Abstract

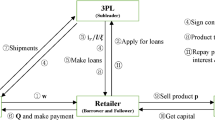

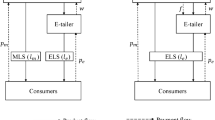

This study explores the operation decisions of a dual-channel supply chain consisting of a capital-constrained manufacturer, an e-commerce platform (ECP), and a third-party logistics company (3PL). This study first proposes two game models to obtain the equilibrium solutions of the supply chain members. Then, it compares and analyzes the equilibrium strategies under the two financing modes. This study has obtained the following interesting findings. The increase of the ECP interest rate will reduce the profit of the unit product in the distribution channel. However, the total income of the ECP will increase with the increase in the financing income. Under the 3PL financing mode, if the transportation fee of the direct sales channel is lower than that of the distribution channel, the ECP will reduce the sales price to compete with the direct sales channel of the manufacturer. Under the same conditions, the ECP financing mode is more competitive than the 3PL financing mode, and ECP financing services are the dominant strategy for the manufacturer, ECP, and consumers. If a 3PL company wants to win in the financing service, lowering interest rate or implementing differentiated transportation charges are important measures.

Similar content being viewed by others

References

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: Are small firms different? Journal of Financial Economics, 89(3), 467–487.

Cai, G. G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Chen, X., & Cai, G. G. (2011). Joint logistics and financial services by a 3PL firm. European Journal of Operational Research, 214(3), 579–587.

Chen, Z., Fang, L., & Wang, H. (2019). Internal incentives and operations strategies for the water-saving supply chain with cap-and-trade regulation. Frontiers of Engineering Management, 6(1), 87–101.

Croom, S. R. (2005). The impact of e-business on supply chain management. International Journal of Operations & Production Management, 25(1), 55–73.

Dada, M., & Hu, Q. (2008). Financing newsvendor inventory. Operations Research Letters, 36(5), 569–573.

David, A., & Adida, E. (2015). Competition and coordination in a two-channel supply chain. Production and Operations Management, 24(8), 1358–1370.

Dong, L., Ren, L., & Zhang, D. (2019). Financing small and medium-size enterprises via retail platforms. Available at SSRN 3257899.

Fassnacht, M., & Unterhuber, S. (2016). Consumer response to online/offline price differentiation. Journal of Retailing and Consumer Services, 28, 137–148.

Ghosh, D., & Shah, J. (2012). A comparative analysis of greening policies across supply chain structures. International Journal of Production Economics, 135(2), 568–583.

Gong, D., Liu, S., Liu, J., & Ren, L. (2020). Who benefits from online financing? A sharing economy E-tailing platform perspective. International Journal of Production Economics, 222, 107490.

Hua, S., Liu, J., Cheng, T. E., & Zhai, X. (2019). Financing and ordering strategies for a supply chain under the option contract. International Journal of Production Economics, 208, 100–121.

Huang, S., Fan, Z. P., & Wang, N. (2020). Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transportation Research Part E, 136, 101885.

Huang, S., Fan, Z. P., & Wang, X. (2019). Optimal operational strategies of supply chain under financing service by a 3PL firm. International Journal of Production Research, 57(11), 3405–3420.

Jing, B., & Seidmann, A. (2014). Finance sourcing in a supply chain. Decision Support Systems, 58, 15–20.

Jing, B., Chen, X., & Cai, G. (2012). Equilibrium financing in a distribution channel with capital constraint. Production and Operations Management, 21(6), 1090–1101.

Khouja, M., Park, S., & Cai, G. G. (2010). Channel selection and pricing in the presence of retail-captive consumers. International Journal of Production Economics, 125(1), 84–95.

Kouvelis, P., & Zhao, W. (2012). Financing the newsvendor: supplier vs. bank, and the structure of optimal trade credit contracts. Operations Research, 60(3), 566–580.

Lam, H. K., Zhan, Y., Zhang, M., Wang, Y., & Lyons, A. (2019). The effect of supply chain finance initiatives on the market value of service providers. International Journal of Production Economics, 216, 227–238.

