Abstract

Globally, Mobile Network Operators (MNOs) incur considerable capital investments towards the acquisition of spectrum, deployment of mobile networks, and marketing and advertising of their mobile services to potential mobile subscribers. The extant literature, which is mainly conceptual, suggests that such capital investments impact the individual mobile subscriber base of MNOs. However, the extant literature lacks in quantitative explanation of such impacts. We address this lacuna by proposing an empirical framework using a novel panel dataset of the four largest MNOs of India, during the years 2009–2017. We find that capital investments in the spectrum (both contemporaneous and lagged) and mobile networks (lagged) positively impact the mobile subscriber base of MNOs in India. We observe that a “triggering effect,” such as the market rollout of 4G (fourth generation) services, leads to an initial slump in the mobile subscriber base of MNOs, which is counterintuitive and signifies the importance of early network-preparedness on the part of MNOs. We also find that, in the event of the aforementioned market triggers, MNOs’ firm-size and potential to invest in the spectrum, in addition to network-preparedness, are crucial for its survival.

(Source: Based on Sabat (2005)). Note: The network investment lifecycle curve (representational only and not to scale) depicts the capital investments incurred by an MNO towards the deployment of a unique mobile network generation, such as 4G. A new network investment lifecycle will follow through whenever the MNO migrates to a newer mobile network generation, such as 5G

(Source: The World Bank Database)

(Source: TRAI, DoT, web-portals). Airtel has incurred the maximum spectrum investments over the years, followed closely by Vodafone and Idea. Notably, post the year 2012, Reliance incurred much lower investments in the spectrum as compared to its peers

Similar content being viewed by others

Notes

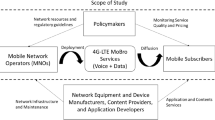

The International Telecommunications Union (ITU) defines mobile service as “a type of telecommunication service between a mobile device (e.g., smartphones) and the mobile network.” Mobile network refers to the physical network infrastructure, which comprises cell-towers, base transceiver stations (BTSs), and optical fiber cables, etc. Mobile services include both “voice” and “non-voice” service, such as short message service (SMS) and mobile data service, respectively.

MNOs undertake the deployment of mobile networks and the subsequent provisioning of mobile services. MNOs first acquire suitable spectrum bands from the government. This is followed by the deployment of mobile network in the target market. MNOs then roll out their services in the market by allowing users access to their individual mobile networks through subscriber identity modules (SIM), more commonly known as the “SIM-cards.” We must note that, the Mobile Virtual Network Operators (MVNOs), as opposite to MNOs, do not deploy their own infrastructure or acquire radio spectrum licenses from the government, but rather lease it from the MNOs for retailing the mobile services.

Network capacity mainly refers to the traffic (voice plus data) carrying capability of the mobile network.

“Diffusion of innovations is a theory propounded by Everett Rogers that seeks to explain how, why, and at what rate new ideas and technology spread in a given social system” (Rogers, 2010).

Source: https://www.livemint.com/Industry/2We3x084sh5ER83bYbxp7I/Airtel-to-invest-Rs25000-crore-in-201718-to-boost-4G-netwo.html. Date of Access: 28/01/2019.

Source: https://e4mevents.com/pitch-madison-advertising-report-2018/public/img/Pitch_Madison_Adveritisng_Report_2018.pdf. Date of Access: 02/12/2019.

Our dataset is quarterly in nature, so one-year lag spans the first four quarters.

In many countries, in addition to MNOs, Mobile Virtual Network Operators (MVNOs) also retail the various mobile services. However, in contrast to MNOs, MVNOs do not own the mobile network or spectrum. MVNOs lease such resources from MNOs on a contractual basis. At the time of writing this paper, MVNOs did not have much presence in India. As such, the retailing activity for mobile services was undertaken by the MNOs themselves.

Wi-max is a 4G standard, which stands for Wireless Interoperability for Microwave access.

Source: https://www.livemint.com/Industry/2We3x084sh5ER83bYbxp7I/Airtel-to-invest-Rs25000-crore-in-201718-to-boost-4G-netwo.html. Date of Access: 28/01/2019.

