Abstract

Inappropriate management of information security of e-commerce websites exerts a negative effect on consumers’ purchase decisions because it may cause consumer data leakage. To mitigate this negative effect, some e-commerce firms such as Taobao in China voluntarily offer privacy breach insurance to consumers. Even though this fresh management of information security is becoming popular in practice, there are still rare academic studies concerning this hot topic. To fill this gap, this paper constructs a multi-stage game-theoretic model to examine the impacts of privacy breach insurance on a monopoly firm and to identify the market condition under which the firm would like to employ privacy breach insurance. We find that when consumers’ data leakage concern is low and firm’s data leakage possibility is low, privacy breach insurance always encourages more consumers to purchase. Otherwise, privacy breach insurance stimulates purchase only when the compensation of privacy breach insurance remains high. Furthermore, we reveal that the monopoly firm would provide privacy breach insurance when consumers’ data leakage concern remains low. These fresh results suggest that privacy breach insurance acts as an efficient measure e-commerce firms could take to address increasingly serious information security threats.

Similar content being viewed by others

References

Acquisti, A., Friedman, A., & Telang, R. (2006). Is There a Cost to Privacy Breaches? An Event Study. ICIS 2006 Proceedings. 94. http://aisel.aisnet.org/icis2006/94.

Angst, C. M., Block, E. S., D’Arcy, J., & Kelley, K. (2017). When do it security investments matter? Accounting for the influence of institutional factors in the context of healthcare data breaches. MIS Quarterly, 41(3), 893-A8.

Ansari, A., & Mela, C. F. (2003). E-customization. J Marketing Res, 40(2), 131–145.

Ariffin, S. K., Mohan, T., & Goh, Y.-N. (2018). Influence of consumers’ perceived risk on consumers’ online purchase intention. Journal of Research in Interactive Marketing, 12(3), 309–327.

Awad, N. F., & Krishnan, M. (2006). The personalization privacy paradox: An empirical evaluation of information transparency and the willingness to be profiled online for personalization. MIS Quarterly, 30(1), 13–28.

Bellman, S., Johnson, E., Kobrin, S., & Lohse, G. (2004). International differences in information privacy concerns: A global survey of consumers. The Information Society, 20(5), 313–324.

Bélanger, F., Hiller, J., & Smith, W. J. (2002). Trustworthiness in electronic commerce: The role of privacy, security, and site attributes. Journal of Strategic Information Systems, 11(3), 245–270.

Cardenas, J., Coronado, A., Donald, A., Parra, F., & Mahmood, A. M. (2012). The Economic Impact of Security Breaches on Publicly Traded Corporations: An Empirical Investigation. AMCIS 2012 Proceedings. 7. http://aisel.aisnet.org/amcis2012/proceedings/StrategicUseIT/7.

Casadesus-Masanell, R., & Hervas-Drane, A. (2015). Competing with privacy. Management Science, 61(1), 229–246.

Chellappa, R. K., & Sin, R. G. (2005). Personalization versus privacy: An empirical examination of the online consumer’s dilemma. Information Technology and Management, 6(2), 181–202.

Choi, B. C. F., & Land, L. (2016). The effects of general privacy concerns and transactional privacy concerns on Facebook apps usage. Information & Management, 53(7), 868–877.

Dinev, T., & Hart, P. (2004). Internet privacy concerns and their antecedents-measurement validity and a regression model. Behaviour & Information Technology, 23(6), 413–422.

D’Souza, G., & Phelps, J. E. (2009). The privacy paradox: The case of secondary disclosure. Review of Marketing Science, 7(1), 0000102202154656161072.

Earp, J. B., & Payton, F. C. (2006). Information privacy in the service sector: An exploratory study of health care and banking professionals. Journal of Organizational Computing and Electronic Commerce, 16(2), 105–122.

Flavia ‘n, C., & Guinalı ‘u, M. (2006). Consumer trust, perceived security and privacy policy. Industrial Management & Data Systems, 106(5), 601–620.

