Abstract

A resale value guaranteed (RVG) strategy has emerged as a novel way to alleviate EV purchasers’ resale anxiety. However, certain questions, such as when to initiate a RVG strategy and whether to share information with supply chain partners, are unanswered. In this study, we aim to investigate the impacts of a RVG strategy and reliability of a RVG decision on EV adoption and supply chain performance. We develop analytical models to analyze the optimal RVG strategy in asymmetric versus symmetric information situations, using the traditional business model as a benchmark. The results indicate that a RVG strategy can be an effective way to increase supply chain profits for products that are subject to a degree of resale anxiety, trade-in cost, and the reliability of the manufacturer’s commitments. Incentives provided by one party to the other can be utilized to encourage information sharing. However, information sharing does not necessarily lead to higher sales volume.

Similar content being viewed by others

Notes

Diss, K. The big problem with electric vehicle resale prices compared to petrol, diesel and hybrid cars. Retrieved February 6, 2018, from https://www.abc.net.au/news/2018-02-06/electric-vehicle-resale-price-compared-to-petrol-diesel-hybrid/9380186.

2019 Annual Report on Resale Value of Automobile in China (2019 中国汽车保值率报告). Accessed on July 2, 2020 at https://www.sohu.com/a/298661196_372777.

The retail price of Audi e-tron can be found at https://www.audi.cn/cn/web/zh/models/e-tron/e-tron.html as of February 18, 2020.

References

Akçay, Y., Boyacı, T., & Zhang, D. (2013). Selling with money-back guarantees: The impact on prices, quantities, and retail profitability. Production and Operations Management, 22(4), 777–791.

Chen, B., & Chen, J. (2017). When to introduce an online channel, and offer money back guarantees and personalized pricing? European Journal of Operational Research, 257(2), 614–624.

Chen, Y., Narasimhan, C., & Zhang, Z. J. (2001). Individual marketing with imperfect targetability. Marketing Science, 20(1), 23–41.

Chu, L. Y., Shamir, N., & Shin, H. (2017). Strategic communication for capacity alignment with pricing in a supply chain. Management Science, 63(12), 4366–4388.

Clarke, R. N. (1983). Collusion and the incentives for information sharing. The Bell Journal of Economics, 14(2), 383–394.

Crocker, K. J., & Letizia, P. (2014). Optimal policies for recovering the value of consumer returns. Production and Operations Management, 23(10), 1667–1680.

Ha, A. Y., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Management Science, 54(4), 701–715.

Hsiao, L., & Chen, Y.-J. (2012). Returns policy and quality risk in E-business. Production and Operations Management, 21(3), 489–503.

Jiang, L., & Hao, Z. (2016). Incentive-driven information dissemination in two-tier supply chains. Manufacturing & Service Operations Management, 18(3), 393–413.

Ketzenberg, M. E., & Zuidwijk, R. A. (2009). Optimal pricing, ordering, and return policies for consumer goods. Production and Operations Management, 18(3), 344–360.

Letizia, P., Pourakbar, M., & Harrison, T. (2018). The impact of consumer returns on the multichannel sales strategies of manufacturers. Production and Operations Management, 27(2), 323–349.

Li, W., Chen, J., Liang, G., & Chen, B. (2018). Money-back guarantee and personalized pricing in a Stackelberg manufacturer’s dual-channel supply chain. International Journal of Production Economics, 197, 84–98.

Li, Z., Gilbert, S. M., & Lai, G. (2014). Supplier encroachment under asymmetric information. Management Science, 60(2), 449–462.

Li, T., & Zhang, H. (2015). Information sharing in a supply chain with a make-to-stock manufacturer. Omega, 50, 115–125.

Lim, M. K., Mak, H.-Y., & Rong, Y. (2015). Toward mass adoption of electric vehicles: Impact of the range and resale anxieties. Manufacturing & Service Operations Management, 17(1), 101–119.

