Abstract

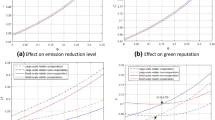

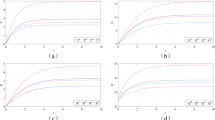

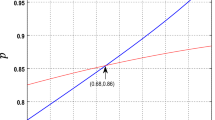

The traditional self-interest hypothesis is far from perfect. Social preference has a significant impact on every firm’s decision making. This paper incorporates reciprocal preferences and consumers’ low-carbon awareness (CLA) into the dyadic supply chain in which a single manufacturer plays a Stackelberg-like game with a single retailer. This research intends to investigate how reciprocity and CLA may affect the decisions and performances of the supply chain members and the system’s efficiency. In this study, the following two scenarios are discussed: (1) both the manufacturer and the retailer have no reciprocal preferences and (2) both of them have reciprocal preferences. We derive equilibriums under both scenarios and present a numerical analysis. We demonstrate that reciprocal preferences and CLA significantly affect the equilibrium and firms’ profits and utilities. First, the optimal retail price increases with CLA, while it decreases with the reciprocity of the retailer and the manufacturer; the optimal wholesale price increases with CLA and the retailer’s reciprocity, while it decreases with the manufacturer’s reciprocity. The optimal emission reduction level increases with CLA and the reciprocity of both the manufacturer and the retailer. Second, the optimal profits of the participants and the supply chain increase with CLA, the participants’ optimal profits are concave in their own reciprocity and increase with their co-operators’ reciprocity. Third, the participants’ optimal utilities increase with CLA and their reciprocity. Finally, the supply chain efficiency increases with the participants’ reciprocity, while the efficiency decreases with CLA.

Similar content being viewed by others

References

Bemporad, R., & Baranowski, M. (2007). Conscious consumers are changing the rules of marketing. Are you ready? Highlights from the BBMG conscious consumer report. http://www.fmi.org/docs/sustainability/BBMG_Conscious_Consumer_White_Paper.pdf.

Bendoly, E., Donohue, K., & Schultz, K. L. (2006). Behavior in operations management: Assessing recent findings and revisiting old assumptions. Journal of Operations Management, 24(6), 737–752.

Benjaafar, S., Li, Y., & Daskin, M. (2013). Carbon footprint and the management of supply chains: Insights from simple models. IEEE Transactions on Automation Science and Engineering, 10(1), 99–116.

Bowles, S. (2004). Microeconomics: Behavior, institutions, and evolution (pp. 121–122). Princeton, DC: Princeton University Press.

Cachon, G. P. (2014). Retail store density and the cost of greenhouse gas emissions. Management Science, 60(8), 1907–1925.

Carbon Trust. (2007). Carbon footprint measurement methodology, version 1.1. London, UK: The Carbon Trust. http://www.carbontrust.co.uk. Accessed February 27, 2008.

Chaabane, A., Ramudhin, A., & Paquet, M. (2012). Design of sustainable supply chains under the emission trading scheme. International Journal of Production Economics, 135(1), 37–49.

Chen, X., Benjaafar, S., & Elomri, A. (2013). The carbon-constrained EOQ. Operations Research Letters, 41(2), 172–179.

Cholette, S., & Venkat, K. (2009). The energy and carbon intensity of wine distribution: A study of logistical options for delivering wine to consumers. Journal of Cleaner Production, 17(16), 1401–1413.

Contea, A., Cagno, D. T. D., & Sciubbad, E. (2015). Behavioural patterns in social networks. Economic Inquiry, 53(2), 1331–1349.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research, 228(1), 135–149.

Du, S., Nie, T., Chu, C., & Yu, Y. (2014). Reciprocal supply chain with intention. European Journal of Operational Research, 239(2), 389–402.

Du, S., Zhu, L., Liang, L., & Ma, F. (2013). Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy, 57, 61–67.

