Abstract

We consider an optimal trading problem for an investor who trades Bitcoin spot and Bitcoin inverse futures, plus a risk-free asset. The investor seeks an optimal strategy to maximize her expected utility of terminal wealth. We obtain explicit solutions to the investor’s optimal strategies under both exponential and power utility functions. Empirical studies confirm that optimal strategies perform well in terms of Sharpe ratio and Sortino ratio and beat the long-only strategy in Bitcoin spot.

Similar content being viewed by others

Notes

Table 3 records daily trading volumes equivalent to nearly 7 billion US dollars on a given day (August 10, 2019).

To the best of our knowledge, Bragin (2015), a co-founder of ICBIT, first proposed Bitcoin inverse futures, and the Russian ICBIT trading platform was the very first Bitcoin exchange to offer Bitcoin futures contracts, later acquired by Swedish-based Bitcoin exchange Safello. See a news report on https://bravenewcoin.com/insights/safello-acquires-icbit-and-appoints-founder-as-new-cto.

See CME Bitcoin futures trading volume information on https://www.cmegroup.com/trading/equity-index/us-index/bitcoin.html.

See reports on https://www.bakkt.com/index.

Two exceptions to our awareness are Deng et al. (2020), which studies an optimal hedging problem with Bitcoin inverse functions under the mean-variance criterion, and Alexander et al. (2020), which studies the hedging effectiveness of an ordinary least squares (OLS) based strategy, among other subjects.

For perpetual contract details offered at BitMEX, please see https://www.bitmex.com/app/perpetualContractsGuide. Alexander et al. (2020) call those contracts perpetual swaps.

The Sortino ratio is a modification of the Sharpe ratio but penalizes only those returns falling below a user-specified target, while the Sharpe ratio penalizes both upside and downside volatility equally (see Sortino and Price 1994).

We thank the anonymous referee for deriving this PDE in the report.

References

Alexander, C., Choi, J., Park, H., & Sohn, S. (2020). Bitmex bitcoin derivatives: Price discovery, informational efficiency, and hedging effectiveness. Journal of Futures Markets, 40(1), 23–43.

Angoshtari, B., & Leung, T. (2019). Optimal dynamic basis trading. Annals of Finance, 15(3), 307–335.

Baur, D. G., & Dimpfl, T. (2019). Price discovery in bitcoin spot or futures? Journal of Futures Markets, 39(7), 803–817.

Bragin, A. (2015). Inverse futures in bitcoin economy. Available at SSRN https://ssrn.com/abstract=2713755.

Carr, P., Jin, X., & Madan, D. B. (2001). Optimal investment in derivative securities. Finance and Stochastics, 5(1), 33–59.

Corbet, S., Lucey, B., Peat, M., & Vigne, S. (2018). Bitcoin futures—what use are they? Economics Letters, 172, 23–27.

Cox, J. C., & Huang, C.-F. (1989). Optimal consumption and portfolio policies when asset prices follow a diffusion process. Journal of Economic Theory, 49(1), 33–83.

Dai, M., Zhong, Y., & Kwok, Y. K. (2011). Optimal arbitrage strategies on stock index futures under position limits. Journal of Futures Markets, 31(4), 394–406.

Deng, J., Pan, H., Zhang, S., & Zou, B. (2020). Minimum-variance hedging of bitcoin inverse futures. Applied Economics, 52(58), 6320–6337.

Duffie, D., & Jackson, M. O. (1990). Optimal hedging and equilibrium in a dynamic futures market. Journal of Economic Dynamics and Control, 14(1), 21–33.

Duffie, D., & Richardson, H. R. (1991). Mean-variance hedging in continuous time. Annals of Applied Probability, 1(1), 1–15.

Escobar, M., Ferrando, S., & Rubtsov, A. (2015). Robust portfolio choice with derivative trading under stochastic volatility. Journal of Banking & Finance, 61, 142–157.

Fleming, W. H., & Soner, H. M. (2006). Controlled Markov Processes and Viscosity Solutions (Vol. 25). Springer.

Giudici, P., & Polinesi, G. (2019). Crypto price discovery through correlation networks. Annals of Operations Research, Special Issue: Recent Developments in Financial Modeling and Risk Management:1–15.

Hale, G., Krishnamurthy, A., Kudlyak, M., & Shultz, P. (2018). How futures trading changed bitcoin prices. FRBSF Economic Letter, 12.

Hudson, R., & Urquhart, A. (2019). Technical trading and cryptocurrencies. Annals of Operations Research, Special Issue on Networks and Risk Management:1–30.

