Abstract

Exploring the value of multi-source information fusion to predict small and medium-sized enterprises’ (SMEs) credit risk in supply chain finance (SCF) is a popular yet challenging task, as two issues of key variable selection and imbalanced class must be addressed simultaneously. To this end, we develop new forecast models adopting an imbalance sampling strategy based on machine learning techniques and apply these new models to predict credit risk of SMEs in China, using financial information, operation information, innovation information, and negative events as predictors. The empirical results show that the financial-based information, such as TOC, NIR, is most useful in predicting SMEs’ credit risk in SCF, and multi-source information fusion is meaningful in better predicting the credit risk. In addition, based on the preferred CSL-RF model, which extends cost-sensitive learning to a random forest, we also present the varying mechanisms of key predictors for SMEs’ credit risk by using partial dependency analysis. The strategic insights obtained may be helpful for market participants, such as SMEs’ managers, investors, and market regulators.

Similar content being viewed by others

References

Andrikopoulos, P., & Khorasgani, A. (2018). Predicting unlisted SMEs’ default: Incorporating market information on accounting-based models for improved accuracy. British Accounting Review, 50, 559–573.

Angilella, S., & Mazzù, S. (2015). The financing of innovative SMEs: A multicriteria credit rating model. European Journal of Operational Research, 244, 540–554.

Arevalillo, J. M. (2019). A machine learning approach to assess price sensitivity with application to automobile loan segmentation. Applied Soft Computing Journal, 76, 390–399.

Bals, C. (2019). Toward a supply chain finance (SCF) ecosystem-proposing a framework and agenda for future research. Journal of Purchasing and Supply Management, 25, 105–117.

Bauer, E., Kohavi, R. (1996). An empirical comparison of voting classification algorithms: Bagging, boosting, and variants[J]. Machine learning, 36(1), 1–38.

Bauer, E., & Kohavi, R. (1999). An empirical comparison of voting classification algorithms: Bagging, boosting, and variants. Machine Learning, 36, 105–139.

Bequé, A., & Lessmann, S. (2017). Extreme learning machines for credit scoring: An empirical evaluation. Expert Systems with Applications, 86, 42–53.

Breiman, L. (2001). Random forests. Machine Learning, 45, 5–32.

Caniato, F., Gelsomino, L. M., Perego, A., & Ronchi, S. (2016). Does finance solve the supply chain financing problem? Supply Chain Management: an International Journal, 21, 534–549.

Chen, J., Chan, K. C., Dong, W., & Zhang, F. (2017). Internal control and stock price crash risk: Evidence from China. European Accounting Review, 26, 125–152.

Chen, L., Jia, F., Li, T., & Zhang, T. (2021). Supply chain leadership and firm performance: A meta-analysis. International Journal of Production Economics, 235, 108082.

Cortes, C., & Vapnik, V. (1995). Support vector networks. Machine Learning, 20, 273–297.

Fantazzini, D., & Figini, S. (2009). Random survival forests models for SME credit risk measurement. Methodology and Computing in Applied Probability, 11, 29–45.

Gupta, J., & Gregoriou, A. (2018). Impact of market-based finance on SMEs failure. Economic Modelling, 69, 13–25.

He, H., & Garcia, E. A. (2009). Learning from imbalanced data. IEEE Transactions on Knowledge and Data Engineering, 21, 1263–1284.

Hirsch, B., Nitzl, C., & Schoen, M. (2018). Interorganizational trust and agency costs in credit relationships between savings banks and SMEs. Journal of Banking and Finance, 97, 37–50.

Hofmann, E. (2005). Supply chain finance: some conceptual insights', Beiträge Zu Beschaffung Und Logistik (pp. 203–14).

Jia, F., Blome, C., Sun, H., Yang, Y., & Zhi, B. (2020). Towards an integrated conceptual framework of supply chain finance: An information processing perspective. International Journal of Production Economics, 219, 18–30.

Jiang, C., Wang, Z., & Zhao, H. (2019). A prediction-driven mixture cure model and its application in credit scoring. European Journal of Operational Research, 277, 20–31.

Ju, Y., & Young Sohn, S. (2015). Stress test for a technology credit guarantee fund based on survival analysis. Journal of the Operational Research Society, 66, 463–475.

Lam, H. K., & Zhan, Y. (2021a). The impacts of supply chain finance initiatives on firm risk: evidence from service providers listed in the US. International Journal of Operations and Production Management, 41, 383–309.

