Abstract

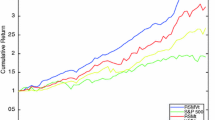

Designed as remedies for uncertain parameters and tiny optimal weights in the portfolio selection problem, we consider a class of distributionally robust portfolio optimization models with cardinality constraints. For considering the statistical significance and tractability, we construct two kinds of ambiguity sets based on L1-norm and moment information, respectively. The nominal distribution, as the core of the first ambiguity set, is determined by non-parametric estimation method. To reduce the disturbing error of the second ambiguity set, we apply a shrinkage estimation method to determine the moment information based on historical data. By introducing a binary variable, the proposed sparse portfolio optimization model can be converted equivalently to a tractable mixed-integer 0-1 programming problem, which can be dealt with efficiently by a modified primal-dual Benders’ decomposition method. Through the actual market data, we test the proposed models and show their validity. Furthermore, performances measured by net portfolio return, Sharpe ratio, and cumulative return are superior to the classical portfolio selection models in the back-testing of out-of-sample data.

Similar content being viewed by others

Notes

Given N historical data, \(\boldsymbol {\xi }^{j}\in \mathbb {R}^{n}, j=1,...,N\), \(\boldsymbol {X}^{j}=\boldsymbol {\xi }^{j}-\frac {1}{N}{\sum }^{N}_{j=1}\boldsymbol {\xi }^{j}\).

References

Markowitz H (1952) J Financ 7(1):77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Ogryczak W, Ruszczynski A (1999) From stochastic dominance to mean-risk models: Semideviations as risk measures. Eur J Oper Res 116(1):33–50. https://doi.org/10.1016/S0377-2217(98)00167-2

Rockafellar RT, Uryasev S (2000) Optimization of conditional value at risk. J Risk 3(3):21–41. https://doi.org/10.21314/JOR.2000.038

Ledoit O, Wolf M (2003) Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J Empir Financ 10(5):603–621. https://doi.org/10.1016/S0927-5398(03)00007-0

Benati S, Rizzi R (2007) A mixed integer linear programming formulation of the optimal mean/value-at-risk portfolio problem. Eur J Oper Res 176(1):423–434. https://doi.org/10.1016/j.ejor.2005.07.020

Bjork T, Murgoci A, Zhou X Y (2014) Mean-variance portfolio optimization with state-dependent risk aversion. Math Financ 24(1):1–24. https://doi.org/10.1111/j.1467-9965.2011.00515.x

Kuhn D, Parpas P, Rustem B, Fonseca RJ (2009) Dynamic mean-variance portfolio analysis under model risk. J Comput Financ 12(4):91–115. https://doi.org/10.21314/JCF.2009.202

Kim WC, Kim JH, Fabozzi FJ (2015) Shortcomings of mean-variance analysis. In: Robust Equity Portfolio Management + Website. Wiley, pp 22–38

Brandimarte P (2002) Numerical methods in finance: A matlab-based introduction. Wiley Interscience

Brodie J, Daubechies I, De Mol C, Giannone D, Loris I (2009) Sparse and stable markowitz portfolios. Proc Natl Acad Sci U S A 106(30):12267–12272. https://doi.org/10.1073/pnas.0904287106

Wang M, Xu F, Wang G (2014) Sparse portfolio rebalancing model based on inverse optimization. Optim Methods Softw 29(2):297–309. https://doi.org/10.1080/10556788.2012.700309

Li J (2015) Sparse and stable portfolio selection with parameter uncertainty. J Bus Econ Stat 33(3):381–392. https://doi.org/10.1080/07350015.2014.954708

Dai Z, Wen F (2018) Some improved sparse and stable portfolio optimization problems. Financ Res Lett 27:46–52. https://doi.org/10.1016/j.frl.2018.02.026

Lai Z, Yang P, Fang L, Wu X (2018) Short-term sparse portfolio optimization based on alternating direction method of multipliers. J Mach Learn Res 19(63):1–28

Pun CS, Wong HY (2019) A linear programming model for selection of sparse high-dimensional multiperiod portfolios. Eur J Oper Res 273(2):754–771. https://doi.org/10.1016/j.ejor.2018.08.025

Chang T-J, Meade N, Beasley JE, Sharaiha YM (2000) Heuristics for cardinality constrained portfolio optimisation. Comput Oper Res 27(13):1271–1302. https://doi.org/10.1016/S0305-0548(99)00074-X

Di Lorenzo D, Liuzzi G, Rinaldi F, Schoen F, Sciandrone M (2012) A concave optimization-based approach for sparse portfolio selection. Optim Methods Softw 27(6):983–1000. https://doi.org/10.1080/10556788.2011.577773

