Abstract

As a significant component of supply chain management, multi-channel pricing decision has received extensive attention in recent years. Many studies have focused on single-channel pricing decision, while limited research has been done on multi-channel pricing decision with a revenue-sharing contract. This paper establishes a multi-channel optimal pricing decision model with a revenue-sharing contract (entailing a revenue apportionment and an additional reward) in the context of a cross-channel effect, consumers trust utility, and after-sales service utility, all of which play roles in increasing or reducing supply chain members’ expected profits. The results indicate that, in a bid to obtain maximum profit, manufacturer and reseller will take different measures for varying levels of differences between cross-channel effects of direct seller (D-seller) and reseller (R-seller), for different levels of consumer trust utility, and for different levels of after-sales service utility. Manufacturer and reseller both try their best to decrease the impact of sales format differences on electronic channel when the differences are small, but the action is opposite when the differences are large. In addition, manufacturer should not blindly improve the additional trust of direct-sale stores relative to reseller, but instead should increase additional reward to R-seller when manufacturer decides to improve the after-sales service of products through D-seller.

Similar content being viewed by others

Notes

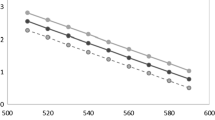

(1) The basic model; R-seller and D-seller’s optimal retail prices are respectively denoted by \(p_{R}^{*}\) and \(p_{D}^{*}\). (2) Incorporating the additional trust utility; the optimal retail prices are denoted by \(\hat{p}_{R}^{*}\) and \(\hat{p}_{D}^{*}\), respectively. (3) Incorporating the additional trust utility and the additional after-sales service utility, the optimal retail prices are denoted by \(\overline{p}_{R}^{*}\) and \(\overline{p}_{D}^{*}\), respectively.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2015). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Akturk, M. S., & Ketzenberg, M. (2021). Exploring the competitive dimension of omnichannel retailing. Management Science. https://doi.org/10.1287/mnsc.2021.4008

Alaei, A. M., Taleizadeh, A. A., & Rabbani, M. (2020). Marketplace, reseller, or web-store channel: The impact of return policy and cross-channel spillover from marketplace to web-store. Journal of Retailing and Consumer Services, 65, 102271.

Biswas, I., Avittathur, B., & Chatterjee, A. K. (2016). Impact of structure, market share and information asymmetry on supply contracts for a single supplier multiple buyer network. European Journal of Operational Research, 253(3), 593–601.

Chen, J., Zhang, H., & Sun, Y. (2012). Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega, 40(5), 571–583.

Chen, Y., & Cui, T. H. (2013). The benefit of uniform price for branded variants. Marketing Science, 32(1), 36–50.

Czinkota, M. R., Kotabe, M., Vrontis, D., et al. (2021). Selling and sales management[M]//marketing management (pp. 649–693). Springer.

Chen, X., Li, B., Chen, W., & Wu, S. (2021). Influences of information sharing and online recommendations in a supply chain: reselling versus agency selling. Annals of Operations Research. https://doi.org/10.1007/s10479-021-03968-7.

Dinner, I. M., Van Heerde, H. J., & Neslin, S. A. (2013). Driving online and offline sales: The cross-channel effects of traditional, online display, and paid search advertising. Journal of Marketing Research, 50(5), 527–545.

Forman, C., Ghose, A., & Goldfarb, A. (2009). Competition between local and electronic markets: How the benefit of buying online depends on where you live. Management Science, 55(1), 47–57.

Hagiu, A., & Wright, J. (2015). Marketplace or reseller? Management Science, 61(1), 184–203.

Hong, I. B., & Cha, H. S. (2013). The mediating role of consumer trust in an online merchant in predicting purchase intention. International Journal of Information Management, 33(6), 927–939.

Hallikainen, H., & Laukkanen, T. (2018). National culture and consumer trust in e-commerce. International Journal of Information Management, 38(1), 97–106.

Hou, X., Li, J., Liu, Z., & Guo, Y. (2022). Pareto and Karldor-Hicks improvements with revenue-sharing and wholesale-price contracts under manufacturer rebate policy. European Journal of Operational Research, 298(1), 152–168.

Harsha, P., Subramanian, S., & Ettl, M. (2019). A practical price optimization approach for omnichannel retailing. Informs Journal on Optimization, 1(3), 241–264.

