Abstract

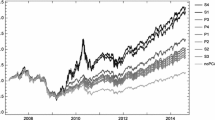

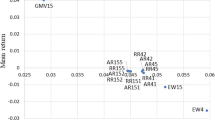

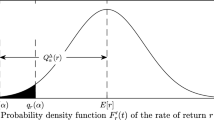

In this paper, we examine the use of conditional expectation, either to reduce the dimensionality of large-scale portfolio problems or to propose alternative reward–risk performance measures. In particular, we focus on two financial problems. In the first part, we discuss and examine correlation measures (based on a conditional expectation) used to approximate the returns in large-scale portfolio problems. Then, we compare the impact of alternative return approximation methodologies on the ex-post wealth of a classic portfolio strategy. In this context, we show that correlation measures that use the conditional expectation perform better than the classic measures do. Moreover, the correlation measure typically used for returns in the domain of attraction of a stable law works better than the classic Pearson correlation does. In the second part, we propose new performance measures based on a conditional expectation that take into account the heavy tails of the return distributions. Then, we examine portfolio strategies based on optimizing the proposed performance measures. In particular, we compare the ex-post wealth obtained from applying the portfolio strategies, which use alternative performance measures based on a conditional expectation. In doing so, we propose an alternative use of conditional expectation in various portfolio problems.

Similar content being viewed by others

Notes

For a survey of recent contributions from operations research and finance to the theory of portfolio selection see Fabozzi et al. (2010).

We define the ith gross return between time t and time \(t+1\) as \(z_{i,t}=\frac{P_{t+1,i}}{P_{t,i}}\), the ith net return (or simply return) as \(y_{i,t}=z_{i,t}-1\), and the ith log return as \(\ln (z_{i,t})\), where \(P_{t,i}\) is the price of the ith asset at time t.

Observe that if we have T observations of n gross returns \(z_{i,t}\) (\(t=1,\ldots , T; i=1,\ldots , n)\), then the T observations of upper stochastic bound U are given by \(U_{t}=\max \limits _{1 \le i \le n} z_{i,t}\), with \(t=1,\ldots ,T\).

See Scott (2015) for a more complete treatment, from a historical viewpoint, and with complete references and a detailed discussion of variations that have been suggested.

For a more detailed discussion about the properties of multivariate locally weighted least squares regressions, refer to Ruppert and Wand (1994).

Several papers examine the impact of transaction costs on trading operation (see, e.g., Georgiev et al. 2015). We use the transaction cost level mentioned above because some trading platforms pay about 20 basis points, with some maximum transaction costs per order. See, for example, the IB platform on the website: https://www.interactivebrokers.com/en/index.php?f=commission&p=stocks2.

The term ‘bear market’ describes the downward trend of a stock index or negative stock index returns over a period, while the term ‘bull market’ is used to describe upward trend.

With a little abuse of notation, we write the dispersion matrix as

$$\begin{aligned} \Sigma =\left[ \begin{array}{lll} \Sigma _{X} &{} \Sigma _{XY} &{} \Sigma _{XZ}\\ \Sigma _{YX} &{} \Sigma _{Y} &{} \Sigma _{YZ}\\ \Sigma _{ZX} &{} \Sigma _{ZY} &{} \Sigma _{Z}\\ \end{array} \right] = \left( \left( \Sigma _{X},\Sigma _{XY},\Sigma _{XZ}\right) ,\left( \Sigma _{YX},\Sigma _{Y},\Sigma _{YZ}\right) ,\left( \Sigma _{ZX},\Sigma _{ZY},\Sigma _{Z}\right) \right) .\end{aligned}$$

References

Ait-Sahalia, Y., & Lo, A. W. (1998). Nonparametric estimation of state-price densities implicit in financial asset prices. The Journal of Finance, 53(2), 499–547.

Angelelli, E., & Ortobelli, S. (2009). American and European portfolio selection strategies: The Markovian approach. In P. N. Catlere (Ed.), Financial hedging (pp. 119–152). New York: Nova Science.