Li, B., Chen, P., Li, Q., & Wang, W. (2014). Dual-channel supply chain pricing decisions with a risk-averse retailer. International Journal of Production Research, 52(23), 7132–7147.

Li, B., Zhu, M., Jiang, Y., & Li, Z. (2016). Pricing policies of a competitive dual-channel green supply chain. Journal of Cleaner Production, 112, 2029–2042.

Li, J., Zhu, S., Zhang, W., & Yu, L. (2020). Blockchain-driven supply chain finance solution for small and medium enterprises. Frontiers of Engineering Management, 7(4), 500–511.

Lu, Q., Gu, J., & Huang, J. (2019). Supply chain finance with partial credit guarantee provided by a third-party or a supplier. Computers & Industrial Engineering, 135, 440–455.

Shen, Y., Willems, S. P., & Dai, Y. (2019). Channel selection and contracting in the presence of a retail platform. Production and Operations Management, 28(5), 1173–1185.

Soleimani, F. (2016). Optimal pricing decisions in a fuzzy dual-channel supply chain. Soft Computing, 20(2), 689–696.

Song, H., Yu, K., & Lu, Q. (2018). Financial service providers and banks’ role in helping SMEs to access finance. International Journal of Physical Distribution & Logistics Management, 48(1), 69–92.

Tseng, M. L., Lim, M. K., & Wu, K. J. (2019). Improving the benefits and costs on sustainable supply chain finance under uncertainty. International Journal of Production Economics, 218, 308–321.

Tunca, T. I., & Zhu, W. (2018). Buyer intermediation in supplier finance. Management Science, 64(12), 5631–5650.

Wang, C., Fan, X., & Yin, Z. (2019a). Financing online retailers: Bank vs. electronic business platform, equilibrium, and coordinating strategy. European Journal of Operational Research, 276(1), 343–356.

Wang, F., Yang, X., Zhuo, X., & Xiong, M. (2019). Joint logistics and financial services by a 3PL firm: Effects of risk preference and demand volatility. Transportation Research Part E: Logistics and Transportation Review, 130, 312–328.

Wang, Z., Wang, Q., Lai, Y., & Liang, C. (2020). Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. International Journal of Production Economics, 220, 107453.

Wuttke, D. A., Blome, C., Heese, H. S., & Protopappa-Sieke, M. (2016). Supply chain finance: Optimal introduction and adoption decisions. International Journal of Production Economics, 178, 72–81.

Xia, C., Xiao, Y., Zhuo, W., & Hsiao, Y. (2020). Mixed financing strategies for capital-constrained retailer in the Chinese financial market. Pacific-Basin Finance Journal, 63, 101395.

Xu, X., Chen, X., Jia, F., Brown, S., Gong, Y., & Xu, Y. (2018). Supply chain finance: A systematic literature review and bibliometric analysis. International Journal of Production Economics, 204, 160–173.

Yan, N., Liu, Y., Xu, X., & He, X. (2020). Strategic dual-channel pricing games with e-retailer finance. European Journal of Operational Research, 283(1), 138–151.

Yan, N., Zhang, Y., Xu, X., & Gao, Y. (2021). Online finance with dual channels and bidirectional free-riding effect. International Journal of Production Economics, 231, 107834.

Yang, H., Sun, F., Chen, J., & Chen, B. (2019). Financing decisions in a supply chain with a capital-constrained manufacturer as new entrant. International Journal of Production Economics, 216, 321–332.

Yang, W., Zhang, J., & Yan, H. (2021). Impacts of online consumer reviews on a dual-channel supply chain. Omega, 101, 102266.

Zhang, C., Wang, Y., & Ma, P. (2021a). Optimal channel strategies in a supply chain under green manufacturer financial distress with advance payment discount. International Transactions in Operational Research, 28(3), 1347–1370.