We do not include the two state-run MNOs in our analysis, since they do not participate in market auctions of spectrum; spectrum is allocated to these state-run MNOs depending on the discretion of the government.

The choice of time span is mainly driven by availability of continuous data on all variables for our study.

For examples, MNOs, such as Videocon, Quadrant, BPL, HFCL, Telenor, Uninor, etc., could not survive for long in the market in India.

We have amortized the capital investments in spectrum figures over various quarters. SUC and LF are already reported quarterly and have been extracted from the Financial Reports of TRAI and DOT. For MNOs, who choose to exercise the deferred payment option after winning the bid, we incorporate both the upfront investment and the deferred payment to arrive at our final spectrum investment figures, which we then amortize over the period of our study (years 2009–2017).

While MNOs in India utilize the services of Managed Service Providers (MSPs) in their operations, however, as mandated by the Department of Telecom (TRAI, 2019), the role of such MSPs in India is only limited to network installation, maintenance, and service provisioning activities, etc. Notably, the ownership of all the network equipment needs to solely reside with the MNOs themselves. MNOs, therefore, need to incur considerable capital investment to procure such network equipment from the vendors, in addition to various operational expenditures incurred through the MSPs.

We consider the one-year lag to be sufficient for observing the impacts due to physical network infrastructures and spectrum, which are supposed to be fully deployed and integrated within that duration (starting from the time the investments were incurred). Notably, deployment of physical network infrastructure on the ground takes a longer time due to hurdles such as “obtaining rights-of-way” with the governments, and various “tower sharing agreements” with third parties, etc. In our analysis, all such network deployment and spectrum integration is expected to complete within a year.

We note that, higher HHI indicates lower degree of market competition, and vice-versa. Therefore, the negative coefficient of the Competition T variable means: an increase in HHI (lower degree of market competition) leads to a decrease in the outcome variable (mobile subscriber base of MNOs). Thus, greater market competition (lower HHI) leads to a healthier mobile subscriber base for MNOs, in this particular case.

References

Abu, S. T. (2010). Technological innovations and 3G mobile phone diffusion: Lessons learned from Japan. Telematics and Informatics, 27(4), 418–432. https://doi.org/10.1016/j.tele.2010.03.001

Akiyoshi, M., & Ono, H. (2008). The diffusion of mobile Internet in Japan. The Information Society, 24(5), 292–303. https://doi.org/10.1080/01972240802356067

Ansari, S., & Krop, P. (2012). Incumbent performance in the face of a radical innovation: Towards a framework for incumbent challenger dynamics. Research Policy, 41(8), 1357–1374. https://doi.org/10.1016/j.respol.2012.03.024

Banker, R., Cao, Z., Menon, N. M., & Mudambi, R. (2012). The red queen in action: The longitudinal effects of capital investments in the mobile telecommunications sector. Industrial and Corporate Change, 22(5), 1195–1228. https://doi.org/10.1093/icc/dts036

Baum, C. F. (2000). XTTEST2: Stata module to perform Breusch-Pagan LM test for cross-sectional correlation in fixed effects model. In Statistical Software Components (No. S415702), Boston College Department of Economics.

Bharadwaj Anandhi S., Bharadwaj Sundar G., & Konsynski Benn R. (1999). Information Technology Effects on Firm Performance as Measured by Tobin’s q. Management Science, 45(7). https://doi.org/10.1287/mnsc.45.7.1008

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20(2), 249–327.

Chu, C. P., & Pan, J. G. (2008). The forecasting of the mobile Internet in Taiwan by diffusion model. Technological Forecasting and Social Change, 75(7), 1054–1067. https://doi.org/10.1016/j.techfore.2007.11.012

Deloitte. (2016). Ind AS Industry Insights- Telecommunications (Issue April). https://www2.deloitte.com/content/dam/Deloitte/in/Documents/risk/in-risk-ind-as-industry-insights-noexp.pdf

Eggers, J. P., Grajek, M., & Kretschmer, T. (2011). Decomposing First Mover Advantages in the Mobile Telecommunications Industry. In DRUID Working Papers (Issue 11). http://www3.druid.dk/wp/20110009.pdf

