D. (1996). Consumer heterogeneity and strategic quality decisions. Management Science, 42(2), 157–172.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. The Review of Economic Studies, 49(1), 3–13.

Shih, W., Chien, C. -F., Wang, J. -C. (2010). Shanzai! MediaTek and the “white box” handset market. Cambridge, MA: Harvard Business School Case 610081.

Sun, J., Debo, L. G., Kekre, S., & Xie, J. (2010). Component-based technology transfer in the presence of potential imitators. Management Science, 56(3), 536–552.

Tirole, J. (1988). The theory of industrial organization. Cambridge: The MIT Press.

Tsai, T. (2010). Taiwan chip firm shakes up cellphone business. The Wall Street Journal.

Tyagi, R. K. (2000). Sequential product positioning under differential costs. Management Science, 46(7), 928–940.

Zhang, J., Hong, L. J., & Zhang, R. Q. (2012). Fighting strategies in a market with counterfeits. Annals of Operations Research, 192(1), 49–66.

Zhu, S., & Shi, Y. (2010). Shanzhai manufacturing-an alternative innovation phenomenon in china: Its value chain and implications for chinese science and technology policies. Journal of Science and Technology Policy in China, 1(1), 29–49.

Acknowledgments

The authors wish to thank three anonymous reviewers for their comments on an earlier version of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

Suppose that \(s_{1} > s_{2}\). Then, from (2), \((p_{1} - p_{2})/(s_{1} - s_{2}) > p_{2}/s_{2}\). Otherwise, the demand for the bandit product is zero, which is not a solution. We next show that \((p_{1} - p_{2})/(s_{1} - s_{2}) > p_{1}/s_{1}\). Suppose that \((p_{1} - p_{2})/(s_{1} - s_{2}) \le p_{1}/s_{1}\), which implies that \(p_{1} s_{2} - p_{2} s_{1} \le 0\). Moreover \((p_{1} - p_{2})/(s_{1} - s_{2}) > p_{2}/s_{2}\) implies that \(p_{1} s_{2} - p_{2} s_{1}>0\). This is a contradiction. Therefore, \((p_{1} - p_{2})/(s_{1} - s_{2}) > p_{1}/s_{1}\) also holds. Consequently, we have \(b > (p_{1} - p_{2})/(s_{1} - s_{2}) > \max (p_{1}/s_{1}, p_{2}/s_{2})\) from (1). \(\square \)

Proof of Lemma 2

First consider the case \(s_{1} > s_{2}\). Note from (5) and (6) that \(\partial ^{2} \pi _{1}(p_{1}|s_{1},s_{2}, p_{2})/\partial p_{1}^{2} =-2/(s_{1}-s_{2})<0\) and \(\partial ^{2}\pi _{3}(p_{2}|s_{1},s_{2}, w, p_{1})/\partial p_{2}^{2}=-2/(s_{1}-s_{2})<0\). Therefore, there exists a unique Nash equilibrium. The prices can be obtained by jointly solving the two first-order conditions: \(\partial \pi _{1}(p_{1}|s_{1},s_{2}, p_{2}) / \partial p_{1} = (-2p_{1}+ p_{2} + b (s_{1} - s_{2}) + \alpha s_{1}^{2}) /({s_{1} -s_{2}})=0\) and \(\partial \pi _{3}(p_{2}|s_{1},s_{2}, w, p_{1}) / \partial p_{2} = (-2p_{2} s_{1} + p_{1} s_{2} + s_{1} w) / [(s_{1}-s_{2})s_{2}] =0. \) We obtain the prices for products 1 and 2: \(p_{1}= [2b(s_{1}-s_{2})+w+2\alpha s_{1}^{2}]s_{1}/(4s_{1}-s_{2}), p_{2}= [b(s_{1}-s_{2})+\alpha s_{1}^{2} ]s_{2}+2ws_{1}/(4s_{1}-s_{2}). \) We can similarly prove the result for the case \(s_{1} < s_{2}\). \(\square \)

