Abstract

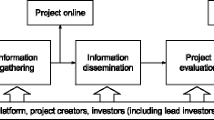

Crowdfunding uses a small amount of money from many people to fund a new venture. It is essentially a collective investment characterized by diversified investors, crowd-based decision-making, and consensus threshold. The sustainability of these markets heavily depends on the screening performance of the crowd. Although empirical studies suggest crowd-based funding decisions can be wise, little is known about the underlying rationale. This paper fills this void. We employ a computational experiment to investigate the impacts of investors’ attributes, i.e. ability and heterogeneity, and the threshold mechanisms on screening performance. We firstly identify the filtering effect of the consensus threshold. The high threshold screens out most of the unattractive projects and leads to less waste of capital, which makes All-Or-Nothing always outperform Keep-It-All. Further, we find a substitution effect of heterogeneity. When the group size is big enough, heterogeneous unsophisticated groups trump same-sized well-chosen ones. Lastly, the substitution effect of heterogeneity is moderated by the effectiveness of signals. In a crowdfunding environment of low predictability, investors’ heterogeneity contributes little to the collective accuracy, while investors’ expertise remains critical. In contrast to popular perceptions of crowdfunding markets as a new financing tool or marketing tool for entrepreneurs, our research indicates that crowdfunding is also an effective screener for collective investment.

Similar content being viewed by others

Notes

Note that in AON the entrepreneur keeps nothing unless the goal is achieved, while in KIA the entrepreneur keeps the entire amount raised regardless of whether or not they meet their goal [20].

The signal effectiveness refers to the extent to which a signal maintains validity in communicating underlying quality and reducing information asymmetry across a breadth of investors or domains in a variety of exchange contexts [51].

The measurements of signal effectiveness are inconsistent in prior literature and most of them are qualitative. For example, Bjornsdottir and Rule [10] argue that the predictability of signals is associated with its visibility and representativeness. In Scheaf et al.’s [51] research, the degree to which a signal is effective is a function of the characteristics of the source and receivers of the signal. Based on the theory of statistics, we quantitively measure signal effectiveness by calculating the assessment model’s explanatory power.

Two signal-based judgmental processes are studied in this paper: perceive the values of proximal signals and weigh the validity of signals. The former is related to the individual’s perception ability while the latter relies on the individual’s reasoning ability, and they are generally independent of each other.

The investor makes a biased estimation for a project largely because he can not perfectly perceive signals and combine the perceived signals in the wrong way, which means the smaller the differences between the real and perceived signal values or the correct and adopted weights, the less biased the investor’s estimation. To precisely portray the two kinds of differences above, we chose root mean squared error (RMSE) as the operationalization of the investors’ ability owing to its useful property of penalizing strong deviations.

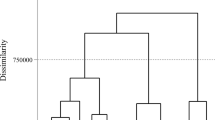

We prefer the pairwise coorelations in that the variance can’t fully depict the heterogeneity among individual cognitions and fails to interpret the deeper evaluating process of investors in the crowdfunding context, while the pairwise correlations precisely characterize the extent of cognitive divergences among investors.

It might seem that our ceiling of \(N = 20\) is not perfectly consistent with the practice that most crowdfunding projects usually are funded by hundreds of backers [43]. Considering the constraints of computing power, we specifically chose this modest range to distinguish from the decision-making literature that focuses on small groups (the range of group size includes 5 and 12), e.g. board of directors and jury [28,26]. Generalizing the experiment by scaling up the group size is a task left to future research.

Most researches on human cognition shows that owing to individuals’ cognitive limitations and cue intercorrelations or information redundancy, judgments based on a finite set of cues can be predicted with a high degree of accuracy from a simple linear combination of three or fewer cues [52].

See [28].

To focus on the effects of investors’ characteristics and consensus threshold on screening performance, we first control the signal effectiveness of a median level. Subsequently, we reran our experiment with various environmental predictability to investigate the moderating effect of signal effectiveness.

Most of the crowdfunding projects raises funds with moderate threshold. The projects with extremely low or unrealistic high threshold are still a minority (see [43]. Consistent with that, we set here the expected value of T as the mid-value of group size.

According to the 3σ principle of the normal distribution, the probability that normally distributed stochastic variable x falls in the interval of \(\left[ {\mu - 3\sigma ,\mu + 3\sigma } \right]\) is 99.74%. That is, our setting of standard deviation of T almost guarantees the value of T falls in the interval of \(\left( {0,N} \right)\).

Note that the crowd has no loss when the project they supported fails to reach the consensus threshold, in that their contributions will be returned in full under the threshold scheme. Those failed projects do not receive any pieces of collective funds, so they have no impact on the efficiency of collective investment.

Panel (b) in Fig. 8 presents a benchmark case of \(R^{2} = 0.80\) (medium signal effectiveness) and facilitates the discussion of the moderating effect of signal effectiveness.

References

Abdel-Khalik, A. R., & El-Sheshai, K. M. (1980). Information choice and utilization in an experiment on default prediction. Journal of Accounting Research, 18(2), 325–342.

