Abstract

This paper studies the impacts of risk inequity averse factor on supply chain performance in the newsvendor context. We apply a downside-risk approach to depict the risk caused by market demand uncertainty and develop the newsvendor model with a risk inequity averse agent. Contrary to the prior literature, we extend inequity averse profits to a broader range by including risk inequity aversion, and we find that risk inequity aversion has large impact on supply chain agents performance. Moreover, we attempt to consider the situation which a risk inequity averse retailer’s information is neglected by the supplier and performed a comparative analysis on different scenarios. If the supplier is only concerned with the risk inequity averse retailer while making decisions, the results range from worsening to improving. To mitigate the negative utilities caused by the factor of risk inequity aversion, we propose a mechanism that the risk-sharing parameter could achieve a better performance for a certain range. Several observations and managerial insights on risk inequity-averse newsvendor models are gathered.

Similar content being viewed by others

References

Adams, J. S. (1965). Inequity in social exchange. In Advances in experimental social psychology, vol 2 (pp 267–299). Elsevier.

Agrawal, V., & Seshadri, S. (2000). Impact of uncertainty and risk aversion on price and order quantity in the newsvendor problem. Manufacturing & Service Operations Management, 2(4), 410–423.

Arrow, K. J. (1971). The theory of risk aversion. Essays in the theory of risk-bearing pp 90–120.

Asian, S., & Nie, X. (2014). Coordination in supply chains with uncertain demand and disruption risks: Existence, analysis, and insights. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 44(9), 1139–1154.

Bolton, G. E., & Ockenfels, A. (2000). Erc: A theory of equity, reciprocity, and competition. American Economic Review, 90(1), 166–193.

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science, 11, 227–339.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Caliskan-Demirag, O., Chen, Y. F., & Li, J. (2010). Channel coordination under fairness concerns and nonlinear demand. European Journal of Operational Research, 207(3), 1321–1326.

Cappelen, A. W., Konow, J., Sørensen, E. Ø., & Tungodden, B. (2013). Just luck: An experimental study of risk-taking and fairness. American Economic Review, 103(4), 1398–1413.

Chen, F., & Federgruen, A. (2000). Mean-variance analysis of basic inventory models. Working paper, Columbia University

Chen, J., Zhou, Y. W., & Zhong, Y. (2017). A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. International Journal of Production Research, 55(18), 5287–5304.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A technical review. Annals of Operations Research, 240(2), 489–507.

Choi, T. M., & Chiu, C. H. (2012). Mean-downside-risk and mean-variance newsvendor models: Implications for sustainable fashion retailing. International Journal of Production Economics, 135(2), 552–560.

Choi, T. M., Li, D., & Yan, H. (2008a). Mean-variance analysis of a single supplier and retailer supply chain under a returns policy. European Journal of Operational Research, 184(1), 356–376.

Choi, T. M., Li, D., Yan, H., & Chiu, C. H. (2008b). Channel coordination in supply chains with agents having mean-variance objectives. Omega, 36(4), 565–576.

Cui, T., Raju, J. S., & Zhang, Z. J. (2007). Fairness and channel coordination. Management Science, 53(8), 1303–1314.

Du, S., Nie, T., Chu, C., & Yu, Y. (2014). Newsvendor model for a dyadic supply chain with Nash bargaining fairness concerns. International Journal of Production Research, 52(17), 5070–5085.

Eeckhoudt, L., Gollier, C., & Schlesinger, H. (1995). The risk-averse (and prudent) newsboy. Management Science, 41(5), 786–794.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Gan, X., Sethi, S., & Yan, H. (2004). Supply chain coordination with a risk-averse retailer and a risk-neutral supplier. Productions and Operations Management, 13(2), 135–149.

Ho, T. H., & Su, X. (2009). Peer-induced fairness in games. American Economic Review, 99(5), 2022–49.

Ho, T. H., Su, X., & Wu, Y. (2014). Distributional and peer-induced fairness in supply chain contract design. Production and Operations Management, 23(2), 161–175.

Kahneman, D., Knetsch, J. L., & Thaler, R. (1986). Fairness as a constraint on profit seeking: Entitlements in the market. The American Economic Review, 76, 728–741.

Katok, E., & Pavlov, V. (2013). Fairness in supply chain contracts: A laboratory study. Journal of Operations Management, 31(3), 129–137.

Lau, H. S. (1980). The newsboy problem under alternative optimization objectives. Journal of the Operational Research Society, 31(6), 525–535.