Kapar, B., & Olmo, J. (2019). An analysis of price discovery between bitcoin futures and spot markets. Economics Letters, 174, 62–64.

Karatzas, I., & Shreve, S. E. (1998). Methods of mathematical finance (Vol. 39). Springer.

Köchling, G., Müller, J., & Posch, P. N. (2019). Does the introduction of futures improve the efficiency of bitcoin? Finance Research Letters, 30, 367–370.

Leung, T., Li, J., Li, X., & Wang, Z. (2016). Speculative futures trading under mean reversion. Asia-Pacific Financial Markets, 23(4), 281–304.

Liu, J., & Pan, J. (2003). Dynamic derivative strategies. Journal of Financial Economics, 69(3), 401–430.

Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. Review of Economics and Statistics, 51(3), 247–257.

Merton, R. C. (1971). Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory, 3(4), 373–413.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available on https://git.dhimmel.com/bitcoin-whitepaper/.

Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: A comprehensive introduction. Princeton University Press.

Sebastião, H., & Godinho, P. (2019). Bitcoin futures: An effective tool for hedging cryptocurrencies. Finance Research Letters, 33, 101230.

Sortino, F. A., & Price, L. N. (1994). Performance measurement in a downside risk framework. Journal of Investing, 3(3), 59–64.

Sotomayor, L. R., & Cadenillas, A. (2009). Explicit solutions of consumption-investment problems in financial markets with regime switching. Mathematical Finance, 19(2), 251–279.

Yan, W., & Li, S. (2008). A class of portfolio selection with a four-factor futures price model. Annals of Operations Research, 164(1), 139.

Yermack, D. (2015). Is bitcoin a real currency? An economic appraisal. In Handbook of digital currency (pp. 31–43). Elsevier.

Yong, J., & Zhou, X. Y. (1999). Stochastic controls: Hamiltonian systems and HJB equations (Vol. 43). Springer.

Zou, B., & Cadenillas, A. (2014). Optimal investment and risk control policies for an insurer: Expected utility maximization. Insurance: Mathematics and Economics, 58, 57–67.

Acknowledgements

We would like to thank an anonymous referee for his/her insightful comments and discussions, which have led to major simplifications in main theorems and proofs, and helped us better present the paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The research of Jun Deng is supported by the National Natural Science Foundation of China (11501105) and the Fundamental Research Funds for the Central Universities in UIBE (19YB10). The research of Huifeng Pan is supported by the Fundamental Research Funds for the Central Universities in UIBE (19YB27) and Smart Finance Lab of Research Institute for ShenZhen in UIBE. The research of Bin Zou is supported by a start-up grant from the University of Connecticut.

Appendices

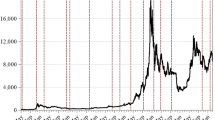

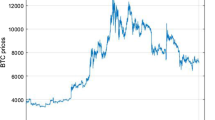

Appendix A: information on Bitcoin and Bitcoin futures

Appendix B: Technical derivations of methodology

1.1 Appendix B.1: Technical derivations in the HJB method

By a measurable selection argument, we show that the value function V to Problem (3.1) satisfies the dynamic programming principle (DPP), also called the Bellman’s principle, which reads as

where \(X^*\) is the optimal wealth process and \(\tau \) is any stopping time over [t, T]. By letting \(\tau \rightarrow t\) and noting \(V \in \mathrm {C}^{1,2}\), we obtain the HJB equation in (3.2).

Proof

(Proof of Theorem 1) Let us take an arbitrary admissible control \(u \in {\mathcal {A}}(t,x)\). By applying Itô’s formula to \(v(t, X_t^u)\) (noting \(v \in \mathrm {C}^{1,2}\)) and taking conditional expectation, we obtain

Using the HJB Eq. (3.2) and the boundary condition, we get

If \(u^*\) solves the optimization problem in (3.3) and \(u^* \in {\mathcal {A}}(t,x)\), then the above inequality becomes an equality for \(u^*\). The proof is now complete. \(\square \)

Suppose there exists a classical solution V to Problem (3.1), and V is concave w.r.t. the argument x. By Theorem 1, we solve the optimization problem in (3.3) and obtain (the candidate of) an optimal strategy \(u^*=(\theta ^*, \delta ^*)\) by

where constants \(\nu _i\), \(i=1,2,3\), are given in (2.4) and \({\mathcal {C}}_i\), \(i=1,2\), are defined by (4.3).

