Abstract

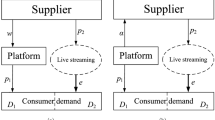

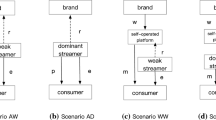

This study considers a manufacturer–retailer–streamer supply chain, in which the retailer first purchases products from a manufacturer and then sells them to consumers through a streamer. In the live streaming context, the retailer usually cooperates with the streamer by providing three different contracts: only a commission of the sale (OC), only a fixed fee (OF), and a commission of the sale and fixed fee (CF). Therefore, this study develops a theoretical model to investigate the effects of these three contracts on supply chain members’ optimal decisions and profits. The following results were obtained: (1) the retailer prefers an OC contract with a high-ability streamer, and the manufacturer benefits from this contract. Additionally, the manufacturer, retailer, and high-ability streamer can achieve a win–win–win outcome in certain cases. Furthermore, the retailer is willing to sign an OC contract with a low-ability streamer when the fixed fee of the OF contract is high. (2) The retailer prefers to cooperate with a low-ability streamer through an OF contract when the fixed fee is low. (3) The CF contract is the most profitable alternative for the retailer when the total commission rate is low and the fixed fee is medium.

Similar content being viewed by others

Data availability

We did not analyze or generate any datasets because our work proceeds within a theoretical and mathematical framework.

Notes

Available at https://vantagedigital.com.au/ultimate-guide-taobao-live-streaming-17-lessons-from-top-5-streamers/. (Accessed 2021).

Available at https://chinamktginsights.com/paying-100k-rmb-to-sell-5-thermoses-how-to-avoid-a-celebrity-livestream-horror-story/. (Accessed 2021).

Wu, J., 2020. Businesses "hollowed out" by Sydney: they can't earn, they can't escape. https://car.inotgo.com/2021/12/202112252017199064.html. (Accessed 2022).

Available at https://lujuba.cc/en/632400.html. (Accessed 2022).

References

Avinadav, T. (2020). The effect of decision rights allocation on a supply chain of perishable products under a revenue-sharing contract. International Journal of Production Economics, 225, 107587.

Benitez, C (2021). The ultimate list of live streaming statistics for 2021. (August 6th). https://findstack.com/live-streaming-statistics/

Bart, N., Chernonog, T., & Avinadav, T. (2021). Revenue-sharing contracts in supply chains: A comprehensive literature review. International Journal of Production Research, 59(21), 6633–6658.

Cai, J., Hu, X., Tadikamalla, P. R., & Shang, J. (2017). Flexible contract design for VMI supply chain with service-sensitive demand: Revenue-sharing and supplier subsidy. European Journal of Operational Research, 261(1), 143–153.

Cao, E. (2014). Coordination of dual-channel supply chains under demand disruptions management decisions. International Journal of Production Research, 52(23), 7114–7131.

Chen, C.-C., & Lin, Y.-C. (2018). What drives live-stream usage intention? The perspectives of flow, entertainment, social interaction, and endorsement. Telematics and Informatics, 35(1), 293–303.

Chen, H., Zhang, S., Shao, B., Gao, W., & Xu, Y. (2021). How do interpersonal interaction factors affect buyers’ purchase intention in live stream shopping? Internet Research. https://doi.org/10.1108/INTR-05-2020-0252

Clement Addo, P., Fang, J., Asare, A. O., & Kulbo, N. B. (2021). Customer engagement and purchase intention in live-streaming digital marketing platforms. The Service Industries Journal, 41, 1–20.

Enron (2020). The sales of 1.2 million pit fees are less than half. Is the live broadcast of selling courses really a loss-making business? http://www.ww01.net/en/archives/73811

Erjiang, E., Yu, M., & Peng, G. (2021). Intermediation in reward-based crowdfunding: A cash deposit mechanism to reduce moral hazard. Electronic Commerce Research, 33, 1–22.

Fatehi, S., & Wagner, M. R. (2019). Crowdfunding via revenue-sharing contracts. Manufacturing and Service Operations Management, 21(4), 875–893.

Gao, X., Xu, X. Y., Tayyab, S. M. U., & Li, Q. (2021). How the live streaming commerce viewers process the persuasive message: An ELM perspective and the moderating effect of mindfulness. Electronic Commerce Research and Applications, 49, 101087.

He, Y., Wang, H., Guo, Q., & Xu, Q. (2019). Coordination through cooperative advertising in a two-period consumer electronics supply chain. Journal of Retailing and Consumer Services, 50, 179–188.

He, Y., Xu, Q., & Shao, Z. (2021). ‘Ship-from-Store’ strategy in platform retailing. Transportation Research Part E: Logistics and Transportation Review, 145, 102153.

