Abstract

This paper examines the problem of hedging banks interest rate margins. We assume that the demand’s deposits follow an exponential Lévy process with potential jumps. The forward market rates are assumed to follow the standard market model introduced by Brace et al. (Math Finance 7(2):127–155, 1997). As Adam et al. (Hedging interest rate margins on demand deposits, Université Paris 1 Panthéon-Sorbonne working paper, 2012), we consider that deposit rates depend linearly on market rates. Face to incompleteness, the liability manager must hedge both interest rate and demand deposit risks. For this purpose, we introduce various quadratic hedging criteria, allowing us to provide explicit hedging strategies that we further analyze. We illustrate in particular the impact of both the trends and the volatilities of interest rates and demand deposits.

Similar content being viewed by others

Notes

The IFRS actually ask banking establishments to account demand deposits at a Fair Value equal to their nominal value, which is equivalent. See e.g. IAS 39—Measurement—Subsequent Measurement of Financial Liabilities—Official IASB Website http://www.iasb.org/.

See European Commission’s (EC) Reference Document IP/04/1385—Official EC Website http://ec.europa.eu.

See e.g. International Convergence of Capital Measurement and Capital Standards—A Revised Framework—Official Bank for International Settlements Website http://www.bis.org/.

See Financial Accounting Standards Advisory Council’s document on Fair Value Option (March 2006)—Official FASB Website http://www.fasb.org/.

This has been suggested by Adam et al. (2012) by considering a Poisson process to model jumps but they have not truly dealt with this case. As they mentioned, the pure jump component cannot be unambiguously estimated upon historical data and one may also rely on expert advice and on a Bayesian approach as for operational risk (see e.g. Chavez-Demoulin et al. 2005).

See Adam et al. (2012) for details about interest rate margins within banking regulation (Case of the SEC).

Let us notice that, according to IFRS-IAS standards, the mark-to-market variations of AFS securities must impact the equity. Yet, these variations are actually very difficult to identify within equity fluctuations. Consequently, we can almost consider that the influence of AFS securities is only noticeable in the income statement at historical cost.

See e.g. See European Commission’s (EC) Reference Document IP/04/1385—Official EC Website http://ec.europa.eu.

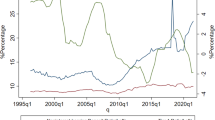

This is due to a too high value of the intercept when being evaluated from 1997 to 2019 with respect to the Euribor parameters. Indeed, banks must take care of sudden decrease of market rates when fixing a deposit rate, as illustrated during 2009 for the Euribor.

The literature provides several mathematical tools to deal with quadratic dynamic hedging in incomplete markets, which is our framework. Additionally, the related results propose quasi-analytical expressions for the hedging strategy. Consistently with Föllmer and Schweizer (1990), we introduce the usual minimal martingale measure \(\mathbb {Q}\) with respect to the “historical” forward probability measure \(\mathbb {P}\). Usually, the minimal martingale measure coincides with the variance minimal measure as defined in Pham et al. (1998) or. This is more generally the case for “almost complete models” (see Pages 1987), including models where the market rate’s diffusion coefficients \(\mu _{L}\) and \(\sigma _{L}\) are random processes adapted to the filtration related to \(W_{L}\). This particularly accounts for models featuring time dependent diffusion coefficients for the market rate or local volatility models.

See “Appendix”.

Integration by part formula: Denote \(\left[ X,Y\right] \) the quadratic covariation. We have:

$$\begin{aligned} d\left( XY\right) =XdY+YdX+d\left[ X,Y\right] . \end{aligned}$$Yor’s formula: for two semimartingales X and Y, we have:

$$\begin{aligned} \mathcal {E}\left[ X\right] \mathcal {E}\left[ Y\right] =\mathcal {E}\left[ X+Y+ \left[ X,Y\right] \right] . \end{aligned}$$See e.g. Ekeland and Turnbull (1983) for such property.

See e.g. Ekeland and Turnbull (1983) for such property.

References

Adam, A. (2007). Handbook of asset and liability management: From models to optimal return strategies. Berlin: Wiley.

Adam, A., Houkari, M., & Laurent, J.-P. (2012). Hedging interest rate margins on demand deposits. Université Paris 1 Panthé on-Sorbonne working paper.

Aldasoro, U., Merino, M., & Pérez, G. (2019). Time consistent expected mean–variance in multistage stochastic quadratic optimization: A model and a matheuristic. Annals of Operations Research, 280, 151–187.

