Abstract

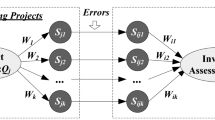

The peer economy, such as crowdfunding, democratizes access to tasks available only to professionals. Although the peer economy has gained great popularity in practice, how crowds infer information from their peers, especially from experts, is still under minimal study in academia. Using data from a debt-based crowdfunding platform in China, this study investigates the impact of seasoned predecessors’ bids on subsequent investors' decisions and how seasoned and unseasoned investors respond differently to herding signals. We discover that the cumulative lending amount from seasoned predecessors is positively associated with the lending amount of a successor, and such an association is greater if the successor is seasoned. In the repayment process, we find that the lending amount from seasoned investors is positively associated with loan performance, while the lending amount from unseasoned investors is not. Our results contribute to the literature on crowds of wisdom, implying that in a context that requires sophisticated knowledge, extracting hidden talents from experts rather than from crowds is more appropriate.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Akerlof, G. A. (1970). The market for “lemons”: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500.

Bloch, P. H., Sherrell, D. L., & Ridgway, N. M. (1986). Consumer search: An extended framework. Journal of Consumer Research, 13(1), 119–136.

Budescu, D. V., & Eva, C. (2015). Identifying expertise to extract the wisdom of crowds. Management Science, 61(2), 267–280.

Caglayan, M., Talavera, O., & Zhang, W. (2019). Herding behaviour in P2P lending markets. Journal of Empirical Finance, 63(September), 27–41.

Chaiken, S. (1980). Heuristic versus systematic information processing and the use of source versus message cues in persuasion. Journal of Personality and Social Psychology, 39(5), 752–766.

Chaiken, S., & Ledgerwood, A. (2012). A theory of heuristic and systematic information processing. In P. Van Lange, A. Kruglanski, & E. Higgins (Eds.), Handbook of theories of social psychology (pp. 246–266). Sage Publications Ltd.

Chen, D., Li, X., & Lai, F. (2021). Shill bidding in lenders’ eyes? A cross-country study on the influence of large bids in online P2P lending. Electronic Commerce Research. Advance online publication. https://doi.org/10.1007/s10660-021-09503-x

Chen, D., & Lin, Z. (2015). Rational or irrational herding in online microloan markets: Evidence from China. Social Science Research Network. working paper. Retrieved May 25, 2022, from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2425047.

Chen, D. Y., Li, X. L., & Lai, F. J. (2017). Gender discrimination in online peer-to-peer credit lending: Evidence from a lending platform in China. Electronic Commerce Research, 17(4), 553–583.

Chen, L., Huang, Z., & Liu, D. (2016). Pure and hybrid crowds in crowdfunding markets. Financial Innovation, 2(1), 1–18.

Chen, L., Xu, P., & Liu, D. (2020). Effect of crowd voting on participation in crowdsourcing contests. Journal of Management Information Systems, 37(2), 510–535.

Chen, Y., & Xie, J. (2008). Online consumer review: Word-of-mouth as a new element of marketing communication mix. Management Science, 54(3), 477–491.

Chernenko, S., Hanson, S. G., & Sunderam, A. (2016). Who neglects risk? Investor experience and the credit boom. Journal of Financial Economics, 122(2), 248–269.

Davis, J. M., & Tuttle, B. M. (2013). A heuristic–systematic model of end-user information processing when encountering IS exceptions. Information & Management, 50(2–3), 125–133.

Deng, Y., & Liu, P. (2009). Mortgage prepayment and default behavior with embedded forward contract risks in China’s housing market. The Journal of Real Estate Finance and Economics, 38(3), 214–240.

Duarte, J., Siegel, S., & Young, L. (2012). Trust and credit: The role of appearance in peer-to-peer lending. Review of Financial Studies, 25(8), 2455–2484.

Ericsson, K. A. (2000). Expertise in interpreting: An expert-performance perspective. Interpreting, 5(2), 187–220.