Proof of Lemma 3

Note that when \(s_{1} > s_{2}\), \(\partial ^{2}\pi _{2}(w,s_{2}|s_{1})/\partial w^{2}=2s_{1}(2s_{1}-s_{2})/[s_{2}(s_{2}-s_{1})(4s_{1}-s_{2})]<0\), which implies that \(\pi _{2} \) is concave with respect to \(w\). Then, firm 2’s wholesale price is obtained by differentiating \(\pi _{2}\) with respect to \(w\) and equating it to zero: \(s_{1} (b s_{2} ( s_{1} - s_{2}) + 2 s_{2} w - 4 s_{1} w - s_{2}^{3} + 2 s_{1} s_{2}^{2} + \alpha s_{1}^{2} s_{2} ) /{s_{2}(s_{2}-s_{1})(s_{2}-4s_{1})} =0\). Therefore

Similarly, for \(s_{1} < s_{2}\): \(w= s_{2} [ 2b(s_{2}-s_{1})+\left( 2s_{2} ^{2}-s_{1}s_{2}+s_{1}^{2}\right) \alpha ] /[2(2s_{2}-s_{1})]. \)

For the case that \(s_{1} > s_{2}\), \({\partial \pi _{2}(w,s_{2}|s_{1})}/{\partial s_{2}} = [ (8 s_{1}^{3}-20 s_{1}^{2} s_{2}+11 s_{1} s_{2}^{2}-2 s_{2}^{3} ) w^{2}+s_{1} s_{2}^{2} (13 s_{1}^{2}-10 s_{1} s_{2}+3 s_{2}^{2} ) w \alpha +s_{1}^{3} s_{2}^{3} (-8 s_{1}+5 s_{2}) \alpha ^{2}+b (s_{1}-s_{2})^{2} sx_{2}^{2} (w+s_{2} (-8 s_{1}+s_{2}) \alpha ) ] /[s_{2}^{2} (4 s_{1}^{2}-5 s_{1} s_{2}+s_{2}^{2} )^{2}s_{1}] = 0\). Therefore, \((8 s_{1}^{3}-20 s_{1}^{2} s_{2}+11 s_{1} s_{2}^{2}-2 s_{2}^{3} ) w^{2}+s_{1} s_{2}^{2} (13 s_{1}^{2}-10 s_{1} s_{2}+3 s_{2}^{2} ) w \alpha +s_{1}^{3} s_{2}^{3} (-8 s_{1}+5 s_{2}) \alpha ^{2}+b (s_{1}-s_{2})^{2} s_{2}^{2} (w+s_{2} (-8 s_{1}+s_{2}) \alpha ) =0\). Combining (23) and following a similar analysis for the case \(s_{1} < s_{2}\) we obtain (10).

