Abstract

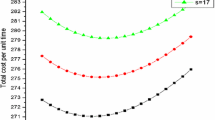

In this paper, we study an inventory system for products where demand depends on time and price. Shortages are allowed and are fully backordered. We suppose that the demand rate is the product of a power time pattern and a three-parametric exponential price function. The objective is to determine the economic lot size, the optimal shortage level and the best selling price to maximize the total profit per unit time. We present an efficient procedure to determine the optimal solution of the inventory problem for all possible scenarios. This procedure is illustrated with several numerical examples. A sensitivity analysis of the optimal inventory policy with respect to the parameters of the demand rate function is also given. Finally, the main contributions of this paper are highlighted and future research directions are introduced.

Similar content being viewed by others

References

Avinadav, T., Herbon, A., & Spiegel, U. (2013). Optimal inventory policy for a perishable item with demand function sensitive to price and time. International Journal of Production Economics, 144, 497–506.

Avinadav, T., Herbon, A., & Spiegel, U. (2014). Optimal ordering and pricing policy for demand functions that are separable into price and inventory age. International Journal of Production Economics, 155, 406–417.

Birbil, Şİ., Bülbül, K., Frenk, J. B. G., & Mulder, H. M. (2015). On EOQ cost models with arbitrary purchase and transportation costs. Journal of Industrial and Management Optimization, 11, 1211–1245.

Bolton, R. N. (1989). The robustness of retail-level price elasticity estimates. Journal of Retailing, 65, 193–219.

Cárdenas-Barrón, L. E., Chung, K. J., & Treviño-Garza, G. (2014). Celebrating a century of the economic order quantity model in honor of Ford Whitman Harris. International Journal of Production Economics, 155, 1–7.

Chen, Y. F., Ray, S., & Song, Y. (2006). Optimal pricing and inventory control policy in periodic-review systems with fixed ordering cost and lost sales. Naval Research Logistics, 53, 117–136.

Cowling, K., & Cubbin, J. (1971). Price, quality and advertising competition: An econometric investigation of the United Kingdom car market. Economica, 38, 378–394.

Datta, T. K., & Pal, A. K. (1988). Order level inventory system with power demand pattern for items with variable rate of deterioration. Indian Journal of Pure and Applied Mathematics, 19, 1043–1053.

Feng, L., Chan, Y. L., & Cárdenas-Barrón, L. E. (2017). Pricing and lot-sizing polices for perishable goods when the demand depends on selling price, displayed stocks, and expiration date. International Journal of Production Economics, 185, 11–20.

Ghoreishi, M., Weber, G. W., & Mirzazadeh, A. (2015). An inventory model for non-instantaneous deteriorating items with partial backlogging, permissible delay in payments, inflation- and selling price-dependent demand and customer returns. Annals of Operations Research, 226, 221–238.

Hanssens, D. M., & Parsons, L. (1993). Econometric and time-series: Market response models. In J. Eliashberg & G. L. Lilien (Eds.), Handbooks in operations research and management science: Marketing (pp. 409–464). Amsterdam: Elsevier.

Hossen, M. A., Hakim, M. A., Ahmed, S. S., & Uddin, M. S. (2016). An inventory model with price and time dependent demand with fuzzy valued inventory costs under inflation. Annals of Pure and Applied Mathematics, 11, 21–32.

Huang, J., Leng, M., & Parlar, M. (2013). Demand functions in decision modeling: A comprehensive survey and research directions. Decision Sciences, 44, 557–609.

Jaggi, C. K., Tiwari, S., & Goel, S. K. (2017). Credit financing in economic ordering policies for non-instantaneous deteriorating items with price dependent demand and two storage facilities. Annals of Operations Research, 248, 253–280.

Jakšič, M., & Fransoo, J. C. (2015). Optimal inventory management with supply backordering. International Journal of Production Economics, 159, 254–264.

Jeuland, A. P., & Shugan, S. M. (1988). Channel of distribution profits when channel members form conjectures. Marketing Science, 7, 202–210.

Krishnamurthi, L. K., & Raj, S. P. (1988). A model of brand choice and purchase quantity price sensitivities. Marketing Science, 7, 1–20.

Lee, W. C., & Wu, J. W. (2002). An EOQ model for items with Weibull distributed deterioration, shortages and power demand pattern. International Journal of Information and Management Sciences, 13, 19–34.