Ericsson, K. A., & Smith, J. (1991). Toward a general theory of expertise: Prospects and limits. Cambridge University Press.

Filieri, R. (2016). What makes an online consumer review trustworthy? Annals of Tourism Research, 58, 46–64.

Gao, Y., Han, X., Li, Y., & Xiong, X. (2021). Investor heterogeneity and momentum-based trading strategies in China. International Review of Financial Analysis, 74(November 2020), 101654.

Ge, R., Feng, J., Gu, B., & Zhang, P. (2017). Predicting and deterring default with social media information in peer-to-peer lending. Journal of Management Information Systems, 34(2), 401–424.

Gross, D. B., & Souleles, N. S. (2002). An empirical analysis of personal bankruptcy and delinquency. Review of Financial Studies, 15(1), 319–347.

Herzenstein, M., Dholakia, U. M., & Andrews, R. L. (2011). Strategic herding behavior in peer-to-peer loan auctions. Journal of Interactive Marketing, 25(1), 27–36.

Huang, J. H., & Chen, Y. F. (2006). Herding in online product choice. Psychology & Marketing, 23(5), 413–428.

Huang, L. (2018). The role of investor gut feel in managing complexity and extreme risk. Academy of Management Journal, 61(5), 1821–1847.

Huang, L., & Pearce, J. L. (2015). Managing the unknowable the effectiveness of early-stage investor gut feel in entrepreneurial investment decisions. Administrative Science Quarterly, 60(4), 634–670.

Iyengar, R., Van den Bulte, C., & Valente, T. W. (2010). Opinion leadership and social contagion in new product diffusion. Marketing Science, 30(2), 195–212.

Jiang, Y., Ho, Y.C., Yan, X., & Tan, Y. (2021). What’s in a “username”? The effect of perceived anonymity on herding in crowdfunding. Information Systems Research, 33(1), 1–17.

Keongtae, K., & Viswanathan, S. (2019). The experts in the crowd: The role of experienced investors in a crowdfunding market. MIS Quarterly, 43(2), 347–372.

Kim, J. S., & Frees, E. W. (2007). Multilevel modeling with correlated effects. Psychometrika, 72(4), 505–533.

Korniotis, G. M., & Kumar, A. (2011). Do older investors make better investment decisions? The Review of Economics and Statistics, 93(1), 244–265.

Lee, E., & Lee, B. (2012). Herding behavior in online P2P lending: An empirical investigation. Electronic Commerce Research and Applications, 2012(11), 495–503.

Lee, Y., Tan, Y., & Hosanagar, K. (2015). Do I follow my friends or the crowd? Informational cascades in online movie ratings. Management Science, 61(9), 2241–2258.

Liang, T. P., Wu, S. P. J., & Huang, C. C. (2019). Why funders invest in crowdfunding projects: Role of trust from the dual-process perspective. Information & Management, 56(1), 70–84.

Lin, H. C., Bruning, P. F., & Swarna, H. (2018). Using online opinion leaders to promote the hedonic and utilitarian value of products and services. Business Horizons, 61(3), 431–442.

Liu, D., Brass, D. J., Lu, Y., & Chen, D. Y. (2015). Friendships in online peer-to-peer lending: Pipes, prisms, and relational herding. MIS Quarterly, 39(3), 729–742.

Lorenz, J., Rauhut, H., Schweitzer, F., & Helbing, D. (2011). How social influence can undermine the wisdom of crowd effect. Proceedings of the National Academy of Sciences, 108(22), 9020.

Mollick, E. R., & Nanda, R. (2016). Wisdom or madness? Comparing crowds with expert evaluation in funding the arts. Management Science, 62(6), 1533–1553.

Palley, A. B., & Soll, J. B. (2019). Extracting the wisdom of crowds when information is shared. Management Science, 65(5), 2291–2309.

