Abstract

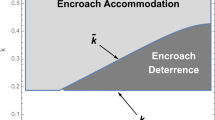

This paper investigates the implication of three channel power structures (i.e., manufacturer-led, vertical Nash and retailer-led) on supply chain management in a setting where a manufacturer determines whether to introduce a direct sales channel and a retailer has two capital status (i.e., capital-constrained status or capital-sufficient status). The capital-constrained retailer faces the decision of financing by trade credit or bank credit. We find that compared to cooperating with a capital-sufficient retailer, cooperating with a capital-constrained retailer will make the manufacturer bear a higher encroachment cost. Surprisingly, the capital-constrained retailer choosing trade credit financing may deter the manufacturer’s encroachment behavior, which means that trade credit financing has a positive financing effect with manufacturer encroachment. However, bank credit financing always makes the retailer worse off after encroachment, and the positive trade credit financing effect achieves the most efficient performance under manufacturer-led structure, yet remarkably impoverished under retailer-led structure. In addition, although conventional wisdom suggests that the manufacturer will lower the wholesale price to boost retail channel’s demand with encroachment, we obtain a different conclusion by demonstrating that manufacturer encroachment has a negative wholesale price effect that the manufacturer will raise the wholesale price after encroachment to ensure that direct sales channel enjoys a price advantage in a Bertrand competition market. Interestingly, we find that retailer-led is the most conducive structure to manufacturer’s encroachment, and manufacturer-led is the most unfavorable structure for manufacturer’s entry except when the manufacturer cooperates the capital-sufficient retailer in a high-risk market. Furthermore, with the increase of channel competition/market risk/production cost, the manufacturer has less motivation to enter the market.

Similar content being viewed by others

Notes

For ease of exposition, we refer to the manufacturer as “she” and the retailer as “he”.

We thank the first anonymous referee for commenting on this point.

We thank the second anonymous referee for commenting on this point.

References

Arya, A., Mittendorf, B., & Sappington, D. (2007). The bright side of supplier encroachment. Marketing Science, 26(5), 651–659.

Bian, J. S., Guo, X. L., Lai, K. K., & Hua, Z. S. (2014). The strategic peril of information sharing in a vertical-nash supply chain: A note. International Journal of Production Economics, 158, 37–43.

Bian, J. S., & Lai, K. K. (2017). Service outsourcing under different supply chain power structures. Annals of Operations Research, 248, 123–142.

Cai, G. S. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Cai, G. S., Dai, Y., & Zhou, S. X. (2012). Exclusive channels and revenue sharing in a complementary goods market. Marketing Science, 31(1), 172–187.

Caldentey, R., & Chen, X. (2009). The role of financial services in procurement contracts. The handbook of integrated risk management in global supply chains. Wiley.

Chen, L. G., Ding, D., & Ou, J. (2014). Power structure and profitability in assembly supply chains. Production and Operations Management, 23(9), 1599–1616.

Chen, X. F., Cai, G. S., & Song, J. S. (2019). The cash flow advantages of 3PLs as supply chain orchestrators. Manufacturing & Service Operations Management, 21(2), 435–451.

Chen, X., & Wang, X. (2015). Free or bundled: Channel selection decisions under different power structures. Omega, 53, 11–20.

Cheng, Y. X., Wu, D. S., Olson, D. L., & Dolgui, A. (2020). Financing the newsvendor with preferential credit: Bank vs. manufacturer. International Journal of Production Research. https://doi.org/10.1080/00207543.2020.1759839

Chod, J., Lyandres, E., & Yang, S. A. (2017). Trade credit and supplier competition. Working Paper.

Dong, B. W., Tang, W. S., Zhou, C., & Ren, Y. F. (2021). Is dual sourcing a better choice? The impact of reliability improvement and contract manufacturer encroachment. Transportation Research Part E: Logistics and Transportation Review, 149, 102275.

Du, R., Banerjee, A., & Kim, S. L. (2013). Coordination of two-echelon supply chains using wholesale price discount and credit option. International Journal of Production Economics, 143(2), 327–334.

Duan, C. Q., Deng, C., Gharaei, A., Wu, J., & Wang, B. R. (2018). Selective maintenance scheduling under stochastic maintenance quality with multiple maintenance actions. International Journal of Production Research, 56(23), 7160–7178.

Dumrongsiri, A., Fan, M., Jain, A., & Moinzadeh, K. (2008). A supply chain model with direct and retail channels. European Journal of Operational Research, 187(3), 691–718.

Edirisinghe, N. C. P., Bichescu, B., & Shi, X. (2011). Equilibrium analysis of supply chain structures under power imbalance. European Journal of Operational Research, 214(3), 568–578.

Fabbri, D., & Menichini, A. M. C. (2010). Trade credit, collateral liquidation, and borrowing constraints. Journal of Financial Economics, 96(3), 413–432.

Guo, Y., Yu, X. N., Zhou, C. F., & Lyu, G. Y. (2021). Government subsidies for preventing supply disruption when the supplier has an outside option under competition. Transportation Research Part E: Logistics and Transportation Review, 147, 102218.

Huang, J., Yang, W. S., & Tu, Y. L. (2020). Financing mode decision in a supply chain with financial constraint. International Journal of Production Economics, 220, 107441.

Huang, S., Fan, Z. P., & Wang, N. (2020). Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transportation Research Part e: Logistics and Transportation Review, 136, 101885.

Jing, B., Chen, X., & Cai, G. (2012). Equilibrium financing in a distribution channel with capital constraint. Production and Operations Management, 21(6), 1090–1101.

Kolay, S., & Shaffer, G. (2013). Contract design with a dominant retailer and a competitive fringe. Management Science, 59(9), 2111–2116.

Kouvelis, P., & Zhao, W. H. (2012). Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Operations Research, 60(3), 566–580.

Kouvelis, P., & Zhao, W. H. (2016). Supply chain contract design under financial constraints and bankruptcy costs. Management Science, 62(8), 2341–2357.

Kouvelis, P., & Zhao, W. H. (2017). Who should finance the supply chain? Impact of credit ratings on supply chain decisions. Manufacturing & Service Operations Management, 20(1), 19–35.

Lai, Z., Lou, G., Zhang, T., et al. (2021). Financing and coordination strategies for a manufacturer with limited operating and green innovation capital: Bank credit financing versus supplier green investment. Annals of Operation Research. https://doi.org/10.1007/s10479-021-04098-w

Lee, C. H., & Rhee, B. D. (2011). Trade credit for supply chain coordination. European Journal of Operational Research, 214(1), 136–146.

Li, G. D., & Zhou, Y. (2016). Strategically decentralise when encroaching on a dominant supplier. International Journal of Production Research, 54(10), 2989–3005.

Li, J., Yi, L., Shi, V., & Chen, X. (2020). Supplier encroachment strategy in the presence of retail strategic inventory: Centralization or decentralization? Omega, 98, 102213.

Li, T., Xie, J., & Zhao, X. (2015a). Supplier encroachment in competitive supply chains. International Journal of Production Economics, 165, 120–131.

Li, Y., Zhen, X., Qi, X., & Cai, G. G. (2016). Penalty and financial assistance in a supply chain with supply disruption. Omega, 61, 167–181.

Li, Z., Gilbert, S., & Lai, G. (2014). Supplier encroachment under asymmetric information. Management Science, 60(2), 449–462.

Li, Z., Gilbert, S., & Lai, G. (2015b). Supplier encroachment as an enhancement or a hindrance to nonlinear pricing. Production and Operations Management, 24(1), 89–109.

Liu G. M., Zhao, W. H., & Zhao, X. (2019). A new firm entry under capital constraint. Social Science Electronic Publishing. Retrieved from https://ssrn.com/abstract=3324336

Liu, Y., Ren, W., Xu, Q., et al. (2021). Decision analysis of supply chains considering corporate social responsibility and government subsidy under different channel power structures. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04213-x

Luo, Z., Chen, X., Chen, J., & Wang, X. J. (2017). Optimal pricing policies for differentiated brands under different supply chain power structures. European Journal of Operational Research, 259(2), 437–451.

Luo, Z., Chen, X., & Kai, M. (2018). The effect of customer value and power structure on retail supply chain product choice and pricing decisions. Omega, 77, 115–126.

Phan, D. A., Vo, T. L. H., & Lai, A. N. (2019). Supply chain coordination under trade credit and retailer effort. International Journal of Production Research, 57(9), 2642–2655.

Rosenbloom, S. (2010). Wal-Mart unveils plan to make supply chain greener. Retrieved June 6, 2021 from http://www.nytimes.com/2010/02/26/business/energy-environment/26walmart.html

Shi, R., Zhang, J., & Ru, J. (2013). Impacts of power structure on supply chains with uncertain demand. Production and Operations Management, 22(5), 1232–1249.

Smith, G. (2002). War of the superstores: Wal-Mart is trouncing the locals, but they’re not giving up. Business Week, September 23, pp. 60–60.

Sun, X. J., Tang, W. S., Chen, J., Li, S., & Zhang, J. X. (2019). Manufacturer encroachment with production cost reduction under asymmetric information. Transportation Research Part e: Logistics and Transportation Review, 128, 191–211.

Sun, X. J., Tang, W. S., Zhang, J. X., & Chen, J. (2021). The impact of quantity-based cost decline on supplier encroachment. Transportation Research Part e: Logistics and Transportation Review, 147, 102245.

Tang, C. S., Yang, S. A., & Wu, J. (2018). Sourcing from suppliers with financial constraints and performance risk. Manufacturing & Service Operations Management, 20(1), 70–84.

Wang, J., Wang, K., Li, X., & Zhao, R. Q. (2022). Suppliers’ trade credit strategies with transparent credit ratings: Null, exclusive, and nonchalant provision. European Journal of Operational Research, 297, 153–163.

Wang, J. C., Wang, Y. Y., & Lai, F. (2019). Impact of power structure on supply chain performance and consumer surplus. International Transactions in Operational Research, 26, 1752–1785.

Wang, L. S., Chen, J., & Song, H. M. (2021). Manufacturer’s channel strategy with retailer’s store brand. International Journal of Production Research, 59(10), 3042–3061.

Xu, J., Zhou, X. H., Zhang, J. H., & Long, Z. Y. (2021). The optimal channel structure with retail costs in a dual-channel supply chain. International Journal of Production Research, 59(1), 47–75.

Xu, S., & Fang, L. (2020). Partial credit guarantee and trade credit in an emission-dependent supply chain with capital constraint. Transportation Research Part e: Logistics and Transportation Review, 135, 101859.

Yang, H., Zhuo, W., & Shao, L. (2017a). Equilibrium evolution in a two-echelon supply chain with financially constrained retailers: The impact of equity financing. International Journal of Production Economics, 185, 139–149.

Yang, L., Zhang, Q., & Ji, J. N. (2017b). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. International Journal of Production Economics, 191, 286–297.

Yang, S. A., & Birge, J. R. (2017). Trade credit, risk sharing, and inventory financing portfolios. Management Science, 64(8), 3667–3689.

Yoon, D. H. (2016). Supplier encroachment and investment spillovers. Production and Operations Management, 25(11), 1839–1854.

Zhang, J., Cao, Q., & He, X. (2020a). Manufacturer encroachment with advertising. Omega, 91, 102013.

Zhang, J., Li, S., Zhang, S., & Dai, R. (2019a). Manufacturer encroachment with quality decision under asymmetric demand information. European Journal of Operational Research, 273(1), 217–236.

Zhang, L. H., Tian, L., & Chang, L. Y. (2022). Equilibrium strategies of channel structure and RFID technology deployment in a supply chain with manufacturer encroachment. International Journal of Production Research, 60(6), 1890–1912.

Zhang, L. H., & Zhang, C. (2022). Manufacturer encroachment with capital-constrained competitive retailers. European Journal of Operational Research, 296, 1067–1083.

Zhang, S., Zhang, J., & Zhu, G. (2019b). Retail service investing: An anti-encroachment strategy in a retailer-led supply chain. Omega, 84, 212–231.

Zhang, Z. C., Xu, H. Y., & Chen, K. B. (2020b). Operational decisions and financing strategies in a capital-constrained closed-loop supply chain. International Journal of Production Research. https://doi.org/10.1080/00207543.2020.1770356

Zheng, B. R., Yang, C., Yang, J., & Zhang, M. (2017). Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. International Journal of Production Research, 55(12), 3510–3527.

