Abstract

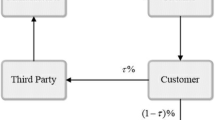

As the demands of some important products such as oil, gas, and agricultural commodities are disrupted, the government often regulates the retail price that includes impositions of a price ceiling and a price floor. In this paper, we analyze the coordination of a supply chain with a dominate retailer under the government price regulation policy by a revenue sharing contract after demand disruption. First, we characterize the optimal decisions of the supply chain under normal circumstance by the revenue sharing contract as a benchmark. Then, when the demand is disrupted, we redesign the contract to coordinate the supply chain and obtain the corresponding revenue sharing contract in different scenarios. Finally, we give some numerical examples to illustrate our theoretical results and explore the impacts of government price regulations on the coordination mechanism.

Similar content being viewed by others

References

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science, 11, 227–339.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: strengths and limitations. Management Science, 51(1), 30–44.

Cao, E., Wan, C., & Lai, M. (2013). Coordination of a supply chain with one manufacturer and multiple competing retailers under simultaneous demand and cost disruptions. International Journal of Production Economics, 141(1), 425–433.

Cao, E., Zhou, X., & Lü, K. (2015). Coordinating a supply chain under demand and cost disruptions. International Journal of Production Research, 53(12), 3735–3752.

Chen, J., & Lin, I. (2010). Ordering and pricing policies under vendor managed inventory and consignment arrangements. International Journal of Information and Management Sciences, 21(4), 453–468.

Chen, K., & Xiao, T. (2009). Demand disruption and coordination of the supply chain with a dominant retailer. European Journal of Operational Research, 197(1), 225–234.

Chen, K., & Zhuang, P. (2011). Disruption management for a dominant retailer with constant demand-stimulating service cost. Computers & Industrial Engineering, 61(4), 936–946.

Choi, T. M., & Cheng, T. E. (Eds.). (2011). Supply chain coordination under uncertainty. Berlin: Springer.

Choi, T. M., Li, Y., & Xu, L. (2013). Channel leadership, performance and coordination in closed loop supply chains. International Journal of Production Economics, 146(1), 371–380.

De Giovanni, P., & Roselli, M. (2012). Overcoming the drawbacks of a revenue-sharing contract through a support program. Annals of Operations Research, 196(1), 201–222.

De Giovanni, P. (2014). Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Annals of Operations Research, 220(1), 135–157.

Engelmann, D., & Müller, W. (2011). Collusion through price ceilings? In search of a focal-point effect. Journal of Economic Behavior & Organization, 79(3), 291–302.

Feng, X., Moon, I., & Ryu, K. (2014). Revenue-sharing contracts in an N-stage supply chain with reliability considerations. International Journal of Production Economics, 147, 20–29.

Gerchak, Y., & Wang, Y. (2004). Revenue-sharing vs. wholesale-price contracts in assembly systems with random demand. Production and Operations Management, 13(1), 23–33.

Geylani, T., Dukes, A. J., & Srinivasan, K. (2007). Strategic manufacturer response to a dominant retailer. Marketing Science, 26(2), 164–178.

Giannoccaro, I., & Pontrandolfo, P. (2004). Supply chain coordination by revenue sharing contracts. International Journal of Production Economics, 89(2), 131–139.

Govindan, K., & Popiuc, M. N. (2014). Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. European Journal of Operational Research, 233(2), 326–336.

Henry, A., & Wernz, C. (2015). A multiscale decision theory analysis for revenue sharing in three-stage supply chains. Annals of Operations Research, 226(1), 277–300.

Hsueh, C. (2013). Improving corporate social responsibility in a supply chain through a new revenue sharing contract. International Journal of Production Economics, 151, 214–222.

Jeuland, A. P., & Shugan, S. M. (1983). Managing channel profits. Marketing Science, 2(3), 239–272.

Koulamas, C. (2006). A newsvendor problem with revenue sharing and channel coordination. Decision Sciences, 37(1), 91–100.

Krishnan, H., & Winter, R. A. (2007). Vertical control of price and inventory. The American Economic Review, 97(5), 1840–1857.

Li, J., Liu, X. F., Wu, J., & Yang, F. M. (2014). Coordination of supply chain with a dominant retailer under demand disruptions. Mathematical Problems in Engineering, 2014, 854681.

Li, J., Wang, S. Y., & Cheng, T. C. E. (2010). Competition and cooperation in a single-retailer two-supplier supply chain with supply disruption. International Journal of Production Economics, 124(1), 137–150.

Linh, C. T., & Hong, Y. (2009). Channel coordination through a revenue sharing contract in a two-period newsboy problem. European Journal of Operational Research, 198(3), 822–829.