Paravisini, D., Rappoport, V., & Ravina, E. (2017). Risk aversion and wealth: Evidence from person-to-person lending portfolios. Management Science, 63(2), 279–297.

Park, D. H., Lee, J., & Han, I. (2007). The effect of on-line consumer reviews on consumer purchasing intention: The moderating role of involvement. International Journal of Electronic Commerce, 11(4), 125–148.

Petty, R. E., & Cacioppo, J. T. (1986). The elaboration likelihood model of persuasion. In L. Berkowitz (Ed.), Communication and persuasion (pp. 123–205). Academic Press.

See, K. E., Morrison, E. W., Rothman, N. B., & Soll, J. B. (2011). The detrimental effects of power on confidence, advice taking, and accuracy. Organizational Behavior and Human Decision Processes, 116(2), 272–285.

Shai, B., Arthur, K., & Laws, K. (2017). Attracting early-stage investors: Evidence from a randomized field experiment. Journal of Finance, 722(2), 509–538.

Shen, T., Ma, J., Zhang, B., Huang, W., & Fan, F. (2020). “I invest by following lead investors!” The role of lead investors in fundraising performance of equity crowdfunding. Frontiers in Psychology, 11(632), 1–8.

Soll, J. B., & Larrick, R. P. (2009). Strategies for revising judgment: How (and how well) people use others’ opinions. Journal of Experimental Psychology: Learning, Memory and Cognition, 35(3), 780–805.

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87(3), 355–374.

Sunder, S., Kim, K. H., & Yorkston, E. A. (2019). What drives herding behavior in online ratings? The role of rater experience, product portfolio, and diverging opinions. Journal of Marketing, 83(6), 93–112.

Surowiecki, J. (2004). The wisdom of crowds: Why the many are smarter than the few and how collective wisdom shapes business, economies, societies, and nations. Doubleday & Co, Little, Brown.

Tejavibulya, P., & Eiamkanchanalai, S. (2011). The impacts of opinion leaders towards purchase decision engineering under different types of product involvement. Systems Engineering Procedia, 12, 12–22.

von Helversen, B., Abramczuk, K., Kopeć, W., & Nielek, R. (2018). Influence of consumer reviews on online purchasing decisions in older and younger adults. Decision Support Systems, 113, 1–10.

Wang, Y., Goes, P., Wei, Z., & Zeng, D. (2019). Production of online word-of-mouth: Peer effects and the moderation of user characteristics. Production and Operations Management, 28, 1621–1640.

Yang, Y., Chen, P. Y., & Banker, R. (2011). Winner determination of open innovation contests in online markets. In International conference on information systems 2011 proceedings (ICIS2011), Shanghai, China (pp. 3737–3752).

Yum, H., Lee, B., & Chae, M. (2012). From the wisdom of crowds to my own judgment in microfinance through online peer-to-peer lending platforms. Electronic Commerce Research and Applications, 11(5), 469–483.

Zhang, J. J. (2009). The sound of silence: Observational learning in the U.S. Kidney market. Marketing Science, 29(2), 315–335.

Zhang, J. J., & Liu, P. (2012). Rational herding in microloan markets. Management Science, 58(2), 892–912.

Zhang, K., & Chen, X. (2017). Herding in a P2P lending market: Rational inference or irrational trust? Electronic Commerce Research and Applications, 23, 45–53.

Acknowledgements

Funding was provided by Natural Science Foundation of China (Grant No. 71771159, 72071160).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Results of investor participation decision

