Abstract

The paper explores the implications of heterogeneous consumer response to advertising for the equilibrium strategies chosen by firms in a distribution channel. We solve a simple game theoretic model using a variation of consumers’ Hotelling utility model for a decentralized and a coordinated channel. The key findings show that heterogeneity considerably affects the value of channel coordination. Overlooking heterogeneous responses to advertising can lead to either undercutting or overestimating channel coordination benefits. In particular, our results indicate that, in contrast to previous findings in the literature, channel coordination might result in higher consumer prices especially when the average response to brand advertising exceeds consumers’ marginal disutility cost.

Similar content being viewed by others

Notes

We thank an anonymous reviewer for suggesting this extension.

Due to the linear quadratic structure of the game, we verify that second-order conditions are satisfied.

References

Ackerberg, D. (2001). Empirically distinguishing informative and prestige effects of advertising. RAND Journal of Economics, 32, 100–118.

Ackerberg, D. (2003). Advertising, learning, and consumer choice in experience good markets: A structural empirical examination. International Economic Review, 44, 1007–1040.

Albuquerque, P., & Bronnenberg, B. J. (2009). Estimating demand heterogeneity using aggregated data: An application to the frozen pizza category. Marketing Science, 28(2), 356–372.

Allenby, G. M., Arora, N., & Ginter, J. L. (1998). On the heterogeneity of demand. Journal of Marketing Research, 35, 384–389.

Becker, G. S., & Murphy, K. M. (1993). A simple theory of advertising as a good or bad. Quarterly Journal of Economics, 108(4), 941–964.

Brusco, M. J., Cradit, J. D., & Stahl, S. (2002). A simulated annealing heuristic for a bicriterion partitioning problem in market segmentation. Journal of Marketing Research, 39(1), 99–109.

Chintagunta, P. K. (2001). Endogeneity and heterogeneity in a Probit demand model: estimation using aggregate data. Marketing Science, 20(4), 442–457.

Chu, W., & Desai, P. S. (1995). Channel coordination mechanisms for customer satisfaction. Marketing Science, 14(4), 343–359.

Green, P. E., & Krieger, A. M. (1991). Segmenting markets with conjoint analysis. Journal of Marketing, 55(4), 20–31.

Gupta, S., & Chintagunta, P. K. (1994). On using demographic variables to determine segment membership in Logit mixture models. Journal of Marketing Research, 31(1), 128–36.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–57.

Ingene, C. A., & Parry, M. E. (1995). Channel coordination when retailers compete. Marketing Science, 14(4), 360–377.

Jeuland, A. P., & Shugan, S. M. (1983). Managing channel profits. Marketing Science, 2(3), 239–272.

Johnson, J. P., & Myatt, D. P. (2006). On the simple economics of advertising, marketing, and product design. American Economic Review, 96(3), 756–784.

Jørgensen, S., & Zaccour, G. (1999). Equilibrium pricing and advertising strategies in a marketing channel. Journal of Optimization Theory and Applications, 102(1), 111–125.

Jørgensen, S., Taboubi, S., & Zaccour, G. (2001). Cooperative advertising in a marketing channel. Journal of Optimization Theory and Applications, 110, 145–158.

Kantar Media online report. (2010). http://kantarmediana.com/intelligence/press/kantar-media-reports-us-advertising-expenditures-increased-57-first-half-2010.

Karray, S., & Martin-Herran, G. (2008). Investigating the relationship between advertising and pricing in a channel with private label offering: A theoretic model, Review of Marketing Science, 6(1).

Karray, S., & Martin-Herran, G. (2009). A dynamic model for advertising and pricing competition between national and store brands. European Journal of Operational Research, 193(2), 451–467.

Karray, S., & Zaccour, G. (2006). Could co-op advertising be a manufacturer’s counterstrategy to store brands? Journal of Business Research, 59(9), 1008–1015.