Acknowledgements

The authors sincerely thank the editor, Professor Héctor Cancela, and two anonymous reviewers for their constructive comments and suggestions that help improve the quality of the study. This study was funded in part by the National Natural Science Foundation of China (71971137, 72032001, 71972071), Chenguang Program of Shanghai Municipal Education Commission (20CG56) and Scientific and Innovative Action Plan of Shanghai (21692109300, 22692110700).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Before our proof begins, we introduce a few additional mild assumptions, which will be used in our solutions and numerical simulations. The assumptions \(\theta < \overline{\theta } = 1 - d\) and \(c_{m} < \overline{c}_{m} = a(1 - \theta )(1 - d - \theta )/(1 - d + \theta )\) state that the sales are non-negative (i.e., \(q_{r} > 0\) and \(q_{m} > 0\)) and the partners should be profitable (i.e., \(p_{r} > w > c_{m}\) and \(p_{m} > w > c_{m}\)) in the potential market, which is a rather weak requirement.

Proof of Lemma 1

Manufacturer-led structure We solve the optimal profit functions by backward induction. From bank’s the loan function, we derive the optimal bank credit rate \(r_{b}^{*} = \theta /(1 - \theta )\). Thereafter, we substitute \(r_{b}^{*}\) into Eq. (N-1) to expand the following solutions. In the second stage, the retailer decides his retail price \(p_{r,BC}^{ms,N}\) on the basis of manufacturer’s wholesale price \(w_{r,BC}^{ms,N}\). For a given wholesale price, we have \(\partial^{2} \pi_{r,BC}^{ms,N} /(\partial p_{r,BC}^{ms,N} )^{2} = - 2(1 - \theta ) < 0\), leading to retailer’s profit function is concave in his retail price. Let \(\partial \pi_{r,BC}^{ms,N} /\partial p_{r,BC}^{ms,N} = 0\), we obtain retailer’s selling price responses to the wholesale price, i.e., \(p_{r,BC}^{ms,N} (w_{r,BC}^{ms,N} ) = [w_{r,BC}^{ms,N} + 2(1 - \theta )^{2} ]/[2(1 - \theta )^{2} ]\). In the first stage, the manufacturer determines her wholesale price, taking into account the retailer’s selling price. We have \(\partial^{2} \pi_{m,BC}^{ms,N} /(\partial w_{BC}^{ms,N} )^{2} = - 1/(1 - \theta )^{2} < 0\), hence manufacturer’s profit is concave in her wholesale price. Let \(\partial \pi_{m,BC}^{ms,N} /\partial w_{BC}^{ms,N} = 0\), we obtain that the optimal wholesale price for the retailer is \(w_{BC}^{ms,N*} = {{[a(1 - \theta )^{2} + c_{m} ]} \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} + c_{m} ]} 2}} \right. \kern-\nulldelimiterspace} 2}\). By substituting \(w_{BC}^{ms,N*}\) into \(p_{r,BC}^{ms,N} (w_{r,BC}^{ms,N} )\), it is easy to derive that retailer’s optimal retail price is \(p_{r,BC}^{ms,N*} = {{[3a(1 - \theta )^{2} + c_{m} ]} \mathord{\left/ {\vphantom {{[3a(1 - \theta )^{2} + c_{m} ]} {2(1 - \theta )^{2} }}} \right. \kern-\nulldelimiterspace} {2(1 - \theta )^{2} }}\). Finally, we take \(w_{BC}^{ms,N*}\) and \(p_{r,BC}^{ms,N*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{ms,N*} = {{[a(1 - \theta )^{2} - c_{m} ]^{2} } \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} - c_{m} ]^{2} } {16(1 - \theta )^{3} }}} \right. \kern-\nulldelimiterspace} {16(1 - \theta )^{3} }}\) and \(\pi_{m,BC}^{ms,N*} = {{[a(1 - \theta )^{2} - c_{m} ]^{2} } \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} - c_{m} ]^{2} } {8(1 - \theta )^{2} }}} \right. \kern-\nulldelimiterspace} {8(1 - \theta )^{2} }}\), respectively.

Vertical-Nash structure

We solve the optimal profit functions by backward induction. From bank’s the loan function, we derive the optimal bank credit rate \(r_{b}^{*} = \theta /(1 - \theta )\). Thereafter, we substitute \(r_{b}^{*}\) into Eq. (N-2) to expand the following solutions. Introducing a marginal price \(m_{BC}^{vn,N}\) constructs that the retailer's profit function is concave. We have \(\partial^{2} \pi_{m,BC}^{vn,N} /(\partial w_{BC}^{vn,N} )^{2} = - 2 < 0\) and \(\partial^{2} \pi_{r,BC}^{vn,N} /(\partial m_{BC}^{vn,N} )^{2} = - 2(1 - \theta ) < 0\), leading to both manufacturer’s and retailer’s profits are concove in the wholesale price and marginal profit, respectively. By solving the combination of first-order condition functions \(\partial \pi_{m,BC}^{vn,N} /\partial w_{BC}^{vn,N} = 0\) and \(\partial \pi_{r,BC}^{vn,N} /\partial m_{BC}^{vn,N} = 0\), we derive the optimal wholesale price \(w_{BC}^{vn,N*} = {{[(a + 2c_{m} )(1 - \theta )^{2} ]} \mathord{\left/ {\vphantom {{[(a + 2c_{m} )(1 - \theta )^{2} ]} {(3 - 4\theta + 2\theta^{2} )}}} \right. \kern-\nulldelimiterspace} {(3 - 4\theta + 2\theta^{2} )}}\) and optimal marginal profit \(m_{TC}^{vn,N*} = [a + c_{m} (4\theta - 2\theta^{2} - 1)]/(2\theta^{2} - 4\theta + 3)\). Finally, we take \(w_{BC}^{vn,N*}\) and \(m_{BC}^{vn,N*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{vn,N*} = {{[a(1 - \theta )^{2} - c_{m} ]^{2} (1 - \theta )} \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} - c_{m} ]^{2} (1 - \theta )} {(3 - 4\theta + 2\theta^{2} )^{2} }}} \right. \kern-\nulldelimiterspace} {(3 - 4\theta + 2\theta^{2} )^{2} }}\) and \(\pi_{m,BC}^{vn,N*} = {{[a(1 - \theta )^{2} - c_{m} ]^{2} } \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} - c_{m} ]^{2} } {}}} \right. \kern-\nulldelimiterspace} {}}8(3 - 4\theta + 2\theta^{2} )^{2}\).

Retailer-led structure We solve the optimal profit functions by backward induction. From bank’s the loan function, we derive the optimal bank credit rate \(r_{b}^{*} = \theta /(1 - \theta )\). Thereafter, We substitute \(r_{b}^{*}\) into Eq. (N-3) to expand the following solutions. In the second stage, the manufacturer decides her wholesale price on the basis of retailer’s marginal profit \(m_{BC}^{rs,N}\). For a given marginal profit, we have \(\partial^{2} \pi_{m,BC}^{rs,N} /(\partial w_{BC}^{rs,N} )^{2} = - 2 < 0\), leading to manufacturer’s profit funcation is concave in her wholesale price. Let \(\partial \pi_{m,BC}^{rs,N} /\partial w_{BC}^{rs,N} = 0\), we obtain manufacturer’s wholesale price responses to the marginal profit, \(w_{BC}^{rs,N} (m_{BC}^{rs,N} ) = (a + c_{m} - m_{BC}^{rs,N} )/2\). In the first stage, the retailer determines his marginal profit, taking into account the manufacturer’s wholesale price. We have \(\partial^{2} \pi_{r,BC}^{rs,N} /(\partial m_{BC}^{rs,N} )^{2} = - (2 - 2\theta + \theta^{2} )/[2(1 - \theta )] < 0\), hence retailer’s profit is concave in his marginal profit. Let \(\partial \pi_{r,BC}^{rs,N} /\partial m_{BC}^{rs,N} = 0\), we obtain that the retailer’s optimal marginal profit is \(m_{BC}^{rs,N*} = [a - c_{m} (1 - \theta )^{2} ]/(2 - 2\theta + \theta^{2} )\). By substituting \(m_{BC}^{rs,N*}\) into \(w_{BC}^{rs,N} (m_{BC}^{rs,N} )\), we derive that the manufacturer’s optimal wholesale price is \(w_{BC}^{rs,N*} = {{[a(1 - \theta )^{2} + c_{m} (3 - 4\theta + 2\theta^{2} )]} \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} + c_{m} (3 - 4\theta + 2\theta^{2} )]} {2(2 - 2\theta + \theta^{2} )}}} \right. \kern-\nulldelimiterspace} {2(2 - 2\theta + \theta^{2} )}}\). Finally, we take \(m_{BC}^{rs,N*}\) and \(w_{BC}^{rs,N*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{rs,N*} = {{[a(1 - \theta )^{2} - c_{m} ]^{2} } \mathord{\left/ {\vphantom {{[a(1 - \theta )^{2} - c_{m} ]^{2} } {4(1 - \theta )(2 - 2\theta + \theta^{2} )}}} \right. \kern-\nulldelimiterspace} {4(1 - \theta )(2 - 2\theta + \theta^{2} )}}\) and \(\pi_{m,BC}^{rs,N*} = [a(1 - \theta )^{2} - c_{m} ]^{2} /4[2 - 2\theta + \theta^{2} ]^{2}\).

Proof of Lemma 2

The proof is similar to that of bank credit financing under non-encroachment scenario with three different power structure which has shown in the Proof of Lemma 1 above and hence is omitted.

Proof of Proposition 1

Financing sub-equilibrium in the non-encroachment scenario of ms structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the non-encroachment scenario of ms structure, and derive that \(\pi_{r,TC}^{ms,N} < \pi_{r,BC}^{ms,N}\) holds, leading to the retailer prefers bank credit financing.

Financing sub-equilibrium in the non-encroachment scenario of vn structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the non-encroachment scenario of vn structure, and derive that \(\pi_{r,TC}^{vn,N} < \pi_{r,BC}^{vn,N}\) holds, leading to the retailer prefers bank credit financing.

Financing sub-equilibrium in the non-encroachment scenario of rs structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the non-encroachment scenario of rs structure, and derive that \(\pi_{r,TC}^{rs,N} < \pi_{r,BC}^{rs,N}\) holds, leading to the retailer prefers bank credit financing.

Therefore, the financing equilibrium is that, for any power structure, the capital-constrained retailer always prefers bank financing in the non-encroachment scenario.

Proof of Lemma 3

The proof is similar to that of bank credit financing under non-encroachment scenario with three different power structure which has shown in the Proof of Lemma 4 above and hence is omitted.

Proof of Corollary 1

Through comparing the optimal solutions in Proposition 1, this corollary can be obtained as follows:

(i) With \(\pi_{r,cs}^{ms,N*} - \pi_{r,BC}^{ms,N*} = \frac{{c_{m} \left( {2a\left( {1 - \theta } \right)^{2} - c_{m} \left( {2 - \theta } \right)} \right)\theta }}{{16\left( {1 - \theta } \right)^{3} }} > 0\), \(\pi_{r,cs}^{vn,N*} - \pi_{r,BC}^{vn,N*} = \frac{{\left( {a + 2c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{\left( {3 - 2\theta } \right)\left( {3 - 4\theta + 2\theta^{2} } \right)}} > 0\) and \(\pi_{r,cs}^{rs,N*} - \pi_{r,BC}^{rs,N*} = \frac{{\theta \left( {a^{2} \left( {1 - \theta } \right)^{3} + 2ac_{m} \left( {1 - \theta } \right)^{3} - c_{m}^{2} \left( {3 - 3\theta + \theta^{2} } \right)} \right)}}{{4\left( {2 - \theta } \right)\left( {1 - \theta } \right)\left( {2 - 2\theta + \theta^{2} } \right)}} > 0\), we derive that \(\pi_{r,BC}^{s,N*} < \pi_{r,cs}^{s,N*}\), which is equal to \(\pi_{r,cc}^{s,N*} < \pi_{r,cs}^{s,N*}\) because the optimal financing decision is bank credit.

