Abstract

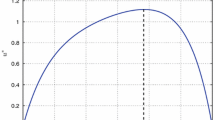

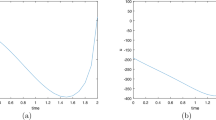

In actual dynamic system, uncertainty is absolute and certainty is relative. This paper presents the optimal dynamic pricing and production control strategy for perishable products in finite horizon. The influence of external environmental disturbance on the system is considered by means of a special uncertain process (Liu process). Then based on uncertainty theory and Hurwicz criterion, the optimization model is built, where control variables are restricted to an admissible control set. In addition, uncertain differential equation is used to describe the changes of inventory. By applying the optimality equation, we determine the optimal price and production strategy to maximize profit. Besides, both the optimal price and production rate are linearly decreasing with inventory. Afterwards, two numerical examples are given, the results reveal that reducing the uncertain disturbance of inventory and expanding the potential market size are beneficial to improving the optimal profit. Moreover, risk-loving decision makers can gain more profits while facing large risks.

Similar content being viewed by others

References

Chen, X. W., & Liu, B. (2010). Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optimization and Decision Making, 9(1), 69–81.

Demirag, O. C., Kumar, S., & Rao, K. S. M. (2017). A note on inventory policies for products with residual-life-dependent demand. Applied Mathematical Modelling, 43, 647–658.

Duan, Y., Cao, Y., & Huo, J. (2018). Optimal pricing, production, and inventory for deteriorating items under demand uncertainty: The finite horizon case. Applied Mathematical Modelling, 58, 331–348.

Feng, L., Zhang, J., & Tang, W. (2018). Dynamic joint pricing and production policy for perishable products. International Transactions in Opernational Research, 25, 2031–2051.

Ge, X., & Zhu, Y. (2013). A necessary condition of optimality for uncertain optimal control problem. Fuzzy Optimization and Decision Making, 12(1), 41–51.

Herbon, A., & Khmelnitsky, E. (2017). Optimal dynamic pricing and ordering of a perishable product under additive effects of price and time on demand. European Journal of Operational Research, 260(2), 546–556.

Jiang, Y., Yan, H., & Zhu, Y. (2016). Optimal control problem for uncertain linear systems with multiple mnput delays. Journal of Uncertainty Analysis and Applications, 4(1), 1–10.

Kaya, O., & Polat, A. L. (2017). Coordinated pricing and inventory decisions for perishable products. OR Spectrum: Quantitative Approaches in Management, 39(2), 589–606.

Li, B., & Zhu, Y. (2017). Parameteric optimal control for uncertain linear quadratic models. Applied Soft Computing, 56, 543–550.

Li, B., & Zhu, Y. (2018). Parametric optimal control of uncertain systems under an optimistic value criterion. Engineering Optimization, 50(1), 55–69.

Li, S., Zhang, J., & Tang, W. (2015). Joint dynamic pricing and inventory control policy for a stochastic inventory system with perishable products. International Journal of Production Research, 53(10), 2937–2950.

Liu, B. (2007). Uncertainy Theory (2nd ed.). Berlin: Springer-Verlag.

Liu, B. (2008). Fuzzy process, hybrid process and uncertain process. Journal of Uncertain Systems, 2(1), 3–16.

Liu, B. (2009). Some research problems in uncertainty theory. Journal of Uncertain Systems, 3(1), 3–10.

Liu, B. (2010). Uncertainty theory: A branch of mathematics for modeling human uncertainty. Berlin: Springer-Verlag.

Lu, L., Gou, Q., Tang, W., & Zhang, J. (2016). Joint pricing and advertising strategy with reference price effect. International Journal of Production Research, 54(17), 5250–5270.

Luo, X., Liu, Z., & Wu, J. (2020). Dynamic pricing and optimal control for a stochastic inventory system with non-instantaneous deteriorating items and partial backlogging. Mathematics, 8(6), 1–22.

Sheng, L., & Zhu, Y. (2013). Optimistic value model of uncertain optimal control. International Journal of Uncertainty, Fuzziness & Knowledge-Based Systems, 21(Supp.1), 75–87.

