Abstract

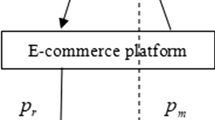

This paper investigates two competitive strategies from two-sides of the e-commerce platform, that is, innovation investment on seller side and product subsidy investment on consumer side. We take competition intensity on seller side into account and analyze how consumer behaviors affect the platform’s strategy under three scenarios: (1) single purchase on single platform(S); (2) single purchase on multi-platforms(M); (3) repeat purchase on single platform (R). The results revel that the innovation investment for sellers is better off in S scenario. However, when the transfer cost is low, taking subsidy strategy is more profitable for the platform in R scenario. If the internal price competition is not sufficiently fierce, subsidy strategy is an efficient approach to reduce the price in M scenario. It is surprising that if the seller’s innovation capability is sufficiently high, the innovation investment strategy dominates no matter what consumer behaviors are. Moreover, how much the platform invests on the seller’s innovation is independent on the consumer’s behavior. These findings have practical managerial insights for the manager of platforms.

Similar content being viewed by others

Notes

http://www.baimaclub.com/html/news/gsdt/20151203/106.html (a news about Amazon in Chinese).

http://tech.sina.com.cn/i/2011-02-24/18275215242.shtml (a news about Taobao in Chinese).

https://baijiahao.baidu.com/s?id=1664504230327549859&wfr=spider&for=pc&isFailFlag=1(a news about Taobao in Chinese).

https://m.chinanews.com/wap/detail/zw/business/2020/01-17/9062644.shtml (a news about Pinduoduo in Chinese).

References

Ansari A, Mela CF, Neslin SA (2008) Customer channel migration. J Mark Res 45(1):60–76

Armstrong M (2006) Competition in two-sided markets. RAND J Econ 37(3):668–691

Anderson EG, Parker G, Tan B (2014) Platform performance investment in the presence of network externalities. Inf Syst Res 25(1):152–172

Brunn P, Jensen M, Skovgaard J (2002) e-Marketplaces: Crafting A Winning Strategy. Eur Manag J 20(3):286–298

Belleflamme P, Peitz M (2010) Platform competition and seller investment incentives. Eur Econ Rev 54(8):1059–1076

Bhattacherjee A (2001) An empirical analysis of the antecedents of electronic commerce service continuance. Decis Support Syst 32:201–214

Cao J, Chen H, Sun W (2010) The effect of multiple platform on B2B platform competition strategy–-based on bilateral market. J Finan Econ 36(9):91–99

Chen S, Leteney F (2000) Get real! Managing the next stage of Internet retail. Eur Manag J 18(5):519–528

Dickinger A, Arami M, Meyer D (2008) The role of perceived enjoyment and social norm in the adoption of technology with network externalities. European J Inf Syst 17(1):4–11

Darley WK, Blankson C, Luethge DJ (2010) Toward an integrated framework for online consumer behavior and decision making process: A review. Psychol Mark 27(2):94–116

Economides N, Katsamakas E (2006) Linux vs. Windows: A comparison of application and platform innovation incentives for open source and proprietary software platforms. In The Economics of Open Source Software Development (pp. 207–218). Elsevier.

Eisenmann T, Parker G, Van MW (2006) Strategies for two-sided markets. Harv Bus Rev 84(10):92–101

Frishammar J, Cenamor J, Cavalli-Björkman H, Hernell E, Carlsson J (2018) Digital strategies for two-sided markets: A case study of shopping malls. Decis Support Syst 108:34–44

Gabszewicz J, Wauthy X (2014) Vertical product differentiation and two-sided markets. Economics Letter 123(1):58–61

Goldbach T, Alexander B, Peter B (2018) Differential effects of formal and self-control in mobile platform ecosystems: Multi-method findings on third-party developers’ continuance intentions and application quality. Inf Manag 55(3):271–284

Gui Y, Gong B (2016) Quality assurance competition strategy under B2C platform. Discrete Dyn Nature Soc 2016:1–5

Hagiu A (2009) Two-sided platforms: product variety and pricing structures. J Econ Manag Strategy 18(4):1011–1043

Huang P, Gaoyan L, Yi, X (2019) Quality regulation strategy in two sided market. Management Science. Forth coming.