(ii) With \(p_{r,BC}^{ms,N*} - p_{r,cs}^{ms,N*} = \frac{{c_{m} \theta }}{{4\left( {1 - \theta } \right)^{2} }} > 0\), \(p_{r,BC}^{vn,N*} - p_{r,cs}^{vn,N*} = \frac{{\left( {a + 2c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{\left( {3 - 2\theta } \right)\left( {3 - 4\theta + 2\theta^{2} } \right)}} > 0\) and \(p_{r,BC}^{rs,N*} - p_{r,cs}^{rs,N*} = \frac{{a\left( {1 - \theta } \right)\theta - c_{m} \left( {4 - 3\theta + \theta^{2} } \right)}}{{2\left( {2 - \theta } \right)\left( {2 - 2\theta + \theta^{2} } \right)}} > 0\), we derive that \(p_{r,BC}^{s,N*} > p_{r,cs}^{s,N*}\) which is equal to \(p_{r,cc}^{s,N*} > p_{r,cs}^{s,N*}\); With \(w_{BC}^{ms,N*} - w_{cs}^{ms,N*} = - \frac{1}{2}a\left( {1 - \theta } \right)\theta < 0\), \(w_{BC}^{vn,N*} - w_{cs}^{vn,N*} = - \frac{{\left( {a + 2c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{\left( {3 - 2\theta } \right)\left( {3 - 4\theta + 2\theta^{2} } \right)}} < 0\) and \(w_{BC}^{rs,N*} - w_{cs}^{rs,N*} = - \frac{{\left( {a + c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{2\left( {2 - \theta } \right)\left( {2 - 2\theta + \theta^{2} } \right)}} < 0\), we derive that \(w_{BC}^{s,N*} < w_{cs}^{s,N*}\) which is equal to \(w_{cc}^{s,N*} < w_{cs}^{s,N*}\); With \(q_{r,BC}^{ms,N*} - q_{r,cs}^{ms,N*} = - \frac{{c_{m} \theta }}{{4\left( {1 - \theta } \right)^{2} }} < 0\), \(q_{r,BC}^{vn,N*} - q_{r,cs}^{vn,N*} = - \frac{{\left( {a + 2c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{\left( {3 - 2\theta } \right)\left( {3 - 4\theta + 2\theta^{2} } \right)}} < 0\) and \(q_{r,BC}^{rs,N*} - q_{r,cs}^{rs,N*} = - \frac{{\left( {a + c_{m} } \right)\left( {1 - \theta } \right)\theta }}{{2\left( {2 - \theta } \right)\left( {2 - 2\theta + \theta^{2} } \right)}} < 0\), we derive \(q_{r,BC}^{s,N*} < q_{r,cs}^{s,N*}\) which is equal to \(q_{r,cc}^{s,N*} < q_{r,cs}^{s,N*}\).

Proof of Lemma 4

Manufacturer-led structure We solve optimal profit functions by backward induction. Similarly, we substitute optimal bank rate \(r_{b}^{*} = \theta /(1 - \theta )\) into Eq. (E-1) to expand the following solutions. In the second stage of price game, the retailer decides his retail price \(p_{r,BC}^{ms,E}\) on the basis of the manufacturer’s wholesale price \(w_{r,BC}^{ms,E}\) and direct selling price \(p_{m,BC}^{ms,E}\). For a given wholesale price and direct selling price, we have \(\partial^{2} \pi_{r,BC}^{ms,E} /(\partial p_{r,BC}^{ms,E} )^{2} = - 2(1 - \theta )/(1 - d^{2} ) < 0\), leading to retailer’s profit is concave in his retail price. Let \(\partial \pi_{r,BC}^{ms,E} /\partial p_{r,BC}^{ms,E} = 0\), we obtain retailer’s retail price responses to the combination of wholesale price and direct selling price, \(p_{r,BC}^{ms,E} (p_{m,BC}^{ms,E} ,w_{BC}^{ms,E} ) = [a(1 - d) + dp_{m,TC}^{ms,E} + w_{BC}^{ms,E} /(1 - \theta )^{2} ]/2\). In the first stage, the manufacturer simultaneously determines her wholesale price and direct selling price, taking into account retailer’s retail price. We have \(\left| {H_{m,BC}^{ms,E} } \right| = \left| {\begin{array}{*{20}c} {\partial^{2} \pi_{m,BC}^{ms,E} /(\partial p_{m,BC}^{ms,E} )^{2} } & {\partial^{2} \pi_{m,BC}^{ms,E} /\partial p_{m,BC}^{ms,E} \partial w_{BC}^{ms,E} } \\ {\partial^{2} \pi_{m,BC}^{ms,E} /\partial w_{BC}^{ms,E} \partial p_{m,BC}^{ms,E} } & {\partial^{2} \pi_{m,BC}^{ms,E} /(\partial w_{BC}^{ms,E} )^{2} } \\ \end{array} } \right| = \frac{{8 - 8\theta - d^{2} (8 - 8\theta + \theta^{2} )}}{{4(1 - d)^{2} (1 + d)^{2} (1 - \theta )^{2} }}\), where \(\left| {H_{m,BC}^{ms,E} } \right| > 0\) in the valid range of \(\theta \in (0,\overline{\theta } )\), \(\partial^{2} \pi_{m,BC}^{ms,E} /(\partial p_{m,BC}^{ms,E} )^{2} = - (1 - \theta )(2 - d^{2} )/(1 - d^{2} ) < 0\), \(\partial^{2} \pi_{m,BC}^{ms,E} /\partial p_{m,BC}^{ms,E} \partial w_{BC}^{ms,E} = d(2 - \theta )/[2(1 - \theta )(1 - d^{2} )]\), \(\partial^{2} \pi_{m,BC}^{ms,E} /\partial w_{BC}^{ms,E} \partial p_{m,BC}^{ms,E} = d(2 - \theta )/[2(1 - \theta )(1 - d^{2} )]\) and \(\partial^{2} \pi_{m,BC}^{ms,E} /(\partial w_{BC}^{ms,E} )^{2} = - 1/[(1 - d^{2} )(1 - \theta )^{2} ]\), identifying \(H_{m,BC}^{ms,E}\) is a negative definite matrix and hence the manufacturer has the maximum profit. Let \(\partial \pi_{m,BC}^{ms,E} /\partial w_{BC}^{ms,E} = 0\) and \(\partial \pi_{m,BC}^{ms,E} /\partial p_{m,BC}^{ms,E} = 0\) simultaneously, we obtain the optimal wholesale price \(w_{BC}^{ms,E*} = {{(1 - d)(1 - \theta )^{2} \left( \begin{gathered} a(1 - \theta )[4 + 2d(2 - \theta ) - 4\theta + d^{2} \theta ] \hfill \\ + c_{m} [4 + 4d - (2d + d^{2} )\theta ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{(1 - d)(1 - \theta )^{2} \left( \begin{gathered} a(1 - \theta )[4 + 2d(2 - \theta ) - 4\theta + d^{2} \theta ] \hfill \\ + c_{m} [4 + 4d - (2d + d^{2} )\theta ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{ms} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{ms} }}\) and direct selling price \(p_{m,BC}^{ms,E*} = {{(1 - d)\left( \begin{gathered} a(4 + 4d - d\theta )(1 - \theta )^{2} \hfill \\ + c_{m} [4 + 4d - (4 + 3d)\theta ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{(1 - d)\left( \begin{gathered} a(4 + 4d - d\theta )(1 - \theta )^{2} \hfill \\ + c_{m} [4 + 4d - (4 + 3d)\theta ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{ms} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{ms} }}\). By substituting \(w_{BC}^{ms,N*}\) and \(p_{m,BC}^{ms,E*}\) into \(p_{r,BC}^{ms,E} (p_{m,BC}^{ms,E} ,w_{BC}^{ms,E} )\), it is easy to confirm that retailer’s optimal retail price is \(p_{r,BC}^{ms,E*} = {{(1 - d)\left( \begin{gathered} a(1 - \theta )[6 + 4d - 2d^{2} - (6 + 3d - 2d^{2} )\theta ] \hfill \\ + c_{m} [2 + 4d + 2d^{2} - (3d + 2d^{2} )\theta ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{(1 - d)\left( \begin{gathered} a(1 - \theta )[6 + 4d - 2d^{2} - (6 + 3d - 2d^{2} )\theta ] \hfill \\ + c_{m} [2 + 4d + 2d^{2} - (3d + 2d^{2} )\theta ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{ms} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{ms} }}\). Finally, we take \(w_{BC}^{ms,N*}\), \(p_{m,BC}^{ms,E*}\) and \(p_{r,BC}^{ms,E*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{ms,E*} = {{(1 - d^{2} )\left( \begin{gathered} a(1 - \theta )[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} (2 - 2d + d\theta ) \hfill \\ \end{gathered} \right)^{2} } \mathord{\left/ {\vphantom {{(1 - d^{2} )\left( \begin{gathered} a(1 - \theta )[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} (2 - 2d + d\theta ) \hfill \\ \end{gathered} \right)^{2} } {(\xi_{BC}^{ms} )^{2} }}} \right. \kern-\nulldelimiterspace} {(\xi_{BC}^{ms} )^{2} }}\) and \(\pi_{r,BC}^{ms,E*} = {{\left( \begin{gathered} a^{2} (1 - d)(1 - \theta )^{3} (3 + d - \theta ) - ac_{m} (1 - \theta )[6 - 4d - 2d^{2} \hfill \\ - (6 - 4d - 2d^{2} )\theta - d\theta^{2} ] + c_{m}^{2} (1 - d)[3 + d - (2 + d)\theta ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{\left( \begin{gathered} a^{2} (1 - d)(1 - \theta )^{3} (3 + d - \theta ) - ac_{m} (1 - \theta )[6 - 4d - 2d^{2} \hfill \\ - (6 - 4d - 2d^{2} )\theta - d\theta^{2} ] + c_{m}^{2} (1 - d)[3 + d - (2 + d)\theta ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{ms} - F}}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{ms} - F}}\), respectively. Where \(\xi_{BC}^{ms} = (1 - \theta )[8(1 - \theta )(1 - d^{2} ) - d^{2} \theta^{2} ]\).

