Abstract

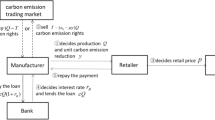

As low-carbon products increasingly become popular among consumers, the manufacturers have begun to advocate low-carbon supply chain to meet consumers’ low-carbon preferences. However, low-carbon investments inevitably bring financing constraints to the supply chain. To provide a potential solution to relieve the financial constrain, we established a two-echelon supply chain consisting of a low-carbon product manufacturer and a retailer. Supply chain members can effectively solve their financing constraints by utilizing portfolio financing consisting of the bank loan (BL), trade credit (TC), and asset-based securitization (ABS). We found that under the financial mode of BL and DC (Dual credit refers to the combination of bank loan and trade credit), only when consumers are highly price-sensitive to low-carbon products can tax preference incentivize the manufacturer to reduce carbon emissions. Under DC mode, consumer’s strong low-carbon preference will push up the retail price level of low-cost products; Under portfolio financing with ABS & DC, consumers’ strong low-carbon preference will force up the retail price level of low-carbon products with low price sensitivity. Compared with pure BL and DC, the cash flow under portfolio financing is the tightest. Besides, we took capital demand of the multi-stage scenario into consideration. Moreover, we found that the tax rate and tax deduction ratio of carbon emissions reduction will affect the retail price, wholesale price, and financing decision in the three financial modes when satisfying certain conditions.

Similar content being viewed by others

References

Augusto, C., Jorge, N., & Salvador, Z. (2017). Debt tax shields around the OECD world. Emerging Markets Finance & Trade, 53, 26–43.

Babich, V., & Kouvelis, P. (2018). Introduction to the special issue on research at the interface of finance, operations, and risk management (iFORM): recent contributions and future directions. Manufacturing & Service Operations Management, 20(1), 1–18.

Benjaafar, S., Li, Y., & Daskin, M. (2013). Carbon footprint and the management of supply chains: Insights from simple models. IEEE Transactions on Automation Science and Engineering, 10(1), 99–116.

Buchanan, B. G. (2016). Securitization: a financing vehicle for all seasons? Journal of Business Ethics, 138(3), 559–577.

Cao, E. B., & Yu, M. (2018). Trade credit financing and coordination for an emission-dependent supply chain. Computers & Industrial Engineering, 119, 50–62.

Cao, K., Xu, X., Wu, Q., & Zhang, Q. (2017). Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. Journal of Cleaner Production, 167, 505–513.

Chen, X., & Wang, A. (2012). Trade credit contract with limited liability in the supply chain with budget constraints. Annals of Operations Research, 196(1), 153–165.

Chen, X., & Wang, G. (2011). The effect of financing on a budget-constrained supply chain under wholesale price contract. Asia Pacific Journal of Operational Research, 28(4), 457–485.

Chern, M. S., Chan, Y. L., Teng, J. T., & Goyal, S. K. (2014). Nash equilibrium solution in a vendor-buyer supply chain model with permissible delay in payments. Computers & Industrial Engineering, 70, 116–123.

Chern, M. S., Pan, Q., Teng, J. T., Chan, Y. L., & Chen, S. C. (2013). Stackelberg solution in a vendor-buyer supply chain model with permissible delay in payments. International Journal of Production Economics, 144, 397–404.

Choi, T. M. (2013). Optimal apparel supplier selection with forecast updates under carbon emission taxation scheme. Computers & Operations Research, 40(11), 2646–2655.

Deng, S., Gu, C., Cai, G., & Li, Y. (2018). Financing multiple heterogeneous suppliers in assembly systems: Retailer finance vs. bank finance. Manufacturing & Service Operations Management, 20(1), 53–69.

Dong, C., Shen, B., Chow, P. S., Yang, L., & Ng, C. T. (2016). Sustainability investment under cap-and-trade regulation. Annals of Operations Research, 240(2), 509–531. https://doi.org/10.1007/s10479-013-1514-1

Dong, G. S., Wei, L. H., Xie, J. P., et al. (2019). Two-echelon supply chain operational strategy under portfolio financing and tax shield. Industrial Management & Data Systems, 120(4), 633–656.

Drake, D., Kleindorfer, P. R., & Van Wassenhove, L. N. (2010). Technology choice and capacity investment under emissions regulation. Faculty and Research, 93(10), 128–145.

Du, S., Hu, L., & Song, M. (2016). Production optimization considering environmental performance and preference in the cap-and-trade system. Journal of Cleaner Production, 112, 1600–1607.

Du, S., Hu, L., & Wang, L. (2015). Low-carbon supply policies and supply chain performance with carbon concerned demand. Annals of Operations Research, 255(1–2), 569–590.

Fan, R. G., Lin, J. C., & Zhu, K. W. (2019). Study of game models and the complex dynamics of a low-carbon supply chain with an altruistic retailer under consumers’ low-carbon preference. Physica A: Statistical Mechanics and its Applications, 528, 121460.

Fang, L., & Xu, S. (2020). Financing equilibrium in a green supply chain with capital constraint. Computers & Industrial Engineering., 143, 106390.

Garella, P. G., & Trentinaglia, M. T. (2018). Carbon tax, emission standards, and carbon leak under price competition. Environment & Resource Economics, 6, 1–24.

Gong, X., Chao, X., & Simchi-Levi, D. (2014). Dynamic inventory control with limited capital and short-term financing. Naval Research Logistics, 61(3), 184–201.

Gong, X., & Zhou, S. X. (2013). Optimal production planning with emissions trading. Operations Research, 61(4), 908–924.

Han, J., & Li, Q. (2012). The study on the innovative financing mode of public rental housing. Technology for Education and Learning.

Hong, Z., Cho, C., & Yu, Y. (2016). Dual-mode production planning for manufacturing with emission constraints. European Journal of Operational Research, 251(1), 96–106.

Hosseini-Motlagh, S. M., Ebrahimi, S., & Jokar, A. (2019). Sustainable supply chain coordination under competition and green effort scheme. Journal of the Operational Research Society. https://doi.org/10.1080/01605682.2019.1671152

Hosseini-Motlagh, S. M., Nematollahi, M., Johari, M., & Sarker, B. R. (2018). A collaborative model for coordination of monopolistic manufacturer’s promotional efforts and competing duopolistic retailers’ trade credits. International Journal of Production Economics, 204, 108–122.

Hosseini-Motlagh, S. M., Nouri-Harzvili, M., Choi, T. M., & Ebrahimi, S. (2019). Reverse supply chain systems optimization with dual channel and demand disruptions: Sustainability, CSR investment and pricing coordination. Information Sciences, 503, 606–634.

Hsu, V. N., & Zhu, K. (2011). Tax-effective supply chain decisions under China’s export-oriented tax policies. Manufacturing & Service Operations Management, 13(2), 163–179.

Hu, Q., Sobel, M. J., & Turcic, D. (2010). Optimization of inventory and dividends with risky debt. http://ssrn.com/paper=1592003.

Huang, S., Fan, Z. P., & Wang, N. N. (2020). Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transportation Research Part E, 136, 101885.

Huh, W. T., & Park, K. S. (2013). Impact of transfer pricing methods for tax purposes on supply chain performance under demand uncertainty. Naval Research Logistics, 60(4), 269–293.