He, Y., Xu, Q., Xu, B., & Wu, P. (2016). Supply chain coordination in quality improvement with reference effects. Journal of the Operational Research Society, 67(9), 1158–1168.

Heydari, J., & Ghasemi, M. (2018). A revenue sharing contract for reverse supply chain coordination under stochastic quality of returned products and uncertain remanufacturing capacity. Journal of Cleaner Production, 197, 607–615.

Hu, M., & Chaudhry, S. S. (2020). Enhancing consumer engagement in e-commerce live streaming via relational bonds. Internet Research, 30(3), 1019–1041.

Hu, Y., Qu, S., Li, G., & Sethi, S. P. (2021). Power structure and channel integration strategy for online retailers. European Journal of Operational Research, 294(3), 951–964.

Kang, K., Lu, J., Guo, L., & Li, W. (2021). The dynamic effect of interactivity on customer engagement behavior through tie strength: Evidence from live streaming commerce platforms. International Journal of Information Management, 56, 102251.

Kim, H. S., & Kim, M. (2021). Viewing sports online together? Psychological consequences on social live streaming service usage. Sport Management Review, 23(5), 869–882.

Kim, J., & Kim, M. (2020). Spectator e-sport and well-being through live streaming services. Technology in Society, 63, 101401.

Li, G., Tian, L., & Zheng, H. (2021). Information sharing in an online marketplace with co-opetitive sellers. Production and Operations Management, 30(10), 3713–3734.

Li, G., Wu, H., & Zheng, H. (2021). Technology investment strategy for a competitive manufacturer in the presence of technology spillover. IEEE Transactions on Engineering Management. https://doi.org/10.1109/TEM.2021b.3105014

Li, Q., Xiao, T., & Qiu, Y. (2018). Price and carbon emission reduction decisions and revenue-sharing contract considering fairness concerns. Journal of Cleaner Production, 190, 303–314.

Li, R., Lu, Y., Ma, J., & Wang, W. (2021). Examining gifting behavior on live streaming platforms: An identity-based motivation model. Information and Management, 58(6), 103406.

Linh, C. T., & Hong, Y. (2009). Channel coordination through a revenue sharing contract in a two-period newsboy problem. European Journal of Operational Research, 198(3), 822–829.

Liu, G., Yang, H., & Dai, R. (2020). Which contract is more effective in improving product greenness under different power structures: Revenue sharing or cost sharing? Computers and Industrial Engineering, 148, 106701.

Liu, H., & Liu, S. (2021). Optimal decisions and coordination of live streaming selling under revenue-sharing contracts. Managerial and Decision Economics, 42(4), 1022–1036.

Lu, B., & Chen, Z. (2021). Live streaming commerce and consumers’ purchase intention: An uncertainty reduction perspective. Information and Management, 58(7), 103509.

Lu, S., Yao, D., Chen, X., & Grewal, R. (2021). Do larger audiences generate greater revenues under pay what you want? Evidence from a live streaming platform. Marketing Science. https://doi.org/10.1287/mksc.2021.1292

Ma, Y. (2021). To shop or not: Understanding Chinese consumers’ live-stream shopping intentions from the perspectives of uses and gratifications, perceived network size, perceptions of digital celebrities, and shopping orientations. Telematics and Informatics, 59, 101562.

Mu, L., Tang, X., Sugumaran, V., Xu, W., & Sun, X. (2021). Optimal rebate strategy for an online retailer with a cashback platform: commission-driven or marketing-based? Electronic Commerce Research, 1–36. https://doi.org/10.1007/s10660-021-09485

Palsule-Desai, O. D. (2013). Supply chain coordination using revenue-dependent revenue sharing contracts. Omega, 41(4), 780–796.

Panja, S., & Mondal, S. K. (2020). Exploring a two-layer green supply chain game theoretic model with credit linked demand and mark-up under revenue sharing contract. Journal of Cleaner Production, 250, 119491.

Park, H. J., & Lin, L. M. (2020). The effects of match-ups on the consumer attitudes toward internet celebrities and their live streaming contents in the context of product endorsement. Journal of Retailing and Consumer Services, 52, 101934.

Song, H., & Gao, X. (2018). Green supply chain game model and analysis under revenue-sharing contract. Journal of Cleaner Production, 170, 183–192.

Sun, Y., Shao, X., Li, X., Guo, Y., & Nie, K. (2019). How live streaming influences purchase intentions in social commerce: An IT affordance perspective. Electronic Commerce Research and Applications, 37, 100886.

Tsao, Y.-C., & Lee, P.-L. (2020). Employing revenue sharing strategies when confronted with uncertain and promotion-sensitive demand. Computers and Industrial Engineering, 139, 106200.

