Abstract

With the application of the optimal stopping techniques, this paper proposes a filter rule for investors in emerging stock markets. In a bull market, once the stock price falls down to the optimal filter size, investors should sell the stock to avoid massive losses. We show that the optimal filter size is a function of the historical highest price, the weights of the future returns and the current drawdown in the investor’s utility function, the characteristics of the underlying stochastic price process, and the discount rate. Out-of-sample tests verify that this filter rule is valid, and the selling signals generated by the filter rule are at the beginning of the downtrend in the most emerging stock markets.

Similar content being viewed by others

References

Alexander, G. J., & Baptista, A. M. (2006). Portfolio selection with a drawdown constraint. Journal of Banking & Finance, 30(11), 3171–3189.

Alexander, S. S. (1961). Price movements in speculative markets: Trends or random walks (pre-1986). Industrial Management Review, 2(2), 7.

Alexander, S. S. (1964). Price movements in speculative markets-trends or random walks, number 2. IMR; Industrial Management Review (pre-1986), 5(2), 25.

Almujamed, H. I. (2019). Filter rule performance in an emerging market: evidence from qatari listed companies. International Journal of Productivity and Performance Management.

Beirne, J., Caporale, G. M., Schulze Ghattas, M., & Spagnolo, N. (2010). Global and regional spillovers in emerging stock markets: A multivariate garch-in-mean analysis. Emerging Markets Review, 11(3), 250–260.

Boyer, B. H., Kumagai, T., & Yuan, K. (2006). How do crises spread? evidence from accessible and inaccessible stock indices. The Journal of Finance, 61(2), 957–1003.

Chambet, A., & Gibson, R. (2008). Financial integration, economic instability and trade structure in emerging markets. Journal of International Money and Finance, 27(4), 654–675.

Chang, T., Gil Alana, L., Aye, G. C., Gupta, R., & Ranjbar, O. (2016). Testing for bubbles in the brics stock markets. Journal of Economic Studies, 43(4), 646–660.

Chen, V. Z., Li, J., & Shapiro, D. M. (2012). International reverse spillover effects on parent firms: Evidences from emerging-market mnes in developed markets. European Management Journal, 30(3), 204–218.

Cooper, M. (1999). Filter rules based on price and volume in individual security overreaction. The Review of Financial Studies, 12(4), 901–935.

Corrado, C. J., & Lee, S.-H. (1992). Filter rule tests of the economic significance of serial dependencies in daily stock returns. Journal of Financial Research, 15(4), 369–387.

Cvitanic, J., & Karatzas, I. (1994). On portfolio optimization under drawdown constraints.

Dayanik, S. (2008). Optimal stopping of linear diffusions with random discounting. Mathematics of Operations Research, 33(3), 645–661.

Dayanik, S., & Karatzas, I. (2003). On the optimal stopping problem for one-dimensional diffusions. Stochastic Processes and Their Applications, 107(2), 173–212.

de Souza, M. J. S., Ramos, D. G. F., Pena, M. G., Sobreiro, V. A., & Kimura, H. (2018). Examination of the profitability of technical analysis based on moving average strategies in brics. Financial Innovation, 4(1), 1–18.

Dimitriou, D., Kenourgios, D., & Simos, T. (2013). Global financial crisis and emerging stock market contagion: A multivariate fiaparch-dcc approach. International Review of Financial Analysis, 30, 46–56.

Egami, M., & Oryu, T. (2017). A direct solution method for pricing options involving the maximum process. Finance and Stochastics, 21(4), 967–993.

Fama, E. F., & Blume, M. E. (1966). Filter rules and stock-market trading. The Journal of Business, 39(1), 226–241.

Fifield, S. G., Power, D. M., & Donald Sinclair, C. (2005). An analysis of trading strategies in eleven European stock markets. The European Journal of Finance, 11(6), 531–548.

Grossman, S. J., & Zhou, Z. (1993). Optimal investment strategies for controlling drawdowns. Mathematical Finance, 3(3), 241–276.

Hsieh, C. H., & Barmish, B. R. (2017). On drawdown-modulated feedback control in stock trading. IFAC PapersOnLine, 50(1), 952–958.

Huang, Y.-S. (1995). The trading performance of filter rules on the Taiwan stock exchange. Applied Financial Economics, 5(6), 391–395.

Huyghebaert, N., & Wang, L. (2010). The co-movement of stock markets in east Asia: Did the 1997–1998 Asian financial crisis really strengthen stock market integration? China Economic Review, 21(1), 98–112.

Hwang, E., Min, H. G., Kim, B. H., & Kim, H. (2013). Determinants of stock market comovements among us and emerging economies during the us financial crisis. Economic Modelling, 35, 338–348.

Iacus, S. M. (2009). Simulation and inference for stochastic differential equations: With R examples. New York: Springer Science & Business Media.

Karpowicz, A., & Szajowski, K. (2007). Double optimal stopping of a risk process. Stochastics An International Journal of Probability and Stochastic Processes, 79(1–2), 155–167.

Kim, B.-H., Kim, H., & Lee, B.-S. (2015). Spillover effects of the us financial crisis on financial markets in emerging Asian countries. International Review of Economics & Finance, 39, 192–210.

Korajczyk, R. A. (1996). A measure of stock market integration for developed and emerging markets. The World Bank Economic Review, 10(2), 267–289.

Kozyra, J., & Lento, C. (2011). Filter rules: Follow the trend or take the contrarian approach? Applied Economics Letters, 18(3), 235–237.

Lam, K., & Yam, H. (1997). Cusum techniques for technical trading in financial markets. Financial Engineering and the Japanese Markets, 4(3), 257–274.

Maier Paape, S. (2018). Risk averse fractional trading using the current drawdown.

Mandelbrot, B. (1966). Forecasts of future prices, unbiased markets, and ‘martingale’ models. The Journal of Business, 39(1), 242–255.

Matsubayashi, N., & Nishino, H. (1999). An application of Lemke’s method to a class of Markov decision problems. European Journal of Operational Research, 116(3), 584–590.

Müller, A. (2000). Expected utility maximization of optimal stopping problems. European Journal of Operational Research, 122(1), 101–114.

Norden, L., & Weber, M. (2009). The co-movement of credit default swap, bond and stock markets: An empirical analysis. European Financial Management, 15(3), 529–562.

Praetz, P. D. (1976). Rates of return on filter tests. The Journal of Finance, 31(1), 71–75.

Samuelson, P. A. (1965). Proof that properly anticipated prices fluctuate randomly. Industrial Management Review, 6(1), 41–49.

Shynkevich, A. (2017). Return predictability in emerging equity market sectors. Applied Economics, 49(5), 433–445.

Sobreiro, V. A., da Costa, T. R. C. C., Nazário, R. T. F., & e Silva, J. L., Moreira, E. A., Lima Filho, M. C., Kimura, H., & Zambrano, J. C. A. (2016). The profitability of moving average trading rules in brics and emerging stock markets. The North American Journal of Economics and Finance,38, 86–101.

Sweeney, R. J. (1988). Some new filter rule tests: Methods and results. Journal of Financial and Quantitative Analysis, 23(3), 285–300.

Szakmary, A., Davidson, W. N., III., & Schwarz, T. V. (1999). Filter tests in nasdaq stocks. Financial Review,34(1), 45–70.

Tai, C. S. (2007). Market integration and contagion: Evidence from Asian emerging stock and foreign exchange markets. Emerging Markets Review, 8(4), 264–283.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Vasiliou, D., Eriotis, N., & Papathanasiou, S. (2006). How rewarding is technical analysis? evidence from athens stock exchange. Operational Research, 6(2), 85–102.

Xanthopoulos, E., Aravossis, K., & Papathanasiou, S. (2017). Profitability of trading strategies before and during the greek crisis: An empirical study. The Journal of Prediction Markets, 11(1), 1–26.

Yang, Z., & Zhong, L. (2013). Towards optimal portfolio strategy to control maximum drawdown: The case of risk based dynamic asset allocation. China Finance Review International, 3(2), 131–163.

Yu, X., Zhou, C., & Zhou, Y. (2018). On dynamic programming principle for stochastic control under expectation constraints. arXiv preprint arXiv:1802.03954.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proof of proposition 3.1

The following lemma is useful in the proof of proposition 3.1

Lemma A.1

Consider a real-valued continuous function \(f(x) = ax^{c_1} + bx^{c_2}\) defined on \({\mathbb {R}}^{+}\). If \(a > 0\), \(b < 0\), and \( c_2 > c_1\), then \(f(x) \ge 0\) on \((0,(-\frac{a}{b})^{\frac{1}{c_2-c_1}}]\) and \(f(x) < 0\) on \(((-\frac{a}{b})^{\frac{1}{c_2-c_1}},+\infty )\).

Proof

Lemma A.1 Let \(f(x) \ge 0\), then we have

Because \(b < 0\), and \( c_2 > c_1\), we can divide both sides by b and \(x^{c_1}\) to derivate the following inequations

Lemma A.1 is proved. \(\square \)

Proof of Proposition3.1

We start by the infinitesimal generator \({\mathbb {L}}\) defined by

and the ordinary differential equation defined by

The positive increasing solution \(\psi (x)\) and the decreasing solution \(\varphi (x)\) of the ODE are following

where

It is clear that \(\gamma _1 > 0 , \gamma _0 < 0\).

For the geometric Brownian motion with the drift term \(\mu \) and the diffusion term \(\sigma \), these two solutions can represent the first passage time \(\tau _k = \inf \{t \ge : X_t = k\}\) by

We consider a general optimal stopping problem defined by

We set the interval [m, n] which the initial value x of the process \(X_t\) belongs to. If \(X_t\) leaves the interval [m, n], the process will stop. The expectation \({\mathbb {E}}^{x}[e^{-r\tau }g(X_{\tau })]\)can be represented as the average of escaping from the upper bound n and escaping from the lower bound m.

And if \(m = x = n\), \({\mathbb {E}}^{x}(e^{-r(\tau _m \wedge \tau _n)}g_{\tau _m \wedge \tau _n}) = g(x)\) The optimal stopping problem is considering to find the optimal interval \([m^*(x), n^*(x)]\) to maximize \({\mathbb {E}}^{x}(e^{-r(\tau _m \wedge \tau _n)}g_{\tau _m \wedge \tau _n})\).

Before giving the solution, we firstly define the continuous and strictly function F(x) by

The Eq. 1.2 can be expressed as

Furthermore, we set function \(G(\cdot )\) as

and

We replace \(X_t\) in Eq. 1.2 by \(Y_t\), then

where \(y_m = F(m)\), \(y_n = F(n)\).

It is natural that the value function V(x) is \(V(F^{-1}(y))\), and it can represented under the optimal interval \([m^*(x), n^*(x)]\) as

where \(y_m^* = F(m^*(x))\), \(y_n^* = F(n^*(x))\) and \(y = F(x)\). Since \(V(x) \ge {\mathbb {E}}^{x}(e^{-r(\tau _m \wedge \tau _n)}g_{\tau _m \wedge \tau _n})\) for any [m, n], we have

So the value function is the smallest nonnegative concave majorant of G(y). And the continue region \({\mathcal {S}}\) and the optimal stopping time \(\tau ^*\) is defined as

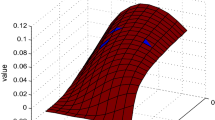

In our optimal stopping problem, the reward function G(y) is

where the subscript S means that the highest price is fixed at S. The method to find the smallest concave majorant is making an tangent line of the curve \(G_S(y)\) from the origin point. Hence, the concavity of \(G_S(y)\) is necessary to indicate the existence of the tangent line. The first-order and second-order derivative of \(G_S(y)\) are presented as followed.

\(G^{\prime \prime }_S(y)\) has the same formula as f(x) in lemma A.1. We can take \(\frac{\gamma _0\gamma _1}{ (\gamma _1-\gamma _0)^2}(\frac{\phi _1}{\phi _2}\sqrt{S} - S)\) as a, \(\phi _2\frac{(1-\gamma _0)(1-\gamma _1)}{(\gamma _1-\gamma _0)^2}\) as b, \(-\frac{\gamma _1}{\gamma _1-\gamma _0}-1\) as \(c_1\) and \(\frac{1-\gamma _1}{\gamma _1-\gamma _0}-1\) as \(c_2\).

Owing to \(\gamma _1 > 1\) and \(\gamma _0 < 0\), we have

We define the lower bound for S by

When \(\frac{\phi _1}{\phi _2}\sqrt{S} - S < 0\), \(\frac{\gamma _0\gamma _1}{ (\gamma _1-\gamma _0)^2}(\frac{\phi _1}{\phi _2}\sqrt{S} - S) > 0\). Based on lemma A.1, \(G^{\prime \prime }_S(y)\) is positive around the origin point and negative with y increasing to infinity. The curve of \(G_S(y)\) is convex with y around zero and becomes concave with y increasing, which guarantees the existence of the tangent line from the origin point.

We can compute the tangent point \(x^*(S)\) that

Since the process \(X_t\) is below S, we have the upper bound that

\(\square \)

Proof of Theorem 3.4

We consider to use mean value theorems for definite integrals in Eq. 3.13 but we just take the approximate value.

Then we define a function \(v(S,\epsilon )\) by

Lemma 4 from Egami and Oryu (2017) shows that

From Eq. 6.14, It can be useful to notice that

where \(e^*(S)\) is the maximizer of Eq. 6.14. Equations 6.15 and 6.16 solve \(v(S, \epsilon )\). It is clear that \(\lim _{\epsilon \rightarrow 0}v(S,\epsilon ) = V(S)\), and we have the expression of the value function V(S) that

Hence, the optimal stopping problem is to find the maximizer \(e^*(S)\) of Eq. 6.17\(\square \)

Appendix B: Robust test

1.1 B.1: Using weekly data

We apply the weekly data to check the robustness of our filter rule. Figures 6, 7, 8, 9 and 10 are the results. we can find that during the 2008 global financial crisis in Chinese stock market, the selling signal based on daily data is around November 2007, but the selling signal based on weekly data is around December 2007. It results in an additional loss of 1.5%, other periods and markets have similar results. However, compared with the entire crisis, the filter rule based on weekly data is still effective to control losses.

1.2 B.2: Using mean absolute deviation

Considering the standard deviation is not the only proxy of the optimal drawdown for investors, we also use the mean absolute deviation(MAD) for estimating \({\hat{\phi }}_1/{\hat{\phi }}_2\) to conduct the robust test. The new esitmated results is presented in Table 5

We can find that the estimated \(\phi _1/\phi _2\) based on the mean absolute deviation is smaller than our original results. We also apply the estimated \(\phi _1/\phi _2\) based on the mean absolute deviation to our empirical tests. The results are shown by Figs. 11, 12, 13, 14, and 15. The thresholds becomes smaller, and the filter rule is more likely to deliver selling signals, especially when the price drop a lot during a uptrend. It makes investor sell stocks too early to get the potential profits in the subsequent price rising. Hence, the standard deviation would be better to estimate \(\phi _1/\phi _2\).

Rights and permissions

About this article

Cite this article

Boubaker, S., Han, X., Liu, Z. et al. Optimal filter rules for selling stocks in the emerging stock markets. Ann Oper Res 330, 211–242 (2023). https://doi.org/10.1007/s10479-021-04381-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04381-w