Jaber, M. Y., Glock, C. H., & El Saadany, A. M. A. (2013). Supply chain coordination with emissions reduction incentives. International Journal of Production Research, 51(1), 69–82.

Kouvelis, P., & Zhao, W. (2012). Financing the newsvendor: supplier vs. bank, and the structure of optimal trade credit contracts. Operations Research, 60(3), 566–580.

Kouvelis, P., & Zhao, W. (2016). Supply chain contract design under financial constraints and bankruptcy costs. Management Science, 62(8), 2341–2357.

Kouvelis, P., & Zhao, W. (2018). Who should finance the supply chain? Impact of credit ratings on supply chain decisions. Manufacturing & Service Operations Management, 20(1), 19–35.

Lee, J. Y., & Choi, S. Y. (2021). Supply chain investment and contracting for carbon emissions reduction: A social planner’s perspective. International Journal of Production Economics, 231, 107873.

Lou, K. R., & Wang, L. (2013). Optimal lot-sizing policy for a manufacturer with defective items in a supply chain with up-stream and down-stream trade credits. Computers & Industrial Engineering, 66, 1125–1130.

Lu, X. Y., & Wu, Z. Q. (2020). How taxes impact bank and trade financing for Multinational Firms. European Journal of Operational Research, 286, 218–232.

Purohit, A. K., Shankar, R., Dey, P. K., & Choudhary, A. (2016). Non-stationary stochastic inventory lot-sizing with emission and service level constraints in a carbon cap-and- trade system. Journal of Cleaner Production, 113, 654–661.

Raghavan, N. S., & Mishra, V. K. (2011). Short-term financing in a cash-constrained supply chain. International Journal of Production Economics, 134(2), 407–412.

Reindorp, M., Tanrisever, F., & Lange, A. (2018). Purchase order financing: Credit, commitment, and supply chain consequences. Operations Research, 66(5), 1287–1303.

Shafinar, I., Mohamed Hariri, B., Rosalan, A., & Azman, M. N. (2015). Financing higher education students in Malaysia using Islamic student loan-backed securitization: An empirical analysis. In R. Omar, H. Bahrom & G. de Mello (Eds.), Islamic perspectives relating to business, arts, culture and communication (pp. 285–293). Singapore: Springer. https://doi.org/10.1007/978-981-287-429-0_27.

Song, J., & Leng, M. (2012). Analysis of the single-period problem under carbon emissions policies (pp. 297–313). Springer.

Su, C. H. (2012). Optimal replenishment policy for an integrated inventory system with defective items and allowable shortage under future revenue right. International Journal of Production Economics, 139(1), 247–256.

Swami, S., & Shah, J. (2013). Channel coordination in green supply chain management. Journal of the Operational Research Society, 64(3), 336–351. https://doi.org/10.1057/jors.2012.44

Tang, R. H., & Yang, L. (2020). Impacts of financing mechanism and power structure on supply chains under cap-and-trade regulation. Transportation Research Part E, 139, 101957.

Teng, J. T., Lou, K. R., & Wang, L. (2014). Optimal trade credit and lot size policies in economic production quantity models with learning curve production costs. International Journal of Production Economics, 155, 318–323.

Tsao, Y. C. (2013). Distribution center network design under trade credits. Applied Mathematics and Computation, 222, 356–364.

Tsenga, M. L., Wub, K. J., Huc, J. Y., & Wangd, C. H. (2018). Decision-making model for sustainable supply chain finance under uncertainties. International Journal of Production Economics., 205, 30–36.

Tunca, T. I., & Zhu, W. (2018). Retailer intermediation in supplier finance. Management Science., 64(12), 5631–5650.

Valaskova, K., & Bakes, V. (2018). Calculation of tax shields using the method of adjusted present value. In N. Tsounis & A. Vlachvei (Eds.), Advances in Panel Data Analysis in Applied Economic Research (pp. 553–562). ICOAE 2017. Springer Proceedings in Business and Economics. Cham: Springer. https://doi.org/10.1007/978-3-319-70055-7_40.

Wang, N. M., Song, Y. S., He, Q. D., & Jiang, T. (2020). Competitive dual-collecting regarding comsumer behavior and coordination in closed-loop supply chain. Computers & Industrial Engineering, 144, 1–15.

Wang, Q., Zhao, D., & He, L. (2016). Contracting emission reduction for supply chains considering market low-carbon preference. Journal of Cleaner Production, 120, 72–84.

Wu, D. S. D., Yang, L. P., & Olson, D. L. (2019). Green supply chain management under capital constraint. International Journal of Production Economics, 215(2019), 3–10.

Wu, J., Al-Khateeb, F. B., Teng, J. T., & Cárdenas-Barrón, L. E. (2016). Inventory models for deteriorating items with maximum lifetime under downstream partial trade credits to credit-risk customers by discounted cash-flow analysis. International Journal of Production Economics, 171, 105–115.

Wu, T., & Kung, C. C. (2020). Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technological Forecasting & Social Change, 152, 119884.

Xie, J. P., Liang, L., Liu, L. H., & Ieromonachou, P. (2017). Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. International Journal of Production Economics, 183(1), 528–538.

Yang, C. T., Dye, C. Y., & Ding, J. F. (2015a). Optimal dynamic trade credit and preservation technology allocation for a deteriorating inventory model. Computers & Industrial Engineering, 87, 356–369.

Yang, H., Zhuo, W., & Shao, L. (2017). Equilibrium evolution in a two-echelon supply chain with financially constrained retailers: the impact of equity financing. International Journal of Production Economics., 185, 139–149.

Yang, S. A., Birge, J. R., & Parker, R. P. (2015b). The supply chain effects of bankruptcy. Management Science, 61(10), 2320–2338.

Yu, J. C. P. (2018). Optimizing a two-warehouse system under shortage backordering, trade credit, and decreasing rental conditions. International Journal of Production Economics, 209, 147–155.

Zhang, S. Y., Wang, C. X., Yu, C., & Ren, Y. J. (2019). Governmental cap regulation and manufacturer’s low carbon strategy in a supply chain with different power structures. Computers & Industrial Engineering, 134, 27–36.

Zhou, S. X., & Chao, X. (2014). Dynamic pricing and inventory management with regular and expedited supplies. Productions and Operations Management, 23(1), 65–80.

Acknowledgements

Funding was provided by the Key Program of National Social Science Foundation of China (Grant No. 20AJY008) and China Postdoctoral Science Foundation (Grant No. 2018M641947). The authors contributed equally to the paper and author names are in alphabetical order.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 Appendix 1

The optimization problem of supply chain participants under the financing model BL is

where \(q = A - \alpha p + \beta L\), \(t_{M} = \left( {w - c} \right)q - \frac{1}{2}\delta kL^{2}\), \({ }t_{R} = \left( {p - w} \right)q - sr\).

We can reorganize and get the following results.

According to the idea of reverse solving, we first optimize the retailer’s problem. The first derivative and the second derivative of the retailer’s profit with respect to the decision variables are as follows.