Agrawal, A., Catalini, C., & Goldfarb, A. (2015). Crowdfunding: Geography, social networks, and the timing of investment decisions. Journal of Economics and Management Strategy, 24(2), 253–274.

Agrawal, A., Catalini, C., & Goldfarb, A. (2016). Are syndicates the killer app of equity-based crowdfunding? California Management Review, 58(2), 111–124.

Ahlers, G. K., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity-based crowdfunding. Entrepreneurship: Theory and Practice, 39(4), 955–980.

Belleflamme, P., Omrani, N., & Peitz, M. (2015). The economics of crowdfunding platforms. Information Economics and Policy, 33, 11–28.

Belleflamme, P., Lambert, T., & Schwienbacher, A. (2014). Crowdfunding: Tapping the right crowd. Journal of Business Venturing., 29(5), 585–609.

Bester, H. (1985). Screening vs. rationing in credit markets with imperfect information. American Economic Review, 75(4), 850–855.

Bi, G., Geng, B., & Liu, L. (2019). On the fixed and flexible funding mechanisms in reward-based crowdfunding. European Journal of Operational Research, 279(1), 168–183.

Biemann, T., & Kearney, E. (2010). Size does matter: How varying group sizes in a sample affect the most common measures of group heterogeneity. Organizational Research Methods, 13(3), 582–599.

Bjornsdottir, R. T., & Rule, N. O. (2017). The visibility of the social class from facial cues. Journal of Personality and Social Psychology, 113(4), 530–546.

Burtch, G., Hong, Y., & Liu, D. (2018). The role of provision points in online crowdfunding. Journal of Management Information Systems, 35(1), 117–144.

Brunswik, E. (1956). Perception and the representative design of psychological experiments. California: Univ of California Press.

Casamatta, C., & Haritchabalet, C. (2007). Experience, screening and syndication in venture capital investments. Journal of Financial Intermediation, 16(3), 368–398.

Chemla, G., & Tinn, K. (2020). Learning through crowdfunding. Management Science, 66(5), 1783–1801.

Chemmanur, T. J., & Fulghieri, P. (2013). Entrepreneurial finance, and innovation: An introduction and agenda for future research. The Review of Financial Studies, 27(1), 1–19.

Chen, M., Liu, Z., Ma, C., & Gong, X. (2019). A distinctive early bird price in reward-based crowdfunding. Electronic Commerce Research. https://doi.org/10.1007/s10660-019-09356-5.

Chen, W., Lin, M., & Zhang, B. Z. (2018). Lower taxes, smarter crowd? The impact of tax incentives on equity-based crowdfunding. Georgia Tech Scheller College of Business Research Paper, 18–27.

Cong L.W., & Xiao, Y. (2018). Up-cascaded wisdom of the crowd. Retrieved from SSRN: https://ssrn.com/abstract, 3030573.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67.

Cumming, D. J., Leboeuf, G., & Schwienbacher, A. (2020). Crowdfunding models: Keep-it-all vs. all-or-nothing. Financial Management, 49(2), 331–360.

Csaszar, F. A., & Eggers, J. P. (2013). Organizational decision making: An information aggregation view. Management Science, 59(10), 2257–2277.

Ellman, M., & Hurkens, S. (2019). Optimal crowdfunding design. Journal of Economic Theory, 184, 104939.

Du, Q. (2016). Birds of a feather or celebrating differences? The formation and impacts of venture capital syndication. Journal of Empirical Finance, 39, 1–14.

Falconieri, S., Filatotchev, I., & Tastan, M. (2019). Size and diversity in VC syndicates and their impact on IPO performance. The European Journal of Finance, 25(11), 1032–1053.

Grüner, H. P., & Siemroth, C. (2019). Crowdfunding, efficiency, and inequality. Journal of the European Economic Association, 17(5), 1393–1427.

Hastie, R., & Kameda, T. (2005). The robust beauty of majority mechanisms in group decisions. Psychological Review, 112(2), 494–508.

Hildebrand, T., Puri, M., & Rocholl, J. (2016). Adverse incentives in crowdfunding. Management Science, 63(3), 587–608.

Hong, L., & Page, S. E. (2004). Groups of diverse problem solvers can outperform groups of high-ability problem solvers. Proceedings of the National Academy of Sciences, 101(46), 16385–16389.

Hopp, C., & Rieder, F. (2011). What drives venture capital syndication? Applied Economics, 43(23), 3089–3102.

Iyer, R., Khwaja, A. I., Luttmer, E. F. P., et al. (2016). Screening peers softly: Inferring the quality of small borrowers. Management Science, 62(6), 1554–1577.

Karelia, N., & Hogarth, R. M. (2008). Determinants of linear judgment: A meta-analysis of lens model studies. Psychological Bulletin, 134(3), 404.

Keuschnigg, M., & Ganser, C. (2016). Crowd wisdom relies on agents’ ability in small groups with a voting aggregation mechanism. Management Science, 63(3), 818–828.