Liu, C., Xiang, X., & Zheng, L. (2020). Value of information sharing in a multiple producers–distributor suppliy chain. [Research article]. Annals of Operations Research, 285(1-2), 121-148.

Liu, C., Xiang, X., & Zheng, L. (2020b). Value of information sharing in a multiple producers–distributor suppliy chain. Annals of Operations Research, 285(1–2), 121–148.

McWilliams, B. (2012). Money-back guarantees: Helping the low-quality retailer. Management Science, 58(8), 1521–1524.

Moorthy, S., & Srinivasan, K. (1995). Signaling quality with a money-back guarantee: The role of transaction costs. Marketing Science, 14(4), 442–466.

Özer, Ö., & Wei, W. (2006). Strategic commitments for an optimal capacity decision under asymmetric forecast information. Management Science, 52(8), 1238–1257.

Sperling, D., & Gordon, D. (2009). Two billion cars: Driving toward sustainability. New York: Oxford University Press.

Svenson, O. (1981). Are we all less risky and more skillful than our fellow drivers? Acta Psychologica, 47(2), 143–148.

Taylor, S. E., & Brown, J. D. (1988). Illusion and well-being: A social psychological perspective on mental health. Psychological Bulletin, 103(2), 193–210.

Zhang, H. (2002). Vertical information exchange in a supply chain with duopoly retailers. Production and Operations Management, 11(4), 531–546.

Zhang, X., & Bai, X. (2017). Incentive policies from 2006 to 2016 and new energy vehicle adoption in 2010–2020 in China. Renewable and Sustainable Energy Reviews, 70, 24–43.

Zhang, X., Bai, X., & Shang, J. (2018). Is subsidized electric vehicles adoption sustainable: Consumers’ perceptions and motivation toward incentive policies, environmental benefits, and risks. Journal of Cleaner Production, 192, 71–79.

Zheng, R., Gu, Y., Pan, S., Gu, C., Fu, L., Li, M., et al. (2020). Lifecycle value management of new energy vehicle: Challenges and outlook 2020. Shanghai: Roland Berger and Autobole.

Acknowledgements

This study is supported by the National Natural Science Foundation of China (No. 71872012, 71521002), the key research program of the Beijing Social Science Foundation (15JDJGA021), the International Clean Energy Talents Program of China Scholarship Council (Liujinfa [2017]5047 and Liujinfa [2018]5023), and the Special Fund of Beijing Municipal Commission of Education (No. 20162139016).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

These authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1

-

(1)

Since \( \pi_{r} = (p_{r} - w)q_{r} = (p_{r} - w)(a - bp_{r} ) \), we have \( p_{r}^{*} = \frac{a + bw}{2b} \) and \( q_{r}^{*} = \frac{a - bw}{2} \). In addition, \( Eq(w) = \Pr (\rho \left| {\varphi_{s} } \right.)\alpha q_{s}^{*} + \Pr (\rho \left| {\varphi_{r} } \right.)\alpha q_{s}^{*} + \Pr (\rho \left| {\varphi_{s} } \right.)(1 - \alpha )q_{r} + \Pr (\rho \left| {\varphi_{r} } \right.)(1 - \alpha )q_{r} = [I + 2(1 - I)\gamma ]\frac{2a - (2b + \beta )w}{2} \). Hence \( \pi_{m}^{A} = (w - c)Eq - \eta \xi q_{r}^{*} = (w - c)\left[ {[I + 2(1 - I)\gamma ]\frac{2a - (2b + \beta )w}{2}} \right] - \eta \xi \frac{a - bw}{2} \). Using the first order condition of πm with respect to w, we have the result \( w_{r}^{A*} = \frac{a}{2b + \beta } + \frac{\eta \xi b}{2[I + 2(1 - I)\gamma ](2b + \beta )} + \frac{c}{2} \).

-

(2)

Replacing \( w_{r}^{A*} \) with w in \( p_{r}^{*} = \frac{a + bw}{2b} \), we have the result.

