Abstract

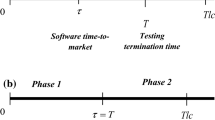

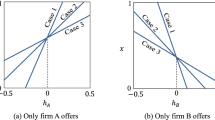

This study proposes a two-period analytical model to explore the relative optimality of three sequential releasing strategies for a software vendor: (1) Skipping Strategy—skip the limited-functionality version and introduce a full-functionality version in the next period, (2) Replacement Strategy—release a limited-functionality version first and replace it with a full-functionality version later, and (3) Line-extension Strategy—release a limited-functionality version first and extend the product line by releasing a full-functionality version later. Word-of-mouth (WOM) effect and uncertainty in consumers’ requirements are taken into consideration. Our analysis shows that Skipping Strategy is optimal when the net WOM is negative and sufficiently small, while the Replacement Strategy becomes the optimal choice when the net WOM is negative but not sufficiently small. However, the Line-extension Strategy dominates other two strategies when the net WOM is positive. Different pricing patterns may be chosen when adopting Line-extension Strategy, i.e. when the net WOM is positive and not very large, Low–High pricing pattern (a relatively low price for the limited-functionality version and a relatively high price for the full-functionality version) is optimal, while High–Low pricing pattern (a relatively high price for the limited-functionality version and a relatively low price for the full-functionality version) becomes optimal when the net WOM is positive and sufficiently large. Numerical experiments show that the software vendor could improve its profit by choosing optimal quality design but the overall dominance pattern of the three release strategies is similar no matter whether the quality design is exogenously given or optimally chosen.

Similar content being viewed by others

Notes

Low-quality version and high-quality version correspond to the limited-functionality version and the full-functionality version respectively in this study.

Usually, software vendors like Microsoft Corporation carries out pre-research and prototype development of innovative software products, including features that requirements are not clear temporarily. When the requirements of these features become clear for consumers in the future, upgrades or upgraded products are released to match these new requirements. Otherwise, if delivering those features that requirements are unfocused and highly volatile prematurely, software vendors will suffer from large risk [13].

We assume that \(p_{f}\) is higher than \(p_{l}\), because in software market, the price of the software usually does not drop especially as the number of features the software contains increases over time through upgrade.

According to [36], not all consumers write reviews after use. Besides, different consumers’ reviews (such as expert consumers and general consumers) have different influence [37]. Therefore, we do not consider the impact of the number of early adopters but consider WOM effect from an overall perspective.

At the beginning, a software product contains a smaller number of features, adding a new feature that requirement is relatively clear to the software will cause a lower mismatch level between the software and consumers’ requirements. However, as more features are contained in the software, adding a new feature that requirement is highly uncertain to the software will result in a higher mismatch level between the software and consumers’ requirements.

The delayed line strategy, where the limited-functionality version is not sold until the full-functionality version is available, is dominated by the skipping strategy according to [38], because we do not consider network effects and consumers in the second period are not affected by WOM effect due to the absence of any release in the first period. Thus we do not discuss this strategy in this study.

In this study, we assume that all consumers re-estimate the value of the full-functionality version product in the second period. Because of the assumption that the upgrade price equals the difference between the price for the full-functionality version and the price for the limited-functionality version, we could equivalently regard the reservation utility of all consumers as zero in the second period. Namely, only if the consumer obtains non-negative utility from the full-functionality version, he or she will purchase (or upgrade to) the full-functionality version. Therefore, if there are some new consumers purchasing the full-functionality version in the second period, all consumers buying the limited-functionality version in the first period will choose to upgrade to the full-functionality version. Similarly, if only a portion of consumers buying the limited-functionality version in the first period choose to upgrade to full-functionality version, there will be no new consumers choosing to buy the full-functionality version. Thus, type LN and type NF cannot co-exist in the market. The similar explanation applies to the case of Line-extension Strategy.

In the case of Line-extension Strategy, type NF and type LN cannot coexist in the market, and the reason is the same as that in the case of Replacement Strategy. Please refer to the footnote 16 for the detailed explanation.

We did nine different numerical experiments by setting \(q_{l}^{min} = 0.2, 0.3, 0.4\) and \(q_{l}^{max} = 0.6, 0.7, 0.8\) respectively and found that the optimality pattern of each release strategy and the optimality pattern of quality level for the limited-functionality version is very close in each experiment. Thus we select \(q_{l}^{min} = 0.3\) and \(q_{l}^{max} = 0.7\) as a representative setting to illustrate the results.

The validity of values selected here can be explained using the similar reason described in footnote 18.

References

Wolfram S. Today we launch version 11! http://blog.wolfram.com/2016/08/08/today-we-launch-version-11/

Siebert R (2015) Entering new markets in the presence of competition: price discrimination versus cannibalization. J Econ Manag Strategy 24(2):369–389

Mahajan V, Muller E, Kerin RA (1984) Introduction strategy for new products with positive and negative word-of-mouth. Manage Sci 30(12):1389–1404

Liu Y (2006) Word of mouth for movies: its dynamics and impact on box office revenue. J Mark 70(3):74–89

Chau NN, Desiraju R (2017) Product introduction strategies under sequential innovation for durable goods with network effects. Prod Oper Manag 26(2):320–340

Kwark Y, Chen J, Raghunathan S (2014) Online product reviews: implications for retailers and competing manufacturers. Inf Syst Res 25:93

Hornik J, Shaanan Satchi R, Cesareo L, Pastore A (2015) Information dissemination via electronic word-of-mouth: good news travels fast, bad news travels faster! Comput Hum Behav 45:273–280

Bensaid B, Lesnea JP (1996) Dynamic monopoly pricing with network externalities. Int J Ind Organ 14:837–855

Foubert B, Gijsbrechts E (2016) Try it, you’ll like it—or will you? The perils of early free-trial promotions for high-tech service adoption. Mark Sci 35(5):810–826

Nidumolu S (1995) The effect of coordination and uncertainty on software project performance: residual performance risk as an intervening variable. Inf Syst Res 6(3):191–219

Ebert C, Man JD (2005) Requirements uncertainty: influencing factors and concrete improvements. In: Proceedings of the 27th international conference on Software engineering, St. Louis, MO, USA, pp 553–560

Nuseibeh B, Easterbrook S (2000) Requirements engineering: a roadmap. In: Proceedings of the conference on the future of software engineering (ICSE ’00), ACM, New York, NY, USA, pp 35–46

Cusumano MA, Selby RW (1997) How Microsoft builds software. Commun ACM 40(6):53–61

Shapiro C (1982) Consumer information, product quality, and seller reputation. Bell J Econ 13(1):20–35

Levinthal DA, Purohit D (1989) Durable goods and product obsolescence. Mark Sci 8(1):35

Moorthy KS, Png IP (1992) Market segmentation, cannibalization, and the timing of product introductions. Manage Sci 38(3):345–359

Padmanabhan V, Rajiv S, Srinivasan K (1997) New products, upgrades, and new releases: a rationale for sequential product introduction. J Mark Res 34(4):456–472

Bhattacharya S, Krishnan V, Mahajan V (2003) Operationalizing technology improvements in product development decision-making. Eur J Oper Res 149(1):102

Pedram M, Balachander S (2015) Increasing quality sequence: when is it an optimal product introduction strategy? Manage Sci 61(10):2487–2494

Biyalogorsky E, Koenigsberg O (2014) The design and introduction of product lines when consumer valuations are uncertain. Prod Oper Manag 23(9):1539–1548

Bhargava HK (2014) Platform technologies and network goods: insights on product launch and management. Inf Technol Manage 15(3):199–209

Dellarocas C (2003) The digitization of word of mouth: promise and challenges of online feedback mechanisms. Manage Sci 49(10):1407–1424

Trusov M, Bucklin RE, Pauwels K (2009) Effects of word-of-mouth versus traditional marketing: findings from an internet social networking site. J Mark 73(5):90–102

Hu N, Liu L, Zhang JJ (2008) Do online reviews affect product sales? The role of reviewer characteristics and temporal effects. Inf Technol Manage 9(3):201–214

