Abstract

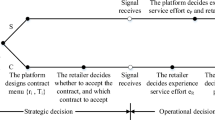

In this study we investigate the effort of a service platform in cooperation with a hotel and its influence on the hotel’s decision about the quantity of reserved rooms. We begin with a newsvendor hotel facing two kinds of customers: D-customers and C-customers. The D-customers order rooms from the hotel’s front desk while the C-customers book rooms through a service platform, i.e., Ctrip.com. The hotel makes decisions about how many rooms to allot to Ctrip.com to achieve optimal profit. Two newsvendor settings are proposed that depict the demands of the two parties independently. We discuss a fixed payment contract and a cost sharing contract and find that the cost sharing contract achieves channel coordination and that the division of profit depends upon the hotel’s payment to Ctrip.com. We then extend our study by taking into consideration the effort Ctrip.com exerts. We verify that a cost sharing contract can achieve channel coordination imperfectly if the idle cost of a vacant reserved room is shared between the hotel and Ctrip.com. Further, given that the cost of effort is shared, the channel is coordinated and a win–win is guaranteed as well if the terms of the new cost sharing contract are properly chosen.

Similar content being viewed by others

References

Antia, K. D., Bergen, M., & Dutta, S. (2004). Competing with gray markets. MIT Sloan Management Review, 46(Fall), 63–69.

Armstrong, M. (2006). Competition in two-sided markets. The RAND Journal of Economics, 37(3), 668–691.

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science, 11, 227–339.

Cachon, G. P. (2004). The allocation of inventory risk in a supply chain: Push, pull, and advance-purchase discount contracts. Management Science, 50(2), 222–238.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Carlton, D. W., & Chevalier, J. A. (2001). Free riding and sales strategies for the internet. The Journal of Industrial Economics, 49(4), 441–461.

Chesbrough, H. (2010). Open services innovation: Rethinking your business to grow and compete in a new era. London: Wiley.

Chesbrough, H. (2011). Bringing open innovation to services. MIT Sloan Management Review, 52(2), 85–90.

Chu, W., & Desai, P. S. (1995). Channel coordination mechanisms for customer satisfaction. Marketing Science, 14(4), 343–359.

Cusumano, M. A., & Gawer, A. (2003). The elements of platform leadership. IEEE Engineering Management Review, 31(1), 8–15.

Fudenberg, D., & Tirole, J. (1991). Game theory, 1991. Cambridge: The MIT Press.

Gawer, A., & Cusumano, M. A. (2008). How companies become platform leaders. MIT Sloan Management Review, 49(2), 28–35.

Gawer, A., & Henderson, R. (2007). Platform owner entry and innovation in complementary markets: Evidence from Intel. Journal of Economics and Management Strategy, 16(1), 1–34.

Gurnani, H., & Erkoc, M. (2008). Supply contracts in manufacturer-retailer interactions with manufacturer-quality and retailer effort-induced demand. Naval Research Logistics (NRL), 55(3), 200–217.

Gurnani, H., Erkoc, M., & Luo, Y. (2007). Impact of product pricing and timing of investment decisions on supply chain co-opetition. European Journal of Operational Research, 180(1), 228–248.

He, Y., Zhao, X., Zhao, L., & He, J. (2009). Coordinating a supply chain with effort and price dependent stochastic demand. Applied Mathematical Modelling, 33(6), 2777–2790.

Karray, S. (2011). Effectiveness of retail joint promotions under different channel structures. European Journal of Operational Research, 210(3), 745–751.

Krishnan, H., Kapuscinski, R., & Butz, D. A. (2004). Coordinating contracts for decentralized supply chains with retailer promotional effort. Management Science, 50(1), 48–63.

Lariviere, M. A., & Padmanabhan, V. (1997). Slotting allowances and new product introductions. Marketing Science, 16(2), 112–128.

Parker, G. G., & Van Alstyne, M. W. (2005). Two-sided network effects: A theory of information product design. Management Science, 51(10), 1494–1504.

Pasternack, B. A. (2008). Optimal pricing and return policies for perishable commodities. Marketing Science, 27(1), 133–140.

Shapiro, C., & Varian, H. R. (1998). Versioning: The smart way to. Harvard Business Review, 107(6), 107.

Shin, J. (2007). How does free riding on customer service affect competition? Marketing Science, 26(4), 488–503.

Taylor, T. A. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Taylor, T. A., & Xiao, W. (2009). Incentives for retailer forecasting: Rebates vs. returns. Management Science, 55(10), 1654–1669.

Tsay, A. A. (1999). The quantity flexibility contract and supplier-customer incentives. Management Science, 45(10), 1339–1358.

Tucker, C., & Zhang, J. (2010). Growing two-sided networks by advertising the user base: A field experiment. Marketing Science, 29(5), 805–814.

Wu, D., Ray, G., Geng, X., & Whinston, A. (2004). Implications of reduced search cost and free riding in e-commerce. Marketing Science, 23(2), 255–262.