Edlund, J. E., Sagarin, B. J., & Johnson, B. S. (2007). Reciprocity and the belief in a just world. Personality and Individual Differences, 43(3), 589–596.

Enkvist, P., & Vanthoumout, H. (2008). How companies think about climate change: A Mckinsey global survey. McKinsey Quarterly, 2, 46.

European Commission. (2008). Attitudes of Europeans citizens towards the environment. European Commission, 295 . http://ec.europa.eu/public_opinion/archives/ebs/ebs_295_en.pdf.

Govindan, K., & Sivakumar, R. (2015). Green supplier selection and order allocation in a low-carbon paper industry: Integrated multi-criteria heterogeneous decision-making and multi-objective linear programming approaches. Annals of Operations Research, 238(1), 1–34.

Hayes, R., Wheelwright, S., & Clark, K. (1988). Dynamic manufacturing (p. 242). NewYork: The Free Press.

Harris, I., Naim, M., Palmer, A., Potter, A., & Mumford, C. (2011). Assessing the impact of cost optimization based on infrastructure modelling on CO\(_2\) emissions. International Journal of Production Economics, 131(1), 313–321.

He, Y., Wang, L., & Wang, J. (2012). Cap-and-trade vs. carbon taxes: A quantitative comparison from a generation expansion planning perspective. Computers and Industrial Engineering, 63(3), 708–716.

Hua, G., Cheng, T. C. E., & Wang, S. (2011). Managing carbon footprints in inventory management. International Journal of Production Economics, 132(2), 178–185.

Jones, R., & Mendelson, H. (2011). Information goods vs. industrial goods: Cost structure and competition. Management Science, 57(1), 164–176.

Kim, Y., Choi, T. Y., Yan, T., & Dooley, K. (2011). Structural investigation of supply networks: A social network analysis approach. Journal of Operations Management, 29(3), 194–211.

Laroche, M., Bergeron, J., & Barbaro-Forleo, G. (2001). Targeting consumers who are willing to pay more for environmentally friendly products. Journal of Consumer Marketing, 18(6), 503–520.

Lee, K. H. (2011). Integrating carbon footprint into supply chain management: The case of Hyundai Motor Company (HMC) in the automobile industry. Journal of Cleaner Production, 19(11), 1216–1223.

Letmathe, P., & Balakrishnan, N. (2005). Environmental considerations on the optimal product mix. European Journal of Operational Research, 167(2), 398–412.

Li, B., Zhu, M., Jiang, Y., et al. (2016). Pricing policies of a competitive dual-channel green supply chain. Journal of Cleaner Production, 112, 2029–2042.

Liu, Z., Anderson, T. D., & Cruz, J. M. (2012). Consumer environmental awareness and competition in two-stage supply chains. European Journal of Operational Research, 218(3), 602–613.

Loch, C. H., & Wu, Y. (2008). Social preferences and supply chain performance: An experimental study. Management Science, 54(11), 1835–1849.

Mallory, M. (2010). How will cap-and-trade affect firms and farms? Environmental Change Institute Uiuc, 1–2. http://hdl.handle.net/2142/16448.

Manikas, A. S., & Kroes, J. R. (2015). A newsvendor approach to compliance and production under cap and trade emissions regulation. International Journal of Production Economics, 159(C), 274–284.

Matthews, H. S., Hendrickson, C. T., & Weber, C. L. (2008). The importance of carbon footprint estimation boundaries. Environmental Science and Technology, 42(16), 5839–5842.

Plambeck, E. L. (2012). Reducing greenhouse gas emissions through operations and supply chain management. Energy Economics, 34, 64–74.

Poyago-Theotoky, J. A. (2007). The organization of r&d and environmental policy. Journal of Economic Behavior and Organization, 62(1), 63–75.

Purohit, A. K., Shankar, R., Dey, P. K., & Choudhary, A. (2016). Non-stationary stochastic inventory lot-sizing with emission and service level constraints in a carbon cap-and-trade system. Journal of Cleaner Production, 113, 654–661.