Both \({\mathcal {C}}_1\) and \({\mathcal {C}}_2\) are well defined due to the assumption (2.3), i.e., \(\nu _1 \nu _2 - \nu _3^2 \ne 0\). By plugging \(u^*=(\theta ^*, \delta ^*)\) in (B.1) and (B.2) into the HJB Eq. (3.2), we obtain

where \(|| \cdot || \) denotes the standard Euclidean norm. We cannot derive a closed form solution to (B.3) for a general utility function U. When U is given by an exponential or a power utility function, we are able to solve (B.3) explicitly.

1.2 Appendix B.2: Technical derivations in the martingale method

Suppose there exists an admissible control \(u^*\) satisfying the condition (3.4) in Lemma 1. Since \(u^* \in {\mathcal {A}}(x)\), we have \({\mathbb {E}}\left[ |X_T^*|^2\right] < \infty \) and thus \(0<{\mathbb {E}}\left[ U'(X_T^{*}) \right] <\infty \). Now we define a new probability measure \({\mathbb {Q}}\) by

and the Radon–Nikodym derivative process \(H=(H_t)_{0 \le t \le T}\) by \(H_t := {\mathbb {E}}_t[H_T]\). By definition, H is a \({\mathbb {P}}\)-martingale, and by the martingale representation theorem, has the representation form of \(\mathrm {d}H_t = - H_t \, \lambda _t^\top \, \mathrm {d}W_t\), or equivalently,

where \(H_0=1\) and \(\lambda =(\lambda _1,\lambda _2,\ldots , \lambda _n)^\top \) is an n-dimensional stochastic process in space \({\mathbb {L}}^2[0,T]\), often called the market price of risk. Using the Girsanov theorem, we assert that \(W^{\mathbb {Q}}\), defined by

is an n-dimensional Brownian motion under the new measure \({\mathbb {Q}}\). By the above change of measure and (2.10), we rewrite the optimality condition (3.4) as

for all \(u \in {\mathcal {A}}(x)\), where \({\mathbb {E}}^{\mathbb {Q}}\) denotes taking expectation under \({\mathbb {Q}}\).

We consider two special admissible strategies \(u_1 = (\theta _1, \delta _1)\) and \(u_2=(\theta _2, \delta _2)\), which are given by

where \(\tau \in [0, T]\) is an arbitrary stopping time and \({\mathbb {I}}\) is an indicator function. It is clear that both \(u_1\) and \(u_2\) are admissible strategies. By (B.6) and the arbitrariness of stopping time \(\tau \), we obtain

are both \({\mathbb {Q}}\)-martingales. In consequence, this result leads to

If the market is complete (\(n=2\)), there exists a unique solution to (B.7); otherwise, we have infinitely many choices for \(\lambda \) (see Karatzas and Shreve 1998).

Given the dynamics of X in (2.10), we apply Itô’s formula to \(U'(X_T^*)\) and get

By matching the drift term in the above equation with the one in (B.4), we obtain an equality that allows us to express \(\lambda \) using \(\theta ^*\) and \(\delta ^*\). We solve the two equations in (B.7) and obtain the optimal strategy \((\theta ^*, \delta ^*)\).

Appendix C: Technical proofs

Proof

(Proof of Theorem 2 using the HJB method) With U being an exponential utility, we make an educated guess of an ansatz in the form of

where f is positive for all t and satisfies \(f(T) = 1\). Let us denote

Plugging the above ansatz into the HJB (B.3), we obtain

which leads to the unique solution given by

The value function to Problem (3.1) is then obtained by

where \(\epsilon \) is defined in (C.1).

Next, we substitute the value function into (B.1) and (B.2), and obtain the (candidate) optimal strategy \(u^*= (\theta ^*, \delta ^*)\) by

where \({\mathcal {C}}_1\) and \({\mathcal {C}}_2\) are defined in (4.3). Using the relation (2.8), we find the optimal number of inverse futures contracts by

Under \(u^*= (\theta ^*, \delta ^*)\), we solve the SDE (2.10) and obtain the optimal wealth process \(X^*\) by

where \(\epsilon \) is defined in (C.1) and the second equality is derived by using (2.4) and (4.3). The strategy \(u^*= (\theta ^*, \delta ^*)\) found above is admissible, and hence is optimal to Problem (2.11) by Theorem 1. The proof is now complete. \(\square \)

Proof

(Proof of Theorem 2using the martingale method) Suppose there exists an admissible strategy \(u^*=(\theta ^*, \delta ^*)\) that satisfies the optimality condition (3.4), and denote the corresponding wealth process by \(X^*\). Recall \(U'(x) = e^{-\gamma x}\). By applying Itô’s formula to \(U'(X^*)\), we derive

By matching the diffusion term in (B.4) and (C.4), we obtain

We next plug the above \(\lambda _t\) into (B.7), and derive the system of equations for \(\theta ^*\) and \(\delta ^*\) as follows (noting the definitions of \(\nu _i\)’s in (2.4))

Due to (2.3), the above system bears a unique solution \((\theta ^*, \delta ^*)\), which is given by (4.2).