Gao, X., Zhong, W., & Mei, S. (2014). A game-theoretic analysis of information sharing and security investment for complementary firms. Journal of the Operational Research Society, 65(11), 1682–1691.

Gruzd, A., & Hernández-Garcíá, A. (2018). Privacy concerns and self-disclosure in private and public uses of social media. Cyberpsychology, Behavior, and Social Networking, 21(7), 418–428.

Hann, I.-H., Hui, K.-L., Lee, S.-Y.T., & Png, I. P. L. (2007). Overcoming online information privacy concerns: An information-processing theory approach. Journal of Management Information Systems, 24(2), 13–42.

Hauer, B. (2015). Data and information leakage prevention. Within the Scope of Information Security, 3, 2554–2565.

Hinz, O., Nofer, M., Schiereck, D., & Trillig, J. (2015). The influence of data theft on the share prices and systematic risk of consumer electronics companies. Information & Management, 52, 337–347.

Hoadley, C. M., Xu, H., Lee, J. J., & Rosson, M. B. (2010). Privacy as information access and illusory control: The case of the facebook news feed privacy outcry. Electronic Commerce Research and Applications, 9, 50–60.

Hong, W., & Thong, J. Y. L. (2013). Internet privacy concerns: an integrated conceptualization and four empirical studies. MIS Quarterly, 37(1), 275–298.

Huang, Z., & Benyoucef, M. (2013). From e-commerce to social commerce: A close look at design features. Electronic Commerce Research and Applications, 12, 246–259.

Hui, K.-L., Teo, H. H., & Lee, S.-Y.T. (2007). The value of privacy assurance: An exploratory field experiment. MIS Quarterly, 31(1), 19–33.

Iyer, G., & Soberman, D. (2005). The targeting of advsertising. Marketing Science, 24(3), 461–476.

Jeong, C. Y., Lee, S.-Y.T., & Lim, J.-H. (2019). Information security breaches and IT security investments: Impacts on competitors. Information & Management, 56(5), 681–695.

Jiang, Z., Heng, C. H., & Choi, B. C. F. (2013). Privacy concerns and privacy-protective behavior. Information Systems Research, 24(3), 579–595.

Kaul, R. (2019). A contemporary analysis of online privacy & data protection in the context of parallel privacy policies. Scholedge International Journal of Management & Development, 6(5), 67–70.

Korzaan, M. L., & Boswell, K. T. (2008). The influence of personality traits and information privacy concerns on behavioral intentions. The Journal of Computer Information Systems, 48(4), 15–24.

Kwon, J., & Johnson, M. E. (2014). Proactive versus reactive security investments in the healthcare sector. MIS Quarterly, 38(2), 451-A3.

Kuo, F. Y., Lin, C. S., & Hsu, M. H. (2007). Assessing gender differences in computer professionals’ self-regulatory efficacy concerning information privacy practices. Journal of Business Ethics, 73(2), 145–160.

Law, M., Kwok, R., & Ng, M. (2016). An extended online purchase intention model for middle-aged online users. Electronic Commerce Research and Applications, 20, 132–146.

Lee, C. H., & Cranage, D. A. (2011). Personalization privacy paradox: The effects of personalized and privacy assurance on customer responses to travel Web sites. Tourism Management, 32, 987–994.

Lee, D.-J., Ahn, J.-H., & Bang, Y. (2011). Managing consumer privacy concerns in personalization: A strategic analysis of privacy protection. MIS Quarterly, 35(2), 423–444.

Lin, Y., & Wu, H. Y. (2008). Information privacy concerns, government involvement, and corporate policies in the customer relationship management context. Journal of Global Business and Technology, 4(1), 79–91.

Malhotra, N. K., Kim, S. S., & Agarwal, J. (2004). Internet users’ information privacy concerns (iuipc): the construct, the scale, and a causal model. Information Systems Research, 15(4), 336–355.

Malhotra, A., & Malhotra, C. K. (2011). Evaluating customer information breaches as service failures: An event study approach. Journal of Service Research, 14(1), 44–59.