Mishra, S. S., Gupta, S., Yadav, S. K., & Rawat, S. (2015). Optimization of fuzzified economic order quantity model allowing shortage and deterioration with full backlogging. American Journal of Operational Research, 5, 103–110.

Mishra, S., Raju, L. K., Misra, U. K., & Misra, G. (2012). A study of EOQ model with power demand of deteriorating items under the influence of inflation. General Mathematics Notes, 10, 41–50.

Mishra, S. S., & Singh, P. K. (2013). Partial backlogging EOQ model for queued customers with power demand and quadratic deterioration: Computational approach. American Journal of Operational Research, 3, 13–27.

Mishra, U., Cárdenas-Barrón, L. E., Tiwari, S., Shaikh, A. A., & Treviño-Garza, G. (2017). An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment. Annals of Operations Research, 254, 165–190.

Naddor, E. (1966). Inventory systems. New York: Wiley.

Prasad, K., & Mukherjee, B. (2016). Optimal inventory model under stock and time dependent demand for time varying deterioration rate with shortages. Annals of Operations Research, 243, 323–334.

Rajeswari, N., & Indrani, K. (2015). EOQ policies for linearly time dependent deteriorating items with power demand and partial backlogging. International Journal of Mathematical Archive, 6(122–130), 2015.

Rajeswari, N., & Vanjikkodi, T. (2011). Deteriorating inventory model with power demand and partial backlogging. International Journal of Mathematical Archive, 2, 1495–1501.

San-José, L. A., & García-Laguna, J. (2009). Optimal policy for an inventory system with backlogging and all-units discounts: Application to the composite lot size model. European Journal of Operational Research, 192, 808–823.

San-José, L. A., Sicilia, J., González-De-la-Rosa, M., & Febles-Acosta, J. (2017). Optimal inventory policy under power demand pattern and partial backlogging. Applied Mathematical Modelling, 46, 618–630.

Sarkar, B., Mandal, P., & Sarkar, S. (2014). An EMQ model with price and time dependent demand under the effect of reliability and inflation. Applied Mathematics and Computation, 231, 414–421.

Sicilia, J., Febles-Acosta, J., & González-De la Rosa, M. (2012). Deterministic inventory systems with power demand pattern. Asia-Pacific Journal of Operational Research, 29, article 1250025.

Sicilia, J., Febles-Acosta, J., & González-de la Rosa, M. (2013). Economic order quantity for a power demand pattern system with deteriorating items. European Journal of Industrial Engineering, 7, 577–593.

Smith, N. R., Martínez-Flores, J. L., & Cárdenas-Barrón, L. E. (2007). Analysis of the benefits of joint price and order quantity optimisation using a deterministic profit maximisation model. Production Planning & Control, 18, 310–318.

Song, Y. Y., Ray, S., & Li, S. L. (2008). Structural properties of buyback contracts for price-setting newsvendors. Manufacturing & Service Operations Management, 10, 1–18.

Soni, H. N. (2013). Optimal replenishment policies for non-instantaneous deteriorating items with price and stock sensitive demand under permissible delay in payment. International Journal of Productions Economics, 146, 259–268.

Valliathal, M., & Uthayakumar, R. (2011). Optimal pricing and replenishment policies of an EOQ model for non-instantaneous deteriorating items with shortages. The International Journal of Advanced Manufacturing Technology, 54, 361–371.

Wu, J., Skouri, K., Teng, J. T., & Ouyang, L. Y. (2014). A note on “optimal replenishment policies for non-instantaneous deteriorating items with price and stock sensitive demand under permissible delay in payment”. International Journal of Productions Economics, 155, 324–329.

Acknowledgements

The authors wish to thank the anonymous referees and the guest editor for their valuable suggestions and comments. This work is partially supported by the Spanish Ministry of Economy, Industry and Competitiveness and European FEDER funds through the research projects MTM2013-43396-P and MTM2017-84150-P.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

For a fixed value p, the function P(Q, B, p) is twice-differentiable on the region

The first partial derivatives are

Thus, the second partial derivatives are given by

If we prove that the determinant of the Hessian matrix is positive for all \( (Q,B)\in \Lambda \), the first assertion follows, because \(\partial ^{2}P(Q,B,p)/\partial Q^{2}<0\) for all \((Q,B)\in \Lambda \).

