Abstract

Predicting whether a borrower will default on a loan is of significant concern to platforms and investors in online peer-to-peer (P2P) lending. Because the data types online platforms use are complex and involve unstructured information such as text, which is difficult to quantify and analyze, loan default prediction faces new challenges in P2P. To this end, we propose a default prediction method for P2P lending combined with soft information related to textual description. We introduce a topic model to extract valuable features from the descriptive text concerning loans and construct four default prediction models to demonstrate the performance of these features for default prediction. Moreover, a two-stage method is designed to select an effective feature set containing both soft and hard information. An empirical analysis using real-word data from a major P2P lending platform in China shows that the proposed method can improve loan default prediction performance compared with existing methods based only on hard information.

Similar content being viewed by others

References

Abdou, H. A., & Pointon, J. (2011). Credit scoring, statistical techniques and evaluation criteria: A review of the literature. Intelligent Systems in Accounting Finance & Management, 18(2–3), 59–88.

Angilella, S., & Mazzù, S. (2015). The financing of innovative SMEs: A multicriteria credit rating model. European Journal of Operational Research, 244(2), 540–554.

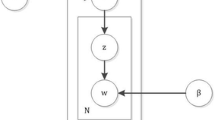

Blei, D. M., Ng, A. Y., & Jordan, M. I. (2003). Latent Dirichlet allocation. JMLR.org.

Breiman, L. (2001). Random forests. Machine Learning, 45(1), 5–32.

Cornée, S. (2017). The relevance of soft information for predicting small business credit default: Evidence from a social bank. Journal of Small Business Management. doi:10.1111/jsbm.12318.

Cortes, C., & Vapnik, V. (1995). Support-vector networks. Machine Learning, 20(3), 273–297.

Crook, J. N., Edelman, D. B., & Thomas, L. C. (2007). Recent developments in consumer credit risk assessment. European Journal of Operational Research, 183(3), 1447–1465.

Dorfleitner, G., Priberny, C., Schuster, S., Stoiber, J., Weber, M., Castro, I. D., et al. (2016). Description-text related soft information in peer-to-peer lending—Evidence from two leading european platforms. Journal of Banking & Finance, 64, 169–187.

Emekter, R., Tu, Y., Jirasakuldech, B., & Lu, M. (2015). Evaluating credit risk and loan performance in online peer-to-peer (p2p) lending. Applied Economics, 47(1), 54–70.

Finlay, S. (2011). Multiple classifier architectures and their application to credit risk assessment. European Journal of Operational Research, 210(2), 368–378.

Friedman, N., Dan, G., & Goldszmidt, M. (1997). Bayesian network classifiers. Machine Learning, 29(2–3), 131–163.

Gao, Q., & Lin, M. (July 15, 2016). Economic value of texts: Evidence from online debt crowdfunding. Available at SSRN: doi:10.2139/ssrn.2446114.

Guo, Y., Zhou, W., Luo, C., Liu, C., & Xiong, H. (2015). Instance-based credit risk assessment for investment decisions in p2p lending. European Journal of Operational Research, 249(2), 417–426.

Hajek, P., & Michalak, K. (2013). Feature selection in corporate credit rating prediction. Knowledge-Based Systems, 51(1), 72–84.

Harris, T. (2013). Quantitative credit risk assessment using support vector machines: Broad versus narrow default definitions. Expert Systems with Applications, 40(11), 4404–4413.

Huang, C. L., Chen, M. C., & Wang, C. J. (2007). Credit scoring with a data mining approach based on support vector machines. Expert Systems with Applications, 33(4), 847–856.

Iyer, R., Khwaja, A. I., Luttmer, E. F., & Shue, K. (2015). Screening peers softly: Inferring the quality of small borrowers. Management Science, 62(6), 1554–1577.

Hájek, P. (2011). Municipal credit rating modelling by neural networks. Decision Support Systems, 51(1), 108–118.

Kruppa, J., Schwarz, A., Arminger, G., & Ziegler, A. (2013). Consumer credit risk: Individual probability estimates using machine learning. Expert Systems with Applications, 40(13), 5125–5131.

Kruppa, J., Ziegler, A., & König, I. R. (2012). Risk estimation and risk prediction using machine-learning methods. Human Genetics, 131(10), 1639–1654.

Landwehr, N., Hall, M., & Frank, E. (2005). Logistic model trees. Machine Learning, 59(1–2), 161–205.

Lessmann, S., Baesens, B., Seow, H. V., & Thomas, L. C. (2015). Benchmarking state-of-the-art classification algorithms for credit scoring: An update of research. European Journal of Operational Research, 247(1), 124–136.

Liberti, J. M., & Petersen, M. A. (2017). Information: Hard and Soft. Working Paper.

Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17–35.

Malekipirbazari, M., & Aksakalli, V. (2015). Risk assessment in social lending via random forests. Expert Systems with Applications, 42(10), 4621–4631.

Michels, J. (2012). Do unverifiable disclosures matter? Evidence from peer-to-peer lending. The Accounting Review, 87(4), 1385–1413.

Paul, S. (2014). Creditworthiness of a borrower and the selection process in micro-finance: A case study from the urban slums of India. Margin: The Journal of Applied Economic Research, 8(1), 59–75.

Pope, D. G., & Sydnor, J. R. (2011). What’s in a picture? Evidence of discrimination from prosper.com. Journal of Human Resources, 46(1), 53–92.

Puro, L., Teich, J. E., Wallenius, H., & Wallenius, J. (2010). Borrower decision aid for people-to-people lending. Decision Support Systems, 49(1), 52–60.

Shao, H., Ju, X., Wu, C., Xu, J., & Liu, M. (2012). Research on commercial bank credit risk evaluation model based on the integration of the probability distribution theory and the bp neural network technology. International Journal of Advancements in Computing Technology, 4(22), 115–128.

Thomas, L. C. (2010). Consumer finance: Challenges for operational research. Journal of the Operational Research Society, 61(1), 41–52.

Wang, G., Ma, J., Huang, L., & Xu, K. (2012). Two credit scoring models based on dual strategy ensemble trees. Knowledge-Based Systems, 26, 61–68.

Wang, S., Qi, Y., Fu, B., & Liu, H. (2016). Credit risk evaluation based on text analysis. International Journal of Cognitive Informatics & Natural Intelligence, 10(1), 1–11.

Wei, X., & Croft, W. B. (2006). LDA-based document models for ad-hoc retrieval. In International ACM SIGIR Conference on Research and Development in Information Retrieval (pp. 178–185). ACM.

Yao, X., Crook, J., & Andreeva, G. (2015). Support vector regression for loss given default modelling. European Journal of Operational Research, 240(2), 528–538.

Acknowledgements

The authors gratefully acknowledge the assistance provided by the constructive comments of the anonymous referees, which considerably improved the paper in terms of quality and clarity. This work was funded primarily by the National Natural Science Foundation of China (Grant Nos. 71571059,71331002 and 71731005), and the Humanities and Social Sciences Fund Projects of the Ministry of Education (Grant Nos. 13YJA630037, 15YJA630010).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jiang, C., Wang, Z., Wang, R. et al. Loan default prediction by combining soft information extracted from descriptive text in online peer-to-peer lending. Ann Oper Res 266, 511–529 (2018). https://doi.org/10.1007/s10479-017-2668-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2668-z