Mousavizadeh, M., Kim, D. J., & Chen, R. (2016). Effects of assurance mechanisms and consumer concerns on online purchase decisions: An empirical study. Decision Support Systems, 92, 79–90.

Mulder, T., & Tudorica, M. (2019). Privacy policies, cross-border health data and the GDPR. Information & Communications Technology Law, 28(3), 261–274.

Nov O. & Wattal S. (2009). Social Computing Privacy Concerns: Antecedents and Effects [C]. in Proceedings of the 27th International Conference on Human Factors in Computing Systems, Boston, MA, April 4–9: 333–336.

Postma, O. J., & Brokke, M. (2001). Personalized in practice: The proven effects of personalized. Journal of Database Marketing, 9(2), 137–142.

Ponte, E. B., Carvajal-Trujillo, E., & Escobar-Rodríguez, T. (2015). Influence of trust and perceived value on the intention to purchase travel online: Integrating the effects of assurance on trust antecedents. Tourism Management, 47, 286–302.

Prakash, M., & Singaravel, G. (2015). An approach for prevention of privacy breach and information leakage in sensitive data mining. Computers and Electrical Engineering, 45, 134–140.

Rehman, M., & Maseeh, H. I. (2020). Impact of YouTube advertising on purchase intention: A Pitch. Accounting and Management Information Systems, 19(4), 805–811.

Rose, E. A. (2006). An examination of the concern for information privacy in the new zealand regulatory context. Information & Management, 43(3), 322–335.

Schreiber, C. (2014). Google’s targeted advertising: an analysis of privacy protections in an internet age. Transnational Law & Contemporary Problems , 24(1), 269–291.

Sen, R., & Borle, S. (2015). Estimating the contextual risk of data breach: An empirical approach. Journal of Management Information Systems, 32(2), 314–341.

Shauhin, A., & Talesh. . (2018). Data breach, privacy, and cyber insurance: How insurance companies act as “compliance managers” for businesses. Law & Social Inquiry, 43(2), 417–440.

Smith, A. D. (2005). Exploring service marketing aspects of e-personalized and its impact on online consumer behavior. Services Marketing Quarterly, 27(2), 89–102.

Smith, H. J., Milberg, S. J., & Burke, S. J. (1996). Information privacy: measuring individuals’ concerns about organizational practices. MIS Quarterly, 20(2), 167–196.

Son, J.-Y., & Kim, S. S. (2008). Internet users’ information privacy-protective responses: A taxonomy and a nomological model. MIS Quart., 32(3), 503–529.

Sutanto, J., Palme, E., Tan, C.-H., & Phang, C.-W. (2013). Addressing the personalized-privacy paradox: An empirical assessment from a field experiment on smartphone users. MIS Quarterly, 37(4), 1141–1164.

The Wall Street Journal. 2010. Facebook in Privacy Breach. <http://terriau.org/blog/postings/20101018%20Facebook%20in%20Online%20Privacy%20Breach%3B%20Applications%20Transmitting%20Identifying%20Information%20-%20WSJ.pdf>

TRUSTe. Consumer opinion and business impact. TRUSTe Research Report. <http://info.truste.com/lp/truste/Web-Resource-HarrisConsumer Research US-Report Q12014 _LP.html>; 2014 [accessed 10.02.15].

Van Slyke, C., Shim, J. T., Johnson, R., & Jiang, J. (2006). Concern for information privacy and online consumer purchasing. Journal of the Association for Information Systems, 7(6), 415–443.

Verena, M., Wottrich, P., Verlegh, W. J., & Smit, E. G. (2017). The role of customization, brand trust, and privacy concerns in advergaming. International Journal of Advertising, 36(1), 60–81.

Wan, L., & Zhang, C. (2014). Responses to trust repair after privacy breach incidents. Journal of Service Science Research, 6, 193–224.

Wang, S., & Huff, L. C. (2007). Explaining buyers’ responses to sellers’ violation of trust. European Journal of Marketing, 41(9/10), 1033–1052.

