Abstract

This paper compares the dynamic of Cournot and Bertrand duopolies with vertical product differentiation and under bounded rationality. We find that an increase in the product differentiation degree destabilizes the Nash equilibrium under quantity competition, while the Bertrand–Nash equilibrium becomes more stable. From a global dynamic analysis, we show that an increase in the firms’ adjustment speed constitutes a source of complexity in both models. There is a cascade of flip bifurcations leading to increasingly complex attractors, and there are global bifurcations generating complex basins of attraction.

Similar content being viewed by others

Notes

Otherwise, the Cournot and Bertrand models can be interpreted as conjectural variation models (Bowley 1924; Frisch 1933). In Cournot’s original model, each firm’s conjecture is that the other firms are satisfied to continue selling their current quantity of output. However, from a purely game-theory perspective, the conjectural variations approach is theoretically unsatisfactory (see Tirole 1988).

The original version of the model was introduced by Musa and Rosen (1978).

Vertical product differentiation studies traditionally distinguish between two alternative cost formulations: (1) they assume that improvements in quality imply a higher fixed cost, while marginal costs need not differ much across firms (Shaked and Sutton 1982; Häckner 1994); and (2) they assume that such improvements lead to an increase in the variable production cost (Musa and Rosen 1978; Champsaur and Rochet 1989).

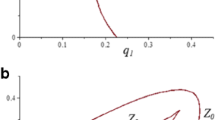

We deduce that \(E_0\), \(E_1\) and \(E_2\) are unstable equilibria. \(E_0\) is a repelling node, and \(E_1\) and \(E_2\) are either repelling nodes or saddle points, depending on the parameter values. If \(\alpha \overline{{v}}s<2 (\alpha \overline{{v}}s>2)\) then \(E_1\) is a saddle point (a repelling node) and if \(\alpha \overline{{v}}<2 (\alpha \overline{{v}}>2)\) then \(E_2\) is a saddle point (a repelling node).

This bifurcation corresponds to the bifurcation of the map \(T_{C}\) described in footnote 5 that transforms the saddle point \(E_{1}\) into a repelling node.

We deduce that \(E_0\) and \(E_1\) are unstable equilibria, with \(E_0\) being a saddle point. \(E_1\) is a repelling node if \(\alpha \overline{{v}}>2\) and a saddle point if \(\alpha \overline{{v}}<2.\)

Note that in a vertical product differentiation context this axis has no economic meaning. However, it must be considered to analyze the global dynamic of \(T_{B}\).

References

Agiza, H. N. (1998). Explicit stability zones for Cournot games with 3 and 4 competitors. Chaos, Solitons and Fractals, 9, 1955–1966.

Agiza, H. N. (1999). On the stability, bifurcations, chaos and control of Kopel map. Chaos, Solitons and Fractals, 11, 1909–1916.

Agiza, H. N., & Elsadany, A. A. (2004). Chaotic dynamics in nonlinear duopoly game with heterogenous players. Applied Mathematics and Computation, 149, 843–860.

Askar, S. S. (2014). On Courmot–Bertrand competition with differentiated products. Annals of Operations Research. doi:10.1007/s10479-014-1612-8.

Bertrand, J. (1883). Révue de la Théorie Mathématique de la Richesse Sociale et des Recherches sur les Principles Mathématiques de la Théorie des Richesses. Journal des Savants, 48, 499–508.

Bischi, G. I., Stefanini, L., & Gardini, L. (1998). Synchronization, intermittency and critical curves in a duopoly game. Mathematics and Computers in Simulation, 44, 559–585.

Bischi, G. I., & Naimzada, A. (2000). Global analysis of a dynamic duopoly game with bounded rationality. In J. A. Filar, V. Gaitsgory, & K. Mizukami (Eds.), Advances in dynamic games and applications (Vol. 5). Basel: Birkhauser.

Bischi, G. I., & Kopel, M. (2001). Equilibrium selection in a nonlinear duopoly game with adaptive expectations. Journal of Economic Behavior and Organization, 46, 73–100.