Meghwani SS, Thakur M (2017) Multi-objective heuristic algorithms for practical portfolio optimization and rebalancing with transaction cost. Appl Soft Comput 67(6):865–894. https://doi.org/10.1016/j.asoc.2017.09.025

Gao J, Li D (2013) Optimal cardinality constrained portfolio selection. Oper Res 61(3):745–761. https://doi.org/10.1287/opre.2013.1170

Chen C, Li X, Tolman C, Wang S, Ye Y (2013) Sparse portfolio selection via quasi-norm regularization. arXiv:1312.6350

Yen Y (2016) Sparse weighted-norm minimum variance portfolios. Eur Finan Rev 20(3):1259–1287. https://doi.org/10.1016/S0927-5398(03)00007-0

Teng Y, Yang L, Yu B, Song X (2017) A penalty palm method for sparse portfolio selection problems. Optim Methods Softw 32(1):126–147. https://doi.org/10.1080/10556788.2016.1204299

Wang Q, Sun H (2017) Sparse Markowitz portfolio selection by using stochastic linear complementarity approach. J Ind Manag Optim 13(2):59–59. https://doi.org/10.3934/jimo.2017059

Hardoroudi ND, Keshvari A, Kallio M, Korhonen P (2017) Solving cardinality constrained mean-variance portfolio problems via milp. Ann Oper Res 254(1):47–59. https://doi.org/10.1007/s10479-017-2447-x

Branda M, Bucher M, Červinka M, Schwartz A (2018) Convergence of a scholtes-type regularization method for cardinality-constrained optimization problems with an application in sparse robust portfolio optimization. Comput Optim Appl:1–28. https://doi.org/10.1007/s10589-018-9985-2

Zhao Z, Xu F, Wang M, Zhang C (2019) A sparse enhanced indexation model with norm and its alternating quadratic penalty method. J Oper Res Soc 70(3):433–445. https://doi.org/10.1080/01605682.2018.1447245

Fastrich B, Paterlini S, Winker P (2014) Cardinality versus q-norm constraints for index tracking. Quant Financ 14(11):2019–2032. https://doi.org/10.2139/ssrn.1679690

Xu F, Lu Z, Xu Z (2016) An efficient optimization approach for a cardinality-constrained index tracking problem. Optim Methods Softw 31(2):258–271. https://doi.org/10.1080/10556788.2015.1062891

Mutunge P, Haugland D (2018) Minimizing the tracking error of cardinality constrained portfolios. Comput Oper Res 90:33–41. https://doi.org/10.1016/j.cor.2017.09.002

Zhang C, Wang J, Xiu N (2019) Robust and sparse portfolio model for index tracking. J Ind Manag Optim 15(3):1001–1015. https://doi.org/10.3934/jimo.2018082

Zhou Z, Jin Q, Xiao H, Wu Q, Liu W (2018) Estimation of cardinality constrained portfolio efficiency via segmented dea. Omega-Int J Manag Sci 76:28–37. https://doi.org/10.1016/j.omega.2017.03.006

Ben-Tal A, El Ghaoui L, Nemirovski A (2009) Robust optimization. Princeton University Press Princeton

Bertsimas D, Brown DB, Caramanis C (2010) Theory and applications of robust optimization. SIAM Rev 53(3):464–501. https://doi.org/10.1137/080734510

Ben-Tal A, Hertog DD, Waegenaere AD, Melenberg B, Rennen G (2013) Robust solutions of optimization problems affected by uncertain probabilities. Manag Sci 59(2):341–57. https://doi.org/10.1287/mnsc.1120.1641

Laurent El G, Maksim O, Francois O (2003) Worst-case value-at-risk and robust portfolio optimization: A conic programming approach. Oper Res 51(4):543–556. https://doi.org/10.1287/opre.51.4.543.16101

Björn F, Peter W (2012) Robust portfolio optimization with a hybrid heuristic algorithm. CMS 9:63–88. https://doi.org/10.1007/s10287-010-0127-2

Lotfi S, Zenios SA (2018) Robust VaR and CVaR optimization under joint ambiguity in distributions, means, and covariances. Eur J Oper Res 269(2):556–576. https://doi.org/10.1016/j.ejor.2018.02.003

Xu F, Wang M, Dai Y, Xu D (2018) A sparse enhanced indexation model with chance and cardinality constraints. J Glob Optim 70(1):5–25. https://doi.org/10.1007/s10898-017-0513-1

Wu D, Wu DD (2019) An enhanced decision support approach for learning and tracking derivative index. Omega-Int J Manag Sci 88:63–76. https://doi.org/10.1016/j.omega.2018.10.021

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its application to tokyo stock market. Manag Sci 37(5):519–531. https://doi.org/10.5555/2751457.2751459

Linsmeier TJ, Pearson ND (1996) Risk measurement: An introduction to value at risk. University of Illinois, Urbana-Champaign