Karray, S., & Zaccour, G. (2007). Effectiveness of coop advertising programs in competitive distribution channels. International Game Theory Review, 9(2), 151–167.

Kim, S. Y., & Staelin, R. (1999). Manufacturer allowances and retailer pass-through rates in a competitive environment. Marketing Science, 18(1), 59–76.

Kaul, A., & Wittink, D. R. (1995). Empirical generalizations about the impact of advertising on price sensitivity and price. Marketing Science, 14(3), 151–160.

Manchanda, P., Dubé, J. P., & Chintagunta, P. K. (2006). The effect of banner advertising on internet purchasing. Journal of Marketing Research, 43(1), 98–108.

Parker, P. M., & Soberman, D. A. (2006). The economics of quality-equivalent store brands. International Journal of Research in Marketing, 23, 125–139.

Putrevu, S., & Lord, K. R. (1994). Comparative and noncomparative advertising: Attitudinal effects under cognitive and affective involvement conditions. Journal of Advertising, 23(2), 77–91.

Shaffer, G., & Zettelmeyer, F. (2004). Advertising in a distribution channel. Marketing Science, 23(4), 619–628.

Simon, C., & Sullivan, M. W. (1993). The measurement and determinants of brand equity: A financial approach. Marketing Science, 12, 28–52.

Sudhir, K. (2001). Structural analysis of manufacturer pricing in the presence of a strategic retailer. Marketing Science, 20(3), 244–264.

Vakratsas, D., & Ambler, T. (1999). How advertising works: What do we really know. Journal of Marketing, 63(January), 26–43.

Yoo, B., Donthu, N., & Lee, S. (2000). An examination of selected marketing mix elements and brand equity. Journal of the Academy of Marketing Science, 28(2), 195–211.

Wang, C. J., Chen, Y. J., & Wu, C. C. (2011). Advertising competition and industry channel structure. Marketing Letters, 22, 79–99.

Acknowledgments

The author thanks the Natural Sciences and Engineering Research Council of Canada (NSERC) for their financial support.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix: The decentralized channel

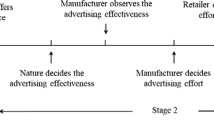

Equilibrium advertising, prices and profits are obtained by solving the three-stage game backwards. We start by solving the retailer’s pricing problem and maximize the retailer’s profits with respect to the retail price (p) by solving the first-order condition (\(\frac{\partial \Pi _\mathrm{R} }{\partial \mathrm{p}}=0\)) in (p). We obtain the price reaction to advertising and to the wholesale price in Eq. (3).

Then, we substitute p by Eq. (3) into the manufacturer’s profit function and maximize the obtained expression w.r.t. the wholesale price (w). Solving the first-order condition (\(\frac{\partial \Pi _\mathrm{M} }{\partial \mathrm{w}}=0\)) in (w), we get the result in Eq. (4). Finally, substitute (w) back in the manufacturer’s profits and solve its first-order condition (\(\frac{\partial \Pi _\mathrm{M} }{\partial \mathrm{a}}=0\)) in (a) to obtain the equilibrium advertising for the game denoted by (\(\mathrm{a}^\mathrm{d}\)) and which expression is in Table 1.Footnote 2

The equilibrium wholesale price (\(\mathrm{w}^\mathrm{d}\)) is then obtained by substituting advertising by (\(\mathrm{a}^\mathrm{d}\)) in Eq. (4). The equilibrium retail price is found by substituting (w) by (\(\mathrm{w}^\mathrm{d}\)) and (a) by (\(\mathrm{a}^\mathrm{d}\)) back in Eq. (3). We finally replace the equilibrium in the profit functions and in \(\mathrm{x}_\mathrm{I}\) to obtain equilibrium profits and demands such as in Table 1.