Vazquez-Casielles R, Suarez-Alvarez L, del Rio-Lanza A-B (2013) The word of mouth dynamic: how positive (and negative) WOM drives purchase probability. J Advert Res 53(1):43–60

Wu Y, Wu J (2016) The impact of user review volume on consumers’ willingness-to-pay: a consumer uncertainty perspective. J Interact Mark 33:43–56

Wu J, Wu Y, Sun J, Yang Z (2013) User reviews and uncertainty assessment: a two stage model of consumers’ willingness-to-pay in online markets. Decis Support Syst 55(1):175–185

Godes D (2017) Product policy in markets with word-of-mouth communication. Manage Sci 63(1):267–278

Dogan K, Ji Y, Mookerjee VS, Radhakrishnan S (2011) Managing the versions of a software product under variable and endogenous demand. Inf Syst Res 22(1):5–21

Hong YK, Pavlou PA (2014) Product fit uncertainty in online markets: nature, effects, and antecedents. Inf Syst Res 25(2):328–344

Cheng HK, Liu Y (2012) Optimal software free trial strategy the impact of network externalities and consumer. Inf Syst Res 23(2):488–504

Dey D, Lahiri A, Liu D (2013) Consumer learning and time-locked trials of software products. J Manag Inf Syst 30(2):239–268

Wei XDQ, Nault BR (2013) Experience information goods: “Version-to-upgrade”. Decis Support Syst 56:494–501

Li S, Cheng HK, Duan Y, Yang Y-C (2017) A study of enterprise software licensing models. J Manag Inf Syst 34(1):177–205

Dey D, Lahiri A (2016) Versioning: go vertical in a horizontal market? J Manag Inf Syst 33(2):546–572

Li M, Feng H, Chen F (2012) Optimal versioning and pricing of information products with considering or not common valuation of customers. Comput Ind Eng 63(1):173–183

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econ Rev 75(3):424–440

Jing B (2007) Network externalities and market segmentation in a monopoly. Econ Lett 95(1):7–13

Acknowledgements

This work was supported by the General Program of the National Science Foundation of China (Nos. 71371135, 71871155), the Key Program of the National Science Foundation of China (No. 71631003), and the National Science Fund for Distinguished Young Scholars of China (Grant No. 70925005). It is also supported by the Program for Changjiang Scholars and Innovative Research Teams in Universities of China (PCSIRT). The authors are very grateful to the editor and all anonymous reviewers whose invaluable comments and suggestions substantially helped improve the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A1: Proof of Proposition 1

-

(I)

Firstly, we give the proof of the local optimum RS-I, corresponding to type-I market segmentation in Fig. 4

-

(II)

In this case, \(0 < \theta_{f}^{RS {\text{-}} I} = \theta_{l}^{RS {\text{-}} I} < \theta_{u}^{RS {\text{-}} I} < 1\), \(\theta_{f}^{RS {\text{-}} I} = \theta_{l}^{RS {\text{-}} I} = \frac{{p_{l}^{RS {\text{-}} I} }}{{q_{l} }}\), \(\theta_{u}^{RS {\text{-}} I} = \frac{{p_{f}^{RS {\text{-}} I} - W_{N} }}{{q_{f} }}\), \(\pi^{RS {\text{-}} I} = \left( {1 - \theta_{u}^{RS {\text{-}} I} } \right)p_{f}^{RS {\text{-}} I} + \left( {\theta_{u}^{RS {\text{-}} I} - \theta_{l}^{RS {\text{-}} I} } \right)p_{l}^{RS {\text{-}} I} = \left( {1 - \frac{{p_{f}^{RS {\text{-}} I} - W_{N} }}{{q_{f} }}} \right)p_{f}^{RS {\text{-}} I} + \left( {\frac{{p_{f}^{RS {\text{-}} I} - W_{N} }}{{q_{f} }} - \frac{{p_{l}^{RS {\text{-}} I} }}{{q_{l} }}} \right)p_{l}^{RS {\text{-}} I}\). Let \(\varvec{p} = \left( {p_{f}^{RS {\text{-}} I} ,p_{l}^{RS {\text{-}} I} } \right)\), then \(H\left( \varvec{p} \right) = \left[ {\begin{array}{*{20}c} { - \frac{2}{{q_{f} }}} & {\frac{1}{{q_{f} }}} \\ {\frac{1}{{q_{f} }}} & { - \frac{2}{{q_{l} }}} \\ \end{array} } \right]\), \(D_{1} \left( H \right) = - \frac{2}{{q_{f} }} < 0\), \(D_{2} \left( H \right) = \frac{{4q_{f} - q_{l} }}{{q_{f}^{2} q_{l} }} > 0\), thus the profit function of RS-I is concave. The first-order conditions of \(\pi^{RS {\text{-}} I}\) with respect to \(p_{f}^{RS {\text{-}} I}\) and \(p_{l}^{RS {\text{-}} I}\) are \(\left\{ {\begin{array}{*{20}l} {\frac{{\partial \pi^{RS {\text{-}} I} }}{{\partial p_{f}^{RS {\text{-}} I} }} = \frac{{q_{f} + W_{N} - 2p_{f}^{RS {\text{-}} I} + p_{l}^{RS {\text{-}} I} }}{{q_{f} }} = 0} \hfill \\ {\frac{{\partial \pi^{RS {\text{-}} I} }}{{\partial p_{l}^{RS {\text{-}} I} }} = \frac{{ - q_{l} W_{N} + q_{l} p_{f}^{RS {\text{-}} I} - 2q_{f} p_{l}^{RS {\text{-}} I} }}{{q_{f} q_{l} }} = 0} \hfill \\ \end{array} } \right.\), and then \(\left\{ {\begin{array}{*{20}c} {p_{f}^{RS {\text{-}} I*} = \frac{{\left( {2q_{f} - q_{l} } \right)W_{N} + 2q_{f}^{2} }}{{4q_{f} - q_{l} }}} \\ {p_{l}^{RS {\text{-}} I*} = \frac{{q_{l} \left( {q_{f} - W_{N} } \right)}}{{4q_{f} - q_{l} }}} \\ \end{array} } \right.\). The optimal segmenting point of different versions are \(\theta_{u}^{RS {\text{-}} I*} = \frac{{2\left( {q_{f} - W_{N} } \right)}}{{4q_{f} - q_{l} }}\) and \(\theta_{l}^{RS {\text{-}} I*} = \frac{{q_{f} - W_{N} }}{{4q_{f} - q_{l} }}\), satisfying the constraint \(0 < \theta_{l}^{RS {\text{-}} I} < \theta_{u}^{RS {\text{-}} I} < 1\). Therefore, The number of all types of consumers are \(D_{LU}^{RS {\text{-}} I*} = 1 - \frac{{2\left( {q_{f} - W_{N} } \right)}}{{4q_{f} - q_{l} }}\), \(D_{LN}^{RS {\text{-}} I*} = \theta_{u}^{RS {\text{-}} I*} - \theta_{l}^{RS {\text{-}} I*} = \frac{{q_{f} - W_{N} }}{{4q_{f} - q_{l} }}\), \(D_{NF}^{RS {\text{-}} I*} = 0\) and \(D_{Total}^{RS {\text{-}} I*} = D_{LU}^{RS {\text{-}} I*} + D_{LN}^{RS {\text{-}} I*} + D_{NF}^{RS {\text{-}} I*} = 1 - \frac{{q_{f} - W_{N} }}{{4q_{f} - q_{l} }}\). Finally, the optimal total profit of Scheme RS-I is \(\pi^{RS {\text{-}} I*} = \frac{{W_{N}^{2} + \left( {2q_{f} - q_{l} } \right)W_{N} + q_{f}^{2} }}{{4q_{f} - q_{l} }}\).

