Abstract

We establish a supply chain finance scheme containing a cash-strapped supplier, a creditworthy retailer as well as a financial institution to explore whether the positive or negative salvage value has a crucial impact on the order decisions and financing strategies. Buyer-backed purchase order financing and advanced payment discount (APD) financing are considered to settle the supplier’s fund shortage problem. We found that the positive and negative salvage values affect (1) the retailer’s optimal order quantity. The buyer orders more products with positive salvage value than those with no salvage value and reduces orders for items with negative salvage value; (2) the profits in the supply chain. Ordering items with a positive salvage value can reduce the risk of loss compared to orders with no salvage value, which leads to more gains for the buyer and the whole supply chain, while orders for items with negative salvage increase the losses, resulting in lower profits; (3) the threshold of the retailer’s internal asset level under single financing. The higher salvage value brings more inventory risk to the retailer; hence the retailer should have a higher asset level to ensure that there is sufficient capital to finance the supplier via APD. Finally, we verify the results by numerical experiments and present some managerial implications for different industries.

Similar content being viewed by others

References

Babich, V. (2010). Independence of capacity ordering and financial subsidies to risky suppliers. Manufacturing & Service Operations Management, 12(4), 583–607.

Bi, G., Song, L., & Fei, Y. (2018). Dynamic mixed-item inventory control with limited capital and short-term financing. Annals of Operations Research, 35(3), 1–32.

Birge, J. R. (2015). OM forum—Operations and finance interactions. Manufacturing Service Operations Management, 17(1), 4–15.

Biswas, I., & Avittathur, B. (2018). The price-setting limited clearance sale inventory model. Annals of Operations Research. https://doi.org/10.1007/s10479-018-2811-5

Cachon, G. P., & Kök, A. G. (2007). Implementation of the newsvendor model with clearance pricing: How to (and how not to) estimate a salvage value. Manufacturing & Service Operations Management, 9(3), 276–290.

Cai, G. G., Chen, X., & Xiao, Z. (2014). The roles of bank and trade credits: Theoretical analysis and empirical evidence. Production and Operations Management, 23(4), 583–598.

Cai, Y. J., Chen, Y., Siqin, T., Choi, T. M., & Chung, S. H. (2019). Pay upfront or pay later? Fixed royal payment in sustainable fashion brand franchising. International Journal of Production Economics, 214, 95–105.

Cao, E., & Yu, M. (2018). Trade credit financing and coordination for an emission-dependent supply chain. Computers & Industrial Engineering, 119, 50–62.

Cao, Y., Zhang, J. H., & Ma, X. Y. (2019). Optimal financing and production decisions for a supply chain with buyer-backed purchase order financing contract. IEEE Access, 7, 119384–119392.

Chen, J., Zhou, Y. W., & Zhong, Y. (2017). A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. International Journal of Production Research, 55(18), 5287–5304.

Chen, X., Lu, Q., & Cai, G. G. (2017). Retailer early payment financing in pull supply chains. Social Science Electronic Publishing. https://doi.org/10.2139/ssrn.3021460

Chod, J. (2017). Inventory, risk shifting, and trade credit. Management Science, 63(10), 3207–3225.

Choi, T. M. (2020a). Supply chain financing using blockchain: Impacts on supply chains selling fashionable products. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03615-7

Choi, T. M. (2020b). Financing product development projects in the blockchain era: Initial coin offerings versus traditional bank loans. IEEE Transactions on Engineering Management. https://doi.org/10.1109/TEM.2020.3032426

Dobbs, I. M. (2004). Replacement investment: Optimal economic life under uncertainty. Journal of Business Finance & Accounting, 31(5–6), 729–757.

Dong, G., Liang, L., Wei, L., Xie, J., & Yang, G. (2021). Optimization model of trade credit and asset-based securitization financing in carbon emission reduction supply chain. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04011-5

Du, M., Chen, Q., Xiao, J., Yang, H., & Ma, X. (2020). Supply chain finance innovation using blockchain. IEEE Transactions on Engineering Management, 67(4), 1045–1058.

Fan, X., Zhao, W., Zhang, T., & Yan, E. (2020). Mobile payment, third-party payment platform entry and information sharing in supply chains. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03749-8

Fu, H., Ke, G. Y., Lian, Z., & Zhang, L. (2021). 3PL firm’s equity financing for technology innovation in a platform supply chain. Transportation Research Part E: Logistics and Transportation Review, 147, 102239.

