Abstract

The behavioral finance studies generally analyse the relationship between investor moods, caused by weather factors and indices returns via investor moods. The present study examines the relationship between three weather factors (temperature, humidity, and wind speed) in capital cities (namely Beijing for China, Tokyo for Japan, Victoria City for Hong Kong, New Delhi for India and Singapore for Singapore), and sample stock indices (Shanghai Stock Exchange from China, Nikkei 225 from Japan, Hang Seng Index from Hong Kong, BSE Sensex from India and Singapore Exchange Limited from Singapore) of selected Asian countries. This study applied statistical tools like Descriptive Statistics, ADF Test, VAR Module and adopted the Granger Causality Approach. The found that among the three weather variables, temperature recorded a statistically significant influence on the returns of Shanghai Stock Exchange (Unidirectional Linkage), HANG SENG Index (Unidirectional Linkage) and also BSE Sensex (Bi-Directional Linkage). Wind speed recorded Bi-Directional Linkages with HANG SENG Index. The findings of this study could help the investors in making better investment management decisions. It is found that there are valuable opportunities to international investors for diversifying their stocks. The study does contribute to the behavioral finance literature.

Source: Developed from Brian M. Lucey and Michael Dowling 2005

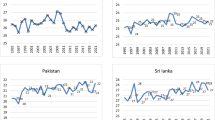

Source: Compiled from http://finance.yahoo.com/ and http://www.ncdc.noaa.gov/oa/climate/isd/index.php and computed using E.Views-9

Source: Compiled from http://finance.yahoo.com/ and http://www.ncdc.noaa.gov/oa/climate/isd/index.php and computed using E.Views-9

Source: Compiled from http://finance.yahoo.com/ and http://www.ncdc.noaa.gov/oa/climate/isd/index.php and computed using E.Views-9

Source: Compiled from http://finance.yahoo.com/ and http://www.ncdc.noaa.gov/oa/climate/isd/index.php and computed using E.Views-9

Source: Compiled from http://finance.yahoo.com/ and http://www.ncdc.noaa.gov/oa/climate/isd/index.php and computed using E.Views-9

Similar content being viewed by others

References

Ameur, H. B., Jawadi, F., Cheffou, A. I., & Louhichi, W. (2018). Measurement errors in stock markets. Annals of Operations Research, 262, 287. https://doi.org/10.1007/s10479-016-2138-z.

Bakar, S., & Sapuin, N. M. (2012). Are stock market returns related to the weather effects factors? Empirical evidence from Malaysia. Terengganu International Finance and Economics Journal, 2(2), 54–62.

Bauer, M., Glenn, T., Grof, P., Rasgon, N. L., Marsh, W., Sagduyu, K., et al. (2009). Relationship among latitude, climate, season and self-reported mood in bipolar disorder. Journal of Affective Disorders, 116, 152–157.

Bertrand, P., & Lapointe, V. (2018). Risk-based strategies: The social responsibility of investment universes does matter. Annals of Operations Research, 262, 413–429. https://doi.org/10.1007/s10479-015-2081-4.

Bower, G. H. (1981). Mood and memory. American Psychologist, 36, 129–148.

Box, G. E. P., & Jenkins, G. M. (1970). Time series analysis forecasting and control. San Francisco: Holden-Day. (new printing (with exercises) 1976).

Brahmana, R. K., Hooy, C. W., & Ahmad, Z. (2014). The role of weather on investors’ monday irrationality: Insights from Malaysia. Contemporary Economics, 8(2), 175–190. https://doi.org/10.5709/ce.1897-9254.139.

Brahmana, R., Hooy, C.-W., & Ahmad, Z. (2015). Monday irrationality of investors in Bursa Malaysia: The role of psychological biases. Malaysian Journal of Economic Studies, 52(2), 227–243.

Cao, G., & Han, Y. (2015). Does the weather affect the Chinese stock markets? Evidence from the analysis of DCCA cross-correlation coefficient. International Journal of Modern Physics B, 29(01), 1450236.

Cao, M., & Wei, J. (2005). Stock market returns: A note on temperature anomaly. Journal of Banking & Finance, 29(6), 1559–1573.

Chang, T., Nieh, C.-C., Yang, M. J., & Yang, T.-Y. (2006). Are stock market returns related to the weather effects? Empirical evidence from Taiwan. Physica A, 364, 343–354.