Vertical-Nash structure

We solve optimal profit functions by backward induction. Similarly, we substitute optimal bank rate \(r_{b}^{*} = \theta /(1 - \theta )\) into Eq. (E-2) to expand the following solutions. Introducing a marginal price \(m_{TC}^{vn,E}\) constructs that the retailer's profit function is concave. In this price game, the manufacturer and the retailer make decisions at the same time. We have \(\left| {H_{m,BC}^{vn,E} } \right| = \left| {\begin{array}{*{20}c} {\partial^{2} \pi_{m,BC}^{vn,E} /(\partial p_{m,BC}^{vn,E} )^{2} } & {\partial^{2} \pi_{m,BC}^{vn,E} /\partial p_{m,BC}^{vn,E} \partial w_{BC}^{vn,E} } \\ {\partial^{2} \pi_{m,BC}^{vn,E} /\partial w_{BC}^{vn,E} \partial p_{m,BC}^{vn,E} } & {\partial^{2} \pi_{m,BC}^{vn,E} /(\partial w_{BC}^{vn,E} )^{2} } \\ \end{array} } \right| = \frac{{4(1 - \theta ) - d^{2} (2 - \theta )^{2} }}{{(1 - d^{2} )^{2} }}\), where \(\left| {H_{m,BC}^{vn,E} } \right| > 0\) in the valid range of \(\theta \in (0,\overline{\theta } )\), \(\partial^{2} \pi_{m,BC}^{vn,E} /(\partial p_{m,BC}^{vn,E} )^{2} = - 2(1 - \theta )/(1 - d^{2} ) < 0\), \(\partial^{2} \pi_{m,BC}^{vn,E} /\partial p_{m,BC}^{vn,E} \partial w_{BC}^{vn,E} = d(2 - \theta )/(1 - d^{2} )\), \(\partial^{2} \pi_{m,BC}^{vn,E} /\partial w_{BC}^{vn,E} \partial p_{m,BC}^{vn,E} = d(2 - \theta )/(1 - d^{2} )\) and \(\partial^{2} \pi_{m,BC}^{vn,E} /(\partial w_{BC}^{vn,E} )^{2} = - 2/(1 - d^{2} )\), leading to \(H_{m,BC}^{vn,E}\) is a negative definite matrix and hence the manufacturer has the maximum profit. We have \(\partial^{2} \pi_{r,BC}^{vn,E} /(\partial m_{BC}^{vn,E} )^{2} = - 2(1 - \theta )/(1 - d^{2} ) < 0\), hence the retailer’s profit is concave in his marginal profit. Let \(\partial \pi_{r,BC}^{vn,E} /\partial m_{BC}^{vn,E} = 0\), \(\partial \pi_{m,BC}^{vn,E} /\partial w_{BC}^{vn,E} = 0\) and \(\partial \pi_{m,BC}^{vn,E} /\partial p_{m,BC}^{vn,E} = 0\) simultaneously, we can derive the the optimal marginal profit \(m_{BC}^{vn,E*}\), wholesale price \(w_{BC}^{vn,E*} = {{(1 - d)(1 - \theta )^{2} \left( \begin{gathered} a(2 + d)(1 + d - d\theta )(1 - \theta ) \hfill \\ + c_{m} [4 - 4\theta + d(3 - 2\theta ) - d^{2} ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{(1 - d)(1 - \theta )^{2} \left( \begin{gathered} a(2 + d)(1 + d - d\theta )(1 - \theta ) \hfill \\ + c_{m} [4 - 4\theta + d(3 - 2\theta ) - d^{2} ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{vn} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{vn} }}\) and direct selling price \(p_{m,BC}^{vn,E*} = {{(1 - d)\left( \begin{gathered} a(1 - \theta )[3 + 3d - (4 + 3d)\theta + (2 + d)\theta^{2} ] \hfill \\ + c_{m} [3 + 3d - (4 + 5d)\theta + (2 + 2d)\theta^{2} ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{(1 - d)\left( \begin{gathered} a(1 - \theta )[3 + 3d - (4 + 3d)\theta + (2 + d)\theta^{2} ] \hfill \\ + c_{m} [3 + 3d - (4 + 5d)\theta + (2 + 2d)\theta^{2} ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{vn} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{vn} }}\), separately. Finally, we take \(m_{BC}^{vn,E*}\), \(w_{BC}^{vn,E*}\) and \(p_{m,BC}^{vn,E*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{vn,E*} = {{(1 - d^{2} )(1 - \theta )\left( \begin{gathered} (1 - \theta )a[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} (2 - 2d + d\theta ) \hfill \\ \end{gathered} \right)^{2} } \mathord{\left/ {\vphantom {{(1 - d^{2} )(1 - \theta )\left( \begin{gathered} (1 - \theta )a[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} (2 - 2d + d\theta ) \hfill \\ \end{gathered} \right)^{2} } {\xi_{BC}^{vn} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{vn} }}\) and \(\pi_{m,BC}^{vn,E*} = {{\left( {f_{BC,1}^{vn} (d,\theta )a^{2} - f_{BC,2}^{vn} (d,\theta )ac_{m} + f_{BC,3}^{vn} c_{m}^{2} } \right)} \mathord{\left/ {\vphantom {{\left( {f_{BC,1}^{vn} (d,\theta )a^{2} - f_{BC,2}^{vn} (d,\theta )ac_{m} + f_{BC,3}^{vn} c_{m}^{2} } \right)} {\xi_{BC}^{vn} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{vn} }} - F\), respectively. Where \(\xi_{BC}^{vn} = (1 - \theta )[(1 - d^{2} )(6 - 8\theta ) + (4 - 3d^{2} )\theta^{2} ]\), \(f_{BC,1}^{vn} (d,\theta ) = (1 - d)(1 - \theta )^{2} \left( \begin{gathered} 13 + 5d - 13d^{2} - 5d^{3} - 4(9 + 4d - 9d^{2} - 4d^{3} )\theta + (40 + 24d - 37d^{2} \hfill \\ - 19d^{3} )\theta^{2} - (20 + 16d - 17d^{2} - 10d^{3} )\theta^{3} + (4 + 4d - 3d^{2} - 2d^{3} )\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{BC,2}^{vn} (d,\theta ) = \left( \begin{gathered} 2\left( {1 - d} \right)^{2} \left( {13 + 18d + 5d^{2} } \right) - 6\left( {1 - d} \right)^{2} \left( {15 + 22d + 7d^{2} } \right)\theta \hfill \\ + \left( {128 - 52d - 202d^{2} + 56d^{3} + 70d^{4} } \right)\theta^{2} - \left( {96 - 24d - 162d^{2} + 32d^{3} + 58d^{4} } \right)\theta^{3} \hfill \\ + \left( {40 - 4d - 68d^{2} + 9d^{3} + 24d^{4} } \right)\theta^{4} - \left( {8 - 12d^{2} + d^{3} + 4d^{4} } \right)\theta^{5} \hfill \\ \end{gathered} \right)\) and \(f_{BC,3}^{vn} = \left( \begin{gathered} (1 - d)^{2} (13 + 18d + 5d^{2} ) - 4(1 - d)^{2} (7 + 11d + 4d^{2} )\theta + (28 - 4d \hfill \\ - 49d^{2} + 6d^{3} + 19d^{4} )\theta^{2} - (16 - 27d^{2} + d^{3} + 10d^{4} )\theta^{3} + 2(2 - 3d^{2} + d^{4} )\theta^{4} \hfill \\ \end{gathered} \right)\).

Retailer-led structure

We solve the optimal profit functions by backward induction. Similarly, we substitute optimal bank rate \(r_{b}^{*} = \theta /(1 - \theta )\) into Eq. (E-3) to expand the following solutions. Introducing a marginal price \(m_{BC}^{rs,E}\) constructs that the retailer's profit function is concave. In the second stage of price game, the manufacturer decides her wholesale price \(w_{BC}^{rs,E}\) and direct selling price \(p_{m,BC}^{rs,E}\) on the basis of retailer’s marginal profit \(m_{TC}^{rs,E}\). For a given marginal profit, we have \(\left| {H_{m,BC}^{rs,E} } \right| = \left| {\begin{array}{*{20}c} {\partial^{2} \pi_{m,BC}^{rs,E} /(\partial p_{m,BC}^{rs,E} )^{2} } & {\partial^{2} \pi_{m,BC}^{rs,E} /\partial p_{m,BC}^{rs,E} \partial w_{BC}^{rs,E} } \\ {\partial^{2} \pi_{m,BC}^{rs,E} /\partial w_{BC}^{rs,E} \partial p_{m,BC}^{rs,E} } & {\partial^{2} \pi_{m,BC}^{rs,E} /(\partial w_{BC}^{rs,E} )^{2} } \\ \end{array} } \right| = \frac{{4(1 - \theta ) - d^{2} (2 - \theta )^{2} }}{{(1 - d^{2} )^{2} }}\), where \(\left| {H_{m,BC}^{rs,E} } \right| > 0\) in the valid range of \(\theta \in (0,\overline{\theta } )\), \(\partial^{2} \pi_{m,BC}^{rs,E} /(\partial p_{m,BC}^{rs,E} )^{2} = - 2(1 - \theta )/(1 - d^{2} ) < 0\), \(\partial^{2} \pi_{m,BC}^{rs,E} /\partial p_{m,BC}^{rs,E} \partial w_{BC}^{rs,E} = d(2 - \theta )/(1 - d^{2} )\), \(\partial^{2} \pi_{m,BC}^{rs,E} /\partial w_{BC}^{rs,E} \partial p_{m,BC}^{rs,E} = d(2 - \theta )/(1 - d^{2} )\) and \(\partial^{2} \pi_{m,BC}^{rs,E} /(\partial w_{BC}^{rs,E} )^{2} = - 2/(1 - d^{2} )\), identifying \(H_{m,BC}^{rs,E}\) is a negative definite matrix and hence the manufacturer has the maximum profit. Let \(\partial \pi_{m,BC}^{rs,E} /\partial w_{BC}^{rs,E} = 0\) and \(\partial \pi_{m,BC}^{rs,E} /\partial p_{m,BC}^{rs,E} = 0\) simultaneously, we obtain wholesale price and direct selling price response to the given marginal profit, \(w_{BC}^{rs,E} (m_{BC}^{rs,E} )\) and \(p_{m,BC}^{rs,E} (m_{BC}^{rs,E} )\), separately. In the first stage, the retailer determines his marginal profit, taking into account manufacturer’s wholesale price and direct selling price. We have \(\partial^{2} \pi_{r,BC}^{rs,E} /(\partial m_{BC}^{rs,E} )^{2} = - \frac{{4(1 - \theta )[2(2 - 2\theta + \theta^{2} ) - d^{2} (2 - \theta )^{2} ]}}{{[4(1 - \theta ) - d^{2} (2 - \theta )^{2} ]^{2} }} < 0\), hence the retailer’s profit is concave in his marginal profit. Let \(\partial \pi_{r,TC}^{rs,E} /\partial m_{TC}^{rs,E} = 0\), we obtain the retailer’s optimal marginal profit is \(m_{BC}^{rs,E*}\). By substituting \(m_{BC}^{rs,E*}\) into \(w_{BC}^{rs,E} (m_{BC}^{rs,E} )\) and \(p_{m,BC}^{rs,E} (m_{BC}^{rs,E} )\), it is easy to confirm that manufacturer’s optimal wholesale price and optimal direct selling price are \(w_{BC}^{rs,E*} = \left( \begin{gathered} a(1 - \theta )[4(1 - d)(1 + d)^{2} - 2(1 - d)(2 + d)(1 + 2d)\theta + d(4 - 2d - d^{2} )\theta^{2} ] + c_{m} [4(1 \hfill \\ - d)(1 + d)(3 - d) - 2(1 - d)(8 + 5d - 2d^{2} )\theta + (8 - 4d - 4d^{2} + d^{3} )\theta^{2} ] \hfill \\ \end{gathered} \right)\bigg/ \xi_{BC}^{rs} \) and \(p_{m,BC}^{rs,E*} = {{\left( \begin{gathered} a(1 - \theta )[8 - 4d - 4d^{2} - (8 - 6d - 4d^{2} )\theta + (4 - 2d - d^{2} )\theta^{2} ] \hfill \\ - c_{m} [4(2 - d - d^{2} ) - 2(4 - d - 2d^{2} )\theta + (4 - d^{2} )\theta^{2} ] \hfill \\ \end{gathered} \right)} \mathord{\left/ {\vphantom {{\left( \begin{gathered} a(1 - \theta )[8 - 4d - 4d^{2} - (8 - 6d - 4d^{2} )\theta + (4 - 2d - d^{2} )\theta^{2} ] \hfill \\ - c_{m} [4(2 - d - d^{2} ) - 2(4 - d - 2d^{2} )\theta + (4 - d^{2} )\theta^{2} ] \hfill \\ \end{gathered} \right)} {\xi_{BC}^{rs} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{rs} }}\), separately. Finally, we take \(m_{BC}^{rs,E*}\), \(w_{BC}^{rs,E*}\) and \(p_{m,BC}^{rs,E*}\) into each firm’s profit function, and obtain the corresponding optimal outcomes \(\pi_{r,BC}^{rs,E*} = {{\left( \begin{gathered} a(1 - \theta )[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} [2 - d(2 - \theta )] \hfill \\ \end{gathered} \right)^{2} } \mathord{\left/ {\vphantom {{\left( \begin{gathered} a(1 - \theta )[2 - 2d - (2 - d)\theta ] \hfill \\ - c_{m} [2 - d(2 - \theta )] \hfill \\ \end{gathered} \right)^{2} } {2\xi_{BC}^{rs} }}} \right. \kern-\nulldelimiterspace} {2\xi_{BC}^{rs} }}\) and \(\pi_{m,BC}^{rs,E*} = {{\left( {f_{BC,1}^{rs} (d,\theta )a^{2} - f_{BC,2}^{rs} (d,\theta )ac_{m} + f_{BC,3}^{rs} c_{m}^{2} } \right)} \mathord{\left/ {\vphantom {{\left( {f_{BC,1}^{rs} (d,\theta )a^{2} - f_{BC,2}^{rs} (d,\theta )ac_{m} + f_{BC,3}^{rs} c_{m}^{2} } \right)} {\xi_{BC}^{rs} }}} \right. \kern-\nulldelimiterspace} {\xi_{BC}^{rs} }} - F\), respectively. Where \(\xi_{BC}^{rs} = 4(1 - \theta )[4(1 - d^{2} )(1 - \theta ) + (2 - d^{2} )\theta^{2} ]\), \(f_{BC,1}^{rs} (d,\theta ) = \left( {1 - \theta } \right)^{2} \left( \begin{gathered} 16\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {5 + 3d} \right) - 16\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {11 + 6d} \right)\theta + 8\left( {1 - d} \right) \hfill \\ \left( {22 + 14d - 18d^{2} - 9d^{3} } \right)\theta^{2} - 4\left( {1 - d} \right)\left( {20 + 16d - 13d^{2} - 6d^{3} } \right)\theta^{3} \hfill \\ + \left( {4 - 2d - d^{2} } \right)\left( {4 + 2d - 3d^{2} } \right)\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{BC,2}^{rs} (d,\theta ) = 2\left( \begin{gathered} 16(1 - d)^{2} (1 + d)(5 + 3d) - 48(1 - d)^{2} (1 + d)(5 + 3d)\theta + (8(1 - d) \hfill \\ (38 + 25d - 35d^{2} - 21d^{3} ))\theta^{2} - 16(1 - d)(13 + 10d - 10d^{2} - 6d^{3} )\theta^{3} \hfill \\ + (80 - 8d - 112d^{2} + 18d^{3} + 27d^{4} )\theta^{4} - (16 - 16d^{2} + 2d^{3} + 3d^{4} )\theta^{5} \hfill \\ \end{gathered} \right)\) and \(f_{BC,3}^{rs} = \left( \begin{gathered} 16\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {5 + 3d} \right) - \left( {48\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {3 + 2d} \right)} \right)\theta \hfill \\ + 8\left( {1 - d} \right)\left( {16 + 14d - 12d^{2} - 9d^{3} } \right)\theta^{2} \hfill \\ - \left( {4\left( {1 - d} \right)\left( {16 + 16d - 7d^{2} - 6d^{3} } \right)} \right)\theta^{3} + \left( {2 - d} \right)\left( {2 + d} \right)\left( {4 - 3d^{2} } \right)\theta^{4} \hfill \\ \end{gathered} \right)\).

