Abstract

Using resource dependency theory (RDT), this research analyzes how organizations control their information technology resources to improve organizational performance. According to RDT, organizations must manage their dependency on external organizations and limit external dependencies when resources are considered critical. The current study proposes and tests a portion of a Strategic Control Model positing that managers seek to control important, strategic resources in order to create value for the firm and to avoid dependency on external entities. Utilizing a research design that captured extensive quantitative data on the control of IT functions and services, the research team gathered 5 years of data on 54 business units (BUs) in 27 global companies located in seven countries. Study examined the linkages of these 54 BUs to firm performance. Locating the Extent of Control within the firm in cases where the firm depends on IT as a strategic resource proves to be a good explanation for effective decisions leading to higher performance. Viewing IT as a strategic resource alone does not lead to positive business unit outcomes, but the moderating influence of Extent of Control is found to establish the complex statistical relationship with business unit performance. For these reasons, it is critical that a theoretically grounded firm-wide process for decisions on locating IT control is in place to capture business value.

Similar content being viewed by others

Notes

Lacity and colleagues use the term “selective outsourcing” in apposition to total outsourcing or insourcing, which is why “Extent of Outsourcing” appears within these two extremes in Fig. 1. Our argument is a selective outsourcing argument in that firms that abjure total outsourcing are making decisions about not outsourcing what are viewed as strategic resources, which allows them more control over their core assets.

These results will be examined further in “Section 4”.

See www.aph.gov.au for details of a Federal Australian Government inquiry into IT outsourcing.

Particularly because we had numerous formative latent constructs in the SCM, we adopted a holistic data analysis approach with measurement and structural models being run simultaneously. That is, no confirmatory factor analysis preceded the structural model to “cleanse” the scales. A holistic analysis grants high conceptual integrity in the latent constructs. Holistic analysis retains the meaning of each construct, which is drawn from both its measurement items and the other latent variables (Bagozzi 1984).

References

Ang, S. (1994). Toward conceptual clarity of outsourcing. In B. C. Glasson, et al. (Ed.) Business process reengineering: Information systems opportunities and challenges (pp. 113–126). North Holland: Elsevier.

Ang, S., & Beath, C. M. (1993). Hierarchical elements in software contracts. Journal of Organizational Computing, 3(3), 329–361.

Ang, S., & Straub, D. W. (1998). Production and transaction economies and IS outsourcing: A study of the U.S. banking industry. MIS Quarterly, 22(4), 535–552.

Bagozzi, R. P. (1984). A prospectus for theory construction in marketing. Journal of Marketing, 48, 11–29 (Winter).

Beier, F. J. (1989). Transportation contracts and the experience effect: A framework for future research. Journal of Business Logistics, 10(2), 73–89.

Bender, D. H. (1986). Financial impact of information processing. Journal of Management Information Systems, 3(2), 22–32.

Birkinshaw, J., Toulan, O., & Arnold, D. (2001). Global account management in multinational corporations: Theory and evidence. Journal of International Business Studies, 32(2), 231–248.

Bradley, S. P., Housman, J. A., & Nolan, R. L. (1993). Globalization and technology. In S. P. Bradley, J. A. Housman, & R. L. Nolan (Eds.) Globalization, technology, and competition: The fusion of computers and telecommunications in the 1990s (pp. 3–32). Boston: Harvard Business School.

Brynjolfsson, E., & Hitt, L. (1996). Paradox lost? Firm-level evidence on the returns to information systems spending. Management Science, 42(4), 541–559.

Campbell, D. T. (1960). Recommendations for APA test standards regarding construct, trait, discriminant validity. American Psychologist, 15, 546–553.

Cash, J. I., McFarlan, F. W., McKenney, J. L., & Applegate, L. M. (1992). Corporate information systems management: Text and cases. Burr Ridge, IL: Irwin.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. In G. A. Marcoulides (Ed.) Modern methods for business research (pp. 295–336). Mahwah, NJ: Erlbaum.

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2), 189–217.

Clemons, E. K. (1991). Evaluation of strategic investments in information technology. Communications of the ACM, 34(1), 24–36.

Clemons, E. K., & Row, M. C. (1991). Sustaining IT advantage: The role of structural differences. MIS Quarterly, 15(3), 275–292.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Hillsdale, NJ: Erlbaum.