Proof of Lemma 4

We first analyze the case \(s_{1} > s_{2}\). In this case, we have \(\partial \pi _{2}(s_{1}, s_{2}) / \partial s_{2} = s_{2} [b+(s_{1}-s_{2}) \alpha ] [b s_{2} (2 s_{1}^{2}+2 s_{1} s_{2}-s_{2}^{2} )+(-s_{1}+s_{2}) (-16 s_{1}^{3}+10 s_{1}^{2} s_{2}-4 s_{1} s_{2}^{2}+s_{2}^{3} ) \alpha ] /[4 (8 s_{1}^{2}-6 s_{1} s_{2}+s_{2}^{2} )^{2} ]\). Therefore, \({\partial ^{2} \pi _{2}(s_{1}, s_{2})}/{\partial s_{1} \partial s_{2}} = {A}/{2 (8 s_{1}^{2}-6 s_{1} s_{2}+s_{2}^{2} )^{3}}, \) where \(A = [b^{2} s_{1} s_{2} (16 s_{1}^{3}+24 s_{1}^{2} s_{2}-24 s_{1} s_{2}^{2}+5 s_{2}^{3} )+b (64 s_{1}^{6}-144 s_{1}^{5} s_{2}+144 s_{1}^{4} s_{2}^{2}-146 s_{1}^{3} s_{2}^{3}+81 s_{1}^{2} s_{2}^{4}-18 s_{1} s_{2}^{5}+s_{2}^{6} ) \alpha +(s_{1}-s_{2}) (64 s_{1}^{6}-224 s_{1}^{5} s_{2}+232 s_{1}^{4} s_{2} ^{2}-150 s_{1}^{3} s_{2}^{3}+64 s_{1}^{2} s_{2}^{4}-14 s_{1} s_{2}^{5} +s_{2}^{6} ) \alpha ^{2} ]\). It suffices to determine the sign of \(A\). We note that \(A = 64 s_{1}^{7}-288 s_{1}^{6} s_{2}+456 s_{1}^{5} s_{2}^{2}-382 s_{1}^{4} s_{2}^{3}+214 s_{1}^{3} s_{2}^{4}-78 s_{1}^{2} s_{2}^{5}+15 s_{1} s_{2}^{6}-s_{2}^{7}+{b^{2}}/{\alpha ^{2}} \left( 16 s_{1}^{4} s_{2}+24 s_{1}^{3} s_{2}^{2}-24 s_{1}^{2} s_{2}^{3}+5 s_{1} s_{2}^{4}\right) +b/\alpha \left( 64 s_{1}^{6}-144 s_{1}^{5} s_{2}+144 s_{1}^{4} s_{2}^{2}-146 s_{1}^{3} s_{2}^{3}+81 s_{1}^{2} s_{2}^{4}-18 s_{1} s_{2}^{5}+s_{2} ^{6}\right) \), and \(A\) is a quadratic function in \(b/\alpha \). Because \(16 s_{1}^{4} s_{2}+24 s_{1}^{3} s_{2}^{2}-24 s_{1}^{2} s_{2}^{3}+5 s_{1} s_{2}^{4} > 0\), then, it suffices to show that \(A ( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2} ) > 0\) and \(A^{\prime }( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2}) ) > 0.\) We calculate \(A ( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2}) ) = [(4 s_{1}-s_{2})^{3} (-2 s_{1}+s_{2})^{2} (32 s_{1}^{4}-68 s_{1}^{3} s_{2}+71 s_{1}^{2} s_{2}^{2}-33 s_{1} s_{2}^{3}+6 s_{2}^{4} )]/(8 s_{1}-3 s_{2})^{2}. \) Because \((4 s_{1}-s_{2})^{3} > 0\), \((-2 s_{1}+s_{2})^{2} > 0\) and \((8 s_{1}-3 s_{2})^{2} > 0\), we only need the sign of \(32 s_{1}^{4}-68 s_{1}^{3} s_{2}+71 s_{1}^{2} s_{2}^{2}-33 s_{1} s_{2}^{3}+6 s_{2}^{4}\). We know that \(32 s_{1}^{4}-68 s_{1}^{3} s_{2}+71 s_{1}^{2} s_{2}^{2}-33 s_{1} s_{2}^{3}+6 s_{2}^{4} = s_{1}^{2}(\sqrt{32}s_{1} + 34s_{2}/\sqrt{32})^{2} + 279s_{1}^{2}s_{2}^{2}/8-33 s_{1} s_{2}^{3}+6 s_{2}^{4} =s_{1}^{2}(\sqrt{32}s_{1} + 34s_{2}/\sqrt{32})^{2} + 33 s_{1} s_{2}^{2}(s_{1}-s_{2})+ 15s_{2}^{2}/8 +6 s_{2}^{4} >0\). Therefore, \(A ( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2} )) > 0\) holds.

