Abstract

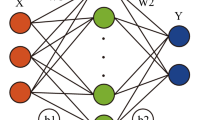

Predicting bankruptcies and assessing credit risk are two of the most pressing issues in finance. Therefore, financial distress prediction and credit scoring remain hot research topics in the finance sector. Earlier studies have focused on the design of statistical approaches and machine learning models to predict a company's financial distress. In this study, an adaptive whale optimization algorithm with deep learning (AWOA-DL) technique is used to create a new financial distress prediction model. The goal of the AWOA-DL approach is to determine whether a company is experiencing financial distress or not. A deep neural network (DNN) model called multilayer perceptron based predictive and AWOA-based hyperparameter tuning processes are used in the AWOA-DL method. Primarily, the DNN model receives the financial data as input and predicts financial distress. In addition, the AWOA is applied to tune the DNN model's hyperparameters, thereby raising the predictive outcome. The proposed model is applied in three stages: preprocessing, hyperparameter tuning using AWOA, and the prediction phase. A comprehensive simulation took place on four datasets, and the results pointed out the supremacy of the AWOA-DL method over other compared techniques by achieving an average accuracy of 95.8%, where the average accuracy equals 93.8%, 89.6%, 84.5%, and 78.2% for compared models.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Abdelaziz, A., & Mahmoud, A. N. (2021). Intelligent system for forecasting failure of agile projects. Journal of Intelligent Systems and Internet of Things, 5(1), 8–15.

Abedin, M. Z., Moon, M. H., Hassan, M. K., & Hajek, P. (2021). Deep learning-based exchange rate prediction during the COVID-19 pandemic. Annals of Operations Research, 5, 1–52. https://doi.org/10.1007/s10479-021-04420-6

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609.

Appiahene, P., Missah, Y. M., & Najim, U. (2020). Predicting bank operational efficiency using machine learning algorithm: comparative study of decision tree, random forest, and neural networks. Advances in Fuzzy Systems, 2020, 1–12.

Ashraf, S., Félix, E. G. S., & Serrasqueiro, Z. (2019). Do traditional financial distress prediction models predict the early warning signs of financial distress? Journal of Risk and Financial Management, 12(2), 55.

Bengio, Y. (2009). Learning deep architectures for AI (pp. 1–127). Now Publishers Inc.

Bengio, Y. (2014). Evolving culture versus local minima. In T. Kowaliw, N. Bredeche, & R. Doursat (Eds.), Growing adaptive machines (pp. 109–138). Springer.

Bluwstein, K., Buckmann, M., Joseph, A., Kang, M., Kapadia, S., & Simsek, Ö. (2020). Credit growth, the yield curve and financial crisis prediction: Evidence from a machine learning approach. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3520659

Chandra, D. K., Ravi, V., & Bose, I. (2009). Failure prediction of dotcom companies using hybrid intelligent techniques. Expert Systems with Applications, 36(3), 4830–4837.

Chatzis, S. P., Siakoulis, V., Petropoulos, A., Stavroulakis, E., & Vlachogiannakis, N. (2018). Forecasting stock market crisis events using deep and statistical machine learning techniques. Expert Systems with Applications, 112, 353–371.

Cleofas-Sánchez, L., Garcia, V., Marqués, A. I., & Sánchez, J. S. (2016). Financial distress prediction using the hybrid associative memory with translation. Applied Soft Computing, 44, 144–152.

Data archieves. Retrieved from https://pages.stern.nyu.edu/~adamodar/New_Home_Page/dataarchived.html

Desai, M., & Shah, M. (2020). An anatomization on breast cancer detection and diagnosis employing multi-layer perceptron neural network (MLP) and Convolutional neural network (CNN). Clinical eHealth, 4, 1–11.

Dua, D., & Graff, C. (2017). {UCI} machine learning repository.

Erhan, D., Manzagol, P.-A., Bengio, Y., Bengio, S., & Vincent, P. (2009). The difficulty of training deep architectures and the effect of unsupervised pre-training. In Artificial Intelligence and Statistics, pp. 153–160.

Freund, Y., & Haussler, D. (1994). Unsupervised learning of distributions of binary vectors using two layer networks.

Gharehchopogh, F. S., & Gholizadeh, H. (2019). A comprehensive survey: Whale Optimization Algorithm and its applications. Swarm and Evolutionary Computation, 48, 1–24.

Ghisellini, P., & Ulgiati, S. (2020). Circular economy transition in Italy. Achievements, perspectives and constraints. Journal of Cleaner Production, 243, 118360.

Hall, M. A., & Holmes, G. (2003). Benchmarking attribute selection techniques for discrete class data mining. IEEE Transactions on Knowledge and Data Engineering, 15(6), 1437–1447.

Hanbal, H., & Metawa, S. (2019). Study on reasons of failure of small and medium enterprises: Looking into Egypt case. American Journal of Business and Operations Research.

Hinton, G. E., Osindero, S., & Teh, Y.-W. (2006). A fast learning algorithm for deep belief nets. Neural Computation, 18(7), 1527–1554.

Huang, Y.-P., & Yen, M.-F. (2019). A new perspective of performance comparison among machine learning algorithms for financial distress prediction. Applied Soft Computing, 83, 105663.