Ramudhin, A., Chaabane, A., Kharoune, M., & Paquet, M. (2009). Carbon market sensitive green supply chain network design. International Journal of Operational Research, 10(4), 1093–1097.

Rezaee, A., Dehghanian, F., Fahimnia, B., & Beamon, B. (2017). Green supply chain network design with stochastic demand and carbon price. Annals of Operations Research, 250(2), 463–485.

Schweitzer, M., & Gibson, D. E. (2008). Fairness, feelings, and ethical decision-making: Consequences of violating community standards of fairness. Journal of Business Ethics, 77(3), 287–301.

Sobel, J. (2005). Interdependent preferences and reciprocity. Journal of Economic Literature, 43(2), 392–436.

Tangpong, C., Li, J., & Hung, K. T. (2016). Dark side of reciprocity norm: Ethical compromise in business exchanges. Industrial Marketing Management, 55, 83–96.

Thaler, R. H., & Camerer, C. F. (1995). Ultimatums, dictators and manners. Journal of Economic Perspectives, 9(2), 209–19.

Tidd, K. L., & Lochard, J. S. (1978). Monetary significance of the affiliative smile: A case for reciprocal altruism. Bulletin of the Psychonomic Society, 11, 344–346.

Toptal, A., & Çetinkaya, B. (2017). How supply chain coordination affects the environment: A carbon footprint perspective. Annals of Operations Research, 250(2), 487–519.

Ulph, A. (1996). Environmental policy and international trade when governments and producers act strategically. Journal of Environmental Economics and Management, 30(3), 265–281.

Wathne, K. H., & Heide, J. B. (2004). Relationship governance in a supply chain network. Journal of Marketing, 68(1), 73–89.

Xu, X., Xu, X., & He, P. (2016). Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. Journal of Cleaner Production, 112, 4093–4106.

Zanoni, Z., Mazzoldiand, L., & Jaber, M. Y. (2014). Vendor-managed inventory with consignment stock agreement for single vendor-single buyer under the emission-trading scheme. International Journal of Production Research, 52(1), 20–31.

Acknowledgements

We thank the anonymous reviewers and the editor for their helpful comments for the revision of this manuscript. This work is partially supported by the NSFC Grant (Nos. 71502123, 71302115, 71301115 and 71540030), Tianjin science and technology plan Projects (15ZLZLZF00990), and the Training Program for Innovation Teams of Universities in Tianjin (No. TD12-5051).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Appendices

Appendix A: Problem-solving process of max \(\pi _{m}\) with K–T condition

We can derive the manufacturer’s optimal solution with the K–T condition. The process can be described as the following:

This problem is equal to the following problem:

In Eqs. (1) and (2), \(p=\frac{a+re}{2b}+\frac{w}{2}\).

Since \(\nabla \pi _m (w,e)\hbox {=}\left( {\begin{array}{l} \frac{\partial \pi _m (w,e)}{\partial w} \\ \frac{\partial \pi _m (w,e)}{\partial e} \\ \end{array}} \right) \), \(\nabla g_1 (w,e)=\left( {\begin{array}{l} 0 \\ 1 \\ \end{array}} \right) \), \(\nabla g_2 (w,e)=\left( {\begin{array}{l} -1 \\ 0 \\ \end{array}} \right) \), \(\nabla g_3 (w,e)=\left( {\begin{array}{l} 0 \\ 1 \\ \end{array}} \right) \) and \(\nabla g_4 (w,e)=\left( {\begin{array}{l} 1 \\ 0 \\ \end{array}} \right) \), the K–T condition of Eq. (2) can be described as follows:

Since \(e~-~1~<~0\) and \(w~>~c, \lambda _{1}~=~ \lambda _{2}~=~\lambda _{4}~=~0\). Thus, we can solve the problem in two kinds of case.