Bischi, G. I., Chiarella, C., Kopel, M., & Szidarovsky, F. (2010). Nonlinear oligopolies. Stability and bifurcations. Berlin: Springer.

Bowley, A. L. (1924). The Mathematical Groundwork of Economics. Oxford: Oxford University Press.

Chamberlin, E. (1933). The theory of monopolistic competition. Cambridge, MA: Harvard University Press.

Champsaur, P., & Rochet, J. C. (1989). Multiproduct duopolists. Econometrica, 57, 533–557.

Cournot, A. (1838). Recherches sur les principes mathématiques de la théorie des richesses. Paris: Hachette.

Devaney, R. L. (1989). An introduction to chaotic dynamical systems (2nd ed.). Boston: Addison Wesley.

Dixit, A. (1986). Comparative statics in oligopoly. International Economic Review, 27(1), 107–122.

Fanti, L., & Gori, L. (2012). The dynamics of a differentiated duopoly with quantity competition. Economic Modelling, 29, 421–427.

Fanti, L., & Gori, L. (2013). Stability analysis in a Bertrand Duopoly with different product quality and heterogeneous expectations. Journal of Industry, Competition and Trade, 13, 481–501.

Fanti, L., Gori, L., & Sodini, M. (2012). Nonlinear dynamics in a Cournot duopoly with relative profit delegation. Chaos, Solitons and Fractals, 45, 1469–1478.

Fershtman, C., & Judd, K. L. (1987). Equilibrium incentives in oligopoly. American Economic Review, 77, 927–940.

Friedman, J. W., & Mezzetti, C. (2002). Bounded rationality, dynamic oligopoly, and conjectural variations. Journal of Economic Behavior and Organization, 49, 287–306.

Frisch, R. (1933). Monopole-polypole. La Notion de Force dans l’Economie. Til Harald Westergaard. Copenhagen: Gyldendalske.

Gandolfo, G. (2010). Economic dynamics (Forth ed.). Springer: Heidelberg.

Häckner, J. (1994). Collusive pricing in markets for vertically differentiated products. International Journal of Industrial Organization, 12, 155–177.

Häckner, J. (2000). A note on price and quantity competition in differentiated oligopolies. Journal of Economic Theory, 93, 233–239.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–57.

Klemperer, P., & Meyer, M. (1986). Price competition versus quantity competition: The role of the uncertainty. Rand Journal of Economics, 17, 618–638.

Kopel, M. (1996). Simple and complex adjustment dynamics in Cournot duopoly models. Chaos, Solitons and Fractals, 12, 2031–2048.

Motta, M. (1993). Endogenous quality choice: Price versus quantity competition. The Journal of Industrial Economics, 49, 113–131.

Musa, M., & Rosen, S. (1978). Monopoly and product quality. Journal of Economic Theory, 18, 301–317.

Padmanabhan, V., Tsetlin, I., & Van Zandt, T. (2010). Setting prices or quantity: Depends on what the seller is more uncertain about. Quantitative Marketing and Economics, 8, 35–60.

Puu, T. (1991). Chaos in duopoly pricing. Chaos, Solitons and Fractals, 1, 573–581.

Puu, T. (1998). The chaotic duopolists revisited. Journal of Economic Behavior and Organization, 33, 385–394.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. Review of Economic Studies, 49, 3–14.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. Rand Journal of Economics, 15, 546–554.

Sklivas, S. D. (1987). The strategic choice of managerial incentives. Rand Journal of Economics, 18, 452–458.

Spiegler, R. (2014). Bounded rationality in industrial organization. Oxford: Oxford University Press.

Symeonidis, G. (2003). Comparing Cournot and Bertrand equilibria in a differentiated duopoly with product R&D. International Journal of Industrial Organization, 21, 39–55.

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: The MIT Press.

Tramontana, F. (2010). Heterogeneous duopoly with isoelastic demand function. Economic Modelling, 27, 350–357.