Palsule-Desai, O. D. (2013). Supply chain coordination using revenue-dependent revenue sharing contracts. Omega, 41(4), 780–796.

Pang, Q., Chen, Y., & Hu, Y. (2014). Three-level supply chain coordination under disruptions based on revenue-sharing contract with price dependent demand. Discrete Dynamics in Nature and Society, 2014, 464612.

Peng, H. J., Zhou, M. H., & Wang, F. D. (2013). Research on double price regulations and peak shaving reserve mechanism in coal–electricity supply chain. Mathematical Problems in Engineering, 2013, 542041.

Qi, X. T., Bard, J. F., & Yu, G. (2004). Supply chain coordination with demand disruptions. Omega, 32(4), 301–312.

Raju, J., & Zhang, Z. J. (2005). Channel coordination in the presence of a dominant retailer. Marketing Science, 24(4), 254–262.

Sang, S. J. (2013). Supply chain contracts with multiple retailers in a fuzzy demand environment. Mathematical Problems in Engineering, 2013, 482353.

Saha, S., & Sarmah, S. P. (2015). Supply chain coordination under ramp-type price and effort induced demand considering revenue sharing contract. Asia-Pacific Journal of Operational Research, 32(2), 1550004.

Shao, J., Krishnan, H., & Thomas McCormick, S. (2013). Distributing a product line in a decentralized supply chain. Production And Operations Management, 22(1), 151–163.

Tavakoli, E., & Mirzaee, M. (2014). Coordination of a three-level supply chain under disruption using profit sharing and return policy contracts. International Journal of Industrial Engineering Computations, 5(1), 139–150.

Useem, J., Schlosser, J., & Kim, H. (2003). One nation under Wal-Mart. Fortune, 147(4), 64–78.

Xiao, T., Qi, X., & Yu, G. (2007). Coordination of supply chain after demand disruptions when retailers compete. International Journal of Production Economics, 109(1), 162–179.

Xiao, T., Yu, G., Sheng, Z., & Xia, Y. (2005). Coordination of a supply chain with one-manufacturer and two-retailersunder demand promotion and disruption management decisions. Annals of Operations Research, 135(1), 87–109.

Xiao, T., & Qi, X. (2008). Price competition, cost and demand disruptions and coordination of a supply chain with one manufacturer and two competing retailers. Omega, 36(5), 741–753.

Xiao, T., & Yang, D. Q. (2009). Risk sharing and information revelation mechanism of a one-manufacturer and one-retailer supply chain facing an integrated competitor. European Journal of Operational Research, 196(3), 1076–1085.

Xiao, T., Choi, T. M., & Cheng, T. C. E. (2015). Optimal variety and pricing decisions of a supply chain with economies of scope. IEEE Transactions on Engineering Management, 62(3), 411–420.

Xu, M., Qi, X., Yu, G., & Zhang, H. (2006). Coordinating dyadic supply chains when production costs are disrupted. IIE Transactions, 38(9), 765–775.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

Xu, M. L., Wang, Q., & Ouyang, L. H. (2013). Coordinating contracts for two-stage fashion supply chain with risk-averse retailer and price-dependent demand. Mathematical Problems in Engineering, 2013, 259164.

Yu, G., & Qi, X. (2004). Disruption management: Framework, models and applications. Singapore: World Scientific.

Zhang, W., Fu, J., Li, H., & Xu, W. (2012). Coordination of supply chain with a revenue-sharing contract under demand disruptions when retailers compete. International Journal of Production Economics, 138(1), 68–75.

Zou, X., Pokharel, S., & Piplani, R. (2004). Channel coordination in an assembly system facing uncertain demand with synchronized processing time and delivery quantity. International Journal of Production Research, 42(22), 4673–4689.

Acknowledgments

This research was partially supported by the National Natural Science Foundation of China under Grant Nos. 71171011, 71372195, 71571011 and the New Century Excellent Talents in Universities scheme (NCET-12-0756).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

In the decentralized supply chain, the dominant retailer decides the retail price to maximize his own profit. By solving the first order conditions of (3) with respect to p and s, we have

Let \(p_d^\Delta =p^{{*}}\), \(s_d^\Delta =s^{{*}}\) and \(\varphi _{r}p^{*}=w_{r}+c_{1}\). We get (8).

Because \(0<\varphi _d^{*} <1\) and \(w_d^{*} >0\), the dominant retailer’s revenue share \(\varphi _d^{*}\) must satisfy

The second objective is in order to satisfy win–win condition for the chain partners by the contracts. Assume that \(\pi _k^{*}\) is the optimal profit of the actor k (\(k=m, d)\) in the supply chain with the revenue-sharing contracts and \(\pi _m\) is the profit of the actor \(k\,(k=m, d)\) without any contracts. Only when \(\pi _k^{*} >\pi _{km}\), the chain partners prefer to design the revenue-sharing contracts. Based on the above inequalities and (19), we can obtain (9).