Cohen, P., Cohen, J., Teresi, J., Marchi, M., & Velez, C. N. (1990). Problems in the measurement of latent variables in structural equation causal models. Applied Psychological Measurement, 14, 183–196.

Cron, W. L., & Sobol, M. G. (1983). The relationship between computerization and performance: A strategy for maximizing the benefits of computerization. Journal of Information Management, 6, 171–181.

De Wit, K., & Verhoeven, J. C. (2000). Stakeholder in universities and colleges in Flanders. European Journal of Education, 35(4), 421–437.

Diamantopoulos, A., & Winklhofer, H. M. (2001). Index construction with formative indicators: An alternative to scale development. Journal of Marketing Research, 38(2), 269–277.

Dibbern, J., Goles, T., Hirschheim, R., & Jayatilaka, B. (2004). Information systems outsourcing: A survey and analysis of the literature. The DATA BASE for Advances in Information Systems, 35(4), 6–102.

Drtina, R. E. (1994). The outsourcing decision. Management Accounting, 75(9), 56–62.

Edwards, E. A., & Bagozzi, R. (2000). On the nature and direction of relationships between constructs and measures. Psychological Methods, 5(2), 155–174.

Floyd, S. W., & Woolridge, B. (1990). Path analysis of the relationship between competitive strategy, information technology, and financial performance. Journal of Management Information Systems, 7, 47–64.

Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39–50.

Fornell, C. R., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research, 19(4), 440–452.

Gefen, D., Straub, D., & Boudreau, M.-C. (2000). Structural equation modeling and regression: Guidelines for research practice. Communications of AIS, 7(7), 1–78.

Gerbing, D. W., & Anderson, J. C. (1988). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research, 25, 186–192.

Grover, V., Cheon, M., & Teng, J. T. C. (1994). An evaluation of the impact of corporate strategy and the role of information technology on IS functional outsourcing. European Journal of Information Systems, 3(3), 179–190.

Grover, V., Cheon, M. J., & Teng, J. T. C. (1996). The effect of service quality and partnership on the outsourcing of information systems functions. Journal of Management Information Systems, 12(4), 89–116.

Harris, S. E., & Katz, J. L. (1991). Organizational performance and information technology investment intensity in the insurance industry. Organization Science, 2(3), 263–295.

Hitt, L. M., & Brynjolfsson, E. (1996). Productivity, business profitability, and consumer surplus: Three different measures of information technology value. MIS Quarterly, 20(2), 121–142.

Insinga, R. C., & Werle, M. J. (2000). Linking outsourcing to business strategy. Academy of Management Executive, 14(4), 59–61.

Ives, B., & Learmonth, G. (1984). The information system as a competitive weapon. Communications of the ACM, 27(12), 1193–1201.

Kaplan, R., & Norton, D. (1992). The balanced scorecard—Measures that drive performance. Harvard Business Review, 70(1), 71–79.

Kern, T., & Willcocks, L. P. (2002). Service provision and the net: Risky application sourcing? In Hirschheim, R., Heinzl, A. and Dibbern, J. (Ed.) Information systems outsourcing: Enduring themes, emergent patterns, and future directions. Heidelberg: Springer.

Lacity, M. (1995). IT outsourcing: Maximize flexibility and control. Harvard Business Review, May–June, 84–93.

Lacity, M., & Hirschheim, R. (1993). Information systems outsourcing myths, metaphors, and realities. New York: Wiley.

Lacity, M., Hirschheim, R., & Willcocks, L. (1994). Realizing outsourcing expectations. Information Systems Management, 11(4), 7–18.

Lacity, M. C., & Willcocks, L. P. (1998). An empirical investigation of information technology sourcing practices: Lessons from experience. MIS Quarterly, 22, 363–408.

Lacity, M. C., & Willcocks, L. P. (2001). Global information technology outsourcing: In search of business advantage. Chicester, UK: Wiley.

Loh, L., & Venkatraman, N. (1992). Diffusion of information technology outsourcing: Influence sources and the Kodak effect. Information Systems Research, 3(4), 334–378.

Markus, L. M., & Soh, C. (1993). Banking on information technology: Converting IT spending into firm performance. In Banker, R. D., Kauffman, R. J. and Mahmood, M. A. (Ed.) Strategic and economic impacts of information technology investment: Perspectives on organizational growth and competitive advantage (pp. 364–392). Middletown, PA: Idea Group.