We next show \(A^{\prime }( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2}) ) > 0\). Because \(A^{\prime }( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2}) ) = (2 s_{1}-s_{2}) (4 s_{1}-s_{2}) (64 s_{1}^{5}-88 s_{1}^{4} s_{2}+168 s_{1}^{3} s_{2}^{2}-121 s_{1}^{2} s_{2}^{3}+34 s_{1} s_{2}^{4}-3 s_{2}^{5} ) /(8 s_{1}-3 s_{2}). \) Note that \(2s_{1} - s_{2} >0\), \(4s_{1} - s_{2} >0\) and \(8 s_{1} - 3s_{2} >0\), so, it suffices to show the sign of \(64 s_{1}^{5}-88 s_{1}^{4} s_{2}+168 s_{1}^{3} s_{2}^{2}-121 s_{1}^{2} s_{2}^{3}+34 s_{1} s_{2}^{4}-3 s_{2}^{5}\). Because \(64 s_{1}^{5}-88 s_{1}^{4} s_{2}+168 s_{1}^{3} s_{2}^{2}-121 s_{1}^{2} s_{2}^{3}+34 s_{1} s_{2}^{4}-3 s_{2}^{5} = s_{1}^{3} (64 s_{1}^{2}- 88s_{1} s_{2} + 44^{2}/64 s_{2}^{2}) + 551 s_{1}^{3} s_{2}^{2} / 4 -121 s_{1}^{2} s_{2}^{3}+34 s_{1} s_{2}^{4}-3 s_{2}^{5} = s_{1}^{3} (64 s_{1}^{2}- 88s_{1} s_{2} + 44^{2}/64 s_{2}^{2}) + 67s_{1}^{3} s_{2}^{2}/4 +121 s_{1}^{2} s_{2}^{2}(s_{1}-s_{2})+31 s_{1} s_{2}^{4}+3 s_{2}^{4}(s_{1}-s_{2}) > 0. \) Then, \(A^{\prime }( (8 s_{1}^{2} - s_{1} s_{2} - s_{2}^{2})/(8 s_{1} - 3 s_{2}) ) > 0\) holds.

So far, we have shown that \(d s_{2}(s_{1})/ds_{1} \ge 0\) for \(s_{1} > s_{2}\). We next show that \(d s_{2}(s_{1})/ds_{1} \ge 0\) for \(s_{1} < s_{2}\). The cross partial of firm 2’s profit with respect to \(s_{1}\) and \(s_{2}\) is \(\pi _{2}(s_{1},s_{2}) /( \partial s_{1} \partial s_{2})= B s_{2}/ [ 2 (s_{1}-4 s_{2})^{3} (s_{1}-2 s_{2})^{3} ], \) where \(B = 4 s_{1} (s_{1}^{3}-3 s_{1}^{2} s_{2}-6 s_{1} s_{2}^{2}+20 s_{2}^{3} )b^{2}/\alpha ^{2} - 2 s_{2} (21 s_{1} ^{4}-122 s_{1}^{3} s_{2}+204 s_{1}^{2} s_{2}^{2}-72 s_{1} s_{2}^{3}+32 s_{2}^{4} ) b/\alpha - (s_{1}^{6}-18 s_{1}^{5} s_{2}+40 s_{1}^{4} s_{2}^{2}+152 s_{1}^{3} s_{2}^{3}-576 s_{1}^{2} s_{2}^{4}+512 s_{1} s_{2}^{5}-192 s_{2}^{6} ) \). We are going to prove that \(B > 0\). Because \(s_{1}^{3}-3 s_{1}^{2} s_{2}-6 s_{1} s_{2}^{2}+20 s_{2}^{3} > 0\) and \(b/\alpha \ge s_{1}/2 + s_{2}\). Therefore, it suffices to show that \(B(s_{1}/2 + s_{2})\ge 0\) and \(B^{\prime }(s_{1}/2 + s_{2})\ge 0\). We have that \(B(s_{1}/2 + s_{2}) = 2 (s_{1}-4 s_{2})^{2} (s_{1}-2 s_{2})^{2} (s_{2}-s_{1}) s_{2} >0\) and \(B^{\prime }(s_{1}/2 + s_{2}) = 2 (s_{1}-4 s_{2}) (s_{1}-2 s_{2})^{2} \left( 2 s_{1}^{2}-7 s_{1} s_{2}+2 s_{2}^{2}\right) \). As \(s_{2} < (7 + \sqrt{33})s_{1}/{4}\), \(B^{\prime }(s_{1}/2 + s_{2})>0 \). \(\square \)