Cunningham, M. (1979). Weather, mood, and helping behavior: Quasi experiments with the sunshine samaritan. Journal of Personality and Social Psychology, 37(11), 1947–1956.

Danışoğlu, S., & Güner, Z. N. (2018). Do price limits help control stock price volatility? Annals of Operations Research, 260, 129. https://doi.org/10.1007/s10479-016-2317-y.

De Bondt, W. F. M., & Thaler, R. H. (1995). Financial decision-making in markets and firms: A behavioral perspective. In R. A. Jarrow et al. (Eds.), Handbook of Finance (vol. 9, pp. 385–410). North Holland: Elsevier.

Dickey, D., & Fuller, W. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431. https://doi.org/10.2307/2286348.

Dowling, M., & Lucey, B. M. (2008). Robust global mood influences in equity pricing. Journal of Multinational Financial Management, 18(2), 145–164.

Eagles, J. M. (1994). The relationship between mood and daily hours of sunlight in rapid cycling bipolar illness. Biological Psychiatry, 36(6), 422–424.

Fama, E. F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49, 283–306.

Floros, C. (2008a). The monthly and trading month effects in Greek stock market returns: 1996–2002. Managerial Finance, 34(7), 453–464. https://doi.org/10.1108/03074350810874415.

Floros, C. (2008b). Stock market returns and the temperature effect: New evidence from Europe. Applied Financial Economics Letters, 4(6), 461–467.

Forgas, J. P., & Bower, G. H. (1987). Mood effects on person-perception judgments. Journal of Personality and Social Psychology, 53(1), 53–60.

Forgas, J., Goldenberg, L., & Unkelbach, C. (2009). Can bad weather improve your memory? An unobtrusive field study of natural mood effects on real-life memory. Journal of Experimental Social Psychology, 45, 254–257.

Hirshleifer, D., & Shumway, T. (2003). Good day sunshine: Stock returns and the weather. Journal of Finance, 58(3), 1009–1032.

Hollwich, F. (1979). The influence of ocular light perception on metabolism in man and in animal. New York: Springer.

Howarth, E., & Hoffman, M. S. (1984). A multidimensional approach to the relationship between mood and weather. British Journal of Psychology, 75(1), 15–23.

Huang, Z., Wei, Y. M., Wang, K., & Liao, H. (2017). Energy economics and climate policy modeling. Annals of Operations Research, 255, 1. https://doi.org/10.1007/s10479-017-2564-6.

Isen, A. M., Shalker, T., Clark, M., & Karp, L. (1978). Affect, accessibility of material in memory and behavior: A cognitive loop? Journal of Personality and Social Psychology, 36, 1–12.

Kamstra, M., Kramer, L., & Levi, M. (2000). Losing sleep at the market: The daylight-savings anomaly. American Economic Review, 90(4), 1005–1011.

Kang, S. H., Jiang, Z., & Yoon, S. M. (2009). Weather effects on the returns and volatility of Hong Kong and Shenzhen stock markets. Working Paper, Pusan National University.

Kathiravan, C., Raja, M., & Chinnadorai, K. M. (2018a). Stock market returns and the weather effect in Sri Lanka. SMART Journal of Business Management Studies, 14(2), 78–85. https://doi.org/10.5958/2321-2012.2018.00019.2.

Kathiravan, C., Selvam, M., Kannaiah, D., Lingaraja, K., & Thanikachalam, V. (2018b). On the relationship between weather and Agricultural Commodity Index in India: A study with reference to Dhaanya of NCDEX. Quality & Quantity. https://doi.org/10.1007/s11135-018-0782-x.

Kathiravan, C., Selvam, M., Venkateswar, S., Lingaraja, K., & Oli, S. M. (2017). Effect of temperature on stock market indices: A study on BSE and NSE in India. International Journal of Economic Research, 14(18), 171–181.

Kathiravan, C., Selvam, M., Venkateswar, S., Lingaraja, K., Vasani, S. A., & Kannaiah, D. (2018c). An empirical investigation of the inter-linkages of stock returns and the weather at the Indian stock exchange. Academy of Strategic Management Journal, 17(1), 1–14.

Keef, S., & Roush, M. (2002). The weather and stock returns in New Zealand. Quarterly Journal of Business and Economics, 41(1–2), 61–80.

Krämer, W., & Runde, R. (1997). Stocks and the weather: An exercise in data mining or yet another capital market anomaly? Empirical Economics, 22(4), 637–641.