Wang, Z., Wang, N., Su, X., & Ge, S. (2016). Differentiated management strategies on cloud computing data security driven by data value. Information Security Journal: A Global Perspective, 25, 280–294.

Xu, H., Teo, H.-H., Bernard, C. Y., & Tan, R. A. (2012). Research note—effects of individual self-protection, industry self-regulation, and government regulation on privacy concerns: A study of location-based services. Information Systems Research, 23(4), 1342–1363.

Xu, H., Luo, X., Carroll, J. M., & Rosson, M. B. (2011). The personalization privacy paradox: An exploratory study of decision-making process for location-aware marketing. Decision Support Systems, 51, 42–52.

Yang, H.L., & Miao, X.M. (2008). Concern for Information Privacy and Intention to Transact Online. In Proceedings of the 4th International Conference on Wireless Communications, Networking and Mobile Computing, Dalian, China, October 12–14, 1–4.

Yang, Z., & Lui, J. C. S. (2014). Security adoption and influence of cyber-insurance markets in heterogeneous networks. Performance Evaluation, 74, 1–17.

Yannacopoulos, A. N., Lambrinoudakis, C., Gritzalis, S., Xanthopoulos, S. Z., & Katsikas, S. N. (2008). Modeling Privacy Insurance Contracts and Their Utilization in Risk Management for ICT Firms. In S. Jajodia & J. Lopez (Eds.), Computer Security - ESORICS 2008. Lecture Notes in Computer Science. (Vol. 5283). Berlin: Springer.

Zarei, G., Nuri, B. A., & Noroozi, N. (2019). The effect of Internet service quality on consumers’ purchase behavior: The role of satisfaction, attitude, and purchase intention. Journal of Internet Commerce, 18(2), 197–220.

Zarouali, B., Ponnet, K., Walrave, M., & Poels, K. (2017). Do you like cookies? Adolescents’ skeptical processing of retargeted Facebook-ads and the moderating role of privacy concern and a textual debriefing. Computers in Human Behavior, 69, 157–165.

Zhang, J., Zhong, W., & Mei, S. (2012). Competitive effects of purchase-based targeted advertising. Journal of Electronic Commerce in Organizations, 10(4), 71–84.

Zhang, J., & He, X. (2019). Targeted advertising by asymmetric firms. Omega, 89, 136–150.

Zhang, J., & Li, K. J. (2020). Quality disclosure under consumer loss aversion. Management Science. https://doi.org/10.1287/mnsc.2020.3745

Zhang, X., Liu, S., Chen, X., Wang, L., Gao, B., & Zhu, Q. (2018). Health information privacy concerns, antecedents, and information disclosure intention in online health communities. Information & Management, 55(4), 482–493.

Zhao, X., & Xue, L. (2012). Competitive target advertising and consumer data sharing. Journal of Management Information, 29(3), 189–221.

Zlatolas, L. N., Welzer, T., Hericko, M., & Hölbl, M. (2015). Privacy antecedents for SNS self-disclosure: The case of Facebook. Computers in Human Behavior, 45, 158–167.

Zukowski, T., &Brown, I. (2007). Examining the influence of demographic factors on internet users’ information privacy concerns. In: Proceedings of the 2007 Annual research conference of the south african institute of computer scientists and information technologists on it research in developing countries, Port Elizabeth, South Africa, October 2–3:197–204.

Funding

This work was supported by the National Social Science, China [Grant No. 17BGL196].

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Publisher's Note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations'' (in PDF at the end of the article below the references; in XML as a back matter article note

Appendices

Appendix A

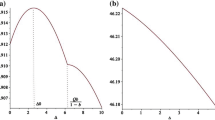

Solving the first-order derivation of function \(n^{F}\) with respect to \(k\), we can get

Letting \(X = 2\left( {1 - \alpha + \gamma k} \right)\gamma + 12\gamma \left( {1 + \gamma } \right)\omega\) and \(Y = 4\gamma \sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega }\), we can get that if \(Y - X > 0\),\(\frac{{\partial n^{F} }}{{\partial k}} > 0\). Further, we can get

For \(X > 0\) and \(Y > 0\), we can get that if \(Y^{2} - X^{2} > 0\), then \(Y - X > 0\).