Wang, X., Tao, Z., Liang, L., & Gou, Q. (2019). An analysis of salary mechanisms in the sharing economy: The interaction between streamers and unions. International Journal of Production Economics, 214, 106–124.

Wongkitrungrueng, A., & Assarut, N. (2020). The role of live streaming in building consumer trust and engagement with social commerce sellers. Journal of Business Research, 117, 543–556.

Wongkitrungrueng, A., Dehouche, N., & Assarut, N. (2020). Live streaming commerce from the sellers’ perspective: Implications for online relationship marketing. Journal of Marketing Management, 36(5–6), 488–518.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

Xu, Q., & He, Y. (2021). Optimal information disclosure strategies for a retail platform in the blockchain technology era. International Journal of Production Research. https://doi.org/10.1080/00207543.2021.1976434

Xu, X., Wu, J.-H., & Li, Q. (2020). What drives consumer shopping behavior in live streaming commerce? Journal of Electronic Commerce Research, 21(3), 144–167.

Yang, H., Luo, J., & Wang, H. (2017). The role of revenue sharing and first-mover advantage in emission abatement with carbon tax and consumer environmental awareness. International Journal of Production Economics, 193, 691–702.

Yan, R. (2008). Profit sharing and firm performance in the manufacturer-retailer dual-channel supply chain. Electronic Commerce Research, 8(3), 155–172.

Yu, E., Jung, C., Kim, H., & Jung, J. (2018). Impact of viewer engagement on gift-giving in live video streaming. Telematics and Informatics, 35(5), 1450–1460.

Zhang, J., & Chen, J. (2013). Coordination of information sharing in a supply chain. International Journal of Production Economics, 143(1), 178–187.

Zhao, D., Chen, M., & Gong, Y. (2019). Strategic information sharing under revenue-sharing contract: Explicit vs. tacit collusion in retailers. Computers and Industrial Engineering, 131, 99–114.

Acknowledgements

This work was supported by China's National Natural Science Foundation (Grant Number 71872075), Hainan Provincial Natural Science Foundation of China (Grant Number 720RC568) and Hainan Provincial Postgraduate Innovation Research Project (Grant Number Qhyb2021-18).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all the authors, the corresponding author states no conflicts of interest.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of equilibrium solutions in Table 2

Under model OC

The retailer’s profit under the OC contract is:

The first and second derivatives of \({\pi }_{r}^{OC}\) regarding \({p}^{OC}\) are \(\frac{d{\pi }_{r}^{OC}}{d{p}^{OC}}=b{e}^{OC}+r+{w}^{OC}-2{p}^{OC}+1\) and \(\frac{{d}^{2}{\pi }_{r}^{OC}}{d{p}^{{2}_{OC}}}=-2\), respectively.

Since \(\frac{{d}^{2}{\pi }_{r}^{OC}}{d{p}^{{2}_{OC}}}=-2<0\), the retailer’s profit under the OC contract is concave in \({p}^{OC}\).

The streamer’s profit under the OC contract is:

The first and second derivatives of \({\pi }_{s}^{OC}\) regarding \({e}^{OC}\) are \(\frac{d{\pi }_{s}^{OC}}{d{e}^{OC}}=br-c{e}^{OC}+s\) and \(\frac{{d}^{2}{\pi }_{s}^{OC}}{d{e}^{{2}_{OC}}}=-c\), respectively.

Since \(\frac{{d}^{2}{\pi }_{s}^{OC}}{d{e}^{{2}_{OC}}}=-c<0\), the streamer’s profit under the OC contract is concave in \({e}^{OC}\).

Thus, by solving \(\frac{d{\pi }_{r}^{OC}}{d{p}^{OC}}=0\) and \(\frac{d{\pi }_{s}^{OC}}{d{e}^{OC}}=0\) simultaneously, we have:

Through backward induction, we substitute \({p}^{OC}\) and \({e}^{OC}\) into the manufacturer’s profit—that is, \({\pi }_{m}^{OC}={w}^{OC}(1-{p}^{OC}+b{e}^{OC})\). We have \({\pi }_{m}^{OC}={w}^{OC}(b\left(br+s\right)/c-({b}^{2}r+bs+cr+c{w}^{OC}+c)/2c+1\).

The first and second derivatives of \({\pi }_{m}^{OC}\) with respect to \({w}^{OC}\) are \(\frac{d{\pi }_{m}^{OC}}{d{w}^{OC}}=b\left(br+s\right)/c-({b}^{2}r+bs+cr+c{w}^{OC}+c)/2c+1-{w}^{OC}/2\) and \(\frac{{d}^{2}{\pi }_{m}^{OC}}{d{w}^{{2}_{OC}}}=-1<0\), respectively.