The proof is then complete once we verify (1) \(u^*\) is admissible (which is already done in the previous proof), (2) the two means of computing \(H_T\), (B.4) and (C.4), are consistent, and (3) the optimality condition (3.4) holds.

To verify the second claim, we solve from (C.4) and get

We then recall (B.4) and obtain

which confirms \(H_T\) (the new measure \({\mathbb {Q}}\)) is well defined.

To show the third assertion, we notice that the optimality condition (3.4) is the same as \({\mathbb {E}}^{\mathbb {Q}}\left[ X_T^u \right] \) is a constant for all \(u \in {\mathcal {A}}(x)\). Given any admissible strategy u, we obtain from (2.10), (B.5) and (B.7) that

which shows \({\mathbb {E}}^{\mathbb {Q}}\left[ X_T^u \right] = x\). The proof is now complete. \(\square \)

Proof

(Proof of Theorem 3using the HJB and the martingale methods)

-

(1)

The HJB Method.

Under the HJB method, we try the following ansatz

$$\begin{aligned} V(t,x) = \frac{1}{\alpha } x^\alpha \cdot g(t), \end{aligned}$$where g is positive for all t and satisfies \(g(T) = 1\).

Plugging the above ansatz into the HJB (B.3) leads to

$$\begin{aligned} g'(t) + \frac{\alpha \, \epsilon }{1 - \alpha } \, g(t) = 0, \quad g(T)=1, \end{aligned}$$where \(\epsilon \) is defined in (C.1). The unique solution is then given by

$$\begin{aligned} g(t) = e^{\frac{\alpha \, \epsilon }{1 - \alpha } (T-t)}, \end{aligned}$$and the value function to Problem (3.1) is obtained by

$$\begin{aligned} V(t, x) =\frac{1}{\alpha } \, e^{\frac{\alpha \, \epsilon }{1 - \alpha } (T-t)} \, x^\alpha . \end{aligned}$$By plugging the above V into (B.1) and (B.2), we obtain the optimal strategy \(u^*=(\theta ^*, \delta ^*)\) in (4.6). The SDE (2.10) under \(u^*\) becomes

$$\begin{aligned} \mathrm {d}X_t^* = X_t^* \, \frac{{\mathcal {C}}_1 \mu _1 + {\mathcal {C}}_2 (\mu _2 - \nu _2)}{1 - \alpha } \, \mathrm {d}t + X_t^* \, \frac{{\mathcal {C}}_1 \sigma _1^\top + {\mathcal {C}}_2 \sigma _2^\top }{1 - \alpha } \, \mathrm {d}W_t, \quad X_0^* = x, \end{aligned}$$which clearly admits a unique positive solution. In addition, we have \(X^* \in {\mathbb {L}}^2[0,T]\), and hence \(\theta ^*, \delta ^* \in {\mathbb {L}}^2[0,T]\), proving the admissibility of \(u^*=(\theta ^*, \delta ^*)\).

-

(2)

The Martingale Method.

Under the martingale method, we have

$$\begin{aligned} \mathrm {d}U'(X_t^*) = - (1-\alpha ) U'(X_t^*) \left( \frac{\theta _t^*}{X_t^*} \sigma _1^\top + \frac{\delta _t^*}{X_t^*} \sigma _2^\top \right) \, \mathrm {d}W_t + \text {(drift term)} \, \mathrm {d}t, \end{aligned}$$and, as a result,

$$\begin{aligned} \lambda _t = (1-\alpha ) \left( \frac{\theta _t^*}{X_t^*} \sigma _1 + \frac{\delta _t^*}{X_t^*} \sigma _2 \right) , \quad \forall \, t \in [0,T]. \end{aligned}$$Using (B.7), we obtain the linear system of \((\theta ^*, \delta ^*)\) by

$$\begin{aligned} {\left\{ \begin{array}{ll} \nu _1 \cdot \theta _t^* + \nu _3 \cdot \delta _t^* = \dfrac{\mu _1}{1 - \alpha } \, X_t^* \\ \nu _3 \cdot \theta _t^* + \nu _2 \cdot \delta _t^* = \dfrac{\mu _2 - \nu _2}{1 - \alpha } \, X_t^* \end{array}\right. } \end{aligned}$$which leads to (4.6). The verification processes are the same as in the exponential utility case, and are omitted. The proof is now complete. \(\square \)

