Abstract

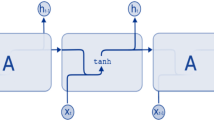

Changes in the composite stock price index are a barometer of social and economic development. To improve the accuracy of stock price index prediction, this paper introduces a new hybrid model, VMD-LSTM, that combines variational mode decomposition (VMD) and a long short-term memory (LSTM) network. The proposed model is based on decomposition-and-ensemble framework. VMD is a data-processing technique through which the original complex series can be decomposed into a limited number of subseries with relatively simple modes of fluctuations. It can effectively overcome the shortcomings of mode mixing that sometimes exist in the empirical mode decomposition (EMD) method. LSTM is an improved version of recurrent neural networks (RNNs) that introduces a “gate” mechanism, and can effectively filter out the critical previous information, making it suitable for the financial time series forecasting. The capability of VMD-LSTM in stock price index forecasting is verified comprehensively by comparing with some single models and the EMD-based and other VMD-based hybrid models. Evaluated by level and directional prediction criteria, as well as a newly introduced statistic called the complexity-invariant distance (CID), the VMD-LSTM model shows an outstanding performance in stock price index forecasting. The hybrid models perform significantly better than the single models, and the forecasting accuracy of the VMD-based models is generally higher than that of the EMD-based models.

Similar content being viewed by others

References

Nam K, Seong N (2019) Financial news-based stock movement prediction using causality analysis of influence in the Korean stock market. Decis Support Syst 117:100–112

Song Y, Lee J, Lee J (2019) A study on novel filtering and relationship between input-features and target-vectors in a deep learning model for stock price prediction. Appl Intell 49:897–911

J. Wang, J. Wang, Forecasting stock market indexes using principle component analysis and stochastic time effective neural networks, Neurocomputing156 (2015) 68–78

Zhang C, Pan H, Ma Y, Huang X (2019) Analysis of Asia Pacific stock markets with a novel multiscale model. Physica A 534:120939

Loureiro ALD, Miguéis VL, Da SLFM (2018) Exploring the use of deep neural networks for sales forecasting in fashion retail. Decis Support Syst 114:81–93

Herzog S, Tetzlaff C, Wörgötter F (2020) Evolving artificial neural networks with feedback. Neural Netw 123:153–162

Adhikari R, Agrawal RK (2014) A combination of artificial neural network and random walk models for financial time series forecasting. Neural Comput Appl 24:1441–1449

Kuremoto T, Kimura S, Kobayashi K, Obayashi M (2014) Time series forecasting using a deep belief network with restricted boltzmann machines. Neurocomputing 137:47–56

Niu H, Wang J (2014) Financial time series prediction by a random data-time effective RBF neural network. Soft Comput 18:497–508

Wang J, Wang J (2017) Forecasting stochastic neural network based on financial empirical mode decomposition. Neural Netw 90:8–20

Das SP, Achary NS, Padhy S (2016) Novel hybrid SVM-TLBO forecasting model incorporating dimensionality reduction techniques. Appl Intell 45:1148–1165

I. Goodfellow, Y. Bengio, A. Courville, Deep learning: Cambridg, MIT press. 2016

Mandic DP, Chambers JA (1999) Exploiting inherent relationships in RNN architectures. Neural Netw 12:1341–1345

Deng T, He X, Zeng Z (2018) Recurrent neural network for combined economic and emission dispatch, applied intelligence. Appl Intell 48:2180–2198

Guo T, Xu Z, Yao X, Chen H, Aberer K, Funaya K (2016) Robust online time series prediction with recurrent neural networks, in: IEEE international conference on data science and advanced analytics. IEEE.:816–825

Hajiabotorabi Z, Kazemi A, Samavati FF, Ghaini FMM (2019) Improving DWT-RNN model via B-spline wavelet multiresolution to forecast a high-frequency time series. Expert Syst Appl 138:112842

Wang Q, Xu W, Huang X, Yang K (2019) Enhancing intraday stock price manipulation detection by leveraging recurrent neural networks with ensemble learning. Neurocomputing 47:46–58

Berradi Z, Lazaar M (2019) Integration of principal component analysis and recurrent neural network to forecast the stock Price of Casablanca stock exchange. Procedia Computer Science 148:55–61