-

(3)

Replacing \( w_{r}^{A*} \) with w in \( q_{r}^{*} = \frac{a - bw}{2} \), we have the result.

-

(4)

Since \( \pi_{r}^{A*} = (p_{r}^{*} - w_{r}^{*} )q_{r}^{*} = \frac{{(a - bw_{r}^{*} )^{2} }}{4b} \), replacing \( w_{r}^{A*} \), we have the result for \( \pi_{r}^{A*} \). In a similar way, since \( \pi_{m}^{A*} = (w_{r}^{*} - c)\left[ {[I + 2(1 - I)\gamma ]\frac{{2a - (2b + \beta )w_{r}^{*} }}{2}} \right] - \eta \xi \frac{{a - bw_{r}^{*} }}{2} \), replacing \( w_{r}^{A*} \), we have the results for \( \pi_{m}^{A*} \).□

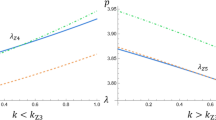

1.2 Proof of Proposition 1

In a traditional selling business, the demand function is \( q_{s} = a - bp_{s} - \beta p_{s} \). The dealer’s profit function is \( \pi_{sr} = (p_{s} - w)(a - bp_{s} - \beta p_{s} ) \), and the manufacturer’s profit function is \( \pi_{sm} = (w - c)q_{s} \). Then we can see that the maximum profit of the manufacturer, \( \pi_{sm}^{*} \), is \( \pi_{sm}^{*} = \frac{{[a - (b + \beta )c]^{2} }}{8(b + \beta )} \), and the maximum profit of the dealer, \( \pi_{sr}^{*} \), is \( \pi_{sr}^{*} = \frac{{[a - (b + \beta )c]^{2} }}{16(b + \beta )} \). We can further obtain the optimal sales volume \( q_{s}^{*} \), the unit retail price \( p_{s}^{*} \), and the unit wholesale price \( w_{s}^{*} \), which are \( q_{s}^{*} = \frac{a - (b + \beta )c}{4} \), \( p_{s}^{*} = \frac{3a + (b + \beta )c}{4(b + \beta )} \), and \( w_{s}^{*} = \frac{a + (b + \beta )c}{2(b + \beta )} \), respectively.

With a RVG strategy, the demand function becomes \( q_{r} = a - bp_{r} \). Even if the dealer agrees to follow the manufacturer’s RVG proposal, the manufacturer needs to account for the possibility that the dealer’s consumer information is not accurate. Hence the manufacturer’s profit function becomes \( \pi_{m}^{A} = (w - c)Eq - \eta \xi q_{r} \), where \( Eq(w) = \Pr (\rho \left| {\varphi_{s} } \right.)q_{s}^{*} + \Pr (\rho \left| {\varphi_{r} } \right.)q_{s}^{*} + \Pr (\rho \left| {\varphi_{s} } \right.)q_{r} + \Pr (\rho \left| {\varphi_{r} } \right.)q_{r} \), as shown in Sect. 3. The dealer’s profit is \( \pi_{r}^{A} = (p_{r} - w)(a - bp_{r} ) \) if the dealer agrees to initiate the RVG strategy. Hence we can obtain the maximum profit of the manufacturer \( \pi_{m}^{A*} \), i.e., \( \pi_{m}^{A*} = \frac{{[I + 2(1 - I)\gamma ]\left[ {2a - (2b + \beta )c} \right]^{2} }}{8(2b + \beta )} + \frac{\eta \xi b(2a + (2b + \beta )c)}{4(2b + \beta )} + \frac{{(\eta \xi b)^{2} }}{8[I + 2(1 - I)\gamma ](2b + \beta )} - \frac{\eta \xi a}{2} \).