Ansel, J. P., & Stricker, C. (1993). Unicité et existence de la loi minimale. In Lecture notes in math. Sem. Prob. XXVII. (Vol. 1557, pp. 22–29). Berlin: Springer.

Brace, A., Gatarek, D., & Musiela, M. (1997). The market model of interest rate dynamics. Mathematical Finance, 7(2), 127–155.

Campbell, J. Y., Lo, A. W., & MacKinlay, A. C. (1997). The econometrics of financial markets. Princeton: Princeton University Press.

Chavez-Demoulin, V., Embrechts, P., & Neslehova, J. (2005). Quantitative models for operational risk: Extremes, dependence and aggregation. Journal of Banking and Finance, 30(10), 2635–2658.

Delbaen, F., & Schachermayer, W. (1996). The variance-optimal martingale measure for continuous processes. Bernouilli, 2(1), 81–105.

Duffie, D., & Richardson, H. R. (1991). Mean–variance hedging in continuous time. Annals of Applied Probability, 1(1), 1–15.

Ekeland, I., & Turnbull, T. (1983). Infinite-dimensional optimization and convexity. Chicago lectures in mathematics. Chicago: University of Chicago Press.

El Karoui, N., & Quenez, M.-C. (1991). Dynamic programming and pricing of contingent claims in incomplete markets. SIAM Journal of Control and Optimization, 33(1), 29–66.

English, W. (2002). Interest rate risk and bank net interest margins. BIS Quarterly Review, 10(DecemberDecember), 67–82.

Ericsson, N. R., & McKinnon, J. G. (1999). Distribution of error correction tests for cointegration. International finance discussion papers, Board of Governors of Federal Reserve System.

Föllmer, H., & Schweizer, M. (1991). Hedging of contingent claims under incomplete information. In M. H. A. Davis & R. J. Elliott (Eds.), Applied stochastic analysis, stochastics monographs (Vol. 5, pp. 389–414). London: Gordon and Breach.

Föllmer, H., & Sondermann, D. (1986). Hedging of non-redundant contingent claims. In W. Hildenbrand & A. Mas-Colell (Eds.), Contributions to mathematical economics in honor of G érard Debreu (pp. 205–223). London: North-Holland.

Frauendorfer, K., & Schurle, M. (2003). Management of non-maturing deposits by multistage stochastic programming. European Journal of Operational Research, 151(3), 602–616.

Gouriéroux, C., Laurent, J.-P., & Pham, H. (1998). Mean–variance hedging and numéraire. Mathematical Finance, 8(3), 179–200.

Hainaut, D. (2009). Dynamic asset allocation under VaR constraint with stochastic interest rates. Annals of Operations Research, 172(1), 97–117.

Hamza, C., & Prigent, J.-L. (2019). Quantile hedging of interest rate margins on demand deposits. Working paper CY Cergy Paris Université.

Hicks, J. R. (1937). Mr. Keynes and the classics. Econometrica, 5(2), 147–159.

Ho, T. S. Y., & Saunders, A. (1981). The determinants of bank interest rate margins: Theory and empirical evidence. Journal of Financial and Quantitative Analysis, 16(4), 581–600.

Hutchison, D. E. (1995). Retail bank deposit pricing: An intertemporal asset pricing approach. Journal of Money, Credit and Banking, 27(1), 217–231.

Hutchison, D. E., & Pennacchi, G. G. (1996). Measuring rents and interest rate risk in imperfect financial markets: The case of retail bank deposits. Journal of Financial and Quantitative Analysis, 31(3), 399–417.

Kalkbrener, M., & Willing, J. (2004). Risk management of non-maturing liabilities. Journal of Banking and Finance, 28(7), 1547–1568.

Karatzas, I. (1997). Lectures on the mathematics of finance. CRM monograph series. American Mathematical Society.

Kramkov, D. (1996). Optional decomposition of supermartingales and hedging contingent claims in incomplete security markets. Probability Theory and Related Fields, 105, 459–479.

Kreps, D. (1981). Arbitrage and equilibrium in economies with infinitely many commodities. Journal of Mathematical Economics, 8(1), 15–35.

Krugman, P. (1998). It’s Baaack: Japan’s slump and the return of the liquidity trap. Brookings Papers on Economic Activity, 2, 137–205.

Jacod, J., & Shiryaev, A. (1987). Limit theorems for stochastic processes. Berlin: Springer.

Janosi, T., Jarrow, R., & Zullo, F. (1999). An empirical analysis of the Jarrow–van Deventer model for valuing non-maturity demand deposits. Journal of Derivatives, 7(Fall 1999), 8–31.