Iravani, F., Dasu, S., & Ahmadi, R. (2016). Beyond price mechanisms: How much can service help manage the competition from gray markets? European Journal of Operational Research, 252(3), 789–800.

Jian, J., Li, B., Zhang, N., et al. (2021). Decision-making and coordination of green closed-loop supply chain with fairness concern. Journal of Cleaner Production, 298, 126779.

Kurata, H., & Nam, S. H. (2010). After-sales service competition in a supply chain: Optimization of customer satisfaction level or profit or both? International Journal of Production Economics, 127(1), 136–146.

Lee, D., Moon, J., Kim, Y. J., et al. (2015). Antecedents and consequences of mobile phone usability: Linking simplicity and interactivity to satisfaction, trust, and brand loyalty. Information & Management, 52(3), 295–304.

Li, B., Chen, W., Xu, C., et al. (2018). Impacts of government subsidies for environmental-friendly products in a dual-channel supply chain. Journal of Cleaner Production, 171, 1558–1576.

Liu, Z., Diallo, C., Chen, J., et al. (2020). Optimal pricing and production strategies for new and remanufactured products under a non-renewing free replacement warranty. International Journal of Production Economics, 226, 107602.

Liu, G., Yang, H., & Dai, R. (2020). Which contract is more effective in improving product greenness under different power structures: Revenue sharing or cost sharing? Computers & Industrial Engineering, 148, 106701.

Li, G., Huang, F. F., Cheng, T. C. E., et al. (2014). Make-or-buy service capacity decision in a supply chain providing after-sales service. European Journal of Operational Research, 239(2), 377–388.

Li, Y., Liu, H., Lim, E. T. K., et al. (2018). Customer’s reaction to cross-channel integration in omnichannel retailing: The mediating roles of retailer uncertainty, identity attractiveness, and switching costs. Decision Support Systems, 109, 50–60.

Liberali, G., Urban, G. L., & Hauser, J. R. (2013). Competitive information, trust, brand consideration and sales: Two field experiments. International Journal of Research in Marketing, 30(2), 101–113.

Liu, J., & Hill, S. (2021). Frontiers: Moment marketing: Measuring dynamics in cross-channel ad effectiveness. Marketing Science, 40(1), 13–22.

Manerba, D., Mansini, R., & Perboli, G. (2018). The capacitated supplier selection problem with total quantity discount policy and activation costs under uncertainty. International Journal of Production Economics, 198, 119–132.

Montes, R., Sand-Zantman, W., & Valletti, T. (2019). The value of personal information in online markets with endogenous privacy. Management Science, 65(3), 1342–1362.

Nie, J., Zhong, L., Yan, H., et al. (2019). Retailers’ distribution channel strategies with cross-channel effect in a competitive market. International Journal of Production Economics, 213, 32–45.

Nault, B. R., & Rahman, M. S. (2019). Proximity to a traditional physical store: The effects of mitigating online disutility costs. Production and Operations Management, 28(4), 1033–1051.

Nan, G., Wang, S., Li, Z., et al. (2018). A novel pricing strategy for mobile broadband carriers using two-stage Stackelberg model. Knowledge-Based Systems, 142, 45–57.

Nan, G., Zang, C., Dou, R., et al. (2015). Pricing and resource allocation for multimedia social network in cloud environments. Knowledge-Based Systems, 88, 1–11.

Prabhuram, T., Rajmohan, M., Tan, Y., et al. (2020). Performance evaluation of Omni channel distribution network configurations using multi criteria decision making techniques. Annals of Operations Research, 288(1), 435–456.

Pu, X., Sun, S., & Shao, J. (2020). Direct selling, reselling, or agency selling? Manufacturer’s online distribution strategies and their impact. International Journal of Electronic Commerce, 24(2), 232–254.

Rigopoulou, I. D., Chaniotakis, I. E., Lymperopoulos, C., et al. (2008). After-sales service quality as an antecedent of customer satisfaction: The case of electronic appliances. Managing Service Quality: An International Journal, 18(5), 512–527.

Roy, A., Sana, S. S., & Chaudhuri, K. (2018). Optimal Pricing of competing retailers under uncertain demand-a two layer supply chain model. Annals of Operations Research, 260(1–2), 481–500.