Thus, by solving \(\frac{d{\pi }_{m}^{OC}}{d{w}^{OC}}=0\), we have \({w}^{OC*}=({b}^{2}r+bs-cr+c)/2c\). Next, we substitute \({w}^{OC*}\) with \({p}^{OC}=({b}^{2}r+bs+cr+c{w}^{OC}+c)/2c\). Thus, we obtain \({p}^{OC*}=(r+3)c+3{b}^{2}r+3bs/4c\).

Under model OF.

The retailer’s profit under the OF contract is:

The first and second derivatives of \({\pi }_{r}^{OF}\) regarding \({p}^{OF}\) are \(\frac{d{\pi }_{r}^{OF}}{d{p}^{OF}}=b{e}^{OF}+{w}^{OF}-2{p}^{OF}+1\) and \(\frac{{d}^{2}{\pi }_{r}^{OF}}{d{p}^{{2}_{OF}}}=-2\), respectively.

Since \(\frac{{d}^{2}{\pi }_{r}^{OF}}{d{p}^{{2}_{OF}}}=-2<0\), the retailer’s profit under the OF contract is concave in \({p}^{OF}\).

The streamer’s profit under the OF contract is:

The first and second derivatives of \({\pi }_{s}^{OF}\) regarding \({e}^{OF}\) are \(\frac{d{\pi }_{s}^{OF}}{d{e}^{OF}}=-c{e}^{OF}+s\) and \(\frac{{d}^{2}{\pi }_{s}^{OF}}{d{e}^{{2}_{OF}}}=-c\), respectively.

Since \(\frac{{d}^{2}{\pi }_{s}^{OF}}{d{e}^{{2}_{OF}}}=-c<0\), the streamer’s profit under OF contract is concave in \({e}^{OF}\).

Thus, by solving \(\frac{d{\pi }_{r}^{OF}}{d{p}^{OF}}=0\) and \(\frac{d{\pi }_{s}^{OF}}{d{e}^{OF}}=0\) simultaneously, we have:

Using backward induction, we substitute \({p}^{OF}\) and \({e}^{OF}\) into the manufacturer’s profit, that is, \({\pi }_{m}^{OF}={w}^{OF}(1-{p}^{OF}+b{e}^{OF})\). We obtain \({\pi }_{m}^{OF}={w}^{OF}\left(bs-c{w}^{OF}+c\right)/2c\).

The first and second derivatives of \({\pi }_{m}^{OF}\) regarding \({w}^{OF}\) are \(\frac{d{\pi }_{m}^{OF}}{d{w}^{OF}}=(bs-c{w}^{OF}+c)/2c-{w}^{OF}/2\) and \(\frac{{d}^{2}{\pi }_{m}^{OF}}{d{w}^{{2}_{OF}}}=-1<0\), respectively.

Thus, by solving \(\frac{d{\pi }_{m}^{OF}}{d{w}^{OF}}=0\), we have \({w}^{OF}=(bs+c)/2c\). Next, we substitute \({w}^{OF*}\) into \({p}^{OF}=(bs+c{w}^{OF}+c)/2c\). Thus, we can obtain \({p}^{OF*}=(3c+3bs)/4c\).

Under model CF.

The retailer’s profit under the CF contract is:

The first and second derivatives of \({\pi }_{r}^{CF}\) regarding \({p}^{CF}\) are \(\frac{d{\pi }_{r}^{CF}}{d{p}^{CF}}=b{e}^{CF}+\beta r+{w}^{CF}-2{p}^{CF}+1\) and \(\frac{{d}^{2}{\pi }_{r}^{CF}}{d{p}^{{2}_{CF}}}=-2\), respectively.

Since \(\frac{{d}^{2}{\pi }_{r}^{CF}}{d{p}^{{2}_{CF}}}=-2<0\), the retailer’s profit under the CF contract is concave in \({p}^{CF}\).

The streamer’s profit under the CF contract is:

The first and second derivatives of \({\pi }_{s}^{CF}\) regarding \({e}^{CF}\) are \(\frac{d{\pi }_{s}^{CF}}{d{e}^{CF}}=b\beta r-c{e}^{OF}+s\) and \(\frac{{d}^{2}{\pi }_{s}^{CF}}{d{e}^{{2}_{CF}}}=-c\), respectively.

Since \(\frac{{d}^{2}{\pi }_{s}^{CF}}{d{e}^{{2}_{CF}}}=-c<0\), the streamer’s profit under the CF contract is concave in \({e}^{CF}\).