Mathieson, K., Peacock, E., & Chin, W. W. (2001). Extending the technology acceptance model: The influence of perceived user resources. The DATA BASE for Advances in Information Systems, 32(3), 86–112.

Nam, K. S., Rajagopalan, H., Rao, R., & Chaudhury, A. (1996). A two-level investigation of information systems outsourcing. Communications of the ACM, 39(7), 36–44.

Nunnally, J. C., & Bernstein, I. H. (1994). Psychometric theory. New York: McGraw-Hill.

Petter, S., Straub, D., & Rai, A. (2007). Specifying formative constructs in IS research. MIS Quarterly, 31(4), 623–656.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependency perspective. New York: Harper & Row (Stanford University Press, originally published 1978).

Porter, M. E., & Millar, V. E. (1985). How information gives you a competitive advantage. Harvard Business Review, 63, 149–160.

Prahalad, C. K. (1993). The Role of core competencies in the corporation. Research-Technology Management, 36(6), 40–47.

Prahalad, C. K., & Hamel, G. (1990). The core competence of the corporation. Harvard Business Review, 68(3), 79–91.

Quinn, J. B., & Hilmer, F. G. (1994). Strategic outsourcing. Sloan Management Review, 35(4), 43–55.

Richmond, W. B., Seidmann, A., & Whinston, A. B. (1992a). Incomplete contracting issues in information systems development outsourcing. Decision Support Systems, 8(5), 459–477.

Richmond, W. B., Seidmann, A., & Whinston, A. B. (1992b). Contract theory and information technology outsourcing. Decision Support Systems, 8(5), 459–477.

Schary, P. B., & Coakley, J. (1991). Logistics organization and the information system. International Journal of Logistics Management, 2(2), 22–29.

Sethi, V., & King, W. (1994). Development of measures to access the extent to which an information technology application provides competitive advantage. Management Science, 40(12), 1601–1627.

Sharma, S., Durand, R. M., & Gur-Arie, O. (1981). Identification and analysis of moderator variables. Journal of Marketing Research, 18, 291–299.

Smith, H. J., Stoddard, D., & Applegate, L. (1987). Manufacturers hangover: The new organization A, B and C (9-189-051). Boston: Harvard Business School Press.

Teng, J. T. C., Cheon, M. J., & Grover, V. (1995). Decisions to outsource information systems functions: Testing a strategy-theoretic discrepancy model. Decision Sciences, 26(1), 75–103.

Thompson, R., Barclay, D. W., & Higgins, C. A. (1995). The partial least squares approach to causal modeling: Personal computer adoption and use as an illustration. Technology Studies: Special Issue on Research Methodology, 2(2), 284–324.

Venkatraman, N. (1989). The concept of fit in strategy research: Toward verbal and statistical correspondence. Academy of Management Review, 13(3), 423–444.

Weill, P. (1992). The relationship between investment in information technology and firm performance: A study of the valve manufacturing sector. Information Systems Research, 3(4), 307–333.

Weill, P., & Broadbent, M. (1998). Leveraging the new infrastructure: How market leaders capitalise on information technology. Cambridge, MA: Harvard Business School Press.

Acknowledgments

We wish to acknowledge researchers who contributed to the collection of insights and data for this research:

– Marianne Broadbent, Edward W Kelley & Partners Pty Ltd (formally with Gartner and University of Melbourne)

– Carey Butler, Monash University, Australia

– John Henderson and Christine Lentz, Boston University

– Jeff Sampler, Oxford University

– Ali Farhoomand, Hong Kong University

– Peter Keen, Keen Education

– Jack Rockart, Jeanne Ross, Massachusetts Institute of Technology

– Judith Quillard, IBM

– Neo Boon Siong National University of Singapore and Christina Soh, Nanyang Technological University, Singapore

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Annotated instrument item

1.1 [CONSTRUCT: DEPENDENCE ON IT AS A STRATEGIC RESOURCE: OBJECTIVE MEASURES (RESOURCE1 AND RESOURCE2)]

Levels of investment in I/T infrastructure

The following questions relate to the level of investments in I/T in the corporate I/S function and the BUSINESS UNITs. Please be as accurate as you can. If you don’t have the information, please provide your best estimation and mark the estimate with a star (*).

In completing these questions, please use the FIRM’s or BUSINESS UNIT’s reporting year. For example, if the last month of your reporting year is September, for Year 1 you would report for the year ended September Year.