Obviously, the retailer’s profit is a concave function of \(p\), and let the first derivative equal to 0, we can get the reaction function, \(p = \frac{A + \alpha w + L\beta }{{2\alpha }}.\)

We put the expression of \(w\) into \({ }\mathop {{\text{max}}}\limits_{{t_{M} > 0}} S_{M}\), then we have the following expression.

The first derivative functions of the manufacturer’s profit function with respect to the decision variables are as follows.

The Hessian matrix of the manufacturer’s profit function on the decision variables is

Because \(\left| { - 4\left( {1 - t} \right)\alpha } \right| < 0\), the above matrix is a negative definite matrix if \(\alpha > \frac{{\left( {1 - t} \right)\beta^{2} }}{{4k\left( {1 - t\delta } \right)}}\), \( S_{M}\) is a joint concave function with respect to \(w\) and \( L\), then we have Theorem 2.

The objective function is a joint concave function, we rewrite the objective function to \(\min - S_{M} = - (w - c)(A - p\alpha + \beta L) + \tfrac{1}{2}kL^{2} + ((w - c)q - \tfrac{1}{2}\delta kL^{2} )t - S_{M0}\).

It is equivalent to that the objective function is a joint concave function, and the inequality constraint function \(g_{1} = cq - S_{M0} + S_{R}^{0} + s\) is a linear function, and \({ }g_{2} = S_{R}^{0} - wq\) is a convex function. Therefore, the Kuhn Tucker condition is necessary and sufficient, the local maximum is the global maximum.

Construct the Lagrangian function as follows.

KKT conditions need to be satisfied aiming for the optimal solution, which are as follow.

(1) \( \lambda_{1} = \lambda_{2} = 0\), In this case, the two constraints are relaxation conditions, the above conditions can be further simplified.

The solution to satisfy the equation is \(L = \frac{{\beta \left( {1 - t} \right)\left( {A - \alpha c} \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - t} \right)}}\), \(w = \frac{{2k\left( {1 - \delta t} \right)\left( {A + \alpha c} \right) - c\beta^{2} \left( {1 - t} \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - t} \right)}}\).

Next, we need to verify the result.

First, verification of \( g_{1} \left( {w,L} \right) < 0\). From previous results, we have \(\left\{ {\begin{array}{*{20}l} {\beta L - \alpha w > \frac{2\alpha sr}{q} - A} \hfill \\ {\left( {w - c} \right)q - \frac{1}{2}\delta kL^{2} > 0} \hfill \\ {pq > wq - S_{R}^{0} } \hfill \\ \end{array} } \right. \Leftrightarrow \left\{ {\begin{array}{*{20}l} {q^{2} > 2\alpha sr} \hfill \\ {\left( {w - c} \right)\left( {A + \beta L - \alpha w} \right) - \frac{1}{2}\delta kL^{2} > 0} \hfill \\ {S_{R}^{0} > wq - pq} \hfill \\ \end{array} } \right. \Leftrightarrow wq - \frac{1}{2}\delta kL^{2} > cq\), \(A + \beta L - \alpha w = q > \sqrt {2\alpha sr} \Leftrightarrow \frac{{A + \beta L - \sqrt {2\alpha sr} }}{\alpha } > w\), and \(\sqrt {2\alpha sr} < q = A + \beta L - \alpha w\left\langle {A + \beta L \Leftrightarrow L} \right\rangle \frac{{\sqrt {2\alpha sr} - A}}{\beta }\). Therefore \(g_{1} \left( {w,L} \right) = cq - S_{M0} + S_{R}^{0} + s < wq - \frac{1}{2}\delta kL^{2} - S_{M0} + S_{R}^{0} + s < \frac{{A + \beta L - \sqrt {2\alpha sr} }}{\alpha } \cdot q - \frac{1}{2}\delta kL^{2} - S_{M0} + S_{R}^{0} + s = \frac{{A\left( {A - \sqrt {2\alpha sr} } \right) + \frac{{\beta^{2} \left( {1 - 2t} \right)\left( {A - c\alpha } \right)\left( {2A - \sqrt {2\alpha sr} } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}}}{\alpha } + \left( {\frac{{\beta^{2} }}{\alpha } - \frac{\delta k}{2}} \right)\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2} - S_{M0} + S_{R}^{0} + s\). When \(\frac{{A\left( {A - \sqrt {2\alpha sr} } \right) + \frac{{\beta^{2} \left( {1 - 2t} \right)\left( {A - c\alpha } \right)\left( {2A - \sqrt {2\alpha sr} } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}}}{\alpha } + \left( {\frac{{\beta^{2} }}{\alpha } - \frac{\delta k}{2}} \right)\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2} + S_{R}^{0} + s < S_{M0}\), \(g_{1} \left( {w,L} \right) < 0\) holds, but its establishing is under some condition.

Second, verification of \(g_{2} \left( {w,L} \right) < 0\). \(g_{2} \left( {w,L} \right) = S_{R}^{0} - wq < S_{R}^{0} - \left( {cq + \frac{1}{2}\delta kL^{2} } \right) < S_{R}^{0} - \left( {c\sqrt {2\alpha sr} + \frac{1}{2}\delta kL^{2} } \right) = S_{R}^{0} - \left( {c\sqrt {2\alpha sr} + \frac{\delta k}{2}\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2} } \right)\). When \(S_{R}^{0} < \sqrt {2\alpha sr} + \frac{\delta k}{2}\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2}\), \(g_{2} \left( {w,L} \right) < 0\) holds, but its establishing is under some condition.

To sum up, when the parameters meet both \(g_{1} \left( {w,L} \right) < 0\) and \(g_{2} \left( {w,L} \right) < 0\) at the same time, that is, \(S_{R}^{0} < {\text{min}}\left( {S_{M0} - s - \frac{{A\left( {A - \sqrt {2\alpha sr} } \right) + \frac{{\beta^{2} \left( {1 - 2t} \right)\left( {A - c\alpha } \right)\left( {2A - \sqrt {2\alpha sr} } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}}}{\alpha } + \left( {\frac{{\beta^{2} }}{\alpha } - \frac{\delta k}{2}} \right)\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2} ,\sqrt {2\alpha sr} + \frac{\delta k}{2}\left( {\frac{{\beta \left( {1 - 2t} \right)\left( {A - c\alpha } \right)}}{{4\alpha k\left( {1 - t\delta } \right) - \beta^{2} \left( {1 - 2t} \right)}}} \right)^{2} } \right)\), which implies if the working capital of retailer is lower than a certain threshold, there is an optimal feasible solution 1.

After \(w\) and \(L\) are determined, according to the retailer’s response function \(p = \frac{A + \alpha w + L\beta }{{2\alpha }}\), we can get the product price, and finally get the following result.

(2) \( \lambda_{1} > 0,\lambda_{2} = 0\).

In this case, one of the constraints is relaxation condition, the KKT conditions are as follow.