Proof of Corollary 1

For convenience, the objective function (10) can be differentiated into two cases. We can combine these two cases to give the optimal solutions for the centralized supply chain.

Based on the above formulas, we can see that \(\tilde{T}^{1}\) and \(\tilde{T}^{2}\) are concave functions of the retail price \(\tilde{p}\) and service investment \(\tilde{s}\), thus the solutions that satisfy the first-order condition give the optimal retail prices and service investments. \(\square \)

The Kuhn–Tucker condition of Eq. (21)

Here \(\lambda \) is the Lagrangian multiplier. Solving (22), we get the flowing:

If there are no price regulations and \(\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}\ge c_u\), the optimal decisions satisfy

When the retail price is regulated, we need to discuss the magnitude of the optimal retail price without regulations.

If \(\bar{{p}}<\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}\), the supply chain is optimal when the retail price is equal to the price ceiling. At this time, the optimal service investment satisfies \(\tilde{s}_1^{*} =\frac{\theta ^{2}[\bar{{p}}-(c_0 +c_1 +c_u )]^{2}}{4}\).

If \(\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}<\underline{p}<\frac{2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )}{4\tilde{\beta }-\theta ^{2}}+\;\frac{\sqrt{\Delta _1 }}{4\tilde{\beta }-\theta ^{2}}\), the supply chain is optimal when the retail price is equal to the price floor (\(\Delta _1 =[2\tilde{\alpha }+(2\tilde{\beta }-\theta ^{2})(c_0 +c_1 +c_u )]^{2}+(4\tilde{\beta }-\theta ^{2})[(\theta ^{2}-4\tilde{\alpha })(c_0 +c_1 +c_u )+c_u q_T^{*} ])\). Then, \(\tilde{s}_1^{*} =\frac{\theta ^{2}[\underline{p}-(c_0 +c_1 +c_u )]^{2}}{4}\).

And if the price floor is too large and is greater than zero point, that there is no solution for the supply chain coordination with demand disruptions.

If \(-c_s<\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}<c_u \), the Lagrangian multiplier \(\lambda >0\), which means that \(\tilde{\alpha }-\tilde{\beta }\tilde{p}+\theta \sqrt{\tilde{s}}-q_T^{*} =0\). From Kuhn–Tucker condition, we obtain \(\tilde{p}_2^{*} =\frac{\beta ^{2}(2\tilde{\beta }-\theta ^{2})}{\tilde{\beta }^{2}(2\beta -\theta ^{2})}(\beta p^{*}-\alpha )+\frac{\tilde{\alpha }}{\tilde{\beta }},\tilde{s}_2^{*} =\frac{\beta ^{2}}{\tilde{\beta }^{2}}s^{*}\).

Similarly, we discuss this issue in four conditions. However, when the optimal retail price exceeds the price regulations, we should discuss whether to change original production quantity nor not.

Likewise, if \(\frac{2\tilde{\alpha }\tilde{\beta }-2\tilde{\beta }^{2}(c_0 +c_1 )-(4\tilde{\beta }-\theta ^{2})q_T^*}{2\tilde{\beta }^{2}}\le -c_s \), the optimal solution of (22) is

When the price is regulated, the optimal solutions are similar to previous proofs.

Combining these two cases, we can obtain the Corollary 1.

Proof of Theorem 2

Because \(0<\tilde{\varphi }_d^{*} <1\) and \(\tilde{w}_d^{*} >0\), \(\tilde{\varphi }_d^{*}\) must satisfy:

We assume that \(\tilde{\pi }_k^*\) and \(\tilde{\pi }_{kr}\) is the optimal profit of the actor \(k\, (k=d, m)\) in the supply chain with the new and the original revenue sharing contracts respectively. In order to assure the partners prefer the new contracts to the original ones, let \(\tilde{\pi }_k^*>\tilde{\pi }_{kr}\). So we can obtain

Substitute (16) to (24), we can obtain

From (23) and (25), we can get (17) (Koulamas 2006). \(\square \)

Similar to Assumption 1, the market share of the dominant retailer \(\gamma \) should satisfy the following condition, so that the dominant retailer should provide the demand-stimulating service voluntarily, and the manufacturer would like to induce such service even when the supply chain is in the decentralized operation.

Therefore, we can obtain (18).

Rights and permissions

About this article

Cite this article

Liu, X., Li, J., Wu, J. et al. Coordination of supply chain with a dominant retailer under government price regulation by revenue sharing contracts. Ann Oper Res 257, 587–612 (2017). https://doi.org/10.1007/s10479-016-2218-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2218-0