Abstract

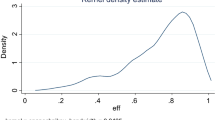

Managerial ability and managerial efforts play key role in the performance of business enterprises. However, this indicator is not directly observable. The current paper focuses on estimating managerial ability in the context of the Indian and Iranian general insurance sectors. The study is based on 140 firm-year observations in India and 140 firm-year observations in Iran spread over 7 years (2012–13 to 2018–19). For measuring managerial ability, we have used a three-stage procedure that involves the estimation of insurer-wise efficiency using Data Envelopment analysis (DEA) in the first stage and then regression of the logarithm of technical efficiency on a set of explanatory variables. In the final stage, we have estimated managerial ability from regression residuals (the difference between the observed and fitted values of insurer efficiency). In order to test the validity of the relationship between return on equity and managerial ability we use the general additive model (GAM). Our results confirmed that there is a positive relationship between return on equity and managerial ability. Our findings also revealed that the mean technical and output allocative efficiencies and managerial ability of Iranian markets highly fluctuated with a high variance. In contrast, these indicators did not fluctuate much in India.

Similar content being viewed by others

Availability of data and materials

All data used in this paper are available per request.

References

Adner R, Helfat C (2003) Corporate effects and dynamic managerial capabilities. Strateg Manag J 24(10):1011–1025

Alchian AA, Demsetz H (1972) Production, information costs, and economic organization. Am Econ Rev 62(5):777–795

Allen DM (1974) The relationship between variable selection and data augmentation and a method for prediction. Technometrics 16:125–127

Bamber L, Jiang J, Wang I (2010) What’s my style? The influence of top managers on voluntary corporate financial disclosures. Account Rev 85(4):1131–1162

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manage Sci 30(9):1078–1092

Banker RD (1993) Maximum likelihood, consistency and data envelopment analysis: a statistical foundation. Manage Sci 39(10):1265–1273

Banker RD, Natarajan R (2008) Evaluating contextual variables affecting productivity using data envelopment analysis. Oper Res 56(1):48–58

Banker RD, Natarajan R, Zhang D (2019) Two-stage estimation of the impact of contextual variables in stochastic frontier production function models using data envelopment analysis: second stage OLS versus bootstrap approaches. Eur J Oper Res 278(2):368–384

Banker RD, Park H (2020) A statistical foundation for the measurement of managerial ability, Working Paper, Temple University, Philadelphia, PA

Banker RD, Luo J, Oh H (2021) Measuring managerial ability in the insurance industry. Data Envelop Anal J 5(1):115–143

Banker RD, Park H, Sahoo B (2022) A statistical foundation for the measurement of managerial ability, MPRA paper, p 111832

Barney JB (1991) Firm resources and sustained competitive advantage. J Manag 17(1):99–120

Barr RS, Seiford LM, Siems TF (1993) An envelopment-analysis approach to measuring the managerial efficiency of banks. Ann Oper Res 45(1–4):1–19. https://doi.org/10.1007/BF02282039

Barr R, T Siems (1997) Bank failure prediction using DEA to measure management quality. In: Barr R, Helgason R, Kennington J (eds) Interfaces in Computer Science and Operations Research: Advances in Metaheuristics, Optimization and Stochastic Modeling Technologies. Kluwer Academic Publishers, Boston, 341–366

Berger AN, Hanweck G, Humphrey D (1987) Competitive viability in banking: scale, scope and product mix economies. J Monet Econ 20(3):501–520

Berger AN, Humphrey D (1992) Measurement and efficiency issues in commercial banking. In: ZviGriliches (ed) Output Measurement in the Service Sectors, 245–300, University of Chicago Press

Bertrand M, Schoer A (2003) Managing with style: The effect of managers on firm policies, Q J Econ 18(4):1169–1208

Castanias RP, Helfat CE (1991) Managerial resources and rents. J Manag 17(1):155–171

Chang YY, Dasgupta S, Hilary G (2010) CEO ability, pay and firm performance. Manage Sci 56(10):1633–1652

Coelli T, Perelman S (1999) Comparison of parametric and non-parametric distance functions: with application to european railways. Eur J Oper Res 117(2):326–339

