Abstract

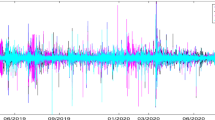

This study investigates the extent to which intraday price jumps and co-jumps in cryptocurrency markets stem from the release of macroeconomic news from the U.S., Germany and Japan. Using 5-min frequency prices for Bitcoin and Ethereum quoted against the U.S. dollar over the 2016–2019 period, we find that intraday price jumps are three times more frequent in Ethereum than in Bitcoin. More importantly, we show that jumps in Ethereum are more sensitive to macroeconomic news than jumps in Bitcoin, and that U.S. news releases exhibit higher influence on jumps in both cryptocurrencies than German and Japanese news announcements. We also find that co-jumps among Bitcoin and Ethereum are scarce and tend be associated only with a few U.S. news announcements, and in particular those related to the unemployment rate, new home sales, housing starts and Fed Beige Book.

Similar content being viewed by others

Availability of data and material

Available upon request.

Code availability

Available upon request.

Notes

See, for instance, Klein et al. (1991), Jensen et al. (1996), Andersen and Bollerslev (1998), Patelis (1997), Bomfim (2003), Green (2004), Erenburg, Kurov, and Lasser (2006), Wongswan (2006), Brandt and Kavajecz (2004), Bernanke and Kuttner (2005), Boyd, Hu, and Jagannathan (2005), Vega (2006), and Pasquariello and Vega (2007), Rigobon and Sack (2008), Love and Payne (2008), Evans and Lyons (2008), Hanousek et al. (2009), Brenner, Pasquariello and Subrahmanyam (2009), Chen and Gau (2010), Nowak et al. (2011), Hautsch, Hess and Veredas (2011), Rosa (2011), Hussain (2011), and Ben Omrane and Savaser (2016, 2017).

Source: https://coinmarketcap.com/all/views/all/ (visited on October 15, 2020).

There is evidence that Bitcoin and other cryptocurrencies are interdependent, with a stronger relationship in the short-run than in the long-run (Ciaian et al., 2018). Bouri et al. (2019) also find that price bubbles exist for various cryptocurrencies and are contemporaneously related to each other.

\({J}_{t,i}>{S}_{n}{\beta }^{*}+{C}_{n}\) with \({\beta }^{*}\,\text{such}\,\text{that}\,\mathrm{exp}\left({-\mathrm{e}}^{-{\beta }^{*}}\right)=1-{\upalpha }=0.9\) , consequently \({\beta }^{*}=-\mathrm{ln}\left(-\mathrm{ln}\left(0.9\right)\right)=2.25.\) .

Based on Schwarz and Akaike criteria, we choose P = 4.

The literature show that news has short-lived effects on volatility that would reach two hours (Andersen et al. 2003; Bauwens et al., 2005).

References

Al-Yahyaee, K. H., Mensi, W., & Yoon, S.-M. (2018). Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Finance Research Letters, 27, 228–234.

Andersen, T. G., & Bollerslev, T. (1998). Deutsche Mark-Dollar volatility: Intraday activity patterns, macroeconomic announcements, and longer run dependencies. The Journal of Finance, 53(1), 219–265.

Andersen, T. G., Bollerslev, T., & Diebold, F. X. (2007a). Roughing It Up: Including Jump Components in the Measurement, Modeling, and Forecasting of Return Volatility. Review of Economics and Statistics, 89(4), 701–720.

Andersen, T. G., Bollerslev, T., Diebold, F. X., & Vega, C. (2007b). Real-time price discovery in global stock, bond and foreign exchange markets. Journal of International Economics, 73(2), 251–277.

Andersen, T. G., Bollerslev, T., & Dobrev, D. (2007c). No-arbitrage semi-martingale restrictions for continuous-time volatility models subject to leverage effects, jumps and i.i.d. noise: Theory and testable distributional implications. Journal of Econometrics, 138(1), 125–180.

Anderson, T. G., Bollerslev, T., Diebold, F. X., & Vega, C. (2003). Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange. American Economic Review, 93(1), 38–62.

Andreou, E., & Ghysels, E. (2002). Rolling-sample volatility estimators: Some new theoretical, simulation, and empirical results. Journal of Business & Economic Statistics, 20, 363–376.

Ardia, D., Bluteau, K., & Rüede, M. (2019). Regime changes in Bitcoin GARCH volatility dynamics. Finance Research Letters, 29, 266–271.