Jarrow, R. A., & Van Deventer, D. R. (1998). The arbitrage-free valuation and hedging of demand deposits and credit card loans. Journal of Banking and Finance, 22(3), 249–272.

Miltersen, K., Sandmann, K., & Sondermann, D. (1997). Closed form solutions for term structure derivatives with lognormal interest rates. Journal of Finance, 52(1), 409–430.

O’Brien, J. (2000). Estimating the value and interest risk of interest-bearing transactions deposits. Division of Research and Statistics/Board of Governors/Federal Reserve System.

Pages, H. (1987). Optimal consumption and portfolio policies when markets are incomplete. London: MIT Mimeo.

Pham, H., Rheinländer, T., & Schweizer, M. (1998). Mean–variance hedging for continuous processes: New proofs and examples. Finance and Stochastics, 2, 173–198.

Prigent, J.-L. (1999). Incomplete markets: Convergence of options values under the minimal martingale measure. Advances in Applied Probability, 31, 1058–1077.

Prigent, J.-L. (2003). Weak convergence of financial markets. Berlin: Springer.

Prigent, J.-L., & Scaillet, O. (2002). Weak convergence of hedging strategies of contingent claims. Working paper no. 39, HEC Geneva.

Saunders, A., & Schumacher, L. (2000). The determinants of bank interest rate margins: An international study. Journal of International Money and Finance, 19(6), 813–832.

Schäl, M. (1994). On quadratic cost criteria for option hedging. Mathematics of Operations Research, 19, 121–131.

Schweizer, M. (1991). Option hedging for semimartingales. Stochastic Processes and Their Applications, 37, 339–363.

Schweizer, M. (1993). Variance-optimal hedging in discrete time. Mathematics of Operations Research, 20, 1–32.

Wong, K. P. (1997). The determinants of bank interest margins under credit and interest rate risks. Journal of Banking and Finance, 21(2), 251–271.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Corollary 2

Recall that we assume

where both \(\left( W_{L,t}\right) _{t}\) and \(\left( W_{K,t}\right) _{t}\) are standard Brownian motions under the same filtration \(\left( \mathcal {F} _{t}\right) _{t}\) and that the pure jump process \(\left( N_{K,t}\right) _{t}\) is a Poisson process with intensity \(\lambda \) with a i.i.d. sequence \( \left( \delta _{K,T_{n}}\right) _{n}\) having expectation \(\overline{\delta }\).

-

1.

Since \(L_{t}\) has a Lognormal distribution, we have:

$$\begin{aligned} \mathbb {E}\left[ L_{t}\right]= & {} L_{0}\exp \left[ \mu _{L}t\right] , \\ Var\left[ L_{t}\right]= & {} L_{0}^{2}\exp \left[ 2\mu _{L}t\right] \left( \exp \left[ \sigma _{L}^{2}t\right] -1\right) . \end{aligned}$$ -

2.

We have also:

$$\begin{aligned} \mathbb {E}\left[ K_{t}\right] =K_{0}\exp \left[ \left( \mu _{K}+\lambda \overline{\delta }\right) t\right] , \end{aligned}$$ -

3.

Notation: \(\mathcal {E}\left[ .\right] \) denotes the stochastic exponential of Doléans-Dade. We have:

$$\begin{aligned} L_{t}= & {} L_{0}\mathcal {E}\left[ \mu _{L}t+\sigma _{L}W_{L,t}\right] , \\ K_{t}= & {} K_{0}\mathcal {E}\left[ \mu _{K}+\sigma _{K}W_{K,t}+\int _{0}^{t}\int _{-\infty }^{+\infty }\delta _{K,s}dN_{K,s} \right] \end{aligned}$$Using Yor’s formula,Footnote 13 we deduce:

$$\begin{aligned} L_{t}K_{t}= & {} L_{0}K_{0} \\&\times \mathcal {E}\left[ \left( \mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t+\sigma _{L}W_{L,t}+\sigma _{K}W_{K,t}+\int _{0}^{t}\int _{-\infty }^{+\infty }\delta _{K,s}dN_{K,s}\right] \\= & {} \exp \left[ \left( \mu _{L}+\mu _{K}-\frac{1}{2}\left[ \sigma _{L}^{2}+\sigma _{K}^{2}\right] \right) t+\sigma _{L}W_{L,t}+\sigma _{K} W_{K,t}\right] \prod _{T_{n}\le t}(1+\delta _{K,T_{n}}). \end{aligned}$$