Lam, H. K. S., & Zhan, Y. (2021b). The impacts of supply chain finance initiatives on firm risk: Evidence from service providers listed in the US. International Journal of Operations and Production Management, 41, 383–409.

Lin, E. M., Sun, E. W., & Yu, M. T. (2018). Systemic risk, financial markets, and performance of financial institutions. Annals of Operations Research, 262, 579–603.

Mai, F., Tian, S., Lee, C., & Ma, L. (2019). Deep learning models for bankruptcy prediction using textual disclosures. European Journal of Operational Research, 274, 743–758.

Martin, J., & Hofmann, E. (2017). Involving financial service providers in supply chain finance practices. Journal of Applied Accounting Research, 18, 42–62.

Pederzoli, C., Thoma, G., & Torricelli, C. (2013). Modelling cedit risk for innovative SMEs: The role of innovation measures. Journal of Financial Services Research, 44, 111–129.

Reza-Gharehbagh, R., Asian, S., Hafezalkotob, A., & Wei, C. (2021). Reframing supply chain finance in an era of reglobalization: On the value of multi-sided crowdfunding platforms. Transportation Research Part E: Logistics and Transportation Review, 149, 102298.

Reza-Gharehbagh, R., Hafezalkotob, A., Asian, S., Makui, A., & Zhang, A. N. (2020). Peer-to-peer financing choice of SME entrepreneurs in the re-emergence of supply chain localization. International Transactions in Operational Research, 27, 2534–2558.

Rizzo, D. M., & Dougherty, D. E. (1994). Characterization of aquifer properties using artificial neural networks: Neural kriging. Water Resources Research, 30, 483–497.

Saito, K., & Tsuruta, D. (2018). Information asymmetry in small and medium enterprise credit guarantee schemes: Evidence from Japan. Applied Economics, 50, 2469–2485.

Sariannidis, N., Papadakis, S., Garefalakis, A., Lemonakis, C. & Kyriaki-Argyro, T. (2020). Default avoidance on credit card portfolios using accounting, demographical and exploratory factors: Decision making based on machine learning (ML) techniques. Annals of Operations Research, 294, 712–739.

Schwab, L., Gold, S., & Reiner, G. (2019). Exploring financial sustainability of SMEs during periods of production growth: A simulation study. International Journal of Production Economics, 212, 8–18.

Song, H. (2019). How do knowledge spillover and access in supply chain network enhance SMEs’ credit quality? Industrial Management and Data Systems, 119, 274–291.

Song, Z. L., & Zhang, X. M. (2018). Lending technology and credit risk under different types of loans to SMEs: Evidence from China. International Review of Economics and Finance, 57, 43–69.

Szutowski, D. (2018). Market reaction to open innovation announcements. European Journal of Innovation Management, 21, 142–156.

Thai-Nghe, N., Gantner, Z. & Schmidt-Thieme, L. (2010) 'Cost-sensitive learning methods for imbalanced data. In The 2010 international joint conference on neural networks (IJCNN). IEEE.

Tkáč, M., & Verner, R. (2016). Artificial neural networks in business: Two decades of research. Applied Soft Computing, 38, 788–804.

Wandfluh, M., Hofmann, E., & Schoensleben, P. (2016). Financing buyer-supplier dyads: An empirical analysis on financial collaboration in the supply chain. International Journal of Logistics Research and Applications, 19, 200–217.

Wang, L., Jia, F., Chen, L., Xu, Q., & Lin, X. (2021). Exploring the dependence structure among Chinese firms in the 5G industry. Industrial Management and Data Systems, 121, 409–435.

Wang, L., Yan, J., Chen, X., & Xu, Q. (2021). Do network capabilities improve corporate financial performance? Evidence from financial supply chains. International Journal of Operations and Production Management., 41, 336–358.

Weng, X., Lu, X., & Wu, Y. (2016). Research on the credit risk management of small and medium-sized enterprises based on supply chain finance. Journal of Finance and Accounting, 4, 245–253.

Wetzel, P., & Hofmann, E. (2019). Supply chain finance, financial constraints and corporate performance: An explorative network analysis and future research agenda. International Journal of Production Economics, 216, 364–383.