-

(i)

$$\begin{aligned} \left\{ {\begin{array}{l} e=0 \\ \lambda _3 >0 \\ \frac{\partial \pi _m (w,e)}{\partial w}=0 \\ \frac{\partial \pi _m (w,e)}{\partial e}+\lambda _3 =0 \\ \end{array}} \right. \end{aligned}$$(4)

The manufacturer’s optimal solution in this case is

$$\begin{aligned} \left\{ {\begin{array}{l} e=0 \\ w_1 =\frac{a+b(c+p_c )}{2b} \\ \lambda _3 = {[2b(bp_c -r)w_1 -2abp_c -2br(c+p_c )]}/4 \\ \end{array}} \right. \end{aligned}$$(5) -

(ii)

$$\begin{aligned} {}\left\{ {\begin{array}{l} e>0 \\ \lambda _3 =0 \\ \frac{\partial \pi _m (w,e)}{\partial w}=0 \\ \frac{\partial \pi _m (w,e)}{\partial e}+\lambda _3 =0 \\ \end{array}} \right. \end{aligned}$$(6)

The manufacturer’s optimal solution in this case is

By comparing the optimal solutions above, we know the optimal solution of case (i) is a special case of case (ii) when \((a~-~ bc~-~ bp_{c})(r~+~ bp_{c})~=~0\). Therefore, we do not need to compare the extreme point and the maximum point on the boundaries of the feasible region.

Substituting Eq. (7) into\( p=\frac{a+re}{2b}+\frac{w}{2}\), we can describe the optimal solution of the game as follows:

Appendix B: Proof of Proposition 1

Proof

From Eq. (5) we can obtain the following equations:

\(\square \)

Given that the basic market demand (a) is sufficiently large and is significantly greater than the other parameters of the model, we assume \(a~-~{ bc}~-~{ bp}_{c}~>~0\). Considering 4 \(bu~-~(r~+~{ bp}_{c})^{2}~>~0\), we obtain \(\frac{de^{{*}}}{dr}>0, \frac{d^{2}e^{{*}}}{dr^{_2 }}>0, \frac{d\pi _m^{*} }{dr}>0, \frac{d^{2}\pi _m^{*} }{dr^{2}}>0, \frac{d\pi _r^{*} }{dr}>0\), and \(\frac{d^{2}\pi _r^{*} }{dr^{2}}>0\).

Proposition 1 is proven.

Appendix C: Problem-solving process of \(\hbox {max}~U_{m}\) with K–T Condition

We can derive the manufacturer’s optimal solution with the K–T condition. The process can be described as follows:

This problem is equal to the following problem:

In Eqs. (1) and (2), \(p=\frac{(a+re+bw)+b\theta _r [(c-w)+p_c (1-e)]}{2b}\).

Given that \(\nabla U_m (w,e)\hbox {=}\left( {\begin{array}{l} \frac{\partial U_m (w,e)}{\partial w} \\ \frac{\partial U_m (w,e)}{\partial e} \\ \end{array}} \right) \), \(\nabla g_1 (w,e)=\left( {\begin{array}{l} 0 \\ 1 \\ \end{array}} \right) \), \(\nabla g_2 (w,e)=\left( {\begin{array}{l} -1 \\ 0 \\ \end{array}} \right) \), \(\nabla g_3(w,e)=\left( {\begin{array}{l} 0 \\ 1 \\ \end{array}} \right) \), and \(\nabla g_4 (w,e)=\left( {\begin{array}{l} 1 \\ 0 \\ \end{array}} \right) \), the K–T condition of Eq. (2) can be described as

Given that \(e-1<~0_{ }\) and \(w > c\), \({\lambda }_{1}=\lambda _{2}={\lambda }_{4}=0\). Thus, we can solve the problem in two cases.