According to the constraint \(p_{f} \ge p_{l} > 0\), \(p_{f}^{RS {\text{-}} I*} - p_{l}^{RS {\text{-}} I*} = \frac{{q_{f} \left( {2q_{f} - q_{l} + 2W_{N} } \right)}}{{4q_{f} - q_{l} }} > 0\), then we have \(W_{N} > \frac{1}{2}q_{l} - q_{f}\), and \(p_{l}^{RS {\text{-}} I*} = \frac{{q_{l} \left( {q_{f} - W_{N} } \right)}}{{4q_{f} - q_{l} }} > 0\) is obvious. Because \(- q_{l}^{2} < W_{N} < q_{l}\), we need to examine which is larger between \(\frac{1}{2}q_{l} - q_{f}\) and \(- q_{l}^{2}\). If \(\frac{1}{2}q_{l} - q_{f} < - q_{l}^{2}\) (namely \(q_{l} < A = \frac{{ - 1 + \sqrt {1 + 16q_{f} } }}{4}\)), then \(p_{f}^{RS {\text{-}} I*} > p_{l}^{RS {\text{-}} I*}\). But if \(\frac{1}{2}q_{l} - q_{f} \ge - q_{l}^{2}\) (namely \(q_{l} \ge A\)), then \(p_{f}^{RS {\text{-}} I*} > p_{l}^{RS {\text{-}} I*}\) when \(W_{N} > \frac{1}{2}q_{l} - q_{f}\), but \(p_{f}^{RS {\text{-}} I*} = p_{l}^{RS {\text{-}} I*}\) when \(W_{N} \le \frac{1}{2}q_{l} - q_{f}\). If \(p_{f}^{RS {\text{-}} I*} = p_{l}^{RS {\text{-}} I*}\), the software vendor will not earn any profit in the second period but just earn profit from the first period, namely \(\pi^{RS {\text{-}} I} = \left( {1 - \theta_{l}^{RS {\text{-}} I} } \right)p_{l}^{RS {\text{-}} I}\). In this case, the optimal prices for both versions are \(p_{l}^{RS {\text{-}} I*} = p_{f}^{RS {\text{-}} I*} = \frac{{q_{l} }}{2}\). \(\theta_{u} = \frac{{\frac{{q_{l} }}{2} - W_{N} }}{{q_{f} }} \ge 1\). Namely, no consumers upgrade in the second period. All types of demand are \(D_{LN}^{RS {\text{-}} I*} = \frac{1}{2}\), \(D_{LU}^{RS {\text{-}} I*} = D_{NF}^{RS {\text{-}} I*} = 0\) and \(D_{Total}^{RS {\text{-}} I*} = \frac{1}{2}\). The optimal profit of the software vendor is \(\pi^{RS {\text{-}} I*} = \frac{{q_{l} }}{4}\).

-

(III)

Now we give the proof of the local optimum RS-II, corresponding to type-II market segmentation in Fig. 4

-

(IV)

In this case, \(0 < \theta_{f}^{RS {\text{-}} II} < \theta_{l}^{RS {\text{-}} II} = \theta_{u}^{RS {\text{-}} II} < 1\), \(\theta_{f}^{RS {\text{-}} II} = \frac{{p_{f}^{RS {\text{-}} II} - W_{N} }}{{q_{f} }},\)\(\pi^{RS {\text{-}} II} = \left( {1 - \theta_{u}^{RS {\text{-}} II} } \right)p_{f}^{RS {\text{-}} II} + \left( {\theta_{l}^{RS {\text{-}} II} - \theta_{f}^{RS {\text{-}} II} } \right)p_{f}^{RS {\text{-}} II} = \left( {1 - \frac{{p_{f}^{RS {\text{-}} II} - W_{N} }}{{q_{f} }}} \right)p_{f}^{RS {\text{-}} II}\). The first- order and second-order conditions of \(\pi^{RS {\text{-}} II}\) with respect to \(p_{f}^{RS {\text{-}} II}\) are \(\frac{{\partial \pi^{RS {\text{-}} II} }}{{\partial p_{f}^{RS {\text{-}} II} }} = \frac{{q_{f} + W_{N} - 2p_{f}^{RS {\text{-}} II} }}{{q_{f} }}\) and \(\frac{{\partial^{2} \pi^{RS {\text{-}} II} }}{{\partial \left( {p_{f}^{RS {\text{-}} II} } \right)^{2} }} = - \frac{2}{{q_{f} }} < 0\), meaning that \(\pi^{RS {\text{-}} II}\) is concave. Let \(\frac{{\partial \pi^{RS {\text{-}} II} }}{{\partial p_{f}^{RS {\text{-}} II} }} = 0\), we get the optimal price of the full-functionality version \(p_{f}^{RS {\text{-}} II*} = \frac{{q_{f} + W_{N} }}{2}\). The indifferent point of the consumer between buying the full-functionality version and nothing is \(\theta_{f}^{RS {\text{-}} II*} = \frac{{q_{f} - W_{N} }}{{2q_{f} }}\), which is between 0 and 1. So the resulting demand of the full-functionality version is \(D_{F}^{RS {\text{-}} II*} = D_{LU}^{RS {\text{-}} II*} + D_{NF}^{RS {\text{-}} II*} = 1 - \theta_{f}^{RS {\text{-}} II*} = \frac{{q_{f} + W_{N} }}{{2q_{f} }}\). As for the price for the limited-functionality version, the software vendor just sets it in \(\left[ {\frac{{q_{l} \left( {q_{f} - W_{N} } \right)}}{{2q_{f} }},min\left\{ {q_{l} ,\frac{{q_{f} + W_{N} }}{2}} \right\}} \right]\) so that \(\theta_{f}^{RS {\text{-}} II} < \theta_{l}^{RS {\text{-}} II}\). As a result, the number of type LU consumer is between \({ \hbox{max} }\left\{ {0,1 - \frac{{q_{f} + W_{N} }}{{2q_{l} }}} \right\}\) and \(\frac{{q_{f} + W_{N} }}{{2q_{f} }}\). Finally, the optimal total demand and profit of the software vendor is \(D_{Total}^{RS {\text{-}} II*} = D_{F}^{RS {\text{-}} II*} = \frac{{q_{f} + W_{N} }}{{2q_{f} }}\) and \(\pi^{RS {\text{-}} II*} = \frac{{\left( {q_{f} + W_{N} } \right)^{2} }}{{4q_{f} }}\).

-

(V)

Finally, we give the globally optimal solution of Replacement Strategy by comparing two local optima RS-I and RS-II. When \(q_{l} > A\) and \(W_{N} > \frac{1}{2}q_{l} - q_{f}\), or \(q_{l} \le A\), \(\pi^{RS {\text{-}} I*} - \pi^{RS {\text{-}} II*} = \frac{{q_{l} \left( {q_{f} + W_{N} } \right)^{2} }}{{4q_{f} \left( {4q_{f} - q_{l} } \right)}} > 0\). When \(q_{l} > A\) and \(W_{N} \le \frac{1}{2}q_{l} - q_{f}\), \(\pi^{RS {\text{-}} I*} - \pi^{RS {\text{-}} II*} = \frac{{q_{l} q_{f} - \left( {q_{f} + W_{N} } \right)^{2} }}{{4q_{f} }} \ge \frac{{q_{l} q_{f} - \left( {q_{f} + \frac{1}{2}q_{l} - q_{f} } \right)^{2} }}{{4q_{f} }} = \frac{{4q_{l} q_{f} - q_{l}^{2} }}{{16q_{f} }} > 0\). Therefore, RS-I is always the optimal choice if the software vendor adopts the Replacement Strategy.

1.2 A2: Proof of Corollary 1

If \(q_{l} > A = \frac{{\sqrt {1 + 16q_{f} } - 1}}{4}\) and \(W_{N} > \frac{1}{2}q_{l} - q_{f},\)\(\frac{{dp_{l}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{ - q_{l} }}{{4q_{f} - q_{l} }} < 0,\)\(\frac{{dp_{f}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > 0\), \(\frac{{dD_{Total}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{1}{{4q_{f} - q_{l} }} > 0\), \(\frac{{d\pi^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{2W_{N} + 2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > \frac{{2\left( {\frac{1}{2}q_{l} - q_{f} } \right) + 2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} = 0\).