Cvetkoska V, Eftimov L, Ivanovsky I, Kamenjarska T (2022) Measuring the managerial ability in the insurance companies in the Republic of North Macedonia Croatia, Serbia and Slovenia and identifying its determinants. Int J Bank Risk Insur 10(1):51–67

Demerjian P, Lev B, McVay S (2012) Quantifying managerial ability: a new measure and validity tests. Manage Sci 58(7):1229–1248

Demerjian P, Lev B, Lewis M, McVay S (2013) Managerial ability and earnings quality. Account Rev 88(2):463–498

Demerjian P, Lewis-Western M, McVay S (2020) How does intentional earnings smoothing vary with managerial ability? J Acc Audit Financ 35(2):1–32

Demerjian P, Lev B (2021) Measuring managerial ability: a retrospective and review of the literature. Data Envelop Anal J 5(1):1–25

Dyreng S, Hanlon M, Maydew E (2010) The effects of executives on corporate tax avoidance. Account Rev 85(4):1163–1189

Eling M, Luhnen M (2010) Frontier efficiency methodologies to measure performance in the insurance industry: overview, systematization, and recent developments. Geneva Papers Risk Insur Issues Pract 35(2):217–265

Ge W, Matsumoto D, Zhang J (2011) Do CFOs have style? An empirical investigation of the effect of individual CFOs on accounting practices. Contemp Account Res 28(4):1141–1179

Grossman SJ, Hart OD (1983) An analysis of the principal-agent problem. Econometrica 51(1):7–45

Jarraya B, Bouri A (2013) Efficiency concept and investigations in insurance industry: a survey. Manag Sci Lett 3(1):39–54

Helfat C, Peteraf M (2015) Managerial cognitive capabilities and the micro foundations of dynamic capabilities. Strateg Manag J 36(6):831–850

Holmström B (1979) Moral hazard and observability. Bell J Econ 10(1):74–91

Holmström B (1982) Moral hazard in teams. Bell J Econ 13(2):324–340

Holmström B, Milgrom R (1991) Multitask principal agent analyses: incentive contracts, asset ownership, and job design. J Law Econ Organ 7:24–52

Jensen MC, Meckling WH (1976) Theory of the firm: manage-rial behavior, agency costs and ownership structure. J Financ Econ 3:305–360

Kweh QL, Chan YC, Ting IWK (2013) Measuring intellectual capital efficiency in the Malaysian software sector. J Intellect Cap 14(2):310–324

Leverty JT, Grace MF (2010) The robustness of output measures in property-liability insurance efficiency studies. J Bank Financ 34(7):1510–1524

Leverty JT, Grace MF (2012) Dupes or incompetents? An examination of management’s impact on firm distress. J Risk Insur 79(3):751–783

Linder S, Foss NJ (2015) Agency theory. In: JD Wright (ed) International encyclopedia of the social & behavioral sciences, 2:344–350

Mcdonald J (2009) Using least squares and Tobit in second stage DEA efficiency analyses. Eur J Oper Res 197(2):792–798

Murthi B, Srinivasan K, Kalyanaram G (1996) Controlling for observed and unobserved managerial skills in determining first-mover market share advantage. J Mark Res 33(3):329–336

Ross SA (1973) The economic theory of agency: the principal’s problem. Am Econ Rev 63(2):134–139

Shephard RW (1953) Cost and Productions. Princeton University Press, Princeton

Shephard RW (1970) Theory of cost and productions. Princeton University Press, Princeton

Shephard RW (1974) Indirect Production functions. Verlag Anton Hain, Meisenheim am Glan

Wilson R (1968) On the theory of syndicates. Econometrica 36(1):119–132

Acknowledgements

The authors would like to thank the Editor-in-Chief, Associate Editor, and anonymous reviewers for their helpful comments on the previous version of this manuscript.

Funding

There is no research funding for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of my co-authors, I declare that we have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Banker, R.D., Amirteimoori, A., Allahviranloo, T. et al. Performance analysis and managerial ability in the general insurance market: a study of India and Iran. Inf Technol Manag 25, 19–31 (2024). https://doi.org/10.1007/s10799-023-00405-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-023-00405-y