Corporate I/T investment

In answering the following questions, please consider I/T Infrastructure as:

the base foundation of I/T capability budgeted for and provided by the I/S function and shared across multiple BUSINESS UNITs. The I/T capability includes both the technical and managerial expertise required to provide reliable services.

1.2 [CONSTRUCT: DEPENDENCE ON IT AS A STRATEGIC RESOURCE: SUBJECTIVE MEASURES (RESOURCE3 THROUGH RESOURCE6)]

Decisions about I/T infrastructure investments

I/T Infrastructure refers to the base foundation of I/T capability budgeted for and provided by the I/S function and shared across multiple BUSINESS UNITS. The I/T capability includes both the technical and managerial expertise required to provide reliable services.

The following questions relate to the way decisions are made about I/T Infrastructure investments. Please CIRCLE the number that best describes your FIRM.

1.3 [CONSTRUCT: EXTENT OF CONTROL OF THE IT RESOURCE (CONTROL1, CONTROL2, AND CONTROL3)]

Management of IT activities

This question seeks to identify various types of responsibility and input for different I/T related activities throughout the FIRM. There are four groups indicated: the Corporate I/S group, the Business I/S group, Business Unit Line Managers and any organizations external to the firm. For each of the activities listed (Items 1–15), please indicate the level of management responsibility and input for each of the four groups using the following symbols:

Each box should have one of the letters (R,I,M,N) entered into it. For a particular activity there may be dual responsibility (or perhaps input). Thus a letter can be used more than once for an activity.

[CONTROL1. This measure was a mean rank of the codings of each of the 15 IT activities in the above scale.]

CONTROL2. Of the business unit IT investment identified earlier in Question 3, what percentage is spent on services provided outside the firm ?

[CONTROL3. Average of last 2 years of the data collected in CONTROL2.]

1.4 [CONSTRUCT: PERFORMANCE (PERF1–PERF4)]

BUSINESS UNIT Financial Performance

The following questions refer to the financial performance of this BUSINESS UNIT.

Appendix B: Research methods

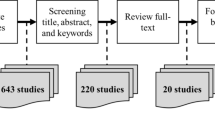

2.1 Data collection

To adequately address the issues raised in the current study requires a study design that collects data from multiple respondents, thereby achieving independence of sources and reducing the likelihood of systematic bias. Data were collected via interviews, the completion of response forms by participants, analysis of organizational documentation (e.g., memos, internal reports) and notes of presentations made by executive managers about recent strategy and technology developments.

In each firm there were a minimum of four participants, some interviewed on multiple occasions. The four participants were the Chief Information Officer (CIO), IS executives from at least two different business units, and a corporate executive (CE) who was able to provide a strategic perspective across the firm as a whole. This person was the CEO, the Chief Financial Officer, Chief Operating Officer, or the Director of Strategy. In each firm, the CIO was interviewed about IS arrangements and the decision-making process relating to both business and IT strategy and the extent of IT outsourcing. Four different response forms were distributed to participants. When these were completed and returned, interviews were held with each IT manager, including the CIO and the BU manager to explore the issues in more depth and to ensure that consistent definitions of constructs were used in the data collection. Excerpts from these interviews appear later in the paper.

To ensure independence of variables, data on IT investment was gathered through different sources. The subjective view of IT as a strategic resource was provided by the CIO while objective IT investment data and performance data were gathered primarily from the CE and his/her staff, the one exception being IT investment in competitive systems, as described below. IT managers from the respective business units provided data on the nature and degree of outsourcing in the BUs. Some of these measurements called for judgments whereas others were more oriented toward accounting-type data. Performance data was also gathered from two sources: the CE and the BU information technology managers and then checked for inter-rater reliability.

2.2 Measures

Dependence on IT as a strategic resource: Objective measures

To capture the firm’s dependence on IT as a strategic resource, we chose first to use objective measures of the percentage of the IT budget that was considered strategic. To achieve consistency across the sample we provided respondents with a simple definition of strategic IT based on the work of Clemons (1991), Ives and Learmonth (1984), and Porter and Millar (1985). CIOs were asked to provide the percentage of the IT budget over the past 5 years that was invested to:

…increase or protect your sales (or market share) by providing new (or improved) customer service or products. This type of investment generally positions the firm in the marketplace (e.g. creates competitive advantage by significantly reducing the delivery time of your services by placing order entry links in your customer’s offices).