Thus, by solving \(\frac{d{\pi }_{r}^{CF}}{d{p}^{CF}}=0\) and \(\frac{d{\pi }_{s}^{CF}}{d{e}^{CF}}=0\) simultaneously, we have:

Using backward induction, we substitute \({p}^{CF}\) and \({e}^{CF}\) into the manufacturer’s profit—that is, \({\pi }_{m}^{CF}={w}^{CF}(1-{p}^{CF}+b{e}^{CF})\). We have \({\pi }_{m}^{CF}={w}^{CF}(b\left(b\beta r+s\right)/c-({b}^{2}\beta r+\beta cr+bs+c{w}^{CF}+c)/2c+1\).

The first and second derivatives of \({\pi }_{m}^{CF}\) for \({w}^{CF}\) are \(\frac{d{\pi }_{m}^{CF}}{d{w}^{CF}}=b\left(b\beta r+s\right)/c-({b}^{2}\beta r+\beta cr+bs+c{w}^{CF}+c)/2c+1-{w}^{CF}/2\) and \(\frac{{d}^{2}{\pi }_{m}^{CF}}{d{w}^{{2}_{CF}}}=-1<0\), respectively.

Thus, by solving \(\frac{d{\pi }_{m}^{CF}}{d{w}^{OF}}=0\), we obtain \({w}^{CF}=(r({b}^{2}-c)\beta +bs+c)/2c\). Next, we substitute \({w}^{CF*}\) with \({p}^{CF}=\left({b}^{2}\beta r+\beta cr+bs+c{w}^{OF}+c\right)/2c\). Thus, we obtain \({p}^{CF*}=(\beta r+3)c+3{b}^{2}\beta r+3bs)/4c\).

1.2 Proof of proposition 1

In accordance with the optimal streamer’s effort, we list the wholesale and product prices under different contracts in Table 2.

Since \({e}^{CF*}-{e}^{OF*}=b\beta r/c>0\) and \({e}^{OC*}-{e}^{CF*}=b\left(1-\beta \right)r/c>0\), we can directly derive, \({e}^{CF*}>{e}^{OF*}\) and \({e}^{OC*}>{e}^{CF*}\). Thus, \({e}^{OF*}<{e}^{CF*}<{e}^{OC*}\).

Since \({p}^{CF*}-{p}^{OF*}=(c\beta r+3{b}^{2}\beta r)/4c>0\) and \({p}^{OC*}-{p}^{CF*}=(r\left(1-\beta \right)c+3{b}^{2}(1-\beta )r)/4c>0\), we can directly derive, \({p}^{CF*}>{p}^{OF*}\) and \({p}^{OC*}>{p}^{CF*}\). Therefore, \({p}^{OF*}<{p}^{CF*}<{p}^{OC*}\).

As before, considering \({w}^{OF*}-{w}^{CF*}=r(c-{b}^{2})\beta /2c\), if \(c<{b}^{2}\), we have \({w}^{OF*}-{w}^{CF*}<0\); otherwise, \({w}^{OF*}-{w}^{CF*}>0\).

Considering \({w}^{OF*}-{w}^{OC*}=r(c-{b}^{2})/2c\), if \(c<{b}^{2}\), we have \({w}^{OF*}-{w}^{OC*}<0\); otherwise, \({w}^{OF*}-{w}^{OC*}>0\).

Considering \({w}^{CF*}-{w}^{OC*}=r\left(1-\beta \right)(c-{b}^{2})/2c\), if \(c<{b}^{2}\), we have \({w}^{CF*}-{w}^{OC*}<0\); otherwise, \({w}^{CF*}-{w}^{OC*}>0\).

To summarize, given that \(c<{b}^{2}\), we have \({w}^{OF*}<{w}^{CF*}<{w}^{OC*}\); otherwise, we have \({w}^{OF*}>{w}^{CF*}>{w}^{OC*}\).

1.3 Proof of proposition 2

Considering \({D}^{OF*}-{D}^{CF*}=r(c-{b}^{2})\beta /4c\), if \(c<{b}^{2}\), we have \({D}^{OF*}-{D}^{CF*}<0\); otherwise, \({D}^{OF*}-{D}^{CF*}>0\).

Considering \({D}^{OF*}-{D}^{OC*}=r(c-{b}^{2})/4c\), if \(c<{b}^{2}\), we have \({D}^{OF*}-{D}^{OC*}<0\); otherwise, \({D}^{OF*}-{D}^{OC*}>0\).

Considering \({D}^{CF*}-{D}^{OC*}=r\left(1-\beta \right)(c-{b}^{2})/4c\), if \(c<{b}^{2}\), we have \({D}^{CF*}-{D}^{OC*}<0\); otherwise, \({D}^{CF*}-{D}^{OC*}>0\).