Frank, L. D. (2004). An analysis of the effect of the economic situation on modeling and forecasting the diffusion of wireless communications in Finland. Technological Forecasting and Social Change, 71(4), 391–403. https://doi.org/10.1016/S0040-1625(02)00392-X

Gamboa, L. F., & Otero, J. (2009). An estimation of the pattern of diffusion of mobile phones: The case of Colombia. Telecommunications Policy, 33(10–11), 611–620. https://doi.org/10.1016/j.telpol.2009.08.004

Gruber, H. (2001) Competition and innovation: The diffusion of mobile telecommunications in central and eastern Europe. Information Economics and Policy, 13(1), 19–34. https://doi.org/10.1016/S0167-6245(00)00028-7

Gruber, H., & Verboven, F. (2001). The diffusion of mobile telecommunications services in the European Union. European Economic Review, 45(3), 577–588. https://doi.org/10.1016/S0014-2921(00)00068-4

GSMA. (2020). The Mobile Economy 2020. In GSMA Intelligence. https://www.gsma.com/. Accessed 10 Feb 2021.

Gupta, R., & Jain, K. (2012). Diffusion of mobile telephony in India: An empirical study. Technological Forecasting and Social Change, 79(4), 709–715. https://doi.org/10.1016/j.techfore.2011.08.003

Hwang, J., Cho, Y., & Long, N. V. (2009). Investigation of factors affecting the diffusion of mobile telephone services: An empirical analysis for Vietnam. Telecommunications Policy, 33(9), 534–543. https://doi.org/10.1016/j.telpol.2009.06.003

Hwang, J., & Yoon, H. (2009). A mixed spectrum management framework for the future wireless service based on techno-economic analysis: The Korean spectrum policy study. Telecommunications Policy, 33(8), 407–421. https://doi.org/10.1016/j.telpol.2009.04.005

Jain, R., & Dara, R. (2017). Framework for evolving spectrum management regimes: Lessons from India. Telecommunications Policy, 41(5–6), 1. https://doi.org/10.1016/j.telpol.2017.04.002

Jerman-Blazic, B. (2008). Techno-economic analysis and empirical study of network broadband investment: The case of backbone upgrading. Information Systems Frontiers, 10, 103–110. https://doi.org/10.1007/s10796-007-9059-y

Jha, A., & Saha, D. (2020). Forecasting and analysing the characteristics of 3G and 4G mobile broadband diffusion in India: A comparative evaluation of Bass, Norton-Bass, Gompertz, and logistic growth models. Technological Forecasting and Social Change, 152(December 2019), 119885. https://doi.org/10.1016/j.techfore.2019.119885

Jha, A., & Saha, D. (2021). Mobile Broadband for Inclusive Connectivity: What Deters the High-Capacity Deployment of 4G-LTE Innovation in India? Information Systems Frontiers. https://doi.org/10.1007/s10796-021-10128-6

Kathuria, R. (2000). Telecom Policy Reforms in India. Global Business Review, 1(2), 301–326. https://doi.org/10.1177/097215090000100208

Kauffman, R. J., & Kumar, A. (2008). Network effects and embedded options: Decision-making under uncertainty for network technology investments. Information Technology and Management, 9(3), 149–168. https://doi.org/10.1007/s10799-008-0037-y

Yates, D. J., Gulati, G. J. J., & Weiss, J. W. (2013). Understanding the impact of policy, regulation and governance on mobile broadband diffusion. Proceedings of the Annual Hawaii International Conference on System Sciences, i, 2852–2861.https://doi.org/10.1109/HICSS.2013.583

Кorchagin, P., Кorneeva, E., & Nikitina, N. (2015). Factors that influence the effectiveness of Russian telecommunication companies. Economics and Sociology, 8(3), 119–130. https://doi.org/10.14254/2071-789X.2015/8-3/9

Koski, H., & Kretschmer, T. (2005). Entry, standards and competition: Firm strategies and the diffusion of mobile telephony. Review of Industrial Organization, 26(1), 89–113. https://doi.org/10.1007/s11151-004-4085-0