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Financ 26(7):1443–471. https://doi.org/10.2139/ssrn.267256

Huang R, Qu S, Gong Z, Goh M, Ji Y (2020) Data-driven two-stage distributionally robust optimization with risk aversion. Appl Soft Comput 87:105978. https://doi.org/10.1016/j.asoc.2019.105978

Fan K (1953) Minimax theorems. Proc Natl Acad Sci U S A 39(1):42–47. https://doi.org/10.1073/pnas.39.1.42

Delage E, Ye Y (2010) Distributionally robust optimization under moment uncertainty with application to data-driven problems. Oper Res 58(3):595–612. https://doi.org/10.1287/opre.1090.0741

Zymler S, Kuhn D, Rustem B (2013) Distributionally robust joint chance constraints with second-order moment information. Math Program 137(1-2):167–198. https://doi.org/10.1007/s10107-011-0494-7

Luc D, László G (1985) Nonparametric density estimation: The l1 view. Wiley, New York

Scott DW (2015) Multivariate density estimation: Theory, practice, and visualization. Wiley

Hoeffding W (1963) Probability inequalities for sums of bounded random variables. J Am Stat Assoc 58(301):13–30. https://doi.org/10.1007/978-1-4612-0865-5_26

Ledoit O, Wolf M (2004) A well-conditioned estimator for large-dimensional covariance matrices. J Multivar Anal 88(2):365–411. https://doi.org/10.1016/S0047-259X(03)00096-4

Chen Y, Wiesel A, Eldar YC, Hero AO (2010) Shrinkage algorithms for MMSE covariance estimation. IEEE Trans Signal Process 58(10):5016–5029. https://doi.org/10.1109/TSP.2010.2053029

Daniels MJ, Kass RE (2001) Shrinkage estimators for covariance matrices. Biometrics 57 (4):1173–1184. https://doi.org/10.1111/j.0006-341X.2001.01173.x

Wu WB, Pourahmadi M (2003) Nonparametric estimation of large covariance matrices of longitudinal data. Biometrika 90(4):831–844. https://doi.org/10.1093/biomet/90.4.831

Couillet R, Mckay MR (2014) Large dimensional analysis and optimization of robust shrinkage covariance matrix estimators. J Multivar Anal 131:99–120. https://doi.org/10.1016/j.jmva.2014.06.018

Benders JF (1962) Partitioning procedures for solving mixed-variables programming problems. Numer Math 4(1):238–252. https://doi.org/10.1007/BF01386316

Toh KC, Todd MJ, Tütüncü RH (1999) Sdpt3a matlab software package for semidefinite programming, version 1.3. Optim Methods Softw 11(1-4):545–581. https://doi.org/10.1080/10556789908805762

Labit Y, Peaucelle D, Henrion D (2002) Sedumi interface 1.02: a tool for solving LMI problems with sedumi. IEEE Int Symp Comput Aided Control Syst Des:272–277. https://doi.org/10.1109/CACSD.2002.1036966

Shapiro A (2001) On duality theory of conic linear problems. Kluwer Academic Publishers

Löfberg J (2004) Yalmip : a toolbox for modeling and optimization in matlab. Optimization 2004(3):284–289. https://doi.org/10.1109/CACSD.2004.1393890

Jarque CM, Bera AK (1981) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 7(4):313–318. https://doi.org/10.1016/0165-1765(80)90024-5

Miller MB (2019) Quantitative financial risk management. Wiley

Demiguel V, Garlappi L, Uppal R (2009) Optimal versus naive diversification: How inefficient is the 1/n portfolio strategy?. Rev Financ Stud 22(5):1915–1953. https://doi.org/10.1093/rfs/hhm075

Fabozzi FJ, Kolm PN, Pachamanova DA, Focardi SM (2007) Robust portfolio optimization. J Portf Manag 33(3):40–48. https://doi.org/10.1007/s001840200193

Sehgal R, Mehra A (2020) Robust portfolio optimization with second order stochastic dominance constraints. Comput Ind Eng 144(6):106396. https://doi.org/10.1007/s10898-019-00809-7

Cesarone F, Scozzari A, Tardella F (2020) An optimization-diversification approach to portfolio selection. J Glob Optim 76(2):1–21

Acknowledgments

This research has been supported by National Natural Science Foundation of China (71571055) and partially supported by the NSF of Anhui Educational Committe (KJ2020A0712). Meanwhile, this research was also supported by Initial Scientific Research Fund of Chuzhou University (2020qd39).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Huang, R., Qu, S., Yang, X. et al. Sparse portfolio selection with uncertain probability distribution. Appl Intell 51, 6665–6684 (2021). https://doi.org/10.1007/s10489-020-02161-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10489-020-02161-w