Proof of Theorem 1

For ease of exposition, denote \(\pi _{2}^L(s_1)\) and \(\pi _{2}^H(s_1)\) to be firm 2’s best profits as a low-quality firm and a high-quality firm respectively, for a given \(s_1\). We first show that \(\pi _{2}^L(s_1)\) increases with respect to \(s_{1}\). The total derivative of \(\pi _{2}^L(s_1)\) with respect to \(s_{1}\) can be written as \({d \pi _{2}^L(s_1)}/{d s_{1}} = {\partial \pi _{2}(s_{1},s_{2}) }/{\partial s_{1}} + (\partial \pi _{2}(s_{1},s_{2}) / \partial s_{2} ) ({\partial s_{2}}/{\partial s_{1}}). \) The second term of the right-hand side of this equation is zero because of the optimality of \(s_{2}\). Therefore, from (12), \({d \pi _{2}^L(s_1)}/{d s_{1}} = {\partial \pi _{2}(s_{1},s_{2})}/{\partial s_{1}} = s_{2} [b+(s_{1}-s_{2}) \alpha ] [b s_{2} (2 s_{1}^{2}+2 s_{1} s_{2}-s_{2}^{2} )+(s_{1}-s_{2}) (16 s_{1}^{3}-10 s_{1}^{2} s_{2}+4 s_{1} s_{2}^{2}-s_{2}^{3} ) \alpha ]/[4 (8 s_{1}^{2}-6 s_{1} s_{2}+s_{2}^{2} )^{2}]. \) Note that \(b+(s_{1}-s_{2}) \alpha > 0\), \(s_{2} > 0\), and \(4 \left( 8 s_{1}^{2}-6 s_{1} s_{2}+s_{2}^{2}\right) ^{2} >0\), therefore, it suffices to show that \(b s_{2} \left( 2 s_{1}^{2}+2 s_{1} s_{2}-s_{2}^{2}\right) +(s_{1}-s_{2}) \left( 16 s_{1}^{3}-10 s_{1}^{2} s_{2}+4 s_{1} s_{2}^{2}-s_{2}^{3}\right) \alpha >0\). \(16 s_{1}^{3}-10 s_{1}^{2} s_{2}+4 s_{1} s_{2}^{2}-s_{2}^{3} \ge 15 s_{1} ^{3}-10 s_{1}^{2} s_{2}+4 s_{1} s_{2}^{2} >0 \) from \(s_{1} > s_{2}\). Therefore, combining the fact that \(b s_{2} \left( 2 s_{1}^{2}+2 s_{1} s_{2}-s_{2}^{2}\right) >0\) and \(s_{1} - s_{2} >0\), we conclude that \({d \pi _{2}^L(s_1)}/{d s_{1}} \ge 0\) as \(s_{1} >s_{2}\).

We next show that \(\pi _{2}^H(s_1)\) decreases with respect to \(s_{1}\). Note that \({d \pi _{2}^H(s_1)}/{d s_{1}} = {\partial \pi _{2}(s_{1},s_{2} )}/{\partial s_{1}} = s_{2}^{2} [2 b-(s_{1}+2 s_{2}) \alpha ] [2 b (s_{1}^{2}-2 s_{1} s_{2}-2 s_{2}^{2} )+ (s_{1}^{3}-14 s_{1}^{2} s_{2}+34 s_{1} s_{2}^{2}-12 s_{2}^{3} ) \alpha ]/{4 (s_{1}-4 s_{2})^{2} (s_{1}-2 s_{2})^{2}}. \) \(s_{2}^{2} [2 b-(s_{1}+2 s_{2}) \alpha ] >0\) follows from \(D_{2} >0\). In order to show that \({d \pi _{2}^H(s_1)}/{d s_{1}}<0\), we need to show that \(2 b \left( s_{1}^{2}-2 s_{1} s_{2}-2 s_{2}^{2}\right) +\left( s_{1}^{3}-14 s_{1}^{2} s_{2}+34 s_{1} s_{2}^{2}-12 s_{2}^{3}\right) \alpha <0\). Since \(s_{1}^{2} - 2 s_{1} s_{2} - 2s_{2}^{2} < 0\), therefore, from \(2b \ge (s_{1} + 2s_{2}) \alpha \), we have \(2 b (s_{1}^{2}-2 s_{1} s_{2}-2 s_{2}^{2} )+ (s_{1}^{3}-14 s_{1}^{2} s_{2}+34 s_{1} s_{2}^{2}-12 s_{2}^{3} ) \alpha \le 2 (s_{1}-4 s_{2}) (s_{1}-2 s_{2}) (s_{1}-s_{2}) \alpha < 0. \)