Thus, we get:

-

(i)

Expectation of the product \(L_{t}K_{t}\):

$$\begin{aligned} \mathbb {E}\left[ L_{t}K_{t}\right] =L_{0}K_{0}\exp \left[ \left( \mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t\right] \exp \left[ \lambda \overline{\delta }t\right] . \end{aligned}$$ -

(ii)

Covariance\(\left[ L_{t};K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] \):

$$\begin{aligned}&Cov\left[ L_{t};K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] \\&\quad =\mathbb {E}\left[ L_{t}K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] -\mathbb {E}\left[ L_{t}\right] \mathbb {E}\left[ K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] . \end{aligned}$$But first we have:

$$\begin{aligned} \mathbb {E}\left[ K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] =\alpha \mathbb {E}\left[ K_{t}\right] +\left( \beta -1\right) \mathbb {E}\left[ K_{t}L_{t}\right] , \end{aligned}$$which implies:

$$\begin{aligned}&\mathbb {E}\left[ K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] \\&\quad =\alpha K_{0}\exp \left[ \left( \mu _{K}+\lambda \overline{\delta }\right) t \right] +\left( \beta -1\right) L_{0}K_{0}\exp \left[ \left( \mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t\right] \exp \left[ \lambda \overline{\delta }t\right] . \end{aligned}$$Second, we get:

$$\begin{aligned}&\mathbb {E}\left[ L_{t}K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] \\&\quad =\alpha \mathbb {E}\left[ L_{t}K_{t}\right] +\left( \beta -1\right) \mathbb {E} \left[ L_{t}^{2}K_{t}\right] . \end{aligned}$$We note that:

$$\begin{aligned} L_{t}^{2}=L_{0}^{2}\exp \left[ \left( 2\mu _{L}-\sigma _{L}^{2}\right) t+2\sigma _{L}W_{L,t}\right] . \end{aligned}$$Therefore, we deduce:

$$\begin{aligned} \mathbb {E}\left[ L_{t}^{2}K_{t}\right]= & {} L_{0}^{2}K_{0}\times \mathbb {E}\left[ \exp \left[ \left( \left( 2\mu _{L}+\sigma _{L}^{2}\right) +\mu _{K}-\frac{1}{2}\left[ 4\sigma _{L}^{2}+\sigma _{K}^{2}\right] \right) t\right. \right. \\&\left. \left. +\,2\sigma _{L}W_{L,t}+\sigma _{K}W_{K,t}\right] \prod \limits _{T_{n}\le t}(1+\delta _{K,T_{n}})\right] \\= & {} L_{0}^{2}K_{0}\exp \left[ \left( \left( 2\mu _{L}+\sigma _{L}^{2}\right) +\mu _{K}+2\sigma _{L}\sigma _{K}\rho \right) t\right] \exp \left[ \lambda \overline{\delta }t\right] . \end{aligned}$$Consequently, we get:

$$\begin{aligned}&Cov\left[ L_{t};K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] \\&\quad =\alpha L_{0}K_{0}\exp \left[ \left( \mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t\right] \exp \left[ \lambda \overline{\delta }t\right] \\&\qquad +\left( \beta -1\right) L_{0}^{2}K_{0}\exp \left[ \left( \left( 2\mu _{L}+\sigma _{L}^{2}\right) +\mu _{K}+2\sigma _{L}\sigma _{K}\rho \right) t \right] \exp \left[ \lambda \overline{\delta }t\right] \\&\qquad -L_{0}K_{0}\left( \alpha \exp \left[ \left( \mu _{L}+\mu _{K}\right) t \right] \exp \left[ \lambda \overline{\delta }t\right] \right. \\&\qquad \left. -\left( \beta -1\right) L_{0}^{2}K_{0}\exp \left[ \left( 2\mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t\right] \exp \left[ \lambda \overline{\delta }t \right] \right) , \end{aligned}$$from which we get:

$$\begin{aligned}&Cov\left[ L_{t};K_{t}\left( \alpha +\left( \beta -1\right) L_{t}\right) \right] =\exp \left[ \lambda \overline{\delta }t\right] \times L_{0}K_{0} \\&\quad \times \left( \begin{array}{l} \alpha \exp \left[ \left( \mu _{L}+\mu _{K}\right) t\right] \left[ \exp \left[ \sigma _{L}\sigma _{K}\rho t\right] -1\right] \\ +\left( \beta -1\right) L_{0}\exp \left[ \left( 2\mu _{L}+\mu _{K}+\sigma _{L}\sigma _{K}\rho \right) t\right] \left( \exp \left[ \left( \sigma _{L}^{2}+\sigma _{L}\sigma _{K}\rho \right) t\right] -1\right) \end{array} \right) \end{aligned}$$