Artzner, P., Delbaen, F., Eber, J. M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9(3), 203–228.

Backus, D., Foresi, S., & Zin, S. (1998). Arbitrage opportunities in arbitrage-free models of bond pricing. Journal of Business and Economic Statistics, 16, 13–24.

Bertocchi, M., Consigli, G., D’Ecclesia, R., Giacometti, R., Moriggia, V., & Ortobelli, L. S. (2013). Euro bonds: Markets, infrastructure and trends. Singapore: World Scientific.

Biglova, A., Ortobelli, S., & Fabozzi, F. (2014). Portfolio selection in the presence of systemic risk. The Journal of Asset Management, 15, 285–299.

Biglova, A., Ortobelli, S., Rachev, S., & Stoyanov, S. (2004). Different approaches to risk estimation in portfolio theory. Journal of Portfolio Management, 31(1), 103–112.

Boente, G., & Fraiman, R. (1989). Robust nonparametric regression estimation. Journal of Multivariate Analysis, 29, 180–198.

Bowman, A. W., & Azzalini, A. (1997). Applied smoothing techniques for data analysis. London: Oxford University Press.

Brockwell, P., & Davis, R. (1998). Time series: Theory and methods. New York: Springer.

Chamberlain, G. (1983). A characterization of the distributions that imply mean-variance utility functions. Journal of Economics Theory, 29, 185–201.

Cherubini, U., Luciano, E., & Vecchiato, W. (2004). Copula methods in finance. Chichester: Wiley.

Coqueret, G., & Milhau, V. (2014). Estimating covariance matrices for portfolio optimization. ERI Scientific Beta White Paper.

Daly, J., Crane, M., & Ruskin, H. (2008). Random matrix theory filters in portfolio optimization: A stability and risk assessment. Physica A: Statistical Mechanics and its Applications, 387(16–17), 4248–4260.

Davidson, R., & Jean-Yves, D. (2000). Statistical inference for stochastic dominance and for the measurement of poverty and inequality. Econometrica, 68(6), 1435–1464.

Dehong, L., Hongmei, G., & Tiancai, X. (2016). The meltdown of the Chinese equity market in the summer of 2015. International Review of Economics & Finance, 45, 504–517.

DeMiguel, V., Garlappi, L., & Uppal, R. (2009). Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Review of Financial Studies, 22, 1915–1953.

Fabozzi, F. J., Dashan, H., & Guofu, Z. (2010). Robust portfolios: Contributions from operations research and finance. Annals of Operations Research, 176(1), 191–220.

Fama, E. (1965). The behavior of stock market prices. Journal of Business, 38, 34–105.

Fan, J., Hu, T. C., & Truong, Y. K. (1994). Robust non-parametric function estimation. Scandinavian Journal of statistics, 21(4), 433–446.

Farinelli, S., Ferreira, M., & Rossello, D. (2008). Beyond Sharpe ratio: Optimal asset allocation using different performance ratios. Journal of Banking & Finance, 32(10), 2057–2063.

Georgiev, K., Kim, Y. S., & Stoyanov, S. (2015). Periodic portfolio revision with transaction costs. Mathematical Methods of Operations Research, 81, 337–359.

Härdle, W., & Müller, M. (2000). Multivariate and semiparametric kernel regression. In M. G. Schimek (Ed.), Smoothing and regression: Approaches, computation, and application (pp. 357–392). New York: Wiley.

Ingersoll, J. E. (1987). Theory of financial decision making. Rowman & Littlefield Studies in Financial Economics.

Jones, M. C., Marron, J. S., & Sheather, J. S. (1996). A brief survey of bandwidth selection for density estimation. Journal of the American Statistical Association, 91(433), 401–407.

Kan, R., & Zhou, G. (2007). Optimal portfolio choice with parameter uncertainty. Journal of Financial and Quantitative Analysis, 42(3), 621–656.