Verification of \(g_{2} \left( {w,L} \right) \le 0\), where \(g_{2} \left( {w,L} \right) = S_{R}^{0} - wq = S_{R}^{0} - \left( {\frac{A}{\alpha } + \frac{{S_{M0} + S_{R}^{0} + s}}{c\alpha } \cdot \left( {\frac{{\beta^{2} \left( {1 - 2t} \right)}}{{2k\left( {1 - t\delta } \right) \cdot \alpha }} - 1} \right)} \right) \cdot \frac{{S_{M0} + S_{R}^{0} + s}}{c}\).When the retailer’s working capital meet condition: \(S_{R}^{0} \le \left( {\frac{A}{\alpha } + \frac{{S_{M0} + S_{R}^{0} + s}}{c\alpha } \cdot \left( {\frac{{\beta^{2} \left( {1 - 2t} \right)}}{{2k\left( {1 - t\delta } \right)\cdot\alpha }} - 1} \right)} \right) \cdot \frac{{S_{M0} + S_{R}^{0} + s}}{c}\), \(g_{2} \left( {w,L} \right) \le 0\) holds and there is an optimal feasible solution 2.

The product price decision is the same as in scenario (1).

(3) \( \lambda_{1} = 0,\lambda_{2} > 0\).

In this case, one of the constraints is relaxation condition, the KKT conditions are as follow.

\(\lambda_{2}\) is the solution of (A1.20).

So the optimal solution is \(\left\{ {\begin{array}{*{20}l} {\lambda_{2}^{*} } \hfill \\ {w = \frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} } \hfill \\ {L = \frac{1}{\beta } \cdot \left( {\frac{{S_{R}^{0} }}{{\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} }} + \alpha \cdot \left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} } \right) - A} \right)} \hfill \\ \end{array} } \right.\).

Verification of \(g_{1} \left( {w,L} \right) \le 0\), where \(g_{1} \left( {w,L} \right) = cq - S_{M0} + S_{R}^{0} + s < wq - \frac{1}{2}\delta kL^{2} - S_{M0} + S_{R}^{0} + s < \frac{{\left( {A + \beta L} \right)^{2} - \left( {A + \beta L} \right) \cdot \sqrt {2\alpha sr} }}{\alpha } - \frac{1}{2}\delta kL^{2} - S_{M0} + S_{R}^{0} + s = \frac{A}{\alpha }\left( {A - \sqrt {2\alpha sr} } \right) + \frac{{\frac{{\left( {2A - \sqrt {2\alpha sr} } \right)}}{\alpha } \cdot S_{R}^{0} }}{{\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} }} + \frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} - A + \left( {1 - \frac{\alpha \delta k}{{2\beta^{2} }}} \right) \cdot \left[ {\frac{{S_{R}^{0} }}{{\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} }} + \alpha \cdot \left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} } \right) - A} \right]^{2} - S_{M0} + S_{R}^{0} + s\). When the manufacturer’s working capital meet condition \(\frac{A}{\alpha }\left( {A - \sqrt {2\alpha sr} } \right) + \frac{{\frac{{\left( {2A - \sqrt {2\alpha sr} } \right)}}{\alpha } \cdot S_{R}^{0} }}{{\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} }} + \frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} - A + \left( {1 - \frac{\alpha \delta k}{{2\beta^{2} }}} \right) \cdot \left[ {\frac{{S_{R}^{0} }}{{\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} }} + \alpha \cdot \left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }} + \sqrt {\left( {\frac{{c\left( {1 - 2t} \right)}}{{2\lambda_{2} }}} \right)^{2} - \frac{{S_{R}^{0} }}{\alpha }} } \right) - A} \right]^{2} + S_{R}^{0} + s < S_{M0}\), there is an optimal feasible solution 3.

The product price decision is the same as in scenario (1).

(4) \( \lambda_{1} > 0,\lambda_{2} > 0\), the KKT conditions are as follow.

When the parameters meet (A1.22), there is an optimal feasible solution 4, which is expressed in (A1.23).

The product price decision is the same as in scenario (1).

1.2 Appendix 2

\(\frac{{\partial p^{*} }}{\partial t} = \frac{{3k\left( {c\alpha - A} \right)\beta^{2} \left( {1 - \delta } \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\). Obviously, the sign of \(\frac{{\partial p^{*} }}{\partial t}\) is the same as the numerator. Because \(0 \le \delta \le 1\), there is \(\frac{{\partial p^{*} }}{\partial t} > 0\) if \(\alpha > \frac{A}{c}\), then \(p^{*}\) increases in \(t\); if \(\alpha < \frac{{\text{A}}}{c}\), we have \( \frac{{\partial p^{*} }}{\partial t} < 0\), then \(p^{*}\) decreases in \(t\).

1.3 Appendix 3

Similarly, because \(0 \le \delta \le 1\), there is \(\frac{{\partial p^{*} }}{\partial \delta } < 0\) if \(\alpha > \frac{A}{c}\), then \(p^{*}\) decreases in \(\delta\); if \(\alpha < \frac{A}{c}\), we have \(\frac{{\partial p^{*} }}{\partial \delta } > 0\), then \(p^{*}\) increases in \(\delta\).

1.4 Appendix 4

\(\frac{{\partial p^{*} }}{\partial \beta } = \frac{{6k\beta \left( {1 - t\delta } \right)\left( {1 - t} \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\left( {A - c\alpha } \right)\), the denominator must be greater than zero. According to the meaning of \(t\), \(\delta\), \(k\), \(\beta\), the sign is positive for \(1 - t\delta\), \(1 - t\), \(k\), \(\beta\). This implies the sign for \(\frac{{\partial p^{*} }}{\partial \beta }\) is dependent on \(A - c\alpha\). When \( A - c\alpha > 0\), that is \(\alpha < \frac{A}{c}\), we have \(\frac{{\partial p^{*} }}{\partial \beta } > 0\), then \(p^{*}\) increases in \(\beta\). When \(A - c\alpha < 0\), that is \(\alpha > \frac{A}{c}\), we can get \(\frac{{\partial p^{*} }}{\partial \beta } < 0\), then \(p^{*}\) decreases in \(\beta\).

1.5 Appendix 5

Obviously, the denominator of the two equations is positive. Because \(0 \le \delta \le 1\), \(0 \le t \le 1\), the sign of \(\frac{{\partial w^{*} }}{\partial t}\) is opposite to that of \(A - c\alpha\), while the sign of \(\frac{{\partial w^{*} }}{\partial \delta }\) is the same as that of \(A - c\alpha\). Thus, there are \(\frac{{\partial w^{*} }}{\partial t} > 0\) and \(\frac{{\partial w^{*} }}{\partial \delta } < 0\) if \(\alpha > \frac{A}{c}\); if \(\alpha < \frac{A}{c}\), we have \(\frac{{\partial w^{*} }}{\partial t} < 0\), \(\frac{{\partial w^{*} }}{\partial \delta } > 0\).

1.6 Appendix 6

Similarly, we have \(\frac{{4k\alpha t\beta \left( {1 - t} \right)}}{{\left( {4\alpha k\left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }} > 0\). When \(\alpha < \frac{A}{c}\), \(\frac{{\partial L^{*} }}{\partial \delta } < 0\), then \(L^{*}\) decreases in \(\delta\); when \(\alpha > \frac{A}{c}\), \(\frac{{\partial L^{*} }}{\partial \delta } > 0\), then \(L^{*}\) increases in \(\delta\).