Indeed, the determinant of the Hessian matrix is

To prove the second assertion, it is sufficient to show that the point \( (Q_{p}^{*},B_{p}^{*})\) given by (10) and (11) belongs to \(\Lambda \) and that \(\left. \frac{\partial P(Q,B,p)}{\partial Q} \right| _{(Q_{p}^{*},B_{p}^{*})}=\left. \frac{\partial P(Q,B,p)}{ \partial B}\right| _{(Q_{p}^{*},B_{p}^{*})}=0\), which is immediate. \(\square \)

Proof of Lemma 2

The second derivative of f(x) is

Note that \(f^{\prime \prime }(x)>0\) for all \(x>0\). Moreover, \( \lim _{x\rightarrow 0^{+}}f(x)=\infty \) and \(\lim _{x\rightarrow \infty }f(x)=\infty \). Therefore, the function f(x) is strictly convex and it attains its minimum at point \(x_{1}\) given by (17). \(\square \)

Proof of Theorem 1

-

1.

If \(x_{1}\le c^{\gamma }\), then \(f^{\prime }(p^{\gamma })>0\) for \(p>c\) and, therefore, \(f(p^{\gamma })>f(c^{\gamma })>0\) for all \(p\ge c\). Since sign\((G^{\prime }(p))=\)sign\((f(p^{\gamma }))\), we see that the function G(p) is strictly increasing on \((c,\infty )\).

-

2.

If \(x_{1}>c^{\gamma }\) and \(f(x_{1})\ge 0\), then it is obvious that \( f(p^{\gamma })>f(x_{1})\ge 0\) for all \(p\ne x_{1}^{1/\gamma }\) and we conclude as in the previous case.

-

3.

If \(x_{1}>c^{\gamma }\) and \(f(x_{1})<0\), then there exist two roots \( x_{0}\) and \(\widetilde{x}\) of the equation \(f(x)=0\), with \(c^{\gamma }<x_{0}<x_{1}<\widetilde{x}\), such that the function f(x) is positive on \( (c^{\gamma },x_{0})\), negative on \((x_{0},\widetilde{x})\) and positive on \(( \widetilde{x},\infty )\). Thus, the function G(p) is strictly increasing on \((c^{\gamma },x_{0})\), strictly decreasing on \((x_{0},\widetilde{x})\) and strictly increasing on \((\widetilde{x},\infty )\). Therefore, G(p) attains its minimum at \(p^{*}=x_{0}^{1/\gamma }\) or \(p^{*}=\infty \). Comparing the values \(G(x_{0}^{1/\gamma })\) and \(\lim _{p\rightarrow \infty }G(p)=0\), we obtain the optimal selling price.

\(\square \)

Proof of Lemma 3

From (21), we have

and

The rest of the proof follows from \(\lim _{x\rightarrow -\infty }f_{1}(x)=\infty \) and \(\lim _{x\rightarrow \infty }f_{1}(x)=\infty \). \(\square \)

Proof of Theorem 2

This follows by the same method as in the proof of Theorem 1. \(\square \)

Proof of Lemma 4

-

1.

Substituting \(p_{1}\) given by (22) in the function \(f_{1}(x)\) given by (21), we have \(f_{1}(p_{1})=\beta (c-p_{1})+3\) and, therefore \(f_{1}(p_{1})\ge 0\) is equivalent to \(p_{1}\le c+3/\beta \).

-

2.

Taking into account that \(f_{1}(p_{0})=0\), it is verified that

$$\begin{aligned} \theta =-\sqrt{\alpha e^{-\beta p_{0}}}\left( c-p_{o}+\frac{1}{\beta } \right) . \end{aligned}$$Substituting this value into the expression (19) of the function, G becomes

$$\begin{aligned} G(p_{0})=\alpha e^{-\beta p_{0}}\left( c-p_{o}+\frac{2}{\beta }\right) \text { .} \end{aligned}$$Thus, \(G(p_{0})<0\) if and only if \(p_{o}>c+2/\beta \).

\(\square \)

Rights and permissions

About this article

Cite this article

San-José, L.A., Sicilia, J., González-De-la-Rosa, M. et al. Best pricing and optimal policy for an inventory system under time-and-price-dependent demand and backordering. Ann Oper Res 286, 351–369 (2020). https://doi.org/10.1007/s10479-018-2953-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2953-5