If \(q_{l} \le A\), then \(\frac{1}{2}q_{l} - q_{f} \le - q_{l}^{2} \le W_{N}\), \(\frac{{dp_{l}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{ - q_{l} }}{{4q_{f} - q_{l} }} < 0\), \(\frac{{dp_{f}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > 0\), \(\frac{{dD_{Total}^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{1}{{4q_{f} - q_{l} }} > 0\), \(\frac{{d\pi^{RS {\text{-}} I*} }}{{dW_{N} }} = \frac{{2W_{N} + 2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > 0\).

1.3 A3: Proof of Proposition 2

-

(I)

Firstly, we give the proof of the local optimum LES-I, corresponding to the type-I market segmentation in Fig. 6. In this case, \(0 < \theta_{2l}^{LES {\text{-}} I} < \theta_{f}^{LES {\text{-}} I} = \theta_{1l}^{LES {\text{-}} I} < \theta_{u}^{LES {\text{-}} I} < 1\), \(\theta_{f}^{LES {\text{-}} I} = \theta_{1l}^{LES {\text{-}} I} = \frac{{p_{l} }}{{q_{l} }}\), \(\theta_{u}^{LES {\text{-}} I} = \frac{{p_{f} - W_{N} }}{{q_{f} }}\) and \(\theta_{2l}^{LES {\text{-}} I} = \frac{{p_{l} - W_{N} }}{{q_{l} }}\). \(\uppi^{LES {\text{-}} I} = \left( {1 - \frac{{p_{f}^{LES {\text{-}} I} - W_{N} }}{{q_{f} }}} \right)p_{f}^{LES {\text{-}} I} + \left( {\frac{{p_{f}^{LES {\text{-}} I} - W_{N} }}{{q_{f} }} - \frac{{p_{l}^{LES {\text{-}} I} - W_{N} }}{{q_{l} }}} \right)p_{l}^{LES {\text{-}} I}\). Let \(\varvec{p} = \left( {p_{f}^{LES {\text{-}} I} ,p_{l}^{LES {\text{-}} I} } \right)\), then \(H\left( \varvec{p} \right) = \left[ {\begin{array}{*{20}c} { - \frac{2}{{q_{f} }}} & {\frac{1}{{q_{f} }}} \\ {\frac{1}{{q_{f} }}} & { - \frac{2}{{q_{l} }}} \\ \end{array} } \right]\), \(D_{1} \left( H \right) = - \frac{2}{{q_{f} }} < 0\), \(D_{2} \left( H \right) = \frac{{4q_{f} - q_{l} }}{{q_{f}^{2} q_{l} }} > 0\), thus the profit function of LES-I is concave. The first-order conditions of \(\pi^{LES {\text{-}} I}\) with respect to \(p_{f}^{LES {\text{-}} I}\) and \(p_{l}^{LES {\text{-}} I}\) are \(\left\{ {\begin{array}{*{20}l} {\frac{{\partial \pi^{LES {\text{-}} I} }}{{\partial p_{f}^{LES {\text{-}} I} }} = \frac{{q_{f} + W_{N} - 2p_{f}^{LES {\text{-}} I} + p_{l}^{LES {\text{-}} I} }}{{q_{f} }} = 0} \hfill \\ {\frac{{\partial \pi^{LES {\text{-}} I} }}{{\partial p_{l}^{LES {\text{-}} I} }} = \frac{{\left( {q_{f} - q_{l} } \right)W_{N} + q_{l} p_{f}^{LES {\text{-}} I} - 2q_{f} p_{l}^{LES {\text{-}} I} }}{{q_{f} q_{l} }} = 0} \hfill \\ \end{array} } \right.\), and then \(\left\{ {\begin{array}{*{20}l} {p_{f}^{LES {\text{-}} I*} = \frac{{\left( {3q_{f} - q_{l} } \right)W_{N} + 2q_{f}^{2} }}{{4q_{f} - q_{l} }}} \hfill \\ {p_{l}^{LES {\text{-}} I*} = \frac{{\left( {2q_{f} - q_{l} } \right)W_{N} + q_{l} q_{f} }}{{4q_{f} - q_{l} }}} \hfill \\ \end{array} } \right.\). \(p_{f}^{LES {\text{-}} I*} - p_{l}^{LES {\text{-}} I*} = \frac{{q_{f} \left( {W_{N} + 2q_{f} - q_{l} } \right)}}{{4q_{f} - q_{l} }} > 0\), which is obvious because \(\left| {W_{N} } \right| < q_{l} < q_{f}\).

The optimal segmenting point of different versions are \(\theta_{u}^{LES {\text{-}} I *} = \frac{{2q_{f} - W_{N} }}{{4q_{f} - q_{l} }},\)\(\theta_{f}^{LES {\text{-}} I *} = \theta_{1l}^{LES {\text{-}} I *} = \frac{{\left( {2q_{f} - q_{l} } \right)W_{N} + q_{l} q_{f} }}{{q_{l} \left( {4q_{f} - q_{l} } \right)}},\) and \(\theta_{2l}^{LES {\text{-}} I *} = \frac{{q_{f} \left( { - 2W_{N} + q_{l} } \right)}}{{q_{l} \left( {4q_{f} - q_{l} } \right)}}\), according to the constraint \(0 < \theta_{2l}^{LES {\text{-}} I} < \theta_{f}^{LES {\text{-}} I} = \theta_{1l}^{LES {\text{-}} I} < \theta_{u}^{LES {\text{-}} I} < 1\), then we get: \(\theta_{2l}^{LES {\text{-}} I *} = \frac{{q_{f} \left( { - 2W_{N} + q_{l} } \right)}}{{q_{l} \left( {4q_{f} - q_{l} } \right)}} > 0\), then \(W_{N} < \frac{1}{2}q_{l}\); \(\theta_{1l}^{LES {\text{-}} I *} - \theta_{2l}^{LES {\text{-}} I *} = \frac{{W_{N} }}{{q_{l} }} > 0\), then \(W_{N} > 0\); \(\theta_{u}^{LES {\text{-}} I *} - \theta_{1l}^{LES {\text{-}} I *} = \frac{{q_{f} \left( { - 2W_{N} + q_{l} } \right)}}{{q_{l} \left( {4q_{f} - q_{l} } \right)}} > 0\), then \(W_{N} < \frac{1}{2}q_{l}\); \(\theta_{u}^{LES {\text{-}} I *} = \frac{{2q_{f} - W_{N} }}{{4q_{f} - q_{l} }} < 1\), then \(W_{N} > - 2q_{f} + q_{l}\). Therefore, when \(0 < W_{N} < \frac{1}{2}q_{l}\), not all old consumers upgrade and not all new consumers purchase the limited-functionality version in the second period. The number of all types of consumers are \(D_{LU}^{LES {\text{-}} I *} = 1 - \theta_{u}^{LES {\text{-}} I *} = \frac{{2q_{f} - q_{l} + W_{N} }}{{4q_{f} - q_{l} }}\), \(D_{LN}^{LES {\text{-}} I *} = \theta_{u}^{LES {\text{-}} I *} - \theta_{1l}^{LES {\text{-}} I *} = \frac{{q_{f} \left( { - 2W_{N} + q_{l} } \right)}}{{q_{l} \left( {4q_{f} - q_{l} } \right)}}\), \(D_{NF}^{LES {\text{-}} I *} = 0\), \(D_{NL}^{LES {\text{-}} I *} = \theta_{1l}^{LES {\text{-}} I *} - \theta_{2l}^{LES {\text{-}} I *} = \frac{{W_{N} }}{{q_{l} }}\), \(D_{Total}^{LES {\text{-}} I *} = D_{LU}^{LES {\text{-}} I *} + D_{LN}^{LES {\text{-}} I *} + D_{NF}^{LES {\text{-}} I *} + D_{NL}^{LES {\text{-}} I *} = \frac{{3q_{l} q_{f} - q_{l}^{2} + 2q_{f} W_{N} }}{{q_{l} \left( {4q_{f} - q_{l} } \right)}}.\) Finally, the optimal total profit of LES-I is \(\pi^{LES {\text{-}} I *} = \frac{{q_{f} W_{N}^{2} + \left( {3q_{l} q_{f} - q_{f}^{2} } \right)W_{N} + q_{l} q_{f}^{2} }}{{q_{l} \left( {4q_{f} - q_{l} } \right)}}\).