1.7 Appendix 7

The optimization problem of supply chain participants under the financing model DC is

The demand function is \( q = A - \alpha p + \beta L\), where \(t_{M} = \left( {w_{\vartriangle } - c} \right)q - \frac{1}{2}\delta kL^{2}\), \(t_{R} = \left( {p - w_{\vartriangle } } \right)q - sr\).

We can reorganize and get the following results.

According to the idea of reverse solving, we first optimize the retailer’s problem. The first derivative and the second derivative of the retailer’s profit function with respect to the decision variables are as follows.

Obviously, the retailer’s profit function is a concave function of \(p\), and let the first derivative is equal to 0, we can get the reaction function, \(p = \frac{A + w\alpha + L\beta + \alpha \Delta }{{2\alpha }}\).

We put the expression of w into \( \mathop {\max }\limits_{{t_{M} > 0}} S_{M}\), then we have the following expression.

The first derivative functions of the manufacturer’s profit function with respect to the decision variables are as follows.

The Hessian matrix of the manufacturer’s profit function on the decision variables is

Because of \(\left| { - \left( {1 - t} \right)\alpha } \right| < 0\), so if \(\alpha > \frac{{\left( {1 - t} \right)\beta^{2} }}{{4k\left( {1 - t\delta } \right)}}\), the above matrix is a negative definite matrix, \(S_{M}\) is a joint concave function with respect to \(w\) and \( L\), both wholesale price \(w\) and carbon emission reduction level \(L\) has optimal solution.

The objective function is a joint concave function and it can be revised as follow, \(\min - S_{M} = - \left( {\frac{ - A + 2p\alpha - L\beta }{\alpha } - c} \right)\left( {A - p\alpha + \beta L} \right)\left( {1 - t} \right) + \frac{{kL^{2} }}{2}\left( {1 - \delta t} \right) - S_{M0}\). It is equivalent to that the objective function is a joint concave function, and the inequality constraint function \(g_{1} = cq - S_{M0} + S_{R}^{0} + s\) is a linear function, and \(g_{2} = S_{R}^{0} - w_{\Delta } q\) is a convex function. Therefore, the Kuhn Tucker condition is necessary and sufficient, and the local maximum is the global maximum.

Construct the Lagrangian function as follows.

The KKT conditions satisfied by the optimal solution are as follows.

(1) \( \lambda_{1} = \lambda_{2} = 0\). The above conditions can be further simplified.

The solution to satisfy the equation is \(L^{*} = \frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}\), \(w^{*} = \frac{{2\alpha k\left( {1 - \delta t} \right)\left( {A + \alpha \left( {c - 2\Delta } \right)} \right) - \beta^{2} \left( {1 - t} \right)\left( {c - \Delta } \right)}}{{(\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}\).

Verification of \(g_{1} \left( {w,L} \right) < 0\). \(g_{1} \left( {w_{\Delta } ,L} \right) = cq - S_{M0} + S_{R}^{0} + s \Leftrightarrow g_{1} \left( {w_{\Delta } ,L} \right) < \frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha w_{\Delta } } \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2} - S_{M0} + S_{R}^{0} + s\).

\(= \frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \frac{L\beta + \alpha c + A}{2}} \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2} - S_{M0} + S_{R}^{0} + s\), insert \(L^{*}\) into the left equation, we have \(g_{1} \left( {w_{\Delta } ,L} \right) < \frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha c} \right)}}{2\alpha } - 2sr - \frac{{\delta kL^{2} }}{2} - S_{M0} + S_{R}^{0} + s\). When \( \frac{{\left( {c\beta^{2} \left( {1 - t} \right) - A4k\left( {1 - \delta t} \right)} \right)\cdot\left( {\alpha c - A} \right)4\alpha k\left( {1 - \delta t} \right)}}{{2\left( {\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)} \right)^{2} }} < 2sr + S_{M0} - S_{R}^{0} - s + \frac{\delta k}{2} \cdot \left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2}\), \(g_{1} \left( {w_{\Delta } ,L} \right) < 0\) holds.

Verification of \(g_{2} \left( {w,L} \right) < 0\). \(g_{2} \left( {w,L} \right) = s + S_{R}^{0} - w_{\Delta } q < s + S_{R}^{0} - c\sqrt {2\alpha sr} - \frac{\delta k}{2} \cdot \left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2}\), so when \(s + S_{R}^{0} < c\sqrt {2\alpha sr} + \frac{\delta k}{2}\cdot\left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2}\), \(g_{2} \left( {w,L} \right) < 0\) holds.

When parameters meet both \(g_{1} \left( {w_{\Delta } ,L} \right) < 0\) and \(g_{2} \left( {w,L} \right) < 0\), that is \(s + S_{R}^{0} < {\text{min}}\left( {2sr + S_{M0} - \frac{{\left( {c\beta^{2} \left( {1 - t} \right) - A4k\left( {1 - \delta t} \right)} \right)\cdot\left( {\alpha c - A} \right)4\alpha k\left( {1 - \delta t} \right)}}{{2\left( {\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)} \right)^{2} }} + \frac{\delta k}{2}\cdot\left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2} ,c\sqrt {2\alpha sr} + \frac{\delta k}{2}\cdot\left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2} } \right)\), we have feasible solution 1.

After \(w\) and \(L\) are determined, according to the retailer’s response function, we can get the product price, and finally get the following result.

(2), the KKT conditions satisfied by the optimal solution are as follows.

The solution satisfying the above formula is as follows.

Verification of \(g_{2} \left( {w,L} \right) < 0\). \(g_{2} \left( {w,L} \right) = s + S_{R}^{0} - w_{\Delta } q < s + S_{R}^{0} - cq - \frac{{\delta kL^{2} }}{2} < s + S_{R}^{0} - c\sqrt {2\alpha sr} - \frac{\delta k}{2} \cdot \left( {\frac{{\beta \left( {1 - t} \right)\left( {\alpha c - A} \right)}}{{\beta^{2} \left( {1 - t} \right) - 4\alpha k\left( {1 - \delta t} \right)}}} \right)^{2}\). Because \(g_{1} \left( {w_{\Delta } ,L} \right) = cq - S_{M0} + S_{R}^{0} + s = 0 \Leftrightarrow cq = S_{M0} - S_{R}^{0} - s\), then, \(g_{2} \left( {w,L} \right) < s + S_{R}^{0} - \left( {S_{M0} - S_{R}^{0} - s} \right) - \frac{{\delta kL^{2} }}{2} = 2s + 2S_{R}^{0} - S_{M0} - \frac{\delta k}{2}\left( {\frac{{2S_{M0} - 2S_{R}^{0} - 2s - cA + \left( {\frac{{\left( {2S_{M0} - 2S_{R}^{0} - 2s - cA + \alpha c^{2} } \right) \cdot k\alpha \left( {1 - \delta t} \right) - \frac{{\beta^{2} }}{2}\left( {S_{M0} - S_{R}^{0} - s} \right) \cdot \left( {1 - t} \right)}}{{\alpha \left( {\beta^{2} \left( {\frac{{c\left( {1 - t} \right)}}{2} - 1} \right) - \alpha ck\left( {1 - \delta t} \right)} \right)}} + 1} \right)\alpha c^{2} }}{c\beta }} \right)^{2}\). If the whole references value makes bellowed inequation hold, \(2s + 2S_{R}^{0} < S_{M0} + \frac{\delta k}{2}\left( {\frac{{2S_{M0} - 2S_{R}^{0} - 2s - cA + \left( {\frac{{\left( {2S_{M0} - 2S_{R}^{0} - 2s - cA + \alpha c^{2} } \right) \cdot k\alpha \left( {1 - \delta t} \right) - \frac{{\beta^{2} }}{2}\left( {S_{M0} - S_{R}^{0} - s} \right) \cdot \left( {1 - t} \right)}}{{\alpha \left( {\beta^{2} \left( {\frac{{c\left( {1 - t} \right)}}{2} - 1} \right) - \alpha ck\left( {1 - \delta t} \right)} \right)}} + 1} \right)\alpha c^{2} }}{c\beta }} \right)^{2}\), we have solution 2 to be feasible.