Zhang, C., Wang, Y., Liu, Y., & Wang, H. (2021b). Coordination contracts for a dual-channel supply chain under capital constraints. Journal of Industrial & Management Optimization, 17(3), 1485.

Zhang, P., He, Y., & Shi, C. V. (2017). Retailer’s channel structure choice: Online channel, offline channel, or dual channels? International Journal of Production Economics, 191, 37–50.

Acknowledgements

The authors sincerely thank the editors and anonymous reviewers for their constructive comments and suggestions. This research is partially supported by the National Natural Science Foundation of China under the grant nos. 71871153 and 71963025; the sponsorship of the Tang Scholar of Soochow University; Postgraduate Research & Practice Innovation Program of Jiangsu Province under the grant no. KYCX21_2924.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Proof of Proposition 1

After substituting \(p_{{1}}^{E} - \hat{\omega } - t_{1} = n\) into the profit function \(\pi_{m}^{E}\), the first and second derivative functions of \(\pi_{m}^{E}\) with respect to \(p_{2}^{E}\) and \(\hat{\omega }\) are.

\(\frac{{\partial \pi_{m}^{E} }}{{\partial p_{2}^{E} }}{ = }\alpha + \beta p_{1}^{E} - \beta (c - \hat{\omega }) + (c + t_{1} - 2p_{2}^{E} ) + c({1} - \beta )(i^{E} + 1)\), \(\frac{{\partial^{2} \pi_{m}^{E} }}{{\partial (p_{2}^{E} )^{2} }}{ = } - {2}\),

\(\frac{{\partial \pi_{m}^{E} }}{{\partial \hat{\omega }}}{ = }\alpha + c - p_{{1}}^{E} - \hat{\omega } + \beta p_{2}^{E} - \beta [c + t_{1} - p_{2}^{E} ] + c({1} - \beta )(i^{E} + 1)\), \(\frac{{\partial^{2} \pi_{m}^{E} }}{{\partial \hat{\omega }^{2} }} = - 2\).

Given that \(0 < \beta < 1\), the Hessian matrix \(H(p_{2}^{E} ,\hat{\omega }) = \left[ {\begin{array}{*{20}c} {\begin{array}{*{20}c} { - 2} \\ {2\beta } \\ \end{array} } & {\begin{array}{*{20}c} {2\beta } \\ { - 2} \\ \end{array} } \\ \end{array} } \right]\) is a second-order negative definite matrix. That is, a unique set of optimal solutions (\(p_{2}^{E}\) and \(\hat{\omega }\)) can maximize the manufacturer’s profit. After setting \(\frac{{\partial \pi_{m}^{E} }}{{\partial p_{2}^{E} }}{ = 0}\) and \(\frac{{\partial \pi_{m}^{E} }}{{\partial \hat{\omega }}}{ = 0}\), we obtain two equations: \(p_{2}^{E} = \frac{{\beta (p_{1}^{E} + \hat{\omega }) + \alpha + c(1 - \beta )(i^{E} + 2) + t_{1} }}{{2}}\) and \(\hat{\omega } = {2}\beta p_{2}^{E} - p_{1}^{E} + \alpha + c(1 - \beta )(i^{E} + 2) - \beta t_{1}\). According to the two equations, we can obtain \(p_{2}^{E*} = \frac{{t_{1} + c(i^{E} + 2)}}{2} + \frac{\alpha }{{{2}(1 - \beta )}}\) and \(\hat{\omega }^{ - } = \frac{{\alpha + c(1 - \beta )(i^{E} + 2)}}{2(1 - \beta )} - \frac{{t_{1} + n}}{2}\).

