Abstract

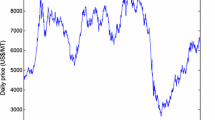

We study an expected payoff maximization problem for a risk-sensitive broker aiming to evaluate the merits of designing and underwriting an option contract on a traded commodity with geometric Brownian motion (GBM) spot price trajectories. Candidate firms for whom the contract would mitigate the commodity’s price risk, each face Poisson demands that are currently the broker’s responsibility to satisfy. Subject to a variance risk budget and a robustness requirement, the broker’s objective is jointly to (1) choose a so-called trigger price function that will fundamentally define the option contract, and (2) select a value-maximizing set of client firms to whom the broker will offer the contract. We reformulate the problem as a bilevel program whose continuous relaxation we transform into a single-level, univariate problem with a convenient property that makes it amenable to line search methods. The optimal solution for that single-level problem is then raw material for constructing the optimal solution for the original problem. Our theoretical and experimental findings indicate that the contract’s optimal value, and optimal trigger price function are both strictly monotone increasing in a cost parameter in the model, as well as in the GBM’s volatility coefficient. The findings also show that those two quantities are strictly monotone decreasing in the GBM’s drift coefficient. We conclude with a benchmarking sensitivity study which uses real-world data to study the implications of violating a certain constraint which implicitly bounds the optimal trigger price.

Similar content being viewed by others

Notes

Another derivative instrument called the commodity futures contract is a standardized, exchange-traded contract that is very similar in structure to a forward contract. However, futures contracts, unlike their forward counterparts, have a near-zero risk of default as they are guaranteed by clearing houses.

References

Arnold, J., & Minner, S. (2011). Financial and operational instruments for commodity procurement in quantity competition. International Journal of Production Economics, 131(1), 96–106.

Arnold, J., Minner, S., & Eidam, B. (2009). Raw material procurement with fluctuating prices. International Journal of Production Economics, 121(2), 353–364.

Australian Government: The Treasury. (2011). Commodity price volatility.

Back, J., Prokopczuk, M., & Rudolf, M. (2013). Seasonality and the valuation of commodity options. Journal of Banking and Finance, 37(2), 273–290.

Barnes-Schuster, D., Bassok, Y., & Anupindi, R. (2002). Coordination and flexibility in supply contracts with options. Manufacturing and Service Operations Management, 4(3), 171–207.

Bartram, S. M. (2005). The impact of commodity price risk on firm value—An empirical analysis of corporate commodity price exposures. Multinational Finance Journal, 9(3/4), 161–187.

Berling, P., & Martínez-de-Albéniz, V. (2011). Optimal inventory policies when purchase price and demand are stochastic. Operations Research, 59(1), 109–124.

Bilsel, R. U., & Ravindran, A. (2011). A multiobjective chance constrained programming model for supplier selection under uncertainty. Transportation Research Part B: Methodological, 45(8), 1284–1300.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–659.

Brennan, M. J., & Schwartz, E. S. (1977). The valuation of American put options. Journal of Finance, 32, 449–462.

Brulard, N., Cung, V., & Catusse, N. (2017). Client selection and combination for farm perishable products. IFAC-PapersOnLine, 50(1), 5006–5011.

Buhl, H. U., Strauss, S., & Wiesent, J. (2011). The impact of commodity price risk management on the profits of a company. Resources Policy, 36(4), 346–353.

Cai, J., Zhong, M., Shang, J., & Huang, W. (2017). Coordinating VMI supply chain under yield uncertainty: Option contract, subsidy contract, and replenishment tactic. International Journal of Production Economics, 185, 196–210.

Clark, I. J. (2014). Commodity option pricing: A practitioner’s guide. Chichester: Wiley.

Colson, B., Marcotte, P., & Savard, G. (2007). An overview of bilevel optimization. Annals of Operations Research, 153(1), 235–256.