Besides RESOURCE1, data on actual firm actions included the calculation of both a 5-year average and an average year-to-year percentage change in assessments of IT as a strategic resource (RESOURCE2).

Dependence on IT as a strategic resource: Subjective measures

The goal of this set of measures (RESOURCE3–RESOURCE6) was to capture the CIO’s belief of the extent to which managers (both senior managers and BU managers) saw IT as a strategic resource. We asked the CIO to consider his or her dealings with senior business managers and answer four items. The items measured factors such as whether BU managers considered IT when they formed business strategies or whether they viewed a flexible IT infrastructure as strategic. Scores from the four, five-point Likert scales were used to measure IT as a strategic resource, with higher scores indicating IT was a highly strategic resource. The measures tap into arguments that a focus on IT lowers dependency on others’ IT resources which will, in turn, lead to advantages. The measures, positioned at a molar level of abstraction, are omnibus measures. See Appendix B for the relevant instrument items.

Extent of control of IT resource: Subjective measures

To capture the extent to which managers decided to give up control of IT resources to outsourcers, we queried managers about fifteen typical IS activities (CONTROL1). The control perspective on IT outsourcing has been conceptualized by Ang (1994) and validated in Ang and Straub (1998). In psychometric tests in the latter study, the researchers found that measures of the control of IT as a resource (not necessarily a strategic resource) correlated highly with an applications-oriented perspective and an operations-oriented perspective. Since validation is always “egalitarian and symmetrical” (Campbell 1960, p. 548), their cross-methods validation suggests that a control-oriented perspective captures the essence of the construct of IT outsourcing (Ang and Straub 1998).

Using Ang’s theoretical perspectives (Ang 1994; Ang and Beath 1993), the instrumentation measured the shift in control from internal to external service providers for each of fifteen IT resources. Participants filled in the matrix entitled “Management of IT Activities” in Appendix B. The list of IT activities on the research instrument was similar to that used in the validated Ang and Straub (1998) field study and Smith et al. (1987) case study; it also aligned well with activities identified in the IT services work of Weill and Broadbent (1998).

The four groups responsible for sourcing are indicated in Table 4 below, which presents an example of how a respondent may have filled out the form. Levels of control were denoted by the respondents as “R” if the group was responsible for an activity, “M” if the group monitored the activity, “I” if the group provided input, and “N” if there was no involvement.

The coding of these levels of control for each activity was a straightforward ordinal scaling, varying from 1 to 4. If the matrix data indicated that control was entirely internal, the IT activity was coded “1.” In cases where the outsourcer was being monitored by the client firm, the decision was coded as “2.” If control was shared with the external provider but only input was provided by the firms’ agents, then it was coded “3.” If control was entirely in the hands of the outsourcer, then the coding was a “4.”

An example might help to explain how this coding was performed. If the codes “M” or “R” was denoted for any of the inside agents (IS corporate, business unit, or line manager) and the outsider (“organization external to the firm”) role was coded “R” as being responsible for the activity, IT planning was coded as a 2. The reasonable assumption here is that the firm is attempting to control this activity by either monitoring it or sharing in the delivery of the service. If the outsider is responsible for the activity (coded as “R”) and one or more of the firm agents is providing input (coded as “I”), then the firm is exerting less influence over the delivery of the service. This lower level of control was classified as “3,” therefore.

Extent of control of IT resource: Objective measures

An objective surrogate for control over the IT resource is the extent to which a firm outsources IT. Two objective measures were also used. The first, CONTROL2, was gathered at the corporate level. It is a financial measure where the outsourcing budget is expressed as a percentage of the firm’s total IS budget for that year. Five years of data were collected allowing the calculation of both a 5-year average (CONTROL2) and an average year-to-year percentage change in outsourcing (CONTROL3). Similar approaches were used in Loh and Venkatraman (1992) and Grover et al. (1996).

The second objective variable, CONTROL3, was the percentage of IT investment spent on services outside the firm. Averaged over the last 5 years, CONTROL3 measured the delta or change in percentage of IT investment outside the firm.