Xie, J., & Neyret, A. (2009). Co-op advertising and pricing models in manufacturer-retailer supply chains. Computers and Industrial Engineering, 56(4), 1375–1385.

Xing, D., & Liu, T. (2012). Sales effort free riding and coordination with price match and channel rebate. European Journal of Operational Research, 219(2), 264–271.

Acknowledgments

This work was supported by the National Natural Science Foundation of China (Grant Nos. 71371008 and 71001093), Major International (Regional) Joint Research Projects (Grant No. 71110107024), the National Natural Science Foundation of China for Innovative Research Groups (Grant No. 71121061) and Major Program (Grant No. 71090400/71090401) of Natural Science Foundation of China. The authors thank two reviewers for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Explaining and proofs

Appendix: Explaining and proofs

Proof of Lemma 1

For

Taking derivative of \(\pi _c (Q)\) gives

Obviously, \({\pi }^{\prime }_c (Q)\) is continuous and decreasing in Q.

-

(a)

If \({\pi }^{\prime }_c (0)\le 0\), \(\pi _c (Q)\) has a unique maximizer and 0 is the unique solution.

-

(b)

If \({\pi }^{\prime }_c (0)\,{\ge }\,0\), since \({\pi }^{\prime }_c (K)=-(p_t -c_v +c_u)F_t (K)-(p_h -p_t)<0, \pi _c (Q)\) is quasi-concave and has a unique maximizer.

Together we know \(\pi _c (Q)\) has a unique maximizer.

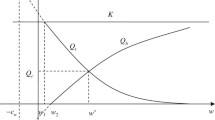

Proof of Lemma 2

(i) For

The first-order-condition yields

Similar to proof of Lemma 1, \(\pi _w^h (Q)\) is quasi-concave and has a unique maximizer.

(ii) The derivative of \(\pi _w^h (Q)\) at \(Q=Q_c\) is

Since \(\pi _w^h (Q)\) is increasing first and then decreasing in Q. Hence there must be \(Q_w \le Q_c\).

Proof of Lemma 3

(i) For

Consider the first-order condition for \(\pi _\beta ^h (Q)\):

The proof is similar to that of Lemma 1 and omitted.

(ii) The derivative of \(\pi _\beta ^h (Q)\) at \(Q=Q_w\) is

Thus \(Q_\beta \ge Q_w\).

(iii) Let us change \(\beta \) to \(\beta +\delta \), where \(\delta >0\). From (EC.3), we have

Let \(Q=Q_\beta \), we have \(\left. {{\pi }_w^{{\prime }h{*}} (Q)} \right| _{Q=Q_\beta } =\delta F_t (Q_c)>0\). For \({\pi }_\beta ^{{\prime }h{*}} (Q)\) is also continuous and decreasing in Q, we know that \(Q_\beta ^{*} >Q_\beta \), where \(Q_\beta ^{*}\) is the solution to \({\pi }_\beta ^{{\prime }h{*}} (Q)=0\). Then we know \(Q_\beta \) is increasing in \(\beta \).

Proof of Theorem 1

Let \(w^{{*}}\in (0,p_t -c_v),\beta ^{{*}}=\frac{w^{{*}}(1-F_t (Q_c))}{c_u F_t (Q_c)}\), we have

\(\left. {{\pi }_\beta ^{{\prime }h} (Q)} \right| _{Q=Q_c } =\pi _c (Q_c )+[w^{{*}}F_t (Q_c)-w^{{*}}+\beta ^{{*}}c_u F_t (Q_c )]=0,\) which means that \(Q_\beta =Q_c\). In other words, the cost sharing contract achieves channel coordination. Furthermore, the resulting profit to Ctrip.com is \(\pi _\beta ^t =\frac{w^{{*}}}{F_t (Q_c)}\int _0^{Q_c } {xf_t (x)dx} =w^{{*}}r\).

Proof of Lemma 4

For

If \(\pi _\beta ^h \ge \pi _w^h\), we have \(\beta \le \beta _1 =\frac{w\left[ E\left( Q_\beta \wedge D_t\right) -E\left( Q_w \wedge D_t\right) \right] }{c_u \left[ Q_\beta -E\left( Q_\beta \wedge D_t\right) \right] }\); If \(\pi _\beta ^t \ge \pi _w^t\),we have

Clearly,

Since \(Q_w \le Q_\beta \), so \(\pi _c (Q_\beta )-\pi _c (Q_w)\ge 0\), thus \(\beta _2 \ge \beta _1\). Let \(\beta _l =\max \{0,\beta _1 \}, \beta _u =\min \{1,\beta _2 \}\). Obviously, when \(\beta \in [\beta _l,\beta _u]\), we have \(\pi _\beta ^h \ge \pi _w^h\) and \(\pi _\beta ^t \ge \pi _w^t\).