By analyzing equation (a2), we can find that if.

\(1 - \alpha - 6\left( {1 + \gamma } \right)\omega \ge 0\) (a3),

then \(Y - X > 0\). When \(\omega < \frac{{1 - \alpha }}{6}\) and \(\gamma \le \frac{{1 - \alpha }}{{6\omega }} - 1\), equation (a3) holds.

Furthermore, if

then when \(k > \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\left( {1 + \gamma } \right)\omega } \right) + 4\sqrt {4\left( {1 + \gamma } \right)^{2} \omega ^{2} + \left( {1 - \alpha } \right)\left( {1 + \gamma } \right)\omega } }}{\gamma }\), equation (a2) holds. Analyzing equation (A4), we can get when 1) \(\omega \ge \frac{{1 - \alpha }}{6}\); or 2)\(\omega < \frac{{1 - \alpha }}{6}\) and \(\gamma > \frac{{1 - \alpha }}{{6\omega }} - 1\), equation (A4) holds.

In summary, according to the above results, we can get that.

-

(1) if \(\omega < \frac{{1 - \alpha }}{6}\) and \(\gamma \le \frac{{1 - \alpha }}{{6\omega }} - 1\), then \(\frac{{\partial n^{F} }}{{\partial k}} > 0\);

-

(2) if \(\omega < \frac{{1 - \alpha }}{6}\) and \(\gamma > \frac{{1 - \alpha }}{{6\omega }} - 1\), then when \(k > k_{0}\), \(\frac{{\partial n^{F} }}{{\partial k}} > 0\) and when \(k < k_{0}\), \(\frac{{\partial n^{F} }}{{\partial k}} < 0\);

-

(3) if \(\omega \ge \frac{{1 - \alpha }}{6}\), then when \(k > k_{0}\), \(\frac{{\partial n^{F} }}{{\partial k}} > 0\) and when \(k < k_{0}\), \(\frac{{\partial n^{F} }}{{\partial k}} < 0\).

Here, \(k_{0} = \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\left( {1 + \gamma } \right)\omega } \right) + 4\sqrt {4\left( {1 + \gamma } \right)^{2} \omega ^{2} + \left( {1 - \alpha } \right)\left( {1 + \gamma } \right)\omega } }}{\gamma }\).

Appendix B

Solving the first-order derivation of function \(n^{F}\) with respect to \(\gamma\), we can get

Letting \(M = 2k\sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega }\) and \(N = \left[ {\left( {1 - \alpha + \gamma k} \right)k + 6\left( {1 + 2\gamma } \right)k\omega } \right]\), we can get that if \(M - N > 0\),\(\frac{{\partial n^{F} }}{{\partial \gamma }} > 0\). Further, we can get

For \(M > 0\) and \(N > 0\), we can get that if \(M^{2} - N^{2} > 0\), then \(M - N > 0\).

By analyzing equation (A6), we can find that:

-

(1) if \(\left( {k - 4\omega } \right) \ge 0\) and \(\left( {1 - \alpha - 6\omega } \right) > 0\), \(M > N\). That is, if \(k \ge 4\omega\) and \(\omega < \frac{{1 - \alpha }}{6}\),\(M > N\);

-

(2) if \(\left( {k - 4\omega } \right) \ge 0\) and \(\left( {1 - \alpha - 6\omega } \right) \le 0\), we have \(k \ge 4\omega\) and \(\omega \ge \frac{{1 - \alpha }}{6}\). Under this condition, when \(\gamma > \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) + 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\), \(M > N\); and when \(\gamma < \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) + 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\),\(M < N\);

-

(3) if \(\left( {k - 4\omega } \right) < 0\) and \(\left( {1 - \alpha - 6\omega } \right) > 0\), we have \(k < 4\omega\) and \(\omega < \frac{{1 - \alpha }}{6}\). Under this condition, when \(\gamma < \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) - 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\), \(M > N\); when \(\gamma > \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) - 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\),\(M < N\);

-

(4) if \(\left( {k - 4\omega } \right) < 0\) and \(\left( {1 - \alpha - 6\omega } \right) \le 0\), we have \(k < 4\omega\) and \(\omega \ge \frac{{1 - \alpha }}{6}\). Under this condition, \(M < N\).