The product price decision is the same as in scenario (1).

(3) \( \lambda_{1} = 0,\lambda_{2} > 0\), the KKT conditions satisfied by the optimal solution are as follows.

Verification of \(g_{1} \left( {w,L} \right) < 0\). \(g_{1} \left( {w_{\Delta } ,L} \right) = cq - S_{M0} + S_{R}^{0} + s < \frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha w_{\Delta } } \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2} - S_{M0} + S_{R}^{0} + s = \frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \frac{L\beta + \alpha c + A}{2}} \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2} - S_{M0} + S_{R}^{0} + s\), insert \(L^{*}\) into the left equation.

When parameters meet \(\frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha c} \right)}}{2\alpha } - \frac{{\delta kL^{2} }}{2} < 2sr + S_{M0} - S_{R}^{0} - s\), \(g_{1} \left( {w_{\Delta } ,L} \right) < 0\) and there exists feasible solution 3.

The product price decision is the same as in scenario (1).

(4) \( \lambda_{1} > 0,\lambda_{2} > 0\), the KKT conditions satisfied by the optimal solution are as follows.

When \(\lambda_{1}\) and \( \lambda_{2}\) are greater than 0, then there is a feasible solution 4.

The product price decision is the same as in scenario (1).

1.8 Appendix 8

\(\frac{{\partial p^{*} }}{\partial t} = \frac{{3\left( {c\alpha - A} \right)k\beta^{2} \left( {1 - \delta } \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\), the denominator must be greater than zero. If \(\frac{{\partial p^{*} }}{\partial t} = 0\), and \(\alpha\) is taken as unknown variable, we have \(\alpha = \frac{{\text{A}}}{c}\). With \(\alpha = \frac{A}{c}\) as the boundary, the sign for \(\frac{{\partial p^{*} }}{\partial t}\) is greater than zero when \(\alpha\) is on the right side of \(\frac{A}{c}\). Conversely, the sign for \(\frac{{\partial p^{*} }}{\partial t}\) is smaller than zero when \(\alpha\) is on the left side of \(\frac{A}{c}\). That is, when \(\alpha > \frac{A}{c}\), there is \(\frac{{\partial p^{*} }}{\partial t} > 0\), then \(p^{*}\) increases in \(t\), when \( \alpha < \frac{A}{c}\), we have \(\frac{{\partial p^{*} }}{\partial t} < 0\), then \(p^{*}\) decreases in \(t\).

1.9 Appendix 9

\(\frac{{\partial p^{*} }}{\partial \beta } = \frac{{6k\beta \left( {1 - t\delta } \right)\left( {1 - t} \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\left( {A - c\alpha } \right)\), the denominator must be greater than zero, if \(\frac{{\partial p^{*} }}{\partial \beta } = 0\), and \(\alpha\) is taken as unknown variable, we also have \(\alpha = \frac{{\text{A}}}{c}\). With \(\alpha = \frac{A}{c}\) as the boundary, the sign for \(\frac{{\partial p^{*} }}{\partial \beta }\) is greater than zero when \(\alpha\) is on the left side of \(\frac{A}{c}\). Conversely, the sign for \(\frac{{\partial p^{*} }}{\partial \beta }\) is smaller than zero when \(\alpha\) is on the right side of \(\frac{A}{c}\). That is, when \( \alpha < \frac{A}{c}\), \(\frac{{\partial p^{*} }}{\partial \beta } > 0\), then \(p^{*}\) increases in \(\beta\); when \(\alpha > \frac{A}{c}\), \(\frac{{\partial p^{*} }}{\partial \beta } < 0\), then \(p^{*}\) decreases in \( \beta\).

1.10 Appendix 10

\(\frac{{\partial w^{*} }}{\partial t} = - \frac{{2k\left( {A - c\alpha } \right)\beta^{2} \left( {1 - \delta } \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\). Taking \(\alpha\) is the unknown variable and solve the left equation we can get the result: when \(c = \frac{A}{\alpha }\), \(\frac{{\partial w^{*} }}{\partial t} = 0\). The result implies the possibility of piecewise monotonicity. With \(\alpha = \frac{A}{c}\) as the boundary, the sign for \(\frac{{\partial w^{*} }}{\partial t}\) is greater than zero when \(\alpha\) is on the right side of \(\frac{A}{c}\). Conversely, the sign for \(\frac{{\partial w^{*} }}{\partial t}\) is smaller than zero when \(\alpha\) is on the left side of \(\frac{A}{c}\). That is, when \(\alpha > \frac{A}{c}\), we have \(\frac{{\partial w^{*} }}{\partial t} > 0\), then \(w^{*}\) increases in \(t\); when \(\alpha < \frac{A}{c}\), there is \(\frac{{\partial w^{*} }}{\partial t} < 0\), then \(w^{*}\) decreases in \( t\).

\(\frac{{\partial w^{*} }}{\partial \delta } = \frac{{2k\left( {1 - t} \right)t\left( {A - c\alpha } \right)\beta^{2} }}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\), the denominator must be greater than zero. Take the \(\alpha\) as the uniquely unknown variable and when \(\frac{{\partial w^{*} }}{\partial \delta } = 0\). Then, we can also get the same result \(\alpha = \frac{A}{c}\) as the above equation. With \(\alpha = \frac{A}{c}\) as the boundary, the sign for \(\frac{{\partial w^{*} }}{\partial \delta }\) is greater than zero when \(\alpha\) is on the left side of \(\frac{A}{c}\). Conversely, the sign for \(\frac{{\partial w^{*} }}{\partial \delta }\) is smaller than zero when \(\alpha\) is on the right side of \(\frac{A}{c}\). That is, when \(\alpha > \frac{A}{c}\), we have \(\frac{{\partial w^{*} }}{\partial \delta } < 0\), then \(w^{*}\) decreases in \(\delta\); when \(\alpha < \frac{A}{c}\), we have \(\frac{{\partial w^{*} }}{\partial \delta } > 0\), then \(w^{*}\) increases in \(\delta\).

