Abstract

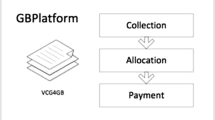

This study investigates a group-buying mechanism that considers strategic consumer behavior. In a market that consists of three types of consumers, the seller offers a product via two channels—spot purchasing and group buying—and maximizes his/her profit by setting the optimal group-buying threshold (G). Strategic consumers then choose one channel and enroll in the group based on the group-buying success rate and utility. Results show that consumer surplus decreases with increasing G and that two equilibria occur between the seller and strategic consumers. The behavior of the strategic consumers influences the group-buying success rate and the seller’s profit. We also discuss the optimization of G and the profit of the seller, and investigate the effects of the model parameters and demand volume on the optimal profit and optimal group-buying threshold G. When the retail inconvenience cost and risk aversion coefficient increase, the optimal profit decreases and the optimal G increases. However, when the demand of spot-purchasing consumers increases, the optimal profit increases and the optimal G decreases.

Similar content being viewed by others

Notes

Report of China group-buying industry statistics in 2015, July 27, 2015. http://zixun.tuan800.com/a/tuangoushujubaogao/20150727/50585.html.

Investopedia, http://www.investopedia.com/terms/c/consumer_surplus.asp.

References

Tang, F.-J., & Jiang, W. (2011). Research on the problems and influencing factors of the development of China’s online group-buying. Commercial Times, 19, 30–31.

Liang, X.-Y., Ma, L.-J., Xie, L., et al. (2014). The informational aspect of the group-buying mechanism. European Journal of Operational Research, 234(1), 331–340.

Yu, D.-G. (2010). Groupon: Group-buying convergence. Business Review, 9, 132–135.

Jing, X.-Q., & Xie, J.-H. (2011). Group buying: A new mechanism for selling through social interactions. Management Science, 57(8), 1354–1372.

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Management, 10(4), 654–675.

Yan, R.-L., & Pei, Z. (2009). Retail services and firm profit in a dual-channel market. Journal of retailing and consumer services, 16(4), 306–314.

Yan, B., & Ke, C.-X. (2015). Two strategies for dynamic perishable product pricing to consider in strategic consumer behavior. International Journal of Production Research, 1–16.

Kadet, A. (2004). The price is right. Smart Money, (December) 90–94.

McWilliams, G. (2004). Minding the store: Analyzing customers, Best Buy decides not all are welcome. Wall Street J. A1.

Ye, T. -F., & Sun, H. (2016). Price-setting newsvendor with strategic consumers. Omega, 63, 455–464.

Anderson, C. K., & Wilson, J. G. (2003). Wait or buy? The strategic consumer: Pricing and profit implications. Journal of the Operational Research Society, 54(3), 299–306.

Su, X.-M., & Zhang, F.-Q. (2008). Strategic consumer behavior, commitment, and supply chain performance. Management Science, 54(10), 1759–1773.

Elmaghraby, W., Gülcü, A., & Keskinocak, P. (2008). Designing optimal preannounced markdowns in the presence of rational customers with multiunit demands. Manufacturing & Service Operations Management, 10(1), 126–148.

Kim, J. B. (2015). A fixed pricing group buying decision model: Insights from the social perspective. International Journal of E-Business Research, 11(2), 40–59.

Chen, J., Chen, X.-L., & Song, X.-P. (2002). Bidder’s strategy under group-buying auction on the Internet. IEEE Transactions on Systems, Man and Cybernetics, Part A: Systems and Humans, 32(6), 680–690.

Chen, J., Chen, X.-L., & Song, X.-P. (2007). Comparison of the group-buying auction and the fixed pricing mechanism. Decision Support Systems, 43(2), 445–459.

Hsieh, F. S., & Lin, J. B. (2012). Assessing the benefits of group-buying-based combinatorial reverse auctions. Electronic Commerce Research and Applications, 11(4), 407–419.