Huang H, Zhao B, Zhao H, Zhuang Z, Wang Z, Yao X, Wang X, Jin H, Fu X (2018) A cross-platform consumer behavior analysis of large-scale mobile shopping data. In Proceedings of the 2018 World Wide Web Conference (pp. 1785–1794).

Hudson S, Thal K (2013) The impact of social media on the consumer decision process: Implications for tourism marketing. J Travel Tour Mark 30(1–2):156–160

Jorde TM, Sidak JG, Teece DJ (2000) Innovation, investment, and unbundling. Yale J on Reg 17:1

Lam W (2017) Switching costs in two-sided markets. J Industrial Econ 65(1):136–182

Li H, Shen Q, Bart Y (2018) Local market characteristics and online-to-offline commerce: An empirical analysis of groupon. Manag Sci 64(4):1860–1878

Ma S, Li G, Sethi SP, Zhao X (2019) Advance selling in the presence of market power and risk averse consumers. Decis Sci 50(1):1477–1973

Ma B, Xu X, Bian SY, Y, (2017) Online search-based advertising strategy for e-Business platform with the consideration of consumer search cost. Kybernetes 46(2):291–309

Parker G, Van Alstyne M (2005) Two-sided network effects: A theory of information product design. Manage Sci 51(10):1494–1504

Pun H (2013) Channel structure design for complementary products under a co-competitive environment. Decis Sci 44(4):785–796

Reisinger M (2014) Two-part tariff competition between two-sided platforms. Eur Econ Rev 68:168–180

Ribeiro VM, Correia J, Resende J (2016) Nesting vertical and horizontal differentiation in two-sided markets. Bull Econ Res 68(S1):133–145

Rochet JC (2006) Two-sided markets: a progress report. Rand Journal of Economics 37(3):645–667

Rochet JC, Tirolead J (2004) Defining two-sided markets, Working Paper. IDEI University of Toulouse. 1–28.

Roger G (2017) Two-sided competition with vertical differentiation. J Econ 120(3):193–217

Song P, Zheng C, Zhang C, Yu X (2018) Data analytics and firm performance: an empirical study in an online B2C platform. Inf Manag 55(5):633–642

Triole J, Rochet JC (2014) Platform competition in two-sided markets. Compet Policy Int 10(2):180–218

Wen Z, Lin L (2016) Optimal fee structures of crowdsourcing platforms. Decis Sci 47(5):820–850

Weyl EG (2010) A price theory of multi-sided platforms. American Econ Rev 100(4):1642–1672

Xu Z, Wang Y, Fang Y, Tan B, Sun H (2017) Understanding the formation of reciprocal hyperlinks between e-marketplace sellers. Decis Support Syst 98:89–98

Xiang L, Zheng X, Lee MK, Zhao D (2016) Exploring consumers’ impulse buying behavior on social commerce platform: The role of parasocial interaction. Int J Inf Manage 36(3):333–347

Zott C, Amit R, Donlevy J (2000) Strategies for value creation in e-commerce: best practices in Europe. European Manag J 18:463–475

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Equilibrium Outcomes

2.1 (a) Single purchase from single platform

The seller’s utility functions on platform 1 and platform 2 are given by

and.

\(U_{s2} = \alpha_{s} \tilde{n}_{b2} + \left( {p - \gamma n_{s2} } \right)n_{b2} - F_{2} - \theta_{j2}\).