In summary, according to the above results, we can get that.

-

(1) if \(k \ge 4\omega\) and \(\omega < \frac{{1 - \alpha }}{6}\), we have \(\frac{{\partial n^{F} }}{{\partial \gamma }} > 0\);

-

(2) if \(k \ge 4\omega\) and \(\omega > \frac{{1 - \alpha }}{6}\), then when \(\gamma > \gamma _{1}\), \(\frac{{\partial n^{F} }}{{\partial \gamma }} > 0\); and when \(\gamma < \gamma _{1}\), \(\frac{{\partial n^{F} }}{{\partial \gamma }} < 0\);

-

(3) if \(k < 4\omega\) and \(\omega < \frac{{1 - \alpha }}{6}\), then when \(\gamma < \gamma _{2}\), \(\frac{{\partial n^{F} }}{{\partial \gamma }} > 0\); and when \(\gamma > \gamma _{2}\),\(\frac{{\partial n^{F} }}{{\partial \gamma }} < 0\);

-

(4) if \(k < 4\omega\) and \(\omega \ge \frac{{1 - \alpha }}{6}\), we have \(\frac{{\partial n^{F} }}{{\partial \gamma }} < 0\).

Here, \(\gamma _{1} = \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) + 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\).and \(\gamma _{2} = \frac{{ - \left( {\left( {1 - \alpha } \right) + 6\omega } \right)\left( {k - 4\omega } \right) - 4\sqrt {\left( {k - 4\omega } \right)\omega \left( { - \left( {1 - \alpha } \right)^{2} + k\left( {1 - \alpha } \right) + 3k\omega } \right)} }}{{\left( {k + 12\omega } \right)\left( {k - 4\omega } \right)}}\).

Appendix C

Letting \(\sqrt {p^{{F*}} } - \sqrt {p^{{N*}} }\), we can get

Since \(\sqrt {p^{{F*}} } > 0\), \(p^{{F*}} > 0\),\(\sqrt {p^{{N*}} } > 0\) and \(p^{{N*}} > 0\), we can get that if \(\sqrt {p^{{F*}} } - \sqrt {p^{{N*}} } > 0\),\(p^{{F*}} > p^{{N*}}\).

Analyzing equation (A7), we can find that if \(\gamma k - \left( {1 - \alpha } \right) \ge 0\), \(\sqrt {p^{{F*}} } - \sqrt {p^{{N*}} } > 0\). If \(\gamma k - \left( {1 - \alpha } \right) < 0\), we further solving the following equation

Solving equation (A8), we can get the following equation

Clearly, \(\Delta > 0\) holds. Therefore, \(\sqrt {p^{{F*}} } - \sqrt {p^{{N*}} } > 0\) always holds.

Furthermore, we analyze the effects of privacy breach insurance compensation on price. Solving the first-order derivative of function \(p^{{F*}}\) with respect to, we can get

It is clearly that \(\frac{{\partial p^{{F*}} }}{{\partial k}} > 0\). Therefore, \(p^{{F*}}\) is increasing in \(k\).

Appendix D

The first-order derivation of function \(\pi ^{F}\) with respect to \(k\) is

where

Since \(\frac{{2\left[ {2\left( {1 + \gamma k} \right) + \alpha - \sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega } } \right]}}{{108\gamma \omega }} > 0\), we can get that if \(M > 0\),\(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\). Now we analyze equation (A11).