When \(W_{N} > \frac{1}{2}q_{l}\), all old consumers upgrade and all new consumers will purchase the limited-functionality version. In this case, \(\theta_{1l}^{LES {\text{-}} I} = \theta_{u}^{LES {\text{-}} I} = \theta_{f}^{LES {\text{-}} I} = \frac{{p_{l}^{LES {\text{-}} I} }}{{q_{l} }}\), and \(\theta_{2l} = 0\). \(\uppi^{LES {\text{-}} I} = p_{l}^{LES {\text{-}} I} + \left( {1 - \frac{{p_{l}^{LES {\text{-}} I} }}{{q_{l} }}} \right)\left( {p_{f}^{LES {\text{-}} I} - p_{l}^{LES {\text{-}} I} } \right)\). Let \(\varvec{p} = \left( {p_{f}^{LES {\text{-}} I} ,p_{l}^{LES {\text{-}} I} } \right)\), then \(H\left( \varvec{p} \right) = \left[ {\begin{array}{*{20}c} 0 & { - \frac{1}{{q_{l} }}} \\ { - \frac{1}{{q_{l} }}} & {\frac{1}{{q_{l} }}} \\ \end{array} } \right]\), \(D_{1} \left( H \right) = 0\), \(D_{2} \left( H \right) = - \frac{1}{{q_{l}^{2} }} < 0\), thus the profit function in LES-I is not concave, then the optimal price should be chosen at boundary value. To ensure the consumer at 0 to buy the limited-functionality, \(p_{l}^{LES {\text{-}} I}\) should be not larger than \(W_{N}\), namely \(0 \le p_{l}^{LES {\text{-}} I} \le W_{N}\). To ensure that all old consumers choose to upgrade and no new consumers choose to buy the full-functionality version, then \(\theta_{1l} q_{f} + W_{N} - p_{f}^{LES {\text{-}} I} \ge 0\) and \(\theta_{1l} q_{f} + W_{N} - p_{f}^{LES {\text{-}} I} \le \theta_{1l} q_{l} + W_{N} - p_{l}^{LES {\text{-}} I}\), namely \(\frac{{q_{f} }}{{q_{l} }}p_{l}^{LES {\text{-}} I} \le p_{f}^{LES {\text{-}} I} \le \frac{{q_{f} }}{{q_{l} }}p_{l}^{LES {\text{-}} I} + W_{N}\). We examine the optimality of four groups of \(\varvec{p}\), namely \(\varvec{p}_{1} = \left( {0,0} \right)\), \(\varvec{p}_{2} = \left( {W_{N} ,0} \right)\),\(\varvec{ p}_{3} = \left( {\frac{{q_{f} }}{{q_{l} }}W_{N} ,W_{N} } \right)\),\(\varvec{ p}_{4} = \left( {\frac{{q_{f} + q_{l} }}{{q_{l} }}W_{N} ,W_{N} } \right)\), then the corresponding profits under different \(\varvec{p}\) are \(\pi^{LES {\text{-}} I} \left( {\varvec{p}_{1} } \right) = 0\), \(\pi^{LES {\text{-}} I} \left( {\varvec{p}_{2} } \right) = W_{N}\), \(\pi^{LES {\text{-}} I} \left( {\varvec{p}_{3} } \right) = \frac{{W_{N} \left[ {q_{l} q_{f} - \left( {q_{f} - q_{l} } \right)W_{N} } \right]}}{{q_{l}^{2} }}\), \(\pi^{LES {\text{-}} I} \left( {\varvec{p}_{4} } \right) = \frac{{W_{N} \left[ {q_{l}^{2} + \left( {q_{l} - W_{N} } \right)q_{f} } \right]}}{{q_{l}^{2} }}\). By comparing four groups of profits, we find \(\pi^{LES {\text{-}} I} \left( {\varvec{p}_{4} } \right)\) is the largest, thus we set the optimal prices for both versions as \(p_{l}^{LES {\text{-}} I*} = W_{N}\) and \(p_{f}^{LES {\text{-}} I*} = \frac{{q_{f} + q_{l} }}{{q_{l} }}W_{N}\). The optimal segmentation points of different versions are \(\theta_{1l}^{LES {\text{-}} I*} = \theta_{f}^{LES {\text{-}} I*} = \theta_{u}^{LES {\text{-}} I*} = \frac{{W_{N} }}{{q_{l} }}\) and \(\theta_{2l}^{LES {\text{-}} I*} = 0\). The number of all types of consumers are \(D_{LU}^{LES {\text{-}} I *} = 1 - \theta_{u}^{LES {\text{-}} I *} = \frac{{q_{l} - W_{N} }}{{q_{l} }}\), \(D_{LN}^{LES {\text{-}} I *} = \theta_{u}^{LES {\text{-}} I *} - \theta_{1l}^{LES {\text{-}} I *} = 0\), \(D_{NF}^{LES {\text{-}} I*} = 0\), \(D_{NL}^{LES {\text{-}} I *} = \theta_{1l}^{LES {\text{-}} I *} - \theta_{2l}^{LES {\text{-}} I *} = \frac{{W_{N} }}{{q_{l} }}\), \(D_{Total}^{LES {\text{-}} I *} = D_{LU}^{LES {\text{-}} I *} + D_{LN}^{LES {\text{-}} I *} + D_{NF}^{LES {\text{-}} I *} + D_{NL}^{LES {\text{-}} I *} = 1\). The resulting profit is \(\pi^{LES {\text{-}} I*} = \frac{{W_{N} \left[ {q_{l}^{2} + \left( {q_{l} - W_{N} } \right)q_{f} } \right]}}{{q_{l}^{2} }}\).

-

(II)