Fisher, M., & Raman, A. (1996). Reducing the cost of demand uncertainty through accurate response to early sales. Operations Research, 44(1), 87–99.

Gamba, A., & Triantis, A. J. (2014). Corporate risk management: Integrating liquidity, hedging, and operating policies. Management Science, 60(1), 246–264.

Guo, S., & Liu, N. (2020). Influences of supply chain finance on the mass customization program: Risk attitudes and cash flow shortage. International Transactions in Operational Research, 27(5), 2396–2421.

Hu, W., Li, Y., & Govindan, K. (2014). The impact of consumer returns policies on consignment contracts with inventory control. European Journal of Operational Research, 233(2), 398–407.

Hua, S., Sun, S., Liu, Z., & Zhai, X. (2021). Benefits of third-party logistics firms as financing providers. European Journal of Operational Research, 294(1), 174–187.

Huang, B., Wu, A., & Chiang, D. (2018). Supporting small suppliers through buyer-backed purchase order financing. International Journal of Production Research, 56(18), 6066–6089.

Huang, J., Yang, W., & Tu, Y. (2019). Supplier credit guarantee loan in supply chain with financial constraint and bargaining. International Journal of Production Research, 57(22), 7158–7173.

Jing, B., Chen, X., & Cai, G. G. (2012). Equilibrium financing in a distribution channel with capital constraint. Production and Operations Management, 21(6), 1090–1101.

Kalakbandi, V. K. (2018). Managing the misbehaving retailer under demand uncertainty and imperfect information. European Journal of Operational Research, 269(3), 939–954.

Keren, B., & Pliskin, J. S. (2006). A benchmark solution for the risk-averse newsvendor problem. European Journal of Operational Research, 174(3), 1643–1650.

Khan, M. A. A., Shaikh, A. A., Panda, G. C., Konstantaras, I., & Cárdenas-Barrón, L. E. (2019). The effect of advance payment with discount facility on supply decisions of deteriorating products whose demand is both price and stock dependent. International Transactions in Operational Research, 27(3), 1343–1367.

Kouvelis, P., & Zhao, W. (2012). Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Operations Research, 60(3), 566–580.

Lekkakos, S. D., Johnson, M., & Serrano, A. (2016). Supply chain finance for small and medium sized enterprises: The case of reverse factoring. International Journal of Physical Distribution & Logistics Management, 46(4), 367–392.

Li, R., Teng, J. T., & Zheng, Y. (2019). Optimal credit term, order quantity and selling price for perishable products when demand depends on selling price, expiration date, and credit period. Annals of Operations Research, 280(1–2), 377–405.

Li, Y., Zhen, X., & Cai, X. (2014). Trade credit insurance, capital constraint, and the behavior of manufacturers and banks. Annals of Operations Research, 240(2), 395–414.

Lin, Z., Shi, R., Stecke, K. E., Xiao, W., & Xu, D. (2021). Selling to a financially constrained E-commerce retailer with bankruptcy cost and tax. Transportation Research Part E: Logistics and Transportation Review, 146, 102180.

Liu, J., Zhai, X., & Chen, L. (2019). Optimal pricing strategy under trade-in program in the presence of strategic consumers. Omega, 84, 1–17.

Maiti, A. K., Maiti, M. K., & Maiti, M. (2009). Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Applied Mathematical Modelling, 33(5), 2433–2443.

Mauer, D. C., & Ott, S. H. (1995). Investment under uncertainty: The case of replacement investment decisions. Journal of Financial and Quantitative Analysis, 30(4), 581–605.

Narayanan, V., Raman, A., & Singh, J. (2005). Agency costs in a supply chain with demand uncertainty and price competiftion. Management Science, 51(1), 120–132.

Nwalozie, C. (2011). All about the TJX Companies. https://doi.org/10.2139/ssrn.1872210

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 183–194.

Qin, J., Han, Y., Wei, G., & Xia, L. (2019). The value of advance payment financing to carbon emission reduction and production in a supply chain with game theory analysis. International Journal of Production Research, 58(1), 200–219.

Reindorp, M., Tanrisever, F., & Lange, A. (2018). Purchase order financing: Credit, commitment, and supply chain consequences. Operations Research, 66(5), 1287–1303.

Reza-Gharehbagh, R., Asian, S., Hafezalkotob, A., & Wei, C. (2021). Reframing supply chain finance in an era of reglobalization: On the value of multi-sided crowdfunding platforms. Transportation Research Part E: Logistics and Transportation Review, 149, 102298.