-

(i)

$$\begin{aligned} \left\{ {\begin{array}{l} e=0 \\ \lambda _3 >0 \\ \frac{\partial U_m (w,e)}{\partial w}=0 \\ \frac{\partial U_m (w,e)}{\partial e}+\lambda _3 =0 \\ \end{array}} \right. \end{aligned}$$(4)

The manufacturer’s optimal solution in this case is

$$\begin{aligned} \left\{ {\begin{array}{l} e=0 \\ w_1 =\frac{a(1-\theta _m )+b(c+p_c )(\theta _r ^{2}\theta _m -2\theta _r +1)}{b(1-\theta _r )(2-\theta _m -\theta _r \theta _m )} \\ \lambda _3 \hbox {=}{\left\{ {\begin{array}{l} -b[(\theta _r -1)(2bp_c +r\theta _m -bp_c \theta _m \theta _r )+(r+bp_c \theta _r )(2-\theta _r \theta _m -\theta _m )]w_1 - \\ 2bp_c (a-2bc\theta _r -2bp_c \theta _r )\hbox {+}2ar\theta _m +2b(bp_c \theta _m \theta _r ^{2}-r)(c+p_c ) \\ \end{array}} \right\} }/4 \\ \end{array}} \right. . \end{aligned}$$(5) -

(ii)

$$\begin{aligned} {}\left\{ {\begin{array}{l} e>0 \\ \lambda _3 =0 \\ \frac{\partial U_m (w,e)}{\partial w}=0 \\ \frac{\partial U_m (w,e)}{\partial e}+\lambda _3 =0 \\ \end{array}} \right. \end{aligned}$$(6)

The manufacturer’s optimal solution in this case is

By comparing the optimal solutions above, we know that the optimal solution of case (i) is a special case of case (ii). We need not compare the extreme point and maximum point on the boundaries of the feasible region. Substituting Eq. (7) into \(p=\frac{(a+re+bw)+b\theta _r [(c-w)+p_c (1-e)]}{2b}\), we can describe the optimal solution of the game as

Appendix D: Proof of Proposition 2

Proof

From \(e_h^{*} =\frac{(a-bc-bp_c )(r+bp_c )(1-\theta _r \theta _m )^{2}}{2bu(1-\theta _r )(2-\theta _m -\theta _r \theta _m )-(r+bp_c )^{2}(1-\theta _r \theta _m )^{2}}\), we can obtain \(\frac{\partial e_{\mathrm{h}} ^{{*}}}{\partial r}\) \( =\frac{(a-bc-bp_c )(1-\theta _r \theta _m )^{2}}{A}\),\(\frac{\partial e_{\mathrm{h}} ^{{*}}}{\partial \theta _m }=\frac{2buB(1-\theta _r )(1-3\theta _r +\theta _r \theta _m +\theta _r ^{2}\theta _m )}{(1-\theta _r \theta _m )A^{2}}\), and \(\frac{\partial e_{\mathrm{h}} ^{*}}{\partial \theta _r }=\frac{4buB(1-\theta _m )^{2}}{(1-\theta _r \theta _m )A^{2}}\). Given that \(A~>~0, B~>~0, -1\le \theta _{\mathrm{m}} \le 1\), and \(-1\le \theta _r \le \sqrt{5}-2\), we obtain \(\frac{\partial e_{\mathrm{h}} ^{{*}}}{\partial r}>0,\frac{\partial e_{\mathrm{h}} ^{{*}}}{\partial \theta _m }>0\), and\(\frac{\partial e_{\mathrm{h}} ^{*}}{\partial \theta _r }>0\). Similarly, \(\frac{\partial ^{2}e_{\mathrm{h}} ^{{*}}}{\partial r^{2}}=\frac{2(r+bp_c )(1-\theta _r \theta _m )^{4}(a-bc-bp_c )}{A^{2}}>0\) is evident. \(\square \)