(1) | |

|---|---|

Participate | |

Seasoned (1 = yes) | − 0.0088*** (0.0024) |

Amount requested | 0.2713*** (0.0025) |

Interest rate | 0.0110*** (0.0003) |

Loan duration | − 0.0291*** (0.0004) |

Credit risky | − 0.2841*** (0.0030) |

Title length | − 0.0003 (0.0002) |

Purpose (enterprise startup) | 0.0538*** (0.0042) |

Purpose (other purpose) | 0.1000*** (0.0040) |

Purpose (short-term turnover debt) | 0.0387*** (0.0028) |

Purpose (not reported) | 0.4559*** (0.0071) |

Borrower age | 0.0008*** (0.0002) |

Education (low) | − 0.0902*** (0.0034) |

Education (not reported) | − 0.2517*** (0.0029) |

Gender (male) | − 0.0804*** (0.0034) |

Num of child | − 0.0059** (0.0030) |

Marriage (not married) | − 0.0156*** (0.0036) |

Marriage (not reported) | − 0.1131*** (0.0079) |

Intercept | − 4.1472*** (0.0239) |

N | 6,520,938 |

AIC | 1,191,191.3033 |

BIC | 1,191,437.7328 |

Log Likelihood | − 595,577.6516 |

Appendix B: Loan level characteristics

Mean | SD | Min | Max | ||

|---|---|---|---|---|---|

\({\mathrm{Y}}^{\mathrm{s}}\): Amount from seasoned | Lending amount from seasoned investors | 4940.770 | 5353.760 | 100.000 | 77,727 |

\({\mathrm{Y}}^{\mathrm{u}}\): Amount from unseasoned | Lending amount from unseasoned investors | 1786.219 | 1773.565 | 0.000 | 20,072 |

Amount requested | Request amount of a loan (RMB) | 6473.993 | 6156.625 | 3000.000 | 88,000 |

Interest rate | Interest rate provided by a borrower (%) | 16.144 | 4.127 | 5.000 | 22 |

Loan duration | The number of months the borrower makes payments | 5.561 | 3.477 | 1.000 | 12 |

Credit risky | 1 if a loan’s credit rating is E or HR, 1 otherwise | 0.153 | 0.360 | 0.000 | 1 |

Title length | Number of characteristics in the title of a loan | 18.519 | 5.846 | 10.000 | 30 |

Late | Whether a loan is late for more than 30 days | 0.062 | 0.242 | 0.000 | 1 |

Default | Whether a loan is late for more than 90 days | 0.048 | 0.213 | 0.000 | 1 |

Purpose (base) | The purpose of a loan is for goods consumption | 0.305 | 0.461 | 0.000 | 1 |

Purpose (enterprise startup) | The purpose of a loan is for enterprise startup | 0.111 | 0.314 | 0.000 | 1 |

Purpose (other purpose) | The purpose of a loan is for other purpose | 0.177 | 0.382 | 0.000 | 1 |

Purpose (short-term turnover debt) | The purpose of a loan is for short-term turnover debt | 0.407 | 0.491 | 0.000 | 1 |

Age | The age of the borrower | 30.537 | 5.337 | 20.000 | 54 |

Num of child | Number of children that the borrower has | 1.492 | 0.589 | 1.000 | 4 |

Education (base) | The borrower has a college diploma or higher | 0.468 | 0.499 | 0.000 | 1 |

Education (low) | The borrower has a high school diploma or lower | 0.142 | 0.350 | 0.000 | 1 |

Education (not reported) | The borrower education level is not reported | 0.389 | 0.488 | 0.000 | 1 |

Gender (base) | The borrower is a female | 0.172 | 0.377 | 0.000 | 1 |

Gender (male) | The borrower is a male | 0.828 | 0.377 | 0.000 | 1 |

Marriage (base) | The borrower has married | 0.578 | 0.494 | 0.000 | 1 |

Marriage (single) | The borrower has not married | 0.401 | 0.49 | 0.000 | 1 |

Marriage (not reported) | The borrower marriage status is not reported | 0.021 | 0.143 | 0.000 | 1 |

Rights and permissions

About this article

Cite this article

Chen, D., Huang, C., Liu, D. et al. The role of expertise in herding behaviors: evidence from a crowdfunding market. Electron Commer Res 24, 155–203 (2024). https://doi.org/10.1007/s10660-022-09570-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-022-09570-8