Abstract

Organizations have adopted new business channels, such as using electronic markets, to better enhance productivity of their operations through information and communications technology (ICT) enablement for greater reach and range in their transactions. These ICT tools, allowing streamlined processes, can enable new means of competition and coordination, changing how individuals and organizations exchange goods and services.

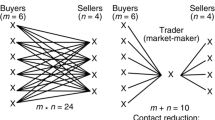

The effectiveness of decision management using these markets depends on the electronic market design. In electronic markets, intermediaries are used as a “someone” who provides an added value mechanism for the transaction. This value role can be to mitigate risk, leverage uncertainties and/or reduce certain economic costs in the exchange of information. How this intermediary is managed and organized is important in achieving the intended value. This is more challenging when the intermediary is not a “someone”, but a “something”, as the design of the resource is impacted by the designer and owner of the resource.

Designing and managing an intermediary resource for intelligence in information sharing across organizations may enhance the quality of the information exchanged between parties, as the role of this intermediary in the information transaction may add value to the timeliness, accuracy and relevancy of the information provided.

In this research, the intermediary is defined as a “something”, an autonomous, intelligent matching solution that is designed to add value for the buyer and seller in an electronic market transaction. The contribution of this paper is to illustrate how matching becomes intelligent should be defined by the mechanism or functionality required of the intelligence. This may be seen as a function of the information quality requirements and of firm boundaries both in terms of collaboration and ownership of the matching solution.

Our findings suggest that intelligent matching impacts decision-making and information acquisition by a combination of positive economic effects, but is still constrained by organizational and technological interoperability.

Similar content being viewed by others

References

G.A. Akerloff, The Market for ‘Lemons’: quality Uncertainty and the Market Mechanism, Quarterly Journal of Economics 84 August (1970) 488–500.

E. Anderson, Transaction Costs as Determinants of Opportunism in Integrated and Independent Sales Forces, Journal of Economic Behavior and Organization 9 (1988) 247–264.

J.P. Bailey and Y. Bakos, An exploratory study of the emerging role of electronic intermediaries, International Journal of Electronic Commerce 1(3) (1997) 7–20.

J.Y. Bakos, A Strategic Analysis of Electronic Marketplaces, MIS Quarterly 15(3) September (1991) 295–310.

J.Y. Bakos, Reducing Buyer Search Costs: implications for Electronic Marketplaces, Management Science 43(12) (1997) 1676–1692.

J.Y. Bakos and C.F. Kemerer, Recent applications of economic theory in information technology research, Decision Support Systems 8(5) December (1992) 365–386.

R. Benjamin and R. Wigand, Electronic Markets and Virtual Value Chains on the Information Superhighway, Sloan Management Review (Winter 1995) 62–72.

M. Bloch, Y. Pigneur and A. Segev, On the Road of Electronic Commerce—a Business Value Framework, Gaining Competitive Advantage and Some Research Issues, http://www.stern.nyu.edu/~mbloch/docs/roadtoec/ec.htm, March (1996).

J. Brown and A. Goolsbee, Does the Internet Make Markets More Competitive? Evidence from the Life Insurance Industry, Working Paper, University of Chicago, Chicago, IL, 2000.

A.M. Chircu and R.J. Kauffman, Strategies for Internet middlemen in the intermediation/disintermediation/reinterme- diation cycle, Electronic Markets 9(2) (1999) 109–117.

E.K. Clemons, S.P. Reddi and M.C. Row, The Impact of Information Technology on the Organization of Economic Activity: the ‘Move to the Middle’ hypothesis, Journal of Management Information Systems 10(2) (1993) 9–35.

P.J.M. Diederen and H.L. Jonkers, Chain and Network Studies, Prepared for KLICT program, The Netherlands. URL: http://www.klict.org (2001).

K.M. Eisenhardt, Agency theory: an Assessment and Review, Academy of Management Review 14 (1989) 57–74.

J. Gebauer, Informationstechnische unterstützung von transaktionen—Eine analyse aus ökonomischer Sicht (Information technology to support transactions—An economic analysis, in German, 1996) Wiesbaden, Germany: Gabler.

J. Gebauer, C. Beam and A. Segev, Impact of the Internet on Procurement, in: Acquisition Review (Spring 1998) 167–181.

R.M. Grant, The resource based theory of competitive advantage, California Management Review 33(3) (1991) 114–135.

S.J. Grossman and O. Hart, The costs and benefits of ownership: a theory of vertical and lateral integration, Journal of Political Economy 94 (1986) 691–719.