Proof of Lemma 5

The proof is similar to that of bank credit financing under encroachment scenario with three different power structure which has shown in the Proof of Lemma 4 above and hence is omitted. Where \(\xi_{TC}^{ms} = 2(1 - \theta )[2 - 2\theta^{2} - d^{2} (2 - \theta^{2} )]\), \(\xi_{TC}^{vn} = (1 - \theta )[(1 - d^{2} )(6 - 8\theta ) + (4 - 3d^{2} )\theta^{2} ]\), \(\xi_{TC}^{rs} = 4(1 - \theta )[(1 - d^{2} )(2 - \theta ) + \theta^{2} ]\), \(f_{TC,1}^{vn} (d,\theta ) = (1 - d)(1 - \theta )^{2} \left( \begin{gathered} 13 + 5d - 13d^{2} - 5d^{3} - 2(15 + 7d - 15d^{2} - 7d^{3} )\theta \hfill \\ + (33 + 25d - 24d^{2} - 14d^{3} )\theta^{2} - 2(8 + 8d - 4d^{2} - 3d^{3} )\theta^{3} \hfill \\ + (4 + 4d - d^{2} - d^{3} )\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{TC,2}^{vn} (d,\theta ) = 2(1 - \theta )\left( \begin{gathered} (1 - d)^{2} (13 + 18d + 5d^{2} ) - 2(1 - d)^{2} (11 + 18d + 7d^{2} )\theta + (17 - 33d^{2} \hfill \\ + 2d^{3} + 14d^{4} )\theta^{2} - (8 - 14d^{2} + 6d^{4} )\theta^{3} + (4 - 3d^{2} + d^{4} )\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{TC,3}^{vn} = \left( \begin{gathered} (1 - d)^{2} (13 + 18d + 5d^{2} ) - 14(1 - d^{2} )^{2} \theta + (17 + 8d - 33d^{2} - 6d^{3} \hfill \\ + 14d^{4} )\theta^{2} - 2(8 - 10d^{2} - d^{3} + 3d^{4} )\theta^{3} + (4 - 5d^{2} + d^{4} )\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{TC,1}^{rs} (d,\theta ) = \left( {1 - \theta } \right)^{2} \left( \begin{gathered} 4\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {5 + 3d} \right) - 4\left( {1 - d} \right)^{2} \left( {1 + d} \right)\left( {7 + 3d} \right)\theta \hfill \\ + \left( {1 - d} \right)\left( {32 + 24d - 13d^{2} - 3d^{3} } \right)\theta^{2} \hfill \\ - 2\left( {1 - d} \right)\left( {6 + 6d - d^{2} } \right)\theta^{3} + \left( {4 - d^{2} } \right)\theta^{4} \hfill \\ \end{gathered} \right)\), \(f_{TC,2}^{rs} (d,\theta ) = 2(1 - \theta )\left( \begin{gathered} 4(1 - d)^{2} (1 + d)(5 + 3d)(1 - \theta ) + (1 - d)(16 + 16d \hfill \\ - 5d^{2} - 3d^{3} )\theta^{2} - (4 - 4d^{2} )\theta^{3} + (4 + d^{2} )\theta^{4} \hfill \\ \end{gathered} \right)\) and \(f_{TC,3}^{rs} = \left( \begin{gathered} 4(1 - d)^{2} (1 + d)(5 + 3d) - 12(1 - d)^{2} (1 + d)^{2} \theta + (1 - d)(16 + 24d \hfill \\ + 3d^{2} - 3d^{3} )\theta^{2} - 2(1 - d)(6 + 6d + d^{2} )\theta^{3} + (4 - d^{2} )\theta^{4} \hfill \\ \end{gathered} \right)\).

Proof of Proposition 2

Financing sub-equilibrium in the encroachment scenario of ms structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the encroachment scenario of ms structure, and derive that \(\pi_{r,TC}^{ms,E} < \pi_{r,BC}^{ms,E}\) holds, leading to the retailer prefers bank credit financing.

Financing sub-equilibrium in the encroachment scenario of vn structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the encroachment scenario of vn structure, and derive that \(\pi_{r,TC}^{vn,E} < \pi_{r,BC}^{vn,E}\) holds, leading to the retailer prefers bank credit financing.

Financing sub-equilibrium in the encroachment scenario of rs structure: we compare the profits of the retailer choosing bank credit financing with that of the retailer choosing trade credit financing in the encroachment scenario of rs structure, and derive that, and derive that \(\pi_{r,TC}^{rs,E} < \pi_{r,BC}^{rs,E}\) holds, leading to the retailer prefers bank credit financing.

Therefore, the financing equilibrium is that, for any power structure, the capital-constrained retailer always prefers bank financing in the encroachment scenario.

Proof of Lemma 6

The proof is similar to that of bank credit financing under encroachment scenario with three different power structure which has shown in the Proof of Lemma 4 above and hence is omitted.

Proof of Corollary 2

Through comparing the optimal solutions in Proposition 2, this corollary can be obtained as follows: (i)\(\pi_{r,cs}^{ms,E*} - \pi_{r,BC}^{ms,E*} > 0\) because of \(\frac{{\left( {ad\left( {4 + d\left( {4 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {8 + 4d + d^{2} \left( { - 4 + \theta } \right)} \right)} \right)\theta }}{{4\left( {1 + d} \right)\left( {1 - \theta } \right)\left( {8\left( {1 - \theta } \right)\left( {1 - d^{2} } \right) - d^{2} \theta^{2} } \right)}} > 0\). Similarly, we derive that \(\pi_{r,cs}^{vn,E*} - \pi_{r,BC}^{vn,E*} > 0\) and \(\pi_{r,cs}^{rs,E*} - \pi_{r,BC}^{rs,E*} > 0\). Therefore, we derive \(\pi_{r,BC}^{s,E*} < \pi_{r,cs}^{s,E*}\) which is equal to \(\pi_{r,cc}^{s,E*} < \pi_{r,cs}^{s,E*}\) because the optimal financing decision is bank credit.

(ii) With \(p_{r,BC}^{ms,E*} - p_{r,cs}^{ms,E*} = \frac{{\theta \left( {ad\left( {1 - \theta } \right)\left( {4 - d\left( {4 - 3\theta } \right) - d^{2} \theta } \right) + c_{m} \left( {8 - 4d - d^{2} \left( {4 - \theta } \right) + d^{3} \theta } \right)} \right)}}{{4\left( {1 - \theta } \right)\left( {8\left( {1 - \theta } \right)\left( {1 - d^{2} } \right) - d^{2} \theta^{2} } \right)}} > 0\), \(p_{r,BC}^{vn,E*} - p_{r,cs}^{vn,E*} = \frac{{\left( {a\left( {2 + d} \right)\left( {1 + d\left( {1 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {4 + d\left( {3 - 2\theta } \right) + d^{2} \left( { - 1 + \theta } \right) - 4\theta } \right) + } \right)\left( {2 - d^{2} \left( {2 - \theta } \right) - 2\theta } \right)\theta }}{{2\left( {1 + d} \right)\left( {1 - \theta } \right)\left( {3 - 2\theta } \right)\left( {\left( {1 - d^{2} } \right)\left( {6 - 8\theta } \right) + \left( {4 - 3d^{2} } \right)\theta^{2} } \right)}} > 0\) and \(p_{r,BC}^{rs,E*} - p_{r,cs}^{rs,E*} = \frac{{\left( {a\left( {2 + d\left( {2 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {2 - d\left( { - 2 + \theta } \right) - 2\theta } \right) + } \right)\left( {2 - d^{2} \left( {2 - \theta } \right) - 2\theta } \right)\theta }}{{\left( {4\left( {1 + d} \right)\left( {2 - \theta } \right)\left( {1 - \theta } \right)\left( {4\left( {1 - d^{2} } \right)\left( {1 - \theta } \right) + \left( {2 - d^{2} } \right)\theta^{2} } \right)} \right)}} > 0\), we derive \(p_{r,BC}^{s,E*} > p_{r,cs}^{s,E*}\) which is equal to \(p_{r,cc}^{s,E*} > p_{r,cs}^{s,E*}\);

With \(w_{BC}^{ms,E*} - w_{cs}^{ms,E*} =\) \(- \frac{{\theta \left( {a\left( {8\left( {1 - \theta } \right)^{2} - 4d\left( {1 - \theta } \right)^{2} + d^{2} \left( {6 - 11\theta + 5\theta^{2} } \right) + 2d^{3} \left( {1 - \theta } \right)^{2} } \right) + c_{m} d\left( {4 - d\left( {2 - \theta } \right) - 2d^{2} \left( {1 - \theta } \right) - 4\theta } \right)} \right)}}{{\left( {8\left( {1 - \theta } \right)\left( {1 - d^{2} } \right) - d^{2} \theta^{2} } \right)}}\break < 0\), \(w_{BC}^{vn,E*} - w_{cs}^{vn,E*} =\) \(- \frac{{\left( {2 - d^{2} \left( {2 - \theta } \right)} \right)\left( {a\left( {2 + d} \right)\left( {1 + d\left( {1 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {4 - 4\theta + d\left( {3 - 2\theta } \right) - d^{2} \left( {1 - \theta } \right)} \right)} \right)\theta }}{{2\left( {1 + d} \right)\left( {3 - 2\theta } \right)\left( {\left( {1 - d^{2} } \right)\left( {6 - 8\theta } \right) + \left( {4 - 3d^{2} } \right)\theta^{2} } \right)}} < 0\) and \(w_{BC}^{rs,E*} - w_{cs}^{rs,E*} =\) \(- \frac{{\left( {2 - d^{2} \left( {2 - \theta } \right)} \right)\left( {a\left( {2 + d\left( {2 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {2 + d\left( {2 - \theta } \right) - 2\theta } \right) + } \right)\theta }}{{4\left( {1 + d} \right)\left( {2 - \theta } \right)\left( {4\left( {1 - d^{2} } \right)\left( {1 - \theta } \right) + \left( {2 - d^{2} } \right)\theta^{2} } \right)}} < 0\), we derive \(w_{BC}^{s,E*} < w_{cs}^{s,E*}\) which is equal to \(w_{cc}^{s,E*} < w_{cs}^{s,E*}\);

With \(q_{r,BC}^{ms,E*} - q_{r,cs}^{ms,E*} = - \frac{{\theta \left( {ad\left( {1 - \theta } \right)\left( {4 - d\left( {4 - \theta } \right)} \right) + c_{m} \left( {8 + 4d - d^{2} \left( {4 - \theta } \right)} \right)} \right)}}{{4\left( {1 - \theta } \right)\left( {1 + d} \right)\left( {8\left( {1 - \theta } \right)\left( {1 - d^{2} } \right) - d^{2} \theta^{2} } \right)}} < 0\), \(q_{r,BC}^{vn,E*} - q_{r,cs}^{vn,E*} = - \frac{{\left( {a\left( {2 + d} \right)\left( {1 + d\left( {1 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {4 + d\left( {3 - 2\theta } \right) - d^{2} \left( {1\theta } \right) - 4\theta } \right)} \right)\theta }}{{\left( {1 + d} \right)\left( {3 - 2\theta } \right)\left( {\left( {1 - d^{2} } \right)\left( {6 - 8\theta } \right) + \left( {4 - 3d^{2} } \right)\theta^{2} } \right)}} < 0\) and \(q_{r,BC}^{rs,E*} - q_{r,cs}^{rs,E*} = - \frac{{\left( {a\left( {2 + d\left( {2 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {2 + d\left( {2 - \theta } \right) - 2\theta } \right)} \right)\theta }}{{2\left( {1 + d} \right)\left( {2 - \theta } \right)\left( {4\left( {1 - d^{2} } \right)\left( {1 - \theta } \right) + \left( {2 - d^{2} } \right)\theta^{2} } \right)}} < 0\), we derive \(q_{r,BC}^{s,E*} < q_{r,cs}^{s,E*}\), which is equal to \(q_{r,cc}^{s,E*} < q_{r,cs}^{s,E*}\).