If \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega \ge 0\), \(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\) holds. Solving \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega \ge 0\), we can get the following results:

-

(1) if \(\omega \le \frac{{1 + 2\alpha }}{6}\) and \(\gamma \le \frac{{1 + 2\alpha }}{{6\omega }} - 1\), \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega \ge 0\) holds;

-

(2) if 1)\(\omega \le \frac{{1 + 2\alpha }}{6}\) and \(\gamma > \frac{{1 + 2\alpha }}{{6\omega }} - 1\); or 2) \(\omega > \frac{{1 + 2\alpha }}{6}\), when \(k \ge - \frac{{1 + 2\alpha - 6\left( {1 + \gamma } \right)\omega }}{\gamma }\), \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega \ge 0\) holds.

If \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega < 0\), we can further let

Since \(\left( {1 + \gamma k} \right) + 2\alpha - 6\left( {1 + \gamma } \right)\omega < 0\) and \(\sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega } > 0\), we can get that if \(Z1 > 0\), \(Z > 0\) holds. Next, we analyze equation (A13). By solving the equation, we can get the following results:

-

(1)If \(\omega\) and \(\gamma\) satisfy the following conditions: 1)\(\frac{{1 + 2\alpha }}{6} < \omega \le \frac{{2 + \alpha }}{6}\) and \(\gamma \le \frac{{2 + \alpha }}{{6\omega }} - 1\); or 2) \(\omega \le \frac{{1 + 2\alpha }}{6}\) and \(\frac{{1 + 2\alpha }}{{6\omega }} - 1 < \gamma \le \frac{{2 + \alpha }}{{6\omega }} - 1\), then when \(k < - \frac{{1 + 2\alpha - 6\left( {1 + \gamma } \right)\omega }}{\gamma }\), \(Z1 > 0\);

-

(2) if \(\omega\) and \(\gamma\) satisfy the following conditions: 1) \(\omega > \frac{{2 + \alpha }}{6}\); or 2) \(\omega \le \frac{{2 + \alpha }}{6}\) and \(\gamma > \frac{{2 + \alpha }}{{6\omega }} - 1\), then when \(- \frac{{\left[ { - \alpha + 2\left( {1 + \gamma } \right)\omega } \right]\left[ {\left( {2 + \alpha } \right) - 6\left( {1 + \gamma } \right)\omega } \right]}}{{2\gamma \left[ { - \alpha + 4\left( {1 + \gamma } \right)\omega } \right]}} < k < - \frac{{1 + 2\alpha - 6\left( {1 + \gamma } \right)\omega }}{\gamma }\), \(Z1 > 0\); and when \(k < - \frac{{\left[ { - \alpha + 2\left( {1 + \gamma } \right)\omega } \right]\left[ {\left( {2 + \alpha } \right) - 6\left( {1 + \gamma } \right)\omega } \right]}}{{2\gamma \left[ { - \alpha + 4\left( {1 + \gamma } \right)\omega } \right]}}\), \(Z1 < 0\).

In summary, according to the above results, we can get that.

-

(1) if \(\omega \le \frac{{1 + 2\alpha }}{6}\) and \(\gamma \le \frac{{1 + 2\alpha }}{{6\omega }} - 1\), we can get \(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\);

-

(2) if \(\frac{{1 + 2\alpha }}{6} < \omega \le \frac{{2 + \alpha }}{6}\) and \(\gamma \le \frac{{2 + \alpha }}{{6\omega }} - 1\), we can get \(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\);

-

(3) if \(\omega \le \frac{{1 + 2\alpha }}{6}\) and \(\frac{{1 + 2\alpha }}{{6\omega }} - 1 < \gamma \le \frac{{2 + \alpha }}{{6\omega }} - 1\), we can get \(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\);

-

(4) if 1)\(\omega > \frac{{2 + \alpha }}{6}\); or 2) \(\omega \le \frac{{2 + \alpha }}{6}\) and \(\gamma > \frac{{2 + \alpha }}{{6\omega }} - 1\), we can get that.