Tang, C. S., Yang, S. A., & Wu, J. (2018). Sourcing from suppliers with financial constraints and performance risk. Manufacturing & Service Operations Management, 20(1), 70–84.

Taylor, T. A. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Tsay, A. (2001). Managing retail channel overstock: Markdown money and return policies. Journal of Retailing, 77(4), 457–492.

Tunca, T. I., & Zhu, W. (2018). Buyer intermediation in supplier finance. Management Science, 64(12), 5631–5650.

Van der Vliet, K., Reindorp, M. J., & Fransoo, J. C. (2015). The price of reverse factoring: Financing rates vs. payment delays. European Journal of Operational Research, 242(3), 842–853.

Wang, C. X., & Webster, S. (2009). Markdown money contracts for perishable goods with clearance pricing. European Journal of Operational Research, 196(3), 1113–1122.

Wang, H., Li, S., & Luo, J. (2018). Optimal markdown pricing for holiday basket with customer valuation. International Journal of Production Research, 56(18), 5982–5996.

Wang, J., Zhao, L., & Huchzermeier, A. (2021). Operations-finance interface in risk management: Research evolution and opportunities. Production Operations Management, 30(2), 355–389.

Welke, W. R. (1988). Accounting for “negative salvage.” Journal of Accounting Education, 6(2), 325–329.

Wu, A. (2017). A supportive pricing model for suppliers with purchase order financing. International Journal of Production Research, 55(19), 5632–5646.

Xiao, Y., & Zhang, J. (2018). Preselling to a retailer with cash flow shortage on the manufacturer. Omega, 80, 43–57.

Xu, X., & Birge, J. R. (2004). Joint Production and Financing Decisions: Modeling and Analysis. https://doi.org/10.2139/ssrn.652562

Yan, N., He, X., & Liu, Y. (2018). Financing the capital-constrained supply chain with loss aversion: Supplier finance vs. supplier investment. Omega, 88, 162–178.

Yan, N., Liu, Y., Xu, X., & He, X. (2020). Strategic dual-channel pricing games with e-retailer finance. European Journal of Operational Research, 283(1), 138–151.

Yang, C., Fang, W., & Zhang, B. (2021). Financing a risk-averse manufacturer in a pull contract: Early payment versus retailer investment. International Transactions in Operational Research, 28(5), 2548–2580.

Yang, S. A., & Birge, J. R. (2013). How inventory is (should be) financed: Trade credit in supply chains with demand uncertainty and costs of financial distress. https://doi.org/10.2139/ssrn.1734682.

Yang, S. A., Birge, J. R., & Parker, R. P. (2015). The supply chain effects of bankruptcy. Management Science, 61(10), 2320–2338.

Yu, K., & He, D. (2018). The choice between bankruptcy liquidation and bankruptcy reorganization: A model and evidence. Journal of Management Analytics, 5(3), 170–197.

Zhang, R., Li, J., Huang, Z., & Liu, B. (2019). Return strategies and online product customization in a dual-channel supply chain. Sustainability, 11(12), 3482.

Zhao, L., & Huchzermeier, A. (2018). Managing supplier financial distress with advance payment discount and purchase order financing. Omega, 88, 77–90.

Zink, T., Maker, F., Geyer, R., Amirtharajah, R., & Akella, V. (2014). Comparative life cycle assessment of smartphone reuse: Repurposing vs. refurbishment. The International Journal of Life Cycle Assessment, 19(5), 1099–1109.

Acknowledgements

The work described in this paper was supported by grants from The Natural Science Foundation of China (Grant No. 71971143); The Research Committee of Hong Kong Polytechnic University (Project Numbers G-UADM; G-UAFS); and the Research Committee of The Hong Kong Polytechnic University under student account code RK2C.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Theorem 1

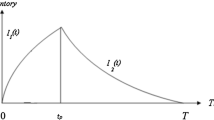

From Eq. (4), the retailer's expected profit can be written as.

Taking the first-order and second-order partial derivative of q, we have

Then, the first derivative with respect to s follows:

Hence, \(q_{1}^{bc} *\) and \(\pi_{r1}^{{{\text{b}}c}}\) increase with the salvage value.

From the first-order condition: \(\frac{{\partial \pi_{r}^{{{\text{b}}c}} }}{{\partial q_{1}^{bc*} }}{ = }0\), we derive \(q_{1}^{{{\text{b}}c*}} = F^{ - 1} \left( {\frac{p - w}{{p - s}}} \right)\).