Solving the inequality \( \pi_{m}^{A*} > \pi_{sm}^{*} \), we obtain the result.□

1.3 Proof of Proposition 2

-

(1)

Because \( \frac{{\partial \pi_{m}^{A*} }}{\partial \beta } = - \frac{{[I + 2(1 - I)\gamma ]\left[ {2a - (2b + \beta )c} \right]c}}{4(2b + \beta )} - \frac{{[I + 2(1 - I)\gamma ]\left[ {2a - (2b + \beta )c} \right]^{2} }}{{8(2b + \beta )^{2} }} - \frac{\eta \xi ab}{{2(2b + \beta )^{2} }} - \frac{{(\eta \xi b)^{2} }}{{8[I + 2(1 - I)\gamma ](2b + \beta )^{2} }} < 0 \), we have the first result in Proposition 2 (1).

From analysis in Sect. 3, we can obtain \( p_{r}^{*} = \frac{a}{2b} + \frac{2[I + 2(1 - I)\gamma ]a + \eta \xi b}{4[I + 2(1 - I)\gamma ](2b + \beta )} + \frac{[I + 2(1 - I)\gamma ]c}{4[I + 2(1 - I)\gamma ]} \). Take the first derivative of \( p_{r}^{*} \) w.r.t. β, we have \( \frac{{\partial p_{r}^{*} }}{\partial \beta } = - \frac{2[I + 2(1 - I)\gamma ]a + \eta \xi b}{{4[I + 2(1 - I)\gamma ](2b + \beta )^{2} }} < 0 \). It is the second result in Proposition 2 (1).

Because \( q_{r}^{*} = \frac{a}{2} - \frac{{2[I + 2(1 - I)\gamma ]ab + \eta \xi b^{2} + [I + 2(1 - I)\gamma ](2b + \beta )bc}}{4[I + 2(1 - I)\gamma ](2b + \beta )} \) and \( \frac{{\partial q_{r}^{*} }}{\partial \eta } = - \frac{{\xi b^{2} }}{{4\left( {I + 2(1 - I)\gamma } \right)(2b + \beta )}} < 0 \), we have the third result in Proposition 2 (1).

-

(2)

Because \( \frac{{\partial \pi_{m}^{A*} }}{\partial \eta } = \frac{{\xi b(2a + (2b + \beta )c)[I + 2(1 - I)\gamma ] + \eta \xi^{2} b^{2} - 2[I + 2(1 - I)\gamma ](2b + \beta )\xi a}}{4[I + 2(1 - I)\gamma ](2b + \beta )} \), \( \frac{{\partial \pi_{m}^{A*} }}{\partial \eta } < 0 \) when \( \eta < \frac{[I + 2(1 - I)\gamma ][2ab + 2\beta a - (2b + \beta )bc]}{{\xi b^{2} }} \). We have the result in Proposition 2 (2).

-

(3)

Because \( \frac{{\partial \pi_{m}^{A *} }}{\partial I} = \frac{{\left( {\left( {2a - (2b + \beta )c} \right)\left( {I + 2(1 - I)\gamma } \right) + \eta \xi b} \right)\left( {\left( {2a - (2b + \beta )c} \right)\left( {I + 2(1 - I)\gamma } \right) - \eta \xi b} \right)(1 - 2\gamma )}}{{8\left( {I + 2(1 - I)\gamma } \right)^{2} (2b + \beta )}} \), when \( \left( {2a - (2b + \beta )c} \right)\left( {I + 2(1 - I)\gamma } \right) - \eta \xi b > 0 \), i.e., \( I > \frac{2\gamma (2a - 2bc - c\beta ) - \eta \xi b}{{\left( {2a - (2b + \beta )c} \right)(2\gamma - 1)}} \), we have the result in Proposition 2 (3).