The consumer’s utility function is given by

and

An indifferent consumer \(\tilde{x}\) is under the equilibrium of \(U_{b1} \left( {\tilde{x}} \right) = U_{b2} \left( {\tilde{x}} \right)\) when it accomplishes game equilibrium. According to consumer rational expectation theory, we can get \(\tilde{n}_{b1} = n_{b1} = \tilde{x}\). So we get

Then, we get the number of conusmers as

and according to \(n_{b2} = 1 - n_{b1}\), we can get

The demand function on the seller side on platform 1,2 are

separately.

So

According to \(U_{s1} = U_{s2}\), substitute \(A1\) and \(A2\) into \(U_{s1}\) and \(U_{s2}\). Then substitute \(n_{s1}\) and \(n_{s2}\) into \(\pi_{1}\) and \(\pi_{2}\). First, platform1 determines the innovation level \(e_{1}\) and platform2 determines subsidy \(e_{2}\). Then, two platforms determine the access fee simultaneously. We use Backward Induction to solve the problem.

We have Hessian Metric \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), and \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), therefore, \(\pi_{1}\) and \(\pi_{2}\) are concave function on \(F_{1}\) and \(F_{2}\).

Thus, the optimal access fee under \(\frac{{\partial \pi_{i} }}{{\partial F_{i} }} = 0\) is given by

The optimal investment level for both platforms are

By maximizing profits for platform 1 and 2, we get the following:

(b) Single purchase from multi-platform

The seller’s utility functions on platform 1 and platform 2 are given by

and

The consumer’s utility function is given by

and

Given the indifference location between 1 and two platforms is \(\tilde{x}_{l}\), the Nash equilibrium is \(U_{b1} \left( {\tilde{x}_{l} } \right) = U_{b1,2} \left( {\tilde{x}_{l} } \right)\); given the indifference location in platform 2 or two platforms is \(\tilde{x}_{r}\), the Nash equilibrium is \(U_{b2} \left( {\tilde{x}_{r} } \right) = U_{b1,2} \left( {\tilde{x}_{r} } \right)\). According to the consumer rational expectation theory, we can get \(\tilde{n}_{b1} = n_{b1} = \tilde{x}_{r}\). Using the traditional Hottling model theory and consumer rational expectation hypothesis, we get

Based on \(n_{b1} + n_{b2} - n_{b1,2} = 1\), we can get

According to \(U_{s1} = U_{s2}\), substitute \(A3,A4\) and \(A5\) into \(U_{s1}\) and \(U_{s2}\), we get \(n_{s1}\) and \(n_{s2}\).

Then substitute \(n_{s1}\) and \(n_{s2}\) into \(\pi_{1}\) and \(\pi_{2}\). First, platform1 determines the innovation level \(e_{1}\) and platform2 determines subsidy \(e_{2}\). Then, two platforms determine the access fee simultaneously. We use Backward Induction to solve the problem.

We have Hessian Metric \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), and \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), therefore, \(\pi_{1}\) and \(\pi_{2}\) are concave function on \(F_{1}\) and \(F_{2}\).

Thus, the optimal access fee under \(\frac{{\partial \pi_{i} }}{{\partial F_{i} }} = 0\) is given by

The optimal investment level for both platforms are

By maximizing profits for platform 1 and 2, we get

(c) Repeat purchase

The second period utility function of the consumers who purchase from platform 1 in the first period is

The second period utility function of the consumers who purchase from platform 2 in the first period is

The seller’s utility function in the second period is

According to consumer rational expectation theory, the number of \(\eta\) percent consumers who choose platform 1 and 2 in the second period are

We have \(\left( {1 - \eta } \right)\) percent consumers keeping the same choice for two periods. Therefore, the number of consumers who choose platform1 and platform 2 in the second period are as follows.