Tremblay, C., & Tremblay, V. (2011). The Cournot–Bertrand model and the degree of product differentiation. Economic Letters, 11(3), 233–235.

Tremblay, V., Tremblay, C., & Isayirawongse, K. (2013). Endogenous timing and strategic choice: The Cournot–Bertrand model. Bulletin of Economic Research, 65(4), 332–342.

Zhang, J., Da, Q., & Wang, Y. (2007). Analysis of nonlinear duopoly game with heterogeneous players. Economic Modelling, 24, 138–148.

Acknowledgments

The authors wish to thank the Spanish Ministry of Economics and Competitiveness (ECO2012-34828 and ECO2013-41353-P) and the Government of Aragon and FEDER (consolidated groups S10 and S13) for their financial support. This paper benefited from comments made by two anonymous referees of this journal.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

From (8) and (9) the trace and the determinant of the matrix \(JT_C (E_C^{*} )\) can be given by:

Thus, the eigenvalues of the matrix \(JT_C (E_C^{*} )\) in terms of Tr and M are:

Analyzing \(\lambda _1 \) and \(\lambda _2 \), we can characterize the equilibrium \(E_C^{*} \) and subsequently the evolution of the solution trajectories of the dynamic system in a neighborhood of this equilibrium. The following proposition is established.

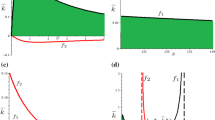

Proposition 4

Under Cournot competition:

(i) If \(\alpha \overline{{v}}<(\alpha \overline{{v}})_3^C =\frac{2s}{2s-1}-\frac{\sqrt{s(4s^{3}-8s^{2}+6s-1}}{s(2s-1)}\), then \(0<\lambda _1 <\lambda _2 <1\) (region A in Fig. 1).

(ii) If \((\alpha \overline{{v}})_3^C <\alpha \overline{{v}}<(\alpha \overline{{v}})_1^C \), then \(-1<\lambda _1 <0<\lambda _2 <1\) (region B in Fig. 1).

(iii) If \(\alpha \overline{{v}}=(\alpha \overline{{v}})_1^C \), then \(-1=\lambda _1 <\lambda _2 <1\), and there is a Flip bifurcation (curve \((\alpha \overline{{v}})_F^C =(\alpha \overline{{v}})_1^C \) in Fig. 1).

(iv) If \((\alpha \overline{{v}})_1^C <\alpha \overline{{v}}<(\alpha \overline{{v}})_2^C \), then \(\lambda _1 <-1<\lambda _2 <1\) (region C in Fig. 1).

(v) If \((\alpha \overline{{v}})_2^C <\alpha \overline{{v}}\), then \(\lambda _1 <\lambda _2 <-1\) (region D in Fig. 1).

(vi) There is neither a transcritical bifurcation nor a Neimark–Sacker bifurcation.

Proof

We deduce the following:

-

(a)

\(\left( {\frac{Tr-2}{2}} \right) ^{2}-M\ge 0\) for all \(s > 1\), \(\overline{{v}}>0\) and \(\alpha >0\) given that:

$$\begin{aligned} (Tr-2)^{2}-4M\ge & {} 0\Leftrightarrow s^{2}q_1^{*2}+q_2^{*2}-(2s-1)q_1^{*} q_2^{*} \\= & {} \left( {s^{2}-\frac{(2s-1)^{2}}{4}} \right) q_1^{*2}+\left( {q_2^{*} -\frac{2s-1}{s}q_1^{*} } \right) ^{2}\ge 0 \end{aligned}$$Therefore, \(\lambda _1 \hbox { and }\lambda _2 \) cannot be complex values. Consequently, there is no Neimark–Sacker bifurcation.

-

(b)

As \(M > 0\), \(\forall s>1,\alpha >0,\overline{{v}}>0\), then \(\lambda _2 <1\), and there is no transcritical bifurcation.

