Abstract

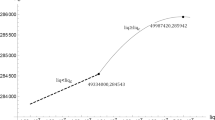

With the rapid growth of the global digital economy, supply chain finance has entered the stage of platform development in view of the history, policy environment, market status and other factors. Supply chain finance relies on multiple supply chain stakeholders to carry out financial business, which needs to solve a variety of financial risk control and pricing issues. The financing model in supply chain finance can be differentiate from the traditional credit model. The service mode and leading mode of supply chain finance need to be adjusted in accordance with the changes of the industrial operation. Further, the business mode of supply chain finance shows a diversification trend, which includes traditional supply chain financial models such as accounts receivable, advance payment, inventory financing, and supply chain credit financing models. In this paper, we investigate the similarities between supply chain finance and options, and further introduce American call options to supply chain financial products under the mode of small and medium-sized enterprises’ (SMEs) accounts receivable financing. The price of supply chain financial products is derived through the trinomial tree option pricing model, which determines the corporate financing interest rates. The rationality of the proposed pricing model is validated in comparison with the medium and long-term load bank interest rates. The contribution of the paper is in providing SMEs with supply chain financial products under the accounts receivable model to resolve financing difficulties and the pricing the products through the trinomial budget pricing model.

Similar content being viewed by others

Availability of data and material

All data generated or used during the study appear in the submitted article.

Code availability

All codes generated or used during the study appear in the submitted article.

Change history

16 September 2022

A Correction to this paper has been published: https://doi.org/10.1007/s10479-022-04987-8

Notes

All data comes from NINGBOYOSUN AUTO-PARTS CO., LTD’s 2019 annual report.

All data comes from Wind and Bloomberg.

References

Basu, P., & Nair, S. K. (2012). Supply chain finance enabled early pay: Unlocking trapped value in B2B logistics. International Journal of Logistics Systems and Management, 12(3), 334–353.

Black, F., & Scholes, M. (2019). The pricing of options and corporate liabilities. In World scientific reference on contingent claims analysis in corporate finance: Volume 1: Foundations of CCA and equity valuation (pp. 3–21).

Boyle, P. P. (1988). A lattice framework for option pricing with two state variables. Journal of Financial and Quantitative Analysis, 23, 1–12.

Burman, R. W. (1948). Practical aspects of inventory and receivables financing. Law and Contemporary Problems, 13(4), 555–565.

Choi, T. M. (2020). Supply chain financing using blockchain: Impacts on supply chains selling fashionable products. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03615-7

Cox, J. C., Ross, S. A., & Rubinstein, M. (1979). Option pricing: A simplified approach. Journal of Financial Economics, 7(3), 229–263.

Demica Limited. (2009). Supply Chain Finance. Available at: www.demica.com

Fellenz, M. R., Augustenborg, C., Brady, M., & Greene, J. (2009). Requirements for an evolving model of supply chain finance: A technology and service providers perspective. Communications of the IBIMA, 10(29), 227–235.

Gao, G. X., Fan, Z. P., Fang, X., & Lim, Y. F. (2018). Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. European Journal of Operational Research, 267(2), 585–597.

Gupta, S., & Dutta, K. (2011). Modeling of financial supply chain. European Journal of Operational Research, 211(1), 47–56.

Hwang, H., & Shinn, S. W. (1997). Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Computers and Operations Research, 24(6), 539–547.

Itô, K. (1944). 109. stochastic integral. Proceedings of the Imperial Academy, 20(8), 519–524.

Kamrad, B., & Ritchken, P. (1991). Multinomial approximating models for options with k state variables. Management Science, 37(12), 1640–1652.

Katsaliaki, K., Mustafee, N., & Kumar, S. (2014). A game-based approach towards facilitating decision making for perishable products: An example of blood supply chain. Expert Systems with Applications, 41(9), 4043–4059.

Klapper, L. (2005). The role of factoring for financing small and medium enterprises. The World Bank.

Koch, A. R. (1948). Economic aspects of inventory and receivables financing. Law and Contemp. Probs., 13, 566.

Lai, Z., Lou, G., Zhang, T., & Fan, T. (2021). Financing and coordination strategies for a manufacturer with limited operating and green innovation capital: Bank credit financing versus supplier green investment. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04098-w

Liu, X. (2009). A multiple criteria decision-making method for enterprise supply chain finance cooperative systems. In 2009 4th international conference on systems (pp. 120–125). IEEE.

Long, H., Li, Z., Jiang, X., & Wu, Y. (2015). Research on the pricing of financing products of finance companies from the perspective of industry chain finance-based on the fuzzy BS European put option model. The Theory and Practice of Finance and Economics, 36(2), 2–8.

Omiccioli, M. (2005). Trade credit as collateral (No. 553). Bank of Italy, Economic Research and International Relations Area.

Pfohl, H. C., & Gomm, M. (2009). Supply chain finance: Optimizing financial flows in supply chains. Logistics Research, 1(3–4), 149–161.

Smith, D. J. (2014). Bond math: The theory behind the formulas. New York: Wiley.

Tian, Y. (1993). A modified lattice approach to option pricing. The Journal of Futures Markets (1986–1998), 13(5), 563.

Wang, B., Li, Z., Fan, T., & Nie, X. (2019). Modeling of economic value assessment of ecological environment agricultural resources based on binary tree option pricing. Ekoloji, 28(107), 2545–2554.

Wang, C., & Chen, X. (2017). Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research, 248(1–2), 471–491.

Wu, X., Zhao, X., Zhang, F., Yang, W., & Cui, Y. (2012). Small and mid-sized enterprise intellectual property rights financing mode analysis. In 2012 International Symposium on Management of Technology (ISMOT) (pp. 421–425). IEEE.

Wu, D., Olson, D. L., & Wang, S. (2019). Finance-operations interface mechanism and models. Omega, 88, 1–3.

Wuttke, D. A., Blome, C., Foerstl, K., & Henke, M. (2013). Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. Journal of Business Logistics, 34(2), 148–166.

Wuttke, D. A., Blome, C., Heese, H. S., & Protopappa-Sieke, M. (2016). Supply chain finance: Optimal introduction and adoption decisions. International Journal of Production Economics, 178, 72–81.

Xie, C. (2000). A trinomial option pricing model dependent on Skewness and Kurtosis. Systems Engineering-Theory Methodology Applications, 9(3), 209–216.

Xiong, Y. (2009). Study on supply chain finance in E-business circumstances. In 2009 International Forum on Computer Science-Technology and Applications (Vol. 3, pp. 322–325). IEEE.

Yan, N., & Sun, B. (2013). Coordinating loan strategies for supply chain financing with limited credit. Or Spectrum, 35(4), 1039–1058.

Zhang, C., Fan, L. W., & Tian, Y. X. (2020). Optimal operational strategies of capital-constrained supply chain with logistics service and price dependent demand under 3PL financing service. Soft Computing, 24(4), 2793–2806.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that there are no conflicts of interests regarding the publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yunzhang, H., Lee, C.K.M. & Shuzhu, Z. Trinomial tree based option pricing model in supply chain financing. Ann Oper Res 331, 141–157 (2023). https://doi.org/10.1007/s10479-021-04294-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04294-8