Radhi, M., & Zhang, G. (2019). Optimal cross-channel return policy in dual-channel retailing systems. International Journal of Production Economics, 210, 184–198.

Smith, M. D., & Telang, R. (2010). Piracy or promotion? The impact of broadband Internet penetration on DVD sales. Information Economics and Policy, 22(4), 289–298.

Sullivan, Y. W., & Kim, D. J. (2018). Assessing the effects of consumers’ product evaluations and trust on repurchase intention in e-commerce environments. International Journal of Information Management, 39, 199–219.

Taylor, T. A. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Tian, Z., & Zhang, G. (2021). Multi-echelon fulfillment warehouse rent and production allocation for online direct selling. Annals of Operations Research, 304(1), 427–451.

Verhagen, T., & Van Dolen, W. (2009). Online purchase intentions: A multi-channel store image perspective. Information & Management, 46(2), 77–82.

Xu, X., He, P., & Zhang, S. (2021). Channel addition from marketplace or reselling under regional carbon cap-and-trade regulation. International Journal of Production Economics, 236, 108130.

Xu, G., Dan, B., Zhang, X., et al. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

You, J., Shangguan, J., Zhuang, L., et al. (2018). An autonomous dynamic trust management system with uncertainty analysis. Knowledge-Based Systems, 161, 101–110.

Zand, F., Yaghoubi, S., & Sadjadi, S. J. (2019). Impacts of government direct limitation on pricing, greening activities and recycling management in an online to offline closed loop supply chain. Journal of Cleaner Production, 215, 1327–1340.

Zeithaml, V. A. (2000). Service quality, profitability, and the economic worth of customers: What we know and what we need to learn. Journal of the Academy of Marketing Science, 28(1), 67–85.

Zhuang, H., Leszczyc, P. T. L. P., & Lin, Y. (2018). Why is price dispersion higher online than offline? The impact of retailer type and shopping risk on price dispersion. Journal of Retailing, 94(2), 136–153.

Zhang, C., Li, Y., & Ma, Y. (2021). Direct selling, agent selling, or dual-format selling: Electronic channel configuration considering channel competition and platform service. Computers & Industrial Engineering, 157, 107368.

Zhang, S., & Zhang, J. (2020). Agency selling or reselling: E-tailer information sharing with supplier offline entry. European Journal of Operational Research, 280(1), 134–151.

Acknowledgements

The research leading to the results presented in this paper was financially supported by the National Natural Science Foundation of China (Grant Nos. 72171182, 71801175, 71902041, 71971182, and 72031009), the Chinese National Funding of Social Sciences (No.20&ZD058), the Henan Province science and technology project (Project No. 222102110292), the Theme-based Research Projects of the Research Grants Council (Grant No. T32-101/15-R), the City University of Hong Kong SRG (Grant No. 7004969), and the Ger/HKJRS project (Grant No. G-CityU103/17).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Proof of Theorem 1

From Eqs. (6) and (8), the first order and second order conditions of \(\Pi_{R}\) and \(\Pi_{M}\) with respect to \(p_{R}\) and \(p_{D}\) give the equations:

It is easy to recognize that \(\Pi_{R}\) and \(\Pi_{M}\) are convex functions with respective to \(p_{R}\) and \(p_{D}\), respectively. Thus, optimal solutions for each both exist and are unique. Letting \(\frac{{\partial \Pi_{R} }}{{\partial p_{R} }} = 0\) and \(\frac{{\partial \Pi_{M} }}{{\partial p_{D} }} = 0\), the optimal pricing strategies will be obtained as follows:

where \(\eta = C_{D} - \lambda_{D} + \lambda_{R} + 3m\). Under the condition of Assumption 1, we can derive:

This ensures that the optimal retail prices are both positive values, i.e., \(p_{R}^{*} \ge 0\) and \(p_{D}^{*} \ge 0\). Thus, Theorem 1 is proven.