To summarize, given that \(c<{b}^{2}\), we have \({D}^{CF*}<{D}^{CF*}<{D}^{OC*}\); otherwise, we have \({D}^{CF*}>{D}^{CF*}>{D}^{OC*}\).

1.4 Proof of proposition 3

Let \({k}_{OF-OC}\) denote the fixed-fee cut-off point for the retailer under OF and OC contracts. We set \({\pi }_{r}^{OF*}-{\pi }_{r}^{OC*}=0\) to derive \({k}_{OF-OC}=\left(\left({b}^{2}r+2bs-c\left(r-2\right)\right)\left(c-{b}^{2}\right)r\right)/16{c}^{2}\). If \(k<{k}_{OF-OC}\), we have \({\pi }_{r}^{OF*}>{\pi }_{r}^{OC*}\); otherwise, we have \({\pi }_{r}^{OF*}<{\pi }_{r}^{OC*}\).

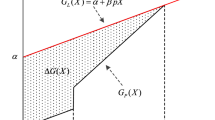

Let \({k}_{CF-OF}\) denote the fixed fee cut-off point for the retailer under CF and OF contracts. We set \({\pi }_{r}^{CF*}-{\pi }_{r}^{OC*}=0\) to derive \({k}_{CF-OF}=\left(\left(r\left({b}^{2}-c\right)\beta +2bs+2c\right)\beta \left(c-{b}^{2}\right)r\right)/16{c}^{2}\left(1-\alpha \right)\). If \(k>{k}_{CF-OF}\), we have \({\pi }_{r}^{CF*}>{\pi }_{r}^{OF*}\); otherwise, we have \({\pi }_{r}^{CF*}<{\pi }_{r}^{OF*}\).

Let \({k}_{CF-OR}\) denote the fixed-fee cut-off point for the retailer under CF and OC contracts. We set \({\pi }_{r}^{CF*}-{\pi }_{r}^{OC*}=0\) to derive \({k}_{CF-OC}=((\left(-r\beta -r+2\right)c+\left(r\left(\beta +1\right)b+2s\right)b)\left(1-\beta \right)\left(c-{b}^{2}\right)r)/16{c}^{2}\). If \(k<{k}_{CF-OC}\), we have \({\pi }_{r}^{CF*}>{\pi }_{r}^{OC*}\); otherwise, we have \({\pi }_{r}^{CF*}<{\pi }_{r}^{OC*}\).

When \(c<{b}^{2}\), we have \({k}_{OF-OC}=\left(\left({b}^{2}r+2bs-c\left(r-2\right)\right)\left(c-{b}^{2}\right)r\right)/16{c}^{2}<0\), \({k}_{CF-OF}=\left(\left(r\left({b}^{2}-c\right)\beta +2bs+2c\right)\beta \left(c-{b}^{2}\right)r\right)/16{c}^{2}\left(1-\alpha \right)<0\), and \({k}_{CF-OC}=((\left(-r\beta -r+2\right)c+\left(r\left(\beta +1\right)b+2s\right)b)\left(1-\beta \right)\left(c-{b}^{2}\right)r)/16{c}^{2}<0\). Since the fixed fee is positive, we can derive \(\forall k>0>{k}_{OF-OC}\) \(\forall k>0>{k}_{CF-OF}\) And \(\forall k>0>{k}_{CF-OR}\). Thus, when \(c<{b}^{2}\), we can derive \({\pi }_{r}^{OC*}>{\pi }_{r}^{CF*}>{\pi }_{r}^{OF*}\).

For \(c-{b}^{2}>0\). To study the effects of the commission of sale \(r\) and fixed fee \(k\) on the retailer’s profit, we set \({k}_{CF-OF}-{k}_{CF-OC}=0\), \({k}_{OF-OC}-{k}_{CF-OF}=0\), and \({k}_{CF-OC}-{k}_{CF-OF}=0\), respectively. For any formula, we can obtain two roots for \(r\)—\({r}_{0}=0\) and \({r}_{1}=2\left(\beta +\alpha -1\right)\left(bs+c\right)/\left(\left({\beta }^{2}+\alpha -1\right)\left(c-{b}^{2}\right)\right)\). On the one hand, if \(\beta +\alpha -1>0\) and \({\beta }^{2}+\alpha -1>0\), we have \({r}_{1}>1\). The second derivative of \({k}_{RF-OF}-{k}_{RF-OR}\) with respect to \(r\) is \({\partial }^{2}\left({k}_{CF-OF}-{k}_{CF-OC}\right)/\partial {r}^{2}=\left({\beta }^{2}+\alpha -1\right){\left({b}^{2}-c\right)}^{2}/\left(16\alpha {c}^{2}\left(1-\alpha \right)\right)>0\). We can derive that \({k}_{CF-OF}>{k}_{CF-OC}\). \({\pi }_{r}^{CF}>max {(\pi }_{r}^{OF},{\pi }_{r}^{OC})\) only if \({k}_{CF-OF}<k<{k}_{CF-OC}\). Any \(k\) cannot satisfy the range; therefore, we can derive \({\pi }_{r}^{CF}<max {(\pi }_{r}^{OF},{\pi }_{r}^{OC})\).