Lee, M., & Cho, Y. (2007). The diffusion of mobile telecommunications services in Korea. Applied Economics Letters, 14(7), 477–481. https://doi.org/10.1080/13504850500461431

Lee, S. S., Marcu, M., & Lee, S. S. (2011). An empirical analysis of fixed and mobile broadband diffusion. Information Economics and Policy, 23(3–4), 227–233. https://doi.org/10.1016/j.infoecopol.2011.05.001

Li, W., & Xu, L. C. (2004). The Impact of Privatization and Competition in the Telecommunications Sector around the World. Journal of Law and Economics, 47(2), 395–430. https://doi.org/10.1086/422984

Liu, X., Wu, F. S., & Chu, W. L. (2012). Diffusion of mobile telephony in China: Drivers and forecasts. IEEE Transactions on Engineering Management, 59(2), 299–309. https://doi.org/10.1109/TEM.2010.2058854

Massini, S. (2004). The diffusion of mobile telephony in Italy and the UK: An empirical investigation. Economics of Innovation & New Technology, 13(3), 251–277. https://doi.org/10.1080/10438590410001628396

Mata, J. F., Fuerst, W. L., & Barney, J. (1995). Information Technology and Sustained Competitive Advantage: A Resource-Based Analysis. MIS Quarterly, 19(4), 487–505. https://doi.org/10.2307/249630

Miranda, L. C. M., & Lima, C. A. S. (2013). Technology substitution and innovation adoption: The cases of imaging and mobile communication markets. Technological Forecasting and Social Change, 80(6), 1179–1193. https://doi.org/10.1016/j.techfore.2012.11.003

Mithas, S., Tafti, A., Bardhan, I., & Goh, J. M. (2012). Information Technology and Firm Profitability: Mechanisms and Empirical Evidence. MIS Quarterly, 36(1), 205–224. https://doi.org/10.2307/41410414

Mölleryd, B. G., & Markendahl, J. (2014). Analysis of spectrum auctions in India - An application of the opportunity cost approach to explain large variations in spectrum prices. Telecommunications Policy, 38(3), 236–247. https://doi.org/10.1016/j.telpol.2014.01.002

Moshi, G. C., & Mwakatumbula, H. J. (2017). Effects of political stability and sector regulations on investments in African mobile markets. Telecommunications Policy, 41(7–8), 651–661. https://doi.org/10.1016/j.telpol.2017.07.005

Nicolle, A., Grzybowski, L., & Zulehner, C. (2018). Impact of competition and regulation on prices of mobile services: Evidence from France. Economic Inquiry, 56(2), 1322–1345. https://doi.org/10.1111/ecin.12547

Polo, Y., Sese, F. J., & Verhoef, P. C. (2011). The Effect of Pricing and Advertising on Customer Retention in a Liberalizing Market. Journal of Interactive Marketing, 25(4), 201–214. https://doi.org/10.1016/j.intmar.2011.02.002

Prins, R., & Verhoef, P. C. (2007). Marketing Communication Drivers of Adoption Timing of a New E-Service Among Existing Customers. Journal of Marketing, 71(2), 169–183. https://doi.org/10.1509/jmkg.71.2.169

Rogers, E. M. (2010). Diffusion of innovations. Simon and Schuster.

Rouvinen, P. (2006). Diffusion of digital mobile telephony: Are developing countries different? Telecommunications Policy, 30(1), 46–63. https://doi.org/10.1016/j.telpol.2005.06.014

Sabat, H. K. (2002a). The Economics of Delivering Mobile Wireless Value. Vision, 6(2), 53–72. https://doi.org/10.1177/097226290200600206

Sabat, H. K. (2002b). The evolving mobile wireless value chain and market structure. Telecommunications Policy, 26(9–10), 505–535. https://doi.org/10.1016/S0308-5961(02)00029-0

Sabat, H. K. (2005). The Network Investment Economics of the Mobile Wireless Industry. Information Systems Frontiers, 7(2), 187–206.