O. Hart and J. Moore, Property Rights and the Nature of the Firm, Journal of Political Economy, University of Chicago Press 98(6) December (1990) 1119–58.

B. Holmstrom and P. Milgrom, Multitask principal-agent analyses: incentive contracts, asset ownership and job design, Journal of Law, Economics, and Organization 7 (1991) 24–52.

B.R. Holmstrom and J. Tirole, The Theory of the Firm, in: R. Schmalensee and R.D. Willig, (eds.) Handbook of Industrial Organization, vol. 1, Amsterdam: North-Holland, 1989.

S. Kaplan, S. and M. Sawhney, M., E-Hubs: The new B2B marketplaces, Harvard Business Review (May–June 2000) 97–103

P.G.W. Keen, Shaping the Future: Business Design Through Information Technology, Boston, Harvard Business School Press, 1991.

S. Klein, Kommerzielle elektronische Transaktionen: Sektorale Struktur, Umfang und strategisches Potential, in: Werle; Raymund; Lang; Christa, Modell Internet? 23–42, Frankfurt/New York: Campus, 1997.

N. Levy, The Boundary of the Firm in a Model of Trade Within a Hierarchy, Discussion Papers 03–13, University at Albany, SUNY, Department of Economics 2003.

D. Lucking-Reiley and D.F., Business-to-business electronic commerce, Working Paper, Vanderbilt University (2000).

T.W. Malone, J. Yates and R.I. Benjamin, Electronic Market and Electronic Hierarchies, Communications of the ACM 30(6) (1987) 484–497.

N. Negroponte N., Reintermediated, Wired 5(9) September (1997) 208.

M.E. Nissen, The commerce model for electronic redesign, Journal for Internet Purchasing 1(2). Retrieved August 12 (2002) from http://www.arraydev.com/commerce/JIP/9702-01.htm.

M.E. Nissen, Multi-agent approach to supply chain disintermediation, in: Proceedings 1999 International Conference on Information Systems, Charlotte, NC, Narasimhan S, Sarker S. (eds.) Workshop on Information Technology and Systems, December (1999).

M.E. Nissen, Agent-based supply chain disintermediationversus re-intermediation: economic and technological perspectives, International Journal of Intell. Sys. Acc. Fin. Mgmt. 9 (2000) 237–256.

J. Pfeffer and G.R. Salancik, The External Control of Organizations, Harper and Row, New York, 1978.

P.H. Phan, A theory of the firm: governance, residual claims, and organizational forms, Administrative Science Quarterly 47(2) June (2002) 387–389.

M.E. Porter, Competitive Advantage: Creating and Sustaining Superior Performance, New York, Free Press, 1985.

B.F. Schmid, Elektronische märkte (Electronic Markets, in German). Wirtschaftsinformatik 35(5) (1993) 465–480.

A. Scott, New Industrial Spaces, Pion, London, England, 1988.

M. Smith, J. Bailey and E. Brynjolfsson, Understanding digital markets: review and assessment, in: Understanding the Digital Economy, Brynjolfsson E, Kahin B (eds.) (MIT Press: Cambridge, MA, 2000).

G.J. Stigler, The Economics of Information, Journal of Political Economy 69(3) (1961) 213–225.

R.S. Taylor, Value-Added Processes in Information Systems. Norwood, NJ: Ablex Publ. 1986.

J. Tirole, The Theory of Industrial Organization, The MIT Press, Cambridge, MA, 1988.

J. Tirole and E. Maskin, Unforeseen Contingencies and Incomplete Contracts, Review of Economic Studies 66 (1999) 83–114.

R.Y. Wang and D.M. Strong, Beyond accuracy: what Data Quality Means to Data Consumers, Journal of Management Information Systems 12(4) (1997) 5–34.

A.B. Whinston AB, D.O. Stahl and S.Y. Choi, The Economics of Electronic Commerce, Macmillan: New York, 1997.

O.E. Williamson, The Economic Institutions of Capitalism, The Free Press: Boston, MA, 1985.

O.E. Williamson, Comparative economic organization: the analysis of discrete structural alternatives, Administrative Science Quarterly 36(2) (1991) 269–296.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fairchild, A.M. Decision management: Role and effect of using an intelligent intermediary to aid in information sharing. Inf Technol Manage 7, 249–258 (2006). https://doi.org/10.1007/s10799-006-0275-9

Issue Date:

DOI: https://doi.org/10.1007/s10799-006-0275-9