On the other hand, we set \(\beta +\alpha -1>0\) and \({\beta }^{2}+\alpha -1<0\) to derive \({r}_{1}<0\) and \({\partial }^{2}\left({k}_{CF-OF}-{k}_{CF-OC}\right)/\partial {r}^{2}=\left({\beta }^{2}+\alpha -1\right){\left({b}^{2}-c\right)}^{2}/\left(16\alpha {c}^{2}\left(1-\alpha \right)\right)<0\); we also derive \({\pi }_{r}^{CF}<max {(\pi }_{r}^{OF},{\pi }_{r}^{OC})\). Therefore, when \(c-{b}^{2}>0\) and \(\beta +\alpha -1>0\), we have \({\pi }_{r}^{CF}<max {(\pi }_{r}^{OF},{\pi }_{r}^{OC})\).

If \(\beta +\alpha -1<0\) and \(\beta \in (\mathrm{0,1})\), \({\beta }^{2}+\alpha -1<0\); we have \({r}_{1}>1\) \({\partial }^{2}\left({k}_{CF-OC}-{k}_{OF-OC}\right)/\partial {r}^{2}=\left({\beta }^{2}+\alpha -1\right){\left({b}^{2}-c\right)}^{2}/\left(16\alpha {c}^{2}\right)<0\); we can derive that \({\pi }_{r}^{OC}\) outperforms both \({\pi }_{r}^{CF}\) and \({\pi }_{r}^{OF}\), if \(k>{k}_{CF-OC}\). Similarly, propositions 1(iii), (b), and (c) can be proved.

1.5 Proof of proposition 4

Let \({k}_{OF-OC}^{^{\prime}}\) denote the fixed fee cut-off point for the streamer under OF and OC contracts. We set \({\pi }_{s}^{OF*}-{\pi }_{s}^{OC*}=0\) to obtain \({k}_{OF-OC}^{^{\prime}}=r\left(-{b}^{2}r+bs-cr+c\right)/(4c)\). If \(k>{k}_{OF-OC}^{^{\prime}}\), we have \({\pi }_{s}^{OF*}>{\pi }_{s}^{OC*}\); otherwise, we have \({\pi }_{s}^{OF*}<{\pi }_{s}^{OC*}\).

Let \({k}_{CF-OF}^{^{\prime}}\) denote the fixed fee cut-off point for the retailer under CF and OF contracts. We set \({\pi }_{s}^{CF*}-{\pi }_{s}^{OF*}=0\) to obtain \({k}_{CF-OF}^{^{\prime}}=\beta r\left(-r\left({b}^{2}+c\right)\beta +bs+c\right)/\left(4c(1-\alpha )\right)\). If \(k<{k}_{CF-OF}^{^{\prime}}\), we have \({\pi }_{s}^{CF*}>{\pi }_{s}^{OF*}\); otherwise, we have \({\pi }_{s}^{CF*}<{\pi }_{s}^{OF*}\).

Let \({k}_{CF-OC}^{^{\prime}}\) denote the fixed-fee cut-off point for the retailer under CF and OC contracts. We set \({\pi }_{s}^{CF*}-{\pi }_{s}^{OC*}=0\) to obtain \({k}_{CF-OC}^{^{\prime}}=(1-\beta )r\left(-r\left({b}^{2}+c\right)(\beta +1)+bs+c\right)/4c\alpha\). If \(k>{k}_{CF-OC}^{^{\prime}}\), we have \({\pi }_{s}^{CF*}>{\pi }_{s}^{OC*}\); otherwise, we have \({\pi }_{s}^{CF*}<{\pi }_{s}^{OC*}\).