After substituting \(p_{2}^{E*}\) and \(\hat{\omega }^{ - }\) into the profit function \(\pi_{p}^{E}\), the first and second derivative functions of \(\pi_{p}^{E}\) with respect to \(n\) are \(\frac{{\partial^{2} \pi_{p}^{E} }}{{\partial n^{2} }} = - {1 < 0}\) and \(\frac{{\partial \pi_{p}^{E} }}{\partial n} = \frac{{\alpha - 2n - (2c + 2ci^{E} + t_{1} )(1 - \beta )}}{2}\). After setting \(\frac{{\partial \pi_{p}^{E} }}{\partial n} = {0}\), the optimal sales revenue per unit product in the ECP distribution channel is \(n^{*} = \frac{{\alpha - 2c(1 + i^{E} )(1 - \beta ) - t_{1} (1 - \beta )}}{2}\). By substituting \(n^{*}\) into \(\hat{\omega }^{ - }\), we obtain \(\hat{\omega }^{*} = \frac{{2c(2 - \beta )i^{E} - (1 + \beta )t_{1} }}{4} + M\). According to \(p_{{1}}^{E} - \hat{\omega } - t_{1} = n\) and \(\hat{\omega }^{*}\), we can obtain the optimal selling price of the ECP distribution channel, that is, \(p_{1}^{E*} = \frac{{2\beta ci^{E} + t_{1} + \beta t_{{1}} }}{4} + N\), where \(M = \frac{6c - 2c\beta }{4} + \frac{\alpha (1 + \beta )}{{4(1 - \beta )}}\) and \(N = \frac{{\alpha {(3} - \beta )}}{4(1 - \beta )} + \frac{{2c({1} + \beta )}}{4}\).

Proof of Proposition 2

After substituting \(p_{{1}}^{L} - \omega - t_{{1}} = n\) into the profit function \(\pi_{m}^{L}\), the first and second derivative functions of \(\pi_{m}^{L}\) with respect to \(p_{2}^{E}\) and \(\hat{\omega }\) could be obtained. By setting \(\frac{{\partial \pi_{m}^{L} }}{{\partial p_{2}^{L} }}{ = 0}\) and \(\frac{{\partial \pi_{m}^{L} }}{\partial \omega }{ = 0}\), we obtain two equations: \(p_{{2}^{L-}} = \frac{{\alpha + \beta ({p_{1}^{L}} + \omega ) + c(1 - \beta )({i^{L}} + 2) + t_{2} }}{{2}}\) and \({\omega^{ - }} = \alpha - {p_{1}^{L}} + {2}\beta {p_{2}^{L}} + c(1 - \beta )({i^{L}} + 2) - \beta t_{2}\). According to the two equations, we can obtain \(p_{2}^{L*} = \frac{\alpha }{{{2}(1 - \beta )}} + \frac{{t_{2} + c(i^{L} + 2)}}{2}\) and \(\omega^{ - } = \frac{{\alpha + c(1 - \beta )(i^{L} + 2)}}{2(1 - \beta )} - \frac{{t_{1} + n}}{2}\).

After substituting \(p_{2}^{L*}\) and \(\omega^{ - }\) into the profit function \(\pi_{p}^{L}\), the first and second derivative functions of \(\pi_{p}^{E}\) with respect to \(n\) are \(\frac{{\partial^{2} \pi_{p}^{L} }}{{\partial n^{2} }} = - {1 < 0}\), \(\frac{{\partial \pi_{p}^{L} }}{\partial n} = \frac{{\alpha - 2n - (2c + ci^{L} )(1 - \beta ) - t_{1} + \beta t_{2} }}{2}\). According to \(\frac{{\partial \pi_{p}^{L} }}{\partial n}{ = 0}\), \(p_{{1}}^{L} - \omega - t_{{1}} = n\), and \(\omega^{ - } = \frac{{\alpha + c(1 - \beta )(i^{L} + 2)}}{2(1 - \beta )} - \frac{{t_{1} + n}}{2}\), we obtain \(\omega^{*} = \frac{{c({3} - \beta )i^{L} - t_{{1}} - \beta t_{2} }}{4} + M\), where \(M = \frac{6c - 2c\beta }{4} + \frac{\alpha (1 + \beta )}{{4(1 - \beta )}}\) and \(N = \frac{{\alpha {(3} - \beta )}}{4(1 - \beta )} + \frac{{2c({1} + \beta )}}{4}\).