Liu, Y., & Sutanto, J. (2012). Buyers’ purchasing time and herd behavior on deal-of-the-day group buying websites. Electronic Markets, 22(2), 83–93.

Kwak, H., Lee, C., Park, H., & Moon, S. (2010). What is Twitter, a social network or a news media? In 19th International Conference on World Wide Web, WWW’10, pp. 591–600.

Liang, T.-P., & Turban, E. (2011). Introduction to the special issue social commerce: A research framework for social commerce. International Journal of Electronic Commerce, 16(2), 5–14.

Chen, Z., Liang, X., Wang, H., & Yan, H. (2012). Inventory rationing with multiple demand classes: The case of group buying. Operations Research Letters, 40(5), 404–408.

Li, Y.-M., Jhang-Li, J.-H., Hwang, T.-K., & Chen, P.-W. (2012). Analysis of pricing strategies for community-based group buying: The impact of competition and waiting cost. Information Systems Frontiers, 14(3), 633–645.

Ni, G., Luo, L., Xu, Y., et al. (2015). Optimal decisions on group buying option with a posted retail price and heterogeneous demand. Electronic Commerce Research and Applications, 14(1), 23–33.

Zhou, G., Xu, K.-Q., & Liao, S. S. Y. (2013). Do starting and ending effects in fixed-price group-buying differ? Electronic Commerce Research and Applications, 12(2), 78–89.

Chen, C. C., & Chung, M.-C. (2015). Predicting the success of group buying auctions via classification. Knowledge-Based Systems, 89, 627–640.

Wu, J.-H., Shi, M.-Z., & Hu, M. (2015). Threshold effects in online group buying. Management Science, 61(9), 2025–2040.

Pi, S.-M., Liao, H.-L., Liu, S.-H., & Lee, I.-S. (2011). Factors influencing the behavior of online group-buying in Taiwan. African Journal of Business Management, 5(16), 7120–7129.

Yuan, P., Liu, Y.-B., Liu, W., Li, X.-S., & Nie, G.-L. (2015). How to measure the operating efficiency of internet group-buying platform? Procedia Computer Science, 55, 213–220.

Lim, W. M. (2014). Sense of virtual community and perceived critical mass in online group buying. Journal of Strategic Marketing, 22(3), 268–283.

Lim, W. M. (2014). Understanding the influence of online flow elements on hedonic and utilitarian online shopping experiences: A case of online group buying. Journal of Information Systems, 28(2), 287–306.

Lim, W. M. (2016). Untangling the relationships between consumer characteristics, shopping values, and behavioral intention in online group buying. Journal of Strategic Marketing, 1–20.

Lim, W. M. (2015). The influence of internet advertising and electronic word of mouth on consumer perceptions and intention: Some evidence from online group buying. Journal of Computer Information Systems, 55(4), 81–89.

Lim, W. M., & Ting, D. H. (2014). Consumer acceptance and continuance of online group buying. Journal of Computer Information Systems, 54(3), 87–96.

Che, T., Peng, Z., Lim, K. H., & Hua, Z. (2015). Antecedents of consumers’ intention to revisit an online group buying website: A transaction cost perspective. Information & Management, 52(5), 588–598.

Coulter, K. S., & Roggeveen, A. L. (2014). Price number relationships and deal processing fluency: The effects of approximation sequences and number multiples. Journal of Marketing Research, 51(1), 69–82.

Shiau, W.-L., & Chau, P. Y. K. (2015). Does altruism matter on online group buying? Perspectives from egotistic and altruistic motivation. Information Technology and People, 28(3), 677–689.

Kukar-Kinney, M., Scheinbaum, A. C., & Schaefers, T. (2016). Compulsive buying in online daily deal settings: An investigation of motivations and contextual elements. Journal of Business Research, 69(2), 691–699.

Kim, M. J., Chung, N., Lee, C.-K., et al. (2015). Online group-buying of tourism products: Effects of value and trust on site attachment, altruism, and loyalty. Journal of Travel & Tourism Marketing, 32(8), 935–952.