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9:1735–1780

Sundermeyer M, Ney H, Schlüter R (2015) From feedforward to recurrent LSTM neural networks for language modeling. IEEE/ACM Trans Audio Speech Lang Process 23:517–529

Mahmoudi N, Docherty P, Moscato P (2018) Deep neural networks understand investors better[J]. Decis Support Syst 112:23–34

Kraus M, Feuerriegel S (2017) Decision support from financial disclosures with deep neural networks and transfer learning[J]. Decis Support Syst 104:38–48

Vo NNY, He X, Liu S, Xu G (2019) Deep learning for decision making and the optimization of socially responsible investments and portfolio. Decis Support Syst 124:113097

Wang K, Qi X, Liu H (2019) Photovoltaic power forecasting based LSTM-convolutional network. Energy 189:116225

Karevan Z, Suykens JAK (2020) Transductive LSTM for time-series prediction: an application to weather forecasting. Neural Netw 125:1–9

Ding G, Qin L (2019) Study on the prediction of stock price based on the associated network model of LSTM. Int J Mach Learn & Cyber 11:1307–1317. https://doi.org/10.1007/s13042-019-01041-1

S. Chen, L. Ge, Exploring the attention mechanism in LSTM-based Hong Kong stock price movement prediction, Quantitative Finance19 (2019) 1507–1515

Baek Y, Kim HY (2018) ModAugNet: a new forecasting framework for stock market index value with an overfitting prevention LSTM module and a prediction LSTM module. Expert Syst Appl 113:457–480

Liang X, Ge Z, Sun L et al (2019) LSTM with wavelet transform based data preprocessing for stock Price prediction. Math Probl Eng 2019:1340174

Xu P, Xie F, Su T, Wan Z, Zhou Z, Xin X, Guan Z (2020) Automatic evaluation of facial nerve paralysis by dual-path LSTM with deep differentiated network. Neurocomputing 388:70–77. https://doi.org/10.1016/j.neucom.2020.01.014

B. Zhang, H. Zhang, G. Zhao, J. Lian, Constructing a PM2.5 concentration prediction model by combining auto-encoder with Bi-LSTM neural networks, Environmental Modelling & Software 124 (2020) 104600

Wang H, Yu L, Tian S, Peng YF, Pei XJ (2019) Bidirectional LSTM malicious webpages detection algorithm based on convolutional neural network and independent recurrent neural network. Appl Intell 49:3016–3026

Kim T, Kim HY (2019) Forecasting stock prices with a feature fusion LSTM-CNN model using different representations of the same data. PLoS One 14:e0212320

Kim HY, Won CH (2018) Forecasting the volatility of stock price index: a hybrid model integrating LSTM with multiple GARCH-type models. Expert Syst Appl 103:25–37

Yang D, Yang K (2016) Multi-step prediction of strong earthquake ground motions and seismic responses of SDOF systems based on EMD-ELM method. Soil Dyn Earthq Eng 85:117–129

N. Gu, H. Pan, Bearing fault diagnosis method based on EMD-CNNs, CSMA. (2017)

Xu W, Peng H, Zeng X, Zhou F, Tian X, Peng X (2019) A hybrid modelling method for time series forecasting based on a linear regression model and deep learning. Appl Intell 49:3002–3015

Yu L, Wang S (2008) Kin Keung Lai, forecasting crude oil price with an EMD-based neural network ensemble learning paradigm. Energy Econ 30:2623–2635

Zhou LG, Fujita H (2017) Posterior probability based ensemble strategy using optimizing decision directed acyclic graph for multi-class classification. Inf Sci 400-401:142–156

Sun J, Li H, Fujita H, Fu BB, Ai WG (2020) Class-imbalanced dynamic financial distress prediction based on Adaboost-SVM ensemble combined with SMOTE and time weighting. Information Fusion 54:128–144

J. Sun, H. Fujita, P. Chen, H. Li, Dynamic financial distress prediction with concept drift based on time weighting combined with Adaboost support vector machine ensemble, Knowledge-Based Systems120 (2017) 4–14

Cao J, Li Z, Li J (2019) Financial time series forecasting model based on CEEMDAN and LSTM. Physica A 519:127–139