Business unit performance

The construct “Performance” is used extensively in organizational and information systems research. A broad range of quantitative performance measures are often employed by researchers, including measures of profit such as return on assets (ROA) (Floyd and Woolridge 1990; Hitt and Brynjolfsson 1996), return on net worth (Cron and Sobol 1983), expenses as a ratio of income (Bender 1986; Harris and Katz 1991), and the ratio of operating profit to revenue (Markus and Soh 1993). These measures of profitability are lagging measures (i.e., accounting end-of-period measures). Kaplan and Norton (1992) recommend a balance of leading (i.e., measures of performance that predict lagging measures) and lagging measures to capture performance. We chose three measures that provide a balance of leading and lagging measures that also relate well with the theoretical issues we are expostulating. They tap into: (1) labor productivity, (2) competitiveness, and (3) return on assets.

First, profit per employee (PERF1–2) was chosen as a measure of labor productivity (Weill 1992) as it is likely to be sensitive to the level of outsourcing used. The first of the measures included cost of goods sold (COGS) and all other expenses. The second was COGS alone. Two other firm-level measures were used, namely, an index of competitiveness of the firm compared to its industry (PERF3). This was assessed by the chief officer of the business unit. Finally, a standard return on assets (ROA) measure (PERF4). All of these measures should reflect higher performance if the firm does not outsource more strategic assets than the SCM argues it should. See Appendix B for instrument items and elaboration.

2.3 Instrument validation

Many of the measures employed to test the SCM are likely formative rather than reflective (Gerbing and Anderson 1988; Petter et al. 2007) in that the types of measurement and the scales being employed were radically different for most measures and constructs. For example, the construct “firm performance” was measured by two profitability per employee figures and two items tapping into competitiveness and asset utilization. While each of these very different measures “forms” the construct of firm performance, they likely do not “reflect” it (Petter et al. 2007; Campbell 1960; Fornell and Larcker 1981; Fornell and Bookstein 1982; Cohen et al. 1990; Thompson et al. 1995; Chin 1998; Diamantopoulos and Winklhofer 2001) in the sense that our four questions with similar low to high semantic anchors do “reflect” the perception of the CIO on whether IT is viewed as a strategic resource.

One indication of whether statistical tests favor a formative or reflective handling is to examine their assumptions. Reliability tests such as Cronbach’s α make the assumption that scales are relatively similar in the meaning of the scale values; if not, the α statistic rapidly becomes meaningless. Constructs that rely on formative measures call for structural equation modeling (SEM) techniques such as Partial Least Squares (PLS) or LISREL, and PLS, in particular, can model the latent construct whether it is reflective or formative (Gefen et al. 2000).The other advantage of using PLS analysis is that the measurement error is being modeled, and it is, therefore, possible to use all measures even when their contribution is calculated as being small or modest.Footnote 4

Given the choice of measures in the present study, we engaged in several different forms of analysis to examine the psychometric properties of the instrument. Cronbach’s α assesses the reliability of the reflective measures. Significance of PLS loadings or weights indicate acceptable construct validity. The relevant PLS loadings/weights are presented in Table 5.

The occasionally insignificant loading/weight in Table 5 is not a surprise, given that some of the measures are formative (Edwards and Bagozzi 2000). The reflective subjective measures (no. 2 in Table B3) should have loaded well, and, indeed, they all load significantly, at α protection level of 0.05, which reinforces the interpretation that the instrument has some convergent validity.

According to Petter et al. (2007), an instrument with formative constructs demonstrates construct validity when the weights are significant, as these generally are. In addition to these tests, the Cronbach’s α for the subjective view of IT as a strategic resource was 0.920, which is acceptable by Nunnally’s rule of thumb (1994). Therefore, our interpretation of these loadings/weightings is that whereas the measures are not perfect, they are sufficiently valid for purposes of further testing. They are also acceptable because we are adopting a holistic analytical approach, which means that no attempts have been made to “cleanse” the constructs and reduce the a priori measurement error in the entire instrument (Bagozzi 1984). Measurement error is accounted for in the statistical technique, but not removed. If we find significance under these harsher statistical conditions, then the findings may be interpreted to be even more robust than otherwise.

We used the summated approach of Goodhue et al. to running our moderations. There are trade-offs between this approach and product-indicator approach of Chin et al. (2003) and we felt that the greater parsimony of the former warranted its use here.

Rights and permissions

About this article

Cite this article

Straub, D., Weill, P. & Schwaig, K.S. Strategic dependence on the IT resource and outsourcing: A test of the strategic control model. Inf Syst Front 10, 195–210 (2008). https://doi.org/10.1007/s10796-008-9064-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10796-008-9064-9