Proof of Proposition 3

The first and second derivative functions of \(\pi_{p}^{E}\) with respect to \(i^{E}\) are \(\frac{{\partial \pi_{p}^{E} }}{{\partial i^{E} }} = \frac{{c(1 + \beta )[2\alpha - (2K + t_{1} + 2c(1 + i^{E} ))(1 - \beta )]}}{2}\) and \(\frac{{\partial^{{2}} \pi_{p}^{E} }}{{\partial (i^{E} )^{2} }} = c^{2} (\beta^{2} - 1) < 0\). We conclude that \(\pi_{p}^{E}\) is a strictly concave function with respect to \(i^{E}\). By setting \(\frac{{\partial \pi_{p}^{E} }}{{\partial i^{E} }} = {0}\), we obtain \(i^{E*} = \frac{{2\alpha - (2K + 2c + t_{1} )(1 - \beta )}}{2c(1 - \beta )}\).

Proof of Corollary 3

-

(1)

The first derivative of \(i^{E*}\) with respect to \(t_{1}\) is \(\frac{{\partial i^{E*} }}{{\partial t_{1} }} = - \frac{{t_{1} }}{2c} < 0\). Then, we could conclude that \(i^{E*}\) is always negatively related to \(t_{1}\).

-

(2)

The first derivative of \(i^{E*}\) with respect to \(c\) is \(\frac{{\partial i^{E*} }}{\partial c} = \frac{{\alpha - (1 - \beta )t_{1} }}{{2c^{2} (\beta - 1)}}\). Given that \(2c^{2} (\beta - 1) < 0\), the sign of \(\frac{{\partial i^{E*} }}{\partial c}\) depends on \(\alpha - (1 - \beta )t_{1}\). According to \(\alpha > (1 - \beta )(2c + t_{1} )\), we obtain \(\frac{{\partial i^{E*} }}{\partial c} < 0\) holds.

Proof of Proposition 4

According to \(\frac{{\partial \pi_{t}^{L} }}{{\partial i^{L} }} = \frac{{c[(3 + \beta )\alpha - 2c(1 - \beta )(3 + \beta )(1 + i^{L} ) - 2t_{1} (1 - \beta ) - 2t_{2} (1 - \beta )(2 + \beta )]}}{4}\) and \(\frac{{\partial^{{2}} \pi_{t}^{L} }}{{\partial (i^{L} )^{2} }} = \frac{{c^{2} (\beta^{2} + 2\beta - 3)}}{2} < 0\), we conclude that \(\pi_{t}^{L}\) is a strictly concave function with respect to \(i^{L}\). By setting \(\frac{{\partial \pi_{t}^{L} }}{{\partial i^{L} }} = {0}\), we obtain \(i^{L*} = \frac{\alpha }{2c(1 - \beta )} - \frac{{t_{1} + (2 + \beta )t_{2} }}{c(3 + \beta )} - 1\). Given that \(0 < i^{L*} < 1\), we have \(0 < \alpha (3 + \beta ) - 2(1 - \beta )(t_{1} + (2 + \beta )t_{2} + c(3 + \beta )) < 2c(1 - \beta )(3 + \beta )\). Solving the inequality, we can obtain the requirement that \(\frac{{2(1 - \beta )(t_{1} + (2 + \beta )t_{2} + c(3 + \beta ))}}{3 + \beta } < \alpha < \frac{{2(1 - \beta )(t_{1} + (2 + \beta )t_{2} + 2c(3 + \beta ))}}{3 + \beta }\).

Proof of Corollary 4

Given that \(\frac{{\partial i^{L*} }}{{\partial t_{1} }} = \frac{\beta - 1}{{c(3 - \beta^{2} - 2\beta )}} < 0\), \(i^{L*}\) is always negatively related to \(t_{1}\).

Given that \(\frac{{\partial i^{L*} }}{{\partial t_{{2}} }} = \frac{{\beta + \beta^{2} - 2}}{{c(3 - \beta^{2} - 2\beta )}} < 0\), \(i^{L*}\) is always negatively related to \(t_{{2}}\).