-

1)when \(k > - \frac{{\left[ { - \alpha + 2\left( {1 + \gamma } \right)\omega } \right]\left[ {\left( {2 + \alpha } \right) - 6\left( {1 + \gamma } \right)\omega } \right]}}{{2\gamma \left[ { - \alpha + 4\left( {1 + \gamma } \right)\omega } \right]}}\),\(\frac{{\partial \pi ^{F} }}{{\partial k}} > 0\);

-

2)when \(k < - \frac{{\left[ { - \alpha + 2\left( {1 + \gamma } \right)\omega } \right]\left[ {\left( {2 + \alpha } \right) - 6\left( {1 + \gamma } \right)\omega } \right]}}{{2\gamma \left[ { - \alpha + 4\left( {1 + \gamma } \right)\omega } \right]}}\),\(\frac{{\partial \pi ^{F} }}{{\partial k}} < 0\).

-

Appendix E

(1) Equilibriums when the firm not providing privacy breach insurance.

Privacy information provision. In the fourth stage, we consider how much privacy consumers will disclose to the firm. Given firm’s product price \(p^{N}\), the consumer maximizes his/her utility which implying the optimal privacy provision

Participate Decision. In the third stage, consumers decide whether to participate in the market. The consumer participates in the market if

Based on equation (A14) and equation (A15), and given firm’s product price \(p^{N}\), we can derive consumers participate when

and as a result, the number of participating is

Product price. In the second stage, the firm maximizes its profit by setting the product price. The first-order of derivative of function \(\pi ^{N}\) with respect to \(p^{N}\) is.

Letting \(\frac{{\partial \pi ^{N} }}{{\partial p^{N} }} = 0\), we derive the equilibrium product price as

According the equilibrium product price, we can further get the equilibrium number of consumers in the market as follows

(2) Equilibriums when the firm providing privacy breach insurance.

Privacy information provision. In the fourth stage, we consider the decision problem that a consumer decides how much privacy he/she will disclose to the firm. The consumer maximizes his/her utility, given the firm’s product price \(p^{F}\). We can derive that the privacy provision is

Participate Decision. In the third stage, consumers decide whether to participate in the market. The consumer can get a utility of zero when existing the market, implying it participates in the market if

Based on equation (a21) and equation (a22), and given firm’s product price \(p^{F}\), we can find consumers participates when

implying the number of participating consumers

Product price. In the second stage, the firm maximizes its profit by setting the product price. The first-order of derivative of function \(\pi ^{F}\) with respect to \(p^{F}\) is

Letting \(\frac{{\partial \pi ^{F} }}{{\partial p^{F} }} = 0\), we derive the equilibrium product price as

According to the equilibrium product price, we can further get the equilibrium number of consumers in the market

Appendix F

Comparing the profits in the two scenarios, we can get

For \(0 \le n^{F} = \frac{{2\left( {1 + \gamma k} \right) + \alpha - \sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega } }}{3} \le 1\), we can get that \(2\left( {1 + \gamma k} \right) + \alpha \ge \sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega }\) and \(2\left( {1 + \gamma k} \right) + \alpha - 3 \le \sqrt {\left( {1 - \alpha + \gamma k} \right)^{2} + 12\gamma \left( {1 + \gamma } \right)k\omega }\).

Hence, we can get

and

Analyzing equation (A29), we can get that if

then \(\pi ^{F} < \pi ^{N}\) holds. Here, we can easily get that

Based on equation (A32) and solving equation (A31), we can get the following results:

Analyzing equation (A30), we can get that if

then \(\pi ^{F} > \pi ^{N}\) holds.

Solving equation (A33), we can get when.

equation (A33) holds.

Rights and permissions

About this article

Cite this article

Cheng, Y., Mei, S., Zhong, W. et al. Managing consumer privacy risk: The effects of privacy breach insurance. Electron Commer Res 23, 807–841 (2023). https://doi.org/10.1007/s10660-021-09492-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-021-09492-x