(iii) Because of \(\frac{{a\left( {2 - 2\theta - d\left( {2 - \theta } \right)} \right)\left( {1 - \theta } \right)}}{{2 - d\left( {2 - \theta } \right)}} > \overline{c}_{m}\), we derive that \(p_{m,cs}^{ms,E*} - p_{m,BC}^{ms,E*} > 0\). With \(p_{m,cs}^{ms,E*} - p_{m,BC}^{ms,E*} > 0\), \(p_{m,cs}^{vn,E*} - p_{m,BC}^{vn,E*} = \frac{{d\left( {a\left( {2 + d} \right)\left( {1 + d\left( {1 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {4 - 4\theta + d\left( {3 - 2\theta } \right) + d^{2} \left( { - 1 + \theta } \right)} \right)} \right)\theta^{2} }}{{2\left( {1 + d} \right)\left( {1 - \theta } \right)\left( {3 - 2\theta } \right)\left( {\left( {1 - d^{2} } \right)\left( {6 - 8\theta } \right) + \left( {4 - 3d^{2} } \right)\theta^{2} } \right)}} > 0\), \(p_{m,cs}^{rs,E*} - p_{m,BC}^{rs,E*} = \frac{{\left( {1 - d} \right)\left( {a\left( {1 - \theta } \right)\left( {2 - 2\theta - d\left( {2 - \theta } \right)\theta - 2d^{2} \left( {1 - \theta } \right)} \right) + 2c_{m} \left( {1 - 2\theta - d^{2} \left( {1 - \theta } \right)} \right)} \right)}}{{\left( {1 - \theta } \right)\left( {8\left( {1 - \theta } \right)\left( {1 - d^{2} } \right) - d^{2} \theta^{2} } \right)}} > 0\), we derive that \(p_{m,cs}^{s,E*} > p_{m,BC}^{s,E*}\), which is equal to \(p_{m,cs}^{s,E*} > p_{m,cc}^{s,E*}\).

With \(q_{m,cs}^{ms,E*} - q_{m,BC}^{ms,E*} = - \frac{{d\theta \left( {a\left( {1 - \theta } \right)\left( {4 - 4\theta + 2d\left( {2 - \theta } \right) + d^{2} \theta } \right) - c_{m} \left( {4 + 2d\left( {2 - \theta } \right) - d^{2} \theta } \right)} \right)}}{{4\left( {1 + d} \right)\left( {1 - \theta } \right)\left( {8\left( {1 - \theta } \right) - d^{2} \left( {8 - 8\theta + \theta^{2} } \right)} \right)}} < 0\), \(q_{m,cs}^{vn,E*} - q_{m,BC}^{vn,E*} = - \frac{{d\left( {a\left( {2 + d} \right)\left( {1 + d\left( {1 - \theta } \right)} \right)\left( {1 - \theta } \right) + cm\left( {4 + d\left( {3 - 2\theta } \right) - d^{2} \left( {1 - \theta } \right) - 4\theta } \right)} \right)\left( {2 - \theta } \right)\theta }}{{2\left( {1 + d} \right)\left( {3 - 2\theta } \right)\left( {\left( {1 - \theta } \right)\left( {\left( {1 - d^{2} } \right)\left( {6 - 8\theta } \right) + \left( {4 - 3d^{2} } \right)\theta^{2} } \right)} \right)}} < 0\), \(q_{m,cs}^{rs,E*} - q_{m,BC}^{rs,E*} = - \frac{{d\left( {a\left( {2 + d\left( {2 - \theta } \right)} \right)\left( {1 - \theta } \right) + c_{m} \left( {2 + d\left( {2 - \theta } \right) - 2\theta } \right) + } \right)\theta^{2} }}{{4\left( {1 + d} \right)\left( {2 - \theta } \right)\left( {1 - \theta } \right)\left( {4\left( {1 - d^{2} } \right)\left( {1 - \theta } \right) + \left( {2 - d^{2} } \right)\theta^{2} } \right)}} < 0\), we derive that \(q_{m,cs}^{s,E*} < q_{m,BC}^{s,E*}\), which is equal to \(q_{m,cs}^{s,E*} < q_{m,cc}^{s,E*}\).

We hold that \(p_{m,BC}^{ms,E*} q_{m,BC}^{ms,E*} - p_{m,cs}^{ms,E*} q_{m,cs}^{ms,E*}\) which can be thought of as a quadratic function of \(c_{m}\), the numerical simulation of quadratic constant \(A\) is shown in Fig. 6a and the numerical simulation of the function’s zeros (\(c_{m1}^{ms}\) and \(c_{m2}^{ms}\)) are shown in Fig. 6b. With \(c_{m1}^{ms} < c_{m2}^{ms} < 0 < \overline{c}_{m}\) and \(A > 0\), we derive that \(p_{m,BC}^{ms,E*} q_{m,BC}^{ms,E*} - p_{m,cs}^{ms,E*} q_{m,cs}^{ms,E*} > 0\). By the similar proof of the comparison of \(p_{m,BC}^{ms,E*} q_{m,BC}^{ms,E*}\) and \(p_{m,cs}^{ms,E*} q_{m,cs}^{ms,E*}\), we compare \(p_{m,BC}^{vn,E*} q_{m,BC}^{vn,E*}\) and \(p_{m,cs}^{vn,E*} q_{m,cs}^{vn,E*}\), and get the solution that \(p_{m,BC}^{vn,E*} q_{m,BC}^{vn,E*} - p_{m,cs}^{vn,E*} q_{m,cs}^{vn,E*} > 0\). Further we compare \(p_{m,BC}^{rs,E*} q_{m,BC}^{rs,E*}\) and \(p_{m,cs}^{ms,E*} q_{m,cs}^{ms,E*}\), and get the solution \(p_{m,BC}^{rs,E*} q_{m,BC}^{rs,E*} - p_{m,cs}^{rs,E*} q_{m,cs}^{rs,E*} > 0\). Therefore \(p_{m,BC}^{s,E*} q_{m,BC}^{s,E*} > p_{m,cs}^{s,E*} q_{m,cs}^{s,E*}\), this is equal to \(p_{m,cc}^{s,E*} q_{m,cc}^{s,E*} > p_{m,cs}^{s,E*} q_{m,cs}^{s,E*}\).

Proof of Proposition 3

(i) Based on Proposition 1, we conclude that the final financing strategy in three structures. We make a difference in the profits of manufacturer encroachment and non-encroachment scenario.

When the retailer is capital-constrained:

-

(I)

For ms structure, bank credit is always the optimal equilibrium result with encroachment and ono-encroachment. Thus, the threshold \(\overline{F}_{cc}^{ms}\) can be gained by \(\pi_{m,BC}^{ms,E*} - \pi_{m,BC}^{ms,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cc}^{ms} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

-

(II)

For vn structure, bank credit is always the optimal equilibrium result with encroachment and ono-encroachment. Thus, the threshold \(\overline{F}_{cc}^{vn}\) can be gained by \(\pi_{m,BC}^{vn,E*} - \pi_{m,BC}^{vn,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cc}^{vn} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

-

(III)

For rs structure, bank credit is always the optimal equilibrium result with encroachment and ono-encroachment. Thus, the threshold \(\overline{F}_{cc}^{rs}\) can be gained by \(\pi_{m,BC}^{rs,E*} - \pi_{m,BC}^{rs,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cc}^{rs} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

When the retailer is capital-sufficient:

-

(IV)

For ms structure, the threshold \(\overline{F}_{cs}^{ms}\) can be gained by \(\pi_{m,cs}^{ms,E*} - \pi_{m,cs}^{ms,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cs}^{ms} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

-

(V)

For vn structure, the threshold \(\overline{F}_{cs}^{vn}\) can be gained by \(\pi_{m,cs}^{vn,E*} - \pi_{m,cs}^{vn,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cs}^{vn} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

-

(VI)

For rs structure, the threshold \(\overline{F}_{cs}^{rs}\) can be gained by \(\pi_{m,cs}^{rs,E*} - \pi_{m,cs}^{rs,N*} = 0\). Then, when \(F \in (0,\overline{F}_{cs}^{rs} ]\), the manufacturer enters the market; otherwise, the manufacturer will forgo encroachment.

The specific encroachment thresholds in three power structures are as follows:

\(\overline{F}_{cc}^{ms} = \frac{{a^{2} (1 - \theta )^{4} (16 - 8d(2 - \theta ) - d^{2} (8 - \theta )\theta ) - 2ac_{m} (1 - \theta )^{2} (16(1 - \theta ) - 4d(2 - \theta )^{2} + d^{2} \theta^{2} ) + c_{m}^{2} (16(1 - \theta )^{2} - 8d(2 - 3\theta + \theta^{2} ) + d^{2} \theta (8 - 7\theta ))}}{{8(1 - \theta )^{2} (8(1 - \theta ) - d^{2} (8 - 8\theta + \theta^{2} ))}}\)\(\overline{F}_{cc}^{vn} = \frac{{\left( \begin{gathered} a^{2} (1 - \theta )^{2} \left( \begin{gathered} (3 - 4\theta + 2\theta^{2} )^{4} - 4d(2 - \theta )(3 - 7\theta + 6\theta^{2} - 2\theta^{3} )^{2} - d^{2} (90 - 492\theta + 1297\theta^{2} \hfill \\ - 2109\theta^{3} + 2279\theta^{4} - 1656\theta^{5} + 784\theta^{6} - 220\theta^{7} + 28\theta^{8} ) + d^{3} (2 - \theta )^{3} (1 - \theta ) \hfill \\ (3 - 4\theta + 2\theta^{2} )^{2} + d^{4} (1 - \theta )^{2} (9 - 42\theta + 106\theta^{2} - 148\theta^{3} + 115\theta^{4} - 47\theta^{5} + 8\theta^{6} ) \hfill \\ \end{gathered} \right) \hfill \\ - ac_{m} (1 - \theta )\left( \begin{gathered} 2(3 - 4\theta + 2\theta^{2} )^{4} - 4d(1 - \theta )(6 - 11\theta + 8\theta^{2} - 2\theta^{3} )^{2} - 2d^{2} (90 - 528\theta \hfill \\ + 1465\theta^{2} - 2428\theta^{3} + 2590\theta^{4} - 1808\theta^{5} + 804\theta^{6} - 208\theta^{7} + 24\theta^{8} )d^{3} (2 - \theta )^{4} \hfill \\ \left( {3 - 4\theta + 2\theta^{2} } \right)^{2} + 2d^{4} \left( {1 - \theta } \right)^{3} (9 - 69\theta + 133\theta^{2} - 115\theta^{3} + 48\theta^{4} - 8\theta^{5} ) \hfill \\ \end{gathered} \right) \hfill \\ + c_{m}^{2} \left( \begin{gathered} \left( {3 - 4\theta + 2\theta^{2} } \right)^{4} - 4d\left( {2 - 3\theta + \theta^{2} } \right)\left( {3 - 4\theta + 2\theta^{2} } \right)^{2} + d^{3} \left( {2 - \theta } \right)^{3} \left( {3 - 4\theta + 2\theta^{2} } \right)^{2} \hfill \\ - d^{2} (90 - 564\theta + 1597\theta^{2} - 2615\theta^{3} + 2714\theta^{4} - 1836\theta^{5} + 796\theta^{6} - 204\theta^{7} + 24\theta^{8} ) \hfill \\ + d^{4} (9 - 132\theta + 499\theta^{2} - 926\theta^{3} + 1009\theta^{4} - 687\theta^{5} + 292\theta^{6} - 72\theta^{7} + 8\theta^{8} ) \hfill \\ \end{gathered} \right) \hfill \\ \end{gathered} \right)}}{{(1 - \theta )(3 - 4\theta + 2\theta^{2} )^{2} (6 - 8\theta + 4\theta^{2} - d^{2} (6 - 8\theta + 3\theta^{2} ))^{2} }}\), \(\overline{F}_{cc}^{rs} = \frac{{\left( \begin{gathered} a^{2} (1 - \theta )^{2} \left( \begin{gathered} 16(2 - 2\theta + \theta^{2} )^{4} - 16d(2 - \theta )(2 - 4\theta + 3\theta^{2} - \theta^{3} )^{2} \hfill \\ - 4d^{2} (2 - \theta )^{2} (24 - 68\theta + 104\theta^{2} - 100\theta^{3} + 64\theta^{4} - 25\theta^{5} + 5\theta^{6} ) \hfill \\ + 4d^{3} (2 - \theta )^{3} (1 - \theta )(2 - 2\theta + \theta^{2} )^{2} + d^{4} \left( {2 - \theta } \right)^{4} (8 - 12\theta + 12\theta^{2} \hfill \\ - 8\theta^{3} + 3\theta^{4} ) \hfill \\ \end{gathered} \right) \hfill \\ 2ac_{m} (1 - \theta )\left( \begin{gathered} 16(2 - 2\theta + \theta^{2} )^{4} - 8d(1 - \theta )(4 - 6\theta + 4\theta^{2} - \theta^{3} )^{2} - 16d^{2} \left( {2 - \theta } \right)^{2} \hfill \\ (6 - 18\theta + 29\theta^{2} - 28\theta^{3} + 17\theta^{4} - 6\theta^{5} + \theta^{6} ) + 2d^{3} \left( {2 - \theta } \right)^{4} \hfill \\ (2 - 2\theta + \theta^{2} )^{2} + d^{4} (2 - \theta )^{4} (8 - 16\theta + 20\theta^{2} - 12\theta^{3} + 3\theta^{4} ) \hfill \\ \end{gathered} \right) \hfill \\ + c_{m}^{2} \left( \begin{gathered} 16(2 - 2\theta + \theta^{2} )^{4} - 16d(2 - 3\theta + \theta^{2} )(2 - 2\theta + \theta^{2} )^{2} - 4d^{2} \left( {2 - \theta } \right)^{2} \hfill \\ (24 - 76\theta + 124\theta^{2} - 116\theta^{3} + 68\theta^{4} - 23\theta^{5} + 4\theta^{6} ) + 4d^{3} \left( {2 - \theta } \right)^{3} \hfill \\ (2 - 2\theta + \theta^{2} )^{2} + d^{4} (2 - \theta )^{4} (8 - 20\theta + 24\theta^{2} - 12\theta^{3} + 3\theta^{4} ) \hfill \\ \end{gathered} \right) \hfill \\ \end{gathered} \right)}}{{16(1 - \theta )(2 - 2\theta + \theta^{2} )^{2} (2(2 - 2\theta + \theta^{2} ) - d^{2} (2 - \theta )^{2} )^{2} }}\), \(\overline{F}_{cs}^{ms} = \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{4\left( {1 + d} \right)\left( {1 - \theta } \right)}}\), \(\overline{F}_{cs}^{vn} = \frac{{\left( {a\left( {1 - \theta } \right) - cm} \right)^{2} \left( {9 + 10d + d^{2} - \left( {12 + 16d + 4d^{2} } \right)\theta + \left( {4 + 8d + 3d^{2} } \right)\theta^{2} } \right)}}{{4\left( {1 + d} \right)^{2} \left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}}\) and \(\overline{F}_{cs}^{rs} = \frac{{\left( {2 + d} \right)\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {8 + 8d - \left( {8 + 8d} \right)\theta + \left( {2 + 3d} \right)\theta^{2} } \right)}}{{16\left( {1 + d} \right)^{2} \left( {2 - \theta } \right)^{2} \left( {1 - \theta } \right)}}\).

(ii) We compare the manufacturer’s encroachment thresholds in Proposition 1(i) when the retailer is capital-constrained and when the retailer is capital-sufficient.

For ms structure: \(\overline{F}_{cc}^{ms} - \overline{F}_{cs}^{ms} =\)

\(\frac{{d\theta (a^{2} (1 - \theta )^{3} (8(1 - \theta ) + d(3 - \theta )\theta - d^{2} (8 - 9\theta + \theta^{2} )) + 2ac_{m} (4 + d - d^{2} )(1 - \theta )^{2} \theta - c_{m}^{2} (8(1 - \theta ) - d(3 - 2\theta )\theta - d^{2} (8 - 7\theta )))}}{{8(1 + d)(1 - \theta )^{2} \left( {8(1 - \theta ) - d^{2} (8 - 8\theta + \theta^{2} )} \right)}}\), which can be thought of as a quadratic function of \(c_{m}\). The numerical simulation of quadratic constant \(A\) is shown in Fig.

7a and the numerical simulation of the function’s zeros (\(c_{m1}^{ms}\) and \(c_{m2}^{ms}\)) are shown in Fig. 7b. With \(c_{m2}^{ms} < 0 < \overline{c}_{m} < c_{m1}^{ms}\) and \(A < 0\), we can derive \(\overline{F}_{cc}^{ms} - \overline{F}_{cs}^{ms} > 0\).

For vn structure: \(\overline{F}_{cc}^{vn} - \overline{F}_{cs}^{vn}\) which can be thought of as a quadratic function of \(c_{m}\), the numerical simulation of quadratic constant \(A\) is shown in Fig.

8a. And the numerical simulation of the function’s zeros (\(c_{m1}^{vn}\) and \(c_{m2}^{vn}\)) are shown in Fig. 8b. With \(c_{m2}^{vn} < 0 < \overline{c}_{m} < c_{m1}^{vn}\) and \(A < 0\), we can derive that \(\overline{F}_{cc}^{vn} - \overline{F}_{cs}^{vn} > 0\).

For rs structure: \(\overline{F}_{cc}^{rs} - \overline{F}_{cs}^{rs}\) which can be thought of as a quadratic function of \(c_{m}\), the numerical simulation of quadratic constant \(A\) is shown in Fig.

9a. And the numerical simulation of the function’s zeros (\(c_{m1}^{rs}\) and \(c_{m2}^{rs}\)) are shown in Fig. 9b. With \(c_{m1}^{rs} < 0 < \overline{c}_{m} < c_{m2}^{rs}\) and \(A < 0\), we derive that \(\overline{F}_{cc}^{rs} - \overline{F}_{cs}^{rs} > 0\).

(iii) We compare the manufacturer encroachment thresholds in Proposition 1(i) under three power structures.

When the retailer is capital-sufficient: \(\overline{F}_{cs}^{vn} - \overline{F}_{cs}^{ms} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {\left( {1 - 2\theta } \right)^{2} + d\left( {1 - 4\theta + 3\theta^{2} } \right)} \right)}}{{4\left( {1 + d} \right)^{2} \left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}} > 0\) when \(\theta \in (0,\widehat{\theta })\), \(\widehat{\theta } = (2 + 2d - \sqrt {d + d^{2} } )/4 + 3d\), otherwise, \(\overline{F}_{cs}^{vn} < \overline{F}_{cs}^{ms}\); \(\overline{F}_{cs}^{rs} - \overline{F}_{cs}^{ms} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {4\left( {2 - 2\theta + \theta^{2} } \right) + d\left( {8 - 8\theta + 3\theta^{2} } \right)} \right)}}{{16\left( {1 + d} \right)^{2} \left( {2 - \theta } \right)^{2} \left( {1 - \theta } \right)}} > 0\); \(\overline{F}_{cs}^{rs} - \overline{F}_{cs}^{vn} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {7 - 4\theta } \right)\left( {8 - 8\theta + d\left( {8 - 8\theta + \theta^{2} } \right)} \right)}}{{16\left( {1 + d} \right)^{2} \left( {3 - 2\theta } \right)^{2} \left( {2 - \theta } \right)^{2} \left( {1 - \theta } \right)}} > 0\). Therefore, \(\overline{F}_{cs}^{rs} > \overline{F}_{cs}^{vn} > \overline{F}_{cs}^{ms}\) when \(\theta \in (0,\widehat{\theta })\), otherwise \(\overline{F}_{cs}^{rs} > \overline{F}_{cs}^{ms} > \overline{F}_{cs}^{vn}\).

When the retailer is capital-constrained: Comparing \(\overline{F}_{cs}^{vn}\) and \(\overline{F}_{cc}^{ms}\), \(\overline{F}_{{{\text{c}} c}}^{vn} - \overline{F}_{cc}^{ms}\) which can be thought of as a quadratic function of \(c_{m}\), and the numerical simulation of quadratic constant \(A\) is shown in Fig.

10a. And the numerical simulation of the function’s zeros (\(c_{m1}^{vn - ms}\) and \(c_{m2}^{vn - ms}\)) are shown in Fig. 10b. With \(0 < \overline{c}_{m} < c_{m2}^{vn - ms} < c_{m1}^{vn - ms}\) and \(A > 0\), we derive that \(\overline{F}_{cs}^{vn} - \overline{F}_{cc}^{ms} > 0\).

Through the similar proofs to the comparison of \(\overline{F}_{cs}^{vn}\) and \(\overline{F}_{cc}^{ms}\), we compare \(\overline{F}_{cc}^{rs}\) and \(\overline{F}_{cc}^{ms}\), and get the solution that \(\overline{F}_{cc}^{rs} > \overline{F}_{cc}^{ms}\). Further, we compare \(\overline{F}_{cc}^{rs}\) and \(\overline{F}_{cc}^{vn}\), and get the solution \(\overline{F}_{cc}^{rs} > \overline{F}_{cc}^{vn}\). Therefore \(\overline{F}_{cc}^{rs} > \overline{F}_{cc}^{vn} > \overline{F}_{cc}^{ms}\).

(iv) We compare all the manufacturer encroachment thresholds in Proposition 1(i), and we through the similar proof of the comparison of \(\overline{F}_{cs}^{vn}\) and \(\overline{F}_{cc}^{ms}\), we get the solutions that \(\overline{F}_{cc}^{ms} < \overline{F}_{cs}^{rs}\), \(\overline{F}_{cc}^{vn} < \overline{F}_{cs}^{rs}\) and \(\overline{F}_{cc}^{ms} > \overline{F}_{cs}^{vn}\). Based on (ii) and (iii), we can derive that \(\overline{F}_{cs}^{rs} > \overline{F}_{cs}^{rs} > \overline{F}_{cs}^{vn} > \overline{F}_{cs}^{ms} > \overline{F}_{cs}^{vn} > \overline{F}_{cs}^{ms}\) when \(\theta \in (0,\widehat{\theta })\), otherwise \(\overline{F}_{cs}^{rs} > \overline{F}_{cs}^{rs} > \overline{F}_{cs}^{vn} > \overline{F}_{cs}^{ms} > \overline{F}_{cs}^{ms} > \overline{F}_{cs}^{vn}\).

Proof of Corollary 3

The impacts of related parameters on encroachment cost thresholds.

(i) \(\overline{F}_{cs}^{ms} = \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{4\left( {1 + d} \right)\left( {1 - \theta } \right)}} > 0\), \(\overline{F}_{cs}^{vn} = \frac{{\left( {a\left( {1 - \theta } \right) - cm} \right)^{2} \left( {9 + 10d + d^{2} - \left( {12 + 16d + 4d^{2} } \right)\theta + \left( {4 + 8d + 3d^{2} } \right)\theta^{2} } \right)}}{{4\left( {1 + d} \right)^{2} \left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}} > 0\) because of \(9 + 10d + d^{2} - \left( {12 + 16d + 4d^{2} } \right)\theta + \left( {4 + 8d + 3d^{2} } \right)\theta^{2} > 0\) and \(\overline{F}_{cs}^{rs} = \frac{{\left( {2 + d} \right)\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {8 + 8d - \left( {8 + 8d} \right)\theta + \left( {2 + 3d} \right)\theta^{2} } \right)}}{{16\left( {1 + d} \right)^{2} \left( {2 - \theta } \right)^{2} \left( {1 - \theta } \right)}} > 0\) because of \(8 + 8d - \left( {8 + 8d} \right)\theta + \left( {2 + 3d} \right)\theta^{2} > 0\). By calculating the derivative of \(\overline{F}_{cc}^{s}\) with respect to \(c_{m}\), we find that \(\overline{F}_{cc}^{s}\) is always monotonically decreasing, and the minimum value of \(\overline{F}_{cc}^{s}\) is always obtained in \(\overline{c}_{m}\) and \(\overline{F}_{cc}^{s} > 0\).