Kondor, I., Pafka, S., & Nagy, G. (2007). Noise sensitivity of portfolio selection under various risk measures. Journal of Banking and Finance, 31, 1545–1573.

Ledoit, O., & Wolf, M. (2003). Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. Journal of Empirical Finance, 10, 603–621.

Ledoit, O., Wolf, M., & Honey, I. (2004). shrunk the covariance matrix. Journal of Portfolio Management, 30(4), 110–119.

Levy, H., & Markowitz, H. M. (1979). Approximating expected utility by a function of mean and variance. American Economic Review, 69, 308–317.

Mandelbrot, B. (1963). The variation of certain speculative prices. Journal of Business, 26, 394–419.

Markowitz, H. M. (1952). The utility of wealth. Journal of Political Economy, 60, 151–158.

Maronna, R. A., Martin, R. D., & Yohai, V. J. (2006). Robust statistics: Theory and methods., Wiley series in probability and statistics Chichester: Wiley.

Martin, D., Rachev, S., & Siboulet, F. (2003). Phi-alpha optimal portfolios and extreme risk management. Wilmott Magazine of Finance, 2003(6), 70–83.

Müller, A., & Stoyan, D. (2002). Comparison methods for stochastic models and risks. New York: Wiley.

Nadaraya, E. A. (1964). On estimating regression. Theory of Probability and its Applications, 9(1), 141–142.

Nolan, J. P., & Ojeda-Revah, D. (2013). Linear and nonlinear regression with stable errors. Journal of Econometrics, 172(2), 186–194.

Ortobelli, S., & Lando, T. (2015). Independence tests based on the conditional expectation. WSEAS Transactions on Mathematics, 14, 335–344.

Ortobelli, S., Petronio, F., & Lando, T. (2017). A portfolio return definition coherent with the investors preferences. IMA Journal of Management Mathematics, 28(3), 451–466.

Ortobelli, S., & Tichý, T. (2015). On the impact of semidefinite positive correlation measures in portfolio theory. Annals of Operations Research, 235(1), 625–652.

Owen, J., & Rabinovitch, R. (1983). On the class of elliptical distributions and their applications to the theory of portfolio choice. Journal of Finance, 38, 745–752.

Papp, G., Pafka, S., Nowak, M. A., & Kondor, I. (2005). Random matrix filtering in portfolio optimization. ACTA Physica Polonica B, 36, 2757–2765.

Rachev, S. T., Menn, C., & Fabozzi, F. J. (2005). Fat-tailed and skewed asset return distributions: Implications for risk management, portfolio selection, and option pricing. New York: Wiley.

Rachev, S. T., & Mittnik, S. (2000). Stable paretian models in finance. Chichester: Wiley.

Rachev, S., Ortobelli, S., Stoyanov, S., Fabozzi, F., & Biglova, A. (2008). Desirable properties of an ideal risk measure in portfolio theory. International Journal of Theoretical and Applied Finance, 11(1), 19–54.

Ross, S. (1978). Mutual fund separation in financial theory-the separating distributions. Journal of Economic Theory, 17, 254–286.

Ruppert, D., & Wand, M. P. (1994). Multivariate locally weighted last squares regression. The Annals of Statistics, 22(3), 1346–1370.

Samorodnitsky, G., & Taqqu, M. S. (1994). Stable non-Gaussian random processes: Stochastic models with infinite variance (Vol. 1). Boca Raton: CRC Press.

Scarsini, M. (1984). On measures of concordance. Stochastica, 8, 201–218.

Schoutens, W. (2003). Levy processes in finance. New York: Wiley.

Scott, D. W. (2015). Multivariate density estimation: Theory, practice, and visualization. New York: Wiley.

Sharpe, W. F. (1994). The sharpe ratio. Journal of Portfolio Management, Fall 21, 45–58.