Sheng, L., Zhu, Y., & Hamalainen, T. (2013). An uncertain optimal control model with Hurwicz criterion. Applied Mathematics and Computation, 224, 412–421.

Sheng, L., Zhu, Y., & Wang, K. (2018). Uncertain dynamic system-based decision making with application to production-inventory problems. Applied Mathematical Modelling, 56, 275–288.

Sheng, L., Zhu, Y., & Wang, K. (2020). Analysis of a class of dynamic programming models for multi-stage uncertain systems. Applied Mathematical Modelling, 86, 446–459.

Yao, K., & Chen, X. (2013). A numerical method for solving uncertain differential equations. Journal of Intelligent & Fuzzy Systems, 25, 825–832.

Yao, Z., Leung, S. C., & Lai, K. (2008). Analysis of the impact of price-sensitivity factors on the returns policy in coordinating supply chain. European Journal of Operational Research, 187(1), 275–282.

Zhu, Y. (2010). Uncertain optimal control with application to a portfolio selection model. Cybernetics and Systems: An International Journal, 41(7), 535–547.

Acknowledgements

This work was supported by Nature Science Foundation of China Grant No.61773150, Science and Technology Project of Hebei Education Department No.ZD2020172.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Matlab procedure for solving \(X_{t}^{\alpha} \)

Take \(X_t\ge 0\), for example, the \(\alpha -\)path \(X_{t}^{\alpha} \) satisfies the ordinary differential equation:

where \( Q(t)=\frac{\theta }{4a}+ \frac{\sqrt{a m}(\zeta e^{4\sqrt{a m}(t-T)}-1)}{2a(1+\zeta e^{4\sqrt{a m}(t-T)})},\, M(t)=\frac{\mu -2\lambda }{4a}\Big (1-\frac{\theta }{2\sqrt{am}}\Big ) \frac{ e^{4\sqrt{am}(t-T)}-2 e^{2\sqrt{am}(t-T)}+1}{\zeta e^{4\sqrt{am}(t-T)}+1}.\) Due to the complexity of differential equation (A.1), it is difficult for us to directly derive the analytical form of \(X_{t}^{\alpha} \), so the mathematical software MATLAB is helpful. In Matlab, ’dsolve’ function is used to calculate the ordinary differential equation directly, and the analytic form of \(X_{t}^{\alpha} \) can be obtained.

For convenience, we use some symbols to represent parameters in MATLAB as follows,

We apply ’dsolve’ function directly to the differential equation (A.1), and the procedure is

After running, the analytical form of \(X_{t}^{\alpha} \) is available. The distribution and inverse distribution of uncertain inventory can be obtained by substituting the values of each parameter.

Appendix B. Numerical algorithms for \(X_t,\,p(t),\,u(t)\)

For \(T=[0,6]\), set \(0=t_0<t_1<\cdots <t_{600}=6\), and \(\Delta t=0.01\). Then, if \(X_t\ge 0\), the uncertain differential equation (6.1) transforms as \( \Delta X_t=\Big ((4aQ(t)-\theta )\Delta X_t+2aM(t)-\frac{\mu }{2}\Big )\Delta t+ \sigma \Delta C_t; \) otherwise, \( \Delta X_t=\Big (4aQ_1(t)\Delta X_t+2aM_1(t)-\frac{\mu }{2}\Big )\Delta t+ \sigma \Delta C_t. \)

According to Jiang et al. (2016), the normal uncertain variable \(\Delta C_t\) has a sample point \(\widetilde{c}_t\), where \(\widetilde{c}_t= \frac{\sqrt{3}\Delta t}{-\pi }\ln \Big ( \frac{1}{rand(0,1)}-1\Big )\). Then, for \(X_t\ge 0\),

and for \(X_t<0\),

By iterative calculation, some data are listed in Table 2.

Rights and permissions

About this article

Cite this article

Shi, R., You, C. Dynamic pricing and production control for perishable products under uncertain environment. Fuzzy Optim Decis Making 22, 359–386 (2023). https://doi.org/10.1007/s10700-022-09396-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-022-09396-x