Proof of Proposition 2

Results are obtained by computing the derivatives of the variables (\(\mathrm{a}^\mathrm{d}, \mathrm{p}^\mathrm{d}, \Pi _\mathrm{R}^\mathrm{d} , \Pi _\mathrm{M}^\mathrm{d}\)) w.r.t. the parameters (\(\mathrm{s}_\mathrm{H} , \mathrm{s}_\mathrm{L} , \upalpha \)), which gives

therefore

Similarly,

therefore,

Finally, from the equilibrium solution in Table 1, it is easy to see that the expressions of \(\frac{\partial \mathrm{w}^\mathrm{d}}{\partial \mathrm{y}}, \frac{\partial \Pi _\mathrm{R}^\mathrm{d} }{\partial \mathrm{y}}, \frac{\partial \Pi _\mathrm{M}^\mathrm{d} }{\partial \mathrm{y}}, \frac{\partial \mathrm{D}^\mathrm{d}}{\partial \mathrm{y}}\) would have the same sign as \(\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \mathrm{y}},\forall \mathrm{y}\in \left( {\mathrm{s}_\mathrm{H} , \mathrm{s}_\mathrm{L} , \upalpha } \right) \) and are hence positive.

Proof of Proposition 3

Results are obtained by computing the derivatives of the variables (\(\mathrm{a}^\mathrm{d}, \mathrm{p}^\mathrm{d}, \Pi _\mathrm{R}^\mathrm{d} , \Pi _\mathrm{M}^\mathrm{d}\)) w.r.t. the parameter (t), which gives;

Finally, from the equilibrium solution in Table 1, it is easy to see that the expressions of \(\frac{\partial \mathrm{w}^\mathrm{d}}{\partial \mathrm{t}}, \frac{\partial \Pi _\mathrm{R}^\mathrm{d} }{\partial \mathrm{t}}, \frac{\partial \Pi _\mathrm{M}^\mathrm{d} }{\partial \mathrm{t}}, \frac{\partial \mathrm{D}^\mathrm{d}}{\partial \mathrm{t}}\) would have the same sign as \(\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \mathrm{t}}\) and are hence negative.

The coordinated channel

For the coordinated channel, the problem is to maximize total channel profits (\(\Pi \)) with respect to consumer price and advertising such as;

The equilibrium advertising and price are obtained by solving the two-stage game backwards. We start by solving the pricing problem and maximize the total channel profits (\(\Pi \)) with respect to the retail price (p) by solving the first-order condition (\(\frac{\partial \Pi }{\partial \mathrm{p}}=0\)) in (p). We obtain the following price reaction to advertising

In a second stage, we substitute (p) back in the channel’s profits and solve the first-order condition (\(\frac{\partial \Pi }{\partial \mathrm{a}}=0\)) in (a) to obtain the equilibrium advertising for the coordinated game

The equilibrium price is found by substituting and (a) by (\(\mathrm{a}^\mathrm{c}\)) back in (6), which gives

We finally replace the equilibrium in the profit functions and in (\(\mathrm{x}_\mathrm{I}\)) to obtain equilibrium profits and demands such as in Table 1.

Proof of Proposition 4

therefore,

Similarly,

therefore,

Compute the derivatives of equilibrium advertising and pricing w.r.t. the cost parameter (t) to obtain;

Finally, from the equilibrium solution in Table 1, it is easy to see that the expressions of \(\frac{\partial \Pi ^\mathrm{c}}{\partial \mathrm{y}}, \frac{\partial \mathrm{D}^\mathrm{c}}{\partial \mathrm{y}}\) would have the same sign as \(\frac{\partial \mathrm{p}^\mathrm{c}}{\partial \mathrm{y}},\forall \mathrm{y}\in \left( {\mathrm{s}_\mathrm{H} , \mathrm{s}_\mathrm{L} , \upalpha , t} \right) \).

We can then conclude that (\(\frac{\partial \mathrm{n}^\mathrm{c}}{\partial \mathrm{y}}\)) and (\(\frac{\partial \mathrm{n}^\mathrm{d}}{\partial \mathrm{y}}\)) have the same sign, \(\forall \mathrm{n}\in \left( {\mathrm{a, p, D}, \Pi } \right) \) and \(\forall \mathrm{y}\in \left( {\mathrm{s}_\mathrm{H} , \mathrm{s}_\mathrm{L} , \upalpha , \mathrm{t}} \right) \).