Proof of Proposition 1

From Eq. (10), the partial derivative of \(p_{D}^{*}\) is solved with respect to \(\lambda_{D}\) and \(\lambda_{R}\),

Thus, the manufacturer’s optimal price \(p_{D}^{*}\) decreases with increase in \(\lambda_{D}\) and increases with increase in \(\lambda_{R}\). Taking a partial derivative of \(p_{R}^{*}\) with respect to \(\lambda_{D}\) and \(\lambda_{R}\) from Eq. (9), we get:

Therefore \(p_{R}^{*}\) also decreases with \(\lambda_{D}\) and increases with \(\lambda_{R}\). In the same way:

According to Assumption 1, \(d_{R} < \frac{{\left( {\delta + 2} \right)^{2} }}{{\delta^{2} }}\eta\), and the inequalities \(\frac{{\partial p_{D}^{*} }}{\partial \delta } < 0\) and \(\frac{{\partial p_{R}^{*} }}{\partial \delta } < 0\) are obtained. Thus, the optimal retail prices for the manufacturer and R-seller both decrease with increase in the revenue apportionment \(\delta\). Proposition 1 is therefore confirmed.

Proof of Proposition 2

From Eqs. (9) and (10), we obtain:

where \(\lambda_{D} - \lambda_{R} < C_{D} + \left( {1 - \delta } \right)m\), the inequality \(p_{D}^{*} > p_{R}^{*}\) is obtained. Thus, in this case, D-seller will set a higher optimal retail price than R-seller; where \(\lambda_{D} - \lambda_{R} > C_{D} + \left( {1 - \delta } \right)m\), the inequality \(p_{D}^{*} < p_{R}^{*}\) is obtained; where \(\lambda_{D} - \lambda_{R} = C_{D} + \left( {1 - \delta } \right)m\), the equality \(p_{D}^{*} = p_{R}^{*}\) is obtained.

Proof of Proposition 3

Solving the partial derivative of Eq. (11) with respect to \(\lambda_{D}\) and \(\lambda_{R}\), we find:

It is easy to identify that \(\frac{{\partial \Pi_{R}^{*} }}{{\partial \lambda_{D} }} = - \frac{{\partial \Pi_{R}^{*} }}{{\partial \lambda_{R} }}\); \(\Pi_{R}^{*}\) has a contrary monotonicity with respect to \(\lambda_{D}\) and \(\lambda_{R}\). According to Assumption 1, \(C_{D} - \lambda_{D} + \lambda_{R} + 3m \ge \frac{\delta + 2}{2}m > 0\). Thus, the inequalities \(\frac{{\partial \Pi_{R}^{*} }}{{\partial \lambda_{D} }} < 0\) and \(\frac{{\partial \Pi_{R}^{*} }}{{\partial \lambda_{R} }} > 0\) always hold. The result is that \(\Pi_{R}^{*}\) decreases with increase in \(\lambda_{D}\) and increases with increase in \(\lambda_{R}\). Because R-seller cannot affect the value of \(\lambda_{D}\) (the cross-channel effect of D-seller’s sales volumes on the E-channel), R-seller should make some effort to maximize the effect of his sales volumes (which occur in the T-channel) on sales volumes in the E-channel, in order to obtain maximum profit. Considering the difference in the cross-channel effect of sales by D-seller and R-seller, the following relationship is derived:

Thus, the optimal profit of R-seller decreases with increase in \(\lambda_{D} - \lambda_{R}\). Because \(\lambda_{R} \le \lambda_{D}\), when \(\lambda_{R} = \lambda_{D}\), R-seller will obtain maximum profit:

Proposition 3 therefore holds.

Proof of Proposition 4

Solving the partial derivative of Eq. (12) with respect to \(\lambda_{D}\) and \(\lambda_{R}\), the following formulae are obtained:

Assuming the first order condition \({{\partial \Pi_{M}^{*} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{*} } {\partial \lambda_{D} }}} \right. \kern-\nulldelimiterspace} {\partial \lambda_{D} }} \ge 0\) to hold, the inequality \(m\left( {\delta^{2} + 3\delta - 1} \right) - C_{D} + \lambda_{D} - \lambda_{R} \ge 0\) should be satisfied, i.e., when \(\lambda_{D} - \lambda_{R} \ge C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\), the manufacturer’s optimal profit \(\Pi_{M}^{*}\) increases with increase in \(\lambda_{1}\); if \({{\partial \Pi_{M}^{*} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{*} } {\partial \lambda_{D} }}} \right. \kern-\nulldelimiterspace} {\partial \lambda_{D} }} < 0\), the inequality \(\lambda_{D} - \lambda_{R} < C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\) is obtained, so that the manufacturer’s optimal profit \(\Pi_{M}^{*}\) decreases with increase in \(\lambda_{D}\). Because the inequality \({{\partial \Pi_{M}^{*} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{*} } {\partial \lambda_{R} }}} \right. \kern-\nulldelimiterspace} {\partial \lambda_{R} }} > 0\) always holds, the manufacturer’s optimal profit \(\Pi_{M}^{*}\) always increases with increase in \(\lambda_{R}\).