Zhao, Y.-B., & Zhao, L.-D. (2006). Another view of sale beyond domain coming from virtual team procurement. Logistics Technology, 11, 9–11.

Miao, H.-Y. (2011). Causes and countermeasures of network sale channel trans-regional. Jiangsu Commercial Forum, 4, 30–34.

Su, X.-M. (2007). Intertemporal pricing with strategic customer behavior. Management Science, 53(5), 726–741.

Li, H., Zhang, Y.-L., & Zhong, W.-J. (2012). Dynamic pricing strategies in the presence of strategic consumer behavior risks. Journal of management science in China, 15(10), 11–25.

Ding, X.-F., Dan, B., He, W.-J., et al. (2013). The optimal pricing policy for remanufactured products considering luxury and green preferences in the market. Chinese Journal of Management Science, 21(5), 94–102.

Aviv, Y., & Pazgal, A. (2008). Optimal pricing of seasonal products in the presence of forward-looking consumers. Manufacturing & Service Operations Management, 10(3), 339–359.

Peng, Z.-Q., Xiong, Z.-K., & Li, G.-D. (2010). The pricing policy and remanufacturing flexible replenishment mechanism of perishable goods in the presence of strategic customer behavior. Chinese Journal of Management Science, 18(2), 32–40.

Lai, G., Sycara, K., Debo, L. et al. (2006). An analysis on price matching policy. In Proceedings of the 8th international conference on Electronic commerce: The new e-commerce: Innovations for conquering current barriers, obstacles and limitations to conducting successful business on the internet (pp. 451–462).

Peng, Z.-Q., Xiong, Z.-K., & Li, G.-D. (2010). The Inter-temporal pricing and price match mechanism with strategic customers. Journal of Industrial Engineering Management, 4, 53–57.

Chen, Z.-S., & Su, S.-I. I. (2014). Photovoltaic supply chain coordination with strategic consumers in China. Renewable Energy, 68, 236–244.

Tilson, V., & Zheng, X.-B. (2014). Monopoly production and pricing of finitely durable goods with strategic consumers’ fluctuating willingness to pay. International Journal of Production Economics, 154, 217–232.

Jiang, W., & Chen, X. (2016). Optimal strategies for low carbon supply chain with strategic customer behavior and green technology investment. Discrete Dynamics in Nature and Society.

Whang, S. (2015). Demand uncertainty and the bayesian effect in markdown pricing with strategic customers. Manufacturing & Service Operations Management, 17(1), 66–77.

Liu, X.-F., & Huang, P. (2009). Optimal dynamic pricing and inventory policy under strategic customers. Journal of Management Science in China, 12(5), 18–26.

Liu, Q., & van Ryzin, G. J. (2008). Strategic capacity rationing to induce early purchases. Management Science, 54(6), 1115–1131.

Hsiao, L., & Chen, Y.-J. (2014). Strategic motive for introducing internet channels in a supply chain. Production and Operations Management, 23(1), 36–47.

Su, X. (2010). Optimal pricing with speculators and strategic consumers. Management Science, 56(1), 25–40.

Acknowledgments

This work was supported by the Program (71471066) and Major International (Regional) Joint Research Project (71420107024) of the Natural Science Foundation of China, the Guangdong Soft Science Research Project (2013B070206013, 2015A070704005), the Guangdong Natural Science Foundation (2016A030313485), the Guangdong “12thFive-Year” Philosophy and Social Sciences Planning Project (GD15CGL15), the Guangdong Science and Technology Planning Project (2013B040500007, 2013B040200057), and the Fundamental Research Funds for the Central Universities (2015XZD14, 2015KXKYJ02).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ke, C., Yan, B. & Xu, R. A group-buying mechanism for considering strategic consumer behavior. Electron Commer Res 17, 721–752 (2017). https://doi.org/10.1007/s10660-016-9232-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-016-9232-9