Secondly, we give the proof of the local optimum LES-II, corresponding to the type-II market segmentation in Fig. 6. In this case, \(0 < \theta_{2l}^{LES {\text{-}} II} < \theta_{f}^{LES {\text{-}} II} < \theta_{1l}^{LES {\text{-}} II} = \theta_{u}^{LES {\text{-}} II} < 1\)\(\theta_{u}^{LES {\text{-}} II} = \theta_{1l}^{LES {\text{-}} II} = \frac{{p_{l}^{LES {\text{-}} II} }}{{q_{l} }}\), \(\theta_{f}^{LES {\text{-}} II} = \frac{{p_{f}^{LES {\text{-}} II} - p_{l}^{LES {\text{-}} II} }}{{q_{f} - q_{l} }}\) and \(\theta_{2l}^{LES {\text{-}} II} = \frac{{p_{l}^{LES {\text{-}} II} - W_{N} }}{{q_{l} }}\). \(\uppi^{LES {\text{-}} II} = \left( {1 - \frac{{p_{f}^{LES {\text{-}} II} - p_{l}^{LES {\text{-}} II} }}{{q_{f} - q_{l} }}} \right)p_{f}^{LES {\text{-}} II} + \left( {\frac{{p_{f}^{LES {\text{-}} II} - p_{l}^{LES {\text{-}} II} }}{{q_{f} - q_{l} }} - \frac{{p_{l}^{LES {\text{-}} II} - W_{N} }}{{q_{l} }}} \right)p_{l}^{LES {\text{-}} II}\). Let \(\varvec{p} = \left( {p_{f}^{LES {\text{-}} II} ,p_{l}^{LES {\text{-}} II} } \right)\), then \(H\left( \varvec{p} \right) = \left[ {\begin{array}{*{20}c} { - \frac{2}{{q_{f} - q_{l} }}} & {\frac{2}{{q_{f} - q_{l} }}} \\ {\frac{2}{{q_{f} - q_{l} }}} & { - \frac{{2q_{f} }}{{q_{l} \left( {q_{f} - q_{l} } \right)}}} \\ \end{array} } \right]\), \(D_{1} \left( H \right) = - \frac{2}{{q_{f} - q_{l} }} < 0\), \(D_{2} \left( H \right) = \frac{4}{{q_{l} \left( {q_{f} - q_{l} } \right)}} > 0\), H is negative definite, so \(\pi^{LES {\text{-}} II}\) is concave and there exists maximal value. The first-order conditions of \(\pi^{LES {\text{-}} II}\) with respect to \(p_{l}^{LES {\text{-}} II}\) and \(p_{f}^{LES {\text{-}} II}\) are \(\left\{ {\begin{array}{*{20}c} {\frac{{\partial \pi^{LES {\text{-}} II} }}{{\partial p_{l}^{LES {\text{-}} II} }} = \frac{{\left( {q_{f} - q_{l} } \right)W_{N} + 2q_{l} p_{f}^{LES {\text{-}} II} - 2q_{f} p_{l}^{LES {\text{-}} II} }}{{q_{l} \left( {q_{f} - q_{l} } \right)}} = 0} \\ {\frac{{\partial \pi^{LES {\text{-}} II} }}{{\partial p_{f}^{LES {\text{-}} II} }} = \frac{{q_{f} - q_{l} - 2p_{f}^{LES {\text{-}} II} + 2p_{l}^{LES {\text{-}} II} }}{{q_{f} - q_{l} }} = 0} \\ \end{array} } \right.\), then \(\left\{ {\begin{array}{*{20}c} {p_{l}^{LES {\text{-}} II*} = \frac{{W_{N} + q_{l} }}{2}} \\ {p_{f}^{LES {\text{-}} II*} = \frac{{W_{N} + q_{f} }}{2}} \\ \end{array} } \right.\). \(p_{f}^{LES {\text{-}} II*} > p_{l}^{LES {\text{-}} II*}\) is obvious.

The optimal segmenting point of all kinds of versions are \(\theta_{f}^{LES {\text{-}} II*} = \frac{1}{2}\), \(\theta_{1l}^{LES {\text{-}} II*} = \theta_{u}^{LES {\text{-}} II*} = \frac{{W_{N} + q_{l} }}{{2q_{l} }}\), and \(\theta_{2l}^{LES {\text{-}} II*} = \frac{{ - W_{N} + q_{l} }}{{2q_{l} }}\). According to the constraint \(0 < \theta_{2l}^{LES {\text{-}} II} < \theta_{f}^{LES {\text{-}} II} < \theta_{1l}^{LES {\text{-}} II} = \theta_{u}^{LES {\text{-}} II} < 1\), then \(\theta_{2l}^{LES {\text{-}} II*} = \frac{{ - W_{N} + q_{l} }}{2} > 0\), which is obvious; \(\theta_{f}^{LES {\text{-}} II*} - \theta_{2l}^{LES {\text{-}} II*} = \frac{{W_{N} }}{{2q_{l} }} > 0\), then \(W_{N} > 0\); \(\theta_{1l}^{LES {\text{-}} II*} - \theta_{f}^{LES {\text{-}} II*} = \frac{{W_{N} }}{{2q_{l} }} > 0\), then \(W_{N} > 0\); \(\theta_{1l}^{LES {\text{-}} II*} = \frac{{W_{N} + q_{l} }}{{2q_{l} }} < 1\), which is obvious.

All types of demand are \(D_{LU}^{LES {\text{-}} II *} = 1 - \theta_{u}^{LES {\text{-}} II *} = \frac{{ - W_{N} + q_{l} }}{{2q_{l} }}\), \(D_{LN}^{LES {\text{-}} II *} = \theta_{u}^{LES {\text{-}} II *} - \theta_{1l}^{LES {\text{-}} II *} = 0\), \(D_{NF}^{LES {\text{-}} II *} = \theta_{1l}^{LES {\text{-}} II *} - \theta_{f}^{LES {\text{-}} II*} = \frac{{W_{N} }}{{2q_{l} }}\), \(D_{NL}^{LES {\text{-}} II*} = \theta_{f}^{LES {\text{-}} II *} - \theta_{2l}^{LES {\text{-}} II *} = \frac{{W_{N} }}{{2q_{l} }}\), \(D_{Total}^{LES {\text{-}} II *} = D_{LU}^{LES {\text{-}} II *} + D_{LN}^{LES {\text{-}} II *} + D_{NF}^{LES {\text{-}} II *} + D_{NL}^{LES {\text{-}} II *} = \frac{{W_{N} + q_{l} }}{{2q_{l} }}\). The optimal total profit of LES-II is \(\pi^{LES {\text{-}} II*} = \frac{{W_{N}^{2} + 2q_{l} W_{N} + q_{l} q_{f} }}{{4q_{l} }}\).

-

(III)

Finally, we give the globally optimal solution of Line-extension Strategy by comparing two local optimum LES-I and LES-II. When \(0 < W_{N} < \frac{1}{2}q_{l}\), \(\pi^{LES {\text{-}} I*} - \pi^{LES {\text{-}} II*} = \frac{{W_{N}^{2} + \left( {4q_{f} - 2q_{l} } \right)W_{N} + q_{l} q_{f} }}{{4\left( {4q_{f} - q_{l} } \right)}} > 0\). When \(\frac{1}{2}q_{l} \le W_{N} \le q_{l}\), \(\pi^{LES {\text{-}} I*} - \pi^{LES {\text{-}} II*} = \frac{{ - \left( {4q_{f} + q_{l} } \right)W_{N}^{2} + \left( {4q_{f} q_{l} + 2q_{l}^{2} } \right)W_{N} - q_{f} q_{l}^{2} }}{{4q_{l}^{2} }}\). Let \(\pi^{LES {\text{-}} I*} - \pi^{LES {\text{-}} II*} > 0\) we could get \(F_{1} < W_{N} < F_{2}\), where \(F_{1} = \frac{{q_{l} \left( {2q_{f} + q_{l} - \sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{4q_{f} + q_{l} }}\) and \(F_{2} = \frac{{q_{l} \left( {2q_{f} + q_{l} + \sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{4q_{f} + q_{l} }}\). In particular, \(F_{1} - \frac{1}{2}q_{l} = \frac{{q_{l} \left( {q_{l} - 2\sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{8q_{f} + 2q_{l} }} < 0\), \(F_{2} - \frac{1}{2}q_{l} = \frac{{q_{l} \left( {q_{l} + 2\sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{8q_{f} + 2q_{l} }} > 0\) and \(F_{2} - q_{l} = \frac{{q_{l} \left( { - 2q_{f} + \sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{4q_{f} + q_{l} }} < 0\) because \(q_{l} \left( {3q_{f} + q_{l} } \right) - \left( {2q_{f} } \right)^{2} = \left( {q_{l} - q_{f} } \right)\left( {4q_{f} + q_{l} } \right) < 0\). Therefore, \(\pi^{LES {\text{-}} I*} > \pi^{LES {\text{-}} II*}\) when \(W_{N} \in \left[ {\frac{1}{2}q_{l} ,F_{2} } \right)\) but \(\pi^{LES {\text{-}} I*} \le \pi^{LES {\text{-}} II*}\) when \(W_{N} \in \left[ {F_{2} ,q_{l} } \right]\).

In sum, \(\pi^{LES {\text{-}} I*} > \pi^{LES {\text{-}} II*}\) when \(W_{N} \in \left( {0,F_{2} } \right)\) but \(\pi^{LES {\text{-}} I*} \le \pi^{LES {\text{-}} II*}\) when \(W_{N} \in \left[ {F_{2} ,q_{l} } \right]\).