Firstly, we consider the case where the difference between D-seller and R-seller’s cross-channel effects is large (i.e., \(\lambda_{D} - \lambda_{R} \ge C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\)). In order to obtain maximum profit, the manufacturer will attempt to maximize the effect of D-seller’s product sales volumes on the E-channel. According to Proposition 3, R-seller will also attempt to minimize the difference between D-seller and R-seller’s cross-channel effect. In accordance with the inequality relation \(\lambda_{D} - \lambda_{R} \ge C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\), R-seller should ensure \(\lambda_{R} = \lambda_{D} - C_{D} + m\left( {\delta^{2} + 3\delta - 1} \right)\) in order to obtain maximum profit. Thus, the manufacturer’s optimal cross-channel effect is \(\lambda_{D} = \lambda_{R}^{*} + C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\).

Secondly, when the difference between D-seller and R-seller’s cross-channel effects is small (i.e., \(\lambda_{D} - \lambda_{R} < C_{D} - m\left( {\delta^{2} + 3\delta - 1} \right)\)), the manufacturer will seek a minimum effect of D-seller’s product sales volumes on the E-channel, and will hope for a maximum effect of R-seller’s product sales volumes on the E-channel. Thus, D-seller’s cross-channel effects parameter \(\lambda_{D} = \lambda_{R}\) represents the manufacturer’s optimal outcome. Moreover, R-seller also obtains a maximum profit in this case.

Proof of Proposition 5

Solving the partial derivative of the formula for R-seller’s optimal profit \(\Pi_{R}^{*}\) (Eq. 11) and the manufacturer’s optimal profit \(\Pi_{M}^{*}\) (Eq. 12) with respect to the revenue apportionment parameter \(\delta\):

Because \(\frac{{\partial \Pi_{R}^{*} }}{\partial \delta } > 0\), R-seller’s optimal profit increases with increase in the revenue apportionment \(\delta\). Considering the relationship between \(\Pi_{M}^{*}\) and \(\delta\), and the inequality:

the equality holds only when:

and the parameters are

For convenience, this denotes \(\delta_{1} = \frac{\beta }{3\gamma } + \frac{3\gamma }{\beta } - \frac{{108d_{R} m\gamma^{2} }}{{\beta^{3} }}{ + }\kappa^{{\frac{{1}}{{3}}}} { + }\left( {\kappa { + }\frac{{\beta^{3} }}{{{27}\gamma^{{3}} }}} \right)^{{\frac{{1}}{{3}}}}\).When \(\delta \le \delta_{1}\), the inequality (A-3) holds, and the optimal profit of the manufacturer increases with increase in the revenue apportionment. Otherwise, the optimal profit of the manufacturer decreases with increase in the revenue apportionment. Therefore, from the manufacturer’s perspective, the optimal revenue apportionment is \(\delta = \delta_{1} = \frac{\beta }{3\gamma } + \frac{3\gamma }{\beta } - \frac{{108d_{R} m\gamma^{2} }}{{\beta^{3} }}{ + }\kappa^{{\frac{{1}}{{3}}}} { + }\left( {\kappa { + }\frac{{\beta^{3} }}{{{27}\gamma^{{3}} }}} \right)^{{\frac{{1}}{{3}}}}\). Proposition 5 is therefore proved.

Proof of Proposition 6

From Eqs. (9), (10), (17) and (18), the following inequality relationships are obtained:

where the equality holds only when \(t = 0\). Note that in such a scenario, where no value is assigned to the additional trust utility of the D-seller relative to the R-seller, the result of the basic model in Sect. 3 is obtained. Here, we recognize an additional trust utility \(t > 0\), thus, \(\hat{p}_{R}^{*} < p_{R}^{*}\) and \(\hat{p}_{D}^{*} > p_{D}^{*}\). Proposition 6 is therefore proved.