1.11 Appendix 11

\({ }\frac{{\partial L^{*} }}{\partial \delta } = \frac{{ - 4k\alpha t\left( {1 - t} \right)\left( {A - c\alpha } \right)\beta }}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\), the denominator must be greater than zero. Take the \(\alpha\) as the uniquely unknown variable and when \(\frac{{\partial L^{*} }}{\partial \delta } = 0\). Then, we can also get the same result \(\alpha = \frac{A}{c}\). With \(\alpha = \frac{A}{c}\) as the boundary, the sign for \(\frac{{\partial L^{*} }}{\partial \delta }\) is greater than zero when \(\alpha\) is on the right side of \(\frac{A}{c}\). Conversely, the sign for \(\frac{{\partial L^{*} }}{\partial \delta }\) is smaller than zero when \(\alpha\) is on the left side of \(\frac{A}{c}\). That is, when \(\alpha < \frac{A}{c}\), there is \(\frac{{\partial L^{*} }}{\partial \delta } < 0\), then \(L^{*}\) decreases in \(\delta\); when \(\alpha > \frac{A}{c}\), there is \( \frac{{\partial L^{*} }}{\partial \delta } > 0\), then \(L^{*}\) increases in \(\delta\).

1.12 Appendix 12

If \( pq - s\left( {1 + r} \right) \le w_{{\tilde{\Delta }}} \cdot q - s - S_{R}^{0}\), it means that the retailer’s sales income is not enough to continue to pay the balance of the manufacturer’s trade credit after the bank loan is repaid. The retailer loses in the current period and does not need to pay taxes. When considering only a single period, we do not discuss the loss situation in depth, so the optimal decision process later in this section is ongoing under the premise of \(pq - s\left( {1 + r} \right) \ge w_{{\tilde{\Delta }}} \cdot q - s - S_{R}^{0}\).

First focus on the optimization problem of the retailer, the retailer’s profit function can be further expressed as

The first derivative and the second derivative of the retailer’s profit function with respect to the decision variables are as follows.

Obviously, the retailer’s profit function is a concave function of \(p\), and let the first derivative is equal to 0, we can get the reaction function, \(p = \frac{{A + \alpha w + L\beta + \alpha \tilde{\Delta }}}{2\alpha }\).

We put the expression of w into \(\mathop {{\text{maxS}}_{M}^{A} }\limits_{{t_{M} > 0,cq > s_{M0}^{A} }}\), then we have the following expression.

The first derivative functions of the manufacturer’s profit function with respect to the decision variables are as follows.

The Hessian matrix of the manufacturer’s profit function on the decision variables is

Because of \(\left| { - \left( {1 - t} \right)\alpha } \right| < 0\), so if \(\alpha > \frac{{\left( { - 1 + t} \right)\left( {7\beta^{2} - 12\beta \tilde{\Delta } + 4\tilde{\Delta }^{2} } \right)}}{{4k\left( { - 1 + t\delta } \right)}}\), the above matrix is a negative definite matrix, \(S_{M}\) is a joint concave function with respect to \(w\) and \( L\), both wholesale price \(w\) and carbon emission reduction level \(L\) has optimal solution.

The manufacturer’s maximum problem is equivalent to the following minimum problem. \(\min - S_{M}^{A} = - \left( {\left( {w_{{\tilde{\Delta }}} - c} \right)q - \left( {cq - S_{M0}^{A} - s - S_{R}^{0} } \right)r_{s} - \left( {\left( {w_{{\tilde{\Delta }}} q - cq\left( {1 + r_{s} } \right) - \left( {S_{M0}^{A} + s + S_{R}^{0} } \right)r_{s} - \frac{{kL^{2} \delta }}{2}} \right)} \right)t - \frac{{kL^{2} }}{2}} \right)\). It is equivalent to that the objective function is a joint concave function, and the inequality constraint function \(g_{1} = cq - S_{M0}^{A} + S_{R}^{0} + s\) is a linear function.

Construct the Lagrangian function as follows.

KKT conditions satisfied by the optimal solution:

(1) \( \lambda_{1} = \lambda_{2} = 0\), in this case, both of the two constraints are relaxation conditions. The above conditions can be further simplified.

The solution satisfying the above formula is as follows.

Because \(t_{M} = \left( {w_{{\tilde{\Delta }}} - c} \right) \cdot q - \left( {cq - S_{M0}^{A} - s - S_{R}^{0} } \right)r_{s} - \frac{{kL^{2} \delta }}{2} > 0\), \(t_{R} = \left( {p - w_{{\tilde{\Delta }}} } \right)q - sr > 0\). From the above result, we have \(q = A + \beta L - \alpha w\) and \(\left\{ {\begin{array}{*{20}l} {\left( {A + \beta L} \right)q > 2\alpha sr + \alpha \left( {w + \tilde{\Delta }} \right)q > 2\alpha sr + \alpha \left( {w + \tilde{\Delta } - c} \right)q} \hfill \\ {\left( {w_{{\tilde{\Delta }}} - c} \right) \cdot q - \left( {S_{M0}^{A} + S_{R}^{0} + s - cq} \right)r_{s} - \frac{{kL^{2} \delta }}{2} > 0} \hfill \\ \end{array} } \right.\), \(g_{1} \left( {w_{{\tilde{\Delta }}} ,L} \right) = S_{M0}^{A} + S_{R}^{0} + s - cq < \left( {\frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha \left( {w + \tilde{\Delta }} \right)} \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2}} \right) \cdot \frac{1}{{r_{s} }}\) When \(\frac{{\left( {A + \beta L^{*} } \right)\left( {A + \beta L^{*} - \alpha \left( {w^{*} + \tilde{\Delta }} \right)} \right)}}{\alpha } < 2sr + \frac{{\delta kL^{*2} }}{2}\) holds, we have \(g_{1} \left( {w_{{\tilde{\Delta }}} ,L} \right) < 0\).

\(g_{2} \left( {w,L} \right) = s + S_{R}^{0} - w_{{\tilde{\Delta }}} q\), When \(s + S_{R}^{0} < \left( {w^{*} + \tilde{\Delta }} \right)\left( {A + \beta L^{*} - \alpha \left( {w^{*} + \tilde{\Delta }} \right)} \right)\) holds, we have \(g_{2} \left( {w_{{\tilde{\Delta }}} ,L} \right) < 0\).

When the above two conditions are jointly satisfied, we have feasible solutions 1.

After \(w\) and \(L\) are determined, according to the retailer’s response function \(p = \frac{A + \alpha w + L\beta }{{2\alpha }}\), we can get the product price, and finally get the following result.

The product price decision is the same as in scenario (1).

(2) \( \lambda_{1} > 0,\lambda_{2} = 0\).

\(g_{2} \left( {w,L} \right) = s + S_{R}^{0} - w_{{\tilde{\Delta }}} q\), When \(s + S_{R}^{0} < \left( {w^{*} + \tilde{\Delta }} \right)\left( {A + \beta L^{*} - \alpha \left( {w^{*} + \tilde{\Delta }} \right)} \right)\) holds, we have \(g_{2} \left( {w_{{\tilde{\Delta }}} ,L} \right) < 0\).