The number of consumers who choose platform 1 and platform 2 in the second period are

We assume consumers are shortsighted and they are not concerned about the impact of their decision in the first period on the second period. Let \(\sigma\) denotes the discount factor of future profit. Then the platform i’s profit function in the first period is

The number of consumers who choose platform 1 and platform 2 in the second period are shown in equations \( A6\) and \(A7\), respectively. The platform determines the innovation level and the access fee at the same time. In the first period, platform 1,2 determines the innovation levels and the access fee at the same time. The profit functions of platform 1 and platform 2, respectively, are as follows:

We have Hessian Metric \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{1} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), and \(\left| {\begin{array}{*{20}c} {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1}^{2} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{1} \partial F_{2} }}} \\ {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2} \partial F_{1} }}} & {\frac{{\partial^{2} \pi_{2} }}{{\partial F_{2}^{2} }}} \\ \end{array} } \right| > 0\), therefore, \(\pi_{1}\). and \(\pi_{2}\) are concave function on \(F_{1}\) and \(F_{2}\).

For the second period, we get the optimal innovation level of platform 1,2 as

Given the same utility for sellers when they join two platforms under equilibrium, and \(\frac{{\partial \pi_{i\left( 2 \right)} }}{{\partial F_{i\left( 2 \right)} }} = 0\), we can get the access fee as following:

And the optimal profit is

where \({\mathcal{R}} = 3s^{2} - \left( {\gamma + \alpha_{b} } \right)s.\)

For the first period, the optimal innovation level of platform 1,2 are

The difference of optimal access fees of platforms (\(i = 1,2\)) is

Appendix 2

5.1 Proof of Propositions

5.1.1 Proof of Proposition 1

From expressions of \({F}_{1}^{s*}\) and \({F}_{2}^{s*}\), we have \({F}_{1}^{s*}-{F}_{2}^{s*}=-\frac{\left(k{\alpha }_{s}+2p\right)\left(2k+1\right)}{4k\left(2k-1\right)}<0\), which implies that \({F}_{1}^{s*}<{F}_{2}^{s*}.\)

According to \({\pi }_{1}^{s*}\) and\({\pi }_{2}^{s*}\), we set \({\mathcal{H}} = \frac{{\pi_{1}^{{s{*}}} }}{{\pi_{2}^{{s{*}}} }} = \frac{{2\left( {\alpha_{s} + 2p} \right)\left[ {2t\left( {\theta + \gamma } \right) - \alpha_{s} \left( {\gamma + \alpha_{d} } \right)} \right]\left[ {\alpha_{s} \left( {\gamma + \alpha_{d} } \right) - t\left( {\theta + \gamma } \right)} \right]}}{{\left( {2k - 1} \right)\left( {\gamma + \alpha_{d} } \right)\alpha_{s} }}\). If \(p > \tilde{p}\), where \(\tilde{p} = \frac{{\left( {2k - 1} \right)\left( {\gamma + \alpha_{d} } \right)\alpha_{s} }}{{4\left[ {2t\left( {\theta + \gamma } \right) - \alpha_{s} \left( {\gamma + \alpha_{d} } \right)} \right]\left[ {\alpha_{s} \left( {\gamma + \alpha_{d} } \right) - t\left( {\theta + \gamma } \right)} \right]}} - \frac{{\alpha_{s} }}{2}\), we obtain \({\mathcal{H}} > 1,\) which implies that \(\pi_{1}^{{s{*}}}\) > \(\pi_{2}^{{s{*}}}\).

5.2 Proof of Proposition 2

-

(1)

According to expression of \(n_{b1}\) and \(n_{b2}\), there exist \(\hat{\gamma }\), when \(\gamma < \hat{\gamma }\), then \(n_{b1} < n_{b2}\); while when \(\gamma > \hat{\gamma }\), then \(n_{b1} > n_{b2}\).

-

(2)

From \(F_{1}^{M*} and F_{2}^{M*}\), it’s obvious that \(F_{1}^{M*} > F_{2}^{M*}\).