Pasternack, B. A. (1985). Optimal pricing and return policies for perishable commodities. Marketing Science, 4(2), 166–176.

Pavlov, V., & Katok, E. (2011). Fairness and coordination failures in supply chain contracts. Working Paper, available online at https://ssrn.com/abstract=262382.

Pavlov, V., & Katok, E. (2015). Fairness and supply chain coordination failures. Working Paper, available online at https://www.researchgate.net/publication/292374227.pdf.

Rabin, M. (1993). Incorporating fairness into game theory and economics. The American Economic Review, 83, 1281–1302.

Schweitzer, M. E., & Cachon, G. P. (2000). Decision bias in the newsvendor problem with a known demand distribution: Experimental evidence. Management Science, 46(3), 404–420.

Spengler, J. J. (1950). Vertical integration and antitrust policy. Journal of Political Economy, 58(4), 347–352.

Tsay, A. A. (1999). The quantity flexibility contract and supplier-customer incentives. Management Science, 45(10), 1339–1358.

Tsay, A. A. (2002). Risk sensitivity in distribution channel partnerships: Implications for manufacturer return policies. Journal of Retailing, 78(2), 147–160.

Tversky, A., & Kahneman, D. (1991). Loss aversion in riskless choice: A reference-dependent model. The Quarterly Journal of Economics, 106(4), 1039–1061.

Wei, Y., & Choi, T. M. (2010). Mean-variance analysis of supply chains under wholesale pricing and profit sharing schemes. European Journal of Operational Research, 204(2), 255–262.

Weng, Z. K. (1995). Channel coordination and quantity discounts. Management Science, 41(9), 1509–1522.

Wu, J., Li, J., Wang, S., & Cheng, T. (2009). Mean-variance analysis of the newsvendor model with stockout cost. Omega, 37(3), 724–730.

Acknowledgements

We are grateful for the editor’s and anonymous reviewers’ constructive comments and suggestions which have improved the quality of this paper. We acknowledge the USTC Modern Logistics Research Centre for its data-driven practical platform. This research was supported by the National Natural Science Foundation of China (Grant Nos. 71571171, 71801210, 71631006), the Youth Innovation Promotion Association, CAS (Grant No. 2015364) and the Fundamental Research Funds for the Central Universities (Grant No. WK2040160028).

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by National Natural Science Foundation of China (Grant Nos. 71571171, 71801210, 71631006).

Appendices

Appendices

Appendix A: The derivation process and proofs of the benchmark model

1.1 The derivation processes of expected profits are as follows:

Given retailer order quantity q and uncertainty demand x, the notation \(min\left( q,x \right) \) denotes the minimum of the two. Therefore, the expected sales can be derived as follows:

The derivation process is calculated separately are as follows.

The expected profit of the risk-neutral retailer and supply chain system can be derived as follows:

Proof

We first discuss the benchmark model that the supply chain agents without risk inequity aversion.

1.2 Step 1: Solve the supply chain members profit maximization problem

In the decentralized system, the profit function of retailer and supplier are given in Eqs. (1) and (2). The first-order conditions of the utility function with respect to q and w respectively are as follows.

Then we obtain the stationary point of the equations.

Next, we take the second-order conditions of the utility function with respect to order quantity q:

Thus, there exists the critical point \(q^*\) which is a local maximum, and this stationary point is the optimal order decision strategy. And the equilibrium solution \((q^*,w^*)\) can be obtained by solving the following equations.

1.3 Step 2: Solve the supply chain systems profit maximization problem

In the supply chain system, we have derived the equation of the supply chain system’s expected profit function. Thus, the first-order condition of utility function with respect to supply chain order quantity q is as follows.

The process of obtaining the stationary point and solving the optimal order quantity of centralized supply chain system is the same as previous. Thus, the optimal order decision strategy \( q^o \) is expressed as follows.

The assumption we proposed previously that \( w>c \), and we assume that \(F\left( \cdot \right) \) is strictly increasing and differentiable with the stochastic market demand is finite. Finally, the optimal order quantity of decentralized supply chain member is smaller than the centralized system: \( q^* < q^o \).