1.2 Proof of Proposition 2

We have to solve

which is equivalent here to

under

– First, we consider the solution under the additional assumption:

Due to its convexity, we can apply results based on Lagrangian conditions.Footnote 14 Let us introduce:

where \(\eta _{T}\) corresponds to the Radon–Nikodym derivative \(\dfrac{d \mathbb {Q}}{d\mathbb {P}}\) of the minimal martingale measure \(\mathbb {Q}\) with respect to the objective probability \(\mathbb {P}\).

Note that, under model assumptions, we have:

from which we deduce that \(\eta _{T}\) is a deterministic function of the market rate at maturity \(L_{T}\) given by:

Then, the optimization problem with the previous additional condition is equivalent to \(Min\mathcal {L}\left( h,\zeta ,\xi \right) \). The first order conditions correspond to:

We deduce that:

with

We deduce:

1.3 Proof of Remark 1

From definition of the interest rate margin, we deduce:

But we have:

Since we have:

with

Therefore, we deduce:

with

Finally, we get:

Now, to compute \(\mathbb {E}_{\mathbb {Q}}\left[ IRM\left( K_{T},L_{T}\right) \right] \), note that, under the risk neutral probability \(\mathbb {Q}\), the process defined by:

is a standard Brownian motion.

Therefore, the dynamics of process L is given by:

and the dynamics of process K is given by:

Thus, we deduce:

Finally we get:

1.4 Proof of Proposition 4

We have to solve:

which is equivalent here to:

under

– First, we consider the solution under the additional assumption:

Due to its convexity, we can apply results based on Lagrangian conditions.Footnote 15 Let us introduce:

where \(\widehat{\eta }_{T}\) corresponds to the Radon–Nikodym derivative \( \dfrac{d\widehat{\mathbb {Q}}}{d\mathbb {P}}\) of the minimal martingale measure \(\widehat{\mathbb {Q}}\) with respect to the objective probability \( \mathbb {P}\) and under the filtration generated by \(W_{L}\), \(W_{K}\) and the jump component. Note that, under model assumptions, we have:

from which we deduce that \(\eta _{T}\) is a deterministic function of the market rate at maturity \(L_{T}\) given by:

Then, the optimization problem with the previous additional condition is equivalent to \(Min\mathcal {L}\left( h,\zeta ,\xi \right) \). The first order conditions correspond to:

We deduce that:

with:

We deduce:

1.5 The locally risk-minimizing strategy

The notations and definitions in this paper are those of Jacod and Shiryaev (1987). All processes are defined on filtered probability spaces \(\left( \Omega ,\mathcal {F},\mathcal {(F}_{t}\mathcal {)},P\right) \) indexed on [0, T] and satisfying the usual conditions.

Let us recall that a semimartingale \(S=(S_{t})_{t\in \left[ 0,1\right] }\) has the following canonical decomposition:

where \(S_{0}\) is finite-valued and \(\mathcal {F}_{0}\)-measurable, A is a process with finite variation and M is a local martingale starting at zero. When A is predictable, this decomposition is unique. We obtain similar results in continuous time (see Ansel and Stricker 1993), as shown in what follows.

1.5.1 Continuous time model

The price S has the following canonical decomposition:

where \(\lambda \) is a predictable process satisfying:

Ansel and Stricker (1993) established the following existence result:

-

If \(1-\lambda \Delta M>0\) a.s. then \(\mathcal {E}(-\,\lambda .M)\) is a positive local martingale, the minimal martingale measure is a probability and its density process is given by \(\mathcal {E}(-\,\lambda .M)\).

-

If \([1-\lambda \Delta M\le 0]>0\), then the minimal martingale measure is not a probability.

We consider a financial market with two traded assets: a riskless money market account and a risky asset, referred to as the bond and the stock, respectively. The value of the money market account at time t is given by \( B_{t}=B_{0}e^{rt}\), where r is the riskfree interest rate. Without loss of generality, we take \(r=0\) and \(B_{0}=1\) in the following. The evolution of the stock price is described by a stochastic process \((S_{t})_{t\in \{0,1,\ldots ,T\}}\) on a probability space \((\Omega ,\mathcal {F}_{t},\mathbb {P})\), with some filtration \((\mathcal {F}_{t})_{t\in \{0,1,\ldots ,T\}}\) on \((\Omega , \mathcal {F})\) (\(\mathbb {P}\) is usually called the historical probability). The price \(S_{t}\) is taken \(\mathcal {F}_{t}\)-measurable and square-integrable.