\(g_{2} \left( {w,L} \right) < 0\tilde{\Delta }s + S_{R}^{0} < \frac{1}{\alpha }\left( {A + \beta L} \right)q - 2sr_{s}\). When \(s + S_{R}^{0} < \frac{1}{\alpha }\left( {A + \beta L^{*} } \right)\left( {A + \beta L^{*} - \alpha \left( {w^{*} + \tilde{\Delta }} \right)} \right) - 2sr_{s}\) holds, we have \(g_{2} \left( {w_{{\tilde{\Delta }}} ,L} \right) < 0\). we have feasible solutions 2.

The product price decision is the same as in scenario (1).

(3) \({ }\lambda_{1} = 0,\lambda_{2} > 0\).

\(g_{1} \left( {w_{{\tilde{\Delta }}} ,L} \right) = S_{M0}^{A} + S_{R}^{0} + s - cq < \left( {\frac{{\left( {A + \beta L} \right)\left( {A + \beta L - \alpha \left( {w + \tilde{\Delta }} \right)} \right)}}{\alpha } - 2sr - \frac{{\delta kL^{2} }}{2}} \right) \cdot \frac{1}{{r_{s} }}\). When \(\frac{{\left( {A + \beta L^{*} } \right)\left( {A + \beta L^{*} - \alpha \left( {w^{*} + \tilde{\Delta }} \right)} \right)}}{\alpha } < 2sr + \frac{{\delta kL^{*2} }}{2}\) holds, we have \(g_{1} \left( {w_{{\tilde{\Delta }}} ,L} \right) < 0\), and it has the feasible solution 2. The results have been put on record for checking, but they are not included in the appendix for too long.

(4) \({ }\lambda_{1} > 0,\lambda_{2} > 0\).

When both \(\lambda_{1}\) and \( \lambda_{2}\) are bigger than zero, we have feasible solution 4.

The product price decision is the same as in scenario (1).

1.13 Appendix 13

\(\frac{{\partial p^{*} }}{\partial \beta } = \frac{{6k\left( {1 - t} \right)\beta \left( {1 - t\delta } \right)\left( {A - c\alpha \left( {1 + r_{s} } \right)} \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\). Take the \(\alpha\) as the uniquely unknown variable and when \(\frac{{\partial p^{*} }}{\partial \beta } = 0\). Then, we get the result \(\alpha = \frac{A}{{c\left( {1 + r_{s} } \right)}}\) as the above equation. With \(\alpha = \frac{A}{{c\left( {1 + r_{s} } \right)}}\) as the boundary, the sign for \(\frac{{\partial p^{*} }}{\partial \beta }\) is greater than zero when \(\alpha\) is on the left side of \(\frac{A}{{c\left( {1 + r_{s} } \right)}}\). Conversely, the sign for \(\frac{{\partial p^{*} }}{\partial \beta }\) is smaller than zero when \(\alpha\) is on the right side of \(\frac{A}{{c\left( {1 + r_{s} } \right)}}\). That is, when \(\alpha < \frac{A}{{c\left( {1 + r_{s} } \right)}}\), \(\frac{{\partial p^{*} }}{\partial \beta } > 0\) holds, then \(p^{*}\) increases in \(\beta\); when \(\alpha > \frac{A}{{c\left( {1 + r_{s} } \right)}}\), \( \frac{{\partial p^{*} }}{\partial \beta } < 0\) holds, then \(p^{*}\) decreases in \(\beta\).

1.14 Appendix 14

\(\frac{{\partial w^{*} }}{\partial t} = \frac{{2k\beta^{2} \left( {1 - \delta } \right)\left( {c\alpha \left( {1 + r_{s} } \right) - A} \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\), taking the \(r_{s}\) as the uniquely unknown variable and when \(\frac{{\partial w^{*} }}{\partial t} = 0\). Then, we get the result \(r_{s} = \frac{A}{c\alpha } - 1\) as the above equation. With \(r_{s} = \frac{A}{c\alpha } - 1\) as the boundary, the sign for \(\frac{{\partial w^{*} }}{\partial t}\) is greater than zero when \(r_{s}\) is on the right side of \(\frac{A}{c\alpha } - 1\). Conversely, the sign for \(\frac{{\partial w^{*} }}{\partial t}\) is smaller than zero when \(r_{s}\) is on the left side of \(\frac{A}{c\alpha } - 1\). That is, when \(r_{s} > \frac{A}{c\alpha } - 1\), we can get \( \frac{{\partial w^{*} }}{\partial t} > 0\), then \(w^{*}\) increases in \(t\); when \(r_{s} < \frac{A}{c\alpha } - 1\), we have \( \frac{{\partial w^{*} }}{\partial t} < 0\), then \(w^{*}\) decreases in \(t\).

\(\frac{{\partial w^{*} }}{\partial \delta } = \frac{{2kt\beta^{2} \left( {1 - t} \right)\left( {A - c\alpha \left( {1 + r_{s} } \right)} \right)}}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\), taking the \(r_{s}\) as the uniquely unknown variable and when \(\frac{{\partial w^{*} }}{\partial \delta } = 0\). Then, we get the result \(r_{s} = \frac{A}{c\alpha } - 1\) as the above equation. With \(r_{s} = \frac{A}{c\alpha } - 1\) as the boundary, the sign for \(\frac{{\partial w^{*} }}{\partial \delta }\) is greater than zero when \(r_{s}\) is on the left side of \(\frac{A}{c\alpha } - 1\). Conversely, the sign for \(\frac{{\partial w^{*} }}{\partial \delta }\) is smaller than zero when \(r_{s}\) is on the right side of \(\frac{A}{c\alpha } - 1\). That is, when \(r_{s} > \frac{A}{c\alpha } - 1\), we can get \(\frac{{\partial w^{*} }}{\partial \delta } < 0\), then \(w^{*}\) decreases in \(\delta\); when \(r_{s} < \frac{A}{c\alpha } - 1\), there is \(\frac{{\partial w^{*} }}{\partial \delta } > 0\), then \(w^{*}\) increases in \(\delta\).

1.15 Appendix 15

\(\frac{{\partial L^{*} }}{\partial \delta } = \frac{{4kt\left( {1 - t} \right)(A - c\alpha \left( {1 + r_{s} } \right)\alpha \beta }}{{\left( {4k\alpha \left( {1 - t\delta } \right) - \left( {1 - t} \right)\beta^{2} } \right)^{2} }}\). Taking the \(c\) as the uniquely unknown variable and when \(\frac{{\partial L^{*} }}{\partial \delta } = 0\), we can also get the same result \(c = \frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\) as the above equation. With \(c = \frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\) as the boundary, the sign for \(\frac{{\partial L^{*} }}{\partial \delta }\) is greater than zero when \(c\) is on the left side of \(\frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\). Conversely, the sign for \(\frac{{\partial L^{*} }}{\partial \delta }\) is smaller than zero when \(c\) is on the right side of \(\frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\). That is, when \(c > \frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\), then \(L^{*}\) decreases in \(\delta\); when \(c < \frac{A}{{\alpha \left( {1 + r_{s} } \right)}}\), then \(L^{*}\) increases in \(\delta\).

Rights and permissions

About this article

Cite this article

Dong, G., Liang, L., Wei, L. et al. Optimization model of trade credit and asset-based securitization financing in carbon emission reduction supply chain. Ann Oper Res 331, 35–84 (2023). https://doi.org/10.1007/s10479-021-04011-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04011-5