Proof of Proposition 7

From Eqs. (7), (8), (17) and (18), for the extended model incorporating consumer’s additional trust, optimal profits of R-seller and the manufacturer are solved as follows:

Applying the expressions of optimal profits in Eqs. (11), (12), (46) and (A-624), we can obtain:

When \(t \ge 2\left[ {\eta - m\left( {\delta + 1} \right)\left( {\delta + 2} \right)} \right]\), the inequality \(\hat{\Pi }_{M}^{*} \ge \Pi_{M}^{*}\) holds; otherwise, \(\hat{\Pi }_{M}^{*} < \Pi_{M}^{*}\). Thus, a large additional trust utility will increase the manufacturer’s optimal profit; otherwise, the additional trust utility will decrease the manufacturer’s optimal profit. R-seller’ optimal profit is smaller in the model incorporating the additional trust utility than in that without regard to the additional trust utility.

Below, we analyze the change in the revenue apportionment \(\delta\) when the parameter \(\eta\) is changed to \(\eta - t\). Solving R-seller and D-seller’s optimal profit with respect to revenue apportionment:

It is clear that R-seller’s optimal profit \(\hat{\Pi }_{R}^{*}\) increases with its proportion of revenue \(\delta\). By solving the equality \({{\partial \hat{\Pi }_{M}^{*} } \mathord{\left/ {\vphantom {{\partial \hat{\Pi }_{M}^{*} } {\partial \delta }}} \right. \kern-\nulldelimiterspace} {\partial \delta }} = 0\), the following equality is found:

For convenience, we introduce the functions \(g_{1} \left( \delta \right) = \frac{{d_{R} }}{{\delta^{2} }}\) and \(g_{2} \left( {\delta ,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \eta } \right) = \frac{\eta - t}{{\left( {\delta + 2} \right)^{2} }} + \frac{{\left( {\eta - t} \right)^{2} }}{{2m\left( {\delta + 2} \right)^{3} }}\), i.e., Eq. (52) is equivalent to the following equality:

It is clear that \(g_{2} \left( {\delta ,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \eta } \right)\) is an increasing function of \(\eta\); \(g_{1} \left( \delta \right)\) and \(g_{2} \left( {\delta ,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \eta } \right)\) are both decreasing functions of \(\delta\), but:

This shows that \(g_{1} \left( \delta \right)\) has a larger rate of change than \(g_{2} \left( {\delta ,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \eta } \right)\) with respect to \(\delta\). This condition ensures that there exists a value of \(\delta\) which allows Equation (A-8) to hold where the value of \(\eta\) has been changed. Where the value \(\eta\) decreases, the value \(g_{2} \left( {\delta ,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \eta } \right)\) will decrease. In order to ensure that Equation (A-8) holds, the value \(\delta\) will increase. The optimal revenue apportionment \(\delta\) is obtained by solving the Equation (A-8), so the value of the optimal revenue apportionment \(\delta\) increases with the reduction from \(\eta\) to \(\eta - t\).

With the condition \(\delta \in (0,{\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} 1]\), Equation (A-8) is solved thus:

where the parameters are \(\kappa_{2} = \sqrt[2]{{\frac{{4d_{R} m}}{{\gamma_{2} }} - \frac{{\beta^{3} }}{{27\gamma_{2}^{3} }} + \frac{{2d_{R} m\beta_{2} }}{{\gamma_{2}^{2} }} - \left( {\frac{{\beta_{2}^{2} }}{{9\gamma_{2}^{2} }} - \frac{{4d_{R} m}}{{\gamma_{2} }}} \right)^{3} }} - \frac{{4d_{R} m}}{{\gamma_{2} }} - \frac{{2d_{R} m\beta_{2} }}{{\gamma_{2}^{2} }}\), \(\beta_{2} = \eta_{2}^{2} + 2m\eta_{2} - 6d_{R} m\), \(\gamma_{2} = \left( {d_{R} - \eta_{2} } \right)m\), and \(\eta_{2} = C_{D} - \lambda_{D} + \lambda_{R} + 3m - t\).

Therefore, \(\delta_{2} \ge \delta_{1}\), so the equality holds only where \(t = 0\) (i.e., where no value is assigned to consumer trust, and so this has no effect on pricing strategies). Proposition 7 is therefore confirmed.