Kim, S., Ku, S., Chang, W., & Song, J. W. (2020). Predicting the direction of US stock prices using effective transfer entropy and machine learning techniques. IEEE Access, 8, 111660–111682.

Liu, C., & Arunkumar, N. (2019). Risk prediction and evaluation of transnational transmission of financial crisis based on complex network. Cluster Computing, 22(2), 4307–4313.

Maghyereh, A. I., & Awartani, B. (2014). Bank distress prediction: Empirical evidence from the Gulf Cooperation Council countries. Research in International Business and Finance, 30, 126–147.

Metawa, N., Pustokhina, I. V., Pustokhin, D. A., Shankar, K., & Elhoseny, M. (2021). Computational intelligence-based financial crisis prediction model using feature subset selection with optimal deep belief network. Big Data, 9(2), 100–115.

Min, J. H., & Lee, Y.-C. (2005). Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Systems with Applications, 28(4), 603–614.

Mobahi, H., Collobert, R., & Weston, J. (2009). Deep learning from temporal coherence in video. In Proceedings of the 26th Annual International Conference on Machine Learning, pp. 737–744.

Moula, F. E., Guotai, C., & Abedin, M. Z. (2017). Credit default prediction modeling: An application of support vector machine. Risk Management, 19(2), 158–187.

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18, 109–131.

Petropoulos, A., Siakoulis, V., Stavroulakis, E., & Vlachogiannakis, N. E. (2020). Predicting bank insolvencies using machine learning techniques. International Journal of Forecasting, 36(3), 1092–1113.

Samitas, A., Kampouris, E., & Kenourgios, D. (2020). Machine learning as an early warning system to predict financial crisis. International Review of Financial Analysis, 71, 101507.

Sankhwar, S., Gupta, D., Ramya, K. C., Rani, S. S., Shankar, K., & Lakshmanaprabu, S. K. (2020). Improved grey wolf optimization-based feature subset selection with fuzzy neural classifier for financial crisis prediction. Soft Computing, 24(1), 101–110.

Serre, T., Kreiman, G., Kouh, M., Cadieu, C., Knoblich, U., & Poggio, T. (2007). A quantitative theory of immediate visual recognition. Progress in Brain Research, 165, 33–56.

Shajalal, M., Hajek, P., & Abedin, M. Z. (2021). Product backorder prediction using deep neural network on imbalanced data. International Journal of Production Research. https://doi.org/10.1080/00207543.2021.1901153

Shankar, K., Lakshmanaprabu, S. K., Gupta, D., Khanna, A., & de Albuquerque, V. H. C. (2020). Adaptive optimal multi key based encryption for digital image security. Concurrency and Computation: Practice and Experience, 32(4), e5122.

Sun, J., Li, H., Huang, Q.-H., & He, K.-Y. (2014). Predicting financial distress and corporate failure: A review from the state-of-the-art definitions, modeling, sampling, and featuring approaches. Knowledge-Based System, 57, 41–56.

Sun, J., Fujita, H., Chen, P., & Li, H. (2017). Dynamic financial distress prediction with concept drift based on time weighting combined with Adaboost support vector machine ensemble. Knowledge-Based Systems, 120, 4–14.

Uthayakumar, J., Metawa, N., Shankar, K., & Lakshmanaprabu, S. K. (2020a). Financial crisis prediction model using ant colony optimization. International Journal of Information Management, 50, 538–556.

Uthayakumar, J., Metawa, N., Shankar, K., & Lakshmanaprabu, S. K. (2020b). Intelligent hybrid model for financial crisis prediction using machine learning techniques. Information Systems and e-Business Management, 18(4), 617–645.

Weston, J., Ratle, F., Mobahi, H., & Collobert, R. (2012). Deep learning via semi-supervised embedding. In G. Montavon, G. Orr, & K. R. Müller (Eds.), Neural networks: Tricks of the trade (pp. 639–655). Springer.

Yang, Y., & Yang, C. (2020). Research on the application of GA improved neural network in the prediction of financial crisis. In 2020 12th International Conference on Measuring Technology and Mechatronics Automation (ICMTMA), pp. 625–629.

Yu, J., & Zhao, J. (2020). Prediction of systemic risk contagion based on a dynamic complex network model using machine learning algorithm. Complexity, 2020, 1–13.

Zeng, S., Li, Y., Yang, W., & Li, Y. (2020). A financial distress prediction model based on sparse algorithm and support vector machine. Mathematical Problems in Engineering, 2020, 1–11.

Zhou, J., Li, X., & Mitri, H. S. (2015). Comparative performance of six supervised learning methods for the development of models of hard rock pillar stability prediction. Natural Hazards, 79(1), 291–316.

Zikeba, M., Tomczak, S. K., & Tomczak, J. M. (2016). Ensemble boosted trees with synthetic features generation in application to bankruptcy prediction. Expert Systems with Applications, 58, 93–101.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Elhoseny, M., Metawa, N., Sztano, G. et al. Deep Learning-Based Model for Financial Distress Prediction. Ann Oper Res 345, 885–907 (2025). https://doi.org/10.1007/s10479-022-04766-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04766-5