Abstract

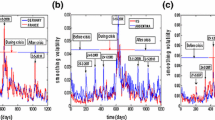

Recently, financial crisis occurred frequently, such as Asian crisis, sub-prime loan crisis and so on. And, financial contagion behavior analysis is an important subject in the field of international finance. This paper analyzes the financial contagion behavior of US subprime crisis and describes the co-movement behavior between US stock index return and the stock index returns of tested countries by complex network approach. The co-movement modes are defined by a coarse graining procedure, and then by weighted complex network models and evolutionary models transformation characteristics between the modes are analyzed. In order to analyze the sub-prime loan crisis contagion from US to other countries, we selected three main stock market indexes (China, Japan and Germany), S&P 500 index to present an empirical analysis, and the stock market index data is from 2006.1.1 to 2009.3.31. To analyze the contagion effect of the sub-prime crisis, the data is divided into three segments to be analyzed based on complex network approach. The empirical result shows that the co-movement modes of the S&P 500 index and the stock indexes of other countries are clustered around a few critical modes during the evolution. The co-movement modes have the characteristic of grouping, and the conversion of the co-movement modes requires an average of 3–5 days. This paper confirms the sub-prime crisis contagion behavior by comparing the parameters including degree, clustering coefficient and betweenness centrality in three stages. This research may provide further information between S&P 500 index and other stock indexes for the co-movement. More importantly, a new approach is provided for testing the financial contagion effect in this paper.

Similar content being viewed by others

References

Allen, F., & Gale, D. (2000). Financial contagion. Journal of Political Economy, 108(1), 1–33.

An, H., Gao, X., Fang, W., Ding, Y., & Zhong, W. (2014). Research on patterns in the fluctuation of the co-movement between crude oil futures and spot prices: A complex network approach. Applied Energy, 136, 1067–1075.

Ang, A., & Chen, J. (2002). Asymmetric correlations of equity portfolios. Journal of Financial Economics, 63(3), 443–494.

Bae, K.-H., Karolyi, G. A., & Stulz, R. M. (2003). A new approach to measuring financial contagion. Review of Financial Studies, 16(3), 717–763.

Bekaert, G., Harvey, C. R., & Ng, A. (2005). Market integration and contagion. Journal of Business, 78(1), 39–70.

Busetti, F., & Harvey, A. (2011). When is a copula constant? A test for changing relationships. Journal of Financial Econometrics, 9(1), 106–131.

Caetano, M. A. L., & Yoneyama, T. (2015). Boolean network representation of contagion dynamics during a financial crisis. Physica A: Statistical Mechanics and its Applications, 417, 1–6.

Coelho, R., Hutzler, S., Repetowicz, P., & Richmond, P. (2007). Sector analysis for a ftse portfolio of stocks. Physica A: Statistical Mechanics and its Applications, 373, 615–626.

Da Costa, L. F., Rodrigues, F. A., Travieso, G., & Villas Boas, P. R. (2007). Characterization of complex networks: A survey of measurements. Advances in Physics, 56, 167–242.

Dias, A., & Embrechts, P. (2009). Testing for structural changes in exchange rates dependence beyond linear correlation. The European Journal of Finance, 15(7–8), 619–637.

Favero, C. A., & Giavazzi, F. (2002). Is the international propagation of financial shocks non-linear?: Evidence from the ERM. Journal of International Economics, 57(1), 231–246.

Freixas, X., Parigi, B. M., & Rochet, J.-C. (2000). Systemic risk, interbank relations, and liquidity provision by the central bank. Journal of Money, Credit and Banking, 32(3), 611–638.

Gai, P., & Kapadia, S. (2010). Contagion in financial networks. In Proceedings of the royal society of London A: Mathematical, physical and engineering sciences (p. rspa20090410). The Royal Society.

Gilmore, C. G., Lucey, B. M., & Boscia, M. (2008). An ever-closer union? Examining the evolution of linkages of European equity markets via minimum spanning trees. Physica A: Statistical Mechanics and its Applications, 387(25), 6319–6329.

Goyal, S., Heidari, H., & Kearns, M. (2014). Competitive contagion in networks. Games and Economic Behavior. doi:10.1016/j.geb.2014.09.002.

Haldane, A. G. (2013). Rethinking the financial network. Berlin: Springer.

Kim, H.-J., Lee, Y., Kahng, B., & Kim, I.-M. (2002). Weighted scale-free network in financial correlations. Journal of the Physical Society of Japan, 71(9), 2133–2136.

Lee, K. E., Lee, J. W., & Hong, B. H. (2007). Complex networks in a stock market. Computer Physics Communications, 177(1), 186–186.

Lei, Z., Zhi-Qiang, G., Rong, Z., & Guo-Lin, F. (2008). An approach to research the topology of chinese temperature sequence based on complex network. Acta Physica Sinica, 57(11), 7380–7389.

Mantegna, R. N. (1999). Hierarchical structure in financial markets. The European Physical Journal B-Condensed Matter and Complex Systems, 11(1), 193–197.

Miccichè, S., Bonanno, G., Lillo, F., & Mantegna, R. N. (2003). Degree stability of a minimum spanning tree of price return and volatility. Physica A: Statistical Mechanics and its Applications, 324(1), 66–73.

Nacaskul, P. (2011). Systemic import analysis (SIA)—application of entropic eigenvector centrality (EEC) criterion for a priori ranking of financial institutions in terms of regulatory-supervisory concern, with demonstrations on stylised small network topologies and connectivity weights. SSRN Working Paper Series.

Nier, E., Yang, J., Yorulmazer, T., & Alentorn, A. (2007). Network models and financial stability. Journal of Economic Dynamics and Control, 31(6), 2033–2060.

Onnela, J.-P., Chakraborti, A., Kaski, K., & Kertesz, J. (2003). Dynamic asset trees and black monday. Physica A: Statistical Mechanics and its Applications, 324(1), 247–252.

Östermark, R. (2001). Multivariate cointegration analysis of the Finnish–Japanese stock markets. European Journal of Operational Research, 134(3), 498–507.

Rodriguez, J. C. (2007). Measuring financial contagion: A copula approach. Journal of Empirical Finance, 14(3), 401–423.

von Peter, G. (2007). International banking centres: A network perspective. BIS Quarterly Review Working Paper.

Wackerbauer, R., Witt, A., Atmanspacher, H., Kurths, J., & Scheingraber, H. (1994). A comparative classification of complexity measures. Chaos, Solitons and Fractals, 4(1), 133–173.

Wei-Dong, C., Hua, X., & Qi, G. (2010). Dynamic analysis on the topological properties of the complex network of international oil prices. Acta Physica Sinica, 59(7), 4514–4523.

Yang, J., & Bessler, D. A. (2008). Contagion around the october 1987 stock market crash. European Journal of Operational Research, 184(1), 291–310.

Ye, W., Liu, X., & Miao, B. (2012). Measuring the subprime crisis contagion: Evidence of change point analysis of copula functions. European Journal of Operational Research, 222(1), 96–103.

Acknowledgements

This research was supported by National Natural Science Foundation of China (Grant Nos. 71371007, 71671171, 71631006, 71322101) and the Fundamental Research Funds for the Central Universities of China (Grant No. WK2040160008).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhu, Y., Yang, F. & Ye, W. Financial contagion behavior analysis based on complex network approach. Ann Oper Res 268, 93–111 (2018). https://doi.org/10.1007/s10479-016-2362-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2362-6