To study the effects of the commission of sale \(r\) and fixed fee \(k\) on the streamer’s profit, we set \({k}_{OF-OC}^{^{\prime}}-{k}_{CF-OC}^{^{\prime}}=0\); \({k}_{OF-OC}^{^{\prime}}-{k}_{CF-OF}^{^{\prime}}=0\); and \({k}_{CF-OC}^{^{\prime}}-{k}_{CF-OF}^{^{\prime}}=0\), respectively. For any formula, we can obtain two roots for \(r\)—\({r}_{0}=0\) and \({r}_{2}=(\beta +\alpha -1)\left(bs+c\right)/(({\beta }^{2}+\alpha -1)({b}^{2}+c))\). For \(\beta +\alpha -1>0\) and \({\beta }^{2}+\alpha -1>0\), we have \({r}_{2}>0\). The second derivative of \({k}_{CF-OC}^{^{\prime}}-{k}_{CF-OF}^{^{\prime}}\) with respect to \(r\) is \({\partial }^{2}\left({k}_{CF-OC}^{^{\prime}}-{k}_{CF-OF}^{^{\prime}}\right)/\partial {r}^{2}=\left({\beta }^{2}+\alpha -1\right)({b}^{2}+c)/\left(4\alpha c(\alpha -1)\right)<0\). Using the same method, the streamer’s profit relationship is that \({\pi }_{s}^{OR}>({\pi }_{s}^{RF}, {\pi }_{s}^{OF})\), if \(k<{k}_{CF-OC}^{^{\prime}}<{k}_{OF-OC}^{^{\prime}}\); if \(k>{k}_{CF-OF}^{^{\prime}}\), \({\pi }_{s}^{OF}>{(\pi }_{s}^{CF}, {\pi }_{s}^{OC})\); if \({k}_{CF-OC}^{^{\prime}}<k<{k}_{CF-OF}^{^{\prime}}\), \({\pi }_{s}^{CF}>({\pi }_{s}^{OF}, {\pi }_{s}^{OC})\).

If \(\beta +\alpha -1<0\) and \(\beta \in (\mathrm{0,1})\), \({\beta }^{2}+\alpha -1<0\). Under this condition, if \({r}_{2}>1\), i.e., \(s>{s}_{1}\), we have \({\partial }^{2}\left({k}_{CF-OC}^{^{\prime}}-{k}_{CF-OF}^{^{\prime}}\right)/\partial {r}^{2}=\left({\beta }^{2}+\alpha -1\right)({b}^{2}+c)/\left(4\alpha c(\alpha -1)\right)>0\). Consequently, \({k}_{CF-OF}<{k}_{CF-OC}\), which cannot satisfy \({k}_{CF-OC}<k<{k}_{CF-OF}\). Hence, \({\pi }_{r}^{CF}<max {(\pi }_{r}^{OF},{\pi }_{r}^{OC})\); furthermore, against this background, if \({r}_{2}<r<1\) and \(0<{r}_{2}<1\), i.e., \(0<s<{s}_{1}\), we have the same result as proposition 2(i). If \(0<r<{r}_{2}\) and \(0<{r}_{2}<1\), we can derive \({k}_{CF-OF}<{k}_{CF-OC}\).

1.6 Proof of proposition 5

Since \({\pi }_{m}^{OF*}-{\pi }_{m}^{OC*}=(2bs+{b}^{2}r+(2-r)c)(c-{b}^{2})r/8{c}^{2}\), if \(c-{b}^{2}>0\), we have \({\pi }_{m}^{OF*}>{\pi }_{m}^{OC*}\); otherwise, \({\pi }_{m}^{OF*}<{\pi }_{m}^{OC*}\).

Since \({\pi }_{m}^{OF*}-{\pi }_{m}^{CF*}=(2bs+{b}^{2}r\beta +(2-r\beta )c)(c-{b}^{2})r\beta /8{c}^{2}\), if \(c-{b}^{2}>0\), we have \({\pi }_{m}^{OF*}>{\pi }_{m}^{CF*}\); otherwise, \({\pi }_{m}^{OF*}<{\pi }_{m}^{CF*}\).

Let \({\pi }_{m}^{CF*}-{\pi }_{m}^{OC*}=(c-{b}^{2})r(1-\beta )(2bs+{b}^{2}r(\beta +1)+(2-r(\beta +1))c)/8{c}^{2}\); if \(c-{b}^{2}>0\), we derive that \({\pi }_{m}^{CF*}>{\pi }_{m}^{OC*}\); otherwise, \({\pi }_{m}^{CF*}<{\pi }_{m}^{OC*}\).

Therefore, if \(c-{b}^{2}>0\), we have \({\pi }_{m}^{OF*}>{\pi }_{m}^{CF*}>{\pi }_{m}^{OC*}\); otherwise, \({\pi }_{m}^{OF*}<{\pi }_{m}^{CF*}<{\pi }_{m}^{OC*}\).

Rights and permissions

About this article

Cite this article

He, Y., Chen, L., Mu, J. et al. Optimal contract design for live streaming shopping in a manufacturer–retailer–streamer supply chain. Electron Commer Res 24, 1071–1093 (2024). https://doi.org/10.1007/s10660-022-09591-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-022-09591-3