So far, we have shown that firm 2’s optimal profit decreases with respect to \(s_{1}\) as firm 2 is the high-quality provider; otherwise, it increases with respect to \(s_{1}\). Further, when \(s_1 = 0\) (resp. \(s_1 = \infty \)), the profit of firm 2 as the high- (resp. low-) quality provider is the same as the optimal profit of a monopolistic firm. In addition, \(\pi _{2}^H(\infty )=\pi _{2}^L(0)=0\). Consequently, \(\pi _{2}^H(0)>\pi _{2}^L(0)\) and \(\pi _{2}^L(\infty )>\pi _{2}^H(\infty )\). Therefore, there must exist a unique threshold \(s_{1}^{c}\) such that firm 2 will choose to be a high- (resp. low-) quality provider for \(s_1<s_{1}^{c}\) (resp. \(s_1>s_{1}^{c}\)). \(\square \)

Proof of Lemma 5

When \(s_{1} > s_{2}\), following (7–8), and (11), the profit margin and corresponding demand of firm 1 are respectively: \(p_{1} - \alpha s_{1}^{2} = [s_{1}(s_{1}-s_{2})[b ( 8 s_{1} - 3 s_{2}) + \alpha (s_{2}^{2} + s_{1} s_{2} - 8 s_{1}^{2})]/[4(s_{2}-2 s_{1})(s_{2} - 4 s_{1})], \) \(D_{1} = s_{1} [b ( 8 s_{1} - 3 s_{2}) + \alpha (s_{2}^{2} + s_{1} s_{2} - 8 s_{1} ^{2})]/[2 (s_{2} - 2 s_{1})(s_{2} - 4 s_{1})]. \) The profit of firm 1 is therefore: \(\pi _{1}(s_{1},s_{2})=[(s_{1}-s_{2})s_{1}^{2}\left[ b(-3s_{2} +8s_{1})+\left( s_{2}^{2}+s_{2}s_{1}-8s_{1}^{2}\right) \alpha \right] ^{2}]/[4(s_{2}-2s_{1})^{2}(s_{2}-4s_{1})^{2}]. \) Similarly, for the case \(s_{1} < s_{2}\): \(\pi _{1}(s_{1},s_{2}) =[s_{2}(s_{2}-s_{1})s_{1} (6bs_{2}-2bs_{1}+2\alpha s_{2}^{2}-7\alpha s_{1}s_{2}+2\alpha s_{1}^{2} )^{2}]/[4(2s_{2}-s_{1})^{2}(4s_{2}-s_{1})^{2}]. \) Combining with Theorem 1, we can obtain (15). \(\square \)

Results on the effect of cost asymmetry First, the profit functions of firms 1 and 3 given the qualities \(s_{1}\) and \(s_{2}\), and the wholesale price \(w\) of product 2 are

We can rewrite the profit functions as follows

We also obtain the profit of the supply chain

In addition, the prices of products 1 and 2 are

The profit margins of the two supply chains are

The demands for product 1 and 2 are

As the game leader, the profit function of firm 1 is

Proof of Lemma 6

By (24), when \(\alpha = 0\), the profit of firm 2 is

Note for a given \(s_{1}\), firm 2’s profit for \(s_{2}>s_{1}\) satisfies

This implies that firm 2 can always set a big quality value \(s_{2}\) so that it obtains a high profit. Therefore, firm 2 will choose to be the high-quality provider for any given \(s_{1}\). Consequently, firm 1 will be the low-quality provider.