Wang J, Tang L, Luo Y, Ge P (2017) A weighted EMD-based prediction model based on TOPSIS and feed forward neural network for noised time series. Knowl-Based Syst 132:167–178

Huang NE, Shen Z, Long SR et al (1988) The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proceedings: mathematical. Phys Eng Sci 454:903–995

Awajan AM, Ismail MT, al Wadi S (2018) Improving forecasting accuracy for stock market data using EMD-HW bagging. PLoS One 13:e0199582

Li H (2017) Price forecasting of stock index futures based on a new hybrid EMD-RBF neural network model. Agro Food Industry Hi Tech 28:1744–1747

Yang H, Lin H (2016) An integrated model combined ARIMA, EMD with SVR for stock indices forecasting. International Journal on Artificial Intelligence Tools 25:1650005

Zhang B, Wang J, Fang W (2015) Volatility behavior of visibility graph EMD financial time series from Ising interacting system. Physica A 432:301–314

Huang Y, Hou S, Xu S, Zhao S, Yang L, Zhang Z (2019) EMD-PNN based welding defects detection using laser-induced plasma electrical signals. J Manuf Process 45:642–651

Tang L, Wu Y, Yu L (2018) A randomized-algorithm-based decomposition-ensemble learning methodology for energy price forecasting. Energy 157:526–538

Upadhyay A, Pachori RB (2015) Instantaneous voiced/non-voiced detection in speech signals based on variational mode decomposition. J Frankl Inst 352:2679–2707

Liu C, Cheng G, Chen X, Pang Y (2018) Planetary gears feature extraction and fault diagnosis method based on VMD and CNN. Sensors 18:1523

Lahmiri S (2014) Comparative study of ECG signal denoising by wavelet thresholding in empirical and variational mode decomposition domains. Healthc Technol Lett 1:104–109

Lahmiri S (2016) A variational mode decomposition approach for analysis and forecasting of economic and financial time series. Expert Syst Appl 55:268–273

Abdoos AA (2016) A new intelligent method based on combination of VMD and ELM for short term wind power forecasting. Neurocomputing 203:111–120

Shahzad SJH, Nor SM, Kumar RR, Mensi W (2017) Interdependence and contagion among industry-level US credit markets: an application of wavelet and VMD based copula approaches. Physica A 466:310–324

Bisoi R, Dash PK, Parida AK (2019) Hybrid Variational mode decomposition and evolutionary robust kernel extreme learning machine for stock price and movement prediction on daily basis. Appl Soft Comput 74:652–678

Salim L (2016) Intraday stock price forecasting based on variational mode decomposition. Journal of Computational Science 12(2016):23–27

Liu Y, Yang C, Huang K, Gui W (2019) Non-ferrous metals price forecasting based on variational mode decomposition and LSTM network. Knowl-Based Syst 188:105006. https://doi.org/10.1016/j.knosys.2019.105006

Liu H, Mi X, Li Y (2018) Smart multi-step deep learning model for wind speed forecasting based on variational mode decomposition, singular spectrum analysis. LSTM network and ELM, Energy Conversion and Management 159:54–64

Dragomiretskiy K, Zosso D (2014) Variational mode decomposition. IEEE Trans Signal Process 62:531–544

Boyd S, Parikh N, Chu E et al (2011) Distributed optimization and statistical learning via the alternating direction method of multipliers. Foundations and Trends in Machine Learning 3:1–122

Makridakis S (1993) Accuracy measures: theoretical and practical concerns. Int J Forecasting 9:527–529

G.E.A.P.A. Batista, E.J. Keogh, O.M. Tataw, V.M. Alves de Souza, CID: an efficient complexity-invariant distance for time series, Data Mining and Knowledge Discovery 28 (2014) 634–669

Acknowledgments

The work was partially supported by the Humanities and Social Sciences Foundation of Ministry of Education of China (No. 18YJCZH134, 18YJC790106) and the Fundamental Research Funds for the Central Universities (No. FRF-BR-18-001B).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Niu, H., Xu, K. & Wang, W. A hybrid stock price index forecasting model based on variational mode decomposition and LSTM network. Appl Intell 50, 4296–4309 (2020). https://doi.org/10.1007/s10489-020-01814-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10489-020-01814-0