1.4 A4: Proof of Lemma 1

When \(0 < W_{N} < \frac{1}{2}q_{l}\), \(p_{l}^{LES {\text{-}} I*} - p_{l}^{LES {\text{-}} II*} = \frac{{q_{l} }}{4}\left[ {\frac{{q_{l} - 2W_{N} }}{{4q_{f} - q_{l} }} - 1} \right] < 0\); \(p_{f}^{LES {\text{-}} I*} - p_{f}^{LES {\text{-}} II*} = \frac{{q_{l} q_{f} + \left( {2q_{f} - q_{l} } \right)W_{N} }}{{2\left( {4q_{f} - q_{l} } \right)}} > 0\).

When \(\frac{1}{2}q_{l} \le W_{N} \le q_{l}\), \(p_{l}^{LES {\text{-}} I*} - p_{l}^{LES {\text{-}} II*} = \frac{{W_{N} - q_{l} }}{2} \le 0\); \(p_{f}^{LES {\text{-}} I*} - p_{f}^{LES {\text{-}} II*} = \frac{{\left( {2q_{f} + q_{l} } \right)W_{N} - q_{l} q_{f} }}{{2q_{l} }} \ge 0\).

1.5 A5: Proof of Corollary 2

When \(0 < W_{N} < \frac{1}{2}q_{l}\), \(\frac{{dp_{l}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{{2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > 0\); \(\frac{{dp_{f}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{{3q_{f} - q_{l} }}{{4q_{f} - q_{l} }} > 0\); \(\frac{{dD_{LU}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{1}{{4q_{f} - q_{l} }} > 0\); \(\frac{{dD_{LN}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{{ - 2q_{f} }}{{q_{l} \left( {4q_{f} - q_{l} } \right)}} < 0\); \(\frac{{dD_{NF}^{LES {\text{-}} I*} }}{{dW_{N} }} = 0\); \(\frac{{dD_{NL}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{1}{{q_{l} }} > 0\); \(\frac{{dD_{Total}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{{2q_{f} }}{{q_{l} \left( {4q_{f} - q_{l} } \right)}} > 0\); \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} = q_{f } \left[ {2W_{N} + 3q_{l} - q_{f } } \right]\), then \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} > 0\) when \(W_{N} > \frac{{q_{f} - 3q_{l} }}{2}\), and \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} < 0\) when \(0 < W_{N} < \frac{{q_{f} - 3q_{l} }}{2}\) if \(q_{l} < \frac{{q_{f} }}{3}\).

When \(\frac{1}{2}q_{l} \le W_{N} \le F_{2}\), \(\frac{{dp_{l}^{LES {\text{-}} I*} }}{{dW_{N} }} = 1 > 0\); \(\frac{{dp_{f}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{{q_{f} + q_{l} }}{{q_{l} }} > 0\); \(\frac{{dD_{LU}^{LES {\text{-}} I*} }}{{dW_{N} }} = - \frac{1}{{q_{l} }} > 0\); \(\frac{{dD_{LN}^{LES {\text{-}} I*} }}{{dW_{N} }} = 0\); \(\frac{{dD_{NF}^{LES {\text{-}} I*} }}{{dW_{N} }} = 0\); \(\frac{{dD_{NL}^{LES {\text{-}} I*} }}{{dW_{N} }} = \frac{1}{{q_{l} }} > 0\); \(\frac{{dD_{Total}^{LES {\text{-}} I*} }}{{dW_{N} }} = 0\); \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} = \frac{{q_{l}^{2} + q_{f} q_{l} - 2q_{f } W_{N} }}{{q_{l}^{2} }}\), then \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} > 0\) when \(W_{N} < \frac{{q_{l}^{2} + q_{f} q_{l} }}{{2q_{f} }}\), and \(\frac{{d\pi^{LES {\text{-}} I *} }}{{dW_{N} }} < 0\) when \(W_{N} > \frac{{q_{l}^{2} + q_{f} q_{l} }}{{2q_{f} }}\).

When \(F_{2} \le W_{N} \le q_{l}\), \(\frac{{dp_{l}^{LES {\text{-}} II*} }}{{dW_{N} }} = \frac{1}{2} > 0\), \(\frac{{dp_{f}^{LES {\text{-}} II*} }}{{dW_{N} }} = \frac{1}{2} > 0\), \(\frac{{dD_{LU}^{LES {\text{-}} II*} }}{{dW_{N} }} = - \frac{1}{{2q_{l} }} < 0\), \(\frac{{dD_{LN}^{LES {\text{-}} II*} }}{{dW_{N} }} = 0\), \(\frac{{dD_{NF}^{LES {\text{-}} II*} }}{{dW_{N} }} = \frac{1}{{2q_{l} }} > 0\), \(\frac{{dD_{NL}^{LES {\text{-}} II*} }}{{dW_{N} }} = \frac{1}{{2q_{l} }} > 0\), \(\frac{{dD_{Total}^{LES {\text{-}} II*} }}{{dW_{N} }} = \frac{1}{{2q_{l} }} > 0\). \(\frac{{d\pi^{LES {\text{-}} II *} }}{{dW_{N} }} = \frac{{W_{N} + q_{l} }}{{2q_{l} }} > 0 .\)

1.6 A6: Proof of Proposition 3

According to \(0 \le\upalpha \le 1\), \(0 \le k \le 1\) and \(W_{N} = \alpha q_{l} - kq_{l}^{2}\), we could get \(- q_{l}^{2} \le W_{N} \le q_{l}\). We examine the optimality of the three strategies (SS, RS, LES-I and LES-II) under different WOM level.

-

1.

When \(0 < W_{N} < \frac{1}{2}q_{l}\), according to Proposition 2, we know that \(\pi^{LES {\text{-}} I*} > \pi^{LES {\text{-}} II*}\). \(\pi^{LES {\text{-}} I*} - \pi^{RS*} = \frac{{W_{N} \left[ {q_{f} q_{l} + \left( {q_{f} - q_{l} } \right)W_{N} } \right]}}{{q_{l} \left( {4q_{f} - q_{l} } \right)}} > 0\); \(\pi^{RS*} - \pi^{SS*} = \frac{{4W_{N}^{2} + \left( {8q_{f} - 4q_{l} } \right)W_{N} + q_{f} q_{l} }}{{4\left( {4q_{f} - q_{l} } \right)}} > 0.\) Then \(\pi^{LES {\text{-}} I*} > \pi^{RS*} > \pi^{SS*}\), thus LES-I is optimal when \(0 < W_{N} < \frac{1}{2}q_{l}\).

-

2.

When \(\frac{1}{2}q_{l} \le W_{N} \le F_{2} = \frac{{q_{l} \left( {2q_{f} + q_{l} + \sqrt {q_{l} \left( {3q_{f} + q_{l} } \right)} } \right)}}{{4q_{f} + q_{l} }}\), according to Proposition 2, we know that \(\pi^{LES {\text{-}} I*} > \pi^{LES {\text{-}} II*}\). Then \(\pi^{LES {\text{-}} I*} - \pi^{RS*} = - \left( {\frac{1}{{4q_{f} - q_{l} }} + \frac{{q_{f} }}{{q_{l}^{2} }}} \right)W_{N}^{2} + \left( {1 - \frac{{2q_{f} - q_{l} }}{{4q_{f} - q_{l} }} + \frac{{q_{f} }}{{q_{l} }}} \right) - \frac{{q_{f}^{2} }}{{4q_{f} - q_{l} }}\), When \(W_{N} = \frac{1}{2}q_{l}\), \(\pi^{LES {\text{-}} I *} - \pi^{RS *} = \frac{{q_{l} \left( {3q_{f} - q_{l} } \right)}}{{4\left( {4q_{f} - q_{l} } \right)}} > 0\), when \(W_{N} = F_{2}\), \(\pi^{LES {\text{-}} I *} - \pi^{RS *} = \frac{{4q_{f}^{2} q_{l}^{2} - 4q_{f} q_{l}^{3} - 2q_{l}^{4} + \left( {4q_{f}^{2} - q_{f} q_{l} - 2q_{l}^{2} } \right)\sqrt {q_{l}^{3} \left( {3q_{f} + q_{l} } \right)} }}{{\left( {4q_{f} - q_{l} } \right)\left( {4q_{f} + q_{l} } \right)^{2} }} > \frac{{4q_{f}^{2} q_{l}^{2} - 4q_{f} q_{l}^{3} - 2q_{l}^{4} + \left( {4q_{f}^{2} - q_{f} q_{l} - 2q_{l}^{2} } \right)2q_{l}^{2} }}{{\left( {4q_{f} - q_{l} } \right)\left( {4q_{f} + q_{l} } \right)^{2} }} = \frac{{q_{l}^{2} \left[ {\left( {q_{f} - q_{l} } \right)\left( {11q_{f} + q_{l} } \right) + q_{f}^{2} } \right]}}{{\left( {4q_{f} - q_{l} } \right)\left( {4q_{f} + q_{l} } \right)^{2} }} > 0\). Then, \(\pi^{LES {\text{-}} I *} > \pi^{RS *}\) for \(W_{N} \in \left[ {\frac{1}{2}q_{l} ,F_{2} } \right]\). \(\pi^{RS *} - \pi^{SS *} = \frac{{4W_{N}^{2} + \left( {8q_{f} - 4q_{l} } \right)W_{N} + q_{f} q_{l} }}{{4\left( {4q_{f} - q_{l} } \right)}} > 0\). Therefore, LES-I is the optimal strategy when \(W_{N} \in \left[ {\frac{1}{2}q_{l} ,F_{2} } \right]\).

