Abstract

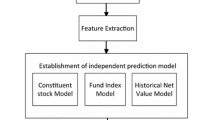

Unlike the previous study, an optimized neutral model, a new evolutionary calculation method, is applied in this study to predict the net value of domestic mutual funds. Firstly, 17 open-end balanced stock funds data will be collected from domestic securities companies’ websites. Funds with the technical efficiency value of 1 will be selected as investment targets to analyze fund performance by using data envelopment analysis. Then, the mutual fund net worth prediction model is built by various new data mining methods including Backpropagation Neural Network and GABPN, and the forecasting ability is compared with the traditional regression model. We can understand the pros and cons of these fund forecasting models after using five kinds of forecast performance evaluation indicators and analyzing rate of return, and the result of which is available for reference to researchers and investors as an investment strategy.

Similar content being viewed by others

References

Yu, S.W., Xu, Y.L.: Prediction of mutual fund net value—application of gray theory. Neural Netw. Adapt. NetworkBased Fuzzy Inference Syst. Chin. Manag. Rev. 8(3), 1–33 (2005)

Pan, W.T., Huang, R.J., Lin, W.H.: Prediction of mutual fund net value using genetic programming. Chin. Manag. Rev. 11(4), 1–12 (2008)

Farrell, M.J.: The measurement of productive efficiency. J. R. Stat. Soc. series A 120, 253–281 (1957)

Charnes, A., Cooper, W.W., Rhodes, E.: Measuring the efficiency of decision making units. Eur. J. Oper. Res. 2(6), 429–444 (1978)

Li, W.Q., Li, J.X.: Evaluation of Taiwan stock index options: comparison of Performance of ANN and GANN Models. Tamsui Oxf. J. Econ. Bus. 8, 25–50 (2003)

Lin, J.C.: Study of Taiwan stock price prediction and trading strategy based on genetic algorithms and neural networks, Master’s thesis of Soochow University (2002)

Ye, Y.C.: Application of neural network. Scholar Publishing House, Delhi (2001)

Specht, D.F.: A general regression neural network. IEEE Trans. Neural Netw. 2(6), 568–576 (1991)

Vapnik, V.: Support-vector networks. Mach. Learn. 20(3), 273–297 (1995)

Li, H.L., Shao, J.J.: Chien JH Optimization pattern based on animal behaviour: fish group algorithm. Syst. Eng. Theor. Pract. 22(11), 32–38 (2002)

Eberhart, R.C., Kennedy, J.: New optimizer using particle swarm theory. In: Proceedings of sixth international symposium on Nagoya, Japan, pp. 39–43 (1995)

Pan, W.T.: A new fruit fly optimization algorithm: taking the financial distress model as an example. KnowledgeBased Syst. 26, 69–74 (2012)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pan, WT., Han, SZ., Yang, HL. et al. Prediction of mutual fund net value based on data mining model. Cluster Comput 22 (Suppl 4), 9455–9460 (2019). https://doi.org/10.1007/s10586-018-2272-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10586-018-2272-2