Abstract

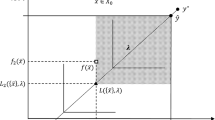

Because of size and covariance matrix problems, computing much of anything along the nondominated frontier of a large-scale (1000–3000 securities) portfolio selection problem with semi-continuous variables is a task that has not previously been achieved. But given (a) the speed at which the nondominated frontier of a classical portfolio problem can now be computed and (b) the possibility that there might be overlaps between the nondominated frontier of the classical problem and that of the same problem but with semi-continuous variables, the paper shows how considerable amounts of the nondominated frontier of a large-scale mean-variance portfolio selection problem with semi-continuous variables can be computed in very little time.

Similar content being viewed by others

Notes

Also known as the “efficient frontier”.

All times in this paper are from an i7-2720 2.20 GHz computer. Sample sizes are 10 throughout.

In the pension fund arena alone, the 300th largest pension fund has assets in excess of $11 billion (Towers Watson, The World’s 300 Largest Pension Funds—Year End 2012, www.towerswatson.com).

A word about the bottommost hyperbolic “segment” of the nondominated frontier: In portfolio selection there is the minimum standard deviation boundary as shown in Sharpe [22]. It is entirely constructed out of hyperbolic segments, and the upper portion of this boundary is the nondominated frontier, that is, from the global minimum standard deviation point upward. With the global minimum standard deviation point likely falling within the relative interior of one of the hyperbolic segments of the minimum standard deviation boundary, the bottommost hyperbolic segment of the nondominated frontier will normally be observed to be a subset of this generally larger hyperbolic segment.

Or stop in the case of the lower endpoint of the bottommost hyperbolic segment, see footnote 5.

References

Anagnostopoulos, K.P., Mamanis, G.: Multiobjective evolutionary algorithms for complex portfolio optimization problems. CMS 8(3), 259–279 (2011)

Bartholomew-Biggs, M.C., Kane, S.J.: A global optimization problem in portfolio selection. CMS 6, 329–345 (2009)

Bonami, P., Lejeune, M.A.: An exact solution approach for portfolio optimization problems under stochastic and integer constraints. Oper. Res. 57(3), 650–670 (2009)

Calvo, C., Ivorra, C., Liern, V.: The geometry of the efficient frontier of the portfolio selection problem. J. Financ. Decis. Mak. 7(1), 27–36 (2011)

Calvo, C., Ivorra, C., Liern, V.: On the computation of the efficient frontier of the portfolio selection problem. J. Appl. Math. (2012). doi:10.1155/2012/105616

Chang, T.-J., Meade, N., Beasley, J.E., Sharaiha, Y.M.: Heuristics for cardinally constrained portfolio optimisation. Comput. Oper. Res. 27(13), 1271–1302 (2000)

Cplex. IBM ILOG CPLEX Optimization Studio, version 12.6 (2013)

Faisca, N.P., Dua, V., Pistikopoulos, E.N.: Multiparametric linear and quadratic programming. In: Pistikopoulos, E.N., Georgiadis, M.C., Dua, V. (eds.) Multi-parametric Programming: Volume 1: Theory, Algorithms, and Applications, pp. 3–23. Wiley-VCH Verlag, Weinheim (2007)

Hirschberger, M., Qi, Y., Steuer, R.E.: Randomly generating portfolio-selection covariance matrices with specified distributional characteristics. Eur. J. Oper. Res. 177(3), 1610–1625 (2007)

Hirschberger, M., Qi, Y., Steuer, R.E.: Large-scale MV efficient frontier computation via a procedure of parametric quadratic programming. Eur. J. Oper. Res. 204(3), 581–588 (2010)

Jobst, N.B., Horniman, M.D., Lucas, C.A., Mitra, G.: Computational aspects of alternative portfolio selection models in the presence of discrete asset choice constraints. Quant. Finance 1(5), 1–13 (2001)

Konno, H., Wijayanayake, A.: Portfolio optimization under D.C. transaction costs and minimal transaction unit constraints. J. Glob. Optim. 22(2), 137–154 (2001)

Konno, H., Yamamoto, R.: Global optimization versus integer programming in portfolio optimization under nonconvex transaction costs. J. Glob. Optim. 32(5), 207–219 (2005a)

Konno, H., Yamamoto, R.: Integer programming approaches in mean-risk models. CMS 2(5), 339–351 (2005b)

Lin, C.-C., Liu, Y.-T.: Genetic algorithms for portfolio selection problems with minimum transaction lots. Eur. J. Oper. Res. 185(1), 393–404 (2008)

Mansini, R., Speranza, M.G.: Heuristic algorithms for the portfolio selection problem with minimum transaction lots. Eur. J. Oper. Res. 114(2), 219–233 (1999)

Markowitz, H.M.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Markowitz, H.M.: The optimization of a quadratic function subject to linear constraints. Nav. Res. Logist. Q. 3(1–2), 111–133 (1956)

Mavrotas, G.: Effective implementation of the \(\varepsilon \)-constraint method in multiobjective mathematical programming. Appl. Math. Comput. 213(2), 455–465 (2009)

Miettinen, K.M.: Nonlinear Multiobjective Optimization. Kluwer, Boston (1999)

Niedermayer, A., Niedermayer, D.: Applying Markowitz’s critical line algorithm. In: Guerard, J.B. (ed.) Handbook of Portfolio Construction, pp. 383–400. Springer, Berlin (2010)

Sharpe, W.F.: Portfolio Theory and Capital Markets. McGraw-Hill, New York (2000)

Stein, M., Branke, J., Schmeck, H.: Efficient implementation of an active set algorithm for large-scale portfolio selection. Comput. Oper. Res. 35(12), 3945–3961 (2008)

Steuer, R.E., Qi, Y., Hirschberger, M.: Comparative issues in large-scale mean-variance efficient frontier computation. Decis. Support Syst. 51(2), 250–255 (2011)

Woodside-Oriakhi, M., Lucas, C., Beasley, J.E.: Heuristic algrithms for the cardinality constrained efficient frontier. Eur. J. Oper. Res. 213, 538–550 (2011)

Xidonas, P., Mavrotas, G.: Multiobjective portfolio optimization with non-convex policy constraints: evidence from the Eurostoxx 50. Eur. J. Finance 20(11), 957–977 (2014)

Acknowledgments

The authors would like to acknowledge helpful comments from the referees.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Steuer, R.E., Hirschberger, M. & Deb, K. Extracting from the relaxed for large-scale semi-continuous variable nondominated frontiers. J Glob Optim 64, 33–48 (2016). https://doi.org/10.1007/s10898-015-0305-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10898-015-0305-4