Davis, A. M., & Leider, S. (2018). Contracts and capacity investment in supply chains. Manufacturing and Service Operations Management, 20(3), 403–421.

Durango-Cohen, E. J., & Yano, C. A. (2006). Supplier commitment and production decisions under a forecast-commitment contract. Management Science, 52(1), 54–67.

Elmachtoub, A. N., & Levi, R. (2016). Supply chain management with online customer selection. Operations Research, 64(2), 458–473.

Fan, Y., Feng, Y., & Shou, Y. (2020). A risk-averse and buyer-led supply chain under option contract: CVaR minimization and channel coordination. International Journal of Production Economics, 219, 66–81.

Fu, Q., Lee, C., & Teo, C. (2010). Procurement management using option contracts: Random spot price and the portfolio effect. IIE Transactions, 42(11), 793–811.

Gan, X., Sethi, S., & Yan, H. (2004). Coordination of supply chains with risk-averse agents. Production and Operations Management, 13(2), 135–149.

Gan, X., Sethi, S., & Yan, H. (2005). Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Production and Operations Management, 14(1), 80–89.

Geunes, J., Levi, R., Romeijn, H. E., & Shmoys, D. B. (2011). Approximation algorithms for supply chain planning and logistics problems with market choice. Mathematical Programming, 130(1), 85–106.

Hosseini, S., Morshedlou, N., Ivanov, D., Sarder, M. D., Barker, K., & Al, K. A. (2019). Resilient supplier selection and optimal order allocation under disruption risks. International Journal of Production Economics, 213, 124–137.

Ioannidis, S. (2011). An inventory and order admission control policy for production systems with two customer classes. International Journal of Production Economics, 131(2), 663–673.

John, L., Gurumurthy, A., Mateen, A., & Narayanamurthy, G. (2020). Improving the coordination in the humanitarian supply chain: exploring the role of options contract. Annals of Operations Research.

Kim, E., & Park, T. (2016). Admission and inventory control of a single-component make-to-order production system with replenishment setup cost and lead time. European Journal of Operational Research, 255(1), 91–102.

Kouvelis, P., Turcic, D., & Zhao, W. (2018). Supply chain contracting in environments with volatile input prices and frictions. Manufacturing and Service Operations Management, 20(1), 130–146.

Larionova, M., & Kirton, J. J. (2015). The G8–G20 relationship in global governance. Routledge.

Lin, G. Y., Yingdong, L., & Yao, D. D. (2008). The stochastic Knapsack revisited: Switch-over policies and dynamic pricing. Operations Research, 56(4), 945–957.

Liu, C., Jiang, Z., Liu, L., & Geng, N. (2013). Solutions for flexible container leasing contracts with options under capacity and order constraints. International Journal of Production Economics, 141(1), 403–413.

Liu, Y., & Yang, J. (2015). Joint pricing-procurement control under fluctuating raw material costs. International Journal of Production Economics, 168, 91–104.

Mlinar, T., & Chevalier, P. (2016). Dynamic admission control for two customer classes with stochastic demands and strict due dates. International Journal of Production Research, 54(20), 6156–6173.

Myers, R. J., & Hanson, S. D. (1993). Pricing commodity options when the underlying futures price exhibits time-varying volatility. American Journal of Agricultural Economics, 75(1), 121–130.

Noh, N. M., Chen, K. C., Bahar, A., & Zainuddin Z. M. (2016). Analysis of oil price fluctuations. In AIP Conference Proceedings.

Ravindran, A. R., Bilsel, R. U., Wadhwa, V., & Yang, T. (2010). Risk adjusted multicriteria supplier selection models with applications. International Journal of Production Research, 48(2), 405–424.

Sawik, T. (2011). Supplier selection in make-to-order environment with risks. Mathematical and Computer Modelling, 53(9–10), 1670–1679.

Sawik, T. (2013). Selection of resilient supply portfolio under disruption risks. Omega, 41(2), 259–269.