Appendix D: Discussions on \(V=V(t,x)\)

In Problem (3.1), we directly assign a function V(t, x) of arguments time t and state x to the supremum problem, and call it the value function of the problem. However, if we directly investigate Problem (2.11) under the original setup and strategies \(u = (\theta , N)\), one may question the claim \(V = V(t,x)\). After all, the state process X in this case is given by (2.7), in which the ratio process \(Z = S / F\) appears explicitly. Should the value function V be in the form of V(t, x, z)? Such a question is also raised by the anonymous referee.

We have provided explanations and references to why \(V=V(t,x)\) in Remark 2, which is convincing after we introduce the fictitious asset \({\bar{F}}\) to replace Bitcoin inverse futures, and the new control variable \(\delta \) in (2.8) to replace the number of inverse contracts N. Here we show that \(V=V(t,x)\) holds as claimed using two different methods. We only focus on the exponential utility case, and note that the power utility case follows as well.

-

(1)

In the first method, we directly compute \({\mathbb {E}}_{t,x}\left[ X_T^*\right] \) and show that it is a function of t and x. Notice that we do not make any assumption on the value function when we obtain the optimal strategy \(u^*\) in (4.2) by the martingale method. Under strategy \(u^*\), the optimal wealth process \(X^*\) is given by (C.3) (the martingale method would lead to the exactly same equation for \(X^*\)). Using this result, we obtain

$$\begin{aligned} {\mathbb {E}}_{t,x}\left[ X_T^*\right]&= {\mathbb {E}}_{t,x}\left[ -\frac{1}{\gamma } \exp \left( - \gamma x - 2 \epsilon (T-t) - ({\mathcal {C}}_1 \sigma _1^\top + {\mathcal {C}}_2 \sigma _2^\top ) (W_T- W_t)\right) \right] \\&= -\frac{1}{\gamma } \exp \left( - \gamma x - \epsilon (T-t) \right) , \end{aligned}$$where we have used \(\frac{1}{2} || {\mathcal {C}}_1 \sigma _1 + {\mathcal {C}}_2 \sigma _2 ||^2 = \epsilon \) to derive the second equality. The above result coincides with the value function found in (C.2) using the HJB method.

-

(2)

In the second method, we revisit Problem (3.1) under the original choice of strategy \(u = (\theta , N)\), where \(\theta \) is the amount invested in Bitcoin and N is the number of the inverse futures contracts. Recall the dynamics of X under \(u = (\theta , N)\) is given by (2.7). In such a setup, we make the following modifications to the admissibility condition in Definition 1: \(\theta \in L^2[t,T]\) and \(Z N \in L^2[t,T]\), where \(Z=S/F\) is defined in (2.6).

For any \(u \in {\mathcal {A}}(t,x)\) and \(\varphi \in \mathrm {C}^{1,2,2}\), define the following operators

The HJB equation to Problem (3.1) then reads as

along with the boundary condition

Solving the supremum problem in (D.1) gives

where \({\mathcal {C}}_1\) and \({\mathcal {C}}_2\) are defined in (4.3). By plugging the above \(u^*=(\theta ^*, N^*)\) back into (D.1), we obtain after simplifications that

where, to ease notations, we define \(\epsilon _i\), \(i=1,2,3,4\), by

Note that the simplified HJB (D.2) holds for a general utility U.

In the next step, given the exponential utility in (4.1), we guess the ansatz in the form of (with slight abuse of notation we still use f here)

Using (D.2), we derive the non-linear PDE of f byFootnote 8

Since f is required to be a positive function, we consider the following transformation

for some \(h \in \mathrm {C}^{1,2}\) with \(h(T,z)=0\). We then derive the PDE of h from (D.3) by

By Feynman–Kac formula, we obtain \(h(t,z)=0\). Since \(\epsilon _1 >0\), the PDE (D.4) is uniformly parabolic and the standard PDE theory then implies \(h(t,z)=0\) is the unique solution to (D.3). As a result, we obtain

which is independent of z and leads to the same value function V(t, x) in (C.2).

Rights and permissions

About this article

Cite this article

Deng, J., Pan, H., Zhang, S. et al. Optimal Bitcoin trading with inverse futures. Ann Oper Res 304, 139–163 (2021). https://doi.org/10.1007/s10479-021-04125-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04125-w