Comparing the sensitivity of equilibrium solution to changes in the model’s parameters across the coordinated and the decentralized channel structures, we obtain;

with

hence \(\mathrm{A}>0\), which implies that \(\frac{\partial \mathrm{a}^\mathrm{c}}{\partial \mathrm{s}_\mathrm{H} }>\frac{\partial \mathrm{a}^\mathrm{d}}{\partial \mathrm{s}_\mathrm{H} }, \; \frac{\partial \mathrm{a}^\mathrm{c}}{\partial \mathrm{s}_\mathrm{L} }>\frac{\partial \mathrm{a}^\mathrm{d}}{\partial \mathrm{s}_\mathrm{L} }\) and \(\frac{\partial \mathrm{a}^\mathrm{c}}{\partial \upalpha }>\frac{\partial \mathrm{a}^\mathrm{d}}{\partial \upalpha }\).

hence \(\mathrm{B}>0\), which implies that \(\frac{\partial \mathrm{p}^\mathrm{c}}{\partial \mathrm{s}_\mathrm{H} }>\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \mathrm{s}_\mathrm{H} }, \; \frac{\partial \mathrm{p}^\mathrm{c}}{\partial \mathrm{s}_\mathrm{L} }>\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \mathrm{s}_\mathrm{L} }, \; \frac{\partial \mathrm{p}^\mathrm{c}}{\partial \upalpha }>\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \upalpha }\) and \(\frac{\partial \mathrm{p}^\mathrm{c}}{\partial \mathrm{t}}<\frac{\partial \mathrm{p}^\mathrm{d}}{\partial \mathrm{t}}\).

hence \(\mathrm{E}>0\), which implies that \(\frac{\partial \mathrm{a}^\mathrm{c}}{\partial \mathrm{t}}<\frac{\partial \mathrm{a}^\mathrm{d}}{\partial \mathrm{t}}\).

Effect of channel coordination

Proof of Proposition 5

Comparison of equilibrium strategies and outputs from the coordinated and the uncoordinated channels gives;

therefore

and since \(\mathrm{x}_\mathrm{H}^\mathrm{c} > \mathrm{x}_\mathrm{H}^\mathrm{d}\) and \(\mathrm{x}_\mathrm{L}^\mathrm{c} > \mathrm{x}_\mathrm{L}^\mathrm{d}\), we get;

Model extension to the case where the retailer also invests in local advertising

We extend the model in the paper to consider the retailer’s local advertising \(n\). A consumer who belongs to segment \(I\in (L,H)\) and is located at distance \(x\in (0,1)\) from his/her ideal point, pays a price (\(p\)) for the product and derives a utility of \(U_{I } (a, n, p, x)\) given by;

For the decentralized channel, each channel members maximizes its profit function such as

For the coordinated channel, the total channel profit is given by

We solve the optimization problem for the coordinated channel to find the optimal strategies in p, n and a. For the decentralized channel, we solve a three-stage-game as in the previous sections, with the difference that the retailer now chooses simultaneously its price and local advertising effort.

Equilibrium solution is obtained using the backward induction method. We can easily verify that interior solutions are obtained for \(t > 3 \delta ^{2}/4\) in the case of the decentralized channel and for \(t > \delta ^{2}\) for the coordinated channel.

It is given in Table 3.

Assuming interior equilibrium solutions for both the decentralized and the coordinated channels, we find, similarly to the paper that

In fact;

Rights and permissions

About this article

Cite this article

Karray, S. Modeling brand advertising with heterogeneous consumer response: channel implications. Ann Oper Res 233, 181–199 (2015). https://doi.org/10.1007/s10479-014-1656-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1656-9