The first derivative of \(i^{L*}\) with respect to \(c\), namely, \(\frac{{\partial i^{L*} }}{\partial c} = - \frac{{\alpha (3 + \beta ) - 2(1 - \beta )(t_{1} + (2 + \beta )t_{2} )}}{{2c^{2} (1 - \beta )(\beta + 3)}} < 0\).

Proof of Corollary 5

-

(i)

On the basis of Sect. 4.1, we have \(\hat{\omega }^{*} - \omega^{*} = \frac{{2c(2 - \beta )i^{E} - c({3} - \beta )i^{L} - \beta (t_{1} - t_{2} )}}{4}\). Therefore, if \(\phi_{1} > \Delta t\), then we have \(\hat{\omega }^{*} > \omega^{*}\); if \(\phi_{1} \le \Delta t\), then we have \(\hat{\omega }^{*} \le \omega^{*}\), where \(\phi_{{1}} { = }\frac{{({4} - {2}\beta )ci^{E} - (3 - \beta )ci^{L} }}{\beta }\)

-

(ii)

\(p_{1}^{E*} - p_{1}^{L*} = \frac{{2\beta ci^{E} - (1 + \beta )ci^{L} + \beta (t_{1} - t_{2} )}}{4}\). Therefore, if \(\phi_{{2}} < \Delta t\), then we have \(p_{1}^{E*} > p_{1}^{L*}\); if \(\phi_{{2}} \ge \Delta t\), then we have \(p_{1}^{E*} \le p_{1}^{L*}\), where \(\phi_{{2}} { = }\frac{{(1 + \beta )ci^{L} - 2\beta ci^{E} }}{\beta }\).

-

(iii)

Similarly, \(p_{2}^{E*} - p_{2}^{L*} = \frac{{c(i^{E} - i^{L} ) + (t_{1} - t_{2} )}}{2}\). Therefore, if \(\phi_{{3}} < \Delta t\), then we have \(p_{2}^{E*} > p_{2}^{L*}\); if \(\phi_{{3}} \ge \Delta t\), then we have \(p_{2}^{E*} \le p_{2}^{L*}\), where \(\phi_{{3}} { = }c(i^{L} - i^{E} )\).

Proof of Corollary 6

The proof of Corollary 6 is similar to that of Corollary 5.

Proof of Corollary 7

In the formula \(i^{E*} - i^{L*} = \frac{{2t_{2} (2 + \beta ) - t_{1} (1 + \beta )}}{2c(3 + \beta )}\), the denominator is positive, namely, \({2}c(3 + \beta ) > 0\). Therefore, if the numerator is greater than zero, then \(i^{E*} - i^{L*} > 0\) holds. The inequality (the numerator is greater than zero) can be transformed into \(0 < t_{1} < \frac{{{2}(\beta + 2)}}{1 + \beta }t_{2}\). Therefore, if \(t_{1} > \frac{{{2}(2 + \beta )}}{1 + \beta }t_{2}\), then \(i^{E*} < i^{L*}\) holds; if \(0 < t_{1} < \frac{{{2}(2 + \beta )}}{1 + \beta }t_{2}\), then \(i^{E*} > i^{L*}\) holds. By setting \(t_{1} = t_{2}\), we find that \(i^{E*} - i^{L*} > 0\) always holds.

Proof of Corollary 8

-

(1)

According to the subtraction of the two profit functions, we obtain \(\pi_{m}^{E*} - \pi_{m}^{L*} = \frac{ci(1 - \beta )(2\alpha - (4c + 2t + ci)(1 - \beta ))}{{16}}\). When \(i^{E} = i^{L} = i\) and \(t_{1} = t_{2} = t\), then according to \(d_{{1}}^{E*} = \frac{{\alpha - (2c + t_{1} )(1 - \beta )}}{4} > 0\) and \(d_{{2}}^{E*} = \frac{{\alpha (2 + \beta ) - (2c + t_{1} + ci^{E} )(1 - \beta )(2 + \beta ) - ci^{E} (1 - \beta )\beta }}{4} > 0\), we can obtain \(\alpha > ({2}c + t)(1 - \beta )\) and \(\alpha > ({2}c + t + ci)(1 - \beta )\). Therefore, if \(2\alpha > (4c + 2t + ci)(1 - \beta )\), then \(\pi_{m}^{E*} - \pi_{m}^{L*} > 0\) holds.