Kunz, M. M., Ulrich, B., Max, E., & Jan, M. L. (2017). An empirical investigation of signaling in reward-based crowdfunding. Electronic Commerce Research, 17(3), 425–461.

Lerner, J. (1994). The syndication of venture capital investments. Financial Management, 23(3), 16–27.

Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17–35.

Lin, M., & Viswanathan, S. (2015). Home bias in online investments: An empirical study of an online crowdfunding market. Management Science, 62(5), 1393–1414.

List, C., & Goodin, R. E. (2001). Epistemic democracy: Generalizing the condorcet jury theorem. Journal of Political Philosophy, 9(3), 277–306.

Liu, Z., Shang, J., Wu, S., et al. (2020). Social collateral, soft information and online peer-to-peer lending: A theoretical model. European Journal of Operational Research, 281(2), 428–438.

Lockett, A., & Wright, M. (2001). The syndication of venture capital investments. Omega, 29(5), 375–390.

Logue, D., & Grimes, M. (2019). Platforms for the people: Enabling civic crowdfunding through the cultivation of institutional infrastructure. Strategic Management Journal. https://doi.org/10.1002/smj.3110.

Lorenz, J., Rauhut, H., Schweitzer, F., & Helbing, D. (2011). How social influence can undermine the wisdom of crowd effect. Proceedings of the National Academy of Sciences, 108(22), 9020–9025.

Mahmood, A., Luffarelli, J., & Mukesh, M. (2019). What’s in a logo? The impact of complex visual cues in equity crowdfunding. Journal of Business Venturing, 34(1), 41–62.

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

Mollick, E., & Nanda, R. (2015). Wisdom or madness? Comparing crowds with expert evaluation in funding the arts. Management Science, 62(6), 1533–1553.

Oliver, P. E., & Marwell, G. (1988). The paradox of group size in collective action: A theory of the critical mass II. American Sociological Review, 53(1), 1–8.

Pahnke, E. C., Katila, R., & Eisenhardt, K. M. (2015). Who takes you to the dance? How partners’ institutional logics influence innovation in young firms. Administrative Science Quarterly, 60(4), 596–633.

Paravisini, D., Rappoport, V., & Ravina, E. (2016). Risk aversion and wealth: Evidence from person-to-person lending portfolios. Management Science, 63(2), 279–297.

Parker, S. C. (2014). Crowdfunding, cascades, and informed investors. Economics Letters, 125(3), 432–435.

Price, P. C., & Stone, E. R. (2004). Intuitive evaluation of likelihood judgment producers: Evidence for a confidence heuristic. Journal of Behavioral Decision Making, 17(1), 39–57.

Sauermann, H., Franzoni, C., & Shafi, K. (2019). Crowdfunding scientific research: Descriptive insights and correlates of funding success. PLoS ONE, 14(1), e0208384.

Scheaf, D. J., Davis, B. C., Webb, J. W., Coombs, J. E., Borns, J., & Holloway, G. (2018). Signals’ flexibility and interaction with visual cues: Insights from crowdfunding. Journal of Business Venturing, 33(6), 720–741.

Slovic, P., & Lichtenstein, S. (1971). Comparison of Bayesian and regression approaches to the study of information processing in judgment. Organizational Behavior and Human Performance, 6(6), 649–744.

Stevenson, R. M., Ciuchta, M. P., Letwin, C., Dinger, J. M., & Vancouver, J. B. (2019). Out of control or right on the money? Funder self-efficacy and crowd bias in equity crowdfunding. Journal of Business Venturing, 34(2), 348–367.

Stiglitz, J. E. (1975). The theory of “screening.” Education, and the distribution of income. American Economic Review, 65(3), 283–300.

Strausz, R. (2017). A theory of crowdfunding: A mechanism design approach with demand uncertainty and moral hazard. American Economic Review, 107(6), 1430–1476.

Welch, I. (1992). Sequential sales, learning, and cascades. Journal of Finance, 47(2), 695–732.

Woolley, A. W., Chabris, C. F., Pentland, A., Hashmi, N., & Malone, T. W. (2010). Evidence for a collective intelligence factor in the performance of human groups. Science, 330(6004), 686–688.

Wright, M., & Lockett, A. (2003). The structure and management of alliances: Syndication in the venture capital industry. Journal of Management Studies, 40(8), 2073–2102.

Zacharakis, A. L., & Meyer, G. D. (1998). A lack of insight: Do venture capitalists really understand their own decision process? Journal of Business Venturing, 13(1), 57–76.

Zacharakis, A. L., & Meyer, G. D. (2000). The potential of actuarial decision models: Can they improve the venture capital investment decision? Journal of Business Venturing, 15(4), 323–346.

Funding

This study is supported by the National Natural Science Foundation of China (71771081), National Natural Science Foundation of China (72071073), Natural Science Foundation of Hunan Province (2017JJ2037).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhou, S., Ma, T. & Liu, Z. Crowdfunding as a screener for collective investment. Electron Commer Res 21, 195–221 (2021). https://doi.org/10.1007/s10660-021-09461-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-021-09461-4