Proof of Proposition 8

-

(1)

The derivative of R-seller and D-seller’s optimal retail prices (i.e., Eqs. 23 and 24) with respect to the additional after-sales service are, respectively:

Thus, \({\kern 1pt} \overline{p}_{R}^{*}\) decreases with increase in \(f\), and \(\overline{p}_{D}^{*}\) increases with increase in \(f\). Because \(\left| {\frac{{\partial {\kern 1pt} \overline{p}_{R}^{*} }}{\partial f}} \right| \ge \left| {\frac{{\partial {\kern 1pt} \overline{p}_{D}^{*} }}{\partial f}} \right|\), the rate of decrease in \(\overline{p}_{R}^{*}\) is larger than the rate of increase in \(\overline{p}_{D}^{*}\).

-

(2)

The derivative of R-seller and D-seller’s optimal retail prices (i.e., Eqs. (23) and (24)) with respective to the effect of after-sales service on the E-channel are, respectively:

Thus, \(\overline{p}_{R}^{*}\) and \(\overline{p}_{D}^{*}\) both decrease with increase in \(\Delta f\). As \(\Delta f\) increases, \(\overline{p}_{D}^{*}\) has a greater rate of decrease than \(\overline{p}_{R}^{*}\).

-

(3)

Comparing the three models’ optimal retail prices from Eqs. (9–10), (17–18) and (23–24), we see that the relationship \({\kern 1pt} {\kern 1pt} \hat{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} p_{R}^{*}\) always holds under Proposition 6. If \({\kern 1pt} \overline{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} \hat{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} p_{R}^{*}\), i.e.,

the inequality \(\mu \le \frac{f + \Delta f}{{\lambda_{D} - \lambda_{R} + \Delta f}}\) should be satisfied; if \({\kern 1pt} {\kern 1pt} \hat{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} \overline{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} p_{R}^{*}\), i.e.,

the inequality \(\frac{f + \Delta f}{{\lambda_{D} - \lambda_{R} + \Delta f}} \le \mu \le \frac{f + \Delta f + t}{{\lambda_{D} - \lambda_{R} + \Delta f}}\) should be satisfied; if \({\kern 1pt} \hat{p}_{R}^{*} \le {\kern 1pt} {\kern 1pt} {\kern 1pt} {\kern 1pt} p_{R}^{*} \le {\kern 1pt} {\kern 1pt} \overline{p}_{R}^{*}\), i.e.,

the inequality \(\mu \ge \frac{f + \Delta f + t}{{\lambda_{D} - \lambda_{R} + \Delta f}}\) should be satisfied.

We further consider the relationship between D-seller’s optimal retail prices under each of the three models. From Proposition 6, it is known that the inequality \(p_{D}^{*} < \hat{p}_{D}^{*}\) always holds. If \(\overline{p}_{D}^{*} < p_{D}^{*} < \hat{p}_{D}^{*}\), i.e.,

the inequality \(\mu \le \frac{{2\Delta f - \delta \left( {f + t} \right)}}{{2\left( {\lambda_{D} - \lambda_{R} + \Delta f} \right)}}\) will be obtained. If \(p_{D}^{*} < \overline{p}_{D}^{*} < \hat{p}_{D}^{*}\), i.e.,

the inequality \(\frac{{2\Delta f - \delta \left( {f + t} \right)}}{{2\left( {\lambda_{D} - \lambda_{R} + \Delta f} \right)}} \le \mu \le \frac{2\Delta f - \delta f}{{2\left( {\lambda_{D} - \lambda_{R} + \Delta f} \right)}}\) will be obtained. Otherwise, \(p_{D}^{*} < \hat{p}_{D}^{*} < \overline{p}_{D}^{*}\), and the inequality \(\mu \ge \frac{2\Delta f - \delta f}{{2\left( {\lambda_{D} - \lambda_{R} + \Delta f} \right)}}\) will be obtained. The relationship \(\frac{2\Delta f - \delta f}{{2\left( {\lambda_{D} - \lambda_{R} + \Delta f} \right)}} \le \frac{f + \Delta f}{{\lambda_{D} - \lambda_{R} + \Delta f}}\) holds in all scenarios, thus Proposition 8 always holds.