General Case Let \((\Omega ,\mathcal {F},\mathbb {P})\) be a probability space with a filtration \((\mathcal {F}_{t})_{t\in [0,T]}\) satisfying the usual conditions of right-continuity and completeness. Assume that \(\mathcal {F} _{0} \) is trivial and that \(\mathcal {F}_{T}=\mathcal {F}\). The price \(S_{t}\) is again supposed to be \(\mathcal {F}_{t}\)-measurable and square-integrable. It is a semimartingale with a decomposition:

such that:

-

1.

M is a square-integrable martingale with \(M_{0}=0\).

-

2.

A is a predictable process of finite variation |A| with \(A_{0}=0\).

We denote the predictable quadratic variation of the martingale M by \( \left\langle M,M\right\rangle \). A trading strategy will be of the form \( (q_{S},q_{B})\) satisfying the following conditions:

-

1.

\((q_{S,t})_{t\in [0,T]}\) is a predictable process.

-

2.

The process \(\int _{0}^{t}q_{S,u}dS_{u}\) is a semimartingale of class \( \mathcal {S}^{2}\), i.e:

$$\begin{aligned} {E}[\int _{0}^{T}q_{S,u}^{2}d\left\langle M,M\right\rangle _{u}+\int _{0}^{T}|q_{S,u}|d|A|_{u})^{2}]<\infty . \end{aligned}$$ -

3.

\((q_{B,t})_{t\in [0,T]}\) is adapted.

The value of the portfolio at time t corresponding to \(\phi \) is then given by the process \(V(\phi )\) defined by \(V_{t}(\phi )=q_{S,t}S_{t}+q_{B,t} \). It is right-continuous and satisfies: \(V_{t}(\phi )\in \mathbb {L}^{2}(\mathbb {P})\).

The cumulated cost up to time t is defined by:

$$\begin{aligned} C_{t}=V_{t}(\phi )-\int _{0}^{t}q_{S,u}dS_{u}. \end{aligned}$$As measure of risk, Schweizer (1991) introduces the conditional mean square error process:

$$\begin{aligned} R_{t}(\phi )=\mathbb {E}_{\mathbb {P}}[(C_{T}(\phi )-C_{t}(\phi ))^{2}| \mathcal {F}_{t}]. \end{aligned}$$A strategy \(\phi \) is mean-self-financing if \(C(\phi )\) is a martingale. A contingent claim is attainable if and only if there exists an admissible strategy \(\phi \) such that \(V_{T}(\phi )=H_{T}\) and \(R_{t}(\phi )=0\), \(\ \forall t\;a.s.\)

As mentioned in Schweizer (1991), it may happen that no strategy \(\phi \) can minimize \(R_{t}(\phi )\) for all t. Therefore, it is necessary to weaken this condition. This gives birth to the notion of locally risk-minimizing strategy, which is defined as follows:

A trading strategy \(\Delta =(\delta ,\epsilon )\) is called a small perturbation if it satisfies the following conditions:

-

1.

\(\delta \) is bounded.

-

2.

\(\int _{0}^{t}|\delta _{u}|d|A_{u}|\) is bounded.

-

3.

\(\delta _{T}=\epsilon _{T}=0\).

The underlying idea is to introduce the concept of local variation of a trading strategy. To this end, consider partitions \(\tau =(t_{i})_{i}\) of the interval [0, T]. Such partitions will always satisfy:

with a mesh size defined by: \(|\tau |=\max _{i}(t_{i}-t_{i-1})\). A sequence \( (\tau _{n})_{n\in {{\mathbb {N}}}}\) of partitions will be increasing if \(\tau _{n}\subseteq \tau _{n+1}\) for all n. It will be called 0-convergent if it satisfies:

If \(\Delta \) is a small perturbation and (s, t] is a subinterval of [0, T], the small perturbation \(\Delta |(s,t]=(\delta |(s,t],\epsilon |(s,t])\) is defined by setting:

The asymmetry corresponds to the fact that \(\delta \) is predictable and \( \epsilon \) adapted.