-

(2)

The first derivative of \(\pi_{m}^{E*} - \pi_{m}^{L*}\) with respect to \(t\) is \(\frac{{\partial (\pi_{m}^{E*} - \pi_{m}^{L*} )}}{\partial t} = \frac{{ - (c(\beta - 1)(4i^{E} - 5i^{L} + 4\beta i^{E} - 3\beta i^{L} ))}}{8}\). If \(\frac{{i^{E} }}{{i^{L} }} > \frac{(5 + 3\beta )}{{4(1 + \beta )}}\), then we obtain \(\frac{{\partial (\pi_{m}^{E*} - \pi_{m}^{L*} )}}{\partial t} > 0\); if \(\frac{{i^{E} }}{{i^{L} }} < \frac{(5 + 3\beta )}{{4(1 + \beta )}}\), then we obtain \(\frac{{\partial (\pi_{m}^{E*} - \pi_{m}^{L*} )}}{\partial t} < 0\). By setting \(\pi_{m}^{E*} - \pi_{m}^{L*} = 0\), we obtain \(t = t^{\prime}\). Therefore, when \(\frac{{i^{E} }}{{i^{L} }} > \frac{(5 + 3\beta )}{{4(1 + \beta )}}\), if \(0 < t^{\prime} < t\), then \(\pi_{m}^{E*} > \pi_{m}^{L*}\) holds; if \(0 < t < t^{\prime}\), then \(\pi_{m}^{E*} < \pi_{m}^{L*}\) holds. When \(\frac{{i^{E} }}{{i^{L} }} < \frac{(5 + 3\beta )}{{4(1 + \beta )}}\), if \(0 < t^{\prime} < t\), then \(\pi_{m}^{E*} < \pi_{m}^{L*}\) holds; if \(0 < t < t^{\prime}\), then \(\pi_{m}^{E*} > \pi_{m}^{L*}\) holds.

-

(3)

After setting \(\pi_{m}^{E*} - \pi_{m}^{L*} = 0\), we can obtain the two roots of the equation, namely, \(i_{1}\) and \(i_{{2}}\). By solving \(\frac{{\partial (\pi_{m}^{E*} - \pi_{m}^{L*} )}}{\partial i} > 0\), we obtain \(i < \tilde{i} = \frac{{\alpha - 2c(1 - \beta ) + (3 + 4\beta )t_{1} - (4 + 3\beta )t_{2} }}{c(1 - \beta )}\). That is, if \(i < \tilde{i}\), then \(\pi_{m}^{E*} - \pi_{m}^{L*}\) increases as \(i\) increases; if \(i > \tilde{i}\), then \(\pi_{m}^{E*} - \pi_{m}^{L*}\) decreases as \(i\) increases. Given that \(\pi_{m}^{E*} - \pi_{m}^{L*}\) is a quadratic function with respect to \(i\), if \(i_{1} < i < i_{2}\), then \(\pi_{m}^{E*} > \pi_{m}^{L*}\) holds; if \(i < i_{1}\) or \(i > i_{{2}}\), then \(\pi_{m}^{E*} < \pi_{m}^{L*}\) holds.

Proof of Corollary 9

Rights and permissions

About this article

Cite this article

Sun, J., Yuan, P. & Hua, L. Pricing and financing strategies of a dual-channel supply chain with a capital-constrained manufacturer. Ann Oper Res 329, 1241–1261 (2023). https://doi.org/10.1007/s10479-022-04602-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04602-w