When \(\alpha _{2} > 0\), firm 1’s profit is

By the envelope theorem, when \(s_{1} > s_{2}\), \({d \pi _{1}^{*}(\alpha _{2})}/{d \alpha _{2}} = [2 s_{1}^{2} [ b(3s_{2}-8s_{1})(s_{2}-s_{1})-s_{2}^{3}\alpha _{2}+2s_{2}^{2} s_{1}(\alpha _{2}-\alpha _{1})+9s_{2}s_{1}^{2}\alpha _{1}-8s_{1}^{3}\alpha _{1}) ](2s_{1}s_{2}^{2}-s_{2}^{3}) ]/[4(s_{2}-4s_{1})^{2}(s_{2}-2s_{1} )^{2} (s_{1}-s_{2})] \ge 0, \) because \(b(3s_{2}-8s_{1})(s_{2}-s_{1})-s_{2}^{3} \alpha _{2}+2s_{2}^{2}s_{1}(\alpha _{2}-\alpha _{1})+9s_{2}s_{1}^{2}\alpha _{1}-8s_{1}^{3}\alpha _{1}) \ge 0\) and \(2s_{1} s_{2}^{2} - s_{2}^{3} > 0\). When \(s_{1}< s_{2}\), \({d \pi _{1}^{*}(\alpha _{2})}/{d \alpha _{2}} = [2 s_{1}s_{2}[ -2 b (s_{1}-3 s_{2})(s_{1}-s_{2})+s_{1}(2 s_{1}^{2}-9 s_{1} s_{2}+8 s_{2}^{2} )\alpha _{1}+(s_{1}-2 s_{2}) \alpha _{2}s_{2}^{2} ](s_{1}-2s_{2})s_{2}^{2} ]/[4(s_{2}-s_{1})(2s_{2}-s_{1})^{2}(4s_{2}-s_{1})^{2}] \le 0, \) because \(-2 b (s_{1}-3 s_{2})(s_{1}-s_{2})+s_{1}\left( 2 s_{1}^{2}-9 s_{1} s_{2}+8 s_{2}^{2}\right) \alpha _{1}+(s_{1}-2 s_{2}) \alpha _{2}s_{2}^{2} \ge 0\) and \(s_{1}- 2s_{2} < 0\). That is, the optimal profit of firm 1 is increasing with \(\alpha _{2}\) when it is the high-quality provider, and decreasing with \(\alpha _{2}\) when it is the lower-quality provider.

When \(\alpha _{2} = \infty \), firm 1 will capture whole the market, and \(\pi _{2}^{*}(\infty ) = 0\). Therefore, when \(\alpha _{2}\) is big, firm 1 chooses to be the low-quality provider from the fact that \(d \pi _{1}^{*}(\alpha _{2})/d \alpha _{2} \ge 0\) as \(s_{1} > s_{2}\), and \(d \pi _{1}^{*}(\alpha _{2})/d \alpha _{2} \le 0\) as \(s_{1} < s_{2}\). From the above observations, we can conclude that as \(\alpha _{2}\) increases, firm 1 first chooses to be the low quality firm, and then it switches to being the high-quality provider. \(\square \)

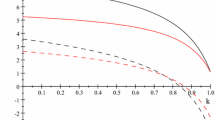

Proof of Theorem 3

It follows from Lemma 6 that firm 1 is the high-quality provider when \(\alpha _{2}\) is large. However, when firm 1 is the high-quality provider, its profit increases in \(\alpha _{2}\) (see the proof of Lemma 6). Furthermore, the firm’s profit decreases in \(\alpha _{2}\) when it is the low-quality provider. Consequently, firm 1’s profit as a function of \(\alpha _{2}\) is U-shaped: it first decreases and then increases in \(\alpha _{2}\). \(\square \)

Proof of Theorem 4

As \(\gamma = 0\), it is clear that firm 2’s demand is zero. Therefore, its product quality is zero. Consequently, firm 1 is the high-quality provider.