Stanton, R. (1997). A nonparametric model of term structure dynamics and the market price of interest rate risk. The Journal of Finance, 52(5), 1973–2002.

Statman, M. (2004). The diversification puzzle. Financial Analysts Journal, 60(4), 44–53.

Stoyanov, S., Rachev, S., & Fabozzi, F. (2007). Optimal financial portfolios. Applied Mathematical Finance, 14(5), 401–436.

Szegö, G. (2004). Risk measures for the 21st century. Chichester: Wiley.

Tobin, J. (1958). Liquidity preference as behavior towards risk. Review of Economic Studies, 25, 65–86.

Watson, G. S. (1964). Smooth regression analysis. Sankhya, Series A, 26(4), 359–372.

Acknowledgements

This paper was supported by the Italian funds MURST 2016/2017 and by STARS Supporting Talented Research—Action 1—2017. The research was also supported by the Czech Science Foundation (GACR) under Project 17-19981S, and by VSB-TU Ostrava under the SGS Project SP2018/34.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Proof of Theorem 1

To prove Theorem 1, we need to prove the following proposition. \(\square \)

Proposition

Let \(W=(X,Y,Z)\) be an n-dimensional elliptically distributed vector \(Ell(\mu ,\Sigma )\), where X, Y, and Z are p-dimensional, q-dimensional, and \(n-p-q\) dimensional vectors (\(n>p>q\ge 1\)), respectively, with dispersion matrix:Footnote 11

and mean \(\mu =(\mu _{X},\mu _{Y},\mu _{Z})\), such that Y and Z are uncorrelated. Moreover, assume that \(W=\mu +AG\), where A is a continuous positive random variable, which is independent of the Gaussian vector G, which has a null mean and variance–covariance matrix \(\Sigma \). Then

Proof

Let \(K=(Y,Z)\). Then, \(\Sigma _{K}=\left( \left( \Sigma _{Y},0\right) ,\left( 0,\Sigma _{Z}\right) \right) \), \(\mu _K=(\mu _Y,\mu _Z)'\) because Y and Z are uncorrelated (i.e., \(\Sigma _{YZ}=0\)). This implies that:

and

where \(\Sigma _{XK}=\left[ \Sigma _{XY},\Sigma _{XZ}\right] \). According to Corollary 1 proposed by Ortobelli and Lando (2015), we know that:

from which we get

Thus, the thesis holds. \(\square \)

The proof of Theorem 1 is a logical consequence of the above proposition. As a matter of fact, we obtain the proof with two factors if we assume Y and Z from the previous Proposition are two uncorrelated one-dimensional factors. The general proof follows by induction.

Appendix B

This appendex provides practical examples of the proposed performance measures TOK and JTOK using five assets, namely Apple Inc. (AAPL), Boeing Company (BA), JPMorgan Chase & Co. (JPM), Coca-Cola Company (KO), and 3M Company (MMM), over the period from January, 2015 to August, 2016.

Let us consider the TOK and JTOK performance measures for the uniform portfolio (i.e., \(x=[0.2,0.2,0.2,0.2,0.2]'\)). First, for the TOK ratio, we approximate the \(\sigma \)-algebras \(\mathfrak {I}_{L}(x)\) and \(\mathfrak {I}_{P}(x)\) generated by the portfolio losses and by the portfolio profits respectively. Thus, for the \(\sigma \)-algebras \(\mathfrak {I}_{L}(x)\) and \(\mathfrak {I}_{P}(x)\) we consider the following partitions \(\{A_1,A_2,A_3\}\) and \(\{B_1,B_2,B_3\}\), respectively, as follows:

Second, for the JTOK ratio, we approximate the \(\sigma \)-algebras \(\mathfrak {I}_{Loss}\) and \(\mathfrak {I}_{G}\) generated by the joint losses and gains respectively. On the one hand, for \(\mathfrak {I}_{Loss}\), we calculate the function g that counts the total number of assets that are jointly lossing more than their \(VaR_{0.2}(z_i)\), i.e., \(g(w)=\sum _{i=1}^5 {\mathbf {1}}_{L_{i}^{(0.2)}}(w)\), where \({\mathbf {1}}_{L_{i}^{(0.2)}}\) is the indicator function of \(L_{i}^{(0.2)}=\{z_i\le F_{z_i}^{-1}(0.2)\}\), and \(F_{z_i}^{-1}(p)=\text{ inf }\{v: F_{z_i}(v)>p\}\). On the other hand, for \(\mathfrak {I}_{G}\), we compute the function f, that counts the total number of assets with returns greater than 0.8 percentile, as \(f(w)=\sum _{i=1}^5 {\mathbf {1}}_{G_{i}^{(0.8)}}(w)\), where \(G_{i}^{(0.8)}=\{z_i\ge F_{z_i}^{-1}(0.8)\}\). Table 8 reports the monthly gross returns and functions f and g of the five assets.

Thus, for \(\mathfrak {I}_{Loss}\) and \(\mathfrak {I}_{G}\), we consider the following partitions \(\{A_{1,g},A_{2,g},A_{3,g}\}\) and \(\{B_{1,f},B_{2,f},B_{3,f}\}\), respectively, as follows:

Table 9 reports the uniform portfolio and the partitions used for the TOK and JTOK performance measures (1 when \(x'z\) belongs to its proper partition, 0 otherwise).

Third, we calculate the quantities \(E(x'z|\mathfrak {I}_{L}(x))\) and \(E(x'z|\mathfrak {I}_{P}(x))\) for the TOK performance measure and \(E(x'z|\mathfrak {I}_{Loss})\) and \(E(x'z|\mathfrak {I}_{G})\) for the JTOK ratio. To this end, we use the following consistent estimator (see Ortobelli et al. 2017):

where \(\eta _{A_j}\) are the numbers of elements of \(A_j\). In this case, \(A_j\) is either \(A_j, B_j, A_{j,g}\), or \(B_{j,f}\). Accordingly, \(\mathfrak {I}_{k}\) is either \(\mathfrak {I}_{L}(x), \mathfrak {I}_{P}(x)\), \(\mathfrak {I}_{Loss}\), or \(\mathfrak {I}_{G}\). Our results based on this estimator are reported in Table 10.

Fourth, we caculate the portfolio net returns every month as follows:

-

\(y_{P}=E(x^{\prime }z|\mathfrak {I}_{P}(x))-1\) and \(y_{L}=E(x^{\prime }z |\mathfrak {I}_{L} (x))-1\) for the TOK performance.

-

\(y_{G}=E(x^{\prime }z|\mathfrak {I}_{G})-1\) and \(y_{Loss}=E(x^{\prime }z |\mathfrak {I}_{Loss})-1\) for the JTOK performance.

Fifth, we compute the cumulative product as follows:

-

\(W_{P,20}=\Pi _{t=1}^{20} (1+y_{P})_{t}=1.1063 \) and \(W_{L,20}= \Pi _{t=1}^{20} (1-y_{L} )_{t}=0.8880 \) for the TOK performance.

-

\(W_{G,20}=\Pi _{t=1}^{20} (1+y_{G})_{t}=1.1076 \) and \(W_{Loss,20}= \Pi _{t=1}^{20} (1-y_{Loss} )_{t}=0.8883 \) for the JTOK performance.

Finally, we calcule the ratio between \(W_{P,20}\) and \(W_{L,20}\) and ratio between \(W_{G,20}\) and \(W_{Loss,20}\) which give respctively \(TOK= 1.2457\) and \(JTOK= 1.2468\).

Rights and permissions

About this article

Cite this article

Ortobelli, S., Kouaissah, N. & Tichý, T. On the use of conditional expectation in portfolio selection problems. Ann Oper Res 274, 501–530 (2019). https://doi.org/10.1007/s10479-018-2890-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2890-3