Abstract

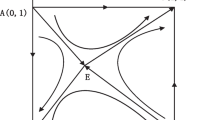

Under incomplete information, a game model is used to investigate the influence of ownership level and learning ability on the stability of technology innovation alliance from the perspective of knowledge transfer. The decision-making processes of involved parties are divided into two stages in the model. In the first stage, the firm possessing advanced technology decides on the level of knowledge it transfers to its alliance partner. In the second stage, the decision of the parties on whether to maintain or terminate the alliance is based on two factors: the level of knowledge learned and profits gained. The outcomes of the Cournot–Nash equilibrium in the model can reveal when the parties decide to maintain or terminate the alliance. The model explores the status of alliance stability under different ownership levels and learning abilities to provide theoretical support for the selection of optimal dynamic competitive-cooperative relationship and managerial flexibility.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Barcena-Ruiz JC, Espinosa MP (1999) Should multiproduct firms provide divisional or corporate incentives? Int J Ind Organ 17(5):751–764

Becerra M, Lunnan R, Huemer L (2008) Trustworthiness, risk, and the transfer of tacit and explicit knowledge between alliance partners. J Manag Stud 45(4):691–713

Bloodgood JM, Salisbury WD (2001) Understanding the influence of organizational change strategies on information technology and knowledge management strategies. Decis Support Syst 31(1):55–69

Butler C (2008) Problems in global strategic alliance management for European defence manufacturing firms. Manag Decis 46(2):330–341

Chen CJ (2004) The effects of knowledge attribute, alliance characteristics, and absorptive capacity on knowledge transfer performance. R&D Manag 34(3):311–321

Das TK, Teng B-S (2000) Instabilities of strategic alliances: An internal tensions perspective. Organ Sci 11(1):77–101

Dussauge P, Garrette B, Mitchell W (2004) Asymmetric performance: the market share impact of scale and link alliances in the global auto industry. Strateg Manag J 25(7):701–711

Ernst D, Bamford J (2005) Your alliances are too stable. Harv Bus Rev 83(6):133–141

Franko LG (1971) Joint venture divorce in the multinational company. Columbia J World Bus 6(3):13–22

Gil AE, Passino KM (2006) Stability analysis of network-based cooperative resource allocation strategies. Automatica 42(2):245–250

Gravier MJ, Randall WS, Strutton D (2008) Investigating the role of knowledge in alliance performance. J Knowl Manag 12(4):117–130

Inkpen AC, Beamish PW (1997) Knowledge, bargaining power, and the instability of international joint ventures. Acad Manag Rev 22(1):177–202

Jiang X, Li Y, Gao S (2008) The stability of strategic alliances: characteristics, factors and stages. J Int Manag 14(2):173–189

Jiang Z, Hu L, Tian Y (2008) Research on stability of industrial technology innovation strategic alliance based on knowledge transfer. In: Proceedings of the 15th international conference on management science and engineering. Long Beach, CA, pp 1509–1515

Kabiraj T, Chowdhury PR (2008) Adoption of new technology and joint venture instability. Res Int Bus Finance 22(2):108–123

Khamseh HM, Jolly DR (2008) Knowledge transfer in alliances: determinant factors. J Knowl Manag 12(1):37–50

Marjit S, Chowdhury PR (2004) Asymmetric capacity costs and joint venture buy-outs. J Econ Behav Organ 54(3):425–438

Narteh B (2008) Knowledge transfer in developed-developing country interfirm collaborations: a conceptual framework. J Knowl Manag 12(1):78–91

Nielsen BB (2005) The role of knowledge embeddedness in the creation of synergies in strategic alliances. J Bus Res 58(9):1194–1204

Parkhe A (1993) Strategic alliance structuring: a game theoretic and transaction cost examination of interfirm cooperation. Acad Manag J 36(4):794–892

Perry ML, Sengupta S, Krapfel R (2004) Effectiveness of horizontal strategic alliances in technologically uncertain environments: are trust and commitment enough? J Bus Res 57(9):951–956

Ruckman K (2009) Technology sourcing acquisitions: what they mean for innovation potential. Strateg Manag J 2(1):56–75

Szulanski G (2000) The process of knowledge transfer: a diachronic analysis of stickiness. Organ Behav Hum Decis Process 82(1):9–27

Walter J, Lechner C, Kellermanns FW (2007) Knowledge transfer between and within alliance partners: Private versus collective benefits of social capital. J Bus Res 60(7):698–710

Weber B, Weber C (2007) Corporate venture capital as a means of radical innovation: relational fit, social capital, and knowledge transfer. J Eng Technol Manag 24(1–2):11–35

Yan A, Zeng M (1999) International joint venture instability: a critique of previous research, a reconceptualization, and directions for future research. J Int Bus Stud 30(2):397–414

Yeung DWK, Petrosyan L (2006) Dynamically stable corporate joint ventures. Automatica 42(3):365–370

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jiang, Zs., Hao, Yh. Game analysis of technology innovation alliance stability based on knowledge transfer. Comput Math Organ Theory 19, 403–421 (2013). https://doi.org/10.1007/s10588-011-9096-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10588-011-9096-4