Wu, P., Gao, L., & Li, X. (2016). Does the reputation mechanism of media coverage affect earnings management?: Evidence from China. Chinese Management Studies, 10, 627–656.

Wu, X., & Liao, H. (2020). Utility-based hybrid fuzzy axiomatic design and its application in supply chain finance decision making with credit risk assessments. Computers in Industry, 114, 103144.

Xu, Q., Wang, L., Jiang, C. & Liu, Y. (2020). A novel (U)MIDAS-SVR model with multi-source market sentiment for forecasting stock returns. Neural Computing and Applications, 32(1), 5875–5888.

Yan, N., & He, X. (2020). Optimal trade credit with deferred payment and multiple decision attributes in supply chain finance. Computers and Industrial Engineering, 147, 106627.

Yu, Y., Huang, G., & Guo, X. (2020). Financing strategy analysis for a multi-sided platform with blockchain technology. International Journal of Production Research, 59, 4513–4532.

Zhang, L., Hu, H., & Zhang, D. (2015). A credit risk assessment model based on SVM for small and medium enterprises in supply chain finance. Financial Innovation, 1, 14.

Zhu, Y., Xie, C., Wang, G. J., & Yan, X. G. (2017). Comparison of individual, ensemble and integrated ensemble machine learning methods to predict China’s SME credit risk in supply chain finance. Neural Computing and Applications, 28, 41–50.

Zhu, Y., Zhou, L., Xie, C., Wang, G.-J., & Nguyen, T. V. (2019a). Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. International Journal of Production Economics, 211, 22–33.

Acknowledgements

The authors gratefully acknowledge financial support from the National Natural Science Foundation of China (71902159, 72171070, 71729001, 72025101), the Humanity and Social Science Foundation of Ministry of Education of China (20YJA630024), and the Fundamental Research Funds for the Central Universities (No. FRF-DF-20-11) the China Postdoctoral Science Foundation under Grant 2021M700380.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The pseudocode of SVM-based classifier

Appendix B: The pseudocode of ANN-based classifier

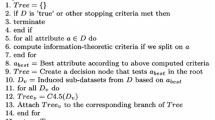

Appendix C: The pseudocode of C4.5 DT

Appendix D: The pseudocode of RF

Appedix E: The pseudocode of bagging

Appendix F: The pseudocode of GB

Appendix G: Variables and definition

Abbreviated | Attribute | Definition |

|---|---|---|

Supply chain capabilities | ||

TPS | CON | TPS is total purchases amount of enterprise from the top five suppliers |

PAS | CON | PAS is the proportion of the total purchase amount from the top five suppliers |

PRP | CON | PRP is the number of listed enterprises in the top five suppliers |

TFR | CON | TFR is total revenue of enterprise from the top five customers |

PTC | CON | PTC is the proportion of the total revenue from the top five customers |

PSP | CON | PSP is the number of listed enterprises in the top five customers |

Capital capabilities | ||

SCR | CON | SCR is the ratio of the net cash flows to the enterprise’s sales income |

CIR | CON | CIR is the ratio of cash flows to capital expenditure and cash dividends |

COI | CON | COI is the ratio of operating cash flows to operating cash |

CRA | CON | CRA is the ratio of net operating cash flows to total assets |

Management capabilities | ||

INT | CON | INT is the average times for an enterprise sold its total during a year |

TRA | CON | TRA is a measure for receivables by clients |

TRC | CON | TRC is the times of the current assets are turned over in a year |

ROA | CON | ROA compares the sales of an enterprise to its asset base |

APT | CON | APT refers to the liquidity of accounts payable of an enterprise |

ITD | CON | ITD is the number of days that an enterprise sells its inventory during a given year |

Profit capabilities | ||

NPT | CON | NPT is the ratio of net profit to total profits |

NIR | CON | NIR is ratio of the sum of net profit and shareholders’ profit to main business revenue |

TOC | CON | TOC is the proportion of operating costs to operating revenue |

MER | CON | MER is the management fee to revenue of main business |

CTP | CON | CTP is the ratio of cash to total profits |

Growth capabilities | ||

GTR | CON | GTR is the growth rate of total operating revenue for an enterprise |

NPR | CON | NPR is the year-on-year growth rate of net profit for an enterprise |

GTL | CON | GTL is the growth rate of total liabilities for an enterprise |

GRA | CON | GRA is the growth rate of total assets for an enterprise |

Solvency capabilities | ||

CUR | CON | GUR is a liquidity ratio that a firm has resources to meet its short-term obligations |