Sawik, T. (2014). Joint supplier selection and scheduling of customer orders under disruption risks: Single vs. dual sourcing. Omega, 43, 83–95.

Shang, W., & Yang, L. (2015). Contract negotiation and risk preferences in dual-channel supply chain coordination. International Journal of Production Research, 53(16), 4837–4856.

Silva, Y. L. T. V., Subramanian, A., & Pessoa, A. A. (2018). Exact and heuristic algorithms for order acceptance and scheduling with sequence-dependent setup times. Computers and Operations Research, 90, 142–160.

Sinha, A., Malo, P., & Deb, K. (2018). A review on bilevel optimization: From classical to evolutionary approaches and applications. IEEE Transactions on Evolutionary Computation, 2(2), 276–295.

Slotnick, S. (2011). Order acceptance and scheduling: A taxonomy and review. European Journal of Operational Research, 212(1), 1–11.

Son, J. (2007). Customer selection problem with profit from a sideline. European Journal of Operational Research, 176(2), 1084–1102.

Stadtler, H. (2007). A general quantity discount and supplier selection mixed integer programming model. OR Spectrum, 29(4), 723–744.

Tsay, R. S. (2010). Analysis of financial time series (3rd ed.). Hoboken: Wiley.

Turcic, D., Kouvelis, P., & Bolandifar, E. (2015). Hedging commodity procurement in a bilateral supply chain. Manufacturing and Service Operations Management, 17(2), 221–235.

Wang, X., & Liu, L. (2007). Coordination in a retailer-led supply chain through option contract. International Journal of Production Economics, 110(1–2), 115–127.

Wang, X., Zhu, Q., & Cheng, T. C. E. (2015). Subcontracting price schemes for order acceptance and scheduling. Omega, 54, 1–10.

World Bank Group. (2019). Commodity markets outlook—October 2018

Wu, A., Chiang, D., & Chang, C. (2010). Using order admission control to maximize revenue under capacity utilization requirements in MTO B2B industries. Journal of the Operations Research Society of Japan, 53(4), 270–288.

Wu, G., Cheng, C., Yang, H., & Chena, C. (2018). An improved water flow-like algorithm for order acceptance and scheduling with identical parallel machines. Applied Soft Computing, 71, 1072–1084.

Xie, Y., Wang, H., & Lu, H. (2018). Coordination of supply chains with a retailer under the mean-CVaR criterion. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 48(7), 1039–1053.

Yang, L., Xu, M., Yu, G., & Zhang, H. (2009). Supply chain coordination with CVaR criterion. Asia-Pacific Journal of Operational Research, 26(1), 135–160.

Yoon, L., Talluri, S., Yildiz, H., & Ho, W. (2018). Models for supplier selection and risk mitigation: A holistic approach. International Journal of Production Research, 56(10), 3636–3661.

Zhang, W., Zhou, D., & Liu, L. (2014). Sourcing with raw material price volatility and information asymmetry. Manufacturing and Service Operations Management, 16(1), 133–148.

Zhao, Y., Wang, S., Cheng, T. C. E., Yang, X., & Huang, Z. (2010). Coordination of supply chains by option contracts: A cooperative game theory approach. European Journal of Operational Research, 207(2), 668–675.

Zhong, X., Ou, J., & Wang, G. (2014). Order acceptance and scheduling with machine availability constraints. European Journal of Operational Research, 232(3), 435–441.

Zhu, L., Ren, X., Lee, C., & Zhang, Y. (2017). Coordination contracts in a dual-channel supply chain with a risk-averse retailer. Sustainability, 9(11), 2148.

Acknowledgements

The authors would like to thank the editor, and the anonymous referees for their constructive and insightful feedback which significantly improved the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Fontem, B., Price, M. Joint client selection and contract design for a risk-averse commodity broker in a two-echelon supply chain. Ann Oper Res 307, 111–138 (2021). https://doi.org/10.1007/s10479-021-04319-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04319-2