Appendix B: The risk inequity averse newsvendor model, proof of Proposition 1

Proof

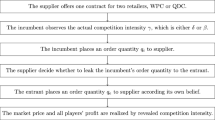

We discuss the model that considering the risk inequity aversion factor of the retailer under the wholesale price contract. The decentralized supply chain members play a Stackelberg game, the supplier is a leader while the retailer is a follower. \(\square \)

1.1 Step 1: Solve the supply chain members profit maximization problem

In the decentralized system, the profit function of retailer and supplier are given in Eqs. (15) and (16). To make the equation is tractable, we let \( g(q) = \int _0^q {{\bar{F}}(x)} dx \), the first-order conditions of the utility function with respect to q and w respectively are as follows.

Then we obtain the stationary point of the equations.

Next, we take the second-order conditions of the utility function of risk-inequity averse retailer with respect to q:

We can obtain the simplified equation \( 1 - \alpha F\left( {g\left( q \right) } \right) = \frac{w}{{p{\bar{F}}\left( q \right) }} \) and substitute into the equation of second-order conditions of the risk inequity averse retailer utility function with respect to q. Finally, the equation above can be simplified as: \( \frac{{{\partial ^2}U\left( {{\pi _{r,f}}} \right) }}{{\partial {q^2}}} = - \frac{{wf\left( q \right) }}{{{\bar{F}}\left( q \right) }} - \alpha pf\left( {g\left( q \right) } \right) \cdot {( {{\bar{F}}\left( q \right) } )^2} < 0 \).

Therefore, there exists a stationary point \( q^*_{r,f} \) to be the local maximum point, and this is the optimal decision strategy of the retailer. And \((q^*_{r,f}, w^*_{r,f} )\) is the unique optimal decision strategy of the decentralized supply chain members by solving the set of equations as follows.

Appendix C: Risk-sharing mechanism, Proof of Proposition 3

Under the risk-sharing mechanism, as we proved previously, the optimal order decision can be obtained by taking the first and second-order derivatives of the retailers utility [Eq. (24)] with respect to the order quantity \(q^*_{r,RS}\). The equations are given as follows.

The equation can be derived by simplifying the equation of the first-order derivatives of the retailer’s utility.

By substituting the above equation into the equation of the second-order derivatives of the retailer’s utility, then the second-order condition can be proved less than zero. Due to \( 0< \lambda <1 \) and \( 0<(1-\lambda )<1 \). The equation can be derived as follows.

Then, we take the derivatives of suppliers utility [Eq. (24)] with respect to the wholesale price w. The equation can be given by:

This indicates that there is the stationary point \((q^*_{r,RS}, w^*_{r,RS})\) of the decentralized supply chain members can be calculated through simultaneous \(p{\bar{F}}\left( q \right) \left[ {1 - \left( {1 - \lambda } \right) \alpha pF\left( {g\left( q \right) } \right) } \right] = w\) and \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) \cdot \frac{{\partial q}}{{\partial w}} + q - \;\alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial w}} = 0\).

To make the equation tractable, we multiply both sides of \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) \cdot \frac{{\partial q}}{{\partial w}} + q - \;\alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial w}} = 0\) with \(\frac{{\partial w}}{{\partial q}}\). The equation could be derived as follows.

The first order condition of w with respect to q and first derivation of \( S\left( {\pi \left( q \right) } \right) \) regarding q respectively are:

The \(\frac{{\partial E({\pi _{s,RS}})}}{{\partial w}} = \left( {w - c} \right) + q\cdot \frac{{\partial w}}{{\partial q}} - \alpha \cdot \frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial q}} = 0\) can be simplified by substituting the equations \(\frac{{\partial w}}{{\partial q}}\) and \(\frac{{\partial S\left( {\pi \left( q \right) } \right) }}{{\partial q}}\) we calculate above, respectively. And the optimal order quantity \( q^*_{r,RS}\) of decentralized retailer is:

As we proved previously, the optimal order quantity of the supply chain system is \( q^*_{sc,RS}\), which satisfies the equation \( \frac{{\partial U\left( {{\pi _{sc,ic}}} \right) }}{{\partial q}} = 0 \). And the equation is given by:

To achieve the channel coordination and performance improvement, let the optimal order quantity of decentralized supply chain members equals to that of the centralized system: \(q^*_{r,RS}=q^*_{sc,RS}\), and we work out the shares of risk parameter \(\lambda \) by simultaneously solving above two equations. The risk sharing parameter is obtained as follows.

Rights and permissions

About this article

Cite this article

Yan, X., Du, S. & Hu, L. Supply chain performance for a risk inequity averse newsvendor. Ann Oper Res 290, 897–921 (2020). https://doi.org/10.1007/s10479-018-3038-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3038-1