Let \(\phi \) be a trading strategy, \(\Delta \) a small perturbation and \(\tau \) a partition of [0, T]. Then, the R-ratio is defined by

The strategy \(\phi \) is called locally risk-minimizing if

or every small perturbation \(\Delta \) and every increasing 0-converging sequence \((\tau _{n})\) of partitions of [0, T]. The ratio \(r^{\tau }[\phi ,\Delta ]\) can be interpreted as a measure for the total change of riskiness if \(\phi \) is locally perturbed by \(\Delta \) along the partition \(\tau \).

Suppose that:

- H1:

-

For \(\mathbb {P}\)-almost all \(\omega \), the measure on [0, T] induced by \(\left\langle M,M\right\rangle (\omega )\) has the whole interval [0, T] as support (the martingale M is not locally constant: for example, a diffusion process with a strictly positive diffusion coefficient or a point process with a strictly positive intensity). Then, Schweizer (1991) shows that if a trading strategy is locally risk-minimizing then it is mean-self-financing.

Recall a main result about the computation of the locally risk-minimizing strategy in continuous time. We denote by \(\widehat{\mathbb {Q}}\) the minimal martingale measure, and by \(\hat{V}\) the conditional expectation of the contingent claim payoff H under \(\widehat{\mathbb {Q}}\), namely

$$\begin{aligned} \hat{V}_{t}=\mathbb {E}_{\widehat{\mathbb {Q}}}[H|\mathcal {F}_{t}]. \end{aligned}$$Suppose furthermore that:

- H2:

-

A is continuous.

- H3:

-

A is absolutely continuous with respect to \(\left\langle M,M\right\rangle \) with a density \(\alpha \) satisfying \(\mathbb {E}_{M}[|\alpha |Log^{+}|\alpha |]<\infty \).

- H4:

-

S is continuous at time T (no fixed time of discontinuity at T).

- H5:

-

There exists a square-integrable \(\mathbb {P}\)-martingale \( \widetilde{M}\) such that M and \(\widetilde{M}\) form a \(\mathbb {P}\)-basis of \(\mathbb {L}^{2}(\mathbb {P})\), and S and \(\widetilde{M}\) form a \(\mathbb { Q}\)-basis of \(\mathbb {L}^{2}(\mathbb {Q})\) (see Schweizer 1991, p. 355).

Proposition 7

(See Schweizer 1991, p. 355) Under conditions H1–5:

-

(i)

Every square-integrable contingent claim payoff H admits a decomposition:

$$\begin{aligned} H=E\left[ H\right] _{\widehat{\mathbb {Q}}}+\int _{0}^{T}\xi _{u}^{H,\widehat{ \mathbb {Q}}}dS_{u}+\int _{0}^{T}\zeta _{u}^{H,\widehat{\mathbb {Q}}}d \widetilde{M}_{u},\widehat{\mathbb {Q}}\,a.s., \end{aligned}$$(16)where \(\xi ^{H,\widehat{\mathbb {Q}}}\) and \(\zeta ^{H, \widehat{\mathbb {Q}}}\) are predictable.

-

(ii)

If \((S_{t})_{t\in [0,T]}\) has continuous trajectories, then the locally risk-minimizing strategy is given by:

$$\begin{aligned} \xi _{t}^{H,\widehat{\mathbb {Q}}}=\dfrac{d\left\langle \widehat{V},S\right\rangle _{t}^{\widehat{\mathbb {Q}}}}{d\left\langle S,S\right\rangle _{t}^{ \widehat{\mathbb {Q}}}}, \end{aligned}$$where \(<.,.>^{\widehat{\mathbb {Q}}}\) is the predictable quadratic covariation with respect to \(\widehat{\mathbb {Q}}\).

-

(iii)

The unique locally risk-minimizing strategy for the contingent claim H is given by \(\theta =\xi ^{H,\widehat{\mathbb {Q}}}\).

Let us remark that the preceding decomposition leading to the characterization of the locally risk-minimizing strategy holds under two different probability measures, namely under the historical probability for the first one, and under the minimal martingale measure for the second one. Nevertheless, as mentioned in Heath et al (1999), under the assumptions H1–5, a strategy is locally risk-minimizing if and only if it is pseudo-locally risk-minimizing (i.e. its cost process C is a square integrable \(\mathbb {P}\)-martingale, strongly \(\mathbb {P}\)-orthogonal to the \( \mathbb {P}\)-martingale part M of S). In that case, finding a locally risk-minimizing strategy is equivalent to finding a decomposition of H:

so that \(H_{0}\) is in \(\mathbb {L}^{2}(\mathcal {F}_{0},\mathbb {P})\) and \( L^{H} \) is a square integrable \(\mathbb {P}\)-martingale null at 0 and strongly \(\mathbb {P}\)-orthogonal to M. In that case, \(\theta =\xi ^{H}\) and \(C_{t}=H_{0}+R_{t}^{H}\).