-

(3)

According to \(\pi_{1}^{M*}\) and \(\pi_{2}^{M*}\), we have

$$ {\mathcal{B}} = \pi_{1}^{M*} - \pi_{2}^{M*} = \frac{{t\left[ {2k\left( {\theta p - \gamma } \right) + 2w - \theta } \right]\left[ {\theta k\alpha_{s} \left( {p - w} \right) + t\left( {w - \theta - k\gamma } \right)} \right] - A}}{{2k^{2} \theta^{2} \left[ {\alpha_{s} \left( {\gamma + \alpha_{b} } \right) - t\left( {\theta + \gamma } \right)} \right]t}}, $$

where \(A = 2k\left[ {\alpha_{s} \left( {\gamma + \alpha_{b} } \right) - t\left( {\theta + \gamma } \right)} \right]\left\{ {t\left[ {k\left( {\theta p - \theta - \gamma } \right) + w} \right] - \left[ {\theta \left( {w - p} \right) + \alpha_{b} + \gamma } \right]\left[ {k\left( {\theta p - \alpha_{b} - \gamma } \right) - w\left( {k\theta + 1} \right)} \right]} \right\}\).

Thus, there exist \(\hat{k}\), when \(k > \hat{k}\), we have \({\mathcal{B}} < 0\), which implies that when innovation capability is not so high, subsidy strategy dominates.

5.3 Proof of Proposition 3

(1) According to \(\pi_{1\left( 2 \right)}^{R*} - \pi_{2\left( 2 \right)}^{R*} = \frac{{\eta \left[ {\left( {\alpha_{s} + 2p} \right)\left( {3s^{2} - \left( {\gamma + \alpha_{b} } \right)s} \right) - k\left( {p + \alpha_{s} } \right)\left( {\gamma + \alpha_{b} } \right)} \right]}}{{\left[ {2\left( {1 - \eta } \right) - 2t + k\left( {\gamma + \alpha_{b} } \right)} \right]}},\) which is concave function on s. Thus, there exist \(\hat{s}\), when \(s < \hat{s}\), we get \(\pi_{1\left( 2 \right)}^{R*} < \pi_{2\left( 2 \right)}^{R*}\); when \(s > \hat{s}\), we get \(\pi_{1\left( 2 \right)}^{R*} < \pi_{2\left( 2 \right)}^{R*}\).

(2) It’s obvious that \(e_{1\left( 1 \right)}^{R*} = e_{1\left( 2 \right)}^{R*} = \frac{1}{k}\).

(3) Since \(F_{1\left( 1 \right)}^{R*} - F_{2\left( 1 \right)}^{R*} = \frac{{\eta \left[ {s\left( {\alpha_{s} + 2p} \right) + k\left( {p + \alpha_{s} } \right)\left( {\gamma + \alpha_{b} } \right)} \right]}}{{\left[ {2\left( {1 - \eta } \right) - 2t + k\left( {\gamma + \alpha_{b} } \right)} \right]}} > 0\), thus platform 1 charges higher access fee than platform 2. From \(F_{1\left( 2 \right)}^{R*} - F_{2\left( 2 \right)}^{R*} = \frac{{\eta \left[ {s\left( {\alpha_{s} + 2p} \right) + s^{2} \eta - \left( {k + 3} \right)} \right]}}{{\left[ {2\left( {1 - \eta } \right) - 2t + k\left( {\gamma + \alpha_{b} } \right)} \right]}}\), there exist \(\tilde{s}\), when \(s < \tilde{s}\), we get \(\frac{{\eta \left[ {s\left( {\alpha_{s} + 2p} \right) + s^{2} \eta - \left( {k + 3} \right)} \right]}}{{\left[ {2\left( {1 - \eta } \right) - 2t + k\left( {\gamma + \alpha_{b} } \right)} \right]}} < 0.\)

5.4 Proof of Proposition 4

According to \(e_{i}^{S*} = e_{i}^{M*} = e_{i}^{R*} = \frac{1}{k}\), it’s easy to get this result.

Rights and permissions

About this article

Cite this article

Wang, M., Deng, H. & Leong, K.G. Innovation investment and subsidy strategy in two-sided market. Inf Technol Manag 24, 337–351 (2023). https://doi.org/10.1007/s10799-021-00331-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-021-00331-x