Abstract

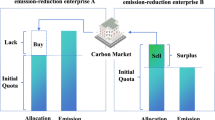

It has become a consensus in the international community to actively address global climate change issues and strive to achieve carbon reduction. For this purpose, carbon finance market plays a significant role in reducing carbon emissions by providing financial mechanisms to support and incentivize emission reduction projects. As a type of carbon finance derivative, carbon swap is an agreement between two parties whereby a floating price is exchange for a fixed price for carbon emission right over a specified period. How to price carbon swap before signing, i.e., determine the fixed price in the swap contract, and valuate carbon swap during the life of the swap contract are key issues. Noting the fact that the underlying asset of carbon swap is carbon price, the primary task is to model carbon price reasonably. Due to the inherent challenges and uncertainties associated with pricing carbon, frequency stability is often not guaranteed, resulting in the failure of probability based methods. Thus, this paper characterizes the carbon price using uncertain differential equation under the framework of uncertainty theory, and derives swap pricing and valuation formulas. Estimations for unknown parameters in the proposed model are given. Finally, with carbon spot price in European Energy Exchange, real data analyses are documented to illustrate our proposed methods in details.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Chevallier, J. (2010). Volatility forecasting of carbon prices using factor models. Economics Bulletin, 30(6), 1642–1660.

Chen, X., & Liu, B. (2010). Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optimization and Decision Making, 9(1), 69–81.

Chen, X., & Gao, J. (2013). Uncertain term structure model of interest rate. Soft Computing, 17, 597–604.

Daskalakis, G., Psychoyios, D., & Markellos, R. (2009). Modeling C02 emission allowance prices and derivatives: Evidence from the European trading scheme. Journal of Banking and Finance, 33(7), 1230–1241.

Lin, L. (2012). Research on international carbon finance market development and risk in low carbon economy. Contemporary Finance Economics, 2, 51–58.

Liu, B. (2007). Uncertainty Theory (2nd ed.). Berlin: Springer.

Liu, B. (2008). Fuzzy process, hybrid process and uncertain process. Journal of Uncertain Systems, 2(1), 3–16.

Liu, B. (2009). Some research problems in uncertainty theory. Journal of Uncertain Systems, 3(1), 3–10.

Liu, B. (2015). Uncertainty Theory (4th ed.). Berlin: Springer.

Liu, Y., & Liu, B. (2022). Residual analysis and parameter estimation of uncertain differential equations. Fuzzy Optimization and Decision Making, 21(4), 513–530.

Liu, Y., & Liu, B. (2022). Estimating unknown parameters in uncertain differential equation by maximum likelihood estimation. Soft Computing, 26(6), 2773–2780.

Liu, Y., Tian, L., Sun, H., Zhang, X., & Kong, C. (2022). Option pricing of carbon asset and its application in digital decision making of carbon asset. Applied Energy, 310(15), 118375.

Liu, Y., & Liu, B. (2023). Estimation of uncertainty distribution function by the principle of least squares. Communications in Statistics-Theory and Methods. https://doi.org/10.1080/03610926.2023.2269451

Liu, Z., & Huang, S. (2021). Brownian motion optimized by GARCH model in carbon emission trading. North American Journal of Economics and Finance, 55, 101307.

Lu, T. (2016). Study on development status of China carbon finance market, international experience and counter measures. Meteorological and Environmental Research, 7, 32–35.

Luo, C., & Wu, D. (2016). Environment and economic risk: An analysis of carbon emission market and portfolio management. Environmental Research, 149(5), 297–301.

Pei, Q., Liu, L., & Zhang, D. (2013). Carbon emission right as a new property right: Rescue CDM developers in China from 2012. International Environmental Agreements: Politics, Law and Economics, 13, 307–320.

Yang, X., & Ke, H. (2023). Uncertain interest rate model for Shanghai interbank offered rate and pricing of American swaption. Fuzzy Optimization and Decision Making, 22, 447–462.

Yang, X., Jia, W., Wang, K., & Peng, G. (2024). Does the National Carbon Emissions Trading Market Promote Corporate Environmental Protection Investment? Evidence from China. Sustainability, 16(1), 402.

Yang, L., & Liu, Y. (2024). Solution method and parameter estimation of uncertain partial differential equation with application to China’s population. Fuzzy Optimization and Decision Making, 23, 155–177.

Ye, T., & Liu, B. (2023). Uncertain hypothesis test for uncertain differential equations. Fuzzy Optimization and Decision Making, 22(2), 195–211.

Ye, T., & Zheng, H. (2023). Analysis of birth rates in China with uncertain statistics. Journal of Intelligent and Fuzzy Systems, 44(6), 10621–10632.

Ye, T. (2024). Partial derivatives of uncertain fields and uncertain partial differential equations. Fuzzy Optimization and Decision Making. https://doi.org/10.1007/s10700-023-09417-3

Zhang, X., Yang, K., Lu, Q., Wu, J., Yu, L., & Lin, Y. (2023). Predicting carbon futures prices based on a new hybrid machine learning: Comparative study of carbon prices in different periods. Journal of Environmental Management, 346, 118962.

Zhang, K., & Liu, B. (2024). Higher-order derivative of uncertain process and higher-order uncertain differential equation. Fuzzy Optimization and Decision Making. https://doi.org/10.1007/s10700-024-09422-0

Acknowledgements

This work was supported by the National Social Science Funds of China (23BJL006).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liu, Z., Li, Y. Pricing and valuation of carbon swap in uncertain finance market. Fuzzy Optim Decis Making 23, 319–336 (2024). https://doi.org/10.1007/s10700-024-09423-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-024-09423-z