Ayadi, M. A., Ben Omrane, W., Wang, J., & Welch, R. (2020). Macroeconomic news, public communications, and foreign exchange jumps around U.S. and European financial crises. International Journal of Finance & Economics, 25(2), 197–227.

Balduzzi, P., Elton, E. J., & Green, T. C. (2001). Economic News and Bond Prices: Evidence from the U.S. Treasury Market. The Journal of Financial and Quantitative Analysis, 36(4), 523.

Barndorff-Nielsen, O. E., & Shephard, N. (2002). Econometric Analysis of Realised Volatility and Its Use in Estimating Stochastic Volatility Models. Journal of the Royal Statistical Society, 64(B), 253–280.

Bai, X., Russell, J. R., & Tiao, G. C. (2004). Effects of non-normality and dependence on the precision of variance estimates using high-frequency financial data. Working paper, University of Chicago.

Bandi, F. M., & Russell, J. R. (2006). Separating market microstructure noise from volatility. Journal of Financial Economics, 79, 655–692.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177–189.

Bauwens, L., Omrane, W. B., & Giot, P. (2005). News announcements, market activity and volatility in the euro/dollar foreign exchange market. Journal of International Money and Finance, 24, 1108–1125.

Ben Omrane, W., & Savaşer, T. (2016). The sign switch effect of macroeconomic news in foreign exchange markets. Journal of International Financial Markets, Institutions and Money, 45, 96–114.

Ben Omrane, W., & Savaşer, T. (2017). Exchange rate volatility response to macroeconomic news during the global financial crisis. International Review of Financial Analysis, 52, 130–143.

Bernanke, B., & Kuttner, K. (2005). What explains the stock market’s reaction to federal reserve policy?”. Journal of Finance, 60, 1221–1257.

Bollerslev, T., & Todorov, V. (2011a). Estimation of jump tails. Econometrica, 79(6), 1727–1783.

Bollerslev, T., & Todorov, V. (2011b). Tails, Fears, and Risk Premia. The Journal of Finance, 66(6), 2165–2211.

Bomfim, A. N. (2003). Pre-announcement effects, news effects, and volatility: Monetary policy and the stock market. Journal of Banking & Finance, 27(1), 133–151.

Boudt, K., Croux, C., & Laurent, S. (2011). Robust estimation of intraweek periodicity in volatility and jump detection. Journal of Empirical Finance, 18(2), 353–367.

Bouri, E., Gupta, R., & Roubaud, D. (2019). Herding behaviour in cryptocurrencies. Finance Research Letters, 29, 216–221.

Boyd, J., Hu, J., & Jagannathan, R. (2005). The stock market’s reaction to unemployment news: Why bad news is usually good for stocks? Journal of Finance, 60, 649–672.

Brandt, M., & Kavajecz, K. (2004). Price discovery in the U.S. treasury market: The impact of order flow and liquidity on the yield curve. Journal of Finance, 59, 2623–2654.

Brenner, M., Pasquariello, P., & Subrahmanyam, M. (2009). On the volatility and co-movement of US financial markets around macroeconomic news announcements. Journal of Financial and Quantitative Analysis, 44, 1265–1289.

Carnero, M. A., Peña, D., & Ruiz, E. (2007). Effects of outliers on the identification and estimation of GARCH models. Journal of Time Series Analysis, 28(4), 471–497.

Catania, L., Grassi, S., & Ravazzolo, F. (2019). Forecasting cryptocurrencies under model and parameter instability. International Journal of Forecasting, 35(2), 485–501.

Chaim, P., & Laurini, M. P. (2018). Volatility and return jumps in bitcoin. Economics Letters, 173, 158–163.

Charfeddine, L., & Maouchi, Y. (2019). Are shocks on the returns and volatility of cryptocurrencies really persistent? Finance Research Letters, 28, 423–430.

Chatrath, A., Miao, H., Ramchander, S., & Villupuram, S. (2014). Currency jumps, cojumps and the role of macro news. Journal of International Money and Finance, 40, 42–62.

Charles, A., & Darné, O. (2005). Outliers and GARCH models in financial data. Economics Letters, 86(3), 347–352.

Chen, Y.-L., & Gau, Y.-F. (2010). News announcements and price discovery in foreign exchange spot and futures markets. Journal of Banking & Finance, 34(7), 1628–1636.

Ciaian, P., Rajcaniova, M., & Kancs, D. A. (2018). Virtual relationships: Short- and long-run evidence from BitCoin and altcoin markets. Journal of International Financial Markets, Institutions and Money, 52, 173–195.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34.

Goutte, S., Guesmi, K., & Saadi, S. (2019a). Cryptofinance and Mechanisms of Exchange: The Making of Virtual Currency. Springer International Publishing.

Goutte, S., Guesmi, K., & Saadi, S. (2020). Cryptofinance: A New Currency for A New Economy. World Scientific Publishing.

Dewachter, H., Erdemlioglu, D., Gnabo, J.-Y., & Lecourt, C. (2014). The intra-day impact of communication on euro-dollar volatility and jumps. Journal of International Money and Finance, 43, 131–154.

Duffie, D., Pan, J., & Singleton, K. (2000). Transform Analysis and Asset Pricing for Affine Jump-diffusions. Econometrica, 68(6), 1343–1376.

Dungey, M., McKenzie, M., & Smith, L. V. (2009). Empirical evidence on jumps in the term structure of the US Treasury Market. Journal of Empirical Finance, 16(3), 430–445.

Dyhrberg, A. H. (2016). Bitcoin, gold, and the dollar – A GARCH volatility analysis. Finance Research Letters, 16, 85–92.

Eraker, B., Johannes, M., & Polson, N. (2003). The Impact of Jumps in Volatility and Returns. The Journal of Finance, 58(3), 1269–1300.

Erenburg, G., Kurov, A., & Lasser, D. J. (2006). Trading around macroeconomic announcements: Are all traders created equal? Journal of Financial Intermediation, 15(4), 470–493.

Evans, K. P. (2011). Intraday jumps and US macroeconomic news announcements. Journal of Banking & Finance, 35(10), 2511–2527.

Evans, M. D. D., & Lyons, R. K. (2008). How is macro news transmitted to exchange rates? Journal of Financial Economics, 88(1), 26–50.

Franses, P. H., & Ghijsels, H. (1999). Additive outliers, GARCH and forecasting volatility. International Journal of Forecasting, 15(1), 1–9.

French, K. R., & Roll, R. (1986). Stock return variances. Journal of Financial Economics, 17(1), 5–26.

Fry, J. (2018). Booms, busts and heavy-tails: The story of Bitcoin and cryptocurrency markets? Economics Letters, 171, 225–229.

Giudici, P., & Abu-Hashish, I. (2019). What determines bitcoin exchange prices? A network VAR approach. Finance Research Letters, 28, 309–318.

Goutte, S., Guesmi, K., & Saadi, S. (2019b). Cryptofinance and Mechanisms of Exchange. Springer.

Green, T. C. (2004). Economic News and the Impact of Trading on Bond Prices. The Journal of Finance, 59(3), 1201–1233.

Grobys, K., & Sapkota, N. (2019). Cryptocurrencies and momentum. Economics Letters, 180, 6–10.

Guesmi, K., Saadi, S., Abid, I., & Ftiti, Z. (2019). Portfolio diversification with virtual currency: Evidence from bitcoin. International Review of Financial Analysis, 63, 431–437.

Hanousek, J., Kočenda, E., & Kutan, A. M. (2009). The reaction of asset prices to macroeconomic announcements in new EU markets: Evidence from intraday data. Journal of Financial Stability, 5(2), 199–219.

Hansen, P. R., & Lunde, A. (2006). Realized variance and market microstructure noise. Journal of Business & Economic Statistics, 24, 127–161.

Hautsch, N., Hess, D., & Veredas, D. (2011). The impact of macroeconomic news on quote adjustments, noise, and informational volatility. Journal of Banking & Finance, 35(10), 2733–2746.

Huang, X. (2005). The Relative Contribution of Jumps to Total Price Variance. Journal of Financial Econometrics, 3(4), 456–499.

Huang, X., & Tauchen, G. (2018). Macroeconomic news announcements, systemic risk, financial market volatility, and jumps. Journal of Futures Markets, 38(5), 513–534.

Hussain, S. M. (2011). Simultaneous monetary policy announcements and international stock markets response: An intraday analysis. Journal of Banking & Finance, 35(3), 752–764.

Jensen, G. R., Mercer, J. M., & Johnson, R. R. (1996). Business conditions, monetary policy, and expected security returns. Journal of Financial Economics, 40(2), 213–237.

Klein, M., Mizrach, B., & Murphy, R. G. (1991). Managing the Dollar: Has the Plaza Agreement Mattered? Journal of Money, Credit and Banking, 23(4), 742.

Lahaye, J., Laurent, S., & Neely, C. J. (2011). Jumps, cojumps and macro announcements. Journal of Applied Econometrics, 26(6), 893–921.

Lee, S. S., & Mykland, P. A. (2008). Jumps in Financial Markets: A New Nonparametric Test and Jump Dynamics. Review of Financial Studies, 21(6), 2535–2563.

Liu, J., Longstaff, F. A., & Pan, J. (2003). Dynamic Asset Allocation with Event Risk. The Journal of Finance, 58(1), 231–259.

Liu, L. Y., Patton, A. J., & Sheppard, K. (2015). Does anything beat 5-minute RV? A comparison of realized measures across multiple asset classes. Journal of Econometrics, 187, 293–311.

Love, R., & Payne, R. (2008). Macroeconomic News, Order Flows, and Exchange Rates. Journal of Financial and Quantitative Analysis, 43(2), 467–488.

Nadarajah, S., & Chu, J. (2017). On the inefficiency of Bitcoin. Economics Letters, 150, 6–9.

Nowak, S., Andritzky, J., Jobst, A., & Tamirisa, N. (2011). Macroeconomic fundamentals, price discovery, and volatility dynamics in emerging bond markets. Journal of Banking & Finance, 35(10), 2584–2597.

Pasquariello, P., & Vega, C. (2007). Informed and strategic order flow in the bond markets. Review of Financial Studies, 20, 1975–2019.

Patelis, A. D. (1997). Stock Return Predictability and The Role of Monetary Policy. The Journal of Finance, 52(5), 1951–1972.

Philippas, D., Rjiba, H., Guesmi, K., & Goutte, S. (2019). Media attention and Bitcoin prices. Finance Research Letters, 30, 37–43.

Piazzesi, M. (2005). Bond Yields and the Federal Reserve. Journal of Political Economy, 113(2), 311–344.

Rigobon, R., & Sack, B. (2008). Noisy macroeconomic announcements, monetary policy, and asset prices. In J. Y. Campbell (Ed.), Asset prices and monetary policy (pp. 335–370). University of Chicago Press.

Rosa, C. (2011). The high-frequency response of exchange rates to monetary policy actions and statements. Journal of Banking & Finance, 35(2), 478–489.

Rousseeuw, P. J., & Leroy, A. M. (1988). A robust scale estimator based on the shortest half. Statistica Neerlandica, 42(2), 103–116.

Sun, X., Liu, M., & Sima, Z. (2020). A novel cryptocurrency price trend forecasting model based on LightGBM. Finance Research Letters, 32, 101084.

Tauchen, G., & Zhou, H. (2011). Realized jumps on financial markets and predicting credit spreads. Journal of Econometrics, 160(1), 102–118.

Urquhart, A. (2016). The inefficiency of Bitcoin. Economics Letters, 148, 80–82.

Vega, C. (2006). Stock price reaction to public and private information. Journal of Financial Economics, 82, 103–133.

Wongswan, J. (2006). Transmission of Information across International Equity Markets. Review of Financial Studies, 19(4), 1157–1189.

Yermack, D. (2015). Is Bitcoin a Real Currency? An Economic Appraisal. In D. L. K. Chuen (Ed.), Handbook of Digital Currency. Elsevier, pp. 31–43

Zhang, W., Wang, P., Li, X., & Shen, D. (2018). The inefficiency of cryptocurrency and its cross-correlation with Dow Jones Industrial Average. Physica a: Statistical Mechanics and Its Applications, 510, 658–670.

Acknowledgements

We are grateful to two anonymous reviewers for helpful comments and suggestions. We also benefited from comments offered by Lamia Chourou, Imed Chkir, Sara Ding, Rui Duan, Ligang Zhong, and seminar participants at the Telfer School of Management of the University of Ottawa and Paris School of Business. Samir Saadi gratefully acknowledges financial support from SSHRC Canada. Walid Ben Omrane acknowledge BUAF Explore grant financial support provided by the Office of Research Services at Brock University. We thank Omar Zidan for excellent research assistance. All errors are our own responsibility

Funding

Samir Saadi gratefully acknowledges financial support from SSHRC Canada. Walid Ben Omrane acknowledge BUAF Explore grant financial support from the Office of Research Services at Brock University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ben Omrane, W., Guesmi, K., Qianru, Q. et al. The high-frequency impact of macroeconomic news on jumps and co-jumps in the cryptocurrency markets. Ann Oper Res 330, 177–209 (2023). https://doi.org/10.1007/s10479-021-04353-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04353-0