-

(4)

Because \( q_{r}^{*} = \frac{a}{2} - \frac{{2[I + 2(1 - I)\gamma ]ab + \eta \xi b^{2} + [I + 2(1 - I)\gamma ](2b + \beta )bc}}{4[I + 2(1 - I)\gamma ](2b + \beta )} \), and \( \frac{{\partial q_{r}^{A*} }}{\partial I} = \frac{{\eta \xi b^{2} (1 - 2\gamma )}}{{4[I + 2(1 - I)\gamma ]^{2} (2b + \beta )}} \), when γ < ½, we have \( \frac{{\partial q_{r}^{A*} }}{\partial I} > 0 \). Otherwise, \( \frac{{\partial q_{r}^{A*} }}{\partial I} < 0 \).□

1.4 Proof of Proposition 3

Because \( \pi_{r}^{S*} = (p_{r}^{S*} - w_{{}}^{S*} )q_{r}^{S*} + A = \frac{{\left( {\frac{a - bc}{2} - \frac{\eta \xi b}{{2\left( {I + \gamma (1 - I)} \right)}}} \right)^{2} }}{4b} + A \), and because \( \pi_{r}^{A*} = \frac{{\left( {\frac{a(b+\beta)}{2(b+\beta)} - \frac{\eta \xi b^2}{{2\left( {I + 2\gamma (1 - I)} \right) 2b+\beta}} - \frac{bc}{2}} \right)^{2} }}{4b} \), solving A from \( \pi_{r}^{S*} > \pi_{r}^{A*} \), we have the result on the left-hand side. Similarly, because \( \pi_{m}^{A*} = \frac{{\left( {I + 2\gamma (1 - I)} \right)\left( {2a - c(2b + \beta )} \right)^{2} }}{8(2b + \beta )} + \frac{{\eta \xi b\left( {2a + c(2b + \beta )} \right)}}{4(2b + \beta )} + \frac{{(\eta \xi b)^{2} }}{{8\left( {I + 2\gamma (1 - I)} \right)(2b + \beta )}} - \frac{\eta \xi a}{2} \), and because \( \pi_{m}^{S*} = \frac{{\left( {\left( {I + 2\gamma (1 - I)} \right)a - \left( {\left( {I + 2\gamma (1 - I)} \right)c + \eta \xi } \right)b} \right)^{2} }}{{8\left( {I + 2\gamma (1 - I)} \right)b}} - A \), solving A from \( \pi_{m}^{S*} > \pi_{m}^{A*} \), we have the result on the right-hand side.□

1.5 Proof of Proposition 4

-

(1)

The proof is obtained by solving η from comparison of \( q_{r}^{S*} \) and \( q_{r}^{A*} \). Because \( q_{r}^{S*} = \frac{a}{2} - \frac{{a\left( {I + 2\gamma (1 - I)} \right) + b\left( {\eta \xi + c\left( {I + 2\gamma (1 - I)} \right)} \right)}}{{4\left( {I + 2\gamma (1 - I)} \right)}} \), \( q_{s}^{*} = \frac{a - (b + \beta )c}{4} \), and because \( q_{r}^{A*} = \frac{a}{2} - \frac{{2ab\left( {I + 2\gamma (1 - I)} \right) + \eta \xi b^{2} + bc(2b + \beta )\left( {I + 2\gamma (1 - I)} \right)}}{{4(2b + \beta )\left( {I + 2\gamma (1 - I)} \right)}} \), we have the result of Proposition 4 (1).

Similarly, we can obtain results of Proposition 4 (2) and (3). (4) The difference between \( q_{r}^{S*} \) and \( q_{r}^{A*} \) is \( q_{r}^{A*} - q_{r}^{S*} = \frac{{\left( {I + 2\gamma (1 - I)} \right)\beta a + (b + \beta )\eta \xi b}}{{4\left( {I + 2\gamma (1 - I)} \right)(2b + \beta )}} > 0 \). Then, we have the result of Proposition 4 (4).□

Rights and permissions

About this article

Cite this article

Zhang, X., Zhao, C. Resale value guaranteed strategy, information sharing and electric vehicles adoption. Ann Oper Res 329, 603–617 (2023). https://doi.org/10.1007/s10479-020-03901-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03901-4