(ii) We investigate the impact of unit production cost on encroachment cost thresholds. We derive that \(\widetilde{c}_{m}^{s}\) is the unique solution of \(\frac{{\partial \overline{F}_{cc}^{s} }}{{\partial c_{m} }} = 0\). Because \(\widetilde{c}_{m}^{s} > \overline{c}_{m}\) which is shown in Fig.

11a and \(\frac{{\partial^{2} \overline{F}_{cc}^{s} }}{{\partial c_{m}^{2} }} > 0\) where is shown in Fig. 11b, \(\frac{{\partial \overline{F}_{cc}^{s} }}{{\partial c_{m} }} < 0\). With \(\frac{{\partial \overline{F}_{cc}^{ms} }}{{\partial c_{m} }} < 0\), \(\frac{{\partial \overline{F}_{cc}^{vn} }}{{\partial c_{m} }} < 0\), \(\frac{{\partial \overline{F}_{cc}^{rs} }}{{\partial c_{m} }} < 0\) \(\frac{{\partial \overline{F}_{cs}^{ms} }}{{\partial c_{m} }} = - \frac{{a\left( {1 - \theta } \right) - c_{m} }}{{2\left( {1 + d} \right)\left( {1 - \theta } \right)}} < 0\), \(\frac{{\partial \overline{F}_{cs}^{vn} }}{{\partial c_{m} }} = - \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)\left( {9 + 10d + d^{2} - \left( {12 + 16d + 4d^{2} } \right)\theta + \left( {4 + 8d + 3d^{2} } \right)\theta^{2} } \right)}}{{2\left( {1 + d} \right)^{2} \left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}} < 0\), \(\frac{{\partial \overline{F}_{cs}^{rs} }}{{\partial c_{m} }} = - \frac{{\left( {2 + d} \right)\left( {a\left( {1 - \theta } \right) - c_{m} } \right)\left( {8 + 8d - \left( {8 + 8d} \right)\theta + \left( {2 + 3d} \right)\theta^{2} } \right)}}{{8\left( {1 + d} \right)^{2} \left( {1 - \theta } \right)\left( {2 - \theta } \right)^{2} }} < 0\), we can hold that \(\frac{{\partial \overline{F}_{v}^{s} }}{{\partial c_{m} }} < 0\).

We investigate the impact of channel competition on encroachment cost thresholds. \(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial d}\) which can be thought of as a quadratic function of \(c_{m}\), and the numerical simulation of quadratic constant \(A\) is shown in Fig.

12a. And the numerical simulation of the function’s zeros (\(c_{m1}^{ms}\) and \(c_{m2}^{ms}\)) are shown in Fig. 12b. With \(0 < \overline{c}_{m} < c_{m1}^{ms} < c_{m2}^{ms}\) and \(A < 0\),we derive that \(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial d} < 0\). Similar to the proof of \(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial d}\), we find \(\frac{{\partial \overline{F}_{cc}^{vn} }}{\partial d} < 0\) and \(\frac{{\partial \overline{F}_{cc}^{rs} }}{\partial d} < 0\). Therefore, with \(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial d} < 0\), \(\frac{{\partial \overline{F}_{cc}^{vn} }}{\partial d} < 0\), \(\frac{{\partial \overline{F}_{cc}^{rs} }}{\partial d} < 0\), \(\frac{{\partial \overline{F}_{cs}^{ms} }}{\partial d} = - \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{4\left( {1 + d} \right)^{2} \left( {1 - \theta } \right)}} < 0\), \(\frac{{\partial \overline{F}_{cs}^{vn} }}{\partial d} = - \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {4 - 4\theta + d\left( {2 - \theta } \right)^{2} } \right)}}{{2\left( {1 + d} \right)^{3} \left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}} < 0\) and \(\frac{{\partial \overline{F}_{cs}^{rs} }}{\partial d} = - \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {4 + d\left( {2 - \theta } \right)^{2} - 4\theta } \right)}}{{8\left( {1 + d} \right)^{3} \left( {2 - \theta } \right)^{2} \left( {1 - \theta } \right)}} < 0\), we derive that \(\frac{{\partial \overline{F}_{v}^{s} }}{\partial d} < 0\).

We investigate the impact of market risk on encroachment cost thresholds. With \(\frac{{\partial \overline{F}_{cs}^{ms} }}{\partial \theta } = - \frac{{\left( {a\left( {1 - \theta } \right) - c_{m} } \right)\left( {a(1 - \theta ) - c_{m} } \right)}}{{4\left( {1 + d} \right)\left( {1 - \theta } \right)^{2} }} < 0\); \(\frac{{\partial \overline{F}_{cs}^{vn} }}{\partial \theta } < 0\); \(\frac{{\partial \overline{F}_{cs}^{rs} }}{\partial \theta } < 0\);\(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial \theta } < 0\); \(\frac{{\partial \overline{F}_{cc}^{vn} }}{\partial \theta } < 0\); \(\frac{{\partial \overline{F}_{cc}^{rs} }}{\partial \theta } < 0\), we derive that \(\frac{{\partial \overline{F}_{v}^{s} }}{\partial d} < 0\). The proofs are similar to the proof of \(\frac{{\partial \overline{F}_{cc}^{ms} }}{\partial d}\). Hence is omitted.

Proof of Proposition 4

(i) We investigate the impact of manufacturer encroachment on the retailer’s profits. When the retailer is capital-sufficient: we derive that \(\pi_{r,cs}^{ms,N*} - \pi_{r,cs}^{ms,E*} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{8\left( {1 + d} \right)\left( {1 - \theta } \right)}} > 0\), \(\pi_{r,cs}^{vn,N*} - \pi_{r,cs}^{vn,E*} = \frac{{2d\left( {1 - \theta } \right)\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{\left( {1 + d} \right)\left( {3 - 2\theta } \right)^{2} }} > 0\), \(\pi_{r,cs}^{rs,N*} - \pi_{r,cs}^{rs,E*} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{2\left( {1 + d} \right)\left( {2 - \theta } \right)}} > 0\).

When the retailer is capital-constrained:

For ms structure: \(\pi_{r,BC}^{ms,N*} - \pi_{r,BC}^{ms,E*}\) which can be thought of as a quadratic function of \(c_{m}\), and the numerical simulation of quadratic constant \(A\) is shown in Fig.

13a. And the numerical simulation of the function’s zeros (\(c_{m1}^{ms}\) and \(c_{m2}^{ms}\)) are shown in Fig. 13b. With \(0 < \overline{c}_{m} < c_{m1}^{ms} < c_{m2}^{ms}\) and \(A > 0\), we derive that \(\pi_{r,BC}^{ms,N*} - \pi_{r,BC}^{ms,E*} > 0\).

For vn structure: \(\pi_{r,BC}^{vn,N*} - \pi_{r,BC}^{vn,E*}\) which can be thought of as a quadratic function of \(c_{m}\), and the numerical simulation of quadratic constant \(A\) is shown in Fig.

14a. And the numerical simulation of the function’s zeros (\(c_{m1}^{vn}\) and \(c_{m2}^{vn}\)) are shown in Fig. 14b. With \(0 < \overline{c}_{m} < c_{m1}^{vn} < c_{m2}^{vn}\) and \(A > 0\), we derive \(\pi_{r,BC}^{vn,N*} - \pi_{r,BC}^{vn,E*} > 0\).

For rs structure: \(\pi_{r,BC}^{rs,N*} - \pi_{r,BC}^{rs,E*}\) which can be thought of as a quadratic function of \(c_{m}\), and the numerical simulation of quadratic constant \(A\) is shown in Fig.

15a. And the numerical simulation of the function’s zeros (\(c_{m1}^{rs}\) and \(c_{m2}^{rs}\)) are shown in Fig. 15b. With \(0 < \overline{c}_{m} < c_{m1}^{rs} < c_{m2}^{rs}\) and \(A > 0\), we derive that \(\pi_{r,BC}^{rs,N*} - \pi_{r,BC}^{rs,E*} > 0\).

(ii) We compare the loss caused by the encroachment to the capital-sufficient retailer’s profit and the capital-constrained retailer under three power structures.

For ms structure: \(\Delta_{cs}^{ms} - \Delta_{cc}^{ms}\) which can be thought of as a quadratic function of \(c_{m}\). The numerical simulation of quadratic constant \(A\) is shown in Fig.

16a and the numerical simulation of the function’s zeros (\(c_{m1}^{ms}\) and \(c_{m2}^{ms}\)) are shown in Fig. 16b. With \(0 < \overline{c}_{m} < c_{m2}^{ms} < c_{m1}^{ms}\) and \(A < 0\), we derive that \(\Delta_{cs}^{ms} - \Delta_{cc}^{ms} < 0\).

For vn structure: \(\Delta_{cs}^{vn} - \Delta_{cc}^{vn}\) which can be thought of as a quadratic function of \(c_{m}\). The numerical simulation of quadratic constant \(A\) is shown in Fig.

17a and the numerical simulation of the function’s zeros (\(c_{m1}^{vn}\) and \(c_{m2}^{vn}\)) are shown in Fig. 17b. With \(c_{m2}^{vn} < 0 < \overline{c}_{m} < c_{m1}^{vn}\) and \(A < 0\), we derive that \(\Delta_{cs}^{vn} - \Delta_{cc}^{vn} > 0\).

For rs structure, the proof is similar to the proof of vn structure, we find \(\Delta_{cs}^{rs} - \Delta_{cc}^{rs} > 0\). Therefore \(\Delta_{cs}^{s} > \Delta_{cc}^{s}\).

(iii) We compare the manufacturer encroachment thresholds in Proposition 1(i) under three power structures.

When the retailer is capital-sufficient:

Compare \(\Delta_{cs}^{rs}\) and \(\Delta_{cs}^{ms}\), \(\Delta_{cs}^{rs} - \Delta_{cs}^{ms} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {2 - 3\theta } \right)}}{{8\left( {1 + d} \right)\left( {2 - \theta } \right)\left( {1 - \theta } \right)}}\), we can derive \(\Delta_{cs}^{rs} - \Delta_{cs}^{ms} > 0\) when \(\theta \in (0,\frac{2}{3}]\), otherwise \(\Delta_{cs}^{rs} - \Delta_{cs}^{ms} < 0\); Compare \(\Delta_{cs}^{rs}\) and \(\Delta_{cs}^{vn}\), \(\Delta_{cs}^{rs} - \Delta_{cs}^{vn} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} }}{{2\left( {1 + d} \right)\left( {3 - 2\theta } \right)^{2} \left( {2 - \theta } \right)}} > 0\), we can derive \(\Delta_{cs}^{rs} - \Delta_{cs}^{vn} > 0\); Compare \(\Delta_{cs}^{rs}\) and \(\Delta_{cs}^{vn}\), \(\Delta_{cs}^{vn} - \Delta_{cs}^{ms} = \frac{{d\left( {a\left( {1 - \theta } \right) - c_{m} } \right)^{2} \left( {7 - 20\theta + 12\theta^{2} } \right)}}{{8\left( {1 + d} \right)\left( {3 - 2\theta } \right)^{2} \left( {1 - \theta } \right)}}\), we can derive \(\Delta_{cs}^{vn} - \Delta_{cs}^{ms} > 0\) when \(\theta \in (0,\frac{1}{2}]\), otherwise \(\Delta_{cs}^{vn} - \Delta_{cs}^{ms} < 0\). Therefore, we can hold that \(\Delta_{cs}^{rs} > \Delta_{cs}^{vn} > \Delta_{cs}^{ms}\) when \(\theta \in (0,\frac{1}{2}]\), \(\Delta_{cs}^{rs} > \Delta_{cs}^{ms} > \Delta_{cs}^{vn}\) when \(\theta \in (\frac{1}{2},\frac{2}{3}]\), otherwise \(\Delta_{cs}^{ms} > \Delta_{cs}^{rs} > \Delta_{cs}^{vn}\).

When the retailer is capital-constrained:

Compare \(\Delta_{cc}^{rs}\) and \(\Delta_{cc}^{ms}\), \(\Delta_{cc}^{rs} - \Delta_{cc}^{ms}\) which can be thought of as a quadratic function of \(c_{m}\). The numerical simulation of quadratic constant \(A\) is shown in Fig.