Proof of Lemma 5

Solving (7) and (8), we get optimal Q and e. Assuming \((Q_1,e_1)\) and \((Q_2,e_2)\) are the optimal solutions of \(\Pi _c (Q,e)\), if \((Q_1,e_1)\ne (Q_2,e_2)\), then we have three cases: (i) \(\frac{Q_1 }{e_1 }=\frac{Q_2 }{e_2 }\); (ii) \(\frac{Q_1 }{e_1 }<\frac{Q_2 }{e_2 }\); (iii) \(\frac{Q_1 }{e_1 }>\frac{Q_2 }{e_2 }\).

-

Case (i): if \(\frac{Q_1 }{e_1 }=\frac{Q_2 }{e_2 }\), from (2), we know \(e_1 =e_2\), then \(Q_1 =Q_2\), that is \((Q_1,e_1)=(Q_2,e_2 )\);

-

Case (ii): if \(\frac{Q_1 }{e_1 }<\frac{Q_2 }{e_2 }\), from (2), we know \(e_1 <e_2\), from (1), we know \(Q_1 >Q_2\), then there must be \(\frac{Q_1 }{e_1 }>\frac{Q_2 }{e_2 }\);

-

Case (iii): if \(\frac{Q_1 }{e_1 }>\frac{Q_2 }{e_2 }\), from (2), we know \(e_1 >e_2\), from (1), we know \(Q_1 <Q_2\), then there must be \(\frac{Q_1 }{e_1 }<\frac{Q_2 }{e_2 }\);

Obviously, all three cases are contradictory and false, so there must be \((Q_1,e_1)=(Q_2,e_2)\).

Proof of Theorem 2

Since the objective functions of both players are continuous and concave, the existence of an equilibrium is established from the Theorem (Section 1.2) in Fudenberg and Tirole (1991). The proof of uniqueness is similar to that of Lemma 4 and omitted.

Proof of Theorem 3

Let \(w^{{*}}=(p_t -c_v +c_u)F_t ({\overline{{Q}}_c }/{\overline{{e}}_c })\) and \(\beta ^{{*}}=[{(p_t -c_v +c_u)}{(1-F_t ({\overline{{Q}}_c }/{\overline{{e}}_c }))]}/{c_u }\), we can see that functions (5) and (6) are the same as functions (1) and (2) respectively. Obviously, the contract can achieve channel coordination.

Proof of Theorem 4

-

(a)

For \(\lambda ={[\overline{{e}}_c \int _0^{{\overline{{Q}}_c }/{\overline{{e}}_c }} {xf_t (x)} dx-{V(\overline{{e}}_c)}/{(p_t -c_v +c_u )}]}/{F_t ({\overline{{Q}}_c }/{\overline{{e}}_c })}\),

if \(\overline{{e}}_c \int _0^{{\overline{{Q}}_c }/{\overline{{e}}_c }} {xf_t (x)} dx-{V(\overline{{e}}_c)}/{(p_t -c_v +c_u) }>0\) is established, then \(\lambda >0\).

Let \(G(e)=(p_t -c_v +c_u)e\int _0^{{Q_c }/{e_c }} {xf_t (x)dx-V(e)} \), the first-order—condition of G(e) is

\({G}^{\prime }(e)=(p_t -c_v +c_u)\int _0^{{Q_c }/{e_c }} {xf_t (x)dx-{V}^{\prime }(e)} ,\) clearly, \({G}^{\prime }(e)\) is decreasing in e. From function (2), we know \({G}^{\prime }(e_c)=0\), then \(G(e_c)=\mathop {\max }\limits _e G(e)\). Since \(G(0)=0\), so \(G(e_c)>0\), that is \(\overline{{e}}_c \int _0^{{\overline{{Q}}_c }/{\overline{{e}}_c }} {xf_t (x)} dx-{V(\overline{{e}}_c)}/{(p_t -c_v +c_u) }>0\), consequently, \(\lambda >0\).

-

(b)

If conditions (1), (2) and (3) are established, we can see functions (7) and (8) are the same as functions (1) and (2) respectively, which reveals that the contract \((w^{{*}},\beta _1^{*},\beta _2^{*})\) can achieves channel coordination.

-

(c)

The resulting profit to Ctrip.com is

$$\begin{aligned} \Pi _{\beta _1,\beta _2 }^{t{*}} =\frac{w^{{*}}}{F_t ({\overline{{Q}}_c }/{\overline{{e}}_c })}\left[ \overline{{e}}_c \int _0^{{\overline{{Q}}_c }/{\overline{{e}}_c }} {xf_t (x)} dx-{V(\overline{{e}}_c)}/{p_t -c_v +c_u }\right] =w^{{*}}\lambda \end{aligned}$$

Rights and permissions

About this article

Cite this article

Zha, Y., Zhang, J., Yue, X. et al. Service supply chain coordination with platform effort-induced demand. Ann Oper Res 235, 785–806 (2015). https://doi.org/10.1007/s10479-015-1918-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-1918-1