-

3.

When \(F_{2} < W_{N} \le q_{l}\), all strategies are feasible. According to Proposition 2, \(\pi^{LES {\text{-}} I*} < \pi^{LES {\text{-}} II*}\). \(\pi^{RS*} - \pi^{SS*} = \frac{{4W_{N}^{2} + \left( {8q_{f} - 4q_{l} } \right)W_{N} + q_{f} q_{l} }}{{4\left( {4q_{f} - q_{l} } \right)}} > 0\). So we just examine the relative optimality of RS and LES-II. Then \(\pi^{RS*} - \pi^{LES {\text{-}} II*} = \frac{{\left( {5q_{l} - 4q_{f} } \right)W_{N}^{2} - 2q_{l}^{2} W_{N} + q_{f} q_{l}^{2} }}{{4q_{l} \left( {4q_{f} - q_{l} } \right)}}\). When \(5q_{l} - 4q_{f} < 0\), namely \(q_{l} < \frac{4}{5}q_{f}\), to make \(\pi^{RS *} - \pi^{LES {\text{-}} II *} > 0\), \(W_{N}\) should satisfy \(G_{1} = \frac{{q_{l} \left( {q_{l} + \sqrt {q_{l}^{2} - q_{f} \left( {5q_{l} - 4q_{f} } \right)} } \right)}}{{5q_{l} - 4q_{f} }} < W_{N} < \frac{{q_{l} \left( {q_{l} - \sqrt {q_{l}^{2} - q_{f} \left( {5q_{l} - 4q_{f} } \right)} } \right)}}{{5q_{l} - 4q_{f} }} = G_{2}\). \(G_{1} < 0\) is obvious. By comparing \(G_{2}\) and \(F_{2}\), we find that \(G_{2}\) is always less than \(F_{2}\) for all \(q_{l} \in \left[ {0,q_{f} } \right]\). Then \(G_{2} < F_{2}\) for all \(q_{l} \in \left[ {0,\frac{4}{5}q_{f} } \right]\), thus \(\pi^{RS *} < \pi^{LES {\text{-}} II *}\) for all \(W_{N} \in \left( {F_{2} ,q_{l} } \right]\).

When \(5q_{l} - 4q_{f} > 0\), namely \(q_{l} > \frac{4}{5}q_{f}\), to make \(\pi^{RS*} - \pi^{LES {\text{-}} II*} > 0\), \(W_{N}\) should satisfy \(0 < W_{N} < G_{2}\) or \(W_{N} > G_{1}\). Because \(G_{1} > q_{l}\) for \(q_{l} > 0\), which is also for \(q_{l} > \frac{4}{5}q_{f}\), so \(W_{N} > G_{1}\) is impossible. When \(q_{l} > \frac{4}{5}q_{f}\), \(G_{2}\) is less than \(\frac{1}{2}q_{l} < F_{2}\), then \(\pi^{RS*} - \pi^{LES {\text{-}} II*} > 0\) is impossible for \(W_{N} > F_{2}\). Therefore, when \(q_{l} > \frac{4}{5}q_{f}\), \(\pi^{RS*} < \pi^{LES {\text{-}} II*}\) for \(W_{N} \in \left( {F_{2} ,q_{l} } \right]\). Therefore, when \(F_{2} < W_{N} \le q_{l}\), the optimal strategy is LES-II.

-

4.

We examine the optimality of three strategies when \(- q_{l}^{2} \le W_{N} < 0\). If \(\frac{1}{2}q_{l} - q_{f} > - q_{l}^{2}\), then for \(\frac{1}{2}q_{l} - q_{f} \le W_{N} < 0\), \(\pi^{RS {\text{-}} I*} - \pi^{SS*} = \frac{{4W_{N}^{2} + \left( {8q_{f} - 4q_{l} } \right)W_{N} + q_{f} q_{l} }}{{4\left( {4q_{f} - q_{l} } \right)}}\). To make \(\pi^{RS {\text{-}} I*} > \pi^{SS*}\),\(W_{N}\) should satisfy \(W_{N} < \frac{{ - \sqrt {\left( {q_{f} - q_{l} } \right)\left( {4q_{f} - q_{l} } \right)} + q_{l} - 2q_{f} }}{2} = X_{1}\) or \(\frac{{\sqrt {\left( {q_{f} - q_{l} } \right)\left( {4q_{f} - q_{l} } \right)} + q_{l} - 2q_{f} }}{2} = X_{2} < W_{N} < 0\). Because \(X_{1} < \frac{1}{2}q_{l} - q_{f}\) and \(X_{2} > \frac{1}{2}q_{l} - q_{f}\), then \(\pi^{RS {\text{-}} I*} > \pi^{SS*}\) when \(W_{N} > X_{2}\), but \(\pi^{RS*} < \pi^{SS*}\) when \(W_{N} < X_{2}\). For \(- q_{l}^{2} < W_{N} < \frac{1}{2}q_{l} - q_{f}\), it is easy to obtain that \(\pi^{RS*} - \pi^{SS*} = \frac{1}{4}\left( {q_{l} - q_{f} } \right) < 0\). Therefore, If \(\frac{1}{2}q_{l} - q_{f} > - q_{l}^{2}\), then SS is optimal when \(W_{N} \in \left[ { - q_{l}^{2} ,X_{2} } \right]\), while RS is the dominant strategy when \(W_{N} \in \left[ {X_{2} ,0} \right]\). If \(\frac{1}{2}q_{l} - q_{f} < - q_{l}^{2}\), then for \(- q_{l}^{2} < W_{N} < 0\), if \(X_{2} < - q_{l}^{2}\), then \(\pi^{RS*} > \pi^{SS*}\) when \(- q_{l}^{2} < W_{N} < 0\); if \(X_{2} > - q_{l}^{2}\), then \(\pi^{RS*} > \pi^{SS*}\) when \(X_{2} < W_{N} < 0\) and \(\pi^{RS*} < \pi^{SS*}\) for \(- q_{l}^{2} < W_{N} < X_{2}\). In sum, \(\pi^{RS*} > \pi^{SS*}\) when \(W_{N} > X_{2}\), but \(\pi^{RS*} < \pi^{SS*}\) when \(W_{N} < X_{2}\).

Rights and permissions

About this article

Cite this article

Wang, Y., Li, M., Feng, H. et al. Optimal sequential releasing strategy for software products in the presence of word-of-mouth and requirements uncertainty. Inf Technol Manag 20, 153–174 (2019). https://doi.org/10.1007/s10799-018-0296-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-018-0296-1