Proof of Proposition 9

From Eqs. (21–24), the manufacturer and R-seller’s optimal profit functions can be obtained:

where \(\rho = \eta_{1} - f - \Delta f + \mu \left( {\Delta f + \lambda_{D} - \lambda_{R} } \right)\) and \(\eta_{1} = C_{D} - \lambda_{D} + \lambda_{R} + 3m - t\). Comparing \(\overline{\Pi }_{R}^{*}\) and \(\hat{\Pi }_{R}^{*}\), we observe:

Because \(\overline{p}_{R}^{*} \ge {0}\), the inequality \(\rho > 0\) holds, when \(f + \Delta f - \mu \left( {\Delta f + \lambda_{D} - \lambda_{R} } \right) \le 0\), i.e., \(\mu \ge \frac{f + \Delta f}{{\Delta f + \lambda_{D} - \lambda_{R} }}\), the condition \(\overline{\Pi }_{R}^{*} - \hat{\Pi }_{R}^{*} \ge 0\) always holds. Thus, if the additional after-sales service \(\mu \ge \frac{f + \Delta f}{{\Delta f + \lambda_{D} - \lambda_{R} }}\), R-seller will obtain more profit by providing additional after-sales service than without providing it.

We then compare manufacturer’s optimal profit, \(\overline{\Pi }_{M}^{*}\) and \(\hat{\Pi }_{M}^{*}\),

Solving the above quadratic function with respect to \(\mu\), we obtain \(\mu \le \frac{{a_{2} - \sqrt {a_{2}^{2} - 4a_{1} a_{3} } }}{{a_{3} }}\), and the parameters are \(a_{1} = \left( {\delta + 1} \right)\left( {f + \Delta f} \right) + \frac{{\left( {f + \Delta f} \right)\left( {f + \Delta f - 2\eta_{1} } \right)}}{{2m\left( {\delta + 2} \right)}}\), \(a_{3} = \frac{{\left( {\Delta f + f} \right)\left( {\Delta f + f - 2\eta_{1} } \right)}}{{2m\left( {\delta + 2} \right)}} + \left( {\delta + 1} \right)\left( {\Delta f + f} \right)\), and \(a_{2} = \delta + 2 + \lambda_{D} + \lambda_{R} + 2q_{E} + \delta \left( {\Delta f + \lambda_{D} + q_{E} } \right) + \frac{{\left( {\Delta f + } \right.\lambda_{D} \left. { - \lambda_{R} } \right)\left( {f + \Delta f - \eta_{1} } \right)}}{{m\left( {\delta + 2} \right)}}\). The manufacturer’s optimal profit is therefore increased in the scenario where additional after-sales service is provided if its marginal cost is low. Thus, the Proposition 9 is confirmed.

Proof of Proposition 10

From Eqs. (21–24), R-seller and the manufacturer’s optimal profit functions can be obtained, respectively:

where \(\rho = \eta_{1} - f - \Delta f + \mu \left( {\Delta f + \lambda_{D} - \lambda_{R} } \right)\) and \(\eta_{1} = C_{D} - \lambda_{D} + \lambda_{R} + 3m - t\). Solving for \(\overline{\Pi }_{R}^{*}\) and \(\overline{\Pi }_{M}^{*}\) with respect to \(f\), we find:

Because \(\frac{{\partial \overline{\Pi }_{R}^{*} }}{{\partial {\kern 1pt} f}} < 0\), we know that \(\overline{\Pi }_{R}^{*}\) is a decreasing function of \(f\). If \(\frac{{\partial \overline{\Pi }_{M}^{*} }}{{\partial {\kern 1pt} f}} \ge 0\), the inequality \(\mu \le \frac{{m\left( {\delta + 2} \right)\left( {\delta + 1} \right) - \eta_{1} + f + \Delta f}}{{\Delta f + \lambda_{D} - \lambda_{R} }}\) will be obtained. Thus, \(\overline{\Pi }_{M}^{*}\) is an increasing function of \(f\) when the marginal cost satisfies \(\mu \le \frac{{m\left( {\delta + 2} \right)\left( {\delta + 1} \right) - \eta_{1} + f + \Delta f}}{{\Delta f + \lambda_{D} - \lambda_{R} }}\). Otherwise, \(\overline{\Pi }_{M}^{*}\) is a decreasing function of \(f\).

Rights and permissions

About this article

Cite this article

Chen, ZS., Wu, S., Govindan, K. et al. Optimal pricing decision in a multi-channel supply chain with a revenue-sharing contract. Ann Oper Res 318, 67–102 (2022). https://doi.org/10.1007/s10479-022-04748-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04748-7