Proof of Theorem 2

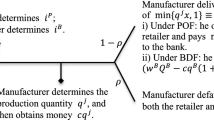

Under BPOF, based on Eq. (6), the problem of the retailer can be expressed as:

Taking the first-order and second-order partial derivative of \(\pi_{r1}^{bpof}\), we have

Accordingly,

Hence,\(q^{bc} *\) and \(\pi_{r1}^{{{\text{bpof}}}}\) increase with the salvage value.

From the first-order condition:\(\frac{{\partial \pi_{r1}^{bpof} }}{{\partial q^{bpof*} }} = 0\), we have

Therefore, \( q_{1}^{{bpof*}} = F^{{ - 1}} \left( {\frac{{p - w - (\delta \lambda w - \delta \gamma w + \delta \gamma c_{p} + \delta \gamma \lambda wr)\left[ {\Phi (\tilde{A}_{S} ) - \Phi (\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{A} _{S} )} \right]}}{{p - s}}} \right) \).

Proof of Theorem 3

Under APD, from Eq. (8),

We can obtain that

Hence,\(q^{bc} *\) and \(\pi_{r1}^{{{\text{apd}}}}\) increase with the salvage value.

Proof of Proposition 1

In the case of reorganization, from Eq. (8) and the first-order condition:\(\frac{{\partial \pi_{r1}^{apd} }}{{\partial q^{apd*} }} = 0\), we derive

In the same way, we can also obtain \(q_{1}^{apd*}\) in the case of continuation satisfies the first-order condition:

Hence, \(q_{1}^{apd*} = F^{ - 1} (\frac{p - (1 - d)w}{{p - s}})\).

To sum up, from the first-order condition:\(\frac{{\partial \pi_{r1}^{apd} }}{{\partial q^{apd*} }} = 0\), we have

\(\begin{gathered} q_{1}^{apd*} = F^{ - 1} (\frac{p - (1 - d)w}{{p - s}}){\text{ Continuation}} \hfill \\ q_{1}^{apd*} = F^{ - 1} (\frac{p - (2 - \alpha )(1 - d)w}{{p - s}}){\text{ Reorganization}} \hfill \\ \end{gathered}\).

Proof of Theorem 4

The financing strategy chosen by the retailer will bring a greater expected profit: \(\pi_{r1}^{bpof*} > \pi_{r1}^{apd*}\) iff.

where the threshold value of the retailer's internal assets:

Since there exist \(s[(q_{1}^{apd*} - D)^{ + } - (q_{1}^{bpof*} - D)^{ + } ]\) and \(q_{1}^{bpof*} > q_{1}^{apd*} > D\), the value of \(\omega_{r1}\) is in direct proportion to the salvage value:

Proof of Theorem 5

From Eq. (12), in the case of reorganization, the retailer’s problem can be rewritten as.

\(\omega_{r1} \left( {s > 0} \right){ > }\omega_{r0} \left( {s = 0, \, no \, salvage \, value} \right) > \omega_{r1} \left( {s < 0} \right)\).

The first and second derivatives of \(\pi_{r1}^{bf}\) are

Based on the above results, we derive the first-order derivative:

Hence,\(q^{{\text{df*}}}\) and \(\pi_{r1}^{{{\text{df}}}}\) increase with the salvage value.

What’s more, in the case of continuation,

Then, we can obtain that

Hence, in both cases of reorganization and continuation,\(q^{{\text{df*}}}\) and \(\pi_{r1}^{{{\text{df}}}}\) increase with the salvage value.

Proof of Proposition 2

In the case of reorganization, from Eq. (12), when \(\frac{{\partial \pi_{r}^{df} }}{\partial q} = 0\), we have

Thus,\(q^{{df{*}}} = F^{ - 1} (\frac{p - [\alpha - \alpha \beta - \alpha d + \alpha d\beta + \beta ]w}{{p - s}})\) in reorganization.

If the retailer does not have financial difficulties, it follows that:

\((p - s)\overline{F} (q^{df} ){ = }[1 - d + d\beta ]w - s\).

Therefore,\(q^{{df{*}}} = F^{ - 1} (\frac{p - [1 - d + d\beta ]w}{{p - s}})\) in continuation.

Profits without considering salvage value In the deconcentrated benchmark without salvage value,

In base case,

In BPOF,

In APD,

Rights and permissions

About this article

Cite this article

Wu, SM., Chan, F.T.S. & Chung, S.H. The influence of positive and negative salvage values on supply chain financing strategies. Ann Oper Res 315, 535–563 (2022). https://doi.org/10.1007/s10479-022-04727-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04727-y