As \(\gamma \in (0,1)\), and \(s_{1} < \gamma s_{2}\) we have that \({d\pi _{1} ^{*}(\gamma )}/{d \gamma } = {\partial \pi _{1}(s_{1},\gamma )}/{\partial \gamma } [s_{1}^{2} s_{2} [-2 b (s_{1}-3 s_{2} \gamma ) (s_{1}-s_{2} \gamma )+\alpha (2 s_{1}^{3}-9 s_{1}^{2} s_{2} \gamma -2 s_{2}^{3} \gamma +s_{1} s_{2}^{2} (1+8 \gamma ^{2}))]]/[ 4 (s_{1}-4 s_{2} \gamma )^{3} (s_{1}-2 s_{2} \gamma )^{3} (s_{1}-s_{2} \gamma )^{2} ][2 b (s_{1}-s_{2} \gamma ) (5 s_{1}^{3}-29 s_{1}^{2} s_{2} \gamma +54 s_{1} s_{2}^{2} \gamma ^{2}-24 s_{2}^{3} \gamma ^{3})-\alpha (8 s_{1}^{5}-59 s_{1}^{4} s_{2} \gamma -48 s_{2}^{5} \gamma ^{3}-24 s_{1}^{2} s_{2}^{3} \gamma (2+7 \gamma ^{2}) +4 s_{1} s_{2}^{4} \gamma ^{2} (21+16 \gamma ^{2})+s_{1}^{3} s_{2}^{2} (9+158 \gamma ^{2}))] \) We know that \(4 (s_{1}-4 s_{2} \gamma )^{3} (s_{1}-2 s_{2} \gamma )^{3} (s_{1}-s_{2} \gamma )^{2} >0\) because \(s_{1} < \gamma s_{2}\). It is also clear that \(s_{1}^{2} s_{2} [-2 b (s_{1}-3 s_{2} \gamma ) (s_{1}-s_{2} \gamma )+\alpha (2 s_{1}^{3}-9 s_{1}^{2} s_{2} \gamma -2 s_{2}^{3} \gamma +s_{1} s_{2}^{2} (1+8 \gamma ^{2}))] \ge 0\) because of the non-negativity of the demand. We can also show that \([2 b (s_{1}-s_{2} \gamma ) (5 s_{1}^{3}-29 s_{1}^{2} s_{2} \gamma +54 s_{1} s_{2}^{2} \gamma ^{2}-24 s_{2}^{3} \gamma ^{3} )-\alpha (8 s_{1}^{5}-59 s_{1}^{4} s_{2} \gamma -48 s_{2}^{5} \gamma ^{3}-24 s_{1}^{2} s_{2}^{3} \gamma (2+7 \gamma ^{2} )+4 s_{1} s_{2}^{4} \gamma ^{2} (21+16 \gamma ^{2} )+s_{1}^{3} s_{2}^{2} (9+158 \gamma ^{2} ) ) ] \le 0 \) by using \(s_{1} < s_{2} \gamma \) extensively. Therefore, firm 2’s profit decreases with respect to \(\gamma \) as \(s_{1} < s_{2} \gamma \). Similarly, we can show that this holds as \(s_{1} > s_{2} \gamma \).

As \(\gamma = 1\), firm 1 is the high-quality provider from Theorem 2. Therefore, we conclude that firm 1 will always be the high-quality provider regardless of the value of \(\gamma \). \(\square \)

Proof of Theorem 6

As \(x_{1} < x_{2}\), firm 1’s optimal profit is \(\pi _{1}^{*} = \max _{x_{2} < x_{1}} \pi _{1} \). From the enveloping theorem and (22), the derivative of firm 1’s optimal profit over the cost difference is

Since \(\Delta < 4b/3\), we have \(3 \Delta -19 b^{2}-x_{1} (x_{1}+2 \sqrt{( x_{1}-2 b)^{2}-3 \Delta } )-2 b (x_{1}+4 \sqrt{( x_{1}-2 b)^{2}-3 \Delta } ) < 0\). That is \(d\pi _{1}^{*} /d \Delta < 0\) for \(x_{1} < x_{2}\). When \(\Delta = 0\), \(x_{1} < x_{2}\) can be a solution as shown in Sect. 5.1. If we keep \(c_{1}\) fixed, then a decreasing \(\Delta \) means an increasing \(c_{2}\). Therefore, we can conclude. \(\square \)

Rights and permissions

About this article

Cite this article

Li, M., Sethi, S.P. & Zhang, J. Competing with bandit supply chains. Ann Oper Res 240, 617–640 (2016). https://doi.org/10.1007/s10479-014-1632-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1632-4