Abstract

We propose an optimization formulation using the l 1 norm to ensure accuracy and stability in calibrating a local volatility function for option pricing. Using a regularization parameter, the proposed objective function balances calibration accuracy with model complexity. Motivated by the support vector machine learning, the unknown local volatility function is represented by a spline kernel function and the model complexity is controlled by minimizing the 1-norm of the kernel coefficient vector. In the context of support vector regression for function estimation based on a finite set of observations, this corresponds to minimizing the number of support vectors for predictability. We illustrate the ability of the proposed approach to reconstruct the local volatility function in a synthetic market. In addition, based on S&P 500 market index option data, we demonstrate that the calibrated local volatility surface is simple and resembles the observed implied volatility surface in shape. Stability is illustrated by calibrating local volatility functions using market option data from different dates.

Similar content being viewed by others

References

Andersen, L.B.G., Brotherton-Ratcliffe, R.: The equity option volatility smile: an implicit finite difference approach. J. Comput. Finance 1(2), 5–37 (1997)

Bates, D.S.: The crash of ’87: was it expected? The evidence from options markets. J. Finance 46, 1009–1044 (1991)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81(1), 637–654 (1973)

Broadie, M., Chernov, M., Johannes, M.: Model specification and risk premia: evidence from futures options (2007)

Coleman, T.F., Li, Y.: On the convergence of reflective Newton methods for large-scale nonlinear minimization on bounds. Math. Program. 67, 189–224 (1994)

Coleman, T.F., Li, Y.: An interior, trust region approach for nonlinear minimization subject to bounds. SIAM J. Optim. 6(2), 418–445 (1996)

Coleman, T.F., Li, Y.: A reflective Newton method for minimizing a quadratic function subject to bounds on the variables. SIAM J. Optim. 6(4), 1040–1058 (1996)

Coleman, T.F., Verma, A.: Structure and efficient Jacobian calculation. In: Berz, M., Bischof, C., Corliss, G., Griewank, A. (eds.) Computational Differentiation: Techniques, Applications, and Tools, pp. 149–159. SIAM, Philadelphia (1996). URL citeseer.ist.psu.edu/coleman96structure.html

Coleman, T.F., Li, Y., Verma, A.: Reconstructing the unknown local volatility function. J. Comput. Finance 2(3), 77–102 (1999)

Derman, E., Kani, I.: Riding on a smile. Risk 7, 32–39 (1994)

Dupire, B.: Pricing with a smile. Risk Mag. 7(1), 18–20 (1994)

Fletcher, R.: Practical Methods of Optimization: Unconstrained Optimization. Wiley, New York (1980)

Gatheral, J.: The Volatility Surface: A Practitioner’s Guide. Wiley, New York (2006)

Girosi, F.: An equivalence between sparse approximation and support vector machines. Neural Comput. 10 (1998)

Glover, J., Ali, M.M.: Using radial basis functions to construct local volatility surfaces. Appl. Math. Comput., 4834–4839 (2011)

He, C., Kennedy, J.S., Coleman, T.F., Forsyth, P.A., Li, Y., Vetzal, K.: Calibration and hedging under jump diffusion. Rev. Deriv. Res. 9, 1–35 (2006)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Hull, J., White, A.: The pricing of options on assets with stochastic volatilities. J. Finance 42, 281–300 (1987)

Merton, R.C.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Naik, V., Lee, M.: General equilibrium pricing of options on the market portfolio with discontinuous returns. Rev. Financ. Stud. 3, 493–521 (1990)

Orosi, G.: Improved implementation of local volatility and its application to s&p 500 index options. J. Deriv. 17(3), 53–64 (2010)

Rubinstein, M.: Implied binomial trees. J. Finance 49, 771–818 (1994)

Shimko, D.: Bounds of probability. Risk, 33–37 (1993)

Vapnik, V.N.: Statistical Learning Theory. Wiley, New York (1998)

Author information

Authors and Affiliations

Corresponding author

Additional information

T.F. Coleman acknowledges funding from the Ophelia Lazaridis University Research Chair (which he holds) and the National Sciences and Engineering Research Council of Canada. The views expressed herein are solely from the authors.

Y. Li acknowledges funding from the National Sciences and Engineering Research Council of Canada.

Authors would like to thank the anonymous referees whose comments have improved the presentation of the paper.

Appendix: Kernels generating splines with an infinite number of knots

Appendix: Kernels generating splines with an infinite number of knots

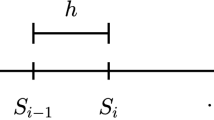

Here we briefly describe kernels generating splines with an infinite number of knots. The presentation follows from discussion in §11.6.2 in [24]. Suppose that we want to approximate a one-dimensional function of one variable s defined on the interval [−b,+∞), 0<b<∞, by splines of order d≥0 with infinite number of knots: {t i }, 1≤i<∞. First the one-dimensional variable s is mapped into a vector u in the feature space of an infinite-dimension:

where

Then the spline has the form:

where a i , i=0,…,d and a(t) are coefficients of expansion. The kernel generating the spline can be obtained by determining the inner product as follows

For the linear spline with d=1 in particular, we have the following function representation for the kernel generating spline:

where s j ,s i are training data points in the interval [−b,+∞), and s j ∧s i denotes min(s j ,s i ). It can shown that the above kernel function is twice differentiable.

Rights and permissions

About this article

Cite this article

Coleman, T.F., Li, Y. & Wang, C. Stable local volatility function calibration using spline kernel. Comput Optim Appl 55, 675–702 (2013). https://doi.org/10.1007/s10589-013-9543-x

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10589-013-9543-x