-

(c)

If \(Tr<\frac{-M}{2}\), then \(\lambda _1 <-1<\lambda _2 <1\), and the Nash equilibrium is a saddle point.

-

Substituting (32) into the inequality \(Tr<\frac{-M}{2}\) we deduce \((\alpha \overline{{v}})_1^C <\alpha \overline{{v}}<(\alpha \overline{{v}})_2^C \), defining region C in Fig. 1, being:

$$\begin{aligned} (\alpha \overline{{v}})_1^C= & {} \frac{4s}{2s-1}-\frac{2\sqrt{s(4s^{3}-8s^{2}+6s-1)}}{s(2s-1)}\hbox { and }\\ (\alpha \overline{{v}})_2^C= & {} \frac{4s}{2s-1}+\frac{2\sqrt{s(4s^{3}-8s^{2}+6s-1)}}{s(2s-1)} \end{aligned}$$

-

(d)

If \(\frac{-M}{2}<Tr<2-2\sqrt{M}\) and \(M>4\), then \(\lambda _1 <\lambda _2 <-1\), and for any initial condition near to equilibrium, the trajectory moves away in a fluctuating manner.

-

Substituting (32) into the above inequalities, we deduce \((\alpha \overline{{v}})_2^C <\alpha \overline{{v}}\), leading to region D in Fig. 1.

-

(e)

If \(Tr=\frac{-M}{2}\) and \(M<4\), then \(\lambda _1 =-1<\lambda _2 <1\). In this case, there is a flip bifurcation.

-

Substituting (32) into the above expressions, we deduce \(\alpha \overline{{v}}=(\alpha \overline{{v}})_1^C \), obtaining the curve \((\alpha \overline{{v}})_F^C =(\alpha \overline{{v}})_1^C \) in Fig. 1.

-

(f)

In the stability area (\(\alpha \overline{{v}}<(\alpha \overline{{v}})_1^C\)), according to the sign of the eigenvalues, we can distinguish the following three subregions:

-

If \(1-M<Tr<2-2\sqrt{M}\) and \(0<M<1\), then \(0<\lambda _1 <\lambda _2 <1\) and the Nash equilibrium is a stable node. Substituting (32) into these expressions, it follows that \(\alpha \overline{{v}}<(\alpha \overline{{v}})_3^C =\frac{2s}{2s-1}-\frac{\sqrt{s(4s^{3}-8s^{2}+6s-1)}}{s(2s-1)}\), giving rise to region A in Fig. 1.

-

If \(-\frac{M}{2}<Tr<1-M\), then \(-1<\lambda _1 <0<\lambda _2 <1\) and the Nash equilibrium is asymptotically stable; however, there is no stable node. As a negative eigenvalue exists (with modulus lower than one), there may appear to be a fluctuating convergence. Introducing (32) into the above expressions holds that \((\alpha \overline{{v}})_3^C <\alpha \overline{{v}}<(\alpha \overline{{v}})_1^C \), leading to region B in Fig. 1.

-

If \(1-M<Tr<2-2\sqrt{M}\) and \(1<M<2\) or \(\frac{-M}{2}<Tr<2-2\sqrt{M}\) and \(2<M<4\), then \(-1<\lambda _1 <\lambda _2 <0\) and for any initial condition near to equilibrium, the trajectory converges to it in a fluctuating manner.

Substituting (32) into these expressions, we conclude that the set of parameters \((s, \alpha , \overline{{v}})\), such that the above inequalities hold, is empty. \(\square \)

-

Rights and permissions

About this article

Cite this article

Andaluz, J., Jarne, G. Stability of vertically differentiated Cournot and Bertrand-type models when firms are boundedly rational. Ann Oper Res 238, 1–25 (2016). https://doi.org/10.1007/s10479-015-2057-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-2057-4

Keywords

- Vertical product differentiation

- Bertrand competition

- Cournot competition

- Bounded rationality

- Dynamic stability

- Bifurcation