We apply such decomposition to \(H=IRM(K_{T},L_{T})\).

1.6 Proof of Proposition 6

Recall that the processes L and K satisfy:

where \(\left( W_{L,t}\right) _{t}\) is a standard Brownian motion under the historical probability measure \(\mathbb {P}\) and where \(\mu _{L}\) and \(\sigma _{L}\) are assumed to be constant. The demand deposit amount follows:

where \(\left( W_{K,t}\right) _{t}\) is a standard Brownian motion and \(\left( N_{K,t}\right) _{t}\) is a pure jump process. The trend \(\mu _{K}\) and the volatility \(\sigma _{K}\) are assumed to be constant, \(\left( N_{K,t}\right) _{t}\) is a Poisson process with intensity \(\lambda \) and that the sequence \( \left( \delta _{K,T_{n}}\right) _{n}\) is i.i.d. with expectation \(\overline{ \delta }\) and standard deviation \(\sigma _{\delta }\). We have also:

where \(\left( \widetilde{W}_{K,t}\right) _{t}\) is a Brownian motion independent of \(\left( W_{L,t}\right) _{t}\), while \(W_{L,t}\) and \(W_{K,t}\) have a correlation parameter \(\rho t\).

Therefore, we note that the martingale part M of process L is given by \( M_{t}=\sigma _{L}\int _{0}^{t}L_{t}dW_{L,t}\) and that we can choose the square-integrable \(\mathbb {P}\)-martingale \(\widetilde{M}\) as follows:

where \(\mu (dt,dx)\) is the counting measure of the compound Poisson process \(\int _{0}^{t}\int _{\mathbb {R}}\delta (u,K_{u-})dN_{K,u}\) and \(\nu (dt,dx)\) is its compensator measure (i.e. \(\nu (dt,dx)=\lambda \overline{\delta }dt\)). Under previous assumptions, the locally risk-minimizing strategy is given by:

Thus, we have to compute both terms \(d\left\langle \widehat{IRM} ,L\right\rangle _{t}^{\widehat{\mathbb {Q}}}\)and \(d\left\langle L,L\right\rangle _{t}^{\widehat{\mathbb {Q}}}\). For this latter one, since under \(\widehat{\mathbb {Q}}\), we have:

where \(\left( \widehat{W}_{L,t}\right) _{t}\) is a Brownian motion under \( \widehat{\mathbb {Q}}\), we deduce that:

To compute \(d\left\langle \widehat{IRM},L\right\rangle _{t}^{\widehat{ \mathbb {Q}}}\), we note that:

where \(\widehat{W}_{L,t}\), \(\widetilde{W}_{K,t}\) and \(\left( N_{K,t}-\lambda \overline{\delta }t\right) \) are orthogonal martingales under \(\widehat{ \mathbb {Q}}\).

We have:

Step 1: Note that:

Thus, we get:

Recall also that we have:

with

But:

Thus:

Therefore, we deduce another expression of \(\mathbb {E}_{\widehat{\mathbb {Q}}} \left[ K_{T}\left| \mathcal {F}_{t}\right. \right] \), namely:

with

Step 2: Note that:

Therefore, applying Yor’s formula, we deduce:

Consequently, we have:

Therefore, we get:

which is equivalent to:

Finally, we get the value of the margin interest rate computed with respect to the minimal martingale measure:

which implies that:

Thus, the process \(\mathbb {E}_{\widehat{\mathbb {Q}}}\left[ IRM\left( K_{T},L_{T}\right) \left| \mathcal {F}_{t}\right. \right] \) has the following form:

with

Now we can determine \(d\left\langle \widehat{IRM},L\right\rangle _{t}^{ \widehat{\mathbb {Q}}}\). For this latter purpose, we must determine the martingale component of \(\widehat{IRM}_{t}\) driven by the Brownian motion \( \left( \widehat{W}_{L,t}\right) _{t}\)with respect to the minimal martingale measure. Using Ito’s formula, its stochastic differential is given by:

Finally, we deduce:

and the locally risk minimizing strategy is given by:

Rights and permissions

About this article

Cite this article

Adam, A., Cherrat, H., Houkari, M. et al. On the risk management of demand deposits: quadratic hedging of interest rate margins. Ann Oper Res 313, 1319–1355 (2022). https://doi.org/10.1007/s10479-020-03726-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03726-1