Sabat, H. K. (2007). Emerging business models and trends in the mobile wireless industry. International Journal of Information Technology and Management, 6(2–4), 299–328. https://doi.org/10.1504/IJITM.2007.014006

Sabat, H. K. (2008). Spectrum acquisition strategies adopted by wireless carriers in the USA. Information Systems Frontiers, 10, 77–102. https://doi.org/10.1007/s10796-007-9056-1

Shin, S., Koh, J., Hu, C., & Lee, S. J. (2015). Analysis of mobile broadband service penetration in Korea. Proceedings of the Annual Hawaii International Conference on System Sciences, 2015-March, 3581–3590. https://doi.org/10.1109/HICSS.2015.431

Singh, S. K. (2008). The diffusion of mobile phones in India. Telecommunications Policy, 32(9–10), 642–651. https://doi.org/10.1016/j.telpol.2008.07.005

Sridhar, V., & Prasad, R. (2011). Towards a new policy framework for spectrum management in India. Telecommunications Policy, 35(2), 172–184. https://doi.org/10.1016/j.telpol.2010.12.004

Sridhar, V. (2010). An Econometric Analysis of Mobile Services Growth Across Regions of India. NETNOMICS, 11(3), 205–220. https://doi.org/10.1007/s11066-009-9041-6

Sridhar, Varadharajan, Casey, T., & Hämmäinen, H. (2013). Flexible Spectrum Management for Mobile Broadband Services: How does it vary across Advanced and Emerging Markets? Telecommunications Policy Special Issue on Cognitive Radio, 37(2–3), 178–191. https://doi.org/10.1016/j.telpol.2012.07.008

Sultanov, A., Lee, D. J., Kim, K. T., & Avila, L. A. P. (2016). The diffusion of mobile telephony in Kazakhstan: An empirical analysis. Technological Forecasting and Social Change, 106, 45–52. https://doi.org/10.1016/j.techfore.2016.01.020

TRAI. (2017). On Valuation and Reserve Price of Spectrum in 700 MHz , 800 MHz , 900 MHz , 1800 MHz , 2100 MHz , 2300 MHz and 2500 MHz bands (Issue April). http://www.trai.gov.in/Content/ReDis/564_0.aspx. Accessed 15 June 2020.

TRAI. (2019). Consultation Paper on Review of Scope of Infrastructure Providers Category-I (IP-I) Registration. Dated 16.08.2019. http://www.trai.gov.in/Content/ReDis/564_0.aspx. Accessed 15 June 2020.

Tseng, F. M., Wang, S. Y., Hsieh, C. H., & Guo, A. (2014). An integrated model for analyzing the development of the 4G telecommunications market in Taiwan. Telecommunications Policy, 38(1), 14–31. https://doi.org/10.1016/j.telpol.2013.04.003

Wareham, J., Levy, A., & Shi, W. (2004). Wireless diffusion and mobile computing: Implications for the digital divide. Telecommunications Policy, 28(5–6), 439–457. https://doi.org/10.1016/j.telpol.2003.11.005

Xia, J. (2012). Reprint of: Competition and regulation in China’s 3G/4G mobile communications industry - Institutions, governance, and telecom SOEs. Telecommunications Policy, 36(10–11), 798–816. https://doi.org/10.1016/j.telpol.2012.10.002

Xia, J. (2016). Convergence and liberalization in China’s ICT sector: New market and new ecosystem. Telecommunications Policy, 40, 81–88. https://doi.org/10.1016/j.telpol.2015.12.002

Yamakawa, P., Rees, G. H., Manuel Salas, J., & Alva, N. (2013). The diffusion of mobile telephones: An empirical analysis for Peru. Telecommunications Policy, 37(6–7), 594–606. https://doi.org/10.1016/j.telpol.2012.12.010

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that there is no conflict of interest regarding the publication of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jha, A., Chakrabarty, M. & Saha, D. Network Investment as Drivers of Mobile Subscription – A Firm-level Analysis. Inf Syst Front 25, 1811–1828 (2023). https://doi.org/10.1007/s10796-022-10322-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10796-022-10322-0