From \(e_h^{*} =\frac{(a-bc-bp_c )(r+bp_c )(1-\theta _r \theta _m )^{2}}{2bu(1-\theta _r )(2-\theta _m -\theta _r \theta _m )-(r+bp_c )^{2}(1-\theta _r \theta _m )^{2}}\), we derive

and

Considering \(-1\le \theta _{\mathrm{m}} \le 1, -1\le \theta _r \le \sqrt{5}-2,A~>~0, B~>~0, 4{bu}~-~(r~+~{bp}_{c})^{2}~>~0\), and \(\frac{\partial ^{2}U_m }{\partial w^{2}}\frac{\partial ^{2}U_m }{\partial e^{2}}-\frac{\partial ^{2}U_m }{\partial w\partial e}\frac{\partial ^{2}U_m }{\partial e\partial w}\ge 0\), we derive

and

Thus, \(\frac{\partial ^{2}e_{\mathrm{h}} ^{{*}}}{\partial \theta _m^2 }>0\) and \(\frac{\partial ^{2}e_{\mathrm{h}} ^{{*}}}{\partial \theta _r^2 }>0\).

Proposition 2 is proven.

Appendix E: Proof of Proposition 3

Proof

Let \(\theta _{m}\) = 1; we obtain the corresponding optimal decisions, utilities, and profits as follows:

\(\square \)

The optimal decisions and corresponding profits of the manufacturer and retailer and the optimal utility of the manufacturer have nothing to do with \(\theta _{r}\).

In the case of \(\theta _{m}~=~1\), we obtain \(\frac{\partial U_{\mathrm{h}r} ^{*} }{\partial \theta _r }=p_c E-\frac{u(r+bp_c )^{2}(a-bc-bp_c )^{2}}{2[2bu-(r+bp_c )^{2}]^{2}}=\pi _{\mathrm{h}m} ^{*} \). Given that \(\pi _{\mathrm{h}m} ^{*}>0, \frac{\partial U_{\mathrm{h}r} ^{*} }{\partial \theta _r }>0\). The optimal utility of the retailer is non-decreasing with \(\theta _{r}\). Thus, the retailer will not be mean to the manufacturer, i.e., \(\theta _{r} >~0.\)

In the case of \(\theta _{m}~=~1\), we obtain \(\pi _{\mathrm{h}m} ^{*} +\pi _{\mathrm{h}r}^{*} -\pi _m^{*} -\pi _r^{*} =\frac{2b^{2}u^{3}(a-bc-bp_c )^{2}}{[2bu-(r+bp_c )^{2}][4bu-(r+bp_c )^{2}]^{2}}\) and \(\pi _{\mathrm{h}r} ^{*} -\pi _r^{*} =\frac{4b^{2}u^{3}(a-bc-bp_c )^{2}[3bu-(r+bp_c )^{2}]}{[2bu-(r+bp_c )^{2}]^{2}[4bu-(r+bp_c )^{2}]^{2}}\). We previously assume that \(2 bu(1 - \theta _{r})(2 - \theta _{m}~-~ \theta _{r} \theta _{m})~-~(r~+~bp_{c})^{2}(1~-~ \theta _{r}\theta _{m})^{2}~>~0\); therefore, we derive \((1~-~\theta _{r})^{2}[2 bu~-~(r~+~{bp}_{c})^{2}]~>~0\) in case of \(\theta _{m}~=~1, \hbox {then } 2{bu}~-~(r~+~{bp}_{c})^{2}~>~0\). We obtain \(\pi _{\mathrm{h}r} ^{*} >\pi _r^{*} \) and \(\pi _{\mathrm{h}m} ^{*} +\pi _{\mathrm{h}r} ^{*} >\pi _m^{*} +\pi _r^{*} \).

Proposition 3 is proven.

Rights and permissions

About this article

Cite this article

Xia, L., Guo, T., Qin, J. et al. Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Ann Oper Res 268, 149–175 (2018). https://doi.org/10.1007/s10479-017-2657-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2657-2