Abstract

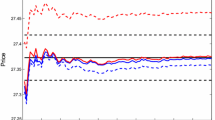

Lower and upper bounds are derived on single-period European options under moment information, without assuming that the asset prices follow geometric Brownian motion, which is frequently untrue in practice. Sometimes the entire asset distribution is not completely known, sometimes it is known but the numerical calculation is easier by the use of the moments than the entire probability distribution. As geometric Brownian motion assumption regarding the asset prices is frequently untrue in practice. Some of the bounds are given by formulas, some are obtained by solving special linear programming problems. The bounds can be made close if a sufficiently large number of moments is used, and may serve for approximation of the values of financial derivatives.

Similar content being viewed by others

References

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. The Journal of Political Economy, 81(3), 637–654.

Fujiwara, O. (1987). Two adjacent pipe diameters at the optimal solution in the water distribution network models. Water Resources Research, 23(8), 1457–1460.

Grundy, B. D. (1991). Option prices and the underlying asset’s return distribution. The Journal of Finance, 46(3), 1045–1070.

Karlin, S., & Studden, W. J. (1996). Pure and Applied Mathematics Tchebysheff systems: With applications in Analysis and Statistics. New York: Interscience Publishers.

Khang, D. B., & Fujiwara, O. (1992). Optimal adjacent pipe diameters in water distribution networks with reliability constraints. Water Resources Research, 28(6), 1503–1505.

Lo, A. (1987). Semi-parametric upper bounds for option prices and expected payoffs. Journal of Financial Economics, 19(2), 373–388.

Lo, A. W., & MacKinlay, A. C. (1999). A Non-Random Walk Down Wall Street. Princeton, NJ: Princeton University Press.

Merton, R. (1973). Theory of rational option pricing. Bell Journal of Economics, 4(1), 141–183.

Krein, M. G., & Nudelman, A. A. (1977). The Markov moment problem and extremal problems. Library of Congress Cataloging in Publication Data, 50.

Prékopa, A. (1990). The discrete moment problem and linear programming. Discrete Applied Mathematics, 27, 235–254.

Prékopa, A. (1990). Sharp bounds on probabilities using linear programming. Operations Research, 38, 227–239.

Prékopa, A. (1995). Stochastic Programming. Boston: Kluwer Scientific Publishers.

Prékopa, A. (2001). Discrete higher order convex functions. In N. Hadjisavvas, J. E. Martinez-Legaz, & J-P. Penot, (eds.) Generalized Convexity and Generalized Monotonicity, Lecture Notes in Economics and Mathematical Systems (Vol. 502, pp. 293–320).

Prékopa, A., & Naumova, M. (2016). The discrete moment method for the numerical integration of piecewise higher order convex functions. Discrete Applied Mathematics, 202(C), 151–162.

Prékopa, A., Ninh, A., & Alexe, G. (2016). On the relationship between the discrete and continuous bounding moment problems and their numerical solutions. Annals of Operations Research, 238(1–2), 521–575.

Ritchken, P. H. (1985). On option pricing bounds. The Journal of Finance, 40(4), 1219–1233.

Ritchken, P. H., & Kuo, S. (1988). Option bounds with finite revision opportunities. The Journal of Finance, 43(2), 301–308.

Zhang, P. G. (1994). Bounds for the option prices and expected payoffs. Review of Quantitative Finance and Accounting, 4, 179–197.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Naumova, M., Prékopa, A. Bounding the values of financial derivatives by the use of the moment problem. Ann Oper Res 305, 211–225 (2021). https://doi.org/10.1007/s10479-020-03839-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03839-7