Kürüm, E., Weber, G. W., & Iyigun, C. (2018). Early warning on stock market bubbles via methods of optimization, clustering and inverse problems. Annals of Operations Research, 260, 293. https://doi.org/10.1007/s10479-017-2496-1.

Lu, J., & Chou, R. K. (2012). Does the weather have impacts on returns and trading activities in order-driven stock markets? Evidence from China. Journal of Empirical Finance, 19(1), 79–93.

Lucey, B. M., & Dowling, M. (2005). The role of feelings in investor decision-making. Journal of Economic Surveys, 19(2), 211–237.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Ortobelli, S., Vitali, S., Cassader, M., & Tichý, T. (2018). Portfolio selection strategy for fixed income markets with immunization on average. Annals of Operations Research, 260(1–2), 395–415. https://doi.org/10.1007/s10479-016-2182-8.

Pardo, A., & Valor, E. (2003). Spanish stock returns: Where is the weather effect? European Financial Management, 9(1), 117–126.

Rami, G. (2010). Causality between money, prices and output in India (1951–2005): A Granger causality approach. Journal of Quantitative Economics, 8(2), 20–41.

Salah, H. B., Chaouch, M., Gannoun, A., de Peretti, C., & Trabelsi, A. (2018). Mean and median-based nonparametric estimation of returns in mean-downside risk portfolio frontier. Annals of Operations Research, 262, 653. https://doi.org/10.1007/s10479-016-2235-z.

Sariannidis, N., Giannarakis, G., & Partalidou, X. (2016). The effect of weather on the European stock market: The case of Dow Jones Sustainability Europe index. International Journal of Social Economics, 43(9), 943–958. https://doi.org/10.1108/IJSE-04-2015-0079.

Schwarz, N., & Clore, G. (1983). Mood, misattribution, and judgments of well-being: Informative and directive functions of affective states. Journal of Personality and Social Psychology, 45, 513–523.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19, 425–442.

Sheikh, M. F., Shah, S. Z. A., & Mahmood, S. (2017). Weather effects on stock returns and volatility in South Asian markets. Asia-Pacific Financial Markets, 24, 75. https://doi.org/10.1007/s10690-017-9225-2.

Shim, H., Kim, H., Kim, J., & Ryu, D. (2015). Weather and stock market volatility: The case of a leading emerging market. Applied Economics Letters, 22(12), 987–992.

Shu, H. C., & Hung, M. W. (2009). Effect of wind on stock market returns: Evidence from European markets. Applied Financial Economics, 19(11), 893–904.

Symeonidis, L., Daskalakis, G., & Markellos, R. N. (2010). Does the weather affect stock market volatility? Finance Research Letters, 7(4), 214–223.

Thaler, R. H. (1999). Mental accounting matters. Journal of Behavioral Decision making, 12(3), 183–206.

Thaler, R. H. (2005). Advances in behavioral finance II, Russell Sage Foundation, New York, 712 pp., $45.00, ISBN: 0-691-12175-3.

Tietjen, G. H., & Kripke, D. F. (1994). Suicides in California (1968–1977): Absence of seasonality in Los Angeles and Sacramento counties. Psychiatry Research, 53(2), 161–172.

Tufan, E., & Hamarat, B. (2004). Do cloudy days affect stock exchange returns? Evidence from Istanbul stock exchange. Journal of Naval Science Engineering, 2(1), 117–126.

Vijayakumar, N., Dharani, M., & Muruganandan, S. (2015). Impact of weather on return and volatility: Evidence from indian stock market. International Journal of Financial Management, 5(2).

Watson, D. (2000). “Situational and environmental influence on mood”, mood and temperature, chapter 3 (pp. 62–103). New York, NY: Guilford Press.

Wright, W. F., & Bower, G. H. (1992). Mood effects on subjective probability assessment. Organizational Behavior and Human Decision Processes, 52(2), 276–291.

Yoon, S. M., & Kang, S. H. (2009). Weather effects on returns: Evidence from the Korean stock market. Physica A: Statistical Mechanics and its Applications, 388(5), 682–690.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kathiravan, C., Selvam, M., Venkateswar, S. et al. Investor behavior and weather factors: evidences from Asian region. Ann Oper Res 299, 349–373 (2021). https://doi.org/10.1007/s10479-019-03335-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03335-7