QUR | CON | QUR is the ratio that quick assets to extinguish its current liabilities immediately |

CAS | CON | CAS is the ratio of the sum of monetary to total current |

RBA | CON | RBA is the ratio of long-term borrowing to total assets |

Innovation capabilities | ||

NPA | CON | NPA is the total number of invention patent applications |

NPO | CON | NPO is the total number of invention patent granted |

RDP | CON | RDP is the ratio of R&D personnel to total employees |

RDR | CON | RDR is the ratio of R&D investment to total revenue |

Negative events | ||

NLD | BIN | NLD = 1 if the enterprise is involved in litigation disputes, else 0 |

CPR | BIN | CPR = 1 if the enterprise is punished by the regulator, else 0 |

EPR | BIN | EPR = 1 if the executives is punished by the regulator, else 0 |

MNN | BIN | MNN = 1 if the enterprise disclosed by the media with negative news, else 0 |

Related transactions | ||

TRT | MUL | TRT = 1 is loans; TRT = 2 is sell products; TRT = 3 is purchase assets; TRT = 4 is accept services; TRT = 5 is purchase goods; TRT = 6 is equity; TRT = 7 is provision of goods or services; TRT = 8 is rents; TRT = 9 is payment of expenses; TRT = 10 is asset transaction; TRT is fee; TRT = 12 is financial dealings; TRT = 13 is investment; TRT = 14 is proxy; TRT = 15 is construction; TRT = 16 is technical services; TRT = 17 is hydropower supply; TRT = 18 is receivable and payable; TRT = 19 is consulting services; TRT = 20 is transfer of assets; TRT = 21 is others |

MRT | CON | MRT is the total currency amount of related transactions |

CRR | BIN | CRR = 1 if the control relationship occurred between related enterprise and the enterprise, else 0 |

Appendix H: Relative importance for each predictor (%)

Variable | SVM | NN | DT | RF | BA | BO | Variable | SVM | NN | DT | RF | BA | BO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

TPS | 0.00 | 0.00 | 1.86 | 2.05 | 3.63 | 1.55 | CTP | 0.00 | 0.00 | 2.11 | 2.01 | 1.38 | 1.51 |

PAS | 2.44 | 2.41 | 0.00 | 2.52 | 1.24 | 1.87 | GTR | 9.80 | 9.79 | 5.05 | 8.71 | 5.64 | 9.14 |

PRP | 0.07 | 0.07 | 0.00 | 0.60 | 0.21 | 0.01 | NPR | 0.28 | 0.00 | 7.78 | 1.93 | 1.39 | 4.34 |

TFR | 0.87 | 0.10 | 3.20 | 1.73 | 1.76 | 1.42 | GTL | 0.00 | 0.00 | 3.20 | 2.86 | 1.78 | 2.72 |

PTC | 2.64 | 1.60 | 4.90 | 3.80 | 2.34 | 1.57 | GRA | 4.02 | 5.61 | 7.12 | 4.85 | 3.57 | 6.08 |

PSR | 0.03 | 0.03 | 0.00 | 0.43 | 0.41 | 0.03 | CUR | 1.35 | 1.79 | 0.00 | 1.99 | 1.43 | 1.44 |

SCR | 2.79 | 3.82 | 0.00 | 4.09 | 2.75 | 5.26 | QUR | 0.80 | 1.08 | 0.00 | 2.16 | 4.55 | 1.51 |

CIR | 0.00 | 0.00 | 3.74 | 1.64 | 2.66 | 1.64 | CAS | 5.17 | 6.13 | 8.21 | 4.38 | 5.57 | 3.76 |

COI | 2.88 | 2.66 | 0.00 | 2.08 | 2.13 | 2.45 | RBA | 1.72 | 1.67 | 0.00 | 2.53 | 2.09 | 2.97 |

CRA | 5.58 | 5.80 | 1.87 | 1.53 | 1.55 | 2.04 | NPA | 0.00 | 0.04 | 1.97 | 1.98 | 1.83 | 0.86 |

INT | 0.00 | 0.00 | 0.00 | 1.74 | 4.21 | 2.69 | NPO | 0.18 | 0.18 | 0.00 | 1.29 | 1.58 | 0.93 |

TRA | 0.00 | 0.03 | 4.84 | 1.83 | 2.88 | 0.84 | RDP | 2.00 | 1.43 | 0.00 | 2.46 | 4.39 | 2.99 |

TRC | 3.19 | 3.16 | 2.22 | 2.58 | 3.43 | 3.42 | RDR | 2.53 | 2.53 | 0.00 | 2.87 | 3.53 | 3.21 |

ROA | 4.96 | 5.81 | 1.85 | 2.72 | 2.76 | 3.63 | NLD | 0.31 | 0.00 | 0.00 | 0.25 | 0.00 | 0.08 |

APT | 1.31 | 1.30 | 2.36 | 2.27 | 1.26 | 3.89 | CPR | 4.58 | 4.14 | 2.52 | 0.72 | 3.01 | 1.06 |

ITD | 4.63 | 3.77 | 4.84 | 3.70 | 3.78 | 2.14 | EPR | 1.44 | 1.75 | 2.79 | 0.57 | 0.30 | 0.18 |

NPT | 0.00 | 0.00 | 0.00 | 3.14 | 2.11 | 2.91 | MNN | 2.28 | 2.28 | 0.00 | 0.90 | 0.32 | 0.11 |

NIR | 13.25 | 12.27 | 14.106 | 5.17 | 6.13 | 5.51 | TRT | 0.48 | 0.47 | 0.00 | 1.12 | 1.93 | 0.69 |

TOC | 14.66 | 15.65 | 13.53 | 6.36 | 4.40 | 8.82 | MRT | 2.83 | 0.74 | 0.00 | 3.83 | 3.44 | 3.39 |

MER | 0.82 | 0.81 | 0.00 | 2.20 | 1.54 | 1.22 | CRR | 0.15 | 0.27 | 0.00 | 0.39 | 0.00 | 0.17 |

Appendix I: The selected key predictor via ensemble learning

Models | TPS | PAS | PRP | TFR | PTC | PSR | SCR | CIR | COI | CRA | INT | TRA | TRC | ROA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

SVM | X | X | X | X | √ | X | √ | X | √ | √ | X | X | √ | √ |

NN | X | X | X | X | X | X | √ | X | √ | √ | X | X | √ | √ |

DT | X | X | X | √ | √ | X | √ | √ | X | X | X | √ | X | X |

RF | X | √ | X | X | √ | X | X | X | X | X | X | X | √ | √ |

BA | √ | X | X | X | √ | X | √ | √ | X | X | √ | √ | √ | √ |

BO | X | X | X | X | X | X | √ | X | X | X | √ | X | √ | √ |

EM | X | X | X | X | √ | X | √ | X | X | X | X | X | √ | √ |

Models | APT | ITD | NPT | NIR | TOC | MER | CTP | GTR | NPR | GTL | GRA | CUR | QUR | CAS |

SVM | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

NN | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

DT | X | √ | X | √ | √ | X | X | √ | √ | √ | √ | X | X | √ |

RF | X | √ | √ | √ | √ | X | X | √ | X | X | √ | X | X | √ |

BA | X | √ | X | √ | √ | X | X | √ | X | X | √ | √ | √ | √ |

BO | √ | X | √ | √ | √ | X | X | √ | √ | √ | √ | X | X | √ |

EM | X | √ | X | √ | √ | X | X | √ | X | X | √ | X | X | √ |

Models | RBA | NPA | NPO | RDP | RDR | NLD | CPR | EPR | MNN | TRT | MRT | CRR | ||

SVM | X | X | X | X | √ | X | √ | X | X | X | √ | X | ||

NN | X | X | X | X | √ | X | √ | X | X | X | X | X | ||

DT | X | X | X | X | X | X | √ | √ | X | X | X | X | ||

RF | √ | X | X | X | √ | X | X | X | X | X | √ | X | ||

BA | X | X | X | √ | √ | X | √ | X | X | X | √ | X | ||

BO | √ | X | X | √ | √ | X | X | X | X | X | √ | X | ||

EM | X | X | X | X | √ | X | √ | X | X | X | √ | X |

Rights and permissions

About this article

Cite this article

Wang, L., Jia, F., Chen, L. et al. Forecasting SMEs’ credit risk in supply chain finance with a sampling strategy based on machine learning techniques. Ann Oper Res 